Fintech PR

Artmarket.com: Artprice looks at 2023’s NFT auction market, and the 50 most successful digital artists, a promising future with the record for cryptocurrencies in ETFs on Wall Street

PARIS, March 12, 2024 /PRNewswire/ — The year 2023 started with the first acquisitions of NFTs by museums and ended with another bull run on the stock markets and the main cryptocurrencies.

The major event in cryptocurrencies is notably BlackRock’s (the largest asset manager in the world) and Fidelity’s introduction of ETFs directly invested in Bitcoin (Bitcoin spot ETFs) authorized by the SEC on 11 January 2024. This is a real consecration for Bitcoin which on 11 March 2024 was quoted at around 72,000 dollars, while Ethereum was at $4,000 (ETH ETFs are expected very soon).

BlackRock and Fidelity have achieved the best ETF launches in 30 years thanks to Bitcoin. In their first month of trading, the “IBIT” and “FBTC” funds raised $6.5 billion, which is more than any of the 5,500 other index funds launched before them (according to Les Échos of 10 January 2024: “Bitcoin ETF: the SEC opens the doors of Wall Street wide to Bitcoin”.

This is a new record for Bitcoin. Of the 5,535 ETFs launched over the last thirty years, none have gotten off to such a strong start as BlackRock’s ‘IBIT’ and Fidelity’s ‘FBTC’, said Bloomberg expert Eric Balchunas.

This Monday, March 11, 2024, a Bloomberg report (by Tom Metcalf & Emily Nicolle) announces “The London Stock Exchange said it will start accepting applications for the admission of exchange traded notes backed by Bitcoin and Ether” in the second quarter, confirming London as the capital of cryptocurrencies on the European continent.

This allows retail and professional investors to gain exposure to the largest cryptocurrency by market capitalization, without having to directly hold the asset.

Via cryptocurrencies, new collectors and art enthusiasts have been attracted to the art market, often younger than their predecessors. Not averse to speculation and the excitement of taking risks, these art enthusiasts and collectors solidly welded to their crypto-universe of Web 3.0.

The near future of Artprice by Artmarket is the meeting place between Web 3.0. (Metaverse and NFT) and Artprice’s artificial intelligence, its Intuitive Artmarket ® AI.

The 2023 period in NFT auctions, significantly less speculative than the two previous years, allowed Digital Art to finally settle peacefully in the international cultural and economic environment. As the NFT market consolidates, Artprice draws up a summary of the transactions on NFTs hammered in auction rooms in 2023, dominated by Sotheby’s, but which finished with Christie’s “Next Wave” sale on the sidelines of the Art Basel Miami Beach fair.

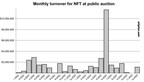

Monthly evolution of proceeds from public NFT auctions

Infographic – https://mma.prnewswire.com/media/2360542/NFT_auctions_1_Infographic.jpg

“Artprice by Artmarket.com recognizes in Digital Art – whether via NFTs or Artificial Intelligence – a revolution that it would be infinitely better to support and accompany than to reject or denigrate“, affirms thierry Ehrmann, CEO of Artmarket.com and Founder of Artprice.

“Artprice subscriptions will soon be able to be paid in ETH and BTC, and our databases have already been adapted to accommodate these two cryptocurrencies. We are very proud to support digital artists with the opening of our Standardized Marketplace to NFTs. Furthermore, we acquired and presented the works Flow (2023) by digital artist Josh Pierce on the cover of our latest Annual Report of the Contemporary Art Market in 2023 and the NFT work Chaos under the pure light by artist 1dontknows for our Annual 2023 Art Market report published in 2024.”

Annual Report of the Contemporary Art Market in 2023:

https://imgpublic.artprice.com/pdf/le-marche-de-lart-contemporain-2023.pdf

https://imgpublic.artprice.com/pdf/the-contemporary-art-market-report-2023.pdf

Annual 2023 Art Market report published in 2024:

https://imgpublic.artprice.com/pdf/le-marche-de-lart-en-2023.pdf

https://imgpublic.artprice.com/pdf/the-art-market-in-2023.pdf

This NFT paradigm shift is well explained in the ARTE documentary, recently released in 5 languages: “NFT, Chaos in the art world”

https://www.youtube.com/watch?v=_08d_1oY-Lo

Throughout this documentary, thierry Ehrmann, visual artist, NFT artist and Founding CEO of Artprice.com, delivers his analysis accompanied by other artists, experts and international players in the world of Art NFTs.

Any attempt to understand the significance of NFTs in Art History requires an appreciation of the digital and cultural revolution that they represent and some kind of prediction regarding their role and impact over the short and medium term.

