Fintech PR

Euroclear continues to deliver profitable growth and invest in its long-term strategy

BRUSSELS, July 20, 2023 /PRNewswire/ — Financial results for the six months ended 30 June 2023

Highlights

Overall financial performance rose sharply in the first half of 2023

- Strong financial performance, with the underlying business performing well and benefitting from its diversified and resilient business model.

- Substantial growth in operating income to reach EUR 3,107 million (vs EUR 998m in H1 2022), driven by continued business income growth and higher interest earnings, including a material rise linked to the application of international sanctions on Russia.

Euroclear more than doubles underlying net profit (excluding impact of Russian sanctions)

- Underlying net profit more than doubled to reach EUR 561 million, reflecting a strong business performance and continued growth of Euroclear’s core business.

- Euroclear achieved an underlying EBITDA margin of 58.3%, an increase of 11.3 percentage points compared to the 47.0% reported in the first half of 2022. The underlying operating margin was 25.1% reflecting investment and inflationary pressures on expenses.

- Euroclear continues to invest in its strategy, its people and technology as demonstrated by the opening of a new Tech Hub in Krakow. The Tech Hub will create 400 new jobs across critical capabilities such as data, digitalisation and cyber, while also reinforcing other key functions.

- Planned investments, alongside the impact of inflation, led to an increase of 19% in underlying operating expenses, totalling EUR 628 million in H1 2023.

- On an underlying basis, earnings per share rose by 102.6% to EUR 178.3 per share, reflecting the increase in net profit.

Lieve Mostrey, Chief Executive Officer of Euroclear Group, commented:

“Euroclear’s underlying performance through the first half of 2023 continues to demonstrate the robustness of its strong and diversified business model.

We remained focused on the execution of our strategy and service to our customers. We continue to invest to support our growth over the long term and despite general inflationary pressures, yet again, we generated a strong underlying performance, which further builds on the progress made over the past years.

The recent opening of our new Tech Hub in Krakow and the expansion of our service capabilities and teams groupwide further accelerates delivery of our purpose to innovate to bring safety, efficiency, and connections to financial markets for sustainable economic growth.“

Financial performance reaches record levels

|

Euroclear Holding |

|||||||||||||||

|

(€ m) |

H1 2022 |

Estimated Russian |

H1 2022 |

H1 2023 |

Estimated Russian |

H1 2023 |

Underlying |

||||||||

|

Operating income |

998 |

107 |

891 |

3,107 |

1,731 |

1,376 |

484 |

54 % |

|||||||

|

Business income |

807 |

-4 |

811 |

827 |

-11 |

838 |

27 |

3 % |

|||||||

|

Interest, banking & other income |

191 |

111 |

80 |

2,280 |

1,743 |

538 |

457 |

571 % |

|||||||

|

Operating expenses |

-534 |

-7 |

-527 |

-649 |

-21 |

-628 |

-101 |

-19 % |

|||||||

|

Operating profit before Impairment |

464 |

100 |

364 |

2,458 |

1,711 |

748 |

383 |

105 % |

|||||||

|

Impairment |

-1 |

-1 |

0 |

0 |

0 |

0 |

0 |

||||||||

|

Pre-tax profit |

463 |

99 |

365 |

2,458 |

1,711 |

748 |

383 |

105 % |

|||||||

|

Tax |

-112 |

-25 |

-87 |

-614 |

-428 |

-187 |

-99 |

-114 % |

|||||||

|

Net profit |

351 |

74 |

277 |

1,844 |

1,283 |

561 |

284 |

103 % |

|||||||

|

EPS |

111.7 |

88.0 |

585.9 |

178.3 |

|||||||||||

|

Business income operating margin |

33.8 % |

35.0 % |

21.5 % |

25.1 % |

|||||||||||

|

EBITDA margin (EBITDA/oper.income) |

52.0 % |

47.0 % |

80.9 % |

58.3 % |

|||||||||||

Euroclear’s underlying business income improved in H1 2023 to reach a record EUR 838 million, an increase of 3% year-on-year.

