Fintech PR

Hut 8 Reports First Quarter 2020 Financial Results

Toronto, Ontario–(Newsfile Corp. – May 11, 2020) – Hut 8 Mining Corp. (TSX: HUT) (OTCQX: HUTMF) (“Hut 8” or “the Company“), one of the world’s largest public cryptocurrency mining companies by operating capacity and market capitalization, today announces its financial results for the first quarter ending March 31, 2020 (“Q1-2020”). Hut 8 reports all amounts in Canadian Dollars unless otherwise stated.

A conference call has been scheduled to discuss the Company’s Q1-2020 financial results, hosted by Interim CEO Jimmy Vaiopoulos, starting at 10:00 a.m. ET on Monday May 11, 2020.

Date: Monday, May 11, 2020

Time: 10:00 a.m. ET

Dial-In: 1 (866) 215-5508, Canada 1 (888) 771-4371, US

Passcode: 4968 1245

Q1-2020 Highlights

- Quarterly revenue of $12.7 million from mining 1,116 bitcoin

- Mining profit margin of 1% was much lower due to the bitcoin price collapse of 48% in two days in mid-March

- Adjusted EBITDA of negative $558k

- Completed the refinancing of the Bitfury debt with a loan extension from Genesis Global Capital, LLC at a 2% lower coupon rate

- Renegotiated master agreements with Bitfury which lowered operating costs and provided autonomy to purchase mining equipment from other suppliers

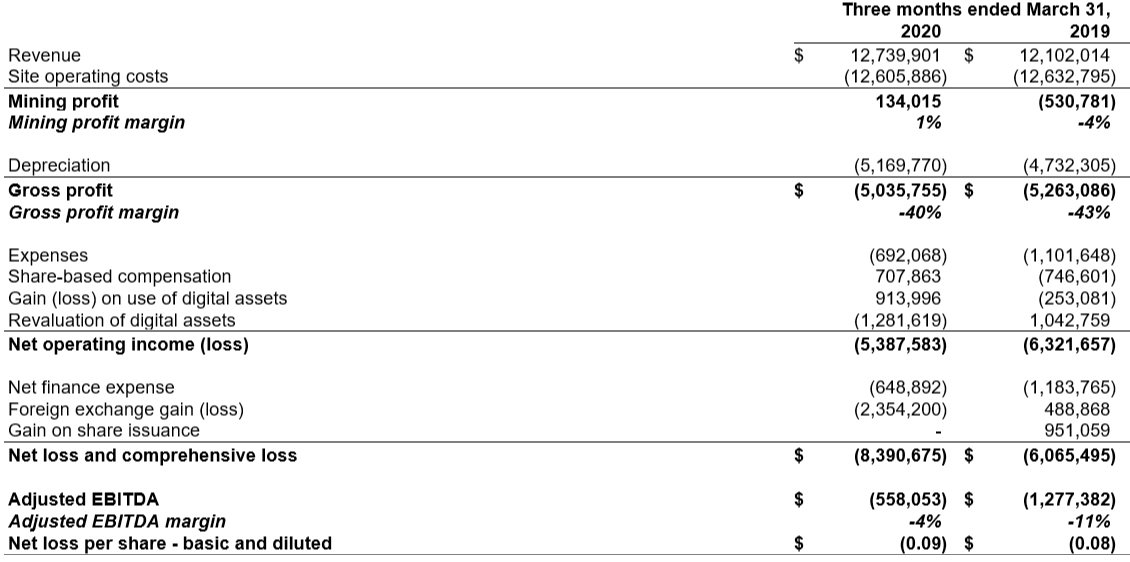

Selected Quarterly Financial Information

| Three months ended March 31, | ||||||

| 2020 | 2019 | |||||

| Revenue | $ | 12,739,901 | $ | 12,102,014 | ||

| Site operating costs | (12,605,886 | ) | (12,632,795 | ) | ||

| Mining profit | 134,015 | (530,781 | ) | |||

| Mining profit margin | 1% | -4% | ||||

| Depreciation | (5,169,770 | ) | (4,732,305 | ) | ||

| Gross profit | $ | (5,035,755 | ) | $ | (5,263,086 | ) |

| Gross profit margin | -40% | -43% | ||||

| Expenses | (692,068 | ) | (1,101,648 | ) | ||

| Share-based compensation | 707,863 | (746,601 | ) | |||

| Gain (loss) on use of digital assets | 913,996 | (253,081 | ) | |||

| Revaluation of digital assets | (1,281,619 | ) | 1,042,759 | |||

| Net operating income (loss) | (5,387,583 | ) | (6,321,657 | ) | ||

| Net finance expense | (648,892 | ) | (1,183,765 | ) | ||

| Foreign exchange gain (loss) | (2,354,200 | ) | 488,868 | |||

| Gain on share issuance | – | 951,059 | ||||

| Net loss and comprehensive loss | $ | (8,390,675 | ) | $ | (6,065,495 | ) |

| Adjusted EBITDA | $ | (558,053 | ) | $ | (1,277,382 | ) |

| Adjusted EBITDA margin | -4% | -11% | ||||

| Net loss per share – basic and diluted | $ | (0.09 | ) | $ | (0.08 | ) |

Q1-2020 Overview

The coronavirus pandemic of 2020 (“COVID-19”) laid its heaviest tolls across the global economy this year, and Hut 8 was no exception. On March 12, 2020, there was one of the largest drops in global capital markets history when the S&P 500 and Dow decreased by nearly 10% in one day, and bitcoin decreased by 37%. The bitcoin price dropped to a low of US$4,107, a level last seen in April of 2019.

For Q1-2020, the Company mined 1,116 bitcoin, resulting in revenue generation of $12.7 million, an increase of 5% from the three months ended March 31, 2019 (“Q1-2019”) with 2,405 bitcoin mined with revenue of $12.1 million. The increasing network difficulty impacted the Company’s production negatively with much fewer bitcoin mined.

Expenses for Q1-2020 were $692k, compared to Q1-2019 of $747k, excluding a reversal gain of non-cash share-based payments of $708k million, compared to Q1-2019 expense of $1.1 million. The reversal is a result of a forfeiture of Restricted Share Units grant by the outgoing CEO.

