Fintech PR

RED SEA ATTACKS DRIVE TRANSPORTATION COSTS TO 15-MONTH HIGH AND SAFETY STOCKPILING INCREASES SLIGHTLY, BUT NO SIGNS OF PANIC SO FAR: GEP GLOBAL SUPPLY CHAIN VOLATILITY INDEX

- Excess global supply chain capacity shrinks to its lowest level in nine months, showing the first signs of recovery in global manufacturing

- Demand for raw materials, commodities and components, while subdued, also trends higher in January

- Asian supply chains at their busiest in nearly a year as factory purchasing rebounds in region’s key markets

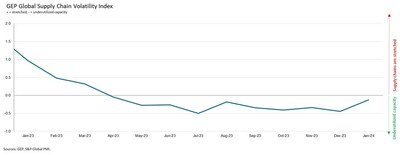

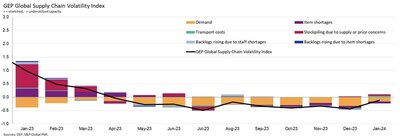

CLARK, N.J., Feb. 13, 2024 /PRNewswire/ — The GEP Global Supply Chain Volatility Index — a leading indicator tracking demand conditions, shortages, transportation costs, inventories and backlogs based on a monthly survey of 27,000 businesses — rose to -0.12 in January, from -0.44 in December, its highest level since last April, indicating that spare capacity across global supply chains has shrunk notably.

Although this is the ninth successive month of excess capacity at global suppliers, the downturn eased to its weakest since last April. The index suggests that underlying trading conditions may be starting to improve as recession and inflation fears fade and businesses prepare for a stronger 2024.

The most noteworthy impact from the Red Sea disruption was to transportation costs, which rose to a 15-month high in January, as commercial ships took the lengthier route around the Cape of Good Hope. There was also a slight pick-up in safety stockpiling, with reports from businesses of inventory building due to supply or price fears at the highest since last June. That said, they were well below the levels seen in 2021-2022 during the post-pandemic supply crunch.

Regionally, Asia’s supply chains were at their busiest in nearly a year as factory purchasing activity in China, South Korea and India rebounded, suggesting manufacturers there are gearing up for growth. In a similar vein, suppliers to North America and Europe saw their spare capacity shrink during January. Less slack was also seen for the U.K.’s suppliers, who have experienced subdued demand for 19 consecutive months.

“The world’s supply chains got busier in January, and activity at our global manufacturing clients is ticking up,” explained Daryl Watkins, senior director, consulting, GEP.

“With input demand trending higher, led by Asia, signalling a return to positive growth in the coming months, it is imperative business keeps tamping down suppliers’ price increases so inflation continues to trend down,” said Watkins, summarizing the implications.

JANUARY 2024 KEY FINDINGS

- DEMAND: Purchases of raw materials, commodities and components remained subdued, although the decline eased to its weakest since last April, hinting at improving demand.

- INVENTORIES: Reports of safety stockpiling due to supply or price concerns ticked up to a seven-month high in January as disruption through the Suez Canal led some companies to build up inventory buffers.

- MATERIAL SHORTAGES: Global supply conditions remain healthy — reports of item shortages remain among the lowest seen in four years.

- LABOR SHORTAGES: Labor availability remains unproblematic for global suppliers, with reports of backlogs rising due to a lack of staff holding close to historically typical levels.

- TRANSPORTATION: Global transportation costs rose to a 15-month high in January, signalling some contagion from the disruption to shipping through the Suez Canal.

REGIONAL SUPPLY CHAIN VOLATILITY

- NORTH AMERICA: Index rose to -0.33, from -0.39, indicating the 10th consecutive month of underutilized supplier capacity.

- EUROPE: Index rose to -0.63, from -0.92, the lowest level of excess vendor capacity in five months.

- U.K.: Index rose to -0.62, from -1.05, showing spare capacity at U.K. suppliers almost halving, which is a positive sign after 19 consecutive months of subdued input demand.

- ASIA: Index rose to 0.14, from -0.42, indicating the strongest pressure on the region’s supply chains in almost a year amid improving demand in key exporting nations.

For more information, visit www.gep.com/volatility.

Note: Full historical data dating back to January 2005 is available for subscription. Please contact [email protected].

