Fintech PR

PSP Investments’ 2023 Sustainable Investment Report outlines progress on top sustainability priorities

Highlights:

- Achieved target to increase investments in transition assets to $7.5 billion ahead of 2026 schedule.

- Reported Scope 1 and Scope 2 GHG data for assets in-scope climbed from 47% in fiscal year 2022 to approximatively 54% in fiscal year 2023.

- Further embedded our understanding of sustainability-related risks and opportunities into our culture, operations and investment practices to enhance our long-term sustainable investment approach.

- Strengthened our approach to sustainability and climate by updating our Sustainable Investment Policy and Corporate Governance and Proxy Voting Principles.

- Increased partnerships with institutional investors, industry associations and NGOs highlight our focus on engagement and collaboration.

MONTRÉAL, Sept. 14, 2023 /PRNewswire/ — The Public Sector Pension Investment Board (PSP Investments) today published its annual Sustainable Investment Report, which outlines how the organization is striving to embed sustainable investing into its culture, operations and investment activities to continue to advance capabilities and address emerging risks and opportunities. Accompanying reporting includes PSP Investments’ climate-related financial disclosures based on the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).

“In a year marked by challenges and uncertainty for investors, PSP Investments continued to deliver resilient long-term financial results and advance its capabilities to address emerging risks and opportunities,” said Deborah K. Orida, President and Chief Executive Officer at PSP Investments. “We aspire to develop additional foresight on the structural changes that will impact investments over the long term. This will include our evolving insights on climate, biodiversity, and the impact of social matters on our license to operate.”

The report outlines PSP Investments’ progress on the organization’s top sustainability priorities, including performance toward fiscal 2026 climate targets, the integration of material sustainability factors into decision-making and evolution of the approach. The climate-related financial disclosures showcase progress on metrics and targets; introducing our first-ever data quality assessment using the Partnership for Carbon Accounting Financials (PCAF) methodology; and present the progress made on the approach and implementation of our Green Asset Taxonomy.

“As a pension investor, one of our core investment beliefs is that identifying, monitoring, integrating and capitalizing on material emerging factors contributes to long-term investment performance and to our ability to deliver on our mandate,” said Eduard van Gelderen, Senior Vice President and Chief Investment Officer at PSP Investments. “Our 2023 Sustainability Investment Report showcases the progress we are making in translating this belief into concrete actions and measurable outcomes.”

Fiscal 2023 highlights include:

Acting on climate change

- Identified more eligible transition assets in our portfolio than anticipated when we first implemented our Green Asset Taxonomy, enabling us to reach our target of increasing investments in transition assets to $7.5 billion earlier than expected.

- Expanded the scope of application of our Green Asset Taxonomy to include listed corporate bonds and applied more stringent criteria for green assets in public and private markets.

- Published a Green Asset Taxonomy white paper in effort to increase transparency and promote market convergence.

- Released our inaugural Green Bond Impact Report, which is linked to the issuance of our first green bond of $1 billion in fiscal 2022.

Continuing to expand our data capabilities

- Rolled out an inaugural total fund sustainability-related data collection process, covering key performance indicators in the areas of climate change, diversity, equity and inclusion (DE&I), business ethics, cybersecurity and data privacy, and human capital management.

- Carried out an asset-level GHG data collection initiative with local operating portfolio company partners in six countries, covering over three million hectares of farmland and timberland across more than 400 individual properties.

- Created sustainability due diligence tools to help our investment professionals integrate material sustainability-related considerations into their investment processes.

Advancing our sustainable investing approach

- Updated our Sustainable Investment Policy and Corporate Governance and Proxy Voting Principles, further embedding our approach to sustainability and climate into our investment and active ownership activities and enhancing our expectations with respect to corporate governance and public disclosures on climate change risks and opportunities.

- Introduced a hub-and-spoke model for integrating material sustainability factors into our investment process, providing our investment teams with tools, resources and training that will ultimately enable them to take on greater responsibility for this activity.

- Leveraged our cross-asset class Climate Investing Workgroup to advance collaboration on climate investing opportunities across PSP Investments and build knowledge on key climate investing themes.

Continuing to create value through active ownership

- Over the past fiscal year, PSP Investments has, where appropriate, engaged with 860 publicly listed companies whose securities it holds. This was done either directly with the company, with the assistance of a global stewardship service provider, or, where appropriate, in collaboration with like-minded investors or organizations such as the Canadian Coalition for Good Governance.

- In fiscal year 2023 PSP Investments voted at 5,760 meetings on a total of 58,872 management and shareholder resolutions.

“PSP Investments has developed a holistic approach to sustainable investing, leveraging our capital, influence and capabilities to preserve and enhance long-term value,” said Herman Bril, Managing Director and Head of Sustainability and Climate Innovation at PSP Investments. “A strong focus on materiality enables us, as investors, to better understand the potential impact of sustainability-related factors on financial performance and to make informed investment decisions that support long-term value creation.”