For Q1-2020, Hut 8 had a revaluation loss of $1.3 million compared to the same period of the prior year gain of $1.0 million. This was from adjusting the value of the digital assets held in inventory to the market value on the reporting date. This loss is from the decrease in bitcoin price from US$7,194 on December 31, 2019 to the March 31, 2020 price of US$6,439. However, by taking advantage of the increasing bitcoin price during the first half of Q1-2020, the Company was able to sell bitcoin for fiat at a higher market price than its adjusted cost base, resulting in a realized gain on use of $0.9 million for Q1-2020, compared to Q1-2019 loss of $0.3 million.

Hut 8 recognized a loss of $0.6 million in Adjusted EBITDA, compared to Q1-2019 loss of $1.3 million. The Adjusted EBITDA losses from Q1-2020 came from the last two weeks of the quarter when the bitcoin price collapsed.

The upcoming bitcoin halving is a major event for bitcoin this year and is also on management’s radar. The halving, set to occur shortly, will have the impact of cutting miners bitcoin compensation per block reward in half. The impact on Hut 8 is difficult to assess. Certainly, without a corresponding increase in the price of bitcoin, Hut 8’s revenue will be impacted negatively. If the price of bitcoin and the network hashrate remain flat, Hut 8’s corresponding revenue would be cut in half subsequent to the halving. Management’s expectation is that there will be a drop in hashrate as less efficient miners shut down, consequently reducing competition. We also anticipate that the price of bitcoin will appreciate post the halving as it has in the past two halvings. However, how these two factors play out is difficult to forecast. Management is actively seeking ways to mitigate these industry specific factors.

In addition, Hut 8 announced the appointment of Kyle Appleby as Interim CFO in place of Jimmy Vaiopoulos, who was previously appointed Interim CEO. Subsequent to his appointment as Interim CFO, Appleby was relieved of his duties as Corporate Secretary and replaced by Viktoriya Griffin. Griffin has significant experience as CFO of various public companies in Canada and is a member of the Chartered Professional Accountants of British Columbia.

This release should be read in conjunction with the Company’s unaudited condensed consolidated interim financial statements and corresponding MD&A for the three months ended March 31, 2020 filed on SEDAR and posted on the Company’s website.

ABOUT HUT 8 MINING CORP.

Hut 8 is a bitcoin mining company with industrial scale operations in Canada. In total, Hut 8 owns and operates two sites in Alberta, Canada utilizing 94 BlockBox AC data centers with current maximum operating capacity of 107 MW and 952 PH/s.

Hut 8 creates value for investors through low production costs and appreciation of its bitcoin inventory. The company provides investors with direct exposure to bitcoin, without the technical complexity or constraints of purchasing the underlying cryptocurrency. Investors avoid the need to create online wallets, wire money offshore, and safely store their bitcoin.

The Company’s common shares are listed under the symbol “HUT” on the TSX and as “HUTMF” on the OTCQX Exchange.

Key investment highlights and FAQ’s: https://www.hut8mining.com/investors.

Keep up-to-date on Hut 8 events and developments and join our online communities at Facebook, Twitter, Instagram and LinkedIn.

Hut 8 Corporate Contact:

Jimmy Vaiopoulos

Interim Chief Executive Officer

Tel: (647) 256-1992

Email: [email protected]

Non-GAAP Measures

This press release presents certain non-GAAP (“GAAP” refers to Generally Accepted Accounting Principles) financial measures to assist readers in understanding the Company’s performance. These non-GAAP measures do not have any standardized meaning and therefore are unlikely to be comparable to similar measures presented by other issuers and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP. Management uses these non-GAAP measures to supplement the analysis and evaluation of operating performance.

The following terms are used, which are not found in the Chartered Professional Accountants of Canada Handbook and do not have a standardized meaning under GAAP.

EBITDA (Earnings before Interest, Taxes, Depreciation, and Amortization)

- “EBITDA” represents net income or loss excluding net finance income or expense, income tax or recovery, depreciation, and amortization.

- “Adjusted EBITDA” represents EBITDA adjusted to exclude share-based compensation, fair value loss or gain on revaluation of digital assets, write-offs, and costs associated with one-time transactions (such as listing fees).

- “Adjusted EBITDA Margin” represents Adjusted EBITDA as a percentage of revenue.

EBITDA is used to show ongoing profitability without the impact of non-cash accounting policies, capital structure, and taxation. This provides a consistent comparable metric for profitability.

“Mining Profit” represents gross profit (revenue less cost of revenue), excluding depreciation. “Mining Profit Margin” represents Mining Profit as a percentage of revenue. Mining Profit and Mining Profit Margin show the cash expenses against the revenue without the impact of non-cash accounting policies such as depreciation.

“Cost per Bitcoin” represents cost of revenue excluding depreciation, divided by the number of bitcoin mined in the period. This metric is commonly referenced in the bitcoin mining industry and is important to gain an understanding of the profitability in reference to the price of bitcoin.

FORWARD-LOOKING STATEMENTS

Certain information in this press release constitutes forward-looking information. In some cases, but not necessarily in all cases, forward-looking information can be identified by the use of forward-looking terminology, such as “plans”, “targets”, “expects” or “does not expect”, “is expected”, “estimates”, “intends”, “assumes”, “anticipates” or “does not anticipate” or “believes”, or variations of such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “might”, “will” or “will be taken”, “occur” or “be achieved”. In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances contain forward-looking information. Statements containing forward-looking information are not historical facts, but instead represent management’s expectations, estimates and projections regarding future events.

Forward-looking information is necessarily based on a number of opinions, assumptions and estimates that, while considered reasonable by Hut 8 as of the date of this press release, are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information, including but not limited to the factors described in greater detail in the “Risk Factors” section of the Filing Statement dated March 1, 2018 relating to the Qualifying Transaction of Oriana Resources Corporation and Hut 8, which is available at www.sedar.com. These factors are not intended to represent a complete list of the factors that could affect Hut 8; however, these factors should be considered carefully. There can be no assurance that such estimates and assumptions will prove to be correct. The forward-looking statements contained in this press release are made as of the date of this press release, and Hut 8 expressly disclaims any obligation to update or alter statements containing any forward-looking information, or the factors or assumptions underlying them, whether as a result of new information, future events or otherwise, except as required by law.