The major policy rates continue to increase which has led to a large increase in interest earnings. On an underlying basis, H1 2023 interest, banking and other income progressed by 571% to EUR 538 million.

Euroclear continues to expect operating expenses to remain above its ‘through-the-cycle’ target of 4-6% p.a. throughout 2023, due to accelerating investment in both its strategy and the resilience of the business, coupled with one-off investments and continued high inflation impact on the cost base.

Once again, Euroclear’s business model has proven itself to be a hedge against market volatility. When equity markets are lower, the impact is mitigated by the group’s diversified and subscription-like business model, and benefits in a similar vein when bond markets are weaker, as approximately three quarters of the group’s business income is decoupled from financial market valuations. The operating entities which have a greater relative weighting to the bond markets, and saw business income grow, help mitigate any potential impact of lower equity valuations and transaction volumes.

Business performance remains robust

The key operating metrics demonstrate a strong business performance during the period. Following last year’s record levels in transaction volumes driven by highly volatile markets, the number of transactions in H1 2023 is 2.2% lower. With little change in equity market valuations, assets under custody and fund assets under custody have slightly increased.

|

H1 2023 |

YoY evolution |

3-year CAGR |

|

|

Assets under custody |

€36.8 trillion |

+3.8 % |

+5.8 % |

|

Number of transactions |

152 million |

-2.2 % |

+2.5 % |

|

Turnover |

€546 trillion |

+4.4 % |

+5.8 % |

|

Fund assets under custody |

€3 trillion |

+4.8 % |

+9.4 % |

|

Collateral highway |

€1.68 trillion |

-12.7 % |

+4.2 % |

To further help investors make better informed decisions and manage their portfolios, Euroclear announced a partnership with BondCliQ Inc, a credit market focused Data as a Service (DaaS) company. Through this partnership, Euroclear will launch a new European fixed income settlement data solution, allowing market participants to gain valuable insights and intelligence, including unparalleled levels of access to refined fixed income settlement data through customised dashboards.

Consistent with its strategy centred on people and technology, Euroclear continues to grow its Krakow facility with the creation of a new Tech Hub and the addition of 400 new jobs in Poland. During Euroclear’s 10 years in Krakow, it has seen its office grow to approximately 800 staff who primarily work in operations, support, and control functions.

As MFEXbyEuroclear is entering the next phase of integration, Euroclear continues to enhance its proposition for funds services. This includes services in private markets assets, where Euroclear has recently announced the completion of the acquisition of Goji, a UK-based FinTech providing digital access and technology-enabled solutions to private markets.

Euroclear further improved its funds data services offering with the first release of a new funds market intelligence product. This cloud-based data analytics platform, designed to help Funds Management Companies improve their distribution strategy, has successfully onboarded its first pilot users.

Aligned to the group’s strategy of embracing innovation to the benefit of capital markets, Euroclear recently joined existing strategic international investors in the third fund of Illuminate Financial. Illuminate Financial, a financial services-focused venture firm, has closed this $235 million new fund to invest in early-stage businesses solving problems for financial institutions.

On 3 July 2023, LCH SA merged its core RepoClear Euro debt service with €GCPlus to provide alternative channels to access general collateral (GC) liquidity. €GCPlus, a general collateral tri-party basket repo clearing service, was initially launched in 2014 by LCH SA in collaboration with Euroclear and Banque de France. The new combined service aims to enable a unique point of access to the world’s largest Euro cleared liquidity pool with clearing members benefitting from a single membership, default fund and set of margins, and further netting opportunities.

ESG is key to Euroclear’s business strategy. Euroclear’s ESG mission is to support and enable a sustainable financial marketplace, while limiting our impact on the environment, providing an equitable and inclusive workplace, and conducting business in an ethical and responsible way.

