Fintech

Daura Capital Corp. Signs Definitive Agreement for Proposed Qualifying Transaction

Vancouver, British Columbia–(Newsfile Corp. – March 30, 2021) – Daura Capital Corp. (TSXV: DUR.P) (the “Company” or “Daura“), a capital pool company under the policies of the TSX Venture Exchange (the “TSXV“), is pleased to announce that it has entered into a definitive agreement dated March 30, 2021 with Estrella Gold S.A.C. (“Estrella“) and the shareholders of Estrella (the “Estrella Shareholders“), whereby the Daura will acquire all of the outstanding shares of Estrella. The acquisition of Estrella will constitute Daura’s qualifying transaction (the “Qualifying Transaction“) under the policies of the TSXV.

As previously announced, Daura has made its initial filings with the TSXV for conditional approval of the proposed Qualifying Transaction. Daura is continuing to work diligently towards the completion of the proposed Qualifying Transaction under the policies of the TSXV.

About Estrella Gold S.A,C. and the Cochabamba Project

Estrella is a closely held corporation (S.A.C.) formed under the laws of Peru, engaged in the acquisition and exploration of mineral resource properties. Estrella was formed in August 2018 for the purpose of engaging in the business of acquiring, exploring and developing mineral resource properties. Estrella’s principal focus to date has been on the acquisition of the mining concessions and applications making up the Cochabamba Project.

The Cochabamba Project consists of a 100% undivided interest in 15 mining concessions and mining applications covering 9,927.113 Ha, and an option (the “Antonella Option“) to acquire a mining concession (the “Antonella Daniela I Concession“) covering an additional 900 Ha, all located in the Ancash Region of north-central Peru. The Cochabamba Project is an exploration stage project prospective for gold, silver, copper, lead and zinc. The Antonella Daniela 1 Concession forms the main area of exploration activity for the Cochabamba Project.

Pursuant to the terms of the Antonella Option, as amended, Estrella has the right to acquire 100% of the Antonella Daniela I mining concession, exercisable by payment of the following amounts:

- US$15,000 on signing of the option agreement (which amount has been paid);

- US$40,000 30 days after the signing date (which amount has been paid);

- US$25,000 on August 15, 2020 (which amount has been paid);

- US$115,000 on the December 15, 2020 (which amount has been paid);

- US$170,000 on September 26, 2021; and,

- US$80,000 on September 26, 2022.

The Antonella Daniela I Concession is currently the main area of exploration on the Cochabamba Project, and was most recently explored and drilled by Minera Silex Peru SRL (“Minera Silex”) from 2006 to 2012.

Minera Silex drilled a total of 11 holes located within the current Antonella Daniela 1 Concession. Drilling totalled 2461 meters in 11 diamond drill holes, from which 360 meters of core yielded 314 samples. All holes intercepted veining and mineralized intervals with the best results coming from CBD11001, CBD11002, CBD11003, CBD11004, CBD11004A, CBD11004B, CBD11006, CBD11007, and CBD11008. Holes CBD11005, CBD11009 CBD11010, and CBD11011 intercepted veining and low grade mineralization.

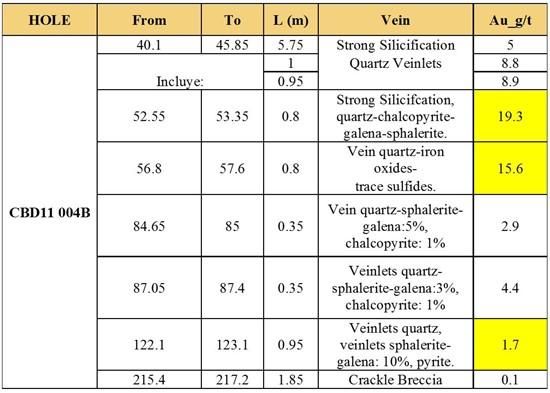

Interpreted sections and mineralized intervals presented below for holes CBD11002 and CBD11004B are representative of the style of mineralization and grades reported by Minera Silex.

