Fintech PR

Artmarket.com: Artprice looks at 2023’s NFT auction market, and the 50 most successful digital artists, a promising future with the record for cryptocurrencies in ETFs on Wall Street

PARIS, March 12, 2024 /PRNewswire/ — The year 2023 started with the first acquisitions of NFTs by museums and ended with another bull run on the stock markets and the main cryptocurrencies.

The major event in cryptocurrencies is notably BlackRock’s (the largest asset manager in the world) and Fidelity’s introduction of ETFs directly invested in Bitcoin (Bitcoin spot ETFs) authorized by the SEC on 11 January 2024. This is a real consecration for Bitcoin which on 11 March 2024 was quoted at around 72,000 dollars, while Ethereum was at $4,000 (ETH ETFs are expected very soon).

BlackRock and Fidelity have achieved the best ETF launches in 30 years thanks to Bitcoin. In their first month of trading, the “IBIT” and “FBTC” funds raised $6.5 billion, which is more than any of the 5,500 other index funds launched before them (according to Les Échos of 10 January 2024: “Bitcoin ETF: the SEC opens the doors of Wall Street wide to Bitcoin”.

This is a new record for Bitcoin. Of the 5,535 ETFs launched over the last thirty years, none have gotten off to such a strong start as BlackRock’s ‘IBIT’ and Fidelity’s ‘FBTC’, said Bloomberg expert Eric Balchunas.

This Monday, March 11, 2024, a Bloomberg report (by Tom Metcalf & Emily Nicolle) announces “The London Stock Exchange said it will start accepting applications for the admission of exchange traded notes backed by Bitcoin and Ether” in the second quarter, confirming London as the capital of cryptocurrencies on the European continent.

This allows retail and professional investors to gain exposure to the largest cryptocurrency by market capitalization, without having to directly hold the asset.

Via cryptocurrencies, new collectors and art enthusiasts have been attracted to the art market, often younger than their predecessors. Not averse to speculation and the excitement of taking risks, these art enthusiasts and collectors solidly welded to their crypto-universe of Web 3.0.

The near future of Artprice by Artmarket is the meeting place between Web 3.0. (Metaverse and NFT) and Artprice’s artificial intelligence, its Intuitive Artmarket ® AI.

The 2023 period in NFT auctions, significantly less speculative than the two previous years, allowed Digital Art to finally settle peacefully in the international cultural and economic environment. As the NFT market consolidates, Artprice draws up a summary of the transactions on NFTs hammered in auction rooms in 2023, dominated by Sotheby’s, but which finished with Christie’s “Next Wave” sale on the sidelines of the Art Basel Miami Beach fair.

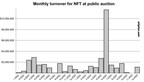

Monthly evolution of proceeds from public NFT auctions

Infographic – https://mma.prnewswire.com/media/2360542/NFT_auctions_1_Infographic.jpg

“Artprice by Artmarket.com recognizes in Digital Art – whether via NFTs or Artificial Intelligence – a revolution that it would be infinitely better to support and accompany than to reject or denigrate“, affirms thierry Ehrmann, CEO of Artmarket.com and Founder of Artprice.

“Artprice subscriptions will soon be able to be paid in ETH and BTC, and our databases have already been adapted to accommodate these two cryptocurrencies. We are very proud to support digital artists with the opening of our Standardized Marketplace to NFTs. Furthermore, we acquired and presented the works Flow (2023) by digital artist Josh Pierce on the cover of our latest Annual Report of the Contemporary Art Market in 2023 and the NFT work Chaos under the pure light by artist 1dontknows for our Annual 2023 Art Market report published in 2024.”

Annual Report of the Contemporary Art Market in 2023:

https://imgpublic.artprice.com/pdf/le-marche-de-lart-contemporain-2023.pdf

https://imgpublic.artprice.com/pdf/the-contemporary-art-market-report-2023.pdf

Annual 2023 Art Market report published in 2024:

https://imgpublic.artprice.com/pdf/le-marche-de-lart-en-2023.pdf

https://imgpublic.artprice.com/pdf/the-art-market-in-2023.pdf

This NFT paradigm shift is well explained in the ARTE documentary, recently released in 5 languages: “NFT, Chaos in the art world”

https://www.youtube.com/watch?v=_08d_1oY-Lo

Throughout this documentary, thierry Ehrmann, visual artist, NFT artist and Founding CEO of Artprice.com, delivers his analysis accompanied by other artists, experts and international players in the world of Art NFTs.

Any attempt to understand the significance of NFTs in Art History requires an appreciation of the digital and cultural revolution that they represent and some kind of prediction regarding their role and impact over the short and medium term.

