Fintech

TRU Releases 3D Model of IP Survey for Jacob’s Pond Target Area at Golden Rose Project

Toronto, Ontario–(Newsfile Corp. – May 25, 2022) – TRU Precious Metals Corp. (TSXV: TRU) (OTCQB: TRUIF) (FSE: 706) (“TRU” or the “Company”) is pleased to announce additional results of its Induced Polarization (“IP”) survey at the Company’s flagship Golden Rose Project (“Golden Rose”), further to its announcement of April 13, 2022. Golden Rose is located in the Central Newfoundland gold belt on the deposit-bearing Cape Ray-Valentine Lake Shear Zone.

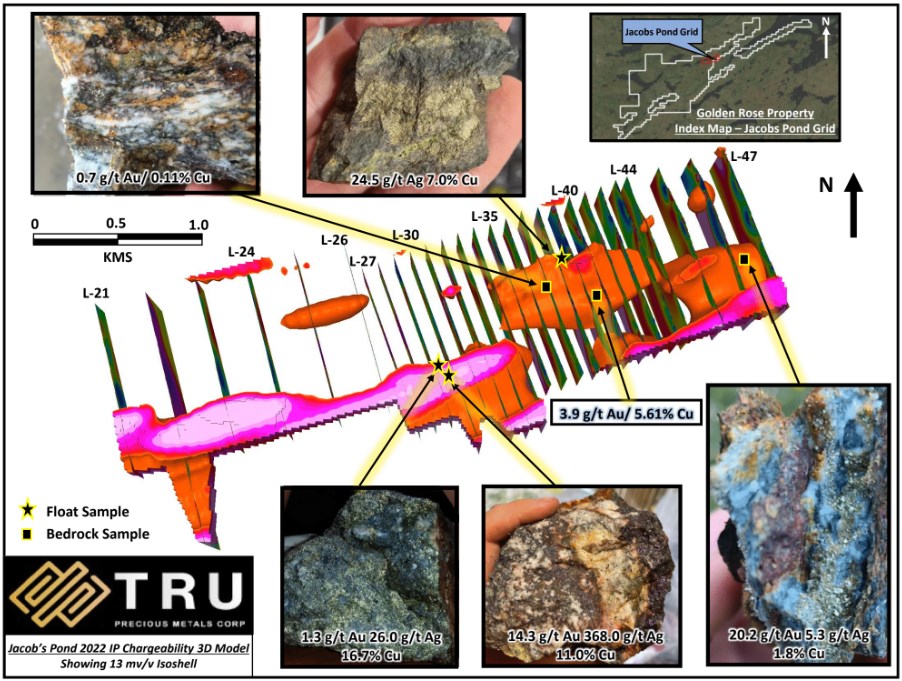

TRU retained Simcoe Geoscience Limited (“Simcoe”) to deploy Simcoe’s next-generation wireless, high-definition Alpha IP technology to conduct a survey comprising 56 line kilometres (km) of wireless time domain IP on newly-defined plus underexplored historical gold exploration targets at Golden Rose. The results in this press release pertain to the developing Jacob’s Pond target area in the northeast of Golden Rose.

Highlights of IP Survey of Jacob’s Pond Include:

- Delineation of an open-ended 4-kilometer-long IP anomalous trend associated with copper-gold-silver-zinc-lead in soils, correlating with chalcopyrite in outcrop and in sheeted quartz veins along the Jacob’s Pond trend.

- 1.6-km-long IP anomaly correlating with the primary high-grade Jacob’s Pond and Rose Gold copper-gold-silver veins, significantly increasing the potential footprint of the mineralized zone.

- Drill target selection has commenced and permits for trenching and drilling at Jacob’s Pond are pending.

TRU VP of Property Development and Director Barry Greene commented: “Having confirmed that the Jacob’s Pond area hosts high-grade copper-gold-silver values in mineralized quartz vein networks at surface, our confidence level was further bolstered when a regional soil sampling survey produced a multi-kilometer anomalous trend in copper-gold-silver-zinc-lead that indicated a potential for much greater distribution to the mineralized system. Now that this 3D IP chargeability model coincides with the high-grade quartz veins and the anomalous soils, we are even more confident in the prospectivity of the Jacob’s Pond area, as we have three different exploration techniques that corroborate the same prospective targets. This IP model is the final layer of exploration data we needed to plan for a comprehensive and systematic trenching and drilling program in the summer and fall of 2022.”