According to thierry Ehrmann “In its various annual reports on the Art Market and the regulated information it publishes as a listed company, Artprice by Artmarket.com has always said with regard to NFTs that it is impossible to apprehend this new market without a true understanding of Blockchain, crypto-currencies and their cultural origins among the Cypherpunks (period of PGP-type data encryption at the beginning of the 1990s).”

Bearing in mind all the underlying parameters and data required, Artprice by Artmarket is the only organization on the global art market to be able to truly respond to the certification of primary issues of Art NFTs in an environment of cryptocurrencies and major international currencies.

In 2024, Artprice will be uniquely positioned in its capacity as a certifier of primary issues of Art NFTs based on the fact that Artprice by Artmarket has been the Global Leader in Art Market Information for more than 27 years and is the creator and owner of its globally recognized databases. It also has the world’s largest documentary collection of art market notes, manuscripts, codices and annotated sales catalogs from 1700 to the present day, which act as a guarantee of the authenticity and historical veracity of its databases.

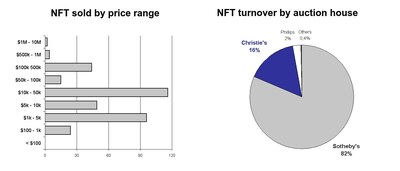

1. Auctions of NFTs in 2023: key figures

– 350 lots sold

– 53 unsold lots (13% of lots)

– 32 sales sessions dedicated to or including NFTs

– 259 distinct artists

– $22.7 million in turnover (including fees)

– +65% growth compared with 2022

– 0.2% of global fine art turnover

– $1.9 million worth of NFTs sold per month on average

– 6 active auction houses

– 82% of the turnover generated by Sotheby’s ($18.4 million)

– $10.9 million total from “Grails: Property from an Iconic Digital Art Collection Part II” sale at Sotheby’s on 15 June 2023

– Minimum price: $126 for Ghost Sphynx (2023) by Asa Jarju

– Average price: $64,800

– Maximum price: $6.2 million for Ringers #879 (The Goose) (2021) by Dmitri Cherniak

https://www.artprice.com/artist/1091079/asa-jarju/nft/31233678/ghost-sphynx

https://www.artprice.com/artist/1023654/dmitri-cherniak/nft/30581409/ringers-879-the-goose

Distribution of public auctions of NFT by price range and by auction house

Infographic – https://mma.prnewswire.com/media/2360541/NFT_auctions_2_Infographic.jpg

2. Seven-digit auction results and other exceptional sales

In 2023, the seven best results of the year in the NFT category were hammered for Generative Art. This self-generating and random artistic approach is at the heart of the history of NFTs, notably with the controversial Profile Pictures (PFP) series such as the Bored Apes and the CryptoKitties. However, these series have now left their place at the forefront of the Generative scene to the abstract works created by artists like Dmitri Cherniak and Tyler Hobbs. Indeed, the series Autoglyph by Larva Labs now fetches higher prices than their CryptoPunks which made the artist duo famous.

Among the most anticipated pieces last year at auction, five digital creations created by Keith Haring at the end of the 1980s were put on sale at Christie’s in September 2023 by the Keith Haring Foundation. In the form of five unique NFTs (#1/1), these experiments were carried out on the first computers equipped with digital creation software a few years after those conducted by Andy Warhol. All the works found buyers at prices between $250,000 and $350,000.

https://onlineonly.christies.com/s/keith-haring-pixel-pioneer/lots/3479?sc_lang=en