Euroclear continues to mature its approach to sustainability, notably with the publication of an expanded Annual Sustainability Report in May 2023 reporting, for the first time, according to the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD). The Annual Sustainability Report can be found here: https://www.euroclear.com/newsandinsights/en/Format/Whitepapers-Reports/sustainability-report.html

In addition, Euroclear published a comprehensive transversal ESG Policy setting out the minimum requirements for the Group in the areas of Environment, Social and Governance. This policy can be found here: https://www.euroclear.com/ourresponsibility/en/esg-policy.html

Implications of Russian sanctions

Russia’s invasion of Ukraine resulted in market-wide application of international sanctions, which have had a material impact on Euroclear. Since considerable uncertainties persist, the Board considers it necessary to separate the estimated sanction-related earnings from the underlying financial results when assessing the company’s performance and resources.

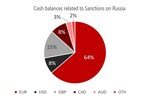

Well-established processes are in place which allow the group to implement the sanctions, while maintaining the normal course of business. However, one consequence of the sanctions is that blocked coupon payments and redemptions owed to sanctioned entities results in an accumulation of cash on Euroclear Bank’s balance sheet. At the end of June 2023, Euroclear Bank’s balance sheet had increased by EUR 47 billion year-on-year to a total of EUR 150 billion.

As per Euroclear’s standard process, which is the same for any client’s long cash balances, the cash balances arising from the sanctions are invested to minimise credit risk. Managing such credit risk is a requirement under Capital Requirements Regulation. The interest paid on reinvestment of cash balances is net interest income earned by Euroclear. Over H1 2023, interest arising on cash balances from Russia-sanctioned assets was EUR 1,743 million.

Such interest earnings are driven by two factors: (i) the prevailing interest rates and (ii) the amount of cash balances that Euroclear is required to invest. As such, future earnings will be influenced by the evolving interest rate environment and the size of cash balances as the sanctions evolve.

At present, the Board expects the growth rate of interest income to slow in the second half of 2023 as blocked payments and redemptions accumulate less rapidly and as economists’ consensus forecasts anticipate a more stable interest rate environment.

In parallel, the European Commission is contemplating various options to use the profits generated by sanctioned amounts held by financial institutions, including Euroclear, for the financing of Ukraine’s reconstruction.

Euroclear is focused on minimising potential legal, technical, and operational risks that may arise for itself and its clients from the implementation of any proposals from the European Commission. The company continues to act in a transparent manner with all authorities involved. The Board will continue to act cautiously, retaining profits related to the Russian sanctions until the situation becomes clearer.

Currently, Euroclear is faced with a high level of complexity in managing both the wide-ranging package of sanctions and a set of complex economic countermeasures, which Russia has implemented since it does not recognise the international sanctions. Euroclear allocates considerable time and resources to manage the market issues and implications of these countermeasures while maintaining regular dialogue with clients and other stakeholders.

Various parties contest the consequences of the application of sanctions and countermeasures, with legal proceedings ongoing in both the European Union and Russia. While recognising the scale of the sanctions and the speed of implementation, Euroclear’s assessment is these legal proceedings are not considered a material risk at present and, so far, they have not incurred any material financial impact.

Overall, Euroclear incurred additional direct costs from the management of Russian sanctions of €21 million in the first half of 2023, with considerable senior management and Board focus on the topic. Additionally, the international sanctions and Russian countermeasures have resulted in a loss of activities from sanctioned clients and Russian securities, which negatively impacted business income by €11 million.

Rating agencies reconfirm Euroclear group’s strong capital position

Euroclear maintains a strong capital position and a low-risk profile, which allows the group to finance further growth plans. Both S&P and Fitch Ratings reconfirmed the AA rating of Euroclear Bank in June 2023. Fitch also assigned the issuing entity of the group, Euroclear Investments SA (EINV), a Viability Rating at ‘aa-‘.

The group capital ratios remain solid, despite the sizable increase of its balance sheet due to the Russian sanctions. Fitch notes that “Euroclear’s investment guidelines for the bank’s portfolio are particularly conservative, limiting holdings to highly liquid securities with strong ratings. Euroclear Bank applies a similarly low-risk policy when re-investing cash proceedings from frozen Russian assets.”