The 3D IP model (Figure 1) shows the shape of the surface and subsurface regions which can hold an electric charge, referred to as an IP anomaly. This method, known as IP geophysics, is regularly used in gold exploration, where gold mineralization is associated with other metals in the ground which can hold an electric charge. The IP anomalies are represented as orange to pink-coloured regions, with hotter colours (pink) representing a stronger IP anomaly.

The existence of gold-bearing rock samples collected from IP anomalies that reach the surface, upgrades the exploration potential of the IP anomalies and provides some context as to the potential size of the overall target. Not all IP anomalies are prospective, therefore, collecting soil samples above multiple IP anomalies can further narrow down areas of interest. If soil is analyzed and is shown to contain gold, plus other metals (such as copper, lead, zinc and silver) (see Figure 2), and those soil samples are situated above areas that can hold an electric charge, then those areas are assigned higher rankings as prospective targets.

When several prospective targets are identified in this manner, exploration then moves to the trenching and drilling stage to define the geometry, grade and continuity of mineralized zones. Accordingly, drill target selection for TRU’s 2022 drill program has commenced.

Figure 2 – Copper, Zinc, Lead, Silver, Arsenic and Gold in Soils – Jacob’s Pond area

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/5993/125192_cb25292c744f98f4_002full.jpg

On May 23, 2022, the field component of the IP survey concluded following the completion of the east Woods Lake area covering the underexplored Sure Shot and Hill Top historic gold showings which contained grab samples of shear hosted quartz veins grading 2.9 grams per tonne (g/t) gold at Sure Shot and 25.8 g/t gold at Hill Top. The analysis and interpretation phase of the IP survey is ongoing.

2021 Drill Program – Final Results Update

The Company is also reporting that results from the final 6 holes of the 2021 drill program have been received; however, there are no additional gold assays of note.

National Instrument 43-101 Disclaimers

Note that soil, rock and float samples are selective by nature, and values reported may not represent the true grade or style of mineralization at Golden Rose. Readers are cautioned that these potential grades are conceptual in nature; there has been insufficient exploration by the Company or its qualified person at Golden Rose to define a mineral resource or mineral reserve; and it is uncertain whether further exploration will result in these targets being delineated as a mineral resource or mineral reserve.

The reader is cautioned that descriptions of mineralization, soil anomalies and IP anomalies reported in this news release are preliminary and/or early-stage results. While these features are considered encouraging, there is no guarantee that these features will return significant gold and/or copper values when drilled.

Qualified Person

Barry Greene, P.Geo. (NL) is a qualified person as defined by National Instrument 43-101 and has reviewed and approved the contents and technical disclosures in this press release. Mr. Greene is a director and officer of the Company and owns securities of the Company.

About TRU Precious Metals Corp.

TRU (TSXV: TRU) (OTCQB: TRUIF) (FSE: 706) is on a mission to build long-term shareholder value, through prudent natural resource property development and transactions. Currently TRU is exploring for gold and copper in the highly prospective Central Newfoundland Gold Belt and has an option with TSX-listed Altius Minerals to purchase 100% of the Golden Rose Project. Golden Rose is a regional-scale 236 km2 land package, including a newly discovered 20 km district-scale structure and an additional 45 km of strike length along the deposit-bearing Cape Ray – Valentine Lake Shear Zone, directly between Marathon Gold’s Valentine Gold Project and Matador Mining’s Cape Ray Gold Project.

TRU is a portfolio company of Resurgent Capital Corp. (“Resurgent”), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization companies listing on Canadian stock exchanges. For more information on Resurgent and its portfolio companies, please visit Resurgent’s website at https://www.resurgentcapital.ca/ or follow Resurgent on LinkedIn at https://ca.linkedin.com/company/resurgent-capital-corp.

For further information about TRU, please contact:

Joel Freudman

Co-Founder & CEO

TRU Precious Metals Corp.

Phone: 1-855-760-2TRU (2878)

Email: [email protected]

To connect with TRU via social media, below are links:

Twitter

https://twitter.com/corp_tru

LinkedIn

https://www.linkedin.com/company/tru-precious-metals-corp

YouTube

https://www.youtube.com/channel/UCHghHMDQaYgS1rDHiZIeLUg/

Acknowledgement

TRU would like to thank the Government of Newfoundland and Labrador for its past financial support through the Junior Exploration Assistance Program.

Cautionary Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release contains certain forward-looking statements relating to exploration activities at Golden Rose. These statements are based on numerous assumptions regarding Golden Rose, and the Company’s exploration and drilling plans, that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation: mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on Golden Rose; the exploration potential of Golden Rose and the nature and style of mineralization; risks inherent in mineral exploration activities; volatility in precious and base metals prices; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/125192

Fintech

Fintech Latvia Association Releases Fintech Pulse 2024: A Guide to Latvia’s Growing Fintech Hub

The Fintech Latvia Association has launched the latest edition of its annual publication, Fintech Pulse 2024, unveiling insights and resources that position Latvia as a thriving hub for European fintech.

