Fintech PR

Smart Contract Market to Reach $2.5 Billion, Globally, by 2032 at 29.6% CAGR: Allied Market Research

The global smart contract market is driven by an increase in the adoption of blockchain technology, an increase in demand for smart contracts in educational institutions, and an increase in demand for automation and digital transformation technology.

WILMINGTON, Del., Oct. 16, 2023 /PRNewswire/ — Allied Market Research published a report, titled, “Smart Contract Market by Type (Contact Payment, and Contactless Payment), and Application (Refuel, Carwash, Malls, and Others): Global Opportunity Analysis and Industry Forecast, 2023-2032″. According to the report, the global Smart Contract Market was valued at $192.7 million in 2022 and is estimated to reach $2.5 billion by 2032, exhibiting a CAGR of 29.6% from 2023 to 2032.

Smart contracts can be described as programs stored on a blockchain network that activate and execute when specific predefined conditions are met. These contracts are commonly employed to automate the enforcement of agreements, ensuring that all parties involved can instantly verify the outcome without relying on intermediaries or enduring delays. Additionally, smart contracts have the capability to automate workflows by initiating subsequent actions as soon as the predetermined conditions are fulfilled, streamlining processes and reducing the need for manual intervention.

(We are providing report as per your research requirement, including the Latest Industry Insight’s Evolution, Potential and COVID-19 Impact Analysis)

- 156 – Tables

- 63 – Charts

- 294 – Pages

Download Research Report Sample & TOC: https://www.alliedmarketresearch.com/request-sample/144582

Prime determinants of growth

Increase in adoption of blockchain technology and increase in demand for smart contracts in educational institutions is boosting the growth of the global smart contracts market. In addition, the increase in demand for automation and digital transformation technology positively impacts the growth of the smart contracts market. However, lack of scalability and standardization and presence of legal and regulatory uncertainties is hampering the smart contracts market growth. On the contrary, increasing adoption of various applications in industries is expected to offer remunerative opportunities for expansion of the smart contracts market during the forecast period.

Report coverage & details:

|

Report Coverage |

Details |

|

Forecast Period |

2023–2032 |

|

Base Year |

2022 |

|

Market Size in 2022 |

$192.7 million |

|

Market Size in 2032 |

$2.5 billion |

|

CAGR |

29.6 % |

|

No. of Pages in Report |

294 |

|

Segments covered |

Contract Type, Platform, Enterprise Size, End User, and Region. |

|

Drivers |

Increase in adoption of blockchain technology. Increase in demand for smart contracts in educational institutions. Increase in demand for automation and digital transformation technology |

|

Opportunities |

Increase in adoption of various applications in industries |

|

Restraints |

Lack of scalability and standardization Presence of legal and regulatory uncertainties |

Covid-19 Scenario

- The Smart Contract market has witnessed stable growth during the COVID-19 pandemic, owing to the rising dependency on contactless agreements. The reliance of customers and vendors on contactless modes to contain the spread of the virus is anticipated to provide opportunities for the market.

- Moreover, with the increased investment in blockchain technology businesses and governments seek to develop more secure and efficient systems for managing data and transactions.

The distributed enterprise size (DAO) segment maintains its leadership status throughout the forecast period.

Based on the contract type, the decentralized autonomous organizations (DAO) segment held the highest market share in 2022, accounting for around one-third of the global smart contract market revenue and is expected to rule the roost throughout the forecast timeframe. As it reduces the possibility of errors and interruptions in contract execution and enables DAO contracts to run continuously without human supervision. However, the distributed enterprise size (DApp) segment is projected to manifest the highest CAGR of 33.4% from 2023 to 2032, owing to an increase in the adoption of digital technology across various industries.

The Ethereum segment to maintain its leadership status throughout the forecast period

Based on platform, the Ethereum segment held the highest market share in 2022, accounting for nearly one-third of the global smart contract market revenue and is projected to retain its dominance during the forecast period. It offers an extremely flexible platform on which to build decentralized applications using the native solidity scripting language and Ethereum virtual machine. However, the NXT segment is projected to manifest the highest CAGR of 33.4% from 2023 to 2032. The growth of the segment is attributed to the scalability and interoperability provided by NXT.