According to thierry Ehrmann “In its various annual reports on the Art Market and the regulated information it publishes as a listed company, Artprice by Artmarket.com has always said with regard to NFTs that it is impossible to apprehend this new market without a true understanding of Blockchain, crypto-currencies and their cultural origins among the Cypherpunks (period of PGP-type data encryption at the beginning of the 1990s).”

Bearing in mind all the underlying parameters and data required, Artprice by Artmarket is the only organization on the global art market to be able to truly respond to the certification of primary issues of Art NFTs in an environment of cryptocurrencies and major international currencies.

In 2024, Artprice will be uniquely positioned in its capacity as a certifier of primary issues of Art NFTs based on the fact that Artprice by Artmarket has been the Global Leader in Art Market Information for more than 27 years and is the creator and owner of its globally recognized databases. It also has the world’s largest documentary collection of art market notes, manuscripts, codices and annotated sales catalogs from 1700 to the present day, which act as a guarantee of the authenticity and historical veracity of its databases.

1. Auctions of NFTs in 2023: key figures

– 350 lots sold

– 53 unsold lots (13% of lots)

– 32 sales sessions dedicated to or including NFTs

– 259 distinct artists

– $22.7 million in turnover (including fees)

– +65% growth compared with 2022

– 0.2% of global fine art turnover

– $1.9 million worth of NFTs sold per month on average

– 6 active auction houses

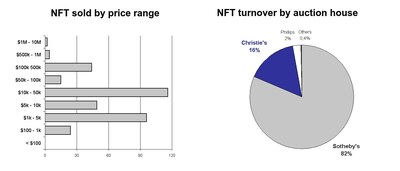

– 82% of the turnover generated by Sotheby’s ($18.4 million)

– $10.9 million total from “Grails: Property from an Iconic Digital Art Collection Part II” sale at Sotheby’s on 15 June 2023

– Minimum price: $126 for Ghost Sphynx (2023) by Asa Jarju

– Average price: $64,800

– Maximum price: $6.2 million for Ringers #879 (The Goose) (2021) by Dmitri Cherniak

https://www.artprice.com/artist/1091079/asa-jarju/nft/31233678/ghost-sphynx

https://www.artprice.com/artist/1023654/dmitri-cherniak/nft/30581409/ringers-879-the-goose

Distribution of public auctions of NFT by price range and by auction house

Infographic – https://mma.prnewswire.com/media/2360541/NFT_auctions_2_Infographic.jpg

2. Seven-digit auction results and other exceptional sales

In 2023, the seven best results of the year in the NFT category were hammered for Generative Art. This self-generating and random artistic approach is at the heart of the history of NFTs, notably with the controversial Profile Pictures (PFP) series such as the Bored Apes and the CryptoKitties. However, these series have now left their place at the forefront of the Generative scene to the abstract works created by artists like Dmitri Cherniak and Tyler Hobbs. Indeed, the series Autoglyph by Larva Labs now fetches higher prices than their CryptoPunks which made the artist duo famous.

Among the most anticipated pieces last year at auction, five digital creations created by Keith Haring at the end of the 1980s were put on sale at Christie’s in September 2023 by the Keith Haring Foundation. In the form of five unique NFTs (#1/1), these experiments were carried out on the first computers equipped with digital creation software a few years after those conducted by Andy Warhol. All the works found buyers at prices between $250,000 and $350,000.

https://onlineonly.christies.com/s/keith-haring-pixel-pioneer/lots/3479?sc_lang=en

