Fintech PR

FinVolution Group’s Subsidiary Receive Approval to Connect to The People’s Bank of China Credit Reference Center

FinVolution Group (formerly known as “PPDAI,” or the “Company”) (NYSE: FINV), a leading fintech platform in China, today announced the People’s Bank of China (PBOC) has approved the Company’s online micro-lending subsidiary to be connected to the PBOC Credit Reference Center, which will allow the subsidiary to access and update borrowers’ credit records to the Credit Reference Center.

Mr. Feng Zhang, Co-Chief Executive Officer of the Company commented, “We are excited to align ourselves with the PBOC Credit Reference Center, which will enhance our risk assessment capabilities and also contribute to the strengthening of the country’s credit infrastructure. Together with the access to Baihang Credit and the National Internet Finance Association’s credit information system, and with our advanced technology capabilities, we are well equipped to effectively manage credit risk and capture the opportunities in China’s consumer finance sector.”

SOURCE FinVolution Group

Fintech PR

AL-BAHAR GROUP INCREASES INVESTMENT IN YOTEL

YOTEL ANNOUNCES PLAN TO DOUBLE PORTFOLIO IN THE NEXT FIVE YEARS

LONDON, April 1, 2025 /PRNewswire/ — YOTEL, the global hotel brand challenging the status quo of the hospitality industry, (‘YOTEL’ or ‘the Company’), announces today that its majority shareholder the Al-Bahar Group (‘the Group’) has acquired an additional 30% stake in the Company. The stake was previously held by a controlled affiliate of Starwood Capital Group (“Starwood Capital”), a global investment firm focused on real estate. The investment increases the Group’s holding in YOTEL to more than 95%.

Talal Al Bahar, Chairman, YOTEL and Al-Bahar Group comments:

“I am delighted with the YOTEL team’s incredible achievements over the last 15 years. From humble beginnings, YOTEL is now a global company with an expansive portfolio of properties in prime locations. We are profitable, financially self-sustaining and growing rapidly.

I am truly grateful to Starwood Capital for their contribution to this success and for eight years of strong partnership.

Our investment today underscores our confidence in the future of YOTEL. Going forward, we will be looking for new and diverse opportunities to develop YOTEL’s brand awareness, franchise model and distribution, to support our ambitious growth plans. We are also making additional capital available for exceptional development opportunities. We are building YOTEL’s exciting future on very strong foundations.”

Hubert Viriot, CEO, YOTEL comments:

“Talal’s vision made YOTEL the success we are today. His additional investment is not just an endorsement of our potential, it also makes us more competitive and agile, simplifying our structure and giving us access to additional growth capital.

YOTEL is now one of very few independent, global asset-light hotel brands. Independence and financial stability give us a unique edge: enabling us to focus on delivering an exceptional guest experience and on long-term portfolio development.

In recent years we have significantly strengthened our senior team and built-out a sophisticated operating platform, to support our portfolio and accelerate future growth. YOTEL has an exciting future ahead with a strong development pipeline and, as announced in Berlin today at IHIF 2025, a plan to double the YOTEL portfolio to 15,000 rooms globally by 2030.”

Tim Abram, Managing Director, Global Co-Head of Hotels, Starwood Capital, comments:

“We would like to thank the Al-Bahar Group along with the rest of the Board, the Management team, and all the employees at YOTEL for their partnership and hard work over the last eight years. YOTEL has achieved tremendous growth over this time period, which is something everyone can be proud of.

We wish the company the best of luck on the next exciting chapter of growth and meanwhile remain an enthusiastic partner of YOTEL as owners of two YOTEL properties.”

Starwood Capital, through its controlled affiliates, has been a powerful development partner, providing capital and expertise, helping to institutionalise the Company and grow the YOTEL portfolio from six to 34 properties (see appendix) in prime locations around the world.

About YOTEL

YOTEL is a global hospitality brand based in London, with regional offices in the US and Asia. It has a portfolio of three brands: YOTEL (city centre hotels), YOTELPAD (extended stay option) and YOTELAIR (airport hotels).

The Company has 23 operating hotels across 16 buzzing cities and airports around the world including New York, Boston, San Francisco, Washington D.C., Miami, Tokyo, Singapore, Edinburgh, London, Amsterdam, Porto, Geneva, Glasgow, Manchester, Paris, and Istanbul. In addition, it has 11 hotels in the pipeline due to open over the next 24 months in Lisbon, London, Belfast, Bangkok, Kuala Lumpur, New York, NEOM (Kingdom of Saudi Arabia) and Perth.