Neither the TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/55656

Powered by WPeMatico

Fintech PR

Ping An Health Reports First Full-Year Profit in 2024

Synergies Between Health Care and Insurance Drive Scalable Growth

AI Innovations Fuel Continued Success

SHANGHAI and HONG KONG, March 13, 2025 /PRNewswire/ — Ping An Healthcare and Technology Company Limited (“Ping An Good Doctor“, “Ping An Health” or “the Company”, Stock Code: 1833.HK) announced its 2024 annual results. With a strategic focus on its two core service hubs – family doctors and senior care concierges – Ping An Health has developed into a leading health and senior care service provider in China. During the reporting period, the Company recorded revenue of RMB4.81 billion and an adjusted net profit of RMB158 million. Notably, revenue from integrated finance business (“F-end”) and corporate clients (“B-end”) increased by 17.2% year-on-year, and revenue from home-based senior care services increased by 413.5% year-on-year. The number of B-end paying users was approximately 5.81 million, representing a year-on-year increase of approximately 13.0%.

Innovation and Upgrades in Synergies Between Health Care and Insurance. Scaling Effects of F-end and B-end Businesses Stand Out

Under Ping An Group’s (“the Group”) “integrated finance + health and senior care” strategy, Ping An Health has fostered closer collaboration with the Group’s integrated financial business through models including “insurance + health care” and ” “insurance + senior care.” During the reporting period, the Company gradually established three major models: “insurance + health and senior care membership,” “collaboration between health care and claim settlement,” and “medical and health benefit services.” These models have supported the Group’s integrated finance business with customer acquisition, retention, conversion and repeat purchases. During the reporting period, the Company achieved steady growth in its F-end business, with revenue exceeding RMB2.4 billion, a year-on-year increase of 9.6%. As of the end of September 2024, Ping An Group’s retail integrated financial customers using services from its health and senior care ecosystem had 1.6 times more contracts and 3.9 times higher AUM per capita than the non-users of these services.

At the same time, as one of the core drivers of the Company’s medium- to long-term growth, the corporate health management business demonstrated robust development. In 2024, the Company continuously improved its capabilities in product design, customer acquisition, and user engagement, fully upgrading the “Ping An Corporate Health Protection Plan” product system for enterprises and their employees. The solutions include health entrusted management, membership-based health management services, and “insurance +” offerings, meeting the diversified scenario needs of different enterprises with a more competitive and differentiated product matrix. During the reporting period, revenue from B-end business exceeded RMB1.4 billion, an increase of 32.7% year-on-year. The number of B-end enterprises cumulatively served reached 2,049, an increase of 35.9% year-on-year.

Further Strengthening Two Service Hubs and Expanded Service Scenarios and Product Empowerment

In 2024, a series of favorable national policies injected strong momentum into the development of the healthcare industry. These policies encouraged the development of innovative medical service models, actively addressed population aging, and improved the senior care service system. Seizing these policy opportunities, Ping An Health leveraged its advantages to further strengthen its two core service hubs – family doctor and senior care concierges – driving rapid growth in the synergies between health care and insurance businesses.

During the reporting period, the Company comprehensively upgraded “Ping An Family Doctor”, its family doctor membership service brand, and established its “1-1-3-12” one-stop, proactive health management service system. Its family doctor team was certified by Peking University International Hospital and the World Organization of Family Doctors (WONCA). Additionally, its service standards and telemedicine management were certified by the General Practice Branch of the Chinese Medical Association and the Royal Australian College of General Practitioners, respectively. These advancements further enabled the Company to provide customers with collaboration between health care and claim settlement, end-to-end critical illness case management, and home-based senior care and healthcare services, enhancing the Group’s integrated financial business with differentiated competitiveness. During the reporting period, family doctor services under the collaboration between health care and claim settlement served over 2 million customers. With the integration of service scenarios and improvements in service capabilities, the Company had over 14 million users with access to family doctor service benefits.

Meanwhile, Ping An Health actively expanded its home-based senior care business and further developed its “insurance + home-based senior care” model. The Company continued to develop a comprehensive “3-in-1” senior care concierge system integrating smart concierges, daily life concierges, and doctor concierges, while collaborating with various parties to establish standardized service systems. During the reporting period, the Company constructed a multi-modal senior care service system of “home-based senior care + sojourn-based senior care + senior care institutions,” providing personalized services for silver-haired population across different ages with different senior care needs, such as smart age-friendly home modifications, emergency rescue services, and professional medical care. During the reporting period, home-based senior care benefits were available in 75 cities across China, recording a year-on-year revenue increase of 413.5%.

AI Empowerment Achieves Breakthrough Growth. Integrating and Upgrading the “Online, In-store, Home and Company-delivered” Service Network

In serious medical scenarios, the Company continues to strengthen its AI-powered healthcare foundation, enhance its O2O service network, and improve refined user operations. Leveraging Ping An’s five industry-leading medical databases and 1.44 billion online consultations, Ping An Health has created the “Ping An Medical Master®” multi-modal medical AI model and the ” Ping An Doctor’s HomeTM” doctor’s workbench, and deployed, applied and validated DeepSeek’s large model. Through AI empowerment, significant improvements were achieved in efficiency and quality metrics across all aspects of medical services during the reporting period. Specifically, AI-powered health checkup interpretation reached an accuracy rate of 98%, AI-assisted diagnosis accuracy over 95%, intelligent recommendation accuracy achieved 99%, and chronic disease management improvement rates reached 90%. Additionally, the efficiency of family doctor services, specialist doctor services and health managers services improved by approximately 62%, 42%, and 55%, respectively. Furthermore, the Company launched the “Ping An Xin Yi” service, fully opening up AI-assisted expert 24/7 health consultation services. In the future, the Company will continue to promote health care service coverage and health record establishment for Ping An Group’s 240 million retail financial customers, and fully utilize its unique advantages such as the closed-loop medical insurance data, self-developed medical large language model, and vertical domain model trained and adapted to medical scenarios to accelerate the application of AI large language models in multidisciplinary consultations and other scenarios for complex diseases.

