Fintech PR

World’s Strongest Perovskite Quantum Dot IP Portfolio on sale

CHICAGO, Nov. 13, 2024 /PRNewswire/ — Ocean Tomo Transactions, a part of J.S. Held, announces the sale of the world’s strongest perovskite quantum dot intellectual property portfolio and related know-how and manufacturing assets by Swiss-based technology company Avantama AG. Avantama is a leader in high-tech materials for electronics with innovations used in optical and electronic coatings.

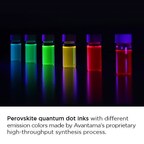

Avantama has developed a global patent portfolio of more than 220 assets covering innovations, including processes, compositions, formulations, films, and devices for the commercialization of semiconductor nanoparticle and quantum dot inks and films, essential for perovskite solar cells, SWIR sensors and LCD, QD-OLED, QD-microLED, and QD-EL displays.

The company has demonstrated the commercialization potential of these technologies with proven and established multi-ton scale production capacities in Switzerland. Avantama’s materials have enabled a world-record power efficiency of 25% in perovskite PV cells and leading QD-EL display demonstrators. The company has been an audited materials supplier for electronics since 2016.

Avantama’s technologies are essential to achieve commercialization in perovskite solar cells leveraging semiconductor nanoparticle ETL and HTL inks, as well as next-generation displays leveraging perovskite quantum dot inks and films. The company’s nanoparticle formulations are routinely used in the development of solution-processed perovskite solar cells, organic solar cells, SWIR detectors and QD-EL displays. Their cadmium-free quantum dots are rapidly redefining the display market with an industry-leading optical performance and unmatched Rec.2020 coverage.

Avantama’s nanoparticle formulations are highly customizable offering unparalleled material flexibility, finely tuned nanoparticle sizes, particle functionalizations and coating formulations for various coating and printing processes. More than a decade of specialization in nanoparticle and formulation engineering confirm the team’s ability to repeatably generate customized nanoparticles and formulations at multi-ton scale. This valuable technological know-how is also on offer with the offering.

Ocean Tomo, a part of J.S. Held, is representing Avantama in this asset transaction. Inquiries related to the transaction or to receive sample materials should be directed to Christopher Bruce at [email protected].

About Ocean Tomo Transactions, a part of J.S. Held

Ocean Tomo Transactions, a part of J.S. Held, works closely with intellectual property owners and corporations seeking to monetize high-value IP-driven businesses, IP portfolios, or proprietary technology solutions. The team has closed transactions totaling more than $1 Billion in IP value realization and has advised on IP engagements totaling over $10 Billion.

As a part of J.S. Held, Ocean Tomo Transactions works alongside more than 1500 professionals globally and assists clients – corporations, insurers, law firms, governments, and institutional investors.

J.S. Held is a global consulting firm that combines technical, scientific, financial, and strategic expertise to advise clients seeking to realize value and mitigate risk. Our professionals serve as trusted advisors to organizations facing high-stakes events demanding urgent attention, staunch integrity, clear-cut analysis, and an understanding of both tangible and intangible assets. The firm provides a comprehensive suite of services, products, and data that enable clients to navigate complex, contentious, and often catastrophic situations.

J.S. Held professionals serve organizations across six continents, including 81% of the Global 200 Law Firms, 70% of the Forbes Top 20 Insurance Companies (85% of the NAIC Top 50 Property & Casualty Insurers), and 65% of the Fortune 100 Companies.

J.S. Held, its affiliates and subsidiaries are not certified public accounting firm(s) and do not provide audit, attest, or any other public accounting services. J.S. Held, its affiliates and subsidiaries are not law firms and do not provide legal advice. Securities offered through PM Securities, LLC, d/b/a Phoenix IB, a part of J.S. Held, member FINRA/ SIPC or Ocean Tomo Investment Group, LLC, a part of J.S. Held, member FINRA/ SIPC. All rights reserved.

Media Contact

Kristi L. Stathis, J.S. Held, +1 773 294 4360, [email protected], JSHeld.com

Photo – https://mma.prnewswire.com/media/2555303/Ocean_Tomo_Avantama_perovskite_quantum_dot_ink.jpg

Logo – https://mma.prnewswire.com/media/1774904/Ocean_Tomo_JS_Held_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/worlds-strongest-perovskite-quantum-dot-ip-portfolio-on-sale-302303083.html

View original content:https://www.prnewswire.co.uk/news-releases/worlds-strongest-perovskite-quantum-dot-ip-portfolio-on-sale-302303083.html

Fintech PR

LONGi advocates for accelerating the energy just transition through green innovation at COP29

BAKU, Azerbaijan, Nov. 22, 2024 /PRNewswire/ — On November 11th, the 29th Conference of the Parties (COP29) to the United Nations Framework Convention on Climate Change kicked off in Baku, the capital of Azerbaijan. The conference focused on how to fairly and effectively allocate climate financing resources, ensuring that every penny can be used to its maximum effect, helping countries achieve low-carbon economic transformation and enhance climate resilience.

At this critical moment in the global fight against climate change, as an advocate, practitioner, and leader in sustainable development in the global clean energy field, LONGi actively participated in COP29, advocating for the promotion of energy equity through green innovation. This marks LONGi’s sixth consecutive participation in the United Nations Framework Convention on Climate Change.

On November 15th, LONGi in collaboration with Deeprock Group, hosted a special event titled “SOLAR FOR ALL — The Key to Tackling Climate Change: Green Innovation Accelerates Just Energy Transition” at the “Biosphere 3” Solutions Pavilion in the Blue Zone of COP29. The event showcased LONGi’s latest scientific and technological achievements and project progress in the field of clean energy. Additionally, LONGi participated in a roundtable forum attended by representatives from UNHCR, the UN Refugee Agency, China Electricity Council (CEC), Global Energy Interconnection Development and Cooperation Organization (GEIDCO), World Economic Forum (WEF), Energy Foundation (EF), and relevant NGOs. At the forum, LONGi shared its stories about “Energy Equity” and discussed how to help climate-vulnerable regions enhance their climate resilience.

Solarization of the Emergency Stockpile in Uzbekistan Completed

UNHCR, the UN Refugee Agency and LONGi, a leading global solar technology company, have completed a groundbreaking project to solarize the UNHCR Regional Humanitarian Logistics Hub located in the Termez Cargo Centre in Surkhandarya, Uzbekistan.

The project, part of a wider UNHCR-LONGi climate action partnership, marks a significant step towards ensuring a sustainable energy supply for logistics that support refugees and internally displaced people (IDPs) across the region and beyond.

The solarization has transformed the Hub into a critical operation powered by clean energy. With the installation of high-efficiency solar panels, a substantial amount of renewable energy will be generated each year, reducing the Hub’s reliance on the grid and significantly lowering its carbon emissions.

“This transition to clean energy – a milestone in greening our supply chain globally – not only provides a renewable, reliable and cost-effective power source for the critical work that the Termez Supply Hub supports in the region, but also demonstrates UNHCR’s strong commitment to environmental sustainability,” said Shoko Shimozawa, Director of UNHCR’s Division of Emergency, Security and Supply (DESS).

The 700kW solar photovoltaic powerplant is expected to generate around 989,993kWh of electricity annually, reducing carbon emissions by approximately 495 metric tons per year. It will also result in significant annual electricity savings, which will benefit local energy infrastructure by reducing operating costs and allowing for reinvestment in further sustainable initiatives.

“By solarizing the Hub and partnering with UNHCR, LONGi is able to provide more efficient, reliable, safe and sustainable energy solutions for refugees around the world, accelerating the global energy transition and promoting energy equity,” said Dennis She, Vice President of LONGi. “Our vision is to promote a global energy transformation using BC (back-contact) solar technology, solving the electricity problem for people who are often without access to basic services, helping refugees to safeguard their rights and live in dignity.”

This partnership sets a precedent for future projects that aim to promote renewable energy adoption and improve the lives of vulnerable populations.

A milestone in UNHCR’s efforts to achieve climate neutrality across its operations, the solarization of the Hub paves the way for further collaboration that draws on the skills and expertise of the private sector. And by investing in renewable energy solutions, alongside strong partners, UNHCR is not only reducing its environmental impact but also building resilience and ensuring a sustainable future for refugees and IDPs.

The Hub, which has served as UNHCR’s regional emergency preparedness and response stockpile since 2021 primarily for the Afghanistan response, will be incorporated into UNHCR’s global stockpile network in 2025. This network, currently consisting of seven UNHCR stockpiles, enables the organization to respond to emergencies anywhere in the world by delivering core relief items (CRIs) – like blankets, mattresses, solar lamps and kitchen sets – to up to 1 million people who have been forced to flee their homes within 72 hours of an emergency being declared.

Turning emergency stockpile operations net carbon-neutral is a critical priority for the sustainability of UNHCR’s work. And the success if this pilot in Termez paves the way for similar projects around the globe.

Accelerating Global Energy Equity with Leading Photovoltaic Technology

Dennis She believes that energy equity lies in providing clean, affordable, and non-discriminatory energy services for all of humanity. However, there is currently a huge disparity in per capita energy consumption levels among countries worldwide, with the top 20% of economies consuming about 80% of the global energy. At the same time, approximately 11% of the global population still lives in darkness without electricity, and about one-third of the population cannot use clean energy for cooking, with energy poverty directly affecting local economic development and the improvement of people’s quality of life. In addition, the uneven distribution of global energy resources and limited affordability also constrain the realization of energy equity on a global scale.

With the deepening implementation of global carbon neutrality goals, clean energy represented by photovoltaics will gradually become the backbone of the global energy transition. In particular, the technological and manufacturing attributes of photovoltaics continuously enhance their cost competitiveness, rapidly driving the process of energy transition.

Solar energy is more widely and abundantly distributed globally than traditional fossil fuels, and it is more beneficial to developing countries. As a new type of clean energy, photovoltaic (PV) power generation has seen a rapid decrease in the cost per kilowatt-hour with the continuous development of photovoltaic technology. Photovoltaics have become the most economical source of electricity in the majority of countries and regions worldwide. Their sustainability, affordability, and characteristics of fairness and security provide an excellent solution to help achieve global energy equity.

As a global leading solar technology company, LONGi calls for global energy equity and has been driving global energy transition in all aspects, reducing the costs for people on the path to carbon neutrality. This allows more people around the world, especially those in developing and underdeveloped countries and regions, to enjoy affordable clean energy and achieve energy equity. In 2022, Dennis She first advocated for global energy equity at COP27, calling for the allocation of limited resources to the popularization of renewable energy and urgent climate actions.

In the future, a new round of energy revolution centered on new energy will be accelerated, and the beautiful vision of a zero-carbon future will be realized sooner based on equal and economical distribution of clean electricity. At that time, light will be brought equally into every corner of the world, providing inclusive clean energy for all regions under all scenarios, truly achieving “SOLAR FOR ALL,” and the world will have unlimited possibilities for sustainable development.

View original content:https://www.prnewswire.co.uk/news-releases/longi-advocates-for-accelerating-the-energy-just-transition-through-green-innovation-at-cop29-302314066.html

Fintech PR

Global focus on vocational education at Tianjin conference

BEIJING, Nov. 22, 2024 /PRNewswire/ — A report from China Daily

The 2024 World Vocational and Technical Education Development Conference brought together around 1,000 delegates in Tianjin in North China this week from Wednesday to Friday. Discussions at the conference have revolved around topics such as industry-education integration, sustainable development, teacher training and lifelong learning.

Co-hosted by China’s Ministry of Education, the National Commission of the People’s Republic of China for UNESCO and the Tianjin municipal government, the conference aims to advance vocational education as a driver of innovation and sustainable development worldwide.

The event introduces six key initiatives to shape vocational education globally: a comprehensive conference featuring keynote speeches, ministerial roundtables and bilateral talks; a global alliance uniting vocational institutions, industries and educational organizations; the presentation of the world vocational education award; an international skills competition with 42 tracks; an exhibition highlighting achievements in vocational education, intangible cultural heritage and international cooperation; and the launch of World Vocational and Technical Education, a journal produced by Tianjin University of Technology and Education.

In a video address to the conference, Stefania Giannini, assistant director-general for education at UNESCO, highlighted vocational education as a catalyst for transformation. She referenced UNESCO’s recent Recommendation on Education for Peace, Human Rights, and Sustainable Development, which emphasizes vocational education as a driver of change.

Calling for greater investment and innovation in vocational education to meet global challenges, Giannini said skills are the passport to navigating today’s complex world.

Huai Jinpeng, China’s minister of education, said vocational education should align with the trends of the times, uphold the essence of education and preserve its unique characteristics. It should anchor its development goals amid evolving opportunities and challenges, striving for innovative breakthroughs, he added.

Huai outlined a vision for vocational education as “5I” education — Inclusive, Industry-oriented, Innovative, Intelligent, and International — positioned to serve all, integrate with industries, drive innovation, embrace smart technologies and foster global cooperation.

To ensure smooth volunteer services during the conference, the Tianjin Municipal Youth League recruited 1,448 young volunteers from nine universities, including Nankai University. Their duties spanned more than 30 roles, including guest registration, conference coordination, translation, media reception and medical assistance.

Photo – https://mma.prnewswire.com/media/2565169/China_Daily.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/global-focus-on-vocational-education-at-tianjin-conference-302314016.html

View original content:https://www.prnewswire.co.uk/news-releases/global-focus-on-vocational-education-at-tianjin-conference-302314016.html

Fintech PR

CKGSB Publishes 2024 ESG and Social Innovation Report Showcasing Progress on Driving Responsible Management Education

BEIJING, Nov. 22, 2024 /PRNewswire/ — On November 21, 2024, Cheung Kong Graduate School of Business (CKGSB) released its 2024 ESG and Social Innovation Report at its event “ESG Strategies Conference: Insights for Business Transition” hosted in Shanghai in collaboration with the European Chamber of Commerce in China, witnessed by nearly 100 ESG-minded multinational business executives.

As the second edition of the school’s English-language ESG report, this report outlines CKGSB’s achievements and progress in the past two years in promoting sustainable business practices, fostering social innovation, and offering solutions to humanity’s common challenges as part of its broader mission to lead and drive responsible business education.

It emphasizes the school’s role in reshaping the future of management education through efforts in integrating ESG factors into its research and insights, programs and courses for decision-makers, strategic partnerships and dialogues, as well as institutional practices, which in return allows it to nurture responsible business leaders for society.

“Our approach to management education is rooted in the belief that businesses can and should be a force for good,” stated Li Haitao, Dean and Dean’s Distinguished Chair Professor of Finance of CKGSB. “CKGSB remains steadfast in its mission to developing leaders who are not only successful in their business endeavors, but also mindful of their responsibilities towards society and the environment.” CKGSB Professor of Marketing Zhu Rui, who drives the school’s efforts in teaching business for good, echoed Dean Li in saying, “Our goal is to empower companies, big or small, to seamlessly integrate ESG considerations into their core strategies and operations.”

The 2024 ESG and Social Innovation Report follows the seven principles of and has