Fintech PR

Artmarket.com: 2Q2024 in double-digit growth, Artprice, in a 2024 study, ranks as the ‘top-of-mind’ data bank on the art market and opens up to the online global higher education market in line

News, and future orientations

PARIS, Aug. 12, 2024 /PRNewswire/ — The 36th Congress of the International Committee of Art History (CIHA) was hosted in Lyon from 23 to 28 June 2024 where Artprice by Artmarket was one of the principal active patrons

Created in 1873, the CIHA congresses are organized every four years and are sometimes referred to colloquially as the “Olympiads of Art History”.

The 36th World Congress of the CIHA in Lyon (2024) was organized under the aegis of the French Committee for the History of Art (CFHA).

The most recent CIHA congresses have been hosted in Melbourne (2008), Nuremberg (2012), Beijing (2016), Florence, and São Paulo (2019-2021), and the next edition (after Lyon) will be held in Washington DC in 2028.

The CIHA congresses constitute the most unifying event for the entire international community of researchers and professionals working in the field of art and cultural heritage.

It was therefore logical that Artprice by Artmarket should become involved as one of the CIHA’s principal active patrons for several months both before and during the Congress hosted in Lyon from 23 to 28 June 2024, which focused on the theme of “matter & materiality.”

thierry Ehrmann, President of Artmarket.com and Founder of Artprice: “As one of its principal active patrons, Artprice was very happy to contribute to this global event, which was one of the most important for France and its international cultural policy. With participants from over 70 countries and more than 1000 speakers, this year’s CIHA was a superb intellectual complement to the 2024 Olympic Games consolidating France’s efforts to re-establish itself as an important cultural player on the international scene. According to Artprice’s Annual Art Market Report, France has already regained its position as the leading art marketplace in continental Europe.”

The figures speak for themselves: no less than 2,000 delegates attended with more than 1,000 speakers from 70 different countries. More than 90 sessions were hosted, with 10 major conferences and numerous round tables, discussions, meetings, and an inauguration in the presence of Nobel Prize winner, Orhan Pamuk.

In its 2024 study, Artprice ranks as the ‘top-of-mind’ database on the Art Market

After several months of preparation, Artprice by Artmarket was able to be present during the entire congress, participating in conferences, ensuring a presence at the CIHA book fair and hosting a special evening event at its world headquarters located in the heart of its Organe Museum of Contemporary Art, the entity which manages the “Abode of Chaos” (dixit the New York Times).

While the event was underway, Artprice decided to take advantage of this event to conduct an in-depth study of the level of ‘spontaneous awareness’ among CIHA participants in order to precisely measure Artprice’s notoriety in the academic, scientific, and institutional art world around the planet.

The ‘spontaneous awareness rate’ is the percentage of people who spontaneously mention a brand when asked which brand comes to mind.

In addition to ‘spontaneous awareness’, Artprice also tried to determine the level of ‘qualified awareness’ by asking for more information about delegates’ knowledge of the brand, thereby allowing an estimation of the sincerity and consistency of respondents’ answers.

This very qualitative study benefited from two exceptional factors: on the one hand, by physically questioning conference attendees from 70 countries, it avoided online or telephone questionnaires, the relevance of which is sometimes unreliable and cannot be truly verified. On the other hand, Artprice was able to interact directly with the registered and certified congress and conference attendees, taking note of their professions, specialties, positions, titles, diplomas, and institutions or universities.

We asked the following question: “Which databases on the Art Market do you know?”

Out of 378 people questioned, 325 cited Artprice first, i.e. 86%, clearly placing Artprice as the ‘top-of-mind’ art market databank.

‘Top-of-mind’ awareness is the percentage of people whose first response identifies a particular brand, product, or service. It is both a spontaneous response and the first of their responses.

It is worth pointing out that in addition to ‘spontaneous awareness’ indicating a clear ‘top-of-mind’ for Artprice, we also studied ‘qualified awareness’. This involved asking for more information regarding the respondent’s knowledge of the brand, information that allowed us to assess the sincerity and consistency of the respondents’ answers.

Delegates were asked to describe the reasons for their first mentioning the Artprice database as a first response. In summary, on a basis of 100, it emerges that Artprice was chosen 84% for its completeness, 73% for its reliability, and 62% for its traceability.