Focused on medical, health, and senior care service scenarios, the Company has upgraded its O2O service network to the “online, in-store, home, and company-delivered” service network. At the same time, leveraging its platform-based and scaled bargaining advantages, the Company continued to improve service cost-effectiveness and service experience, launching innovative products and service commitments including “Ping An worry-free care,” “specialist doctor consultation in as fast as three hours,” and “refund the price if the medicine is more expensive or delivery is slow, and replace expired medicines.” As of the end of 2024, the Company has established a team of approximately 50,000 internal and external doctors covering 29 departments, signed contracts with over 2,900 specialist doctors, including expert doctors from Fudan’s Top 100 Hospitals, partnered with nearly 4,000 hospitals, approximately 105,000 cooperative health service providers, nearly 2,600 physical examination providers, 235,000 pharmacies, and over 150 senior care service providers.

Contributing to sustainable development, the Company achieved remarkable results in ESG. During the reporting period, its MSCI ESG rating was upgraded from A to AA for the first time, becoming the first in the healthcare equipment industry in the Hang Seng Index. The Company joined hands with various parties to launch the ” Healthy Steps” National Health Literacy Improvement Campaign, aiming to enhance public health management awareness and literacy, and promote the development of national health.

2025 marks the final year of the “14th Five-Year Plan” and the year for planning and laying out the “15th Five-Year Plan.” With the continued improvement of the macroeconomy and the continued release of policy benefits in health care and senior care, Ping An Health will continue adhering to the value proposition of “worry-free, time-saving and money-saving”, focusing on the operating principle of “deep empowerment, word-of-mouth service, and innovative growth,” promoting the “integrated finance + health and senior care” strategy, constructing a collaborative model of health and senior care services and financial payers, creating long-term value for users, shareholders, and society, and contributing to the solid implementation of the Digital China and Healthy China strategies.

View original content:https://www.prnewswire.co.uk/news-releases/ping-an-health-reports-first-full-year-profit-in-2024-302400582.html

Fintech

Fintech Pulse: Your Daily Industry Brief – March 12, 2025 | Stax Payments, St. Pete Fintech, Credit Rewards Fintech, The Power of Time: London

In the ever-evolving landscape of financial technology, each day brings a fresh wave of innovation, regulatory shifts, and market movements that continually reshape the industry. Today’s briefing dives deep into a series of groundbreaking developments that signal both tremendous opportunities and emerging challenges for the global fintech ecosystem. From ambitious seed funding rounds and strategic relocations to transformative regulatory debates and innovative consumer solutions, we explore how these diverse stories are interwoven into the fabric of today’s digital finance world. This detailed op-ed-style analysis offers not only a summary of the latest news but also incisive commentary on the implications for investors, entrepreneurs, and policy makers alike.

Over the past 24 hours, we’ve witnessed an exciting resurgence of entrepreneurial spirit with the sibling founders of Stax Payments returning to the scene with a bold new fintech venture backed by a $20 million seed raise. Simultaneously, regulatory watchdogs in Brazil are re-examining fintech reporting rules to curb money laundering, while a promising fintech firm from St. Pete makes a strategic relocation to the bustling Water Street corridor of Tampa. In another innovative twist, a cutting-edge fintech is now helping consumers maximize credit card rewards at retailers and on vacation, reshaping the way shoppers think about financial benefits in their day-to-day spending. Finally, the global dialogue on time management and operational wisdom takes center stage as London’s “The Power of Time” initiative partners with Eastern management philosophies to propose new frameworks for business productivity. Each of these narratives not only underscores the diversity of the fintech field but also provides a window into the transformative trends that continue to drive this dynamic industry.

In this comprehensive briefing, we’ll dissect each of these news stories, examine their broader implications, and offer expert opinions on what they mean for the future of financial technology. We’ll also discuss how today’s headlines reflect a larger trend of convergence between technology, regulatory environments, and consumer empowerment in the financial sector.

1. The Return of the Visionaries: Stax Payments Sibling Founders Launch a New Fintech Venture

The fintech world is no stranger to disruption, and the latest development from the sibling founders of Stax Payments is yet another powerful reminder that innovation never sleeps. With the recent announcement of a $20 million seed funding round, these entrepreneurial veterans are stepping into a new arena with a fresh fintech venture designed to challenge the status quo. Source: TechCrunch

A Bold New Venture in an Evolving Market

The new fintech startup emerges at a time when consumer expectations are evolving rapidly. Amid rising demand for frictionless payment experiences and seamless integration between digital wallets and traditional banking, this venture is poised to fill an urgent gap in the market. The Stax Payments founders, leveraging their previous success, are infusing their new initiative with deep industry insights and a clear understanding of the evolving landscape. Their decision to secure a robust seed round not only validates the potential of their business model but also signals strong investor confidence in their ability to drive the next wave of fintech innovation.

Capitalizing on Past Success and Future Trends

The narrative behind this startup is compelling. It is built upon the foundation of past success, yet it is designed to meet future demands. The infusion of $20 million in seed funding will likely accelerate product development, expand market reach, and allow the company to build a robust platform that addresses multiple pain points in digital payments. Observers in the fintech community point to the growing necessity for innovative payment solutions that can handle cross-border transactions, real-time data analytics, and security concerns with equal finesse. In this context, the new venture’s promise lies not just in the technology it plans to deploy but also in its strategic vision for long-term scalability.

Industry Implications and Investor Sentiment

Analysts have been quick to note that the timing of this launch is critical. With emerging technologies such as blockchain, artificial intelligence, and real-time fraud detection transforming how financial transactions are processed, the competitive edge now belongs to those who can quickly adapt. The sibling founders’ proven track record gives them a unique advantage over competitors who are only now scrambling to enter the market. Investors are drawn to the potential for high returns in an industry where every innovative idea can rapidly scale into a major market disruptor. This fresh infusion of capital suggests that venture capitalists see the value in backing a team that not only understands the nuances of fintech but also has a clear roadmap to sustainable growth.