Dividends

On 20 July 2023, Euroclear will pay its previously announced dividend relating to the 2022 underlying business results of EUR 115.5 per share (for a total of EUR 363.5 million), representing a 31% increase compared to the dividend on 2021 results.

Annexes

Photo – https://mma.prnewswire.com/media/2157613/Euroclear1.jpg

Photo – https://mma.prnewswire.com/media/2157614/Euroclear2.jpg

Euroclear Bank and Euroclear Investments are the two group issuing entities. The summary income statements and financial positions at Q2 2023 for both entities are shown below.

|

Euroclear Bank Income Statement (BE GAAP) |

||||||||

|

Figures in Million of EUR |

Q2 2023 |

Q2 2022 |

Variance |

|||||

|

Net interest income |

2,261.5 |

203.8 |

2,057.6 |

|||||

|

Net fee and commission income |

550.0 |

511.1 |

39.0 |

|||||

|

Other income |

17.0 |

-4.8 |

21.8 |

|||||

|

Total operating income |

2,828.5 |

710.1 |

2,118.3 |

|||||

|

Administrative expenses |

-404.7 |

-314.3 |

-90.4 |

|||||

|

Operating profit before impairment and taxation |

2,423.8 |

395.8 |

2,028.0 |

|||||

|

Result for the period |

1,814.1 |

301.8 |

1,512.3 |

|||||

|

Euroclear Bank Statement of Financial Position |

||||||||

|

Shareholders’ equity |

4,416.2 |

2,306.6 |

2,109.6 |

|||||

|

Debt securities issued and funds borrowed (incl. subordinated debt) |

5,822.7 |

5,029.8 |

792.9 |

|||||

|

Total assets |

150,376.0 |

103,634.3 |

46,741.7 |

|||||

|

Euroclear Investments Income Statement (BE GAAP) |

||||||||

|

Dividend |

395.5 |

0.0 |

395.5 |

|||||

|

Net gains/(losses) on financial assets & liabilities |

5.5 |

-4.8 |

10.3 |

|||||

|

Other income |

-0.2 |

-0.1 |

-0.2 |

|||||

|

Total operating income |

400.7 |

-4.9 |

405.6 |

|||||

|

Administrative expenses |

-0.5 |

-2.6 |

2.1 |

|||||

|

Operating profit before impairment and taxation |

400.2 |

-7.5 |

407.7 |

|||||

|

Result for the period |

399.0 |

-7.4 |

406.4 |

|||||

|

Euroclear Investments Statement of Financial Position |

||||||||

|

Shareholders’ equity |

693.4 |

636.3 |

57.1 |

|||||

|

Debt securities issued and funds borrowed |

1,651.7 |

1,647.7 |

4.0 |

|||||

|

Total assets |

2,345.7 |

2,284.4 |

61.3 |

|||||

Euroclear Investments has been relocated from Luxembourg to Belgium on 31 December 2022 at midnight. The financial statements are now prepared under Belgian GAAP, and the 2022 have been restated accordingly.

Note to editors

Euroclear group is the financial industry’s trusted provider of post trade services. Guided by its purpose, Euroclear innovates to bring safety, efficiency, and connections to financial markets for sustainable economic growth. Euroclear provides settlement and custody of domestic and cross-border securities for bonds, equities and derivatives, and investment funds. As a proven, resilient capital market infrastructure, Euroclear is committed to delivering risk-mitigation, automation, and efficiency at scale for its global client franchise. The Euroclear group comprises Euroclear Bank, the International CSD, as well as Euroclear Belgium, Euroclear Finland, Euroclear France, Euroclear Nederland, Euroclear Sweden, Euroclear UK & International and MFEXbyEuroclear.