Announced at this year’s Fintech Forum, the magazine is now available in digital format, offering a comprehensive guide for fintech professionals and entrepreneurs navigating the Latvian market and exploring its advantages.

This issue covers essential topics, from support tools provided by Latvijas Banka and newcomer roadmaps to Riga’s investor resources and fintech education opportunities. Readers will find the latest fintech news from Latvia, coverage of this year’s key industry events, and member insights on the future of fintech. The Fintech Landscape section provides a comprehensive overview of the Latvian fintech ecosystem.

Tina Lūse, Managing Director of Fintech Latvia Association, expressed excitement about the ecosystem’s growth: “We are excited to unveil the third annual edition of Fintech Pulse. This year has been pivotal for our ecosystem, and together with public sector stakeholders, we are enhancing financial inclusion, democratizing investments, and driving innovation throughout the sector. This is a testament to Latvia’s emergence as a fintech hub, establishing itself as an equal partner in innovation and support within the Baltic region.”

Minister of Finance Arvils Ašeradens highlighted Latvia’s fintech potential in the magazine, stating: “Latvia has already made strides in adapting its regulatory framework to support a stable financial system. Now, we encourage financial market players to invest in modern technologies to meet the growing demand for inclusive financial services and solidify Latvia’s position in the fintech landscape. We are confident that with the combined offer of the government, Latvijas Banka and Riga city, we are a great place to start your next scalable European FinTech!”

Minister of Economics Viktors Valainis expressed Latvia’s ambition in the magazine, stating: “Latvia wants to become a WEB 3.0. innovation hub and solidify itself as one of the leaders of a newly regulated EU crypto-asset market. We welcome international companies to choose Latvia, a flexible and fast-paced country, where you can obtain a MICA license in just 3 months. Open your office in Latvia, receive a MICA license and serve the whole EU market!”

The Fintech Latvia Association brings together fintech and non-banking financial service providers to represent their interests at both the national and international levels. It promotes sustainable development in Latvia’s financial sector by fostering reliable, responsible, and long-term industry practices that earn trust from consumers and regulatory authorities. The association is committed to supporting innovation and growth opportunities within the fintech landscape.

The post Fintech Latvia Association Releases Fintech Pulse 2024: A Guide to Latvia’s Growing Fintech Hub appeared first on News, Events, Advertising Options.

Fintech

Quantum Security and the Financial Sector: Paving the Way for a Resilient Future

The World Economic Forum (WEF) has released a pivotal white paper in collaboration with the Financial Conduct Authority (FCA), titled “Quantum Security for the Financial Sector: Informing Global Regulatory Approaches”. This January 2024 publication underscores the urgent need for global cooperation as the financial sector transitions from a digital economy to a quantum economy, highlighting both the immense opportunities and cybersecurity challenges posed by quantum computing.

Quantum: A Double-Edged Sword for Finance

Quantum computing offers transformative benefits for the financial sector, such as accelerated portfolio optimization, enhanced fraud detection, and improved risk management. Yet, it simultaneously threatens the very foundation of cybersecurity. With quantum’s ability to break traditional encryption methods, sensitive data and financial transactions face significant risks. The white paper warns that such vulnerabilities could erode trust in the financial system and destabilize global markets.

The urgency to prepare is evident, with some quantum threats, such as “Harvest Now, Decrypt Later” attacks, already emerging. Governments and regulators, including the United States with its National Security Memorandum on Quantum (2022), have begun advocating for quantum security readiness by 2035. However, as noted in the paper, transitioning to a quantum-secure infrastructure is a monumental task requiring unprecedented coordination between regulators, industry leaders, and technology providers.

A Collaborative Framework: Four Guiding Principles

To address the complex challenges posed by quantum technologies, the WEF and FCA have proposed four guiding principles to inform global regulatory and industry approaches:

- Reuse and Repurpose: Leverage existing regulatory frameworks and tools to address quantum risks, rather than creating entirely new systems.

- Establish Non-Negotiables: Define baseline requirements for quantum security, ensuring consistency and interoperability across organizations and jurisdictions.

- Increase Transparency: Foster open communication between regulators and industry players to share best practices, strategies, and knowledge.

- Avoid Fragmentation: Prioritize global collaboration to harmonize regulatory efforts and avoid inconsistencies that could burden multinational organizations.