Top 20 results for NFT works sold at auction in 2023

1. Dmitri Cherniak (b. 1988) – Ringers #879 (The Goose) (2021): $6,215,100

2. Tyler Hobbs (b. 1987) – fidenza #725 (2021): $1,016,000

3. Snowfro (XX-XXI) – Chromie Squiggle #1780 (2021): $635,000

4. Tyler Hobbs (b. 1987) – Fidenza #479 (2021): $622,300

5. Tyler Hobbs (b. 1987) – fidenza #216 (2021): $609,600

6. Larva Labs (b. 2005) – Autoglyph #187 (2019): $571,500

7. Tyler Hobbs (b. 1987) – fidenza #724 (2021): $442,170

8. Keith Haring (1958-1990) – Untitled (April 14, 1987) (1987): $352,800

9. Keith Haring (1958-1990) – Untitled #1 (April 16, 1987) (1987): $352,800

10. Keith Haring (1958-1990) – untitled #2 (April 16, 1987) (1987): $352,800

11. Kjetil Golid (b. 1991) – Archetype #397 (2021): $330,200

12. Larva Labs (b. 2005) – autoglyph #218 (2019): $330,200

13. Tyler Hobbs (b. 1987) – Fidenza #290 (2021): $279,400

14. Tyler Hobbs (b. 1987) – Fidenza #871 (2021): $279,400

15. Keith Haring (1958-1990) – untitled (feb 2, 1987) (1987): $277,200

16. XCOPY (b. 1981) – Loading New Conflict… Redux 6 (2018): $254,000

17. Larva Labs (b. 2005) – CryptoPunk#4153 (2017): $254,000

18. Keith Haring (1958-1990) – untitled (Feb 3, 1987) (1987): $252,000

19. Tyler Hobbs (b. 1987) – Fidenza #370 (2021): $241,300

20. Tyler Hobbs (b. 1987) – Fidenza #861 (2021): $241,300

3. Both in auction rooms and on the Metaverse

Sotheby’s now stands out as the most active auction house on the NFT market, regularly hosting sessions dedicated to this new medium. On 15 June 2023, Part II of its sale Grails: Property from an Iconic Digital Art Collection totaled $10.9 million in New York. But apart from these sales dedicated to NFTs, Sotheby’s now also includes NFTs in general sessions: at its day sale of Contemporary Art on 19 May 2023 in New York, Tyler Hobbs’ Fidenza #725 (2021) fetched over a million dollars (including fees), against an estimated range of $120,000 – $180,000.

https://www.artprice.com/artist/1062390/tyler-hobbs/nft/30222588/fidenza-725

Under Patrick Drahi’s leadership, Sotheby’s has also deployed a brand new platform called Metaverse, entirely dedicated to Web3: https://metaverse.sothebys.com. In 2023, it hosted the sale of 5,000 photographs by Sebastião Salgado in the form of NFTs, then a session entitled Snow Crash curated by artist Tony Sheeder, and lastly, a sale of 500 unique works generated by the pioneer Vera Molnar (who sadly passed away shortly after on 7 December 2023).

The projects carried out by Sotheby’s on its Metaverse platform, however, deviate somewhat from public sales in terms of transparency and communication of results and are undoubtedly more similar to private sales. Several important NFT works are still visible today on the sothebys-grails.eth wallet and are – according to Michael Bouhanna (VP, Contemporary Art Specialist & Head of Digital Art and NFTs at Sotheby’s) – available for private sale:

CryptoPunk #6669:

https://opensea.io/assets/ethereum/0xb47e3cd837ddf8e4c57f05d70ab865de6e193bbb/6669

Fidenza #526:

https://opensea.io/assets/ethereum/0xa7d8d9ef8d8ce8992df33d8b8cf4aebabd5bd270/78000526

Bored Ape #8552:

https://opensea.io/assets/ethereum/0xbc4ca0eda7647a8ab7c2061c2e118a18a936f13d/8552

4. ‘On-chain’ versus ‘off-chain’ transactions

The majority of NFT artworks publicly auctioned by Sotheby’s have so far gone through its main website, not through its Metaverse, and the transactions have therefore taken place outside the Blockchain. In other words, they were concluded “off-chain”; the hammer prices do not appear in the history of the NFT, where only a double transfer of ownership of the work is visible: from the seller’s portfolio (of the artist or collector) to that of Sotheby’s, and then from Sotheby’s to the buyer’s wallet, once payment is complete.

These “off-chain” transactions allow the auction house to maintain greater control over the transactions, in particular to collect payment before transferring the work to its new owner. This allows Sotheby’s to collect a commission by adding the usual fees. For its part, Christie’s, which carries out “on-chain” transactions via its Christie’s 3.0 platform https://nft.christies.com, does without a commission. Its FAQ specifies that “ Christie’s 3.0 does not add Buyer’s Premium to the hammer price” and that “You will need to pay a gas fee when you place a bid and, if applicable, when you pay sales tax and collect your NFT, Gas fees are not included in the final purchase price”. But these gas fees only concern the operating costs of the Blockchain and are not collected by the auction house.

5. The entry of NFTs into museum collections

The year 2023 saw the first acquisitions of NFTs by several museums, starting with the most prestigious, the LACMA, the MoMA, the Pompidou Center, and the Granet Museum in Aix-en-Provence. Unlike the ambiguous situation of 2021 which saw several institutions put digital duplicates of their masterpieces on sale, it is now a matter of acquisitions of NFTs by museums, directly from artists or via their collectors.

- CryptoPunks #110 acquired by the Center Pompidou and

- CryptoPunks #3831 acquired by LACMA

The reluctance of auction houses regarding “on-chain” transactions is shared by museums, which are subject to strict regulations regarding the acquisition of works. The procedures they must follow sometimes conflict with the principles of transparency and decentralization of Web3. Public institutions therefore prefer for the moment to acquire “off-chain” works and avoid placing all their NFT artworks in a single wallet.