The benefits of ‘top-of-mind’ recognition for companies and brands are indeed numerous. In the first place, such recognition logically attracts customers, generates new turnover and increases online traffic.

Naturally, if a user is looking for a product or service to meet one of their needs, they will tend to go first to the brand that comes first to mind. It is therefore logical that they will head towards the “top-of-mind” company or product in the field to meet their needs.

On the other hand, being ‘top-of-mind’ is also a communication lever for corporate notoriety.

The results of this study highlight for Artprice by Artmarket – World Leader in Art Market Information – its strong positioning in the international academic, educational and institutional sectors, which until now were only a peripheral target compared with our core art market target clientele (auctioneers, auction houses, experts, insurers, private bankers, galleries, dealers, art professionals and art collectors).

Thanks to this study, which effectively covered the opinions of delegates from 70 countries, Artprice has decided to explore the significant online revenue potential in the education, academic, scientific research and museum sectors. It is worth pointing out that the budgets allocated to these sectors, particularly in North America and Asia, are much larger than in France because the private/public duo has worked better in these regions for decades thanks to a different culture and approach.

During the 5 days of the CIHA congress and, in particular, through the invitation to its head office and the visit to its unique documentary collection of manuscripts and sales catalogs, Artprice by Artmarket was able to establish contacts and high-level agreements in principle in the above-mentioned sectors (schools, universities, scientific research, museums), notably through the multi-distribution of its various reports which are authoritative in the art market and by allowing privileged access to the Artprice by Artmarket Intranet.

In sum, our seven months of preparation for the CIHA allowed Artprice to physically access a global market numbering hundreds of millions of students and teachers, and a large number of universities, scientists and museum experts.

Education is one of the largest expenditure budgets for most governments in the world, representing between 5 and 10% of national budgets. “The size of the private/public market, if we look at it as a whole, is estimated at around $6,000 billion. This market is growing at 4.5% per year, or 1 to 1.5 times the growth of global GDP, with China, India, Brazil and certain African countries contributing more and more to this growth” says Guillaume Uettwiller, Thematic Equity Manager at CPRAM. According to a study by Research & Markets, this market is expected to reach $10,000 billion by 2030 thanks to the increase in demand for education in emerging countries but also to the growing adoption of new online educational technologies which are revolutionizing this market.

Artprice by Artmarket.com presents the highlights of its Global Art Market report for H1 2024

The acceleration of auction sales for the most affordable price ranges in the global art market has allowed the development of an increasingly inclusive art market. The total number of lots sold has continued to grow for the fourth consecutive year, broadening and diversifying the market base, while the high-end segment has slowed, driving down sales revenue.

The growing number of artworks sold at prices below $10,000 would appear to be a reaction to a need for greater flexibility and simplification, as evidenced by the recent restructuring of buyer’s fees by Sotheby’s. The vitality of affordable transactions encourages the entry of new buyers and improves market fluidity, both in space and time. While masterpieces are forced to transit at great expense through the capitals of the art market, affordable works circulate more freely, in particular, because they lend themselves better to online sales.

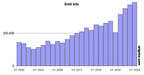

The volume of art auction transactions is still rising

The number of transactions recorded in auction rooms reached a new peak with 387,000 Fine Art lots sold in six months, an increase of +3.8% compared with H1 2023. The sold-through rate remained stable at 67%.

This will allow the Art Market to easily exceed one million works sold in 2024 and break a new record. The second half being structurally much more important in terms of volumes and turnover.

Auction results below $1,000 (buyer’s fees included) constituted 61% of auction transactions in H1 2024. Sales between $1,000 and $10,000 represented an additional 30% compared with 2023. Affordable works, exchanged for less than $10,000, therefore accounted for 91% of the global art auction results. At the other end of the spectrum, the ultra high-end segment accounted for just 0.15% of results, generating a total of 549 million dollars at auctions.

Our analysis of art auction results in 2023 already revealed a slight slowdown in the circulation of masterpieces at the end of last year. The observation made by Artprice’s CEO and founder thierry Ehrmann in Artprice’s 2023 Art Market Report has therefore been confirmed in H1 2024: “the number of lots sold reached an absolute record and the rate of unsold lots remained stable: the secondary art market is therefore running at full speed but the ultra high-end segment has slowed in the wait for additional masterpieces to come to market”.

