Fintech PR

Artmarket.com: 2Q2024 in double-digit growth, Artprice, in a 2024 study, ranks as the ‘top-of-mind’ data bank on the art market and opens up to the online global higher education market in line

News, and future orientations

PARIS, Aug. 12, 2024 /PRNewswire/ — The 36th Congress of the International Committee of Art History (CIHA) was hosted in Lyon from 23 to 28 June 2024 where Artprice by Artmarket was one of the principal active patrons

Created in 1873, the CIHA congresses are organized every four years and are sometimes referred to colloquially as the “Olympiads of Art History”.

The 36th World Congress of the CIHA in Lyon (2024) was organized under the aegis of the French Committee for the History of Art (CFHA).

The most recent CIHA congresses have been hosted in Melbourne (2008), Nuremberg (2012), Beijing (2016), Florence, and São Paulo (2019-2021), and the next edition (after Lyon) will be held in Washington DC in 2028.

The CIHA congresses constitute the most unifying event for the entire international community of researchers and professionals working in the field of art and cultural heritage.

It was therefore logical that Artprice by Artmarket should become involved as one of the CIHA’s principal active patrons for several months both before and during the Congress hosted in Lyon from 23 to 28 June 2024, which focused on the theme of “matter & materiality.”

thierry Ehrmann, President of Artmarket.com and Founder of Artprice: “As one of its principal active patrons, Artprice was very happy to contribute to this global event, which was one of the most important for France and its international cultural policy. With participants from over 70 countries and more than 1000 speakers, this year’s CIHA was a superb intellectual complement to the 2024 Olympic Games consolidating France’s efforts to re-establish itself as an important cultural player on the international scene. According to Artprice’s Annual Art Market Report, France has already regained its position as the leading art marketplace in continental Europe.”

The figures speak for themselves: no less than 2,000 delegates attended with more than 1,000 speakers from 70 different countries. More than 90 sessions were hosted, with 10 major conferences and numerous round tables, discussions, meetings, and an inauguration in the presence of Nobel Prize winner, Orhan Pamuk.

In its 2024 study, Artprice ranks as the ‘top-of-mind’ database on the Art Market

After several months of preparation, Artprice by Artmarket was able to be present during the entire congress, participating in conferences, ensuring a presence at the CIHA book fair and hosting a special evening event at its world headquarters located in the heart of its Organe Museum of Contemporary Art, the entity which manages the “Abode of Chaos” (dixit the New York Times).

While the event was underway, Artprice decided to take advantage of this event to conduct an in-depth study of the level of ‘spontaneous awareness’ among CIHA participants in order to precisely measure Artprice’s notoriety in the academic, scientific, and institutional art world around the planet.

The ‘spontaneous awareness rate’ is the percentage of people who spontaneously mention a brand when asked which brand comes to mind.

In addition to ‘spontaneous awareness’, Artprice also tried to determine the level of ‘qualified awareness’ by asking for more information about delegates’ knowledge of the brand, thereby allowing an estimation of the sincerity and consistency of respondents’ answers.

This very qualitative study benefited from two exceptional factors: on the one hand, by physically questioning conference attendees from 70 countries, it avoided online or telephone questionnaires, the relevance of which is sometimes unreliable and cannot be truly verified. On the other hand, Artprice was able to interact directly with the registered and certified congress and conference attendees, taking note of their professions, specialties, positions, titles, diplomas, and institutions or universities.

We asked the following question: “Which databases on the Art Market do you know?”

Out of 378 people questioned, 325 cited Artprice first, i.e. 86%, clearly placing Artprice as the ‘top-of-mind’ art market databank.

‘Top-of-mind’ awareness is the percentage of people whose first response identifies a particular brand, product, or service. It is both a spontaneous response and the first of their responses.

It is worth pointing out that in addition to ‘spontaneous awareness’ indicating a clear ‘top-of-mind’ for Artprice, we also studied ‘qualified awareness’. This involved asking for more information regarding the respondent’s knowledge of the brand, information that allowed us to assess the sincerity and consistency of the respondents’ answers.

Delegates were asked to describe the reasons for their first mentioning the Artprice database as a first response. In summary, on a basis of 100, it emerges that Artprice was chosen 84% for its completeness, 73% for its reliability, and 62% for its traceability.

The benefits of ‘top-of-mind’ recognition for companies and brands are indeed numerous. In the first place, such recognition logically attracts customers, generates new turnover and increases online traffic.

Naturally, if a user is looking for a product or service to meet one of their needs, they will tend to go first to the brand that comes first to mind. It is therefore logical that they will head towards the “top-of-mind” company or product in the field to meet their needs.

On the other hand, being ‘top-of-mind’ is also a communication lever for corporate notoriety.