The Los Angeles County Museum of Art (LACMA), which received a donation of 22 NFTs in February 2023 from anonymous collector Cozomo de’ Medici, has only 8 pieces on its e-wallet. Several NFTs, like Fragments of an Infinite Field #972 by Monica Rizzolli, have not yet been delivered and are still on the Cozomo de’ Medici wallet. As for the famous CryptoPunk #3831, the work has been placed in an independent portfolio.

Official announcement of the 22 NFTs acquired by LACMA:

https://unframed.lacma.org/2023/02/24/new-acquisition-cozomo-de-medici-collection

LACMA Collection on Opensea:

https://opensea.io/0x9482B7FEF251Ebb81CeF01108c5512C27520003D

Fragments of an Infinite Field #972 de Monica Rizzolli :

https://opensea.io/assets/ethereum/0xa7d8d9ef8d8ce8992df33d8b8cf4aebabd5bd270/159000972

CryptoPunk #3831 by Larva Labs :

https://opensea.io/0x0f7f63BA74681EfC4eab9777a463E2aF45916EDf

Marcella Lista, Head Curator at the Centre Pompidou explains the procedure followed by the French museum to make its first NFT acquisitions:

“The Center Pompidou has opened a digital wallet exclusively dedicated to the reception and conservation of tokens, knowing that the files of the works have been uploaded in parallel to be stored on the conservation servers of the Pompidou Center as is the case with any digital work in the collection. The works were acquired via a classic acquisition and distribution authorization contract, following the museum’s usual practice, and were paid in euros.

“The various states of visibility of these works on NFT platforms and on the Pompidou Center database can be explained by the long contractualization procedure, their registration on our inventory, and their entry into the database. Works that have not yet appeared are being processed in this administrative, accounting and technical chain.”

The Centre Pompidou NFT collection on Opensea:

https://opensea.io/Centre_Pompidou_MNAM

CryptoPunk #110 from the Centre Pompidou:

https://cryptopunks.app/cryptopunks/details/110

6. A reassuring start to 2024

Auction houses Christie’s and Sotheby’s have started 2024 with one and two sales respectively dedicated to NFTs. Patrick Drahi’s company has already taken the lead this year, generating 92% of the segment’s turnover.

Sotheby’s sessions GRAILS: Starry Night and Natively Digital: An Ordinals Curated Sale totaled over $1 million each, with 19 and 18 lots sold respectively, and no unsold lots. One of the best results was hammered for Genesis Cat, for Taproot Wizards (2024) by digital artist FAR. It was generally believed that the NFT market was now focused on more ‘serious’ creations, but this off-beat work – reminiscent of CryptoKitties – fetched the best NFT result at the start of 2024: $254,000 versus an estimated range of $15,000 to $20,000 (January 22 at Sotheby’s in New York).

Auction results exceeding $100,000 for Satoshi Nakamoto, Xcopy, Beeple and Des Lucréce continue to show that the success of these digital artists is not just anecdotal. In 2024 we will probably see a consolidation of the prices of works by these key signatures on the NFT market. And the rising values of Bitcoin and Ethereum will no doubt contribute to this progression.

7. Top 50 Artists by NFT public auction turnover in 2023

1. Dmitri Cherniak (b. 1988): $7,880,898 (14 lots sold)

2. Tyler Hobbs (b. 1987): $4,919,950 (15 lots sold)

3. Larva Labs (b. 2005): $1,811,675 (9 lots sold)

4. Keith Haring (1958-1990): $1,587,600 (5 lots sold)

5. Snowfro (XX-XXI): $743,529 (3 lots sold)

6. Kjetil Golid (b. 1991): $453,390 (7 lots sold)

7. Refik Anadol (b.1985-): $386,796 (4 lots sold)

8. Shroomtoshi (XX-XXI): $342,900 (2 lots sold)

9. 0xDEAFBEEF (XX-XXI): $325,120 (3 lots sold)

10. Des Lucréce (xx-xxi): $289,599 (10 lots sold)

11. Xcopy (b. 1981): $254,000 (1 lot sold)

12. Six N. Five (b. 1985): $210,321 (1 lot sold)

13. Seerlight (b. 1993): $165,100 (2 lots sold)

14. Andrea Bonaceto (b. 1989): $157,947 (1 lot sold)

15. Jack Butcher (xx-xxi): $144,534 (4 lots sold)

16. Ripcache (XX-XXI): $121,611 (2 lots sold)

17. Deekay Kwon (b. 1989): $115,597 (1 lot sold)

18. Grant Riven Yun (xx-xxi): $107,100 (1 lot sold)

19. Beeple & Madonna (XX-XXI): $100,800 (1 lot sold)

20. luxpris (xx-xxi): $90,170 (4 lots sold)