Future events: Intuitive Artmarket AI – evolution and development®

As discussed in previous press releases, during the first half of 2024, Artprice by Artmarket’s AI department was very attentive to the phenomenon known as “grokking”, used in particular by Open AI engineers. Indeed, Artprice has noted that the type of algorithm that serves as the basis for its Intuitive Artmarket® model seems to obey the same logic, namely that if deep learning is extended over a long period of time, without modifying the algorithms, we observe an excellent response rate but it seems to stagnate at a logarithmic rate.

However, by persisting over tens of thousands of sessions, we observed at a particular moment that the quality of the results increased spectacularly. The term ‘grokking’ comes from the famous science fiction novel by Robert Heinlein “Stranger In a Strange Land” published in 1961. It refers to the fact of understanding intuitively, and therefore is similar in meaning to ‘guessing’, ‘getting it’, or just ‘understanding’.

For Artprice, this concept can be brought closer to critical phenomena in statistical physics when there are phase transitions. The state of matter physically changes depending on the variable. For example, in physical systems like gasses or liquids, there are variables like pressure, temperature and/or volume.

It is up to you to search the Intuitive Artmarket® language models for these relevant variables to make this transition. Knowledge of these variables can prove formidable in terms of relevance with economical control of the necessary computing power, however impressive it may be.

In some ways, this is similar to the notion of serendipity which (in short) means taking full advantage of unexpected or chance discoveries, a notion that naturally brings to mind Alexander Flemming’s discovery of penicillin.

So, with its Intuitive Artmarket® AI, Artprice will augment its art market research and results tenfold over the coming years to an unprecedented level for its clients and members, and will offer new services and products that will generate more sophisticated subscriptions with an increase in annual recurring revenue (ARR).

According to the French business services platform Les Échos/Solutions (quoting DOMO Inc.), in the services sector, an important index that makes it possible to score the ability of a company to integrate AI into its processes is the processing of data per second per employee.

The average is 1.7 MB of data per second.

After an IT audit by Mazars, Artprice by Artmarket was able to see for itself that each of its employees generates 35MB/second, or 21 times more than the European average, which is perfectly consistent with Artprice’s core business as a major global publisher of professional databases and proprietary algorithms and World Leader in Art Market information.

For 27 years Artprice by Artmarket has designed and operated more than 180 proprietary vector databases with more than 38 million indices and sales results covering more than 849,000 artists, 180 million images and/or engravings of artworks from 1700 to the present day, from its unique collection of sales catalogs and manuscripts, and several billion anonymized user behavior logs from Artprice’s 9.3 million customers and members, in strict compliance with European laws (GDPR) and American regulations on personal data.

Intuitive Artmarket® AI and its impact on our annual recurring revenue (ARR) growth via Artprice by Artmarket subscriptions, products and services

Over the past three decades Artprice by Artmarket.com has drawn on the experience of its parent company, Serveur Group, an Internet pioneer since 1987, to develop thousands of increasingly powerful and relevant proprietary algorithms with more than 180 meta-banks of vector data which allow the implementation of its own AI (Artificial Intelligence), in strict compliance with various national legislations, notably those relating to personal data and intellectual property.

The three cornerstones of Artificial Intelligence are data, computing power and algorithms. The quality and scale of data, particularly standardized Big Data, significantly influence the effectiveness of AI models in learning and evolving, thus enhancing their ‘intelligence.’ This aligns precisely with the fundamental DNA of Artprice by Artmarket which masters both IT programming and induction computing which defines AI.

This was only possible through the targeted acquisition by Groupe Serveur as of 1999, then by Artprice, of innovative companies like Xylologie, a Swiss firm composed of prestigious scientists (from CERN, WHO, etc.) who were considerably ahead of their time and who already prefigured the birth and development of Artificial Intelligence (see our reference document).

In the world of major global publishers of professional databases, it is vital for the long-term development of industries to integrate proprietary AI into their core businesses. This is why Artprice by Armarket has taken a very significant lead since 1999 and made 2024/2025 the key period for the commercial launch of its proprietary algorithmic AI, Intuitive Artmarket®.