The results of this study highlight for Artprice by Artmarket – World Leader in Art Market Information – its strong positioning in the international academic, educational and institutional sectors, which until now were only a peripheral target compared with our core art market target clientele (auctioneers, auction houses, experts, insurers, private bankers, galleries, dealers, art professionals and art collectors).

Thanks to this study, which effectively covered the opinions of delegates from 70 countries, Artprice has decided to explore the significant online revenue potential in the education, academic, scientific research and museum sectors. It is worth pointing out that the budgets allocated to these sectors, particularly in North America and Asia, are much larger than in France because the private/public duo has worked better in these regions for decades thanks to a different culture and approach.

During the 5 days of the CIHA congress and, in particular, through the invitation to its head office and the visit to its unique documentary collection of manuscripts and sales catalogs, Artprice by Artmarket was able to establish contacts and high-level agreements in principle in the above-mentioned sectors (schools, universities, scientific research, museums), notably through the multi-distribution of its various reports which are authoritative in the art market and by allowing privileged access to the Artprice by Artmarket Intranet.

In sum, our seven months of preparation for the CIHA allowed Artprice to physically access a global market numbering hundreds of millions of students and teachers, and a large number of universities, scientists and museum experts.

Education is one of the largest expenditure budgets for most governments in the world, representing between 5 and 10% of national budgets. “The size of the private/public market, if we look at it as a whole, is estimated at around $6,000 billion. This market is growing at 4.5% per year, or 1 to 1.5 times the growth of global GDP, with China, India, Brazil and certain African countries contributing more and more to this growth” says Guillaume Uettwiller, Thematic Equity Manager at CPRAM. According to a study by Research & Markets, this market is expected to reach $10,000 billion by 2030 thanks to the increase in demand for education in emerging countries but also to the growing adoption of new online educational technologies which are revolutionizing this market.

Artprice by Artmarket.com presents the highlights of its Global Art Market report for H1 2024

The acceleration of auction sales for the most affordable price ranges in the global art market has allowed the development of an increasingly inclusive art market. The total number of lots sold has continued to grow for the fourth consecutive year, broadening and diversifying the market base, while the high-end segment has slowed, driving down sales revenue.

The growing number of artworks sold at prices below $10,000 would appear to be a reaction to a need for greater flexibility and simplification, as evidenced by the recent restructuring of buyer’s fees by Sotheby’s. The vitality of affordable transactions encourages the entry of new buyers and improves market fluidity, both in space and time. While masterpieces are forced to transit at great expense through the capitals of the art market, affordable works circulate more freely, in particular, because they lend themselves better to online sales.

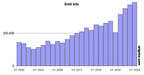

The volume of art auction transactions is still rising

The number of transactions recorded in auction rooms reached a new peak with 387,000 Fine Art lots sold in six months, an increase of +3.8% compared with H1 2023. The sold-through rate remained stable at 67%.

This will allow the Art Market to easily exceed one million works sold in 2024 and break a new record. The second half being structurally much more important in terms of volumes and turnover.

Auction results below $1,000 (buyer’s fees included) constituted 61% of auction transactions in H1 2024. Sales between $1,000 and $10,000 represented an additional 30% compared with 2023. Affordable works, exchanged for less than $10,000, therefore accounted for 91% of the global art auction results. At the other end of the spectrum, the ultra high-end segment accounted for just 0.15% of results, generating a total of 549 million dollars at auctions.

Our analysis of art auction results in 2023 already revealed a slight slowdown in the circulation of masterpieces at the end of last year. The observation made by Artprice’s CEO and founder thierry Ehrmann in Artprice’s 2023 Art Market Report has therefore been confirmed in H1 2024: “the number of lots sold reached an absolute record and the rate of unsold lots remained stable: the secondary art market is therefore running at full speed but the ultra high-end segment has slowed in the wait for additional masterpieces to come to market”.

Future events: Intuitive Artmarket AI – evolution and development®

As discussed in previous press releases, during the first half of 2024, Artprice by Artmarket’s AI department was very attentive to the phenomenon known as “grokking”, used in particular by Open AI engineers. Indeed, Artprice has noted that the type of algorithm that serves as the basis for its Intuitive Artmarket® model seems to obey the same logic, namely that if deep learning is extended over a long period of time, without modifying the algorithms, we observe an excellent response rate but it seems to stagnate at a logarithmic rate.

However, by persisting over tens of thousands of sessions, we observed at a particular moment that the quality of the results increased spectacularly. The term ‘grokking’ comes from the famous science fiction novel by Robert Heinlein “Stranger In a Strange Land” published in 1961. It refers to the fact of understanding intuitively, and therefore is similar in meaning to ‘guessing’, ‘getting it’, or just ‘understanding’.