To read PSP Investments’ 2023 Sustainable Investment and TCFD reports, visit our website.

About PSP Investments

The Public Sector Pension Investment Board (PSP Investments) is one of Canada’s largest pension investors with $243.7 billion of net assets under management as of March 31, 2023. It manages a diversified global portfolio composed of investments in capital markets, private equity, real estate, infrastructure, natural resources, and credit investments. Established in 1999, PSP Investments manages and invests amounts transferred to it by the Government of Canada for the pension plans of the federal Public Service, the Canadian Forces, the Royal Canadian Mounted Police and the Reserve Force. Headquartered in Ottawa, PSP Investments has its principal business office in Montréal and offices in New York, London and Hong Kong. For more information, visit investpsp.com or follow us on LinkedIn.

![]() View original content:https://www.prnewswire.co.uk/news-releases/psp-investments-2023-sustainable-investment-report-outlines-progress-on-top-sustainability-priorities-301927986.html

View original content:https://www.prnewswire.co.uk/news-releases/psp-investments-2023-sustainable-investment-report-outlines-progress-on-top-sustainability-priorities-301927986.html

Fintech PR

7th CIIE Successfully Wraps: Highlights by the Numbers

SHANGHAI, Nov. 28, 2024 /PRNewswire/ — The 7th China International Import Expo (CIIE) drew to a successful close on November 10th in Shanghai. While many intangible achievements and connections were made, this year’s data shows how the Expo achieved unprecedented success in global participation and business opportunities. Tentative deals totaled USD 80.01 billion, marking a 2 percent increase from the previous year.

Vibrant Participation from around the World

As a crucial platform for global collaboration, the 7th CIIE invited 77 countries and international organizations from five continents for the Comprehensive Country Exhibition. Participants incorporated unique cultures, national identities, and modern technology into booth designs, with an impressive lineup of over 200 captivating events hosted at the booths. A total of 3,496 companies from 129 countries and regions participated in the Enterprise & Business Exhibition, including 1,585 companies from 104 countries in the Belt and Road Initiative, 1,106 companies from 13 countries in the Regional Comprehensive Economic Partnership, and 132 exhibitors from 35 least developed countries.

Wide Range of Cutting-Edge Innovations and Debuts

Innovative achievements and diverse debuts have consistently been a major highlight from each edition of the expo. At the 7th CIIE, the Innovation Incubation Special Section showcased 360 innovative projects from 34 countries and regions, supporting the development of small and medium-sized enterprises (SMEs) and startups. In addition, multinational companies introduced 450 new products, services, and technologies, including over 100 global launches, 40 Asia premieres, and over 200 China debuts, unlocking momentum for new drivers of consumer demand.

International Perspectives and Collaborative Dialogues at the HQF

Serving as an important platform for international communication, the Hongqiao International Economic Forum (HQF) becomes a focal point of attention at each edition of the CIIE. Focusing on trending topics, the 7th HQF attracted over 8,600 registrations and convened more than 300 globally renowned experts and leaders in politics, business, and academia. The 7th HQF also released the World Openness Report 2024 alongside the World Openness Index, delivering a message of openness and fostering international cooperation.

The 7th China International Import Expo was undoubtedly a complete success, demonstrating its significant role as a stage for advancing global cooperation. With preparations for the 8th CIIE actively underway, the expo continues to expand opportunities for global trade and economic cooperation, warmly inviting countries and enterprises from abroad to join!

Visit CIIE official website for more information: https://www.ciie.org/zbh/en/?from=prnewswire

Contact: Ms. Cui Tel.: 0086-21-968888 Email: [email protected]

Photo – https://mma.prnewswire.com/media/2569264/image_5031553_31815944.jpg

Fintech PR

Europi Property Group AB (publ) successfully issues senior unsecured green bonds

STOCKHOLM, Nov. 28, 2024 /PRNewswire/ —

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES OR TO ANY PERSON LOCATED OR RESIDENT IN ANY OTHER JURISDICTION WHERE IT IS UNLAWFUL OR WOULD REQUIRE REGISTRATION OR OTHER MEASURES TO DISTRIBUTE THIS ANNOUNCEMENT.

Europi Property Group AB (publ) (“Europi” or the “Company“) has successfully issued senior unsecured green bonds of EUR 50m under a framework of up to EUR 100m and a tenor of three years (the “Green Bonds“). The Green Bonds have a floating interest of 3M Euribor plus 500 basis points per annum. Europi intends to list the Green Bonds on the sustainable bond list of Nasdaq Stockholm within 12 months and Nasdaq Transfer Market within 60 days, with an ambition to have the Green Bonds admitted to trading within 30 days.

An amount corresponding to the net proceeds from the Green Bonds will be used in accordance with the Company’s green finance framework (the “Green Finance Framework“).

Skandinaviska Enskilda Banken AB (publ) and ABG Sundal Collier AB have acted as advisors in relation to the issue of the Green Bonds. Vinge has acted as legal counsel in relation to the issue of the Green Bonds.