Top 20 results for NFT works sold at auction in 2023

1. Dmitri Cherniak (b. 1988) – Ringers #879 (The Goose) (2021): $6,215,100

2. Tyler Hobbs (b. 1987) – fidenza #725 (2021): $1,016,000

3. Snowfro (XX-XXI) – Chromie Squiggle #1780 (2021): $635,000

4. Tyler Hobbs (b. 1987) – Fidenza #479 (2021): $622,300

5. Tyler Hobbs (b. 1987) – fidenza #216 (2021): $609,600

6. Larva Labs (b. 2005) – Autoglyph #187 (2019): $571,500

7. Tyler Hobbs (b. 1987) – fidenza #724 (2021): $442,170

8. Keith Haring (1958-1990) – Untitled (April 14, 1987) (1987): $352,800

9. Keith Haring (1958-1990) – Untitled #1 (April 16, 1987) (1987): $352,800

10. Keith Haring (1958-1990) – untitled #2 (April 16, 1987) (1987): $352,800

11. Kjetil Golid (b. 1991) – Archetype #397 (2021): $330,200

12. Larva Labs (b. 2005) – autoglyph #218 (2019): $330,200

13. Tyler Hobbs (b. 1987) – Fidenza #290 (2021): $279,400

14. Tyler Hobbs (b. 1987) – Fidenza #871 (2021): $279,400

15. Keith Haring (1958-1990) – untitled (feb 2, 1987) (1987): $277,200

16. XCOPY (b. 1981) – Loading New Conflict… Redux 6 (2018): $254,000

17. Larva Labs (b. 2005) – CryptoPunk#4153 (2017): $254,000

18. Keith Haring (1958-1990) – untitled (Feb 3, 1987) (1987): $252,000

19. Tyler Hobbs (b. 1987) – Fidenza #370 (2021): $241,300

20. Tyler Hobbs (b. 1987) – Fidenza #861 (2021): $241,300

3. Both in auction rooms and on the Metaverse

Sotheby’s now stands out as the most active auction house on the NFT market, regularly hosting sessions dedicated to this new medium. On 15 June 2023, Part II of its sale Grails: Property from an Iconic Digital Art Collection totaled $10.9 million in New York. But apart from these sales dedicated to NFTs, Sotheby’s now also includes NFTs in general sessions: at its day sale of Contemporary Art on 19 May 2023 in New York, Tyler Hobbs’ Fidenza #725 (2021) fetched over a million dollars (including fees), against an estimated range of $120,000 – $180,000.

https://www.artprice.com/artist/1062390/tyler-hobbs/nft/30222588/fidenza-725

Under Patrick Drahi’s leadership, Sotheby’s has also deployed a brand new platform called Metaverse, entirely dedicated to Web3: https://metaverse.sothebys.com. In 2023, it hosted the sale of 5,000 photographs by Sebastião Salgado in the form of NFTs, then a session entitled Snow Crash curated by artist Tony Sheeder, and lastly, a sale of 500 unique works generated by the pioneer Vera Molnar (who sadly passed away shortly after on 7 December 2023).

The projects carried out by Sotheby’s on its Metaverse platform, however, deviate somewhat from public sales in terms of transparency and communication of results and are undoubtedly more similar to private sales. Several important NFT works are still visible today on the sothebys-grails.eth wallet and are – according to Michael Bouhanna (VP, Contemporary Art Specialist & Head of Digital Art and NFTs at Sotheby’s) – available for private sale:

CryptoPunk #6669:

https://opensea.io/assets/ethereum/0xb47e3cd837ddf8e4c57f05d70ab865de6e193bbb/6669

Fidenza #526:

https://opensea.io/assets/ethereum/0xa7d8d9ef8d8ce8992df33d8b8cf4aebabd5bd270/78000526

Bored Ape #8552:

https://opensea.io/assets/ethereum/0xbc4ca0eda7647a8ab7c2061c2e118a18a936f13d/8552

4. ‘On-chain’ versus ‘off-chain’ transactions

The majority of NFT artworks publicly auctioned by Sotheby’s have so far gone through its main website, not through its Metaverse, and the transactions have therefore taken place outside the Blockchain. In other words, they were concluded “off-chain”; the hammer prices do not appear in the history of the NFT, where only a double transfer of ownership of the work is visible: from the seller’s portfolio (of the artist or collector) to that of Sotheby’s, and then from Sotheby’s to the buyer’s wallet, once payment is complete.

These “off-chain” transactions allow the auction house to maintain greater control over the transactions, in particular to collect payment before transferring the work to its new owner. This allows Sotheby’s to collect a commission by adding the usual fees. For its part, Christie’s, which carries out “on-chain” transactions via its Christie’s 3.0 platform https://nft.christies.com, does without a commission. Its FAQ specifies that “ Christie’s 3.0 does not add Buyer’s Premium to the hammer price” and that “You will need to pay a gas fee when you place a bid and, if applicable, when you pay sales tax and collect your NFT, Gas fees are not included in the final purchase price”. But these gas fees only concern the operating costs of the Blockchain and are not collected by the auction house.

5. The entry of NFTs into museum collections

The year 2023 saw the first acquisitions of NFTs by several museums, starting with the most prestigious, the LACMA, the MoMA, the Pompidou Center, and the Granet Museum in Aix-en-Provence. Unlike the ambiguous situation of 2021 which saw several institutions put digital duplicates of their masterpieces on sale, it is now a matter of acquisitions of NFTs by museums, directly from artists or via their collectors.