21. Pindar Van Arman (b. 1974): $82,786 (3 lots sold)

22. Ryan Koopmans (b. 1986): $78,315 (2 lots sold)

23. Matt Deslauriers (XX-XXI): $62,611 (6 lots sold)

24. Hideki Tsukamoto (b. 1973): $62,230 (4 lots sold)

25. Helena Sarin (XX-XXI)$61,355 (3 lots sold)

26. Anyma (b. 1988): $54,658 (1 lot sold)

27. Terrell Jones (b. 1997): $54,052 (3 lots sold)

28. Jack Kaido (xx-xxi): $49,638 (2 lots sold)

29. Mad Dog Jones (b. 1985): $48,165 (1 lot sold)

30. Sam Spratt (XX-XXI): $48,165 (1 lot sold)

31. Alpha Centauri Kid (b. 1986): $45,139 (2 lots sold)

32. Elman Mansimov (XX-XXI): $41,314 (1 lot sold)

33. GMUNK (b. 1975): $38,559 (1 lot sold)

34. Sofia Crespo (b. 1991): $36,915 (2 lots sold)

35. Laura El (b. 1991): $35,645 (2 lots sold)

36. William Mapan (b. 1988): $34,984 (1 lot sold)

37. Pop Wonder (b. 1982): $34,925 (2 lots sold)

38. 0xdgb (XX-XXI)$33,020 (1 lot sold)

39. neurocolor (XX-XXI): $30,480 (2 lots sold)

40. omentejovem (XX-XXI): $30,462 (1 lot sold)

41. Casey Reas (b. 1972): $28,669 (3 lots sold)

42. Samantha Cavet (b. 1997): $28,389 (2 lots sold)

43. Bryan Brinkman (b. 1985): $28,236 (3 lots sold)

44. Luke Shannon (b. 2000): $27,988 (1 lot sold)

45. Isaac Wright (xx-xxi): $27,940 (1 lot sold)

46. Yatreda ያጥሬዳ (XXI): $27,543 (1 lot sold)

47. Ryan Talbot (b. 1997): $27,329 (1 lot sold)

48. Guido Di Salle (b. 1979): $26,308 (1 lot sold)

49. Tyler Hobbs & Dandelios Wist (xx-xxi): $25,400 (1 lot sold)

50. Carlos Marcial (b. 1984): $24,596 (1 lot sold)

Images:

Copyright 1987-2024 thierry Ehrmann www.artprice.com – www.artmarket.com

- Don’t hesitate to contact our Econometrics Department for your requirements regarding statistics and personalized studies: econometrics@artprice.com

- Try our services (free demo): https://www.artprice.com/demo

- Subscribe to our services: https://www.artprice.com/subscription

Artmarket.com is listed on Eurolist by Euronext Paris, and Euroclear: 7478 – Bloomberg: PRC – Reuters: ARTF.

Discover Artmarket and its Artprice department on video: www.artprice.com/video

Artmarket and its Artprice department was founded in 1997 by its CEO, thierry Ehrmann. Artmarket and its Artprice department is controlled by Groupe Serveur, created in 1987.

See certified biography in Who’s who ©:

Artmarket is a global player in the Art Market with, among other structures, its Artprice department, world leader in the accumulation, management and exploitation of historical and current art market information (the original documentary archives, codex manuscripts, annotated books and auction catalogs acquired over the years ) in databanks containing over 30 million indices and auction results, covering more than 835,800 artists.

Artprice by Artmarket, the world leader in information on the art market, has set itself the ambition through its Global Standardized Marketplace to be the world’s leading Fine Art NFT platform.

Artprice Images® allows unlimited access to the largest Art Market image bank in the world: no less than 180 million digital images of photographs or engraved reproductions of artworks from 1700 to the present day, commented by our art historians.

Artmarket with its Artprice department accumulates data on a permanent basis from 7200 Auction Houses and produces key Art Market information for the main press and media agencies (7,200 publications). Its 7.2 million (‘members log in’+social media) users have access to ads posted by other members, a network that today represents the leading Global Standardized Marketplace® to buy and sell artworks at a fixed or bid price (auctions regulated by paragraphs 2 and 3 of Article L 321.3 of France’s Commercial Code).

The Art Market’s future is now brighter than ever with Artprice’s Artmarket® Intuitive AI

Artmarket, with its Artprice department, has twice been awarded the State label “Innovative Company” by the Public Investment Bank (BPI), which has supported the company in its project to consolidate its position as a global player in the art market.