A Look at the Future

As this startup embarks on its journey, its progress will undoubtedly be a bellwether for broader industry trends. The fintech space is increasingly defined by a blend of technology and human-centric design, where customer experience is paramount. The new venture appears to be geared towards creating solutions that prioritize user-friendly interfaces, robust security protocols, and seamless integration with existing financial infrastructures. The anticipated innovations may very well set new standards for the industry, potentially prompting competitors to rethink their own product offerings.

Commentary: A Turning Point in Fintech Innovation

In my view, the launch of this new fintech venture is more than just a typical startup launch—it represents a turning point in how seasoned entrepreneurs can continue to innovate despite market saturation. The infusion of fresh capital combined with a wealth of experience positions the founders as catalysts for change in an industry ripe for transformation. The emphasis on robust funding also signals a growing trend: investors are not merely interested in novelty but in strategic, well-grounded visions that promise longevity and adaptability. This move, therefore, might well be the beginning of a new chapter in fintech innovation that will encourage more industry leaders to reimagine the future of financial transactions.

2. Brazil’s Regulatory Shake-Up: Revisiting Fintech Reporting Rules Amid Money Laundering Concerns

As fintech innovation surges forward, regulatory frameworks are struggling to keep pace. In a significant development, Brazilian authorities are currently re-evaluating fintech reporting rules as part of a broader initiative to clamp down on money laundering. Source: Reuters

The Regulatory Landscape: A Balancing Act

Regulation has always been a double-edged sword in the fintech arena. On one side, effective oversight is crucial to maintain market stability and protect consumers from fraud and abuse; on the other, overregulation can stifle innovation and slow down the adoption of new technologies. The current reassessment in Brazil underscores the challenges faced by regulators worldwide as they try to strike the right balance. With fintech companies increasingly handling vast sums of money and complex transactions, the risks associated with money laundering and other illicit financial activities have never been higher.

Money Laundering Concerns and the Need for Reform

Recent incidents and global trends have shone a spotlight on the vulnerabilities within financial systems. In Brazil, these concerns have been amplified by cases of illicit money flows that exploit gaps in current reporting frameworks. The government’s decision to revisit these rules is a proactive measure aimed at closing these gaps and enhancing transparency within the industry. For fintech companies operating in Brazil, the impending regulatory changes could mean tighter controls, more rigorous compliance requirements, and a need for robust internal monitoring systems. While these changes might initially present challenges, they could also pave the way for a more secure and trustworthy financial ecosystem in the long run.

Industry Reaction: Cautious Optimism

From an industry perspective, reactions to Brazil’s proposed regulatory overhaul have been mixed. Some stakeholders view it as an essential step toward cleaning up the financial landscape, ultimately building greater trust among consumers and investors. Others express concerns that overly stringent measures could hinder innovation, increase operational costs, and limit the competitive edge of emerging fintech players. In my view, while the initial adjustment period may be difficult, the long-term benefits of enhanced security and regulatory clarity could outweigh the short-term inconveniences. A well-regulated market is one that fosters sustainable growth and innovation, provided that regulators engage in continuous dialogue with industry leaders.

The Global Context: Lessons for Other Markets

Brazil’s regulatory recalibration is not happening in isolation. Around the world, governments and financial authorities are grappling with similar issues as they seek to update legacy systems and create frameworks that are fit for the digital age. The challenge is to develop rules that are adaptable, technology-neutral, and robust enough to handle the pace of change in fintech. By taking decisive steps to revisit reporting standards, Brazil could serve as a model for other emerging markets that face analogous challenges. This proactive stance also signals to global investors that Brazil is committed to maintaining a secure, transparent, and dynamic financial environment, despite the inherent risks associated with rapid technological advancement.

A Critical View: Weighing Security Against Innovation

In my analysis, the regulatory tightening in Brazil is both a necessary and timely intervention. The potential for money laundering and other financial crimes presents a significant threat not only to the fintech sector but to the broader economy. However, the key will be in the implementation. Regulators must work closely with fintech companies to ensure that compliance measures are integrated in a way that does not stifle the very innovation they seek to protect. In other words, a balanced approach that safeguards security without impeding growth is essential. If Brazil can achieve this balance, it may well set a new standard for regulatory reform in the fintech industry worldwide.

The Road Ahead

Looking forward, fintech companies in Brazil and beyond should prepare for an era of increased regulatory scrutiny. Firms that invest in robust compliance systems and foster transparent communication with regulatory bodies will be better positioned to thrive in this new environment. Moreover, these changes could encourage the development of advanced regulatory technologies (RegTech) that help automate compliance, reduce errors, and provide real-time monitoring. As the industry adapts to these challenges, the convergence of regulatory oversight and technological innovation will likely become one of the defining trends of the coming decade.

3. Strategic Moves: St. Pete Fintech Firm Relocates to Water Street Tampa

In a move that underscores the importance of location in the competitive fintech landscape, a prominent fintech firm from St. Pete has recently relocated its headquarters to Water Street Tampa. Source: St. Pete Catalyst

Why Location Matters in Fintech

While technology and innovation are the lifeblood of fintech, the physical location of a company can also have a profound impact on its growth trajectory. The relocation of this fintech firm from St. Pete to Tampa’s Water Street is more than a geographic change—it’s a strategic decision aimed at tapping into a thriving business ecosystem. Tampa, with its growing reputation as a hub for tech startups and financial services, offers several advantages. The city boasts a robust infrastructure, access to a diverse talent pool, and a vibrant network of investors and mentors who are deeply familiar with the nuances of fintech innovation.

The Benefits of a Centralized Business Hub

Water Street Tampa is rapidly emerging as a central hub for startups and established companies alike. By relocating here, the fintech firm is positioning itself to benefit from enhanced visibility, improved operational efficiency, and closer proximity to key partners and clients. The move is likely to facilitate better networking opportunities and foster a collaborative environment where ideas can be exchanged freely. For a fintech company that thrives on rapid iteration and agile decision-making, these benefits are invaluable. In my view, the decision to move to a well-connected, innovation-friendly environment is both a smart business strategy and a reflection of the broader trend toward geographic consolidation in the tech and finance sectors.