NOTE: The Al-Bahar Group’s stake is held through three different entities: United Investment Portugal, Kuwait Real Estate Company (Aqarat) and Med Al-Bahar International Limited.

The Al-Bahar Group has been invested in YOTEL since inception in 2005 and the Company’s major shareholder since 2013.

About Al-Bahar Group

Al-Bahar Group is a diversified conglomerate comprising listed and unlisted companies across multiple sectors in the Gulf and beyond. Under the leadership of Talal Al-Bahar, the group maintains a strong presence in financial services, real estate, insurance and food, while expanding its footprint through strategic investments and subsidiaries.

In Kuwait’s public market, Al-Bahar Group includes leading financial institutions such as Arzan Financial Group for Finance and Investment, Aldeera Holding, and International Financial Advisors Holding; real estate companies Kuwait Real Estate Company (AQARAT) and IFA Hotels and Resorts; and First Takaful Insurance Company providing Sharia-compliant insurance solutions.

Talal Al-Bahar also represents the group’s interests in Boursa Kuwait, Kuwait’s national stock exchange and in MIAX, a U.S.-based operator of global financial exchanges and execution services.

Al-Bahar Group’s companies also include EFS Facilities Services, United Hospitality Management (UHM), Strive Services Group, and Domus Managed Housing.

EFS is a regional powerhouse in integrated facilities management, operating across 25 countries while managing over 75 million square meters of real estate and a contract backlog exceeding $2.5 billion.

UHM brings +30 years of luxury hospitality expertise as a global management company, partnering with world-class brands including Marriott’s Luxury Collection, IHG’s Vignette Collection, Hyatt, Wyndham, Sheraton, YOTEL, Accor, Mövenpick, Bespoke Hotels, and voco Hotels.

Strive Services Group delivers an integrated facilities management solution for real estate asset owners across the UAE and beyond. Domus Managed Housing, a division of Strive Services Group, specializes in purpose-built corporate housing solutions for clients including Wyndham, Mövenpick, and Millennium Hotels.

Currently, Al-Bahar Group operates in over 25 countries, developed and invested in more than 80 projects, +21,000 keys, +3,000 commercial units, and +46 hotels under +10 international brands.

Logo: https://mma.prnewswire.com/media/1861362/Yotel_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/al-bahar-group-increases-investment-in-yotel-302416227.html

View original content:https://www.prnewswire.co.uk/news-releases/al-bahar-group-increases-investment-in-yotel-302416227.html

Fintech PR

Bybit x Block Scholes: BTC fell after touching $88K but bearish derivatives trend holds

DUBAI, UAE, April 1, 2025 /PRNewswire/ — Bybit, the world’s second-largest cryptocurrency exchange by trading volume, released the latest weekly crypto derivatives analytics report in collaboration with Block Scholes. The report provides insights into macroeconomic developments, the state of crypto spot and derivatives markets, and emerging trading signals.

Key insights

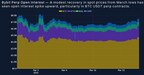

Since bottoming out on March 11, crypto asset prices have climbed steadily over a two-week period, with BTC briefly surpassing $87,000 and ETH recovering above $2,000. XRP has remained relatively stable, while BTC, ETH, and SOL continue to trade below their year-opening levels. SOL, which hit an all-time high in January following Cboe’s Solana Spot ETF filing, also remains down year-to-date. While the broader market has shown signs of recovery, derivatives activity reflects lingering caution. Demand for BTC and ETH put options remains elevated, signaling ongoing hedging behavior.

Cautious rebound in perpetuals

Perpetual open interest stayed flat for most of the week, underscoring a cautious, risk-off tone. A brief market rebound saw BTC rise to $88,000 — a two-week high — triggering modest increases in perpetual trade volume, primarily driven by BTC. Still, volumes remain significantly below those recorded earlier this month, when U.S. President Donald Trump proposed a national crypto reserve centered on the four largest tokens.

Funding rates suggest persistent bearish sentiment

Despite lower realized volatility and positive price movement among major assets, BTC and ETH perpetual contracts continued to post negative funding rates. This indicates that short sellers are still paying long positions, an ongoing sign of bearish sentiment. In contrast, large-cap altcoins showed more mixed positioning, with funding rates fluctuating between positive and negative without a clear directional bias.

Volatility retreats to yearly lows

Implied volatility declined by 3 to 5 points over the past week, with 30-day options now trading at their lowest levels since the beginning of the year. Realized volatility is also nearing the 30% floor last seen in February. As typically observed in low-volatility periods, options market activity has slowed, with open interest remaining low and relatively balanced between puts and calls. Around $40 million in options expired during the week.