Mineralized Intervals for CDB11002

To view an enhanced version of this graphic, please visit:

Mineralized Intervals for CDB11004B

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/6523/78985_dauratable2.jpg

The technical information in this news release has been reviewed and approved by Owen D.W. Miller, the author of the Technical Report on the Cochabamba Project, and a qualified person within the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Financial Information

The following table represents selected financial information regarding the financial condition and results of operation for Estrella. The following is derived from Estrella’s financial statements for the years ended December 31, 2019 (audited) and 2018 (unaudited). The following information should be read in conjunction with Estrella’s audited and unaudited financial statements for the periods presented, which financial statements will be included in the filing statement to be filed by Daura on SEDAR in connection with the Qualifying Transaction.

| Nine months ended September 30, 2020* (unaudited) |

December 31, 2019* (audited) |

December 31, 2018* (unaudited) |

|||||||

| Total Revenues | S/ | — | S/ | — | S/ | — | |||

| Net Income (Loss) | S/ | (95,000 | ) | S/ | (7,174 | ) | S/ | (518 | ) |

| Total Assets | S/ | 844,351 | S/ | 326,973 | S/ | 35,657 | |||

| Total Long-term Liabilities | S/ | 736,584 | S/ | — | S/ | — |

* Presented in Peruvian soles (“S/”)

About the Qualifying Transaction

Daura entered into a definitive share exchange agreement dated March 30, 2021 (the “Share Exchange Agreement“) with Estrella and the Estrella Shareholders, whereby Daura has agreed to acquire all of the outstanding shares of Estrella from the Estrella Shareholders in exchange for an aggregate of 3,000,000 common shares in the capital of Daura (the “Daura Shares“). Dr. Raul Ernesto Lima Osorio, a resident of Uruguay, is the owner of 95% of the outstanding shares of Estrella, with Lara Exploration Ltd., a mineral resource exploration company listed on the TSXV, owning the remaining 5% of Estrella’s outstanding shares. It is expected that, upon completion of the proposed Qualifying Transaction, the Company will change its name to Daura Gold Corp. (the “Resulting Issuer“), with Estrella being a wholly owned subsidiary of the Resulting Issuer.

The Qualifying Transaction will be an arm’s length transaction and approval from the shareholders of Daura is not expected to be required.

Closing of the Qualifying Transaction remains subject to the satisfaction of certain conditions precedent, including but not limited to, closing of the Concurrent Financing (see “Concurrent Financing“, below), satisfactory completion by Daura of its due diligence investigations, and the receipt of all required third party consents, waivers or approvals, including the approval of the TSXV.

Daura has advanced to Estrella the sum of $25,000 as a non-refundable deposit, and loaned to Estrella $75,000, plus an additional US$115,000 (collectively, the “Loans“). The Loans are secured by the assets of Estrella and bear interest at a rate of 10% per annum. The Loans were advanced to fund exploration work by Estrella and to make option payments on the Cochabamba Project.

Upon completion of the Qualifying Transaction, the resulting entity (the “Resulting Issuer“) will be engaged in the business of exploring and developing the Cochabamba Project. In addition, the Resulting Issuer may explore and develop such other properties and interests as may be subsequently acquired by the Resulting Issuer.

Proposed Directors and Officers of the Resulting Issuer

Upon completion of the Qualifying Transaction, it is currently anticipated that Daura’s existing board of directors, consisting of Mark Sumner, Nicholas Lindsay, Duncan Quinn-Smith, and Christina Cepeliauskas will remain with the Resulting Issuer, with Dr. Lima, the majority shareholder of Estrella, also expected to join the Resulting Issuer’s board of directors. Luis Saenz is expected to be appointed as the Chief Executive Officer of the Company, with William Tsang continuing as the Chief Financial Officer and Corporate Secretary of the Resulting Issuer.

The following provides a brief background of each person who is expected to be a director or officer of the Resulting Issuer upon completion of the Qualifying Transaction.

Luis Saenz, Chief Executive Officer

Mr. Sáenz is a finance executive with nearly 30 years of experience in corporate finance, strategic consulting, and metal trading with a focus on Latin America. He was recently CEO of Compañía Minera Quiruvilca (Peru) and Director of Business Development for Latin America at the engineering multinational Ausenco (Australia). Mr. Sáenz is founder and former CEO of Li3 Energy and now Director of Bearing Lithium Corp., which has a stake in the Maricunga lithium project in Chile. In addition, he is a Director of Atico Mining Corporation, which operates the El Roble mine in Colombia and develops the La Plata polymetallic project in Ecuador. Throughout his career, Mr. Sáenz has held senior executive positions at Standard Bank of South Africa, Merrill Lynch and Pechiney World Trade. He has a BA in Economics and International Affairs from Franklin & Marshall College in Lancaster, PA.