Get Customized Reports with your Requirements: https://www.alliedmarketresearch.com/request-for-customization/144582

North America to maintain its dominance by 2032

Based on region, North America held the highest market share in terms of revenue in 2022, accounting for nearly two-fifths of the global smart contract market revenue, owing to growing innovation and technological progression in this region. In addition, companies are paying attention to launching product platforms and forming partnerships to support their market position in this region. However, the Asia-Pacific region is expected to witness the fastest CAGR of 33.0% from 2023 to 2032 and is likely to dominate the market during the forecast period, owing to increasing mergers and acquisitions activities, and the growing adoption of digital platforms in this region.

Leading Market Players: –

- ScienceSoft USA Corporation,

- innowise group,

- IBM Corporation,

- Tata Consultancy Services,

- BlockCypher,

- Blockstream Corporation Inc.,

- Monax Industries Limited,

- BitPay, Inc.,

- Chain, Inc.,

- Coinbase,

The report provides a detailed analysis of these key players of the global smart contract market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Inquiry before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/144582

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the smart contracts market analysis from 2023 to 2032 to identify the prevailing smart contracts market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- In-depth analysis of the smart contracts market segmentation assists to determine the prevailing smart contracts market outlook.

- Major countries in each region are mapped according to their revenue contribution to the global smart contracts market forecast.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the smart contracts market players.

- The report includes the analysis of the regional as well as global smart contracts market trends, key players, market segments, application areas, and market growth strategies.

Smart Contracts Market Key Segments:

By Contract Type:

- Smart Legal Contract

- Decentralized Autonomous Organizations (DAO)

- Enterprise Size Logic Contracts (ALC)

- Distributed Enterprise Size (DApp)

By Platform:

- Ethereum

- Bitcoin

- Sidechains

- NXT

- Others

By Enterprise Size:

- Large Enterprise

- Small and Medium-sized Enterprises

By End User:

- BFSI

- Retail

- Healthcare

- Real Estate

- Logistics

- Others

By Region:

- North America (U.S., Canada)

- Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of Asia-Pacific)

- LAMEA (Latin America, Middle East, Africa)

Procure Complete Report (294 Pages PDF with Insights, Charts, Tables, and Figures) @

Trending Reports in BFSI Industry (Book Now with 10% Discount + COVID-19 Scenario):

Blockchain Government Market by Provider (Application Providers, Middleware Providers, Infrastructure Providers), by Application (Identity Management, Asset Registry, Smart Contracts, Payments, Voting, Others): Global Opportunity Analysis and Industry Forecast, 2023-2032

Commercial Property Insurance Market by Coverage (Open Perils, Named Perils), by Distribution Channels (Agents and Brokers, Direct Response, Others), by Enterprise Size (Large Enterprises, Small and Medium-sized Enterprises), by Industry Vertical (Manufacturing, Construction, IT and Telecom, Healthcare, Energy and Utilities, Transportation and Logistics , Others ): Global Opportunity Analysis and Industry Forecast, 2023-2032

Embedded Finance Market by Type (Embedded Payment, Embedded Lending, Embedded Investment, Embedded Insurance), by Industry Vertical (Retail and E-Commerce, Transportation and Logistics, Healthcare, Media and Entertainment, Others): Global Opportunity Analysis and Industry Forecast, 2023-2032

Southeast Asia Commercial Banking Market by Products (Commercial Lending, Treasury Management, Project Finance, Syndicated Loans, Capital Market and Others), Application (Healthcare, Construction, Transportation and Logistics, Media and Entertainment, and Others): Opportunity Analysis and Industry Forecast, 2022-2031

Commercial Insurance Market By Type (Commercial Motor Insurance, Commercial, Property Insurance, Liability Insurance, Marine Insurance, and Others), Distribution Channel (Agents & Brokers, Direct Response, and Others) Enterprise Size (Large Enterprises, Medium-Sized Enterprises, and Small-Sized Enterprises), and Industry Vertical (Manufacturing, Construction, IT & Telecom, Healthcare, Energy & Utilities, Transportation & Logistics, and Others): Global Opportunity Analysis and Industry Forecast, 2021-2030

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports Insights” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060

Fax: +1-800-792-5285

[email protected]

Allied Market Research Blog: https://blog.alliedmarketresearch.com

BFSI Blog

Logo: https://mma.prnewswire.com/media/636519/Allied_Market_Research_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/smart-contract-market-to-reach-2-5-billion-globally-by-2032-at-29-6-cagr-allied-market-research-301957705.html

View original content:https://www.prnewswire.co.uk/news-releases/smart-contract-market-to-reach-2-5-billion-globally-by-2032-at-29-6-cagr-allied-market-research-301957705.html

Fintech PR

7th CIIE Successfully Wraps: Highlights by the Numbers

SHANGHAI, Nov. 28, 2024 /PRNewswire/ — The 7th China International Import Expo (CIIE) drew to a successful close on November 10th in Shanghai. While many intangible achievements and connections were made, this year’s data shows how the Expo achieved unprecedented success in global participation and business opportunities. Tentative deals totaled USD 80.01 billion, marking a 2 percent increase from the previous year.

