Fintech PR

Top 5 questions to cover on cybercrime when looking at equity investing

All companies, regardless of size or industry, are vulnerable to cyber threats like phishing scams, ransomware attacks, and data breaches, according to Prism Global Group.

LONDON, Oct. 16, 2023 /PRNewswire/ — In today’s digital age, the threat of cybercrime looms large over businesses and individuals alike. The need for robust cybersecurity solutions has never been more critical as the world becomes increasingly interconnected. To stay ahead of the curve, organisations must take proactive steps to protect their digital assets from malicious attacks.

Most companies that investors are looking at are proactive and vigilant in addressing cybersecurity threats. Cybersecurity must be prioritised, as it serves as an intelligent investment, safeguarding the firm’s assets and reputation and ensuring long-term success.

Alev Dover, CEO of Prism Global Group, stated: “Cybersecurity is a significant concern for businesses of all sizes and industries. Threats like data breaches, ransomware, and scams can lead to financial losses, reputation damage, and legal responsibility. Protecting your business against these threats is crucial.

Prism has identified five effective strategies to enhance cybersecurity. When investors look at the company that they wish to invest in, these controls are a helpful list to check against:

1. Is the firm regularly testing their defences and ensuring they are prepared for any possible situation?

As technology advances, the potential for security breaches increases. With each new addition to a company’s systems, such as users, applications, devices, and acquisitions, the complexity of cybersecurity grows. Therefore, organisations need a regular process that identifies security gaps, vulnerabilities, and loopholes before they lead to major incidents.

2. How is the firm implementing identity and access management systems?

To keep daily operations running smoothly and protect sensitive information from unauthorised access, it’s crucial to have a system that allows for appropriate data access to prevent internal breaches. Data breaches are caused by insider threats like misusing privileged access, weak or stolen passwords, unpatched applications, malware, social engineering, and physical attacks. To protect against both external and internal threats, it’s crucial that the firm has a robust data security program in place to safeguard sensitive data.

3. Does the firm conduct regular cybersecurity awareness training?

Equipping employees with cybersecurity knowledge and best practices is essential to defend against phishing and social engineering attacks. Providing education on identifying these types of attacks and understanding what information should not be shared is crucial. Every individual within an organisation can play a significant role in maintaining cybersecurity.

4. What Network Monitoring measures are in place?

Effective network security monitoring services safeguard organisations against potential security threats. By providing constant surveillance, these services enable prompt identification and response to suspicious activities, thus minimising the risk of a significant breach. To ensure maximum protection, it is crucial to have trained professionals monitoring the business network for any unusual behaviour that may indicate a potential attack.

5. Who at the firm is responsible for device discovery & continuous policy enforcement?

To improve network security, teams can identify and evaluate endpoints for vulnerabilities. If any issues are found, steps can be taken to address them, such as separating insecure endpoints from the rest of the network, and the problem can be quickly discovered and fixed if a resource violates established security policies. Newly installed devices that match a particular device profile with an active policy are also automatically protected.

Dover concluded: ‘From reading industry research and talking with our investment networks we can conclude that significant cybersecurity breaches cause material, short term declines in stock price and market share. These analyses are based on reviewing publicly disclosed breaches and tracking stock price post-breach.

Our company’s equity investment platform and products are highly secure in terms of cybersecurity. This assurance enables us to instil confidence for all our clients and the financial markets when they make long-term investment decisions. We maintain strict controls that undergo regular reviews to ensure the utmost security.

About Prism Global Group

Prism Global Group is an innovator of a new equity orientated financial infrastructure.

The company was established in Sydney and has expanded its international footprint under CEO Alev Dover. PRISM moved its global HQ to London in 2022.

This disclaimer is for Prism Global Group Plc (Reg No: 14476793), Prism Global Group Ltd (ACN 630 730 415), Prism Global (UKEUR) Ltd (Reg No 13579812), Prism Operations Australia Pty Ltd (ACN650 476 378) and Prism Securities Australia Ltd (ACN 650 488 136) and any other associated entities referred to collectively as ‘Prism’.

Prism Operations Australia Pty Ltd is a Corporate Authorised Representative (authorised representative number: 1292289) of Sanlam Private Wealth Pty Ltd (“Sanlam”) which is the holder of an Australian Financial Services Licence (AFS Licence No. 337927).

Prism Global (UKEUR) Ltd (FRN: 999737) is an Appointed Representative of Sapia Partners LLP which is authorised and regulated by the Financial Conduct Authority (FRN: 550103) as an arranger for investments only. For avoidance of doubt, Prism Global (UKEUR) Limited does not manufacture or issue investments, and only arranges for deals in investments issued by Prism Group companies.