These principles aim to create a unified, forward-looking strategy that balances innovation with security.

A Four-Phase Roadmap for Quantum Security

The white paper introduces a phased roadmap to help the financial sector transition toward quantum security:

- Prepare: Raise awareness of quantum risks, assess cryptographic infrastructure, and build internal capabilities.

- Clarify: Formalize engagement between stakeholders, map current regulations, and model the cost and complexities of transitioning to quantum-safe systems.

- Guide: Address regulatory gaps, translate technical standards into actionable frameworks, and develop industry-wide best practices.

- Transition and Monitor: Implement cryptographic management modernization and adopt iterative, adaptable regulatory approaches to remain resilient in the quantum economy.

This roadmap emphasizes adaptability, encouraging stakeholders to continuously refine their strategies as quantum technologies evolve.

The Path Forward: Collaboration as a Catalyst

The transition to a quantum-secure financial sector is not merely a technological shift but a comprehensive rethinking of how industries and regulators approach cybersecurity. The interconnected nature of global finance means that collaboration between mature and emerging markets is crucial to avoid vulnerabilities that could undermine the entire system.

Regulators and financial institutions must act with urgency. As Sebastian Buckup, Head of Network and Partnerships at the World Economic Forum, notes in the report:

“The quantum economy era is fast approaching, and we need a global public-private approach to address the complexities it will introduce. We welcome this opportunity to collaborate with the FCA to chart the roadmap for a seamless and secure transition for the financial services sector.”

Similarly, Suman Ziaullah, Head of Technology, Resilience, and Cyber at the FCA, emphasizes:

“Quantum computing presents considerable opportunities but also threats. The financial sector relies heavily on encryption to protect sensitive information, the exposure of which could cause significant harm to consumers and markets. Addressing this requires a truly collaborative effort to transition to a quantum-secure future.”

Global Impact: Ensuring Resilience in an Evolving Landscape

As quantum technologies mature, they will redefine the landscape of cybersecurity. The financial sector, as one of the most sensitive and interconnected industries, must prioritize preparedness to ensure stability, protect consumers, and maintain trust.

The Quantum Security for the Financial Sector: Informing Global Regulatory Approaches white paper offers an essential foundation for continued dialogue and action. By adhering to the guiding principles and roadmap outlined in the report, stakeholders can navigate this transformation with foresight and cooperation.

The full report, published by the World Economic Forum, highlights the need for a unified global approach to quantum security, serving as a rallying call for industry and regulatory leaders alike.

Source: World Economic Forum, “Quantum Security for the Financial Sector: Informing Global Regulatory Approaches”, January 2024.

The post Quantum Security and the Financial Sector: Paving the Way for a Resilient Future appeared first on News, Events, Advertising Options.

Fintech

Fintech Pulse: Daily Industry Brief – A Dive into Today’s Emerging Trends and Innovations

The fintech landscape continues to redefine itself, driven by innovation, partnerships, and groundbreaking strategies. Today’s roundup focuses on the latest digital wallet offerings, evolving payment trends, strategic collaborations, and notable funding achievements. This editorial explores the broader implications of these developments, casting light on how they shape the future of fintech and beyond.

Beacon’s Digital Wallet for Immigrants: A Gateway to Financial Inclusion

Beacon Financial, a leading player in financial technology, recently launched a digital wallet tailored to meet the unique needs of immigrants moving to Canada. This offering bridges a critical gap, enabling seamless financial integration for newcomers navigating a foreign system.

By combining intuitive technology with user-centric features, Beacon aims to empower immigrants with tools for payments, savings, and remittances. This aligns with the growing demand for tailored financial products that resonate with specific demographics.

Op-Ed Insight:

Financial inclusion is more than just a buzzword; it’s a moral imperative in the fintech space. Products like Beacon’s digital wallet highlight the industry’s potential to create tangible change. As global migration trends increase, such offerings could inspire similar initiatives worldwide.

Source: Fintech Futures.

Juniper Research Highlights 2025’s Payment Trends

Juniper Research’s latest report unveils pivotal payment trends poised to dominate in 2025. Central themes include the adoption of instant payment networks, a surge in embedded finance solutions, and the rise of crypto-backed financial products.

The research underscores the rapid adoption of real-time payment systems, fueled by increasing consumer demand for speed and efficiency. Meanwhile, embedded finance promises to blur the lines between traditional banking and non-financial services, delivering personalized and context-specific solutions.

Op-Ed Insight:

As the lines between financial services and technology continue to blur, these trends emphasize the industry’s shift toward convenience and personalization. The growing role of crypto-based solutions reflects an evolving consumer mindset, where decentralization and digital-first experiences gain precedence.