William Tsang, Chief Financial Officer and Corporate Secretary

Mr. Tsang is a Chartered Professional Accountant with a Bachelor of Commerce from the University of British Columbia with more than 10 years of financial accounting and auditing experience in the mineral exploration and mining industry. He had worked in public practice providing professional services and advice to publicly traded companies on the NYSE, TSX-V, and OTC markets on various public reporting services, such as Qualifying Transactions for Reverse Take-Over, mergers and acquisitions, and financing transactions. Mr. Tsang was the Corporate Controller of Atico Mining Corporation for 4 years and now holds the position of Chief Financial Officer at Atico. Mr. Tsang also holds the position of Chief Financial Officer of Nova Royalty Corp.

Mark Sumner, Director

Mr. Sumner is the founder and managing director of Kiwanda Group LLC (the “Kiwanda Group”), a US-based resources venture capital business. Founded in 2007, Kiwanda Group has financed mining and exploration projects across a range of commodities and regions, with a particular focus on metals in South America. Prior to founding Kiwanda Group, Mr. Sumner was an investment specialist at Madison Avenue Financial Group, a private wealth boutique based in Portland, OR. Mr. Sumner is also on the board of BiFox Ltd., an unlisted Chilean phosphate rock development company. Mr. Sumner previously held the position of Executive Chairman for Valor Resources Ltd.

Nicholas Mark Lindsay, Director

Dr. Lindsay is an experienced mining executive with about 30 years of experience in the exploration and development of projects in Australia and South America, specifically Chile and Peru. Dr. Lindsay is a geologist by profession, specialized in applied mineralogy and geometallurgy, and has a BSC (Hons Geology) and MBA from the University of Otago, and a PhD from the University of the Witwatersrand; and is an experienced Director of ASX-listed junior exploration companies. Dr. Lindsay is a member of the Australasian Institute of Mining and Metallurgy and the Australian Institute of Geoscientists.

Duncan Quinn-Smith, Director

Mr. Quinn-Smith has law degrees from the University of Bristol (LL.B), Bristol, England, and Columbia University (LL.M), New York, USA. Mr Quinn-Smith was formerly an attorney at the offices of Kirkland & Ellis LLP in New York City, specializing in all aspects of private equity transactions. He founded DQ, LLC, a luxury lifestyle brand, in 2003 where he holds the position of Chief Executive Officer.

Christina Cepeliauskas, Director

Ms. Cepeliauskas is a CPA, CGA professional accountant with more than 25 years of financial accounting and treasury experience in the mineral exploration and mining industry. Ms. Cepeliauskas was the Chief Financial Officer of EMX Royalty Corp. for 12 years from September 2008 until July 2020 wherein she assumed the role of Chief Administrative Officer. Additionally, Ms. Cepeliauskas is currently the Chief Financial Officer of Pan Global Resources Inc. Ms. Cepeliauskas also holds the volunteer position of Treasurer and Board member of Fraserside Community Services Society, an organization committed to helping people overcome challenges. Ms. Cepeliauskas has been a member of the Institute of Corporate Directors since May 2015 since she completed the comprehensive Corporate Directors Program.

Raul Ernesto Lima Osorio

Dr. Lima is the majority shareholder of Estrella. Dr. Lima has over 20 years of experience in the mining and exploration business across South America. Dr. Lima has been responsible for numerous mining development and construction projects throughout Uruguay, Brazil, Chile, Venezuela, Argentina and Peru. Dr. Lima’s notable engineering and construction experience in South America includes engineering and development of the San Grigorio gold mine in Uruguay for Rea Gold Corporation (now operated by Orosur), construction and engineering of the $450 million Pirquitas open pit silver mine in Argentina for Silver Standard Resources and engineering and construction of the Tucano Gold-Iron Mining Project in Brazil for Beadell Resources Ltd. Dr. Lima was previously Chief Operating Officer for Valor Resources Limited, an ASX-listed metals company focused on the development of the Berenguela Polymetallic Project in the Puno Department of Peru.