Logo – https://mma.prnewswire.com/media/832898/Euroclear_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/euroclear-continues-to-deliver-profitable-growth-and-invest-in-its-long-term-strategy-301881267.html

View original content:https://www.prnewswire.co.uk/news-releases/euroclear-continues-to-deliver-profitable-growth-and-invest-in-its-long-term-strategy-301881267.html

Fintech PR

2 Billion USD Polypropylene (PP) Production Plant and Terminal Investment to Contribute $300 Million Annually to Türkiye’s Trade Balance

ISTANBUL, April 25, 2025 /PRNewswire/ — Rönesans Holding, one of Europe’s leading contracting and investment groups, has initiated one of the largest private sector investments in Türkiye to date: the construction of a new Polypropylene (PP) Production Plant and Liquid Bulk Terminal in Ceyhan. With a total investment of $2 billion, these strategic projects aim to increase Türkiye’s industrial self-sufficiency, reduce foreign dependency, and enhance the country’s position in global trade.

Dr. Erman Ilıcak, Honorary President of Rönesans Holding, said: “Once operational, these projects will directly contribute USD 300 million annually to reducing Türkiye’s current account deficit.”

Rönesans Holding recently announced that it has secured total of $1.3 billion in financing for these projects –from the U.S. International Development Finance Corporation (DFC) and Spain’s Export Credit Agency (Cesce).

Dr. Ilıcak highlighted the group’s longstanding role in advancing Türkiye’s economy through value-added projects: “Our story began with international contracting services. To date, we have undertaken projects worth a total of USD 50 billion. Seventy per cent of this, approximately USD 35 billion, was carried out abroad, and we have pioneered many firsts in the world in this field. We have worked on a wide range of projects, from Europe’s longest tunnel to its tallest building, from the world’s largest GTG facility to the world’s largest seismically isolated building. Following this, we became a large-scale investment holding company operating in real estate, social infrastructure, renewable energy, and more recently, industrial facilities. Over the past 15 years, with the significant contributions of stakeholders such as the World Bank’s investment arm IFC and the EBRD, we have structured our business in line with sustainable development goals.”

He continued: “Our model is centred on developing the right project with the right partners, and delivering it at the right time. We have successfully implemented this model with partners such as Singapore’s sovereign wealth fund GIC, Meridiam Infrastructure from France, Japan’s Sojitz, Samsung C&T, and TotalEnergies. Together, we have completed $10 billion worth of investments in Türkiye. These initiatives have laid the foundation for broader transformation, and we will continue to focus on projects that help reduce our country’s trade gap.”

Ceyhan Projects Developed with Expertise from 12 Countries

Reflecting on shifting global economic trends, Dr. Ilıcak said: “Protectionism is increasing, and supply chains are being reshaped. Energy and production are becoming localised. This transformation holds significant opportunities for countries like ours. In particular, strategic heavy industry investments are needed to reduce the foreign trade deficit arising due to imports of industrial machinery, plastics and chemicals, as well as industrial and precious metals. Over the past 10 years, industrial investments totalling approximately USD 20 billion have been made in Türkiye, including projects worth over USD 500 million. But this is not enough.”

He further emphasised: “To close the gap, Türkiye needs to allocate at least $12 billion annually over the next five years, totalling $60 billion. If an investment initiative of this scale is undertaken, we could see a USD 15 billion annual increase in GDP and a USD 10 billion reduction in the foreign trade deficit. At Rönesans Holding, we have secured international financing for our Ceyhan Polypropylene Production Facility and Liquid Bulk Terminal investments, totalling USD 2 billion, which serve this very purpose. The construction of these projects, developed in collaboration with expert solution partners from 12 countries, are ongoing. Once operational, these investments will directly contribute USD 300 million annually to reducing Türkiye’s current account deficit.”

Attracting Foreign Investment Through Strong Partnerships

Dr. Ilıcak also reflected on the importance of international collaborations: “Perhaps the most challenging project we undertook with the EBRD was Türkiye’s transformation in healthcare. The EBRD shared its expertise from around the world. As a result, Türkiye was able to attract USD 15 billion in financing from abroad and carry out its healthcare transformation. We also worked with the IFC for many years on project financing. In difficult conditions, IFC has always stood by our side. We have formed company partnerships with them. Most recently, we have been developing a PPP hospital in Kazakhstan together. In every project we have undertaken, the first question they asked was, ‘What will be the social impact of this?’ Profitability was always the last topic. Those are the reasons why I am grateful to both banks.”