View original content:https://www.prnewswire.co.uk/news-releases/top-5-questions-to-cover-on-cybercrime-when-looking-at-equity-investing-301957763.html

Fintech PR

7th CIIE Successfully Wraps: Highlights by the Numbers

SHANGHAI, Nov. 28, 2024 /PRNewswire/ — The 7th China International Import Expo (CIIE) drew to a successful close on November 10th in Shanghai. While many intangible achievements and connections were made, this year’s data shows how the Expo achieved unprecedented success in global participation and business opportunities. Tentative deals totaled USD 80.01 billion, marking a 2 percent increase from the previous year.

Vibrant Participation from around the World

As a crucial platform for global collaboration, the 7th CIIE invited 77 countries and international organizations from five continents for the Comprehensive Country Exhibition. Participants incorporated unique cultures, national identities, and modern technology into booth designs, with an impressive lineup of over 200 captivating events hosted at the booths. A total of 3,496 companies from 129 countries and regions participated in the Enterprise & Business Exhibition, including 1,585 companies from 104 countries in the Belt and Road Initiative, 1,106 companies from 13 countries in the Regional Comprehensive Economic Partnership, and 132 exhibitors from 35 least developed countries.

Wide Range of Cutting-Edge Innovations and Debuts

Innovative achievements and diverse debuts have consistently been a major highlight from each edition of the expo. At the 7th CIIE, the Innovation Incubation Special Section showcased 360 innovative projects from 34 countries and regions, supporting the development of small and medium-sized enterprises (SMEs) and startups. In addition, multinational companies introduced 450 new products, services, and technologies, including over 100 global launches, 40 Asia premieres, and over 200 China debuts, unlocking momentum for new drivers of consumer demand.

International Perspectives and Collaborative Dialogues at the HQF

Serving as an important platform for international communication, the Hongqiao International Economic Forum (HQF) becomes a focal point of attention at each edition of the CIIE. Focusing on trending topics, the 7th HQF attracted over 8,600 registrations and convened more than 300 globally renowned experts and leaders in politics, business, and academia. The 7th HQF also released the World Openness Report 2024 alongside the World Openness Index, delivering a message of openness and fostering international cooperation.

The 7th China International Import Expo was undoubtedly a complete success, demonstrating its significant role as a stage for advancing global cooperation. With preparations for the 8th CIIE actively underway, the expo continues to expand opportunities for global trade and economic cooperation, warmly inviting countries and enterprises from abroad to join!

Visit CIIE official website for more information: https://www.ciie.org/zbh/en/?from=prnewswire

Contact: Ms. Cui Tel.: 0086-21-968888 Email: [email protected]

Photo – https://mma.prnewswire.com/media/2569264/image_5031553_31815944.jpg

Fintech PR

Europi Property Group AB (publ) successfully issues senior unsecured green bonds

STOCKHOLM, Nov. 28, 2024 /PRNewswire/ —

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES OR TO ANY PERSON LOCATED OR RESIDENT IN ANY OTHER JURISDICTION WHERE IT IS UNLAWFUL OR WOULD REQUIRE REGISTRATION OR OTHER MEASURES TO DISTRIBUTE THIS ANNOUNCEMENT.

Europi Property Group AB (publ) (“Europi” or the “Company“) has successfully issued senior unsecured green bonds of EUR 50m under a framework of up to EUR 100m and a tenor of three years (the “Green Bonds“). The Green Bonds have a floating interest of 3M Euribor plus 500 basis points per annum. Europi intends to list the Green Bonds on the sustainable bond list of Nasdaq Stockholm within 12 months and Nasdaq Transfer Market within 60 days, with an ambition to have the Green Bonds admitted to trading within 30 days.

An amount corresponding to the net proceeds from the Green Bonds will be used in accordance with the Company’s green finance framework (the “Green Finance Framework“).

Skandinaviska Enskilda Banken AB (publ) and ABG Sundal Collier AB have acted as advisors in relation to the issue of the Green Bonds. Vinge has acted as legal counsel in relation to the issue of the Green Bonds.

More information regarding the Green Finance Framework and Sustainalytics’ second party opinion can be found at https://europi.se/bond-investors/

For further information, please contact:

Jonathan Willén, CEO, [email protected]

+46 (0) 8 411 55 77

About Europi (www.europi.se)

Europi Property Group, founded in 2019, is a pan-European real estate investment company headquartered in Stockholm (with an office also in London) investing discretionary capital across all sectors with a flexible investment strategy. Europi has since inception completed public and private transactions of more than €700m in gross asset value alongside its established network of local operating partners and completed four successful exists. By combining a truly entrepreneurial, active ownership approach with focus on social and environmental sustainability, Europi generates long term value and positive impact for all stakeholders.