- CryptoPunks #110 acquired by the Center Pompidou and

- CryptoPunks #3831 acquired by LACMA

The reluctance of auction houses regarding “on-chain” transactions is shared by museums, which are subject to strict regulations regarding the acquisition of works. The procedures they must follow sometimes conflict with the principles of transparency and decentralization of Web3. Public institutions therefore prefer for the moment to acquire “off-chain” works and avoid placing all their NFT artworks in a single wallet.

The Los Angeles County Museum of Art (LACMA), which received a donation of 22 NFTs in February 2023 from anonymous collector Cozomo de’ Medici, has only 8 pieces on its e-wallet. Several NFTs, like Fragments of an Infinite Field #972 by Monica Rizzolli, have not yet been delivered and are still on the Cozomo de’ Medici wallet. As for the famous CryptoPunk #3831, the work has been placed in an independent portfolio.

Official announcement of the 22 NFTs acquired by LACMA:

https://unframed.lacma.org/2023/02/24/new-acquisition-cozomo-de-medici-collection

LACMA Collection on Opensea:

https://opensea.io/0x9482B7FEF251Ebb81CeF01108c5512C27520003D

Fragments of an Infinite Field #972 de Monica Rizzolli :

https://opensea.io/assets/ethereum/0xa7d8d9ef8d8ce8992df33d8b8cf4aebabd5bd270/159000972

CryptoPunk #3831 by Larva Labs :

https://opensea.io/0x0f7f63BA74681EfC4eab9777a463E2aF45916EDf

Marcella Lista, Head Curator at the Centre Pompidou explains the procedure followed by the French museum to make its first NFT acquisitions:

“The Center Pompidou has opened a digital wallet exclusively dedicated to the reception and conservation of tokens, knowing that the files of the works have been uploaded in parallel to be stored on the conservation servers of the Pompidou Center as is the case with any digital work in the collection. The works were acquired via a classic acquisition and distribution authorization contract, following the museum’s usual practice, and were paid in euros.

“The various states of visibility of these works on NFT platforms and on the Pompidou Center database can be explained by the long contractualization procedure, their registration on our inventory, and their entry into the database. Works that have not yet appeared are being processed in this administrative, accounting and technical chain.”

The Centre Pompidou NFT collection on Opensea:

https://opensea.io/Centre_Pompidou_MNAM

CryptoPunk #110 from the Centre Pompidou:

https://cryptopunks.app/cryptopunks/details/110

6. A reassuring start to 2024

Auction houses Christie’s and Sotheby’s have started 2024 with one and two sales respectively dedicated to NFTs. Patrick Drahi’s company has already taken the lead this year, generating 92% of the segment’s turnover.

Sotheby’s sessions GRAILS: Starry Night and Natively Digital: An Ordinals Curated Sale totaled over $1 million each, with 19 and 18 lots sold respectively, and no unsold lots. One of the best results was hammered for Genesis Cat, for Taproot Wizards (2024) by digital artist FAR. It was generally believed that the NFT market was now focused on more ‘serious’ creations, but this off-beat work – reminiscent of CryptoKitties – fetched the best NFT result at the start of 2024: $254,000 versus an estimated range of $15,000 to $20,000 (January 22 at Sotheby’s in New York).

Auction results exceeding $100,000 for Satoshi Nakamoto, Xcopy, Beeple and Des Lucréce continue to show that the success of these digital artists is not just anecdotal. In 2024 we will probably see a consolidation of the prices of works by these key signatures on the NFT market. And the rising values of Bitcoin and Ethereum will no doubt contribute to this progression.

7. Top 50 Artists by NFT public auction turnover in 2023

1. Dmitri Cherniak (b. 1988): $7,880,898 (14 lots sold)

2. Tyler Hobbs (b. 1987): $4,919,950 (15 lots sold)

3. Larva Labs (b. 2005): $1,811,675 (9 lots sold)

4. Keith Haring (1958-1990): $1,587,600 (5 lots sold)

5. Snowfro (XX-XXI): $743,529 (3 lots sold)

6. Kjetil Golid (b. 1991): $453,390 (7 lots sold)

7. Refik Anadol (b.1985-): $386,796 (4 lots sold)

8. Shroomtoshi (XX-XXI): $342,900 (2 lots sold)

9. 0xDEAFBEEF (XX-XXI): $325,120 (3 lots sold)

10. Des Lucréce (xx-xxi): $289,599 (10 lots sold)

11. Xcopy (b. 1981): $254,000 (1 lot sold)

12. Six N. Five (b. 1985): $210,321 (1 lot sold)

13. Seerlight (b. 1993): $165,100 (2 lots sold)

14. Andrea Bonaceto (b. 1989): $157,947 (1 lot sold)

15. Jack Butcher (xx-xxi): $144,534 (4 lots sold)

16. Ripcache (XX-XXI): $121,611 (2 lots sold)

17. Deekay Kwon (b. 1989): $115,597 (1 lot sold)

18. Grant Riven Yun (xx-xxi): $107,100 (1 lot sold)

19. Beeple & Madonna (XX-XXI): $100,800 (1 lot sold)

20. luxpris (xx-xxi): $90,170 (4 lots sold)