Implications for the Local Market

The relocation also has significant implications for the local market in Tampa. As more fintech firms choose to establish a presence in the city, Tampa is poised to become a critical node in the national fintech ecosystem. This influx of innovative companies could drive job creation, stimulate local economic growth, and enhance the city’s reputation as a forward-thinking business center. Moreover, the clustering of fintech companies in a single locale can lead to beneficial spillover effects—such as shared resources, collaborative projects, and accelerated innovation cycles—that are often hard to replicate in dispersed settings.

A Perspective on Industry Trends

From an industry standpoint, the relocation of fintech companies to vibrant urban centers is part of a broader trend towards strategic geographic consolidation. As companies seek to optimize operations and maximize opportunities, the importance of physical proximity to resources and networks cannot be understated. Although digital connectivity has shrunk the world, the human element of collaboration remains crucial for sustained innovation. The move to Water Street Tampa is emblematic of this trend, signaling that even in an age dominated by virtual interactions, the benefits of a physical business hub continue to be highly relevant.

My Take: A Calculated Risk Paying Off

In my opinion, relocating to Water Street Tampa is a calculated risk that appears destined to pay dividends. The decision reflects a deep understanding of the current market dynamics and the importance of a supportive ecosystem in driving growth. By aligning itself with a region known for its entrepreneurial vigor and financial acumen, the fintech firm is likely to accelerate its development, attract top-tier talent, and foster an environment ripe for innovation. For other fintech companies contemplating similar moves, this relocation could serve as a powerful case study in the benefits of strategic geographic repositioning.

4. Maximizing Consumer Benefits: The Rise of a Fintech Reward Platform

In a competitive retail landscape where consumers are constantly seeking to optimize their financial benefits, a breakthrough fintech platform has emerged to help users secure more credit card rewards both at retailers and on vacation. Source: Forbes

Reinventing the Consumer Experience

Today’s consumers are increasingly aware of the hidden potential in everyday transactions. The fintech solution in focus has tapped into this awareness by developing a platform that aggregates credit card rewards and presents them in a user-friendly, actionable format. By streamlining the process of redeeming rewards, this innovative service transforms a previously cumbersome task into an effortless experience. For frequent shoppers and travelers, the promise of maximizing benefits without the hassle of navigating complex reward schemes is a game changer.

How It Works: Innovation Meets Practicality

At its core, the platform utilizes sophisticated algorithms to analyze consumer spending patterns, identify the most lucrative reward opportunities, and then deliver personalized recommendations directly to users. This not only empowers consumers to make informed financial decisions but also creates a competitive advantage for retailers who partner with the platform. The underlying technology is emblematic of the broader trend toward data-driven personalization in fintech, where machine learning and predictive analytics are leveraged to enhance user engagement and drive value.

Benefits for Consumers and Retailers Alike

The dual impact of this fintech innovation is particularly noteworthy. On one hand, consumers gain a tool that demystifies the process of accumulating and redeeming rewards—transforming what was once an arcane part of credit card management into a transparent and easily navigable service. On the other hand, retailers benefit from increased customer loyalty and deeper insights into spending habits, enabling them to tailor their offerings more effectively. In an era where consumer trust and engagement are paramount, the platform’s success could serve as a bellwether for similar initiatives across the financial services industry.

Market Impact and Industry Commentary

Analysts predict that innovations like this will fundamentally alter how consumers perceive and interact with financial rewards. The platform’s focus on user-centric design and data analytics not only positions it as a leader in its niche but also highlights a broader shift towards consumer empowerment in financial services. As traditional reward programs continue to evolve, fintech companies that can seamlessly blend technology with tangible benefits for the end user are likely to disrupt established market paradigms.

From an op-ed perspective, I see this as a clear signal that fintech is no longer just about backend infrastructure or B2B transactions—it is increasingly about delivering real, measurable benefits directly to consumers. The rise of this platform epitomizes the shift from passive financial management to active, personalized financial optimization. In my view, this trend will only accelerate, as more fintech innovators look to harness data and technology to create intuitive, consumer-friendly products.

The Future of Reward Programs

Looking ahead, the integration of AI and advanced analytics into consumer reward programs is likely to redefine the industry. As platforms become more sophisticated, we can expect an era where financial incentives are not just an add-on, but a central feature of the consumer experience. The implications for the retail sector are profound: enhanced loyalty programs, more effective marketing strategies, and a closer alignment between consumer behavior and business objectives. This, in turn, will drive further innovation in the fintech space, as companies race to offer the next big breakthrough in financial technology.

5. Time is of the Essence: London’s “The Power of Time” and Eastern Management Wisdom

In a world where every second counts, the fusion of Eastern management wisdom with modern time management practices is generating a fresh dialogue on business productivity. London’s “The Power of Time” initiative has launched a series of discussions designed to bridge cultural insights with contemporary operational strategies. Source: PR Newswire

Merging Tradition with Innovation

The concept behind “The Power of Time” is as compelling as it is timely. By drawing on centuries-old Eastern philosophies and management principles, the initiative seeks to redefine how businesses approach time—not merely as a resource to be managed, but as a strategic asset that can drive long-term success. The collaboration between London-based innovators and experts in Eastern management underscores a growing recognition that the challenges of the modern business world require a blend of tradition and cutting-edge technology.

Strategic Implications for Global Business

This initiative represents a bold experiment in cross-cultural collaboration, one that could have far-reaching implications for global business practices. In today’s fast-paced market, the pressure to optimize time usage is immense. Traditional Western methods of time management, which often emphasize speed and efficiency, are being complemented by Eastern practices that value balance, mindfulness, and long-term perspective. The result is a holistic approach that not only boosts productivity but also fosters a more sustainable and balanced business environment.

Industry Impact and Expert Opinions

Industry experts are already weighing in on the potential impact of “The Power of Time.” Some view it as an essential corrective to a hyper-accelerated business culture that can sometimes sacrifice quality for speed. Others argue that integrating these time-tested principles could spur innovation, improve employee well-being, and ultimately lead to better decision-making processes. From my perspective, this initiative is a refreshing reminder that the fastest solution is not always the best one—sometimes, a thoughtful, measured approach can yield superior long-term results.