The next release of the GEP Global Supply Chain Volatility Index will be 8 a.m. ET, March 13, 2024.

About the GEP Global Supply Chain Volatility Index

The GEP Global Supply Chain Volatility Index is produced by S&P Global and GEP. It is derived from S&P Global’s PMI® surveys, sent to companies in over 40 countries, totaling around 27,000 companies. The headline figure is a weighted sum of six sub-indices derived from PMI data, PMI Comments Trackers and PMI Commodity Price & Supply Indicators compiled by S&P Global.

- A value above 0 indicates that supply chain capacity is being stretched and supply chain volatility is increasing. The further above 0, the greater the extent to which capacity is being stretched.

- A value below 0 indicates that supply chain capacity is being underutilized, reducing supply chain volatility. The further below 0, the greater the extent to which capacity is being underutilized.

A Supply Chain Volatility Index is also published at a regional level for Europe, Asia, North America and the U.K. For more information about the methodology, click here.

About GEP

GEP® delivers AI-powered procurement and supply chain solutions that help global enterprises become more agile and resilient, operate more efficiently and effectively, gain competitive advantage, boost profitability and increase shareholder value. Fresh thinking, innovative products, unrivaled domain expertise, smart, passionate people — this is how GEP SOFTWARE™, GEP STRATEGY™ and GEP MANAGED SERVICES™ together deliver procurement and supply chain solutions of unprecedented scale, power and effectiveness. Our customers are the world’s best companies, including more than 550 Fortune 500 and Global 2000 industry leaders who rely on GEP to meet ambitious strategic, financial and operational goals. A leader in multiple Gartner Magic Quadrants, GEP’s cloud-native software and digital business platforms consistently win awards and recognition from industry analysts, research firms and media outlets, including Gartner, Forrester, IDC, ISG, and Spend Matters.

GEP is also regularly ranked a top procurement and supply chain consulting and strategy firm, and a leading managed services provider by ALM, Everest Group, NelsonHall, IDC, ISG and HFS, among others. Headquartered in Clark, New Jersey, GEP has offices and operations centers across Europe, Asia, Africa and the Americas. To learn more, visit www.gep.com.

About S&P Global

S&P Global (NYSE: SPGI) S&P Global provides essential intelligence. We enable governments, businesses and individuals with the right data, expertise and connected technology so that they can make decisions with conviction. From helping our customers assess new investments to guiding them through ESG and energy transition across supply chains, we unlock new opportunities, solve challenges and accelerate progress for the world. We are widely sought after by many of the world’s leading organizations to provide credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help the world’s leading organizations plan for tomorrow, today.

Disclaimer

The intellectual property rights to the data provided herein are owned by or licensed to S&P Global and/or its affiliates. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without S&P Global’s prior consent. S&P Global shall not have any liability, duty or obligation for or relating to the content or information (“Data”) contained herein, any errors, inaccuracies, omissions or delays in the Data, or for any actions taken in reliance thereon. In no event shall S&P Global be liable for any special, incidental, or consequential damages, arising out of the use of the Data. Purchasing Managers’ Index™ and PMI® are either trade marks or registered trade marks of S&P Global Inc or licensed to S&P Global Inc and/or its affiliates.

This Content was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global. Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content.

Media Contacts

|

Derek Creevey |

Joe Hayes |

Photo – https://mma.prnewswire.com/media/2338874/GEP_Global_Supply_Chain_Volatility_Index_1.jpg

Photo – https://mma.prnewswire.com/media/2338873/GEP_Global_Supply_Chain_Volatility_Index_2.jpg

Logo – https://mma.prnewswire.com/media/518346/GEP_Logo.jpg

Fintech PR

Xinhua Silk Road: Conference on deepening financial openness and co-op in Northeast Asia held in NE. China’s Shenyang

BEIJING, Dec. 27, 2024 /PRNewswire/ — The 2nd Northeast Asia Finance Conference and 2024 “Revitalizing Liaoning with Finance” Excellent Cases Release kicked off on Tuesday in Shenyang, capital of northeast China’s Liaoning Province, aiming to further deepen financial openness and cooperation in the Northeast Asian region and advance construction of a regional financial center.