21. Pindar Van Arman (b. 1974): $82,786 (3 lots sold)

22. Ryan Koopmans (b. 1986): $78,315 (2 lots sold)

23. Matt Deslauriers (XX-XXI): $62,611 (6 lots sold)

24. Hideki Tsukamoto (b. 1973): $62,230 (4 lots sold)

25. Helena Sarin (XX-XXI)$61,355 (3 lots sold)

26. Anyma (b. 1988): $54,658 (1 lot sold)

27. Terrell Jones (b. 1997): $54,052 (3 lots sold)

28. Jack Kaido (xx-xxi): $49,638 (2 lots sold)

29. Mad Dog Jones (b. 1985): $48,165 (1 lot sold)

30. Sam Spratt (XX-XXI): $48,165 (1 lot sold)

31. Alpha Centauri Kid (b. 1986): $45,139 (2 lots sold)

32. Elman Mansimov (XX-XXI): $41,314 (1 lot sold)

33. GMUNK (b. 1975): $38,559 (1 lot sold)

34. Sofia Crespo (b. 1991): $36,915 (2 lots sold)

35. Laura El (b. 1991): $35,645 (2 lots sold)

36. William Mapan (b. 1988): $34,984 (1 lot sold)

37. Pop Wonder (b. 1982): $34,925 (2 lots sold)

38. 0xdgb (XX-XXI)$33,020 (1 lot sold)

39. neurocolor (XX-XXI): $30,480 (2 lots sold)

40. omentejovem (XX-XXI): $30,462 (1 lot sold)

41. Casey Reas (b. 1972): $28,669 (3 lots sold)

42. Samantha Cavet (b. 1997): $28,389 (2 lots sold)

43. Bryan Brinkman (b. 1985): $28,236 (3 lots sold)

44. Luke Shannon (b. 2000): $27,988 (1 lot sold)

45. Isaac Wright (xx-xxi): $27,940 (1 lot sold)

46. Yatreda ያጥሬዳ (XXI): $27,543 (1 lot sold)

47. Ryan Talbot (b. 1997): $27,329 (1 lot sold)

48. Guido Di Salle (b. 1979): $26,308 (1 lot sold)

49. Tyler Hobbs & Dandelios Wist (xx-xxi): $25,400 (1 lot sold)

50. Carlos Marcial (b. 1984): $24,596 (1 lot sold)

Images:

Copyright 1987-2024 thierry Ehrmann www.artprice.com – www.artmarket.com

- Don’t hesitate to contact our Econometrics Department for your requirements regarding statistics and personalized studies: [email protected]

- Try our services (free demo): https://www.artprice.com/demo

- Subscribe to our services: https://www.artprice.com/subscription

Artmarket.com is listed on Eurolist by Euronext Paris, and Euroclear: 7478 – Bloomberg: PRC – Reuters: ARTF.

Discover Artmarket and its Artprice department on video: www.artprice.com/video

Artmarket and its Artprice department was founded in 1997 by its CEO, thierry Ehrmann. Artmarket and its Artprice department is controlled by Groupe Serveur, created in 1987.

See certified biography in Who’s who ©:

Artmarket is a global player in the Art Market with, among other structures, its Artprice department, world leader in the accumulation, management and exploitation of historical and current art market information (the original documentary archives, codex manuscripts, annotated books and auction catalogs acquired over the years ) in databanks containing over 30 million indices and auction results, covering more than 835,800 artists.

Artprice by Artmarket, the world leader in information on the art market, has set itself the ambition through its Global Standardized Marketplace to be the world’s leading Fine Art NFT platform.

Artprice Images® allows unlimited access to the largest Art Market image bank in the world: no less than 180 million digital images of photographs or engraved reproductions of artworks from 1700 to the present day, commented by our art historians.

Artmarket with its Artprice department accumulates data on a permanent basis from 7200 Auction Houses and produces key Art Market information for the main press and media agencies (7,200 publications). Its 7.2 million (‘members log in’+social media) users have access to ads posted by other members, a network that today represents the leading Global Standardized Marketplace® to buy and sell artworks at a fixed or bid price (auctions regulated by paragraphs 2 and 3 of Article L 321.3 of France’s Commercial Code).

