Fintech PR

Aghanim, a mobile gaming fintech company founded by former CEO and CTO of Xsolla, launches to transform how mobile games are monetized and distributed

Company is backed by Bessemer Venture Partners, QED Investors, Point72 Ventures, and A16Z GAMES SPEEDRUN

LOS ANGELES, Feb. 14, 2024 /PRNewswire/ — Aghanim, an integrated commerce, liveops automation, community engagement, and payments platform for mobile games soft-launched today by the former CEO and CTO from Xsolla, a global video game payments company.

Empowering Game Studios with Innovative Solutions

Los Angeles-based Aghanim has built a direct-to-consumer platform that enables mobile game developers to create web-based game hubs and deliver personalized offers, while engaging player communities with a variety of metagame experiences such as news, leaderboards, achievements, daily rewards, and more. Publishers also receive Merchant of Record-level commerce support, meaning that back-office financial tasks related to fraud, taxes, regulatory compliance, currency exchanges, and other aspects of accepting payments on a multinational scale are already handled for them.

Aghanim’s core team has an extensive track record delivering platform-expansion enablement solutions through a variety of video game companies, decades of experience in gaming, and over 20 years’ combined expertise at the intersection of fintech and video games. The company was founded by Konstantin Golubitsky, former CEO and CTO of Xsolla, Constantin Andry, former CEO of Xsolla Labs, and Albert Tugushev, former CTO of Xsolla Labs, who saw an opportunity to fundamentally transform the landscape of mobile gaming by reimagining distribution and monetization strategies, thereby unlocking billions in value for video game studios and ensuring this newfound wealth remains circulating within the broader video game ecosystem, fostering the creation of new games, demand for new technologies, and ultimately making the world a better place.

Aghanim significantly lowered barriers for mobile-to-web expansion for mobile games, helping studios of all sizes to perform direct-to-consumer distribution and multiply their net revenues as a result. With higher margins, game studios can more competitively execute their user acquisition strategies to scale their games.

Introducing Aghanim’s Core Product Suite:

Game Hub Builder: A code-free website creation tool that empowers game studios to establish a captivating web-based home for their mobile games. Within minutes, developers can create a customized game hub that aligns seamlessly with their brand identity. Powered by generative AI, the Game Hub Builder generates an initial version of the hub, allowing studios to fine-tune colors, visuals, and overall user experience.

LiveOps Builder: A groundbreaking visual marketing automation tool that keeps players engaged and excited. With LiveOps Builder, studios can precisely target different player segments across channels. Tailored campaigns and individual offers—triggered by events like cart abandonment, game hub visits, and leveling up—create a personalized experience for players. Messaging channels such as pop-ups, in-game and browser push notifications, and emails ensure seamless communication.

Player Segmentation: A sophisticated system that categorizes players based on behavior, preferences, and engagement patterns. By understanding player segments, studios can tailor their strategies, optimize monetization, and enhance overall game experiences.

SKU Management: Simplifying the management of stock-keeping units (SKUs) for game studios, this tool streamlines the process of tracking inventory, sales, and revenue. With SKU Management Tool, studios can focus on creating exceptional games while leaving the back-office financial work to Aghanim.

Billing Engine: A mobile-first checkout experience, built with an obsession for constant optimization of distribution costs, offers the most valuable payment options, including credit cards, ACH, Apple Pay, and others.

Constantin Andry, co-founder of Aghanim, said in a statement, “In context of shrinking net revenues due to constantly worsening user acquisition environment, and in light of the latest changes in the regulatory space and Apple’s response to these changes, it becomes clear that not having a direct-to-consumer strategy could be an existential threat for mobile game publishers who have historically been too reliant on distribution channels. Studios are now strategically considering having their own standalone game hub rather than web checkout that barely delivers results.”

“Due to the high variety of player profiles and specifics of distribution channels, player segmentation and liveops have become must-have capabilities for every game studio that wants to be competitive in the space. However, they’re often managed somewhat manually from spreadsheets. Since Aghanim is hyper-focused on serving mobile games, segmentation and liveops are built into the very foundation of the platform,” says Albert Tugushev, co-founder of Aghanim.

Aghanim’s conversational analytics is performed by the company’s generative AI copilot, Newton, which proactively searches for anomalies, trends, and growth hacks and suggests improvements based on those findings. “Soon, you will be able to simply task Newton to increase LTV and cut distribution costs, and he will work 24/7/365 to A/B test email messaging, experiment with monetization offers, and run it all through different segments within the available toolset to achieve the best possible result for you.” says Konstantin Golubitsky, another co-founder of Aghanim.

Aghanim is designed as an open platform that welcomes gaming experts, marketing agencies, and gaming tool providers to sign up or complete a pre-integration to become easily accessible to Aghanim partners through their Connectors Marketplace and Experts Directory.

The company will launch an advisory board with key partners to enhance the platform and align priorities.

Aghanim has raised strategic financing from a syndicate of four US-based VC firms: early Shopify investor Bessemer Venture Partners, Point72 Ventures, leading fintech VC firm QED Investors, and from the A16Z GAMES SPEEDRUN, a well-known leader in tech x games investments.

About Aghanim

Founded in June 2023, Aghanim is poised to transform the way mobile games are monetized and distributed. For more information, visit Aghanim’s website.

Press Contact: [email protected]

Follow Aghanim on LinkedIn, Twitter, Facebook, and Instagram for updates.

Photo – https://mma.prnewswire.com/media/2340194/Aghanim_1.jpg

Photo – https://mma.prnewswire.com/media/2340195/Aghanim_2.jpg

Logo – https://mma.prnewswire.com/media/2340196/Logo_Logo.jpg

Fintech PR

7th CIIE Successfully Wraps: Highlights by the Numbers

SHANGHAI, Nov. 28, 2024 /PRNewswire/ — The 7th China International Import Expo (CIIE) drew to a successful close on November 10th in Shanghai. While many intangible achievements and connections were made, this year’s data shows how the Expo achieved unprecedented success in global participation and business opportunities. Tentative deals totaled USD 80.01 billion, marking a 2 percent increase from the previous year.

Vibrant Participation from around the World

As a crucial platform for global collaboration, the 7th CIIE invited 77 countries and international organizations from five continents for the Comprehensive Country Exhibition. Participants incorporated unique cultures, national identities, and modern technology into booth designs, with an impressive lineup of over 200 captivating events hosted at the booths. A total of 3,496 companies from 129 countries and regions participated in the Enterprise & Business Exhibition, including 1,585 companies from 104 countries in the Belt and Road Initiative, 1,106 companies from 13 countries in the Regional Comprehensive Economic Partnership, and 132 exhibitors from 35 least developed countries.

Wide Range of Cutting-Edge Innovations and Debuts

Innovative achievements and diverse debuts have consistently been a major highlight from each edition of the expo. At the 7th CIIE, the Innovation Incubation Special Section showcased 360 innovative projects from 34 countries and regions, supporting the development of small and medium-sized enterprises (SMEs) and startups. In addition, multinational companies introduced 450 new products, services, and technologies, including over 100 global launches, 40 Asia premieres, and over 200 China debuts, unlocking momentum for new drivers of consumer demand.

International Perspectives and Collaborative Dialogues at the HQF

Serving as an important platform for international communication, the Hongqiao International Economic Forum (HQF) becomes a focal point of attention at each edition of the CIIE. Focusing on trending topics, the 7th HQF attracted over 8,600 registrations and convened more than 300 globally renowned experts and leaders in politics, business, and academia. The 7th HQF also released the World Openness Report 2024 alongside the World Openness Index, delivering a message of openness and fostering international cooperation.

The 7th China International Import Expo was undoubtedly a complete success, demonstrating its significant role as a stage for advancing global cooperation. With preparations for the 8th CIIE actively underway, the expo continues to expand opportunities for global trade and economic cooperation, warmly inviting countries and enterprises from abroad to join!

Visit CIIE official website for more information: https://www.ciie.org/zbh/en/?from=prnewswire

Contact: Ms. Cui Tel.: 0086-21-968888 Email: [email protected]

Photo – https://mma.prnewswire.com/media/2569264/image_5031553_31815944.jpg

Fintech PR

Europi Property Group AB (publ) successfully issues senior unsecured green bonds

STOCKHOLM, Nov. 28, 2024 /PRNewswire/ —

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES OR TO ANY PERSON LOCATED OR RESIDENT IN ANY OTHER JURISDICTION WHERE IT IS UNLAWFUL OR WOULD REQUIRE REGISTRATION OR OTHER MEASURES TO DISTRIBUTE THIS ANNOUNCEMENT.

Europi Property Group AB (publ) (“Europi” or the “Company“) has successfully issued senior unsecured green bonds of EUR 50m under a framework of up to EUR 100m and a tenor of three years (the “Green Bonds“). The Green Bonds have a floating interest of 3M Euribor plus 500 basis points per annum. Europi intends to list the Green Bonds on the sustainable bond list of Nasdaq Stockholm within 12 months and Nasdaq Transfer Market within 60 days, with an ambition to have the Green Bonds admitted to trading within 30 days.

An amount corresponding to the net proceeds from the Green Bonds will be used in accordance with the Company’s green finance framework (the “Green Finance Framework“).

Skandinaviska Enskilda Banken AB (publ) and ABG Sundal Collier AB have acted as advisors in relation to the issue of the Green Bonds. Vinge has acted as legal counsel in relation to the issue of the Green Bonds.

More information regarding the Green Finance Framework and Sustainalytics’ second party opinion can be found at https://europi.se/bond-investors/

For further information, please contact:

Jonathan Willén, CEO, [email protected]

+46 (0) 8 411 55 77

About Europi (www.europi.se)

Europi Property Group, founded in 2019, is a pan-European real estate investment company headquartered in Stockholm (with an office also in London) investing discretionary capital across all sectors with a flexible investment strategy. Europi has since inception completed public and private transactions of more than €700m in gross asset value alongside its established network of local operating partners and completed four successful exists. By combining a truly entrepreneurial, active ownership approach with focus on social and environmental sustainability, Europi generates long term value and positive impact for all stakeholders.

This information was brought to you by Cision http://news.cision.com

View original content:https://www.prnewswire.co.uk/news-releases/europi-property-group-ab-publ-successfully-issues-senior-unsecured-green-bonds-302318389.html

Fintech PR

Bybit x Block Scholes Derivatives Report: ETH Outperforms BTC

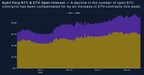

DUBAI, UAE, Nov. 28, 2024 /PRNewswire/ — Bybit, the world’s second-largest cryptocurrency exchange by trading volume, in collaboration with Blocks Scholes, released the latest weekly derivatives analytics report and uncovered signals indicating ETH’s rise above BTC in the past week.

Fueled by news of current U.S. SEC Chair Gary Gensler’s departure at the end of the Biden administration’s term, ETH performance has positively surprised investors. In particular, open interest in ETH perpetual has been on the rise. Several large-cap altcoins also benefited from Gensler’s announcement, anticipating less scrutiny upcoming January.

Key Insights:

ETH outperformed BTC in open interest: Perpetual swap data has seen a gradual decline in BTC open interest while ETH contracts increased. ETH has also been taking a bigger share of daily trading volumes in the past 6-month time frame despite an overall slower market this week. The optimism could be attributed to hopeful investors’ expectation of a more crypto-friendly SEC Chair after Gensler’s last day on Jan. 20, 2025.

BTC price in retreat: BTC price’s ebbing from the $100K mark has flattened the ATM volatility term structure, with short-tenor options dipping below 60%. This mirrors a pattern observed since the U.S. election. Lower realized volatility explains the drop, while open interest in calls and puts remains unchanged, demands for short-term options this week have stagnated.

ETH options – bullish sentiment in moderation: ETH options show slightly more bullish sentiment than BTC options. Markets have recalibrated after the post-election high, but call options remain in the lead in both trading volumes and open interests.

Access the Full Report:

Read the full report in context here.

#Bybit / #TheCryptoArk /#BybitResearch

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving over 50 million users. Established in 2018, Bybit provides a professional platform where crypto investors and traders can find an ultra-fast matching engine, 24/7 customer service, and multilingual community support. Bybit is a proud partner of Formula One’s reigning Constructors’ and Drivers’ champions: the Oracle Red Bull Racing team.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: [email protected]

For more information, please visit: https://www.bybit.com

For updates, please follow: Bybit’s Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

Photo – https://mma.prnewswire.com/media/2569395/Bybit_x_Block_Scholes_Derivatives_Report_ETH_Outperforms_BTC.jpg

Logo – https://mma.prnewswire.com/media/2267288/Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/bybit-x-block-scholes-derivatives-report-eth-outperforms-btc-302318387.html

View original content:https://www.prnewswire.co.uk/news-releases/bybit-x-block-scholes-derivatives-report-eth-outperforms-btc-302318387.html

-

Fintech7 days ago

Fintech7 days agoFintech Pulse: Daily Industry Brief – A Dive into Today’s Emerging Trends and Innovations

-

Fintech PR6 days ago

Fintech PR6 days agoAlkira Ranked 25th Fastest-Growing Company in North America and 6th in the Bay Area on the 2024 Deloitte Technology Fast 500™

-

Fintech2 days ago

Fintech2 days agoFintech Pulse: A Daily Dive into Industry Innovations and Developments

-

Fintech PR6 days ago

Fintech PR6 days agoCorinex Ranked Number 331 Fastest-Growing Company in North America on the 2024 Deloitte Technology Fast 500™

-

Fintech PR6 days ago

Fintech PR6 days agoCathay Financial Holdings Advances Climate Finance Leadership at COP29, Championing Public-Private Partnerships and Asia’s Low-Carbon Transition

-

Fintech PR6 days ago

Fintech PR6 days agoROYAL CANADIAN MINT REPORTS PROFITS AND PERFORMANCE FOR Q3 2024

-

Fintech PR6 days ago

Fintech PR6 days agoRedefining Financial Frontiers: Nucleus Software Celebrates 30 Years with Synapse 2024 in Singapore

-

Fintech PR6 days ago

Fintech PR6 days agoEliTe Solar: Realizing Our Mission and Standing by Our Core Values