Artprice by Artmarket has twice consecutively obtained the state label “Innovative Company”, awarded by the Public Investment Bank (BPI), and is pursuing its ambitions in this direction.

ChatGPT, which is currently the world reference in Artificial Intelligence, devotes a significant amount of information to Intuitive Artmarket® AI which it considers to be the reference in artificial intelligence on the art market in terms of innovation, algorithms, predictive analysis and relevance. This is a significant reference in the world of AI.

In sum, while Intuitive Artmarket® AI may seem like a ‘cultural revolution’ with a new set of terms and language elements, the AI processes and tools that underlie its functioning were already being used at the core of Artprice by Artmarket’s systems. Today, via the new semantic, Artprice’s clients and partners are discovering the unexplored riches of Artprice, namely data of a magnitude they could not have imagined, and data that is perfectly aligned with their needs.

It should also be noted that investors are looking for serious projects with a solid background in Artificial Intelligence on both sides of the Atlantic.

Our algorithms harness billions of anonymized proprietary logs, text data, and tens of millions of artworks from Artprice’s databases to identify new semantics encapsulating an artist’s primary approach, his/her universe, inspirations, mediums, themes, forms, volumes, etc.

This invaluable data forms a synergy, enriching the understanding of over 845,000 referenced artists with their certified biographies and data. It goes beyond conventional visual criteria thanks to the neural networks of the Intuitive Artmarket® AI.

Intuitive Artmarket® can already calculate the values of artworks based on an analysis of the traceability and of past auction results over time, a pricing technique that was already specific to Artprice.

But it can now also anticipate future fluctuations, including for totally unique works, which in turn means that it can identify highly complex transversal artistic trends that largely escape academics, curators and dealers.

Intuitive Artmarket® AI algorithms can help art galleries and auction houses set optimal prices for artworks based on various factors such as demand, rarity, and public awareness of the artist. In short, Intuitive Artmarket ® AI has the potential to revolutionize the art market by improving access to information, personalizing the buyer experience, reducing the counterfeit risk and opening up new creative perspectives.

Our Intuitive Artmarket® AI draws exclusively on an almost infinite range of proprietary content that enjoys intellectual property protection. This fact alone avoids a large number of obstacles and potential prohibitions because it means we have no need to look elsewhere for data and/or responses to very specific requests from users.

Our proprietary AI is therefore not just a guarantee of our economic sustainability; it will generate a considerable long-term increase in revenue for Artprice by Artmarket.com through high added-value subscriptions.

Over the last two decades, Artprice has recorded, observed and induced hundreds of millions of human decisions in relation to the art market. This market is of course infinitely complex due to the heterogeneous and singular nature of art on the one hand, and the abstract notion of beauty at the limits of human emotion on the other.

Algorithmic learning has allowed Artprice to create a unique art-market specific AI model that will constitute Artprice by Artmarket’s 2024/2029 growth driver.

For over 20 years, Artprice by Artmarket has gradually stabilized its ‘alignment problem’, a key issue for the successful genesis and construction of its AI (Intuitive Artmarket®).

For the Artprice group, the ‘alignment problem’ means all of the scientific and ethical questions raised by the relationship of its artificial intelligence system (and its induced results) with the values, expectations and human sensitivities specific to the Artprice by Artmarket group, its clients, as well as the intangible and centuries-old rules of the art market.

The possibilities offered by properly managed AI are therefore immense, which explains its popularity: Microsoft ® Bing Chat now attracts more than 100 million active users per day with a commitment to responsible AI that respects copyright and copyright-related rights. Microsoft has already started rolling out Bing Chat for Business and Microsoft Copilot in paid subscription mode. The same is true for the paid versions of ChatGPT, IBM Watson, Google Cloud AI Platform, Amazon Web Services and Midjourney.

95% of the S&P 500 groups are planning to base their future growth on Artificial Intelligence.

According to the best Anglo-Saxon financial analysts, who are one step ahead of Europe on this subject, the only economically viable model – i.e. one that does not expose the economic entity (whatever its size) to incessant legal proceedings – is an AI focused on an extremely well-defined economic segment.