Vibrant Participation from around the World

As a crucial platform for global collaboration, the 7th CIIE invited 77 countries and international organizations from five continents for the Comprehensive Country Exhibition. Participants incorporated unique cultures, national identities, and modern technology into booth designs, with an impressive lineup of over 200 captivating events hosted at the booths. A total of 3,496 companies from 129 countries and regions participated in the Enterprise & Business Exhibition, including 1,585 companies from 104 countries in the Belt and Road Initiative, 1,106 companies from 13 countries in the Regional Comprehensive Economic Partnership, and 132 exhibitors from 35 least developed countries.

Wide Range of Cutting-Edge Innovations and Debuts

Innovative achievements and diverse debuts have consistently been a major highlight from each edition of the expo. At the 7th CIIE, the Innovation Incubation Special Section showcased 360 innovative projects from 34 countries and regions, supporting the development of small and medium-sized enterprises (SMEs) and startups. In addition, multinational companies introduced 450 new products, services, and technologies, including over 100 global launches, 40 Asia premieres, and over 200 China debuts, unlocking momentum for new drivers of consumer demand.

International Perspectives and Collaborative Dialogues at the HQF

Serving as an important platform for international communication, the Hongqiao International Economic Forum (HQF) becomes a focal point of attention at each edition of the CIIE. Focusing on trending topics, the 7th HQF attracted over 8,600 registrations and convened more than 300 globally renowned experts and leaders in politics, business, and academia. The 7th HQF also released the World Openness Report 2024 alongside the World Openness Index, delivering a message of openness and fostering international cooperation.

The 7th China International Import Expo was undoubtedly a complete success, demonstrating its significant role as a stage for advancing global cooperation. With preparations for the 8th CIIE actively underway, the expo continues to expand opportunities for global trade and economic cooperation, warmly inviting countries and enterprises from abroad to join!

Visit CIIE official website for more information: https://www.ciie.org/zbh/en/?from=prnewswire

Contact: Ms. Cui Tel.: 0086-21-968888 Email: [email protected]

Photo – https://mma.prnewswire.com/media/2569264/image_5031553_31815944.jpg

Fintech PR

Europi Property Group AB (publ) successfully issues senior unsecured green bonds

STOCKHOLM, Nov. 28, 2024 /PRNewswire/ —

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES OR TO ANY PERSON LOCATED OR RESIDENT IN ANY OTHER JURISDICTION WHERE IT IS UNLAWFUL OR WOULD REQUIRE REGISTRATION OR OTHER MEASURES TO DISTRIBUTE THIS ANNOUNCEMENT.

Europi Property Group AB (publ) (“Europi” or the “Company“) has successfully issued senior unsecured green bonds of EUR 50m under a framework of up to EUR 100m and a tenor of three years (the “Green Bonds“). The Green Bonds have a floating interest of 3M Euribor plus 500 basis points per annum. Europi intends to list the Green Bonds on the sustainable bond list of Nasdaq Stockholm within 12 months and Nasdaq Transfer Market within 60 days, with an ambition to have the Green Bonds admitted to trading within 30 days.

An amount corresponding to the net proceeds from the Green Bonds will be used in accordance with the Company’s green finance framework (the “Green Finance Framework“).

Skandinaviska Enskilda Banken AB (publ) and ABG Sundal Collier AB have acted as advisors in relation to the issue of the Green Bonds. Vinge has acted as legal counsel in relation to the issue of the Green Bonds.

More information regarding the Green Finance Framework and Sustainalytics’ second party opinion can be found at https://europi.se/bond-investors/

For further information, please contact:

Jonathan Willén, CEO, [email protected]

+46 (0) 8 411 55 77

About Europi (www.europi.se)

Europi Property Group, founded in 2019, is a pan-European real estate investment company headquartered in Stockholm (with an office also in London) investing discretionary capital across all sectors with a flexible investment strategy. Europi has since inception completed public and private transactions of more than €700m in gross asset value alongside its established network of local operating partners and completed four successful exists. By combining a truly entrepreneurial, active ownership approach with focus on social and environmental sustainability, Europi generates long term value and positive impact for all stakeholders.