The Role of Dialogue and Cultural Exchange

Central to the success of this initiative is the open dialogue between experts from different cultural and professional backgrounds. Such exchanges not only enrich the conversation but also pave the way for novel solutions to longstanding challenges in time management. By creating a forum for discussion, London’s initiative is fostering a collaborative spirit that could redefine industry standards on productivity and efficiency. In an era where global collaboration is increasingly essential, initiatives like this serve as a powerful reminder that innovation often lies at the intersection of diverse perspectives.

My Reflection: A Timely Convergence

I find the convergence of Eastern wisdom and modern time management practices particularly intriguing. In an environment where technological advancements can sometimes obscure the human element of business, this initiative brings focus back to the art of managing time as a core strategic asset. The emphasis on dialogue and the exchange of ideas is a testament to the fact that the best innovations often come from blending diverse approaches. If successful, “The Power of Time” could well set a new benchmark for how businesses worldwide approach productivity and operational excellence.

6. Industry Analysis: Trends, Challenges, and Opportunities in Today’s Fintech Ecosystem

The news of today paints a vibrant picture of an industry in flux—one that is rapidly adapting to new technological paradigms, regulatory imperatives, and evolving consumer expectations. Below, we dive into a broader analysis of the prevailing trends and challenges, offering insights into where the fintech ecosystem might be headed in the coming years.

Embracing Technological Innovation

At the heart of the fintech revolution is the relentless drive to leverage technology to simplify, secure, and enhance financial services. Whether it’s through groundbreaking payment solutions like those pioneered by the Stax Payments founders or through sophisticated algorithms that optimize consumer rewards, technological innovation is the lifeblood of this industry. Companies are continuously investing in research and development to stay ahead of the curve, and those that can effectively harness emerging technologies such as blockchain, artificial intelligence, and cloud computing will be the ones to define the future.

The Regulatory Tightrope

One of the major challenges facing fintech companies today is the balancing act between innovation and compliance. As seen in Brazil’s proactive review of fintech reporting rules, governments are under pressure to safeguard the financial system without stifling the creative energies that drive innovation. This tension is not unique to Brazil; it is a global phenomenon that requires constant dialogue between regulators and industry stakeholders. The emergence of RegTech—technological solutions designed to streamline regulatory compliance—signals a promising way forward, as fintech firms can use data analytics and real-time monitoring to satisfy regulatory requirements while continuing to innovate.

The Importance of Strategic Relocation and Clustering

The relocation of fintech firms to innovation hubs like Water Street Tampa highlights another critical trend in the industry: the strategic importance of geographic clustering. By co-locating in vibrant urban centers, fintech companies not only gain access to a broader network of investors, talent, and collaborative opportunities but also benefit from a supportive ecosystem that fosters rapid growth. This trend is likely to continue, as more companies recognize that physical proximity to key resources can accelerate both development and market penetration.

Consumer Empowerment and Data-Driven Solutions

Today’s fintech solutions are increasingly designed with the end user in mind. The rise of platforms that optimize credit card rewards, for instance, reflects a broader trend towards data-driven personalization. Consumers are no longer passive recipients of financial services; they are active participants who demand tools that enhance their financial well-being. This shift is driving fintech companies to focus on creating intuitive, user-friendly applications that not only offer convenience but also deliver measurable value. In turn, this is fostering a more competitive and dynamic market where customer-centric innovation is paramount.

Global Collaboration and Cross-Cultural Integration

The global nature of fintech innovation is perhaps best exemplified by initiatives like London’s “The Power of Time.” In an increasingly interconnected world, the exchange of ideas across cultural and regional boundaries is essential. Collaborations that blend diverse perspectives and expertise can yield transformative solutions that transcend traditional business models. As companies and regulators around the globe work together to address shared challenges, we can expect to see more cross-border partnerships and collaborative projects that drive industry-wide progress.

Overcoming Challenges and Seizing Opportunities

The fintech landscape is not without its challenges. Cybersecurity threats, the complexities of global compliance, and the rapid pace of technological change present significant hurdles that companies must overcome. However, these challenges are also opportunities for those who can innovate and adapt. Firms that invest in robust security measures, embrace a culture of continuous improvement, and maintain agile business models will be well-positioned to thrive in this competitive environment. In my view, the future of fintech lies in the ability to balance risk and innovation, transforming obstacles into stepping stones for success.

7. Conclusion: The Road Ahead for Fintech

As we reflect on today’s stories—from the resurgence of entrepreneurial zeal with the new fintech venture led by the Stax Payments founders, through the rigorous regulatory reforms in Brazil, to the strategic relocations and consumer-driven innovations reshaping the industry—a clear narrative emerges: the fintech sector is at a pivotal moment. Innovation is accelerating, regulatory frameworks are evolving, and consumers are increasingly empowered by data-driven tools that transform everyday financial decisions.

In this dynamic environment, companies must remain agile, continuously adapt to new market realities, and foster a spirit of collaboration across borders and disciplines. The interplay between technology, regulation, and consumer behavior will dictate the pace and direction of fintech innovation in the coming years. As industry leaders and investors navigate this complex landscape, they must be prepared to balance risk with opportunity, ensuring that the drive for progress does not compromise the stability and security of the financial system.

The developments highlighted in today’s briefing serve as both a testament to the remarkable progress already made and a clarion call for even greater innovation in the future. Whether it is through pioneering new payment technologies, reimagining regulatory frameworks, or leveraging global expertise to enhance operational efficiency, the future of fintech is bright and full of promise. For those at the forefront of this revolution, the challenge is to harness these opportunities while staying true to the core values of transparency, security, and customer empowerment.

As we close this edition of Fintech Pulse, one thing is clear: the fintech industry is not just transforming how we manage money—it is redefining the very nature of financial services in a digital age. For investors, entrepreneurs, regulators, and consumers alike, the key to success will lie in embracing change, fostering innovation, and maintaining a relentless focus on delivering real value in an increasingly complex financial landscape.