Source: Juniper Research.

MeaWallet and Integrated Finance Partner to Revolutionize Digital Wallets

MeaWallet, a prominent fintech solutions provider, has partnered with Integrated Finance to advance digital wallet capabilities and secure card data access for fintech companies. This collaboration focuses on empowering fintechs to deliver better, safer digital payment experiences.

MeaWallet’s role as a technology enabler aligns seamlessly with Integrated Finance’s goal of simplifying complex financial infrastructures. Together, they aim to create scalable, robust platforms for secure payment solutions.

Op-Ed Insight:

Partnerships like this underscore the importance of collaboration in driving innovation. As security concerns grow in tandem with digital payment adoption, solutions addressing these challenges are essential for maintaining consumer trust. The fintech ecosystem thrives when synergy and innovation coalesce.

Source: MeaWallet News.

Nucleus Security Among Deloitte’s Fastest-Growing Companies

Nucleus Security has achieved a remarkable milestone, ranking 85th on Deloitte’s 2024 Technology Fast 500 list. This achievement is attributed to its robust cybersecurity solutions, which cater to the increasingly digital fintech environment.

With cyberattacks becoming more sophisticated, fintech companies are under immense pressure to safeguard their platforms. Nucleus Security’s growth reflects the rising demand for comprehensive, scalable security solutions that protect sensitive financial data.

Op-Ed Insight:

In a digital-first world, robust cybersecurity isn’t optional—it’s fundamental. The recognition of companies like Nucleus Security signals the growing importance of protecting fintech infrastructure as the industry scales globally.

Source: PR Newswire.

OpenYield Secures Funding to Transform the Bond Market

OpenYield has announced a successful funding round, aiming to revolutionize the bond market through innovative technology. The platform promises greater transparency, efficiency, and accessibility in fixed-income investments.

This funding underscores the growing appetite for digitizing traditionally opaque financial markets. By leveraging cutting-edge technology, OpenYield seeks to democratize bond investments, making them accessible to a broader audience.

Op-Ed Insight:

The bond market, long viewed as complex and inaccessible, is ripe for disruption. OpenYield’s efforts to modernize this space highlight fintech’s transformative potential to democratize finance and empower individual investors.

Source: PR Newswire.

Key Takeaways: Shaping the Future of Fintech

Today’s developments underscore several critical themes in the fintech landscape:

- Personalization and Inclusion: Products like Beacon’s wallet highlight the importance of understanding and addressing specific user needs.

- Collaborative Ecosystems: Partnerships, like that of MeaWallet and Integrated Finance, emphasize the power of collaboration in solving industry challenges.

- Emerging Technologies: Juniper Research’s predictions affirm the continued influence of blockchain, embedded finance, and instant payment networks.

- Security at the Core: The recognition of Nucleus Security underscores the essential role of cybersecurity in fintech.

- Market Transformation: OpenYield’s funding signifies the ongoing disruption of traditional financial markets, paving the way for broader accessibility.

The post Fintech Pulse: Daily Industry Brief – A Dive into Today’s Emerging Trends and Innovations appeared first on News, Events, Advertising Options.

-

Fintech6 days ago

Fintech6 days agoFintech Pulse: Industry Updates, Innovations, and Strategic Moves

-

Fintech5 days ago

Fintech5 days agoFintech Pulse: Daily Industry Brief – A Dive into Today’s Emerging Trends and Innovations

-

Fintech PR5 days ago

Fintech PR5 days agoTAILG Represents the Industry at COP29, Advancing South-South Cooperation with Low-Carbon Solutions

-

Fintech PR6 days ago

Fintech PR6 days agoROLLER Releases 2025 Attractions Industry Benchmark Report, Unveiling Key Trends and Revenue Strategies

-

Fintech7 days ago

Fintech7 days agoFintech Pulse: Milestones, Partnerships, and Transformations in Fintech

-

Fintech PR4 days ago

Fintech PR4 days agoAlkira Ranked 25th Fastest-Growing Company in North America and 6th in the Bay Area on the 2024 Deloitte Technology Fast 500™

-

Fintech PR6 days ago

Fintech PR6 days agoThe CfC St. Moritz Announces New Speakers from BlackRock, Binance, Bpifrance, Temasek, PayPal, and More for Upcoming 2025 Conference

-

Fintech PR4 days ago

Fintech PR4 days agoCorinex Ranked Number 331 Fastest-Growing Company in North America on the 2024 Deloitte Technology Fast 500™