Fintech PR

RepRisk data shows decrease in greenwashing for first time in six years, but severity of incidents is on the rise

Research by RepRisk reveals a 12% year-on-year decrease of companies linked to greenwashing, signaling a major shift in corporate behavior

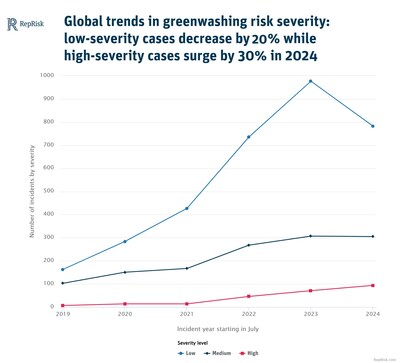

- Despite an overall decline, high-risk cases of greenwashing surged by over 30%.

- Nearly 30% of companies linked to greenwashing in 2023 were repeat offenders in 2024.

- While the Banking and Financial Services sector experienced a 70% increase in climate-related greenwashing risk last year, this year’s report reveals a 20% decrease.

ZURICH, Oct. 9, 2024 /PRNewswire/ — New research from RepRisk, a global leader in ESG data technology, shows a 12% decrease in greenwashing risk globally across all sectors during the year ending in June 2024. This is the first such decrease in six years.

RepRisk’s third annual greenwashing report finds this is likely the result of increased regulatory measures and companies engaging in greenhushing out of fear of pushback from stakeholders, especially consumers, investors, and regulators. While the prevalence of incidents has fallen, the number of severe greenwashing cases has increased by 30%, indicating there is still work to be done.

“Stakeholders are more aware of greenwashing risk than ever before,” commented Dr. Philipp Aeby, CEO and Co-Founder of RepRisk. “While regulators have successfully pushed forward legislation to deter greenwashing, the risk will keep evolving as new forms emerge, leaving companies open to reputational damage which impacts their bottom line. Greenwashing is often driven by corporate narratives. To uncover it, investors and companies should rely on what external sources reveal about these claims.”

The fall in net cases underlines that companies are increasingly cognizant that greenwashing is a material offence and are taking proactive steps to mitigate exposure. This is an encouraging sign for governing bodies banking on pending and active greenwashing legislation to instigate change.

However, RepRisk data found that 30% of all companies linked to greenwashing in 2023 were also flagged in 2024. This indicates that while public perception is having a big impact on the overall downward trend, more regulation, coupled with transparent data, is needed to reduce protracted cases and tackle the growing number of severe incidents.

The report also signals a significant shift in the greenwashing landscape of Banking and Financial Services. While the sector experienced a 70% increase in climate-related greenwashing from 2022 to 2023 – a trend also reflected in a report from the European Banking Authority published this summer – new RepRisk data reveals a 20% decrease in incidents globally across the sector from 2023 to 2024. Just over a third (36%) of financial companies linked to greenwashing last year were also linked to greenwashing in 2024, slightly above the 30% average across all sectors.

It is clear that regulation has had an impact on the overall downward trend. The UK saw a relatively modest reduction in incidents of 4%, whereas there was a 20% decline in the EU, which led the regulation wave based on the sheer volume of legislation that went into effect in the past 12 months. For example, the EU’s Green Claims Directive mandates that companies substantiate their environmental claims with robust evidence, contributing to a reduction in incidents across the continent.

However, regulation may not be the sole driver, as US greenwashing trends paint a different picture. Greenwashing cases in the US peaked in 2022, with 503 incidents – a 35% year-over-year increase from 2021. This was followed by a 10% decline in 2023 and a modest 6% rise in 2024. One possible explanation for the divergence in the US is the increasing politicization of ESG. The earlier decline may be linked to companies and funds becoming more cautious about promoting their green credentials, responding to pressure from investors, state attorneys general, and other state-level political figures opposed to considering ESG criteria in investments.

Notes to Editors

RepRisk captures greenwashing through the intersection of two criteria: (1) misleading communication and (2) an environmental issue such as local pollution or impacts on ecosystems and biodiversity. ESG risk incidents in this scope may include criticism of an advertising campaign deceiving consumers on environmental impacts, research findings revealing that a company is overstating the impact of an initiative, or coverage of company actions in direct contrast to climate commitments.

By excluding company self-disclosures in its data generation, RepRisk illuminates business conduct risks that could otherwise be obscured and could materialize into adverse impacts.

RepRisk determines severity as a function of three dimensions: firstly, the consequences of the risk incident (e.g., the scale of actual environmental repercussions relative to the green claims); secondly, the extent of the impact (e.g., one person, a group of people, a large number of people); and thirdly, whether the risk incident was caused by accident, negligence, or intent, or even in a systematic way. There are three levels of severity: low severity, medium severity, and high severity.

To provide more up-to-date data, RepRisk has discontinued the use of calendar years. While the 2023 report presented results based on both calendar years and the period from September 1, 2022, to August 31, 2023, the 2024 report adopts a uniform timeframe from July 1 to June 30 for all years from 2019 to 2024.