The Art Market’s future is now brighter than ever with Artprice’s Artmarket® Intuitive AI

Artmarket, with its Artprice department, has twice been awarded the State label “Innovative Company” by the Public Investment Bank (BPI), which has supported the company in its project to consolidate its position as a global player in the art market.

Artprice by Artmarket’s Global Art Market Report, “The Art Market in 2023”, published in March 2024:

https://www.artprice.com/artprice-reports/the-art-market-in-2023

Artprice by Artmarket publishes its 2023 Contemporary Art Market Report:

https://www.artprice.com/artprice-reports/the-contemporary-art-market-report-2023

Index of press releases posted by Artmarket with its Artprice department:

https://serveur.serveur.com/artmarket/press-release/en/

Follow all the Art Market news in real time with Artmarket and its Artprice department on Facebook and Twitter:

www.facebook.com/artpricedotcom/ (over 6.5 million followers)

Discover the alchemy and universe of Artmarket and its artprice department https://www.artprice.com/video headquartered at the famous Organe Contemporary Art Museum “The Abode of Chaos” (dixit The New York Times): https://issuu.com/demeureduchaos/docs/demeureduchaos-abodeofchaos-opus-ix-1999-2013

La Demeure du Chaos / Abode of Chaos

GESAMTKUNSTWERK & SINGULAR ARCHITECTURE

Confidential bilingual work now public:

https://ftp1.serveur.com/abodeofchaos_singular_architecture.pdf

• L’Obs – The Museum of the Future: https://youtu.be/29LXBPJrs-o

• www.facebook.com/la.demeure.du.chaos.theabodeofchaos999 (over 4 million followers)

Contact Artmarket.com and its Artprice department – Contact: Thierry Ehrmann, [email protected]

Logo – https://mma.prnewswire.com/media/2260897/Artmarket_logo.jpg

Fintech PR

Heidrick & Struggles Announces 2025 Global and Regional Leader Appointments

The promotions span across six practice areas and three regions to drive growth in 2025 and beyond

CHICAGO, Jan. 6, 2025 /PRNewswire/ — Heidrick & Struggles (Nasdaq: HSII), a premier provider of global leadership advisory and on-demand talent solutions, today announced key global and regional leader appointments, effective January 1, 2025. The appointed leaders will continue advancing the firm’s objective of delivering exceptional value to clients by fostering differentiated, deep, and durable relationships.

“Having the right leadership in place is increasingly crucial to business performance, growth, and prosperity, making our work more important than ever,” said Tom Monahan, CEO, Heidrick & Struggles. “This dynamic group embodies our values as a firm as well as our unwavering commitment to delivering superior client service. We’re excited to promote these outstanding leaders as they continue to shepherd our clients through their most pressing business and talent challenges.”

These leaders span Heidrick & Struggles’ priority practice and solution areas, as well as multiple regions globally.

Individuals appointed to Regional Leader:

- Anne Rockey, North America

- Richard Guest, Asia Pacific & Middle East

Individual appointed to Global Managing Partner:

- Todd Taylor, Client Driven Growth, a newly created role

Individuals appointed to Executive Search Global Practice Managing Partner:

- Jaimee Eddington, Corporate Officers Practice

- Dominique Fortier, Financial Services Practice

- Chris Bray, Global Technology & Services Practice

- Gustavo Alba, Co-Lead, Private Equity Practice

Individuals appointed to Executive Search Regional Practice Managing Partner:

- Liz Langel, Americas, Financial Services Practice

- Ina Sood, Americas, Healthcare & Life Sciences Practice

- David Burd, Americas, Corporate Officers Practice

- David Crawford, Asia Pacific & Middle East, Global Technology & Services Practice

- Tom Cunningham, Europe & Africa, Global Technology & Services Practice

- Sarah Driscoll, Europe & Africa, Global Technology & Services Practice

- Roman Wecker, Europe & Africa, Industrial Practice

Individuals appointed to Partner-in-Charge:

- Jane Xing, Beijing

- Jessi Gentile, Chicago

- Maliha Jilani, Dubai

- Kim Pomoell, Finland

- Kiwook Kim, Korea

- David Richardson, New York/Stamford

- Christina Besozzi Cary, Washington, D.C.