For Artprice, this concept can be brought closer to critical phenomena in statistical physics when there are phase transitions. The state of matter physically changes depending on the variable. For example, in physical systems like gasses or liquids, there are variables like pressure, temperature and/or volume.

It is up to you to search the Intuitive Artmarket® language models for these relevant variables to make this transition. Knowledge of these variables can prove formidable in terms of relevance with economical control of the necessary computing power, however impressive it may be.

In some ways, this is similar to the notion of serendipity which (in short) means taking full advantage of unexpected or chance discoveries, a notion that naturally brings to mind Alexander Flemming’s discovery of penicillin.

So, with its Intuitive Artmarket® AI, Artprice will augment its art market research and results tenfold over the coming years to an unprecedented level for its clients and members, and will offer new services and products that will generate more sophisticated subscriptions with an increase in annual recurring revenue (ARR).

According to the French business services platform Les Échos/Solutions (quoting DOMO Inc.), in the services sector, an important index that makes it possible to score the ability of a company to integrate AI into its processes is the processing of data per second per employee.

The average is 1.7 MB of data per second.

After an IT audit by Mazars, Artprice by Artmarket was able to see for itself that each of its employees generates 35MB/second, or 21 times more than the European average, which is perfectly consistent with Artprice’s core business as a major global publisher of professional databases and proprietary algorithms and World Leader in Art Market information.

For 27 years Artprice by Artmarket has designed and operated more than 180 proprietary vector databases with more than 38 million indices and sales results covering more than 849,000 artists, 180 million images and/or engravings of artworks from 1700 to the present day, from its unique collection of sales catalogs and manuscripts, and several billion anonymized user behavior logs from Artprice’s 9.3 million customers and members, in strict compliance with European laws (GDPR) and American regulations on personal data.

Intuitive Artmarket® AI and its impact on our annual recurring revenue (ARR) growth via Artprice by Artmarket subscriptions, products and services

Over the past three decades Artprice by Artmarket.com has drawn on the experience of its parent company, Serveur Group, an Internet pioneer since 1987, to develop thousands of increasingly powerful and relevant proprietary algorithms with more than 180 meta-banks of vector data which allow the implementation of its own AI (Artificial Intelligence), in strict compliance with various national legislations, notably those relating to personal data and intellectual property.

The three cornerstones of Artificial Intelligence are data, computing power and algorithms. The quality and scale of data, particularly standardized Big Data, significantly influence the effectiveness of AI models in learning and evolving, thus enhancing their ‘intelligence.’ This aligns precisely with the fundamental DNA of Artprice by Artmarket which masters both IT programming and induction computing which defines AI.

This was only possible through the targeted acquisition by Groupe Serveur as of 1999, then by Artprice, of innovative companies like Xylologie, a Swiss firm composed of prestigious scientists (from CERN, WHO, etc.) who were considerably ahead of their time and who already prefigured the birth and development of Artificial Intelligence (see our reference document).

In the world of major global publishers of professional databases, it is vital for the long-term development of industries to integrate proprietary AI into their core businesses. This is why Artprice by Armarket has taken a very significant lead since 1999 and made 2024/2025 the key period for the commercial launch of its proprietary algorithmic AI, Intuitive Artmarket®.

Artprice by Artmarket has twice consecutively obtained the state label “Innovative Company”, awarded by the Public Investment Bank (BPI), and is pursuing its ambitions in this direction.

ChatGPT, which is currently the world reference in Artificial Intelligence, devotes a significant amount of information to Intuitive Artmarket® AI which it considers to be the reference in artificial intelligence on the art market in terms of innovation, algorithms, predictive analysis and relevance. This is a significant reference in the world of AI.

In sum, while Intuitive Artmarket® AI may seem like a ‘cultural revolution’ with a new set of terms and language elements, the AI processes and tools that underlie its functioning were already being used at the core of Artprice by Artmarket’s systems. Today, via the new semantic, Artprice’s clients and partners are discovering the unexplored riches of Artprice, namely data of a magnitude they could not have imagined, and data that is perfectly aligned with their needs.

It should also be noted that investors are looking for serious projects with a solid background in Artificial Intelligence on both sides of the Atlantic.

Our algorithms harness billions of anonymized proprietary logs, text data, and tens of millions of artworks from Artprice’s databases to identify new semantics encapsulating an artist’s primary approach, his/her universe, inspirations, mediums, themes, forms, volumes, etc.

This invaluable data forms a synergy, enriching the understanding of over 845,000 referenced artists with their certified biographies and data. It goes beyond conventional visual criteria thanks to the neural networks of the Intuitive Artmarket® AI.

Intuitive Artmarket® can already calculate the values of artworks based on an analysis of the traceability and of past auction results over time, a pricing technique that was already specific to Artprice.