More information regarding the Green Finance Framework and Sustainalytics’ second party opinion can be found at https://europi.se/bond-investors/

For further information, please contact:

Jonathan Willén, CEO, [email protected]

+46 (0) 8 411 55 77

About Europi (www.europi.se)

Europi Property Group, founded in 2019, is a pan-European real estate investment company headquartered in Stockholm (with an office also in London) investing discretionary capital across all sectors with a flexible investment strategy. Europi has since inception completed public and private transactions of more than €700m in gross asset value alongside its established network of local operating partners and completed four successful exists. By combining a truly entrepreneurial, active ownership approach with focus on social and environmental sustainability, Europi generates long term value and positive impact for all stakeholders.

This information was brought to you by Cision http://news.cision.com

View original content:https://www.prnewswire.co.uk/news-releases/europi-property-group-ab-publ-successfully-issues-senior-unsecured-green-bonds-302318389.html

Fintech PR

Bybit x Block Scholes Derivatives Report: ETH Outperforms BTC

DUBAI, UAE, Nov. 28, 2024 /PRNewswire/ — Bybit, the world’s second-largest cryptocurrency exchange by trading volume, in collaboration with Blocks Scholes, released the latest weekly derivatives analytics report and uncovered signals indicating ETH’s rise above BTC in the past week.

Fueled by news of current U.S. SEC Chair Gary Gensler’s departure at the end of the Biden administration’s term, ETH performance has positively surprised investors. In particular, open interest in ETH perpetual has been on the rise. Several large-cap altcoins also benefited from Gensler’s announcement, anticipating less scrutiny upcoming January.

Key Insights:

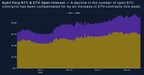

ETH outperformed BTC in open interest: Perpetual swap data has seen a gradual decline in BTC open interest while ETH contracts increased. ETH has also been taking a bigger share of daily trading volumes in the past 6-month time frame despite an overall slower market this week. The optimism could be attributed to hopeful investors’ expectation of a more crypto-friendly SEC Chair after Gensler’s last day on Jan. 20, 2025.

BTC price in retreat: BTC price’s ebbing from the $100K mark has flattened the ATM volatility term structure, with short-tenor options dipping below 60%. This mirrors a pattern observed since the U.S. election. Lower realized volatility explains the drop, while open interest in calls and puts remains unchanged, demands for short-term options this week have stagnated.

ETH options – bullish sentiment in moderation: ETH options show slightly more bullish sentiment than BTC options. Markets have recalibrated after the post-election high, but call options remain in the lead in both trading volumes and open interests.

Access the Full Report:

Read the full report in context here.

#Bybit / #TheCryptoArk /#BybitResearch

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving over 50 million users. Established in 2018, Bybit provides a professional platform where crypto investors and traders can find an ultra-fast matching engine, 24/7 customer service, and multilingual community support. Bybit is a proud partner of Formula One’s reigning Constructors’ and Drivers’ champions: the Oracle Red Bull Racing team.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: [email protected]

For more information, please visit: https://www.bybit.com

For updates, please follow: Bybit’s Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

Photo – https://mma.prnewswire.com/media/2569395/Bybit_x_Block_Scholes_Derivatives_Report_ETH_Outperforms_BTC.jpg

Logo – https://mma.prnewswire.com/media/2267288/Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/bybit-x-block-scholes-derivatives-report-eth-outperforms-btc-302318387.html

View original content:https://www.prnewswire.co.uk/news-releases/bybit-x-block-scholes-derivatives-report-eth-outperforms-btc-302318387.html

-

Fintech PR7 days ago

Fintech PR7 days agoAlkira Ranked 25th Fastest-Growing Company in North America and 6th in the Bay Area on the 2024 Deloitte Technology Fast 500™

-

Fintech2 days ago

Fintech2 days agoFintech Pulse: A Daily Dive into Industry Innovations and Developments

-

Fintech PR7 days ago

Fintech PR7 days agoCorinex Ranked Number 331 Fastest-Growing Company in North America on the 2024 Deloitte Technology Fast 500™

-

Fintech PR7 days ago

Fintech PR7 days agoCathay Financial Holdings Advances Climate Finance Leadership at COP29, Championing Public-Private Partnerships and Asia’s Low-Carbon Transition

-

Fintech PR6 days ago

Fintech PR6 days agoROYAL CANADIAN MINT REPORTS PROFITS AND PERFORMANCE FOR Q3 2024

-

Fintech PR6 days ago

Fintech PR6 days agoRedefining Financial Frontiers: Nucleus Software Celebrates 30 Years with Synapse 2024 in Singapore

-

Fintech2 days ago

Fintech2 days agoFormer MD of SUI Foundation, Greg Siourounis, Joins xMoney Global as Co-Founder and CEO to build MiCA-Regulated Stablecoin Platform

-

Fintech PR7 days ago

Fintech PR7 days agoEliTe Solar: Realizing Our Mission and Standing by Our Core Values