Final Thoughts: A Dynamic Future in Fintech

Today’s developments underscore that the future of fintech is being written not just in boardrooms and tech hubs but also through the collaborative efforts of visionary entrepreneurs, proactive regulators, and informed consumers. Every new venture, regulatory update, and strategic relocation contributes to a broader mosaic of innovation that is reshaping global finance. As we look ahead, it is vital for all stakeholders to engage in thoughtful dialogue, invest in technology and talent, and remain agile in the face of evolving challenges.

In my opinion, the stories we covered today are indicative of an industry that is vibrant, resilient, and ready to tackle the complexities of the modern financial world. The successful fusion of innovation with regulatory oversight and consumer empowerment will ultimately determine which companies lead the next wave of fintech evolution. For those who are part of this journey, the road ahead is filled with both promise and responsibility—a challenge that must be met with unwavering commitment to excellence, creativity, and ethical leadership.

As we continue to monitor these trends and anticipate future breakthroughs, it is essential to remember that fintech is more than just technology—it is about transforming lives, enabling financial inclusion, and building a more secure, efficient, and transparent financial system for everyone.

The post Fintech Pulse: Your Daily Industry Brief – March 12, 2025 | Stax Payments, St. Pete Fintech, Credit Rewards Fintech, The Power of Time: London appeared first on News, Events, Advertising Options.

Fintech PR

OKX Europe Enhances Institutional Offering, Announces MiFID II License Acquisition at Exclusive Event in Malta

VALLETTA, Malta, March 12, 2025 /PRNewswire/ — OKX, a leading global blockchain technology company, today announced its strategic acquisition of a Markets in Financial Instruments Directive (MiFID II) licensed entity at a star-studded exclusive event at Manoel Island in Malta. This entity is expected to become operational later this year subject to the approval of the MFSA.

With MiFID II, OKX will be able to offer regulated derivative products and services to its institutional clients across the European Economic Area, including all 30 EU member states, a significant step forward in OKX’s commitment to regulatory compliance and innovation in onshore financial markets.

OKX Europe CEO, Erald Ghoos said: “Securing a MiFID II license marks a significant milestone in our mission to integrate digital assets with traditional financial markets. This authorization strengthens our position in Europe, underscoring our commitment to regulatory compliance, security, and innovation. With this license, we are set to deliver institutional-grade services, partner with tier 1 financial institutions, and offer regulated investment solutions that enhance market access and empower investors across the continent.”

On 27 January, OKX became the first global crypto exchange to receive a full MiCA license and now offers fully localised products and services to the EU through passporting.

Customers in the region have access to OKX’s regulated crypto exchange products under the MiCA licensing framework, including OTC trading, spot trading, bot and copy trading, for 240+ cryptocurrency tokens across 300 trading pairs, and 60+ Euro-based trading pairs. The OKX website and mobile app will feature customization for local languages, local currency displays, and local-language customer support across the region.

OKX President Hong Fang said: “OKX is committed to advancing a sustainable and transparent ecosystem in the crypto space. Obtaining a MiFID II license aligns with our mission to make regulated crypto products accessible across Europe, underscoring our dedication to responsible expansion with regulatory compliance at the forefront.”

To celebrate OKX’s expansion in Europe and the MiFID II license announcement, the company held an exclusive VIP event at Manoel Island in Malta.

As one of the largest cryptocurrency exchanges by trading volume, OKX leads the industry with cutting-edge technology, robust security measures, and a commitment to transparency. With a global user base exceeding 60 million, the company remains focused on driving the adoption of digital assets through regulatory alignment and product innovation.

Learn more at okx.com

ENDS

About OKX

OKX is a technology company with a mission to organize the world’s blockchains and make them more accessible and useful.

We want to create a future that makes our world more efficient, transparent and connected.

OKX began as a crypto exchange giving millions of people access to trading and over time became among the largest platforms in the world. In recent years, we have developed one of the most connected onchain wallets used by millions to access decentralized applications (dApps).

OKX is a brand trusted by hundreds of large institutions seeking access to crypto markets on a reliable platform that seamlessly connects with global banking and payments.

Our most well-known products include: The OKX Exchange, OKX Wallet, OKX Marketplace, OKX Explorer, OKX Chain and OS for developers, OKX Ventures and OKX Institutional Services. To learn more about OKX, download our app or visit: okx.com

Logo – https://mma.prnewswire.com/media/2014295/OKX_Logo_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/okx-europe-enhances-institutional-offering-announces-mifid-ii-license-acquisition-at-exclusive-event-in-malta-302399960.html

View original content:https://www.prnewswire.co.uk/news-releases/okx-europe-enhances-institutional-offering-announces-mifid-ii-license-acquisition-at-exclusive-event-in-malta-302399960.html

-

Fintech PR6 days ago

Fintech PR6 days agoWTA and PIF create the PIF WTA Maternity Fund Program, the first-ever paid maternity leave for professional tennis players

-

Fintech PR7 days ago

Fintech PR7 days agoWirex Secures Registration as a Digital Currency Exchange Provider in Australia

-

Fintech5 days ago

Fintech5 days agoFintech Pulse: Your Daily Industry Brief – March 7, 2025 | Wise, Visa, Cadence, Unicredit, Aion Bank, Vodeno

-

Fintech6 days ago

Fintech6 days agoFintech Pulse: Your Daily Industry Brief – March 6, 2025 – Featuring Bolt, WSFS Bank, Greenlight, Bkash, Huawei, Meliuz

-

Fintech PR7 days ago

Fintech PR7 days agoDaupler Raises $15 Million Series B to Help Utilities Automate Real-time Incident Response Management

-

Fintech PR5 days ago

Fintech PR5 days agoInnocan Pharma Announces Closing of Debenture Unit Offering to its Largest Shareholder, Tamar Innovest Limited

-

Fintech PR7 days ago

Fintech PR7 days agoMiami International Holdings Participates in Ring the Bell for Gender Equality Campaign for International Women’s Day

-

Fintech PR6 days ago

Fintech PR6 days agoMinesto selected to participate in GIA (Global Innovation Accelerator) programme by Swedish Energy Agency