The main forum held a series of activities, including an opening ceremony, two round-table dialogues on “finance + biomedical industry” and “finance + cultural industry”, a symposium for foreign financial institutions, a seminar on innovative development of financial clusters, a forum on development of technology and finance, a forum on industrial low-carbon transformation and financial innovation, as well as an enterprise project roadshow and industry-finance matchmaking event.

During the conference themed on “accelerating the construction of a regional financial center in Northeast Asia and creating a new highland for opening up”, excellent cases of revitalizing Liaoning through finance in 2024 were unveiled and the index for core areas of regional financial centers in northeast China was released.

The conference also held an unveiling ceremony for the upgrading of the Shenyang finance and trade development zone to a national-level development zone, and a launch ceremony of a platform for Shenyang industrial insights and decision analysis.

The conference was co-hosted by China Economic Information Service, Liaoning Branch of Xinhua News Agency, Shenhe District People’s Government, Shenyang local financial administration under guidance of Shenyang Municipal People’s Government and Liaoning local financial supervision and administration bureau.

Original link: https://en.imsilkroad.com/p/343777.html

Photo – https://mma.prnewswire.com/media/2588005/Liaoning_finance.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/xinhua-silk-road-conference-on-deepening-financial-openness-and-co-op-in-northeast-asia-held-in-ne-chinas-shenyang-302339538.html

View original content:https://www.prnewswire.co.uk/news-releases/xinhua-silk-road-conference-on-deepening-financial-openness-and-co-op-in-northeast-asia-held-in-ne-chinas-shenyang-302339538.html

Fintech PR

BingX Introduces ALTCOIN Index Futures Trading: One Click, Countless Trends

VILNIUS, Lithuania, Dec. 27, 2024 /PRNewswire/ — BingX, a global leading cryptocurrency exchange, is excited to announce the launch of ALTCOIN Index, the first futures trading pair involving top altcoins. This innovative trading product offers users a one-click solution to efficiently track and trade major cryptocurrency trends with ease.

Traditionally used in stock markets, a futures index is a financial derivative that tracks the performance of a group of assets, such as stocks of commodities. These instruments were first introduced to simplify trading by allowing investors to speculate on or hedge against the collective movements of selected market sectors. Instead of purchasing individual stocks, traders are able to access broad market exposure in a single transaction, saving time and reducing costs.

In the cryptocurrency market, this new ALTCOIN/USDT futures trading pair works similarly by bundling the performance of the top mainstream cryptocurrencies by market capitalization, excluding Bitcoin (BTC) and stablecoins. The current index includes ETH, XRP, SOL, BNB, DOGE, ADA, TRX, AVAX, and SHIB. This approach is more efficient compared to buying individual cryptocurrencies or ETFs as this allows for direct speculation using tiered leverage options without the need to manage multiple positions, effectively diversifying trading risks associated with individual asset volatility.

Vivien Lin, Chief Product Officer of BingX, commented on the new offering: “By aggregating a range of leading cryptocurrencies into a single trading instrument, we’re giving users a practical and efficient way to better capture market trends. This index trading pair should help our less experienced users with their trading goals more easily, particularly when they are unsure which asset to trade and just want to trade major altcoins in general with leverage.”

BingX users can take advantage of tiered leverage options and competitive rates consistent with the platform’s perpetual futures terms, simplifying open order management and enhancing trading efficiency. The platform also ensures that the index composition remains current, with regular quarterly adjustments and temporary updates in response to market conditions.

About BingX

Founded in 2018, BingX is a leading crypto exchange, serving over 10 million users worldwide. BingX offers diversified products and services, including spot, derivatives, copy trading, and asset management – all designed for the evolving needs of users, from beginners to professionals. BingX is committed to providing a trustworthy platform that empowers users with innovative tools and features to elevate their trading proficiency. In 2024, BingX proudly became the official crypto exchange partner of Chelsea Football Club, marking an exciting debut in the world of sports.

For more information please visit: https://bingx.com/

Photo – https://mma.prnewswire.com/media/2587929/IMG_0649.jpg

Logo – https://mma.prnewswire.com/media/2310183/BingX_logo_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/bingx-introduces-altcoin-index-futures-trading-one-click-countless-trends-302339486.html

View original content:https://www.prnewswire.co.uk/news-releases/bingx-introduces-altcoin-index-futures-trading-one-click-countless-trends-302339486.html

Fintech PR

Nodepay Raises $7M Total Funding To Power AI Growth with Real-Time Data Infrastructure

SINGAPORE, Dec. 27, 2024 /PRNewswire/ — Nodepay, a decentralized AI platform transforming unused internet bandwidth into real-time data pipelines for AI training, today announced it has raised a second round of funding, bringing its total to $7 million.