Dr. Lima holds an engineering degree from the University of the Republic in Montevideo, Uruguay, an MBA from ORT University in Montevideo and a Doctorate in Management with a focus on mining projects from University of Phoenix. Dr. Lima is a resident of Montevideo, Uruguay and speaks fluent English, Portuguese and native Spanish.

Concurrent Financing

In conjunction with closing of the proposed Qualifying Transaction, Daura intends to complete a non-brokered private placement financing of a minimum of 12,500,000 units (each a “Unit”) and a maximum of up to 15,000,000 Units at a price of $0.20 per Unit for gross proceeds of between $2,500,000 and $3,000,000. Each Unit will consist of one Daura Share and one-half of one share purchase warrant (each a “Warrant“), with each whole Warrant entitling the holder to purchase one additional Daura Share at a price of $0.30 per share for a period of two years from the date of issuance. Net proceeds from the Concurrent Financing will be used to fund exploration of the Cochabamba Project, expenses related to the Qualifying Transaction and for general working capital purposes.

Subject to the approval of the TSXV, Daura may pay eligible finders a fee equal to 7% of the Concurrent Financing in cash, and 7% in share purchase warrants under the QT Financing.

All securities issued under the Concurrent Financing will be subject to hold periods expiring four months and one day after the date of issuance. Additional restrictions may apply under the rules of the TSXV and applicable securities laws.

This news release does not constitute an offer to sell, or solicitation of an offer to buy, nor will there be any sale of any of the securities offered in any jurisdiction where such offer, solicitation or sale would be unlawful, including the United States of America. The securities being offered as part of the QT Financing have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act“), or any state securities laws, and accordingly may not be offered or sold in the United States except in compliance with the registration requirements of the U.S. Securities Act and any applicable state securities laws, or pursuant to available exemptions therefrom.

Closing of the Concurrent Financing is subject to the approval of the TSXV.

Sponsorship of the Qualifying Transaction

Sponsorship of a Qualifying Transaction of a capital pool company is required by the TSXV unless waived in accordance with TSXV policies. Daura intends to apply for a waiver from the sponsorship requirements, however there is no assurance that a waiver will be granted.

Adoption of Changes in New CPC Policy

The Company intends to implement certain amendments permitted by the TSXV pursuant to amended Policy 2.4 – Capital Pool Companies, which became effective January 1, 2021 (the “New CPC Policy“). As permitted under the New CPC Policy, the Company intends to rely on Section 7.1 and 7.2 of the New CPC Policy. Section 7.1 and 7.2 of the New CPC Policy pertain to the permitted use of proceeds, and prohibitions on certain payments, by a capital pool company. Under the provisions of Section 7.1 and 7.2 of the New Policy, capital pool companies are no longer subject to a limitation on the amount of non-qualifying transaction related expenses of the lesser of: (i) $210,000, and (ii) 30% of the gross proceeds raised by the capital pool company.

Additional Information

In accordance with the policies of the TSXV, the Daura Shares are currently halted from trading and will remain halted until further notice.

Daura and Estrella will provide further details in respect of the Qualifying Transaction, in due course once available, by way of press releases.

All information provided in this press release related to Estrella has been provided by management of Estrella and has not been independently verified by management of Daura.

Investors are cautioned that, except as disclosed in the management information circular or filing statement to be prepared in connection with the Qualifying Transaction, any information released or received with respect to the Qualifying Transaction may not be accurate or complete and should not be relied upon. Trading in the securities of a capital pool company should be considered highly speculative.

For further information please contact:

Daura Capital Corp.

543 Granville, Suite 501

Vancouver BC V6C 1X8

William T.P. Tsang CFO and Secretary

(604) 669-0660

[email protected]

Mark D. Sumner CEO and Director

[email protected]

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Information set forth in this news release contains forward-looking statements. These statements reflect management’s current estimates, beliefs, intentions and expectations; they are not guarantees of future performance. Daura cautions that all forward-looking statements are inherently uncertain and that actual performance may be affected by a number of material factors, many of which are beyond Daura’s control. Such factors include, among other things: risks and uncertainties relating to Daura’s ability to complete the proposed Qualifying Transaction; and other risks and uncertainties. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, Daura undertakes no obligation to publicly update or revise forward-looking information.