This information was brought to you by Cision http://news.cision.com

View original content:https://www.prnewswire.co.uk/news-releases/europi-property-group-ab-publ-successfully-issues-senior-unsecured-green-bonds-302318389.html

Fintech PR

Bybit x Block Scholes Derivatives Report: ETH Outperforms BTC

DUBAI, UAE, Nov. 28, 2024 /PRNewswire/ — Bybit, the world’s second-largest cryptocurrency exchange by trading volume, in collaboration with Blocks Scholes, released the latest weekly derivatives analytics report and uncovered signals indicating ETH’s rise above BTC in the past week.

Fueled by news of current U.S. SEC Chair Gary Gensler’s departure at the end of the Biden administration’s term, ETH performance has positively surprised investors. In particular, open interest in ETH perpetual has been on the rise. Several large-cap altcoins also benefited from Gensler’s announcement, anticipating less scrutiny upcoming January.

Key Insights:

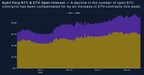

ETH outperformed BTC in open interest: Perpetual swap data has seen a gradual decline in BTC open interest while ETH contracts increased. ETH has also been taking a bigger share of daily trading volumes in the past 6-month time frame despite an overall slower market this week. The optimism could be attributed to hopeful investors’ expectation of a more crypto-friendly SEC Chair after Gensler’s last day on Jan. 20, 2025.

BTC price in retreat: BTC price’s ebbing from the $100K mark has flattened the ATM volatility term structure, with short-tenor options dipping below 60%. This mirrors a pattern observed since the U.S. election. Lower realized volatility explains the drop, while open interest in calls and puts remains unchanged, demands for short-term options this week have stagnated.

ETH options – bullish sentiment in moderation: ETH options show slightly more bullish sentiment than BTC options. Markets have recalibrated after the post-election high, but call options remain in the lead in both trading volumes and open interests.

Access the Full Report:

Read the full report in context here.

#Bybit / #TheCryptoArk /#BybitResearch

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving over 50 million users. Established in 2018, Bybit provides a professional platform where crypto investors and traders can find an ultra-fast matching engine, 24/7 customer service, and multilingual community support. Bybit is a proud partner of Formula One’s reigning Constructors’ and Drivers’ champions: the Oracle Red Bull Racing team.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: [email protected]

For more information, please visit: https://www.bybit.com

For updates, please follow: Bybit’s Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

Photo – https://mma.prnewswire.com/media/2569395/Bybit_x_Block_Scholes_Derivatives_Report_ETH_Outperforms_BTC.jpg

Logo – https://mma.prnewswire.com/media/2267288/Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/bybit-x-block-scholes-derivatives-report-eth-outperforms-btc-302318387.html

View original content:https://www.prnewswire.co.uk/news-releases/bybit-x-block-scholes-derivatives-report-eth-outperforms-btc-302318387.html

-

Fintech PR7 days ago

Fintech PR7 days agoAlkira Ranked 25th Fastest-Growing Company in North America and 6th in the Bay Area on the 2024 Deloitte Technology Fast 500™

-

Fintech2 days ago

Fintech2 days agoFintech Pulse: A Daily Dive into Industry Innovations and Developments

-

Fintech PR7 days ago

Fintech PR7 days agoCorinex Ranked Number 331 Fastest-Growing Company in North America on the 2024 Deloitte Technology Fast 500™

-

Fintech PR6 days ago

Fintech PR6 days agoROYAL CANADIAN MINT REPORTS PROFITS AND PERFORMANCE FOR Q3 2024

-

Fintech PR7 days ago

Fintech PR7 days agoCathay Financial Holdings Advances Climate Finance Leadership at COP29, Championing Public-Private Partnerships and Asia’s Low-Carbon Transition

-

Fintech PR6 days ago

Fintech PR6 days agoRedefining Financial Frontiers: Nucleus Software Celebrates 30 Years with Synapse 2024 in Singapore

-

Fintech2 days ago

Fintech2 days agoFormer MD of SUI Foundation, Greg Siourounis, Joins xMoney Global as Co-Founder and CEO to build MiCA-Regulated Stablecoin Platform

-

Fintech PR7 days ago

Fintech PR7 days agoEliTe Solar: Realizing Our Mission and Standing by Our Core Values