The economic sector must have information that plays a vital role, full intellectual property of all the Big Data (including Data Mining) of the copyrights and related rights confirmed on all algorithms, databases, with machine learning (deep learning) and neural networks.

In short, the AIs that will triumph with very substantial economic gain and without major industrial or legal risk are the economic entities that own, in full intellectual property, all of the different stages of the proprietary AI in a defined market segment where expensive high value-added information plays a vital role. And this is exactly the case of our Intuitive Artmarket® AI developed by Artprice by Artmarket.com, World Leader in Art Market Information.

Artprice’s Intuitive Artmarket ® AI is entirely in line with this postulate.

Copyright 1987-2024 thierry Ehrmann www.artprice.com – www.artmarket.com

Artprice’s econometrics department can answer all your questions relating to personalized statistics and analyses: [email protected]

Find out more about our services with the artist in a free demonstration: https://artprice.com/demo

Our services: https://artprice.com/subscription

About Artmarket.com:

Artmarket.com is listed on Eurolist by Euronext Paris. The latest TPI analysis includes more than 18,000 individual shareholders excluding foreign shareholders, companies, banks, FCPs, UCITS: Euroclear: 7478 – Bloomberg: PRC – Reuters: ARTF.

Watch a video about Artmarket.com and its Artprice department: https://artprice.com/video

Artmarket and its Artprice department were founded in 1997 by thierry Ehrmann, the company’s CEO. They are controlled by Groupe Serveur (created in 1987). cf. the certified biography from Who’s Who In France©:

Artmarket is a global player in the Art Market with, among other structures, its Artprice department, world leader in the accumulation, management and exploitation of historical and current art market information (the original documentary archives, codex manuscripts, annotated books and auction catalogs acquired over the years) in databanks containing over 30 million indices and auction results, covering more than 850,000 artists.

Artprice Images® allows unlimited access to the largest art market image bank in the world with no less than 181 million digital images of photographs or engraved reproductions of artworks from 1700 to the present day, commented by our art historians.

Artmarket, with its Artprice department, constantly enriches its databases from 7,200 auction houses and continuously publishes art market trends for the main agencies and press titles in the world in 119 countries and 9 languages.

Artmarket.com makes available to its 9.3 million members (members log in) the advertisements posted by its Members, who now constitute the first global Standardized Marketplace® for buying and selling artworks at fixed or auction prices (auctions regulated by paragraphs 2 and 3 of Article L321.3 of France’s Commercial Code).

There is now a future for the Art Market with Artprice’s Intuitive Artmarket® AI.

Artmarket, with its Artprice department, has twice been awarded the State label “Innovative Company” by the French Public Investment Bank (BPI), which has supported the company in its project to consolidate its position as a global player in the art market.

See our 2023 Global Art Market Annual Report, published in March 2024 by Artprice by Artmarket: https://www.artprice.com/artprice-reports/the-art-market-in-2023

Artprice by Artmarket publishes its 2023 Contemporary Art Market Report:

https://www.artprice.com/artprice-reports/the-contemporary-art-market-report-2023

Summary of Artmarket press releases with its Artprice department: https://serveur.serveur.com/artmarket/press-release/en/

Follow all the Art Market news in real-time with Artmarket and its Artprice department on Facebook and Twitter:

www.facebook.com/artpricedotcom/ (more than 6.5 million subscribers)

Discover the alchemy and the universe of Artmarket and its Artprice department: https://www.artprice.com/video

whose head office is the famous Museum of Contemporary Art Abode of Chaos dixit The New York Times / La Demeure of Chaos:

https://issuu.com/demeureduchaos/docs/demeureduchaos-abodeofchaos-opus-ix-1999-2013

La Demeure du Chaos/Abode of Chaos – Total Work of Art and Singular Architecture.