Individual promoted in Heidrick Consulting:

- Eric Joseph, leading North America on an interim basis

About Heidrick & Struggles

Heidrick & Struggles (Nasdaq: HSII) is a premier provider of global leadership advisory services and on-demand talent solutions, serving the senior talent and consulting needs of the world’s top organizations. Heidrick & Struggles pioneered the profession of executive search more than 70 years ago. Today, we partner with clients to develop future-ready leaders and organizations, combining our expertise in executive search, leadership consulting, and on-demand, critical talent solutions to achieve the highest levels of profitability and performance. Helping our clients change the world, one leadership team at a time.® www.heidrick.com

Media Contact

Bianca Wilson

Global Director, Public Relations

Heidrick & Struggles

[email protected]

Logo – https://mma.prnewswire.com/media/139029/heidrick_struggles_logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/heidrick–struggles-announces-2025-global-and-regional-leader-appointments-302343456.html

View original content:https://www.prnewswire.co.uk/news-releases/heidrick–struggles-announces-2025-global-and-regional-leader-appointments-302343456.html

Fintech PR

Finastra announces leadership transition: welcoming Chris Walters as new CEO

LONDON, Jan. 6, 2025 /PRNewswire/ — Finastra, a global provider of financial services software applications, today announced a significant leadership transition. After nearly a decade of transformative leadership, Simon Paris will step down from his role as Chief Executive Officer. Chris Walters has joined Finastra and will assume the role of Chief Executive Officer.

Chris brings a wealth of experience from senior executive leadership positions, driving innovation and scaling technology companies. He recently served as CEO of Pluralsight and Avantax, a leading company within Financial Services, where he orchestrated significant performance improvement and the company’s successful sale. Prior to Pluralsight and Avantax, Chris served in a variety of leadership roles, including being a Partner at McKinsey & Company and the COO of Bloomberg Industry Verticals Group.

On his appointment, Chris said, “I’m excited to join Finastra at this pivotal moment in its journey and am impressed by the significant progress that has been made during Simon’s leadership. I look forward to working with the talented team to drive sustainable growth and continue to deliver more value to our customers, team members, and investors.”

Under Simon’s stewardship, the company has achieved remarkable milestones, including:

- Leading the charge in Open Finance, following the merger of Misys and D+H in 2017 to form Finastra

- Building a loyal customer base of over 8,000 clients in 130 countries, including 45 of the world’s top 50 banks

- Achieving recognition as a leader in Generative AI, with all employees upskilled and ~50 capabilities in progress from ideation to production stages

- Garnering extensive market accolades, including multiple product, culture, and leadership awards, and being named the #1 Banking Technology company, the #2 Financial Technology company, and appearing in the top 15 Software companies worldwide in 2024 alone

- Delivering record financial performance and double-digit Annual Recurring Revenue (ARR) growth

As Finastra embarks on its new strategic sprint in 2025, the company is well-positioned for continued success. During the transition period, Simon and Chris will work closely together to ensure a smooth handover.

Simon reflected on his tenure, saying, “This journey with Finastra has been a privilege. Chris is a seasoned professional, and I am honored to ‘pass the baton’ to him. I leave incredibly proud of what Finastra has achieved so far and excited for the company’s future under Chris’s leadership.”

About Finastra

Finastra is a global provider of financial services software applications across Lending, Payments, Treasury and Capital Markets, and Universal (retail and digital) Banking. Committed to unlocking the potential of people, businesses and communities everywhere, its vision is to accelerate the future of Open Finance through technology and collaboration, and its pioneering approach is why it is trusted by ~8,100 financial institutions, including 45 of the world’s top 50 banks. For more information, visit finastra.com.

Photo – https://mma.prnewswire.com/media/2591526/Simon_Paris_and_Chris_Walters.jpg

Logo – https://mma.prnewswire.com/media/1916021/5100855/FINASTRA_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/finastra-announces-leadership-transition-welcoming-chris-walters-as-new-ceo-302343232.html

View original content:https://www.prnewswire.co.uk/news-releases/finastra-announces-leadership-transition-welcoming-chris-walters-as-new-ceo-302343232.html

Fintech PR

DXC Technology’s AI Impact Helps Customers Across Industries Innovate with AI

AI Impact leverages DXC’s combined consulting, engineering, and secure enterprise services

ASHBURN, Va., Jan. 6, 2025 /PRNewswire/ — DXC Technology (NYSE: DXC), a leading Fortune 500 global technology services provider, today announced AI Impact, an approach designed to help solve customers’ most pressing challenges. By combining DXC consulting, engineering and secure enterprise services, DXC will help clients across industries securely innovate and drive real business outcomes with AI.

DXC takes a pragmatic approach to AI by focusing on developing solutions that solve real world challenges and support business growth. With DXC’s AI Impact, customers benefit from DXC’s vast industry expertise and technology experience to build solutions, services and experiences together that will deliver real business outcomes using the latest technology innovation. Read more about DXC’s approach here.