He concluded: “Our relations with Central Asian countries, in particular, have developed substantially. Then, our ties with African countries began to strengthen. Today, Türkiye has become a hub that serves a population ten times its own, meeting needs such as healthcare and education. We closely follow these developments and ensure that growing diplomatic relations are also reflected in trade. We are working to support the progress of Türkiye’s industrialisation initiative. We secure financing from abroad to carry out our projects wherever possible instead of using our country’s limited resources.”

Photo – https://mma.prnewswire.com/media/2673351/Ronesans_Holding_President.jpg

Photo – https://mma.prnewswire.com/media/2673352/Ronesans_Holding_Ceyhan_Polypropylene.jpg

Logo – https://mma.prnewswire.com/media/2213961/5287131/ronesans_holding_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/2-billion-usd-polypropylene-pp-production-plant-and-terminal-investment-to-contribute-300-million-annually-to-turkiyes-trade-balance-302438408.html

View original content:https://www.prnewswire.co.uk/news-releases/2-billion-usd-polypropylene-pp-production-plant-and-terminal-investment-to-contribute-300-million-annually-to-turkiyes-trade-balance-302438408.html

Fintech PR

NYSE Content Advisory: Pre-Market update + NYSE President congratulates new SEC Chair Paul Atkins

NEW YORK, April 25, 2025 /PRNewswire/ — The New York Stock Exchange (NYSE) provides a daily pre-market update directly from the NYSE Trading Floor. Yesterday, NYSE President Lynn Martin congratulated newly sworn-in SEC Chairman Paul Atkins, supporting his longstanding views on the markets.

Kristen Scholer delivers the pre-market update on April 25th

- In an article on LinkedIn, NYSE President Lynn Martin wrote that she looks forward to working closely with Atkins and others in Washington D.C. to “create an environment that ensures our capital markets remain the envy of the world.”

- This week’s three-day stock rally is taking a pause early Friday. This comes after the S&P 500 gained 6.3% from Tuesday to Thursday.

- As earnings season ramps up, Alphabet reported better than expected results after the market closed Thursday. Its shares jumped about 5% in extended hours.

Opening Bell

The Arbor Day Foundation celebrates the Arbor Day national holiday, a day to appreciate and acknowledge all that the simple act of planting a tree provides for our communities and ecosystems.

Closing Bell

LogProstyle Inc. (NYSE American: LGPS) celebrates its listing on the New York Stock Exchange

Read NYSE President Lynn Martin’s LinkedIn Article Here

Watch NYSE TV Live every weekday 9:00-10:00am ET

Video – https://mma.prnewswire.com/media/2673374/NYSE_April_25_2025_Market_Update.mp4

Logo – https://mma.prnewswire.com/media/2581322/New_York_Stock_Exchange_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/nyse-content-advisory-pre-market-update–nyse-president-congratulates-new-sec-chair-paul-atkins-302438378.html

View original content:https://www.prnewswire.co.uk/news-releases/nyse-content-advisory-pre-market-update–nyse-president-congratulates-new-sec-chair-paul-atkins-302438378.html

Fintech PR

A New Chapter in Caribbean Leadership: André Ebanks

GEORGE TOWN, Grand Cayman, April 25, 2025 /PRNewswire/ — As the Caribbean navigates a time of global uncertainty and regional transformation, a new leader is rising from the Cayman Islands. André Ebanks, Leader of The Caymanian Community Party (TCCP), brings a compelling blend of global insight and grassroots connection that signals a fresh direction for modern governance in the region.