Access the full report

For detailed insights, readers may download the full report.

#Bybit / #TheCryptoArk /#BybitResearch

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving a global community of over 60 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at Bybit.com.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: media@bybit.com

For updates, please follow: Bybit’s Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

Photo – https://mma.prnewswire.com/media/2654983/Sources_Bybit_Block_Scholes.jpg

Logo – https://mma.prnewswire.com/media/2267288/Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/bybit-x-block-scholes-btc-fell-after-touching-88k-but-bearish-derivatives-trend-holds-302416731.html

View original content:https://www.prnewswire.co.uk/news-releases/bybit-x-block-scholes-btc-fell-after-touching-88k-but-bearish-derivatives-trend-holds-302416731.html

Fintech PR

YOFC Unveils Game-Changing Hollow-Core Fibre Advances at OFC 2025

SAN FRANCISCO, April 1, 2025 /PRNewswire/ — At the OFC Conference, from March 30 to April 3, 2025, at San Francisco’s Moscone Center, Yangtze Optical Fibre and Cable Joint Stock Limited Company (YOFC) (stock tickers: 601869. SH, 06869.HK) highlighted several new developments in hollow-core fibre technology. During a workshop entitled “How will future submarine systems look like”, Dr. LUO Jie, YOFC’s Chief Technology Officer, presented groundbreaking advances in the field of hollow-core fibre technology.

YOFC’s presentation focused on its latest strides in reducing attenuation to a record-low of 0.05dB/km and extending the manufacturing length of single fibres to over 20 kilometers—achievements that not only set new global benchmarks but also starkly outperform traditional solid-core fibres. These technological advancements were demonstrated through a 21.7 km long hollow-core fibre with a proprietary supporting tube structure (ST-HCF). This drew considerable attention at the exhibition for its potential implications in optical communications.

Hollow-core fibre technology represents a paradigm shift in optical communications, enabling light to be transmitted through an air core. The design facilitates a 47% increase in transmission speed and a 31% reduction in latency compared to conventional fibres, showcasing the significant potential for applications requiring rapid and efficient data transmission such as in data centers, AI models, and financial trading. Additionally, the technology’s exceptionally low attenuation and nonlinearity could potentially address the capacity bottlenecks faced by submarine communication networks and long-distance terrestrial communication lines.

In his presentation, Dr. LUO Jie explored both the practical and theoretical enhancements that hollow-core fibres could bring to submarine cable systems, emphasizing their ability to increase data throughput and reduce transmission times in future deployments.

YOFC has been at the forefront of hollow-core fibre technology development, leveraging its comprehensive research capabilities and autonomous raw material research system to overcome significant industrial challenges. As the digital economy grows, YOFC’s continued innovation in hollow-core fibre technology is set to play a crucial role in supporting the evolution of global digital infrastructure, ensuring it is robust, efficient, and equipped to meet future demands.

View original content:https://www.prnewswire.co.uk/news-releases/yofc-unveils-game-changing-hollow-core-fibre-advances-at-ofc-2025-302416716.html

-

Fintech6 days ago

Fintech6 days agoFintech Pulse: Your Daily Industry Brief – March 26, 2025 | Featuring Chime, Klarna, Unlock Technologies, Fenergos

-

Fintech PR5 days ago

Fintech PR5 days agoPublic Sector Pension Investment Board announces new Chief Financial Officer and new Chief Risk Officer

-

Fintech PR4 days ago

Fintech PR4 days agoTransactions for persons discharging managerial responsibilities – CEO Jörg Brinkmann have purchased shares in H+H International A/S

-

Fintech PR6 days ago

Fintech PR6 days agoSTARCOMPLIANCE SUPPORTS COMPLIANCE TEAMS AMID RISING REGULATORY DEMANDS

-

Fintech7 days ago

Fintech7 days agoFintech Pulse: Your Daily Industry Brief – March 25, 2025 | Rockfi, Bankwell Bank, Louis Limited

-

Fintech PR4 days ago

Fintech PR4 days agoBybit Launches ‘Foolproof Fortune’ Event with 100,000 USDT Prize Pool and a Chance to Win a Luxury Watch

-

Fintech3 days ago

Fintech3 days agoFintech Pulse: Your Daily Industry Brief – March 27, 2025 | Almond Fintech, Maplerad & More

-

Fintech PR7 days ago

Fintech PR7 days agoFounders Future opens its share capital to MACSF, the Dassault and CMA CGM Group to accelerate growth and international expansion