Artprice by Artmarket’s Global Art Market Report, “The Art Market in 2023”, published in March 2024:

https://www.artprice.com/artprice-reports/the-art-market-in-2023

Artprice by Artmarket publishes its 2023 Contemporary Art Market Report:

https://www.artprice.com/artprice-reports/the-contemporary-art-market-report-2023

Index of press releases posted by Artmarket with its Artprice department:

https://serveur.serveur.com/artmarket/press-release/en/

Follow all the Art Market news in real time with Artmarket and its Artprice department on Facebook and Twitter:

www.facebook.com/artpricedotcom/ (over 6.5 million followers)

Discover the alchemy and universe of Artmarket and its artprice department https://www.artprice.com/video headquartered at the famous Organe Contemporary Art Museum “The Abode of Chaos” (dixit The New York Times): https://issuu.com/demeureduchaos/docs/demeureduchaos-abodeofchaos-opus-ix-1999-2013

La Demeure du Chaos / Abode of Chaos

GESAMTKUNSTWERK & SINGULAR ARCHITECTURE

Confidential bilingual work now public:

https://ftp1.serveur.com/abodeofchaos_singular_architecture.pdf

• L’Obs – The Museum of the Future: https://youtu.be/29LXBPJrs-o

• www.facebook.com/la.demeure.du.chaos.theabodeofchaos999 (over 4 million followers)

Contact Artmarket.com and its Artprice department – Contact: Thierry Ehrmann, ir@artmarket.com

Logo – https://mma.prnewswire.com/media/2260897/Artmarket_logo.jpg

Fintech PR

Safello teams up with Zumo to set the standard for sustainability in Sweden’s crypto sector

Swedish cryptocurrency exchange Safello has entered into a strategic partnership with Zumo to comply with sustainability disclosures under MiCAR.

STOCKHOLM and EDINBURGH, Scotland, March 14, 2025 /PRNewswire/ — Safello, the leading cryptocurrency exchange in the Nordics, has entered into an agreement with Zumo, a B2B digital assets platform, to facilitate sustainability disclosure requirements under MiCAR.

Through this collaboration, Safello will leverage Zumo’s expertise in carbon calculations and crypto sustainability impact to ensure accurate and transparent sustainability disclosures. This initiative accommodates the requirements in the European Union’s (EU’s) Markets in Crypto-Assets (MiCA) regulation, which through Article 66 mandates crypto asset service providers (CASPs) active in the EU to display sustainability disclosures on their websites on the environmental impact of the digital assets in relation to which the CASPs offer services.

In implementing MiCAR, the Swedish Financial Supervisory Authority (FSA) has stipulated a nine-month transition period during which it will grandfather the CASP registrations that were granted before MiCAR came into force. Therefore, Swedish CASPs must obtain their MiCA license by 30 September 2025.

“Compliance is at the core of our business. Partnering with Zumo is one of the steps we are taking to meet MiCA’s sustainability disclosure requirements and ensure we provide accurate data to our customers,” says Tara Abdi, Chief Compliance Officer at Safello.

“Safello is a market leader in the Nordics so we’re delighted the team has chosen to partner with Zumo to help meet new regulatory requirements,” adds Nick Jones, Founder and CEO, Zumo.

“Our award-winning Oxygen product was introduced to help CASPs better align their digital asset activities with net zero principles and adopt more sustainable practices. We’re committed to supporting CASPs at every stage of their sustainability journey, and complying to the MiCAR sustainability requirements is a critical first step – By championing actionable steps, and providing new, accessible solutions, we’re supporting the transition towards a more transparent, sustainable, and compliant crypto industry.”

As part of the agreement, Safello will now explore Zumo’s Oxygen solution suite, reinforcing its commitment to both regulatory adherence and sustainability within the crypto industry.

Notes To Editors

Certified Adviser

Amudova AB is Safello’s certified adviser.

Safello is the leading cryptocurrency exchange in the Nordics, with over 400,000 users. The company is empowering financial independence by making crypto accessible to everyone. Safello offers a secure and easy solution for buying, selling, storing, as well as depositing and withdrawing cryptocurrencies directly from the blockchain – ensuring seamless transactions at industry-leading speeds. Operating in Sweden, Safello has been registered as a financial institution with Finansinspektionen (Swedish Financial Supervisory Authority) since 2013 and is listed at Nasdaq First North Growth Market since 2021. For more information visit www.safello.com

About Zumo

Zumo is an award-winning crypto-as-a-service platform. It provides banks, fintechs and other businesses with the infrastructure they need to launch sustainable digital asset solutions.

The company’s purpose is to help build a financial future that creates new opportunities whilst leaving a positive impact on the planet. To achieve this, Zumo is creating easy-to-use financial tools that businesses can embed seamlessly via APIs, so that digital assets are adopted by the mainstream market and used in total peace of mind, every day.

Zumo was an early signatory of the Crypto Climate Accord and has become a key contributor to industry guidance on the decarbonisation of digital assets, working closely with the World Economic Forum. Zumo’s employees also co-founded the Emerging Technologies Sustainability Taskforce (ETST) to help ensure the specific characteristics of emerging technologies, such as blockchain, are encapsulated so the standards used for sustainability across the global digital assets sector are fit for purpose.