This information was brought to you by Cision http://news.cision.com

View original content:https://www.prnewswire.co.uk/news-releases/europi-property-group-ab-publ-successfully-issues-senior-unsecured-green-bonds-302318389.html

Fintech PR

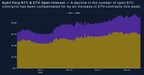

Bybit x Block Scholes Derivatives Report: ETH Outperforms BTC

DUBAI, UAE, Nov. 28, 2024 /PRNewswire/ — Bybit, the world’s second-largest cryptocurrency exchange by trading volume, in collaboration with Blocks Scholes, released the latest weekly derivatives analytics report and uncovered signals indicating ETH’s rise above BTC in the past week.

Fueled by news of current U.S. SEC Chair Gary Gensler’s departure at the end of the Biden administration’s term, ETH performance has positively surprised investors. In particular, open interest in ETH perpetual has been on the rise. Several large-cap altcoins also benefited from Gensler’s announcement, anticipating less scrutiny upcoming January.

Key Insights:

ETH outperformed BTC in open interest: Perpetual swap data has seen a gradual decline in BTC open interest while ETH contracts increased. ETH has also been taking a bigger share of daily trading volumes in the past 6-month time frame despite an overall slower market this week. The optimism could be attributed to hopeful investors’ expectation of a more crypto-friendly SEC Chair after Gensler’s last day on Jan. 20, 2025.

BTC price in retreat: BTC price’s ebbing from the $100K mark has flattened the ATM volatility term structure, with short-tenor options dipping below 60%. This mirrors a pattern observed since the U.S. election. Lower realized volatility explains the drop, while open interest in calls and puts remains unchanged, demands for short-term options this week have stagnated.

ETH options – bullish sentiment in moderation: ETH options show slightly more bullish sentiment than BTC options. Markets have recalibrated after the post-election high, but call options remain in the lead in both trading volumes and open interests.

Access the Full Report:

Read the full report in context here.

#Bybit / #TheCryptoArk /#BybitResearch

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving over 50 million users. Established in 2018, Bybit provides a professional platform where crypto investors and traders can find an ultra-fast matching engine, 24/7 customer service, and multilingual community support. Bybit is a proud partner of Formula One’s reigning Constructors’ and Drivers’ champions: the Oracle Red Bull Racing team.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: [email protected]

For more information, please visit: https://www.bybit.com

For updates, please follow: Bybit’s Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

Photo – https://mma.prnewswire.com/media/2569395/Bybit_x_Block_Scholes_Derivatives_Report_ETH_Outperforms_BTC.jpg

Logo – https://mma.prnewswire.com/media/2267288/Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/bybit-x-block-scholes-derivatives-report-eth-outperforms-btc-302318387.html

View original content:https://www.prnewswire.co.uk/news-releases/bybit-x-block-scholes-derivatives-report-eth-outperforms-btc-302318387.html

-

Fintech PR7 days ago

Fintech PR7 days agoAlkira Ranked 25th Fastest-Growing Company in North America and 6th in the Bay Area on the 2024 Deloitte Technology Fast 500™

-

Fintech2 days ago

Fintech2 days agoFintech Pulse: A Daily Dive into Industry Innovations and Developments

-

Fintech PR7 days ago

Fintech PR7 days agoCorinex Ranked Number 331 Fastest-Growing Company in North America on the 2024 Deloitte Technology Fast 500™

-

Fintech PR6 days ago

Fintech PR6 days agoROYAL CANADIAN MINT REPORTS PROFITS AND PERFORMANCE FOR Q3 2024

-

Fintech PR7 days ago

Fintech PR7 days agoCathay Financial Holdings Advances Climate Finance Leadership at COP29, Championing Public-Private Partnerships and Asia’s Low-Carbon Transition

-

Fintech PR6 days ago

Fintech PR6 days agoRedefining Financial Frontiers: Nucleus Software Celebrates 30 Years with Synapse 2024 in Singapore

-

Fintech2 days ago

Fintech2 days agoFormer MD of SUI Foundation, Greg Siourounis, Joins xMoney Global as Co-Founder and CEO to build MiCA-Regulated Stablecoin Platform

-

Fintech PR7 days ago

Fintech PR7 days agoEliTe Solar: Realizing Our Mission and Standing by Our Core Values