Ebanks’ career reflects an ideal balance of private sector success and public service. A former legal professional and the Cayman Islands’ Representative to the UK and Europe, he went on to serve as Deputy Premier. His leadership is marked by a rare combination of intellect, diplomacy, and authentic community engagement, positioning him as a standout figure in Caribbean politics.

What sets Ebanks apart is his ability to bridge global and local priorities. Equally at home in international finance circles and local community gatherings, he offers an innovative yet grounded approach. His focus remains on improving the lives of Caymanians—especially children, families, and the elderly—while also navigating the demands of a sophisticated, service-based economy.

Under his leadership, the TCCP has formed a diverse and balanced team that reflects the evolving identity of the Cayman Islands. With an even gender split—five women and five men—the team includes well-known leaders such as former Premier Wayne Panton, former Speaker Katherine Ebanks-Wilks, Ministers like Sabrina Turner and Osbourne Bodden, and a respected Parliamentary Secretary in Heather Bodden. They are joined by new voices including Robert Bodden, Emily DeCou, Anthony Ramoon, and Natasha Whitelocke.

“Our vision is clear,” says Ebanks. “Cayman can lead not only in financial services, but also in social innovation, environmental responsibility, and inclusive economic growth. The key is embracing change, while holding fast to our values.”

The TCCP’s platform is comprehensive and action-oriented, tackling Cayman’s most pressing issues—rising living costs, housing shortages, education reform, and immigration policy. Their proposals emphasize economic innovation, strong governance, and anti-corruption, aiming to create a more equitable and sustainable society.

As the April 30th elections draw near, the rise of Ebanks and the TCCP signals more than a potential shift in power. It reflects a larger movement toward a Caribbean future shaped by vision, optimism and integrity. Their approach combines ambition with a track record of delivery, offering hope not only to Caymanians but to the broader region.

This evolving leadership model—rooted in both experience and innovation—could provide a blueprint for the Caribbean as it seeks to meet the demands of the 21st century. In André Ebanks, the Cayman Islands may have found not just a national leader, but a regional symbol of what modern, effective governance can truly look like.

About André Ebanks:

Leader of the Caymanian Community Party and former Deputy Premier, Ebanks is known for combining financial insight with deep community focus, helping to position Cayman as a socially aware global financial hub.

About TCCP:

The Caymanian Community Party is committed to a just, prosperous, and sustainable Cayman through inclusive leadership and forward-thinking policy.

Photo – https://mma.prnewswire.com/media/2672992/Andre_Ebanks_01.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/a-new-chapter-in-caribbean-leadership-andre-ebanks-302438005.html

View original content:https://www.prnewswire.co.uk/news-releases/a-new-chapter-in-caribbean-leadership-andre-ebanks-302438005.html

-

Fintech PR6 days ago

Fintech PR6 days agoBybit’s CEO Meets with Vietnam’s Minister of Finance to Support Regulatory Sandbox and Strengthen Crypto Compliance

-

Fintech PR7 days ago

Fintech PR7 days agoYarbo Secures $27M+ Series B Funding to Accelerate Global Growth, Innovation, and Ecosystem Expansion

-

Fintech PR6 days ago

Fintech PR6 days ago“Shanghai Summer”: A Living Case of a Next-Generation Consumer Hub

-

Fintech PR6 days ago

Fintech PR6 days agoShanghai Summer: A One-of-a-Kind Seasonal Experience

-

Fintech PR7 days ago

Fintech PR7 days agoDeclaration on longevity and precision medicine launched at Abu Dhabi Global Health Week

-

Fintech PR6 days ago

Fintech PR6 days agoBreaking Borders, Building Bridges: How “Shanghai Summer” Is Redefining Global Consumption

-

Fintech3 days ago

Fintech3 days agoFintech Pulse: Your Daily Industry Brief – April 22, 2025 (Fiserv, Circle, Braviant, ANNA Money & Shaype, Yubi)

-

Fintech PR4 days ago

Fintech PR4 days agoSuperAI Brings the Frontier of Artificial Intelligence to Singapore: Over 7,000 Innovators to Connect on Breakthrough AI Technologies