“AI has already captured the attention and imagination of industries everywhere. From AI agents to autonomous driving and personalized medicine, companies are taking steps to unlock value from AI, which promises to reshape our world,” said Howard Boville, EVP, Consulting & Engineering Services – Powered by AI. “With DXC’s AI Impact approach, we are helping to push the boundaries of what AI makes possible, guided by our team of consulting, engineering and technology experts to address our clients’ most pressing challenges.”

Customers across industries are leveraging AI Impact, including:

- Automotive: DXC is helping customers leverage AI-powered diagnostic tools to make it easier for automotive manufacturers and service providers to identify potential issues before they become critical, reducing downtime and maintenance costs. DXC is also helping customers leverage AI to personalize every aspect of a vehicle, including personal assistants that learn a driver’s preferences and habits over time to make more intuitive recommendations.

- Public Sector: To provide more transparency, governments are using DXC AI Impact to efficiently engage with citizens and make it easier for them to access public services. This includes the use of AI Agents and AI enhanced processes that streamline and simplify tax, national lending and even public healthcare processes.

- Financial Services and Insurance: DXC is helping customers optimize operations, from underwriting and risk assessment to claims processing and customer service. By working with DXC, financial institutions are leveraging chatbots to make it easy for human agents to respond faster and more accurately to customer inquiries by analyzing thousands of documents in minutes with Generative AI.

- Healthcare: DXC implemented an AI-powered app to help measure patient symptoms in real-time, analyzing data to provide clinicians with insights that enable more accurate diagnoses and treatment plans, improving the quality of care and proactively addressing prescription resistance.

For more information on DXC AI Impact and how we’re working with the most innovative industry leaders to securely innovate, visit here.

Forward Looking Statements

All statements in this press release that do not directly and exclusively relate to historical facts constitute “forward-looking statements.” These statements represent current expectations and beliefs, and no assurance can be given that any result, goal or plan set forth in any forward-looking statement can or will be achieved. Such statements are subject to numerous assumptions, risks, uncertainties and other factors that could cause actual results to differ materially from those described in such statements, many of which are outside of our control. For a written description of these factors, see the section titled “Risk Factors” in DXC’s Annual Report on Form 10-K for the fiscal year ended March 31, 2024, and any updating information in subsequent SEC filings. Readers are cautioned not to place undue reliance on such statements which speak only as of the date they are made. We do not undertake any obligation to update or release any revisions to any forward-looking statement or to report any events or circumstances after the date of this document or to reflect the occurrence of unanticipated events, except as required by law.

About DXC Technology

DXC Technology (NYSE: DXC) helps global companies run their mission-critical systems and operations while modernizing IT, optimizing data architectures, and ensuring security and scalability across public, private and hybrid clouds. The world’s largest companies and public sector organizations trust DXC to deploy services to drive new levels of performance, competitiveness, and customer experience across their IT estates. Learn more about how we deliver excellence for our customers and colleagues at DXC.com.

CONTACT: Mihir Bellamkonda, Media Relations, [email protected]; Roger Sachs, Investor Relations, [email protected]

![]() View original content:https://www.prnewswire.co.uk/news-releases/dxc-technologys-ai-impact-helps-customers-across-industries-innovate-with-ai-302343102.html

View original content:https://www.prnewswire.co.uk/news-releases/dxc-technologys-ai-impact-helps-customers-across-industries-innovate-with-ai-302343102.html

-

Fintech PR7 days ago

Fintech PR7 days agoOutsourced Accounting Service: The New Standard for Business Finance Industry

-

Fintech PR7 days ago

Fintech PR7 days agoBybit Launchpad Onboards Xterio, Opening up Opportunities in Blockchain Gaming for Users

-

Fintech PR7 days ago

Fintech PR7 days agoCKGSB Professor Mei Jianping Launches Global Indices Tracking Impressionist, Contemporary, and Chinese Art Markets

-

Fintech PR7 days ago

Fintech PR7 days agoIBN Technologies Sets the Benchmark in Financial Management Accounting Excellence

-

Fintech PR4 days ago

Fintech PR4 days agoBybit x Block Scholes Report: BTC Options Steady with Call-Put Parity, ETH Braces for Short-Term Volatility

-

Fintech PR6 days ago

Fintech PR6 days agoDayOne Launches as an Independent Global Data Center Pioneer Following Series B Funding Closure

-

Fintech PR6 days ago

Fintech PR6 days agoGES Completes Sale to Truelink Capital

-

Fintech PR4 days ago

Fintech PR4 days agoArtificial Intelligence (AI) in Trading Market to Reach USD 35 Billion by 2030, Growing at a 10% CAGR | Valuates Reports