Completion of the transaction is subject to conditions, including but not limited to, TSXV acceptance and if applicable pursuant to TSXV requirements, majority of the minority shareholder approval. Where applicable, the transaction cannot close until the required shareholder approval is obtained. There can be no assurance that the transaction will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the management information circular or filing statement to be prepared in connection with the transaction, any information released or received with respect to the transaction may not be accurate or complete and should not be relied upon. Trading in the securities of a capital pool company should be considered highly speculative.

The TSX Venture Exchange has in no way passed upon the merits of the proposed transaction and has neither approved nor disapproved the contents of this press release.

A halt in trading shall remain in place until after the Qualifying Transaction is completed or such time that acceptable documentation is filed with the TSX Venture Exchange.

Not for Distribution to US Newswire Services or Dissemination in the United States

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/78985

Fintech

Fintech Pulse: Daily Industry Brief – A Dive into Today’s Emerging Trends and Innovations

The fintech landscape continues to redefine itself, driven by innovation, partnerships, and groundbreaking strategies. Today’s roundup focuses on the latest digital wallet offerings, evolving payment trends, strategic collaborations, and notable funding achievements. This editorial explores the broader implications of these developments, casting light on how they shape the future of fintech and beyond.

Beacon’s Digital Wallet for Immigrants: A Gateway to Financial Inclusion

Beacon Financial, a leading player in financial technology, recently launched a digital wallet tailored to meet the unique needs of immigrants moving to Canada. This offering bridges a critical gap, enabling seamless financial integration for newcomers navigating a foreign system.

By combining intuitive technology with user-centric features, Beacon aims to empower immigrants with tools for payments, savings, and remittances. This aligns with the growing demand for tailored financial products that resonate with specific demographics.

Op-Ed Insight:

Financial inclusion is more than just a buzzword; it’s a moral imperative in the fintech space. Products like Beacon’s digital wallet highlight the industry’s potential to create tangible change. As global migration trends increase, such offerings could inspire similar initiatives worldwide.

Source: Fintech Futures.

Juniper Research Highlights 2025’s Payment Trends

Juniper Research’s latest report unveils pivotal payment trends poised to dominate in 2025. Central themes include the adoption of instant payment networks, a surge in embedded finance solutions, and the rise of crypto-backed financial products.

The research underscores the rapid adoption of real-time payment systems, fueled by increasing consumer demand for speed and efficiency. Meanwhile, embedded finance promises to blur the lines between traditional banking and non-financial services, delivering personalized and context-specific solutions.

Op-Ed Insight:

As the lines between financial services and technology continue to blur, these trends emphasize the industry’s shift toward convenience and personalization. The growing role of crypto-based solutions reflects an evolving consumer mindset, where decentralization and digital-first experiences gain precedence.

Source: Juniper Research.

MeaWallet and Integrated Finance Partner to Revolutionize Digital Wallets

MeaWallet, a prominent fintech solutions provider, has partnered with Integrated Finance to advance digital wallet capabilities and secure card data access for fintech companies. This collaboration focuses on empowering fintechs to deliver better, safer digital payment experiences.

MeaWallet’s role as a technology enabler aligns seamlessly with Integrated Finance’s goal of simplifying complex financial infrastructures. Together, they aim to create scalable, robust platforms for secure payment solutions.

Op-Ed Insight:

Partnerships like this underscore the importance of collaboration in driving innovation. As security concerns grow in tandem with digital payment adoption, solutions addressing these challenges are essential for maintaining consumer trust. The fintech ecosystem thrives when synergy and innovation coalesce.

Source: MeaWallet News.

Nucleus Security Among Deloitte’s Fastest-Growing Companies

Nucleus Security has achieved a remarkable milestone, ranking 85th on Deloitte’s 2024 Technology Fast 500 list. This achievement is attributed to its robust cybersecurity solutions, which cater to the increasingly digital fintech environment.

With cyberattacks becoming more sophisticated, fintech companies are under immense pressure to safeguard their platforms. Nucleus Security’s growth reflects the rising demand for comprehensive, scalable security solutions that protect sensitive financial data.