Find out more at: https://zumo.tech/

View original content:https://www.prnewswire.co.uk/news-releases/safello-teams-up-with-zumo-to-set-the-standard-for-sustainability-in-swedens-crypto-sector-302401221.html

Fintech PR

Concirrus: If AI Is Good Enough for Government, It’s Good Enough for Insurance

LONDON, March 14, 2025 /PRNewswire/ — AI to Replace Civil Servants and Save £45 Billion: What Does This Mean for Insurance?

The UK government is betting big on AI. Prime Minister Sir Keir Starmer has pledged to replace civil servants with artificial intelligence, calling the state “overcautious and flabby” and promising sweeping reforms. The goal? To cut inefficiencies and save taxpayers £45 billion through automation.

With thousands of government jobs under review and AI well-suited for routine tasks, the civil service could unlock unprecedented efficiency – saving an estimated £45 billion while empowering its workforce

Will the Government’s use of AI legitimise its use in wider industry? Are their parallels within insurance?

The insurance industry faces the same challenges as a market that’s burdened with time-consuming, manual data entry and administrative tasks. AI is poised to change that by automating these processes, allowing underwriters to focus on higher-value decisions, resulting in faster, more accurate quotes, better risk management and a more competitive insurance market.

Much like in government, AI can reduce operational costs in insurance by eliminating repetitive tasks such as keying (and re-keying) submissions, document analysis, and manual risk evaluations. By leveraging AI, insurers can significantly speed up the quote process, improve efficiency and lower premiums.

Rewriting the Underwriter job description

However, AI isn’t replacing underwriters; it’s redefining their roles. As Starmer put it, “No person’s time should be spent on a task where AI can do it better, quicker, and to the same high quality.”

For underwriters, this signals a shift from administrative work to strategic decision-making, portfolio expansion, and coverage innovation. Instead of spending time on data entry or outsourcing submissions for manual processing, underwriters will be free to focus on evaluating complex risks and maximising capacity deployment.

AI won’t make you obsolete; but your competitors using it might

As the government leads the charge in AI-driven reform, the insurance sector must follow. AI is not just a tool for cost-cutting, it’s a powerful driver of efficiency, customer experience, and competitive advantage.

The question is no longer if AI will reshape underwriting but how quickly insurers will adopt it. Those who embrace AI may well outpace their competitors. Those who don’t? They risk being left behind, because AI won’t replace underwriters – but underwriters who use AI will replace those who don’t.

About Concirrus

Concirrus revolutionizes underwriting in specialty and commercial insurance with AI-driven solutions that turn hours-long processes into decisions made in seconds. Founded in 2012, it serves sectors like aviation, transportation, marine, surety, construction, political violence, and terrorism. Trusted by leading insurers, its AI analytics streamline operations, optimize risk assessment, and empower smarter, faster decisions in a rapidly evolving industry. To learn more, visit: https://concirrus.ai

Logo – https://mma.prnewswire.com/media/2638210/5216092/Concirrus.jpg

![]() View original content to download multimedia:https://www.prnewswire.co.uk/news-releases/concirrus–if-ai-is-good-enough-for-government-its-good-enough-for-insurance-302401580.html

View original content to download multimedia:https://www.prnewswire.co.uk/news-releases/concirrus–if-ai-is-good-enough-for-government-its-good-enough-for-insurance-302401580.html

Fintech PR

The 137th Canton Fair: Strengthening Middle East Trade Ties with Successful Promotion Events

GUANGZHOU, China, March 14, 2025 /PRNewswire/ — The 137th Canton Fair is coming this April. Recognized as the largest trade fair in China, the fair successfully conducted a Middle East roadshow in February, with trade promotion events in Qatar, Saudi Arabia and United Arab Emirates.

“The Canton Fair provides a one-stop service platform for the global business community to trade commodities, exchange ideas and align rules and policies. The 137th Canton Fair will open on April 15, and we cordially invite Middle East enterprises to join the exhibition to strengthen cooperation and achieve win-win with global business partners,” said Ma Fengmin, Deputy Director General of China Foreign Trade Centre.

On February 13, the 137th Canton Fair Promotion Workshop was successfully held in Doha. Ali Saeed Bu Sharbak Al Mansori, the Acting General Manager of the Qatar Chamber (QC), praised the strong Qatar–China relations, noting China’s importance as one of Qatar’s most important trade partners and the noticeable developments in various fields, especially in economic and trade sectors. He emphasized the significance of the Canton Fair and Qatar Chamber’s commitment in fostering business ties and partnerships between Qatar and China. GAC (Guangzhou Automobile Group) highlighted the Canton Fair as a bond of friendship and a bridge for trade, encouraging the Qatari business community to attend the Canton Fair.