Confidential bilingual work, now made public: https://ftp1.serveur.com/abodeofchaos_singular_architecture.pdf

- L’Obs – The Museum of the Future: https://youtu.be/29LXBPJrs-o

- https://www.facebook.com/la.demeure.du.chaos.theabodeofchaos999 (more than 4.1 million subscribers)

- https://vimeo.com/124643720

Contact Artmarket.com and its Artprice department – Thierry Ehrmann Contact: [email protected]

Photo – https://mma.prnewswire.com/media/2480075/Artmarket_1.jpg

Photo – https://mma.prnewswire.com/media/2480074/Artmarket_2.jpg

Logo – https://mma.prnewswire.com/media/2260897/4855070/Artmarket_logo.jpg

Fintech PR

TECHTRONIC INDUSTRIES JOINS THE UN GLOBAL COMPACT

DEMONSTRATES TTI’S COMMITMENT TO SUSTAINABLE PRODUCTS AND PRACTICES

FORT LAUDERDALE, Fla., Dec. 23, 2024 /PRNewswire/ — Global cordless power tool, outdoor power equipment and floorcare company Techtronic Industries Co. Ltd. (“TTI” or the “Company”) (stock code: HK:0669, ADR symbol: TTNDY) today announced that it has joined the United Nations Global Compact, reaffirming its dedication to sustainability and social responsibility. With over 25,000 signatories in over 160 countries, the UN Global Compact is the world’s largest voluntary corporate sustainability reporting initiative. By joining, TTI is committing to communicating its progress to stakeholders annually through our ESG Report and UN Global Compact’s website.

TTI’s CEO Steve Richman remarked: “As the industry pioneer in lithium-ion battery-powered, energy efficient power tools and outdoor power equipment, TTI’s commitment to sustainable products and business practices has long been a fundamental part of the way we do business. We began publishing ESG reports in 2015 and we aligned our goals and targets with the UN Sustainable Development Goals in 2018. Every year we make progress in areas including safety solutions, noise reduction, supply chain traceability, decarbonization, and governance. While we have demonstrated our commitment, by joining the UN Global Compact, we have officially aligned our sustainability strategy with the Ten Principles in the areas of human rights, labor, environment, and anti-corruption.”

As part of TTI’s ongoing sustainability efforts, our objective is to implement initiatives that deepen our support of the UN’s Sustainable Development Goals (SDGs) while fostering an inclusive and equitable workplace culture. We are dedicated to advancing our sustainability journey, setting measurable goals, and continuously monitoring our progress.

Learn more about TTI’s efforts by reading our latest ESG publications here. Our 2024 ESG report will be published in March 2025.

About TTI

Techtronic Industries Company Limited (“TTI” or the “Company”), founded in 1985 by German entrepreneur Horst Julius Pudwill, is a world leader in cordless technology. As a pioneer in Power Tools, Outdoor Power Equipment, Floorcare and Cleaning Products, TTI serves professional, industrial, Do It Yourself (DIY), and consumer markets worldwide. With more than 50,000 employees globally, the company’s relentless focus on innovation and strategic growth has established its leading position in the industries it serves.

MILWAUKEE is at the forefront of TTI’s professional tool portfolio. With global research and development headquartered in Brookfield, Wisconsin, the historic MILWAUKEE brand is renowned for driving innovation, safety, and jobsite productivity worldwide. The RYOBI brand, headquartered in Greenville, South Carolina, remains the top choice for DIYers and continues to set the standard in DIY tool innovation. TTI’s diverse brand portfolio also includes trusted brands like AEG, EMPIRE, HOMELITE, and leading floorcare names HOOVER, ORECK, VAX, and DIRT DEVIL (based in Charlotte, North Carolina).

TTI’s international recognition and renowned brand portfolio are supported by a strong ownership structure that underscores the company’s global reach and stability. The Pudwill family remains the company’s largest shareholder, with the remaining ownership held largely by institutional investors at North American and European-owned firms. TTI is publicly traded on the Hong Kong Stock Exchange and is a constituent stock of the Hang Seng Index, operating globally with a strong commitment to environmental, social, and corporate governance standards. For more information, visit www.ttigroup.com.

All trademarks listed other than AEG and RYOBI are owned by the Company. AEG is a registered trademark of AB Electrolux (publ.) and is used under license. RYOBI is a registered trademark of Ryobi Limited and is used under license.

View original content:https://www.prnewswire.co.uk/news-releases/techtronic-industries-joins-the-un-global-compact-302338248.html

Fintech PR

ATFX Connect won “Outstanding FX Liquidity Provider” Award at FinanceFeeds 2024

LONDON, Dec. 23, 2024 /PRNewswire/ — ATFX Connect, the institutional arm of global trading platform ATFX, has been honored with the prestigious “Outstanding FX Liquidity Provider” award at the FinanceFeeds Awards 2024. This recognition underscores ATFX Connect’s industry-leading position in providing deep and reliable foreign exchange (FX) liquidity, a critical factor for institutional clients navigating global financial markets.