Op-Ed Insight:

In a digital-first world, robust cybersecurity isn’t optional—it’s fundamental. The recognition of companies like Nucleus Security signals the growing importance of protecting fintech infrastructure as the industry scales globally.

Source: PR Newswire.

OpenYield Secures Funding to Transform the Bond Market

OpenYield has announced a successful funding round, aiming to revolutionize the bond market through innovative technology. The platform promises greater transparency, efficiency, and accessibility in fixed-income investments.

This funding underscores the growing appetite for digitizing traditionally opaque financial markets. By leveraging cutting-edge technology, OpenYield seeks to democratize bond investments, making them accessible to a broader audience.

Op-Ed Insight:

The bond market, long viewed as complex and inaccessible, is ripe for disruption. OpenYield’s efforts to modernize this space highlight fintech’s transformative potential to democratize finance and empower individual investors.

Source: PR Newswire.

Key Takeaways: Shaping the Future of Fintech

Today’s developments underscore several critical themes in the fintech landscape:

- Personalization and Inclusion: Products like Beacon’s wallet highlight the importance of understanding and addressing specific user needs.

- Collaborative Ecosystems: Partnerships, like that of MeaWallet and Integrated Finance, emphasize the power of collaboration in solving industry challenges.

- Emerging Technologies: Juniper Research’s predictions affirm the continued influence of blockchain, embedded finance, and instant payment networks.

- Security at the Core: The recognition of Nucleus Security underscores the essential role of cybersecurity in fintech.

- Market Transformation: OpenYield’s funding signifies the ongoing disruption of traditional financial markets, paving the way for broader accessibility.

The post Fintech Pulse: Daily Industry Brief – A Dive into Today’s Emerging Trends and Innovations appeared first on News, Events, Advertising Options.

Fintech

Fintech Pulse: Industry Updates, Innovations, and Strategic Moves

As fintech continues to reshape the global financial landscape, today’s briefing highlights pivotal developments, strategic expansions, and innovative launches across the industry. This op-ed explores the latest advancements with commentary on their potential impacts and challenges.

Finastra Data Breach: A Wake-Up Call for Fintech Security

Source: KrebsOnSecurity

The cybersecurity landscape is buzzing after Finastra, one of the largest financial technology providers globally, confirmed an investigation into a potential data breach. Reports suggest unauthorized access to its systems, raising concerns about data security across its client base, which includes thousands of banks and financial institutions worldwide.

Implications and Challenges

While the details of the breach remain sparse, this incident underscores a glaring vulnerability in the fintech sector—cybersecurity. As financial services increasingly rely on interconnected ecosystems, breaches like these threaten not only individual institutions but also the trust customers place in fintech platforms.

The key takeaway for the fintech industry is clear: proactive cybersecurity strategies must go beyond compliance. Real-time threat detection, robust encryption standards, and regular audits are no longer optional but essential for maintaining operational integrity.

Future Considerations

This breach could trigger a domino effect, prompting regulators to tighten security standards and requiring fintech companies to double down on investments in data protection. Startups and mid-tier players, often lacking extensive cybersecurity budgets, may face significant pressure to keep pace.

PayPal Resurrects Money Pooling Feature

Source: TechCrunch

In a bid to stay ahead of the competition, PayPal is reintroducing its Money Pooling feature, a popular tool that was discontinued in 2021. The feature allows users to pool funds collectively, catering to families, small businesses, and social groups.

Strategic Revival

This move reflects PayPal’s commitment to customer-centric innovation. By reinstating a feature beloved by its user base, the company seeks to reclaim market share lost to emerging competitors offering similar functionalities.

Broader Industry Impacts

Money pooling represents a broader trend in fintech—customized solutions that cater to niche needs. This reintroduction may inspire competitors like Venmo and CashApp to refine their collaborative payment offerings.

While this move strengthens PayPal’s ecosystem, its success will depend on seamless integration with existing services and robust fraud prevention mechanisms to avoid abuse of the feature.

Santander Expands Fintech Reach in Mexico

Source: Yahoo Finance

Santander is making waves in the Latin American fintech space with the launch of a dedicated fintech unit in Mexico. The initiative aims to capitalize on Mexico’s growing fintech adoption and digital payments market, valued at billions of dollars annually.