The latest funding round welcomed new strategic investors IDG Capital ($23 Billion AUM), Mythos, Elevate Ventures, IBC, Optic Capital, Funders.VC, Matthew Tan (Etherscan founder) and Yusho Liu (CoinHako Co-founder & CEO) as notable angels. They join an impressive roster of previous backers that includes Animoca Brands, Mirana, OKX Ventures, JUMP Crypto, Tokenbay Capital and more.

Nodepay’s network taps into a global community of users running privacy-protected nodes. By sharing their spare internet bandwidth, these participants earn rewards for creating a real-time data source that improves AI inference with accurate, timely information—an approach known as Retrieval Augmented Generation (RAG).

Darren Nguyen, co-founder of Nodepay commented: “Our mission is to develop solutions that create tangible value for both AI developers and its end users. We give contributors a share in the AI ecosystem they help fundamentally build.”

Nodepay’s infrastructure platform integrates real-time data retrieval, a Web3-focused decentralized answer engine, reinforcement learning for more accurate model output, and gamified human verification. Together, these components combine to create a fair, collaborative, and innovative AI ecosystem.

Eric Le, investment director of IDG Capital, said, “The team at Nodepay is democratizing the AI economy by providing a platform that allows users to share directly in the value they create. We’re proud to support their vision of making AI more accessible and beneficial to all.”

With this funding, Nodepay will continue to commercialize its infrastructure to benefit both its community and partner AI labs. As it prepares to launch on Solana, Nodepay stands ready to lead the next era of decentralized AI development and training.

Already serving over 1.5 million active users worldwide, Nodepay continues to expand its reach, solidifying its role as a leader in the integration of AI and blockchain technology. Users can expect further updates and new announcements through their social channels and official website.

About Nodepay

Nodepay is a decentralized AI platform dedicated to democratizing AI training through real-time data retrieval. By turning idle internet bandwidth into a valuable resource, Nodepay fuels the next generation of AI models and stands at the forefront of AI decentralization.

Photo – https://mma.prnewswire.com/media/2587832/7M_Raised_Funds.jpg

Logo – https://mma.prnewswire.com/media/2587833/1080x1080_Black___Nodepay_2_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/nodepay-raises-7m-total-funding-to-power-ai-growth-with-real-time-data-infrastructure-302339478.html

View original content:https://www.prnewswire.co.uk/news-releases/nodepay-raises-7m-total-funding-to-power-ai-growth-with-real-time-data-infrastructure-302339478.html

-

Fintech PR7 days ago

Fintech PR7 days agoAccording to Tickmill survey, 3 in 10 Britons in economic difficulty: Purchasing power down 41% since 2004

-

Fintech PR7 days ago

Fintech PR7 days agoPresident Emmerson Mnangagwa met this week with Zambia’s former Vice President and Special Envoy Enoch Kavindele to discuss SADC’s candidate for the AfDB

-

Fintech PR4 days ago

Fintech PR4 days agoGCL Energy Technology and Ant Digital Technologies Launch First Blockchain-Based RWA Project in Photovoltaic Industry

-

Fintech PR3 days ago

Fintech PR3 days ago2025 Will See Increased QR Code Payments but Payment Card IC ASPs Will Not Return to Pre-Covid Levels

-

Fintech PR3 days ago

Fintech PR3 days agoBybit Champions Web3 Innovation and Strengthens Ties with Asia’s Crypto Community at Taipei Blockchain Week

-

Fintech PR7 days ago

Fintech PR7 days agoStay Cyber Safe This Holiday Season: Heimdal’s Checklist for Business Security

-

Fintech PR7 days ago

Fintech PR7 days agoMedicilon Appoints Dr. Lilly Xu as Chief Technology Officer

-

Fintech PR4 days ago

Fintech PR4 days agoCKGSB Successfully Hosts 2024 MBA Professor Training Program for Western China