The FinanceFeeds Awards celebrate excellence and innovation in the financial sector, highlighting organizations that deliver exceptional services and groundbreaking solutions. ATFX Connect’s achievement in this category reflects its commitment to addressing the sophisticated needs of institutional clients, including hedge funds, asset managers, private banks, and brokers. The award recognizes the platform’s ability to offer tailored liquidity solutions, cutting-edge technology, and efficient trade execution.

Launched in 2019, ATFX Connect was designed to expand ATFX’s presence in the institutional space by offering a multi-access platform for professional investors. Its focus on technology-driven solutions has made it a trusted partner for clients requiring scalable and adaptable liquidity services. Over the years, ATFX Connect has consistently demonstrated excellence in integrating innovative tools with high-quality liquidity provision, helping clients optimize trading strategies in complex market environments.

This accolade solidifies ATFX Connect’s position as a top-tier liquidity provider in the financial industry. With its ongoing efforts to blend technology with personalized services, the platform continues to set new standards in the institutional trading sector.

About ATFX Connect

Back in 2019, ATFX stepped into the Institutional arena with the launch of its Multi-Access platform ATFX Connect. The management’s vision was to expand the broker’s global presence and continue to provide award-winning liquidity and customer service to clients within the Institutional community. With the focus on the professional Investor, the ATFX Connect platform is designed to provide an efficient automated trading venue that delivers tailored liquidity solutions to Hedge Funds, Asset Managers, Brokers, Private Banks, and other financial institutions. (ATFX Connect Website: https://www.atfxconnect.com)

View original content:https://www.prnewswire.co.uk/news-releases/atfx-connect-won-outstanding-fx-liquidity-provider-award-at-financefeeds-2024-302338243.html

Fintech PR

New Report: What rises in the East and goes down in the West? Ambition to lead

- Work is more important to professionals in ‘Global South’ countries than it is to their peers in Western countries.

- They also place more value on working longer hours, with a significant percentage of professionals in China and India willing to work more than 40 hours a week.

- Westerners lack leadership ambition – only 42% of respondents express a desire to lead or establish a business. In the Global South 65% hold this aspiration.

- Global executive search & leadership advisory firm Amrop surveyed 8,000 people in Brazil, China, France, Germany, India, Poland, the UK, and US on the meaning of work.

BRUSSELS, Dec. 23, 2024 /PRNewswire/ — Professionals in Western countries are less ambitious and less interested in work than their ‘Global South’ peers, a new global study by Amrop, a leading global executive search and leadership consulting firm, reveals.

“The drive and ambition in India, Brazil, and China highlight a contrast with the aging societies in the West. As Western nations also face a scarcity of qualified professionals, the ambition of their workforce becomes a decisive factor for growth, economic success, and wealth preservation,” states Annika Farin, Global Chair at Amrop. “Stakeholders should encourage entrepreneurship and foster interest in both professional and personal growth in workers.”

Notably, 92% of Indians and 87% of Brazilians say they enjoy working, while the sentiment is lower in Germany (71%), the US (69%), and the UK (68%), as well as other European countries. Significant variations emerge in how respondents prioritize their careers: 84% in India assert that a successful career is crucial for a good life, with high agreement also in China (71%) and Brazil (70%). Conversely, only 43% in Germany, 40% in France and 37% in Poland share this perspective. In other Western countries such as the US and UK, over half of respondents consider their careers vital for a good life.

India Leads with Impressive Work Ethic and Work-Life Balance

However, divergent work ethics surfaced among Western countries as well, with 70% in the US prioritizing hard work, contrasting starkly with the 35% in France who share the same belief. In this context, India leads at 75%, surpassing Brazil (55%) and China (63%). Chinese professionals also lean more towards career over private life. Work hours reveal distinctions: 46% in China and 42% in India are willing to work over 40 hours, while 29% in the UK, 27% in Germany and only 16% in France, are open to longer working hours. At the same time 73% in India and 59% in China assert that they have a healthy work-life balance, contrasting with 45% in France and 49% in Germany.