Strategic Significance

Santander’s expansion into Mexico highlights the region’s untapped potential. Latin America is a burgeoning market for fintech, driven by increasing smartphone penetration, a youthful demographic, and demand for accessible financial services.

Challenges on the Horizon

While Mexico offers immense opportunities, regulatory complexities and market competition from local players like Clip and Konfío pose significant challenges. Santander will need to blend its global expertise with local adaptability to succeed in this dynamic market.

2024 Global Fintech Awards: Spotlighting Excellence

Source: PRNewswire

Benzinga has announced the winners of the 2024 Global Fintech Awards, honoring companies and individuals driving innovation in financial technology. This year’s winners spanned categories like blockchain, artificial intelligence, and payment solutions.

Recognizing Industry Leaders

Awards like these highlight the collaborative spirit and entrepreneurial drive fueling fintech growth. Recognizing trailblazers not only motivates incumbents but also inspires startups to push the boundaries of innovation.

What It Means for the Ecosystem

The awards also bring attention to emerging technologies. Categories such as blockchain and AI signal the industry’s continued focus on leveraging cutting-edge tech for efficiency and scalability.

Commonwealth Central Credit Union Partners with Jack Henry

Source: FinTech Futures

Commonwealth Central Credit Union (CCCU) has announced a partnership with Jack Henry, a leading financial technology provider, for a comprehensive tech upgrade. The collaboration focuses on enhancing member experience through improved digital services.

Modernizing Member Experiences

Credit unions have often lagged behind major banks in adopting advanced digital solutions. By partnering with Jack Henry, CCCU aims to bridge this gap, offering members streamlined services such as mobile banking, automated lending, and personalized financial tools.

A Growing Trend

This partnership reflects a broader trend in the financial industry—credit unions and smaller banks embracing fintech to remain competitive. As customer expectations evolve, partnerships like this may become the norm rather than the exception.

Key Takeaways for the Fintech Industry

- Cybersecurity is Critical: The Finastra breach underscores the need for robust security measures.

- Innovation Drives Loyalty: PayPal’s revival of its Money Pooling feature highlights the importance of listening to customers.

- Regional Opportunities: Santander’s expansion into Mexico showcases the untapped potential of emerging markets.

- Recognition Matters: Awards like Benzinga’s provide valuable visibility for companies and individuals shaping the industry.

- Partnerships Foster Growth: Collaborations between credit unions and fintech companies signify a trend towards modernized financial solutions.

The post Fintech Pulse: Industry Updates, Innovations, and Strategic Moves appeared first on News, Events, Advertising Options.

Fintech

Fintech Pulse: Milestones, Partnerships, and Transformations in Fintech

The fintech sector continues its relentless drive toward innovation and market dominance. Today’s highlights include a record-breaking customer milestone for Revolut, groundbreaking fintech solutions for women in the EU, open entries for the PayTech Awards 2025, implications of political shifts on funding, and notable recognition at the US FinTech Awards.

Revolut Hits 50 Million Customers: A Global Fintech Giant’s Milestone

Source: Revolut

Revolut, the UK-based financial super app, has achieved a monumental feat: surpassing 50 million customers worldwide. This milestone underscores its position as a leader in the global fintech landscape, furthering its ambition to create the world’s first truly global bank.

Key to this success has been Revolut’s strategy of expanding its offerings, from banking to travel and crypto services, all within a seamless user experience. The company’s recent ventures into emerging markets such as Latin America and Asia demonstrate its intent to bridge financial services gaps while retaining competitive differentiation through technology.

This milestone is not just a triumph for Revolut but a signal of fintech’s capacity to redefine traditional banking. It reinforces the narrative that digital-first strategies, customer-centric innovation, and international scalability can challenge long-standing financial institutions.

PayTech Awards 2025: Celebrating Excellence in Innovation

Source: FinTech Futures

The PayTech Awards 2025 are officially open for entries, promising to spotlight the brightest minds and most innovative projects in the payment technology sector. These awards are a testament to the industry’s commitment to advancing secure, seamless, and scalable payment systems.

This year, the focus is on emerging technologies that redefine how businesses and consumers interact financially. Categories will recognize achievements across multiple domains, including sustainability in payments, AI-driven solutions, and partnerships that push boundaries.