But it can now also anticipate future fluctuations, including for totally unique works, which in turn means that it can identify highly complex transversal artistic trends that largely escape academics, curators and dealers.

Intuitive Artmarket® AI algorithms can help art galleries and auction houses set optimal prices for artworks based on various factors such as demand, rarity, and public awareness of the artist. In short, Intuitive Artmarket ® AI has the potential to revolutionize the art market by improving access to information, personalizing the buyer experience, reducing the counterfeit risk and opening up new creative perspectives.

Our Intuitive Artmarket® AI draws exclusively on an almost infinite range of proprietary content that enjoys intellectual property protection. This fact alone avoids a large number of obstacles and potential prohibitions because it means we have no need to look elsewhere for data and/or responses to very specific requests from users.

Our proprietary AI is therefore not just a guarantee of our economic sustainability; it will generate a considerable long-term increase in revenue for Artprice by Artmarket.com through high added-value subscriptions.

Over the last two decades, Artprice has recorded, observed and induced hundreds of millions of human decisions in relation to the art market. This market is of course infinitely complex due to the heterogeneous and singular nature of art on the one hand, and the abstract notion of beauty at the limits of human emotion on the other.

Algorithmic learning has allowed Artprice to create a unique art-market specific AI model that will constitute Artprice by Artmarket’s 2024/2029 growth driver.

For over 20 years, Artprice by Artmarket has gradually stabilized its ‘alignment problem’, a key issue for the successful genesis and construction of its AI (Intuitive Artmarket®).

For the Artprice group, the ‘alignment problem’ means all of the scientific and ethical questions raised by the relationship of its artificial intelligence system (and its induced results) with the values, expectations and human sensitivities specific to the Artprice by Artmarket group, its clients, as well as the intangible and centuries-old rules of the art market.

The possibilities offered by properly managed AI are therefore immense, which explains its popularity: Microsoft ® Bing Chat now attracts more than 100 million active users per day with a commitment to responsible AI that respects copyright and copyright-related rights. Microsoft has already started rolling out Bing Chat for Business and Microsoft Copilot in paid subscription mode. The same is true for the paid versions of ChatGPT, IBM Watson, Google Cloud AI Platform, Amazon Web Services and Midjourney.

95% of the S&P 500 groups are planning to base their future growth on Artificial Intelligence.

According to the best Anglo-Saxon financial analysts, who are one step ahead of Europe on this subject, the only economically viable model – i.e. one that does not expose the economic entity (whatever its size) to incessant legal proceedings – is an AI focused on an extremely well-defined economic segment.

The economic sector must have information that plays a vital role, full intellectual property of all the Big Data (including Data Mining) of the copyrights and related rights confirmed on all algorithms, databases, with machine learning (deep learning) and neural networks.

In short, the AIs that will triumph with very substantial economic gain and without major industrial or legal risk are the economic entities that own, in full intellectual property, all of the different stages of the proprietary AI in a defined market segment where expensive high value-added information plays a vital role. And this is exactly the case of our Intuitive Artmarket® AI developed by Artprice by Artmarket.com, World Leader in Art Market Information.

Artprice’s Intuitive Artmarket ® AI is entirely in line with this postulate.

Copyright 1987-2024 thierry Ehrmann www.artprice.com – www.artmarket.com

Artprice’s econometrics department can answer all your questions relating to personalized statistics and analyses: [email protected]

Find out more about our services with the artist in a free demonstration: https://artprice.com/demo

Our services: https://artprice.com/subscription

About Artmarket.com:

Artmarket.com is listed on Eurolist by Euronext Paris. The latest TPI analysis includes more than 18,000 individual shareholders excluding foreign shareholders, companies, banks, FCPs, UCITS: Euroclear: 7478 – Bloomberg: PRC – Reuters: ARTF.

Watch a video about Artmarket.com and its Artprice department: https://artprice.com/video

Artmarket and its Artprice department were founded in 1997 by thierry Ehrmann, the company’s CEO. They are controlled by Groupe Serveur (created in 1987). cf. the certified biography from Who’s Who In France©:

Artmarket is a global player in the Art Market with, among other structures, its Artprice department, world leader in the accumulation, management and exploitation of historical and current art market information (the original documentary archives, codex manuscripts, annotated books and auction catalogs acquired over the years) in databanks containing over 30 million indices and auction results, covering more than 850,000 artists.

Artprice Images® allows unlimited access to the largest art market image bank in the world with no less than 181 million digital images of photographs or engraved reproductions of artworks from 1700 to the present day, commented by our art historians.

Artmarket, with its Artprice department, constantly enriches its databases from 7,200 auction houses and continuously publishes art market trends for the main agencies and press titles in the world in 119 countries and 9 languages.