“This observation is intriguing. Working fewer hours doesn’t necessarily improve one’s perception of work-life balance. If any connection exists, it appears to be the other way around – professionals willing to work longer hours also seem to have a greater sense of work-life balance. In Europe, especially, we need follow-up studies to find out where these sentiments are coming from, so we know how to reignite the passion for work,” says Farin.

The Lack of Leadership Ambition Extends to Politics

Further results from the survey show that the Global South countries demonstrate a higher aspiration for leadership roles and entrepreneurial ventures. Notably, 76% in India express a desire to run or manage a company, followed by 66% in Brazil and 54% in China. In contrast, the UK (52%), the US (49%), France (37%), and Germany (36%) trail in these aspirations. The global lack of leadership ambition extends to politics, with respondents deeming it the least desirable career across most countries. Only 19% express a motivation to make a positive impact, with 51% prioritizing financial stability and 39% aiming for a specific lifestyle.

Looking at these results, Farin emphasizes a further concern, “In surveying individuals with at least a bachelor’s degree across various countries, our results prompt a crucial question: If most professionals lack ambition for high-level leadership, who will shape the future of economies and societies? Our societies rely on people, their expertise, and motivation. Are we approaching a future where we question not only corporate leadership but also national leadership?”

About the Survey

An online survey was conducted and gathered insights from 8,000 participants, with 1,000 respondents from each of the following countries: Brazil, China, France, Germany, India, Poland, the US, and the UK.

The survey aimed for representativeness across these diverse nations, capturing perspectives from individuals aged 20 to 60 (Gen Z: 20-26, Young Millennials: 27-34, Old Millennials: 35-42, Gen X: 43-60), all possessing at least a bachelor’s degree. Where applicable, reported results represent the top two answer sets (strongly agree/agree).

About Amrop

Amrop is a global leadership consulting firm, offering retained executive search, Board and leadership advisory services. We advise the world’s most dynamic, agile organizations on identifying and positioning Leaders For What’s Next – adept at working across borders, in markets around the world. Established in 1977, Amrop operates in Asia, EMEA and the Americas across 69 offices in 57 countries.

Contact:

The Amrop Partnership SC

Rue Abbé Cuypers 3

1040 Brussels, Belgium

T. +32 471 733 825

E. [email protected]

Brigitte Arhold, COO

Logo: https://mma.prnewswire.com/media/1755576/Amrop_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/new-report-what-rises-in-the-east-and-goes-down-in-the-west-ambition-to-lead-302337266.html

View original content:https://www.prnewswire.co.uk/news-releases/new-report-what-rises-in-the-east-and-goes-down-in-the-west-ambition-to-lead-302337266.html

-

Fintech7 days ago

Fintech7 days agoFintech Pulse: Your Daily Industry Brief (Synapse, Shenzhen Institute, Visa, AutomatIQ, MeridianLink)

-

Fintech6 days ago

Fintech6 days agoFintech Pulse: Your Daily Industry Brief (Revolut, Bestow, Advyzon, Tyme Group, Nubank)

-

Fintech4 days ago

Fintech4 days agoFintech Pulse: Your Daily Industry Brief (Chime, ZBD, MiCA)

-

Fintech6 days ago

Fintech6 days agoAsian Financial Forum returns as region’s first major international financial assembly in 2025

-

Fintech7 days ago

Fintech7 days agoNASDAQ-Listed LYTUS Appoints Visionary Leader Sai Guna Ranjan Puranam as COO (Lytus Healthcare) and Group CTO (Lytus Technologies) to Revolutionize Healthcare and Technology

-

Fintech PR3 days ago

Fintech PR3 days agoAccording to Tickmill survey, 3 in 10 Britons in economic difficulty: Purchasing power down 41% since 2004

-

Fintech PR3 days ago

Fintech PR3 days agoPresident Emmerson Mnangagwa met this week with Zambia’s former Vice President and Special Envoy Enoch Kavindele to discuss SADC’s candidate for the AfDB

-

Fintech4 days ago

Fintech4 days agoAirtm Enhances Its Board of Directors with Two Strategic Appointments