As fintech companies prepare their entries, the awards provide a timely reminder of the sector’s ongoing evolution and the collaborative efforts required to achieve meaningful breakthroughs.

U.S. Politics and the Fintech Sector: A New Era of Funding?

Source: American Banker

The U.S. fintech sector might witness an infusion of optimism as speculation about a second Trump presidency gains momentum. The Trump-era policies of deregulation and venture capital encouragement are remembered as catalysts for unprecedented fintech growth during his first term.

While it remains uncertain how regulatory landscapes will shift, the possibility of a more relaxed approach toward fintech compliance could rejuvenate funding inflows. Investors and startups alike are watching closely, weighing the potential benefits against long-term risks tied to reduced oversight.

A politically charged backdrop often spells volatility, but for fintech, it may also spell opportunity. Preparing to adapt quickly will be crucial for startups and established players in the face of any regulatory pivot.

Klara AI and Unlimit: Addressing the €1.3 Trillion Female Economy

Source: FF News

Klara AI has teamed up with Unlimit to launch a fintech solution aimed at empowering women across the EU. This collaboration targets the €1.3 trillion female economy by addressing the unique financial needs of women entrepreneurs and consumers.

The solution promises to integrate AI-powered tools with streamlined financial management services, enabling users to access credit, manage investments, and scale businesses effectively. By tailoring services to the underserved female demographic, the partnership hopes to drive financial inclusion and support economic growth.

This initiative stands as a blueprint for fintechs exploring niche markets, proving that innovation tailored to specific segments can yield transformative results.

Autire: Accounting Tech of the Year at US FinTech Awards

Source: Business Wire

Autire, a rising star in financial technology, has been crowned ‘Accounting Tech of the Year’ at the US FinTech Awards 2024. The award recognizes Autire’s ability to blend cutting-edge AI with intuitive user interfaces, delivering unparalleled accounting solutions for businesses of all sizes.

Autire’s platform has gained traction for automating complex accounting tasks, ensuring compliance, and delivering actionable insights through real-time analytics. Its emphasis on reducing administrative burdens for SMEs has been particularly impactful, enabling entrepreneurs to focus on growth rather than bookkeeping.

The recognition not only cements Autire’s reputation but also highlights the role of AI-driven accounting solutions in reshaping business operations globally.

Final Thoughts: A Fintech Revolution in Full Swing

From customer milestones to policy-driven opportunities, the fintech ecosystem is in constant evolution. Revolut’s ascent to 50 million users signals growing consumer trust in digital platforms. The PayTech Awards continue to inspire innovation, while political shifts could redefine the regulatory landscape. Initiatives like Klara AI and Unlimit emphasize the power of targeted solutions, and companies like Autire show how niche technologies can achieve broad impact.

The next phase of fintech growth will likely hinge on inclusivity, adaptability, and innovation—pillars that today’s news stories exemplify.

The post Fintech Pulse: Milestones, Partnerships, and Transformations in Fintech appeared first on .

-

Fintech4 days ago

Fintech4 days agoFintech Pulse: Industry Updates, Innovations, and Strategic Moves

-

Fintech3 days ago

Fintech3 days agoFintech Pulse: Daily Industry Brief – A Dive into Today’s Emerging Trends and Innovations

-

Fintech PR4 days ago

Fintech PR4 days agoROLLER Releases 2025 Attractions Industry Benchmark Report, Unveiling Key Trends and Revenue Strategies

-

Fintech PR4 days ago

Fintech PR4 days agoTAILG Represents the Industry at COP29, Advancing South-South Cooperation with Low-Carbon Solutions

-

Fintech6 days ago

Fintech6 days agoFintech Pulse: Navigating Expansion, Innovation, and Sustainability

-

Fintech5 days ago

Fintech5 days agoFintech Pulse: Milestones, Partnerships, and Transformations in Fintech

-

Fintech PR2 days ago

Fintech PR2 days agoAlkira Ranked 25th Fastest-Growing Company in North America and 6th in the Bay Area on the 2024 Deloitte Technology Fast 500™

-

Fintech PR4 days ago

Fintech PR4 days agoThe CfC St. Moritz Announces New Speakers from BlackRock, Binance, Bpifrance, Temasek, PayPal, and More for Upcoming 2025 Conference