The Canton Fair working group also visited manufacturing group QIMC, home furniture chain Nabina Group, premium department store Blue Salon and Doha Exhibition and Convention Center.

On February 16 and 17, the Canton Fair working group hosted two promotion conferences in Riyadh and Jeddah, Saudi Arabia, and over 130 local representatives attended the conferences to exchange ideas and promote trade cooperation. He Song, Minister-Counsellor for Economic and Commercial Affairs at the Chinese Embassy in Saudi Arabia, stated that bilateral trade between China and Saudi Arabia has significantly expanded in recent years. Saudi Arabia’s exports to China are extending from traditional energy to diversification, while China’s exports to Saudi Arabia, including mechanical and electrical equipment, automobiles, new energy products, and IT equipment, are also becoming increasingly abundant. Saudi buyer representative highlighted the Canton Fair’s importance for sourcing goods, expanding business, and giving Saudi factories a global platform. Midea expressed that the Canton Fair serves as a global opportunity engine, accelerating the building of mutual trust and promoting shared growth. ToGo power said that the Canton Fair is an excellent platform for finding new suppliers, developing exclusive product lines, and establishing strategic partnerships.

Subsequently, the working group continued to visit the local home furniture retailer Saco and retail enterprise Bin Dawood, and attended the Big 5 exhibition, where they engaged with some of the exhibitors.

In Dubai, the 137th Canton Fair Promotion Conference held on February 19 was attended by about 100 partners and guests. Wang Xiaojia, Counsellor of the Chinese Consulate-General in Dubai, highlighted the strengthening economic ties between China and the UAE. The Canton Fair has become a premium platform for deepening cooperation between two countries. UAE enterprises are welcomed to join the 137th session and further expand business cooperation. Danube Group Vice Chairman and Milano Founder Anis Sajan reflected on his long-standing attendance at the Fair since the early 2000s, commending China’s robust supply capabilities and the event’s role in gathering global business opportunities. Haricharan DTP, Haier Gulf Electronics LLC sales Director, noted that the Canton Fair provides a window for communication, a stage to showcase the strength and image of the enterprise, and promotes technological innovation and industrial upgrading.

The working group visited Dubai World Trade Centre, port and logistics enterprise Gulftainer, Expo Centre Sharjah, retailer LULU, overseas warehouses of cross-border e-commerce companies as well as Gulfood tradeshow.

As an important milestone in building the online platform of the fair, the Canton Fair App now brings integrated online and offline experience for exhibitors and buyers, and serves as a 365-day, uninterrupted business matchmaking platform.

The 137th Canton Fair will be held from April 15 to May 5, 2025 in Guangzhou. To download the Canton Fair App, please visit https://cief.cantonfair.org.cn/en/app/appintro.html.

Photo – https://mma.prnewswire.com/media/2641668/137th_Canton_Fair.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/the-137th-canton-fair-strengthening-middle-east-trade-ties-with-successful-promotion-events-302401793.html

View original content:https://www.prnewswire.co.uk/news-releases/the-137th-canton-fair-strengthening-middle-east-trade-ties-with-successful-promotion-events-302401793.html

-

Fintech7 days ago

Fintech7 days agoFintech Pulse: Your Daily Industry Brief – March 7, 2025 | Wise, Visa, Cadence, Unicredit, Aion Bank, Vodeno

-

Fintech7 days ago

Fintech7 days agoHyPerform Receives ‘Excellence in Fintech’ Award at ET NOW Business Conclave & Awards 2025

-

Fintech PR7 days ago

Fintech PR7 days agoInnocan Pharma Announces Closing of Debenture Unit Offering to its Largest Shareholder, Tamar Innovest Limited

-

Fintech PR7 days ago

Fintech PR7 days agoMinesto selected to participate in GIA (Global Innovation Accelerator) programme by Swedish Energy Agency

-

Fintech PR7 days ago

Fintech PR7 days agoElliptic Data used by US Secret Service in Investigation into $96 Billion Russian Crypto Exchange Garantex

-

Fintech PR7 days ago

Fintech PR7 days agoApollo Group TV Expands Payment Options Making Premium Streaming More Accessible In 2025

-

Fintech4 days ago

Fintech4 days agoFintech Pulse: Your Daily Industry Brief – March 10, 2025 | Finovifi, Modern Banking Systems, France Flowdesk, Fintech Galaxy, ProgressSoft, Finory Investment, 1337 Ventures

-

Fintech3 days ago

Fintech3 days agoFintech Pulse: Your Daily Industry Brief – March 11, 2025: Apex Fintech, Bakkt, Stripe, PayPal, Nvidia, Shopify, Adyen, Intergiro, Seon, Infintegration