Artmarket.com makes available to its 9.3 million members (members log in) the advertisements posted by its Members, who now constitute the first global Standardized Marketplace® for buying and selling artworks at fixed or auction prices (auctions regulated by paragraphs 2 and 3 of Article L321.3 of France’s Commercial Code).

There is now a future for the Art Market with Artprice’s Intuitive Artmarket® AI.

Artmarket, with its Artprice department, has twice been awarded the State label “Innovative Company” by the French Public Investment Bank (BPI), which has supported the company in its project to consolidate its position as a global player in the art market.

See our 2023 Global Art Market Annual Report, published in March 2024 by Artprice by Artmarket: https://www.artprice.com/artprice-reports/the-art-market-in-2023

Artprice by Artmarket publishes its 2023 Contemporary Art Market Report:

https://www.artprice.com/artprice-reports/the-contemporary-art-market-report-2023

Summary of Artmarket press releases with its Artprice department: https://serveur.serveur.com/artmarket/press-release/en/

Follow all the Art Market news in real-time with Artmarket and its Artprice department on Facebook and Twitter:

www.facebook.com/artpricedotcom/ (more than 6.5 million subscribers)

Discover the alchemy and the universe of Artmarket and its Artprice department: https://www.artprice.com/video

whose head office is the famous Museum of Contemporary Art Abode of Chaos dixit The New York Times / La Demeure of Chaos:

https://issuu.com/demeureduchaos/docs/demeureduchaos-abodeofchaos-opus-ix-1999-2013

La Demeure du Chaos/Abode of Chaos – Total Work of Art and Singular Architecture.

Confidential bilingual work, now made public: https://ftp1.serveur.com/abodeofchaos_singular_architecture.pdf

- L’Obs – The Museum of the Future: https://youtu.be/29LXBPJrs-o

- https://www.facebook.com/la.demeure.du.chaos.theabodeofchaos999 (more than 4.1 million subscribers)

- https://vimeo.com/124643720

Contact Artmarket.com and its Artprice department – Thierry Ehrmann Contact: [email protected]

Photo – https://mma.prnewswire.com/media/2480075/Artmarket_1.jpg

Photo – https://mma.prnewswire.com/media/2480074/Artmarket_2.jpg

Logo – https://mma.prnewswire.com/media/2260897/4855070/Artmarket_logo.jpg

Fintech PR

ROYAL CANADIAN MINT REPORTS PROFITS AND PERFORMANCE FOR Q3 2024

OTTAWA, ON, Nov. 22, 2024 /PRNewswire/ — The Royal Canadian Mint (the “Mint”) announces its financial results for the third quarter of 2024 that provide insight into its activities, the markets influencing its businesses and its expectations for the next 12 months.

“As the markets continue to change, the Mint is proving its ability to seize on new opportunities thanks to its diversified structure and flexible business strategy” said Marie Lemay, President and CEO of the Royal Canadian Mint.

The financial results should be read in conjunction with the Mint’s annual report available at www.mint.ca . All monetary amounts are expressed in Canadian dollars, unless otherwise indicated.

Financial and Operational Highlights

- The financial results for the third quarter of 2024 were ahead of target and higher than 2023 levels. Higher gold market pricing and foreign circulation volumes combined with lower fixed costs were the main drivers for the quarter over quarter increase. These increases were partially offset by lower than expected bullion volumes from the continued soft demand in the global bullion market. The Mint expects to meet its financial goals for 2024, as set out in its 2024-2028 Corporate Plan, the Mint’s Leadership team continues to actively monitor its status.

- Consolidated revenue decreased to $252.7 million in 2024 (2023 – $360.6 million).

Revenue from the Precious Metals business decreased to $217.6 million in 2024

(2023 – $328.4 million):- Gold bullion volumes decreased 38% quarter over quarter to 106.1 thousand ounces (2023 – 170.1 thousand ounces) while silver bullion volumes decreased 20% to 2.7 million ounces (2023 – 3.4 million ounces).

- Gold and silver market prices increased quarter over quarter by 27% and 23%, respectively.

- Sales of numismatic products decreased 12% quarter over quarter mainly due to the high demand in 2023 for the Queen Elizabeth II’s Reign products.

- Revenue from the Circulation business increased to $35.1 million in 2024

(2023 – $32.2 million):- Revenue from the Foreign Circulation business increased 77% quarter over quarter, a reflection of higher volumes produced and shipped in 2024 as compared to 2023.

- Revenue from Canadian coin circulation products and services decreased 12% quarter over quarter as fewer coins were required to replenish inventories, combined with lower program fees in accordance with the memorandum of understanding with the Department of Finance.

- Overall, operating expenses decreased 27% quarter over quarter to $28.3 million (2023 – $36.0 million) mainly due to planned reductions in consulting and workforce expenses.

Consolidated results and financial performance

(in millions)

|

13 weeks ended |

39 weeks ended |

|||||||||||

|

Change |

Change |

|||||||||||

|

September |

September |

$ |

% |

September |

September 30, 2023 |

$ |

% |

|||||

|

Revenue |

$ |

252.7 |

$ 360.6 |

(107.9) |

(30) |

$ 861.2 |

$ 1,841.8 |

(980.6) |

(53) |

|||

|

Profit (loss) for the period |

$ |

5.7 |

$ (5.8) |

11.5 |

(198) |

$ 24.1 |

$ 15.0 |

9.1 |

61 |

|||

|

Profit (loss) before |

$ |

1.4 |

$ (8.7) |

10.1 |

(116) |

$ 12.3 |

$ 23.4 |

(11.1) |

(47) |

|||

|

Profit (loss) before |

0.6 % |

(2.4) % |

1.4 % |

1.3 % |

||||||||

|

(1) Profit (loss) before income tax and other items is a non-GAAP financial measure. A reconciliation from profit for the period to profit before income tax and other items is included on page 13 of the Mint’s 2024 Third Quarter Report. |

|

(2) Profit (loss) before income tax and other items margin is a non-GAAP financial measure and its calculation is based on profit before income tax and other items. |

|

As at |

||||||||||

|

September 28, 2024 |

December 31, 2023 |

$ Change |

% Change |

|||||||

|

Cash |

$ |

58.4 |

$ |

59.8 |

(1.4) |

(2) |

||||

|

Inventories |

$ |

71.5 |

$ |

68.8 |

2.7 |

4 |

||||

|

Capital assets |

$ |

174.2 |

$ |

173.0 |

1.2 |

1 |

||||

|

Total assets |

$ |

376.8 |

$ |

380.4 |

(3.6) |

(1) |

||||

|

Working capital |

$ |

99.2 |

$ |

97.8 |

1.4 |

1 |

||||

As part of its enterprise risk management program, the Mint continues to actively monitor its global supply chain and logistics networks in support of its continued operations. Despite its best efforts, the Mint expects changes in the macro-economic environment and other external events around the globe to continue to impact its performance in 2024. The Mint continues to mitigate potential risks as they arise through its enterprise risk management process.

To read more of the Mint’s Third Quarter Report for 2024, please visit www.mint.ca.

About the Royal Canadian Mint

The Royal Canadian Mint is the Crown corporation responsible for the minting and distribution of Canada’s circulation coins. The Mint is one of the largest and most versatile mints in the world, producing award-winning collector coins, market-leading bullion products, as well as Canada’s prestigious military and civilian honours. As an established London and COMEX Good Delivery refiner, the Mint also offers a full spectrum of best-in-class gold and silver refining services. As an organization that strives to take better care of the environment, to cultivate safe and inclusive workplaces and to make a positive impact on the communities where it operates, the Mint integrates environmental, social and governance practices in every aspect of its operations.

For more information on the Mint, its products and services, visit www.mint.ca. Follow the Mint on LinkedIn, Facebook and Instagram.

FORWARD LOOKING STATEMENTS AND NON-GAAP FINANCIAL MEASURES

This Earnings Release contains non-GAAP financial measures that are clearly denoted where presented. Non-GAAP financial measures are not standardized under International Financial Reporting Standards (IFRS) and might not be comparable to similar financial measures disclosed by other corporations reporting under IFRS.

This Earnings Release contains forward-looking statements that reflect management’s expectations regarding the Mint’s objectives, plans, strategies, future growth, results of operations, performance, and business prospects and opportunities. Forward-looking statements are typically identified by words or phrases such as “plans”, “anticipates”, “expects”, “believes”, “estimates”, “intends”, and other similar expressions. These forward-looking statements are not facts, but only estimates regarding expected growth, results of operations, performance, business prospects and opportunities (assumptions). While management considers these assumptions to be reasonable based on available information, they may prove to be incorrect. These estimates of future results are subject to a number of risks, uncertainties and other factors that could cause actual results to differ materially from what the Mint expects. These risks, uncertainties and other factors include, but are not limited to, those risks and uncertainties set forth in the Risks to Performance section of the Management Discussion and Analysis in the Mint’s 2023 annual report, as well as in Note 9 – Financial Instruments and Financial Risk Management to the Mint’s Audited Consolidated Financial Statements for the year ended December 31, 2023. The forward-looking statements included in this Earnings Release are made only as of November 20, 2024 and the Mint does not undertake to publicly update these statements to reflect new information, future events or changes in circumstances or for any other reason after this date.

For more information, please contact: Alex Reeves, Senior Manager, Public Affairs, Tel: (613) 884-6370, [email protected]

View original content:https://www.prnewswire.co.uk/news-releases/royal-canadian-mint-reports-profits-and-performance-for-q3-2024-302314428.html

Fintech PR

OIVE and ViniPortugal celebrate closing of joint campaign that reached 100 million consumers

MADRID and PORTO, Portugal, Nov. 22, 2024 /PRNewswire/ — For three years, A Shared Passion showed European consumers the quality and unparalleled versatility of Iberian wines. The program reached over 100 million consumers with advertising in airports, train stations, press trips, digital content, and other actions with opinion leaders.

The wine interprofessionals of Spain (OIVE) and Portugal (ViniPortugal) celebrated the closing of their ambitious joint campaign A Shared Passion with flagship events in Madrid and Porto. The closing event in Spain took place in Madrid’s iconic Calle Alcalá, while in Portugal, the World of Wine (WOW) in Porto was the perfect setting to present the achievements of the international collaboration. Both ceremonies were very well received by the press and the wine sector, highlighting the impact of the promotional actions that reached more than 79.2 million travelers in key transport infrastructures.

The campaign included 22 study trips, taking 150 specialized journalists to explore the world of wine in both countries and generating publications that reached nearly 15 million European consumers.

On social media, the A Shared Passion profile on Instagram exceeded 15,000 followers, consolidating its presence in the digital sphere. In addition, exclusive activities such as workshops and VIP dinners contributed significantly to this initiative’s global impact.

The final events were honored by the presence of opinion leaders, such as Masters of Wine Pedro Ballesteros and Dirceu Vianna Júnior, who moderated round tables with the presidents of OIVE, Fernando Ezquerro, and ViniPortugal, Frederico Falcão. The conference concluded with masterclasses that highlighted Spain and Portugal’s extraordinary oenological diversity, reinforcing the relevance of the sector in the economic, social, and environmental sustainability of both countries.

With funding from the European Union, A Shared Passion highlighted not only the quality and authenticity of Iberian wines but also their strategic role in the sustainable development of numerous municipalities. This initiative underlines the passion with which Spanish and Portuguese wines are made, reflecting their rich traditions and commitment to the future.

For more information: www.asharedpassion.com

Video: https://mma.prnewswire.com/media/2565600/ViniPortugal_and_OIVE.mp4

![]() View original content to download multimedia:https://www.prnewswire.co.uk/news-releases/oive-and-viniportugal-celebrate-closing-of-joint-campaign-that-reached-100-million-consumers-302314339.html

View original content to download multimedia:https://www.prnewswire.co.uk/news-releases/oive-and-viniportugal-celebrate-closing-of-joint-campaign-that-reached-100-million-consumers-302314339.html

Fintech PR

Alkira Ranked 25th Fastest-Growing Company in North America and 6th in the Bay Area on the 2024 Deloitte Technology Fast 500™

Alkira attributes its 7,194% revenue growth to consistent innovation, enabling enterprises to overcome mounting network complexity in the cloud and AI era

SAN JOSE, Calif., Nov. 22, 2024 /PRNewswire/ — Alkira® Inc., the leader in Network Infrastructure as a Service, today announced that it ranked as the 6th fastest-growing technology company in the Bay Area and the 25th fastest-growing company in North America on the Deloitte Technology Fast 500™, a ranking of the 500 fastest-growing technology, media, telecommunications, life sciences, fintech, and energy tech companies in North America. Now in its 30th year, the list recognized Alkira for achieving a growth rate of 7,194% during this period.

“Being recognized as one of North America’s fastest-growing companies by Deloitte is a tremendous honor. This achievement reflects Alkira’s unwavering commitment to equipping frontline networking teams with solutions that dramatically simplify enterprise networking amidst escalating complexity,” said Amir Khan, CEO at Alkira. “Today’s enterprises are racing to support cloud, AI and machine learning workloads, but their existing networks weren’t built for this dynamic environment. Alkira’s network infrastructure as-a-service platform enables organizations to connect any cloud, on-premise location, and remote user with a unified, secure, and highly scalable network fabric that reduces deployment times from months to minutes.”

“For 30 years we’ve been celebrating companies that are actively driving innovation. The software industry continues to be a beacon of growth, and the fintech industry made a strong showing on this year’s list, surpassing life sciences for the first time,” said Steve Fineberg, vice chair, U.S. technology sector leader, Deloitte. “Significantly, we also saw a breakthrough in performance of private companies, with the highest number of private companies named to the list in our program’s history. This year’s winners have shown they have the vision and expertise to continue to perform at a high level, and that deserves to be celebrated.”

“Innovation, transformation and disruption of the status quo are at the forefront for this year’s Technology Fast 500 list, and there’s no better way to celebrate 30 years of program history,” said Christie Simons, partner, Deloitte & Touche LLP and industry leader for technology, media and telecommunications within Deloitte’s Audit & Assurance practice. “This year’s winning companies have demonstrated a continuous commitment to growth and remarkable consistency in driving forward progress. We extend our congratulations to all of this year’s winners — it’s an incredible time for innovation.”

Overall, 2024 Technology Fast 500 companies achieved revenue growth ranging from 201% to 186,373% over the three-year time frame, with an average growth rate of 2,097% and median growth rate of 458%.

Now in its 30th year, the Deloitte Technology Fast 500 provides a ranking of the fastest-growing technology, media, telecommunications, life sciences, fintech, and energy tech companies — both public and private — in North America. Technology Fast 500 award winners are selected based on percentage fiscal year revenue growth from 2020 to 2023.

In order to be eligible for Technology Fast 500 recognition, companies must own proprietary intellectual property or technology that is sold to customers in products that contribute to a majority of the company’s operating revenues. Companies must have base-year operating revenues of at least US$50,000, and current-year operating revenues of at least US$5 million. Additionally, companies must be in business for a minimum of four years and be headquartered within North America.

About Alkira

Alkira is the leader in Network Infrastructure on Demand. We unify any environments, sites, and users via an enterprise network built entirely in the cloud. The network is managed using the same controls, policies, and security systems network administrators know, is available as a service, and can instantly scale as needed. There is no new hardware to deploy, software to download, or architecture to learn. Alkira’s solution is trusted by Fortune 100 enterprises, leading system integrators, and global managed service providers. Learn more at alkira.com and follow us @alkiranet.

About Deloitte

Deloitte provides industry-leading audit, consulting, tax and advisory services to many of the world’s most admired brands, including nearly 90% of the Fortune 500® and more than 8,500 U.S.-based private companies. At Deloitte, we strive to live our purpose of making an impact that matters by creating trust and confidence in a more equitable society. We leverage our unique blend of business acumen, command of technology, and strategic technology alliances to advise our clients across industries as they build their future. Deloitte is proud to be part of the largest global professional services network serving our clients in the markets that are most important to them. Bringing more than 175 years of service, our network of member firms spans more than 150 countries and territories. Learn how Deloitte’s approximately 460,000 people worldwide connect for impact at www.deloitte.com.

Media Contact:

Jelena Dopudj, Sr. Communications Manager, Alkira Marketing

[email protected]

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee (“DTTL”), its network of member firms, and their related entities. DTTL and each of its member firms are legally separate and independent entities. DTTL (also referred to as “Deloitte Global”) does not provide services to clients. In the United States, Deloitte refers to one or more of the US member firms of DTTL, their related entities that operate using the “Deloitte” name in the United States and their respective affiliates. Certain services may not be available to attest clients under the rules and regulations of public accounting. Please see www.deloitte.com/about to learn more about our global network of member firms.

Logo – https://mma.prnewswire.com/media/1743646/Alkira_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/alkira-ranked-25th-fastest-growing-company-in-north-america-and-6th-in-the-bay-area-on-the-2024-deloitte-technology-fast-500-302313919.html

View original content:https://www.prnewswire.co.uk/news-releases/alkira-ranked-25th-fastest-growing-company-in-north-america-and-6th-in-the-bay-area-on-the-2024-deloitte-technology-fast-500-302313919.html

-

Fintech PR7 days ago

Fintech PR7 days agoSustainable Infrastructure Holding Company (“SISCO”) Q3FY24 revenue (excluding accounting construction revenue) increases by 23.8% to 341.8 million

-

Fintech2 days ago

Fintech2 days agoFintech Pulse: Industry Updates, Innovations, and Strategic Moves

-

Fintech PR7 days ago

Fintech PR7 days agoLaunch of Al Faisal Al Baladi Holding

-

Fintech1 day ago

Fintech1 day agoFintech Pulse: Daily Industry Brief – A Dive into Today’s Emerging Trends and Innovations

-

Fintech PR2 days ago

Fintech PR2 days agoROLLER Releases 2025 Attractions Industry Benchmark Report, Unveiling Key Trends and Revenue Strategies

-

Fintech PR2 days ago

Fintech PR2 days agoTAILG Represents the Industry at COP29, Advancing South-South Cooperation with Low-Carbon Solutions

-

Fintech4 days ago

Fintech4 days agoFintech Pulse: Navigating Expansion, Innovation, and Sustainability

-

Fintech3 days ago

Fintech3 days agoFintech Pulse: Milestones, Partnerships, and Transformations in Fintech