Later this year, RepRisk will expand its methodology by introducing six new Topic Tags. Alongside Greenwashing, the new tags will include Artificial intelligence, Deforestation, Ecocide, Mercury, and Social washing.

About RepRisk

RepRisk is a global leader in identifying and assessing business conduct and ESG risks for organizations worldwide. RepRisk focuses on what companies may not disclose, uncovering risks such as deforestation, human rights abuses, and corruption, giving stakeholders a clearer view of their business relationships and investments.

Through a combination of advanced AI with human expertise in 23 languages, RepRisk delivers daily updated data on business conduct risks for organizations of all sizes. RepRisk’s transparent and consistent methodology, refined over nearly two decades, transforms risk incidents into actionable insights to conduct due diligence and mitigate risk exposure.

RepRisk saves clients valuable time on research and analysis, empowering decision-makers to make fast, informed decisions that protect their interests, enhance value, and promote sustainability. Trusted by over 80 of the world’s leading banks, 17 of the 25 largest investment managers, top corporations, and the world’s largest sovereign wealth funds, RepRisk sets the global standard for business conduct data.

Visit us at www.reprisk.com.

Contact:

Mathias Fürer

Corporate Communications Manager

[email protected]

+41 41 552 30 01

Photo – https://mma.prnewswire.com/media/2526214/RepRisk_1.jpg

Photo – https://mma.prnewswire.com/media/2526215/RepRisk_2.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/reprisk-data-shows-decrease-in-greenwashing-for-first-time-in-six-years-but-severity-of-incidents-is-on-the-rise-302270751.html

View original content:https://www.prnewswire.co.uk/news-releases/reprisk-data-shows-decrease-in-greenwashing-for-first-time-in-six-years-but-severity-of-incidents-is-on-the-rise-302270751.html

Fintech PR

Wahed appoints Khalid Al Jassim as Executive Chairman of Wahed MENA to help guide the strategic growth of Wahed in the region

DOHA, Qatar, Nov. 24, 2024 /PRNewswire/ — Wahed, a global Shariah-compliant fintech, has appointed Khalid Al Jassim as Chairman of Wahed MENA.

On this appointment, Khalid commented, ”I am excited to guide Wahed’s growth in the region. Wahed’s mission of furthering Islamic Finance is one I resonate with deeply and I look forward to supporting its growth ambitions.”

Khalid has over twenty five years of investment banking and corporate advisory experience gained with some of the most innovative and groundbreaking institutions in the world.

His career spans leading firms including SABIC, Arthur Anderson and Arcapita Bank in Bahrain, where he was instrumental in making it into one of the PE powerhouses in the region. His responsibilities started in the earlier years with establishing the Investment Placement Team and transforming it into one of the most robust teams in the industry. At the time that Khalid left Arcapita to build his personal business, he was an Executive Director. Today he is Chairman of Afkar Vision, a private advisory house specialized in mergers and acquisitions with offices in Manama, Dubai and Riyadh.

As well as being one of the earliest investors in Wahed, he is currently Chairman of the Audit Committee and Board Member at Bahrain Islamic Bank, the 4th oldest Islamic Bank in the World and Board Member at SICO Bank and SICO Capital in Saudi, an $8bn asset manager in the region.

Mohsin Siddiqui, Wahed CEO said, “We are delighted to announce Khalid’s appointment. His unique understanding of the financial landscape in the MENA region is unparalleled and we are excited to bring this expertise in continuing to grow our presence in the region.”

About Wahed

Founded in 2015, Wahed is a financial technology company that is advancing financial inclusion through accessible, affordable, and values-based investing. The company has made significant inroads in the world Shariah compliant investing by creating an easy-to-use digital platform that provides a suite of Shariah compliant investing products including managed portfolios and venture and real estate investments. Wahed caters to over 400,000 customers globally and manages over $ 1 billion in assets.

For more information, visit: www.wahed.com

Photo – https://mma.prnewswire.com/media/2566076/Wahed_MENA_Khalid_Al_Jassim.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/wahed-appoints-khalid-al-jassim-as-executive-chairman-of-wahed-mena-to-help-guide-the-strategic-growth-of-wahed-in-the-region-302314779.html

View original content:https://www.prnewswire.co.uk/news-releases/wahed-appoints-khalid-al-jassim-as-executive-chairman-of-wahed-mena-to-help-guide-the-strategic-growth-of-wahed-in-the-region-302314779.html

Fintech PR

Qatar Development Bank announces strategic investment in global Islamic FinTech, Wahed

DOHA, Qatar, Nov. 24, 2024 /PRNewswire/ — Qatar Development Bank (QDB) announces a strategic investment in Wahed, a global Shariah-compliant fintech.

Wahed currently manages over $1 billion in assets and has attracted over 400,000 clients worldwide. The company is built on the principles of democratizing access to financial services and offers clients access to Shariah-compliant investments in its mobile app. Wahed removes the barriers to sophisticated investment management services that have been traditionally reserved for high-net-worth investors.

Khalid Al Jassim, Executive Chairman of Wahed MENA said: ‘We are delighted to welcome our new shareholders, QDB. We believe Qatar is fully aligned with our mission in creating a technology-first Islamic finance leader that unlocks a financial ecosystem free from Riba. We look forward to supporting the Qatar National Vision 2030 of becoming a leading knowledge-based economy.

Ali Rahimtula, Partner at Cue Ball Capital said: “Qatar Development Bank’s strategic investment is a clear signal of the faith the industry has in Wahed and its ability to create the future of Islamic Finance.”

About Wahed

Founded in 2015, Wahed is a financial technology company that is advancing financial inclusion through accessible, affordable, and values-based investing. The company has made significant inroads in the world Shariah compliant investing by creating an easy-to-use digital platform that provides a suite of Shariah compliant investing products including managed portfolios and venture and real estate investments. Wahed caters to over 400,000 customers globally and manages over $ 1 billion in assets.

For more information, visit: www.wahed.com

About Qatar Development Bank

Qatar Development Bank’s mission is to advance the economic and innovation development cycle of Qatar, supporting and contributing to the nation’s economic diversification. As well as a focus on the development of Qatar’s private sector, QDB is a powerful catalyst for socio-economic development in the country, empowering the local economy and bettering living standards.

For more information, visit: https://www.qdb.qa/

Photo – https://mma.prnewswire.com/media/2566075/Qatar_Development_Bank_Announcement.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/qatar-development-bank-announces-strategic-investment-in-global-islamic-fintech-wahed-302314778.html

View original content:https://www.prnewswire.co.uk/news-releases/qatar-development-bank-announces-strategic-investment-in-global-islamic-fintech-wahed-302314778.html

Fintech PR

China’s AIMA brand electric motorbike is now in Bangladesh

DHAKA, Bangladesh, Nov. 23, 2024 /PRNewswire/ — With the popularity of electric vehicles in Bangladesh, the globally renowned AIMA brand has also arrived in Bangladesh. The esteemed DX Group has brought the AIMA F-626 to customers. This environmentally friendly battery-operated electric motorbike has already been approved by the Bangladesh Road Transport Authority (BRTA) now.

In light of the increasing popularity of electric motorcycles in the country, the internationally-leading brand AIMA has entered the market. By the end of 2023, AIMA electric two-wheelers had established a presence in over 50 countries worldwide, with 11 global production bases, including overseas factories in Indonesia and Vietnam. In 2022, AIMA collaborated with Rob Janoff, the designer of the Apple logo, to refresh the brand’s VI system with a youthful and fashionable image. In 2023, AIMA teamed up with PANTONE, the global authority in color expertise, to create the trending color of the year. As an industry leader, AIMA spearheads the electric two-wheeler sector and showcases the prowess of a leading electric two-wheeler brand on a global scale. As of March 31, 2024, AIMA’s total electric two-wheeler sales had reached 80 million units, earning certification from Frost & Sullivan, a globally recognized business growth consulting firm, as the “Global Leading Electric Two-wheeler Brand”.

Over the years, AIMA has always been a product trendsetter in the electric two-wheeler sector. As of March 31, 2024, the total sales volume of AIMA electric two-wheelers reached 80 million, and Frost & Sullivan, a world-renowned market consulting company, awarded AIMA with the market status certification of the “Global Leading Electric Two-wheeler Brand (by Sales)”.

AIMA adhere to the customer-centered product philosophy and technologies that support long-term innovation and breakthroughs. We believe that the efficiency and modern technology of the AIMA F-626 will present an excellent alternative means of communication for our customers.

Photo – https://mma.prnewswire.com/media/2557788/image.jpg

Photo – https://mma.prnewswire.com/media/2565550/Image2.jpg

Logo – https://mma.prnewswire.com/media/2449955/5026987/AIMA_Technology_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/chinas-aima-brand-electric-motorbike-is-now-in-bangladesh-302314773.html

View original content:https://www.prnewswire.co.uk/news-releases/chinas-aima-brand-electric-motorbike-is-now-in-bangladesh-302314773.html

-

Fintech4 days ago

Fintech4 days agoFintech Pulse: Industry Updates, Innovations, and Strategic Moves

-

Fintech3 days ago

Fintech3 days agoFintech Pulse: Daily Industry Brief – A Dive into Today’s Emerging Trends and Innovations

-

Fintech PR3 days ago

Fintech PR3 days agoTAILG Represents the Industry at COP29, Advancing South-South Cooperation with Low-Carbon Solutions

-

Fintech PR4 days ago

Fintech PR4 days agoROLLER Releases 2025 Attractions Industry Benchmark Report, Unveiling Key Trends and Revenue Strategies

-

Fintech5 days ago

Fintech5 days agoFintech Pulse: Milestones, Partnerships, and Transformations in Fintech

-

Fintech6 days ago

Fintech6 days agoFintech Pulse: Navigating Expansion, Innovation, and Sustainability

-

Fintech PR2 days ago

Fintech PR2 days agoAlkira Ranked 25th Fastest-Growing Company in North America and 6th in the Bay Area on the 2024 Deloitte Technology Fast 500™

-

Fintech PR4 days ago

Fintech PR4 days agoThe CfC St. Moritz Announces New Speakers from BlackRock, Binance, Bpifrance, Temasek, PayPal, and More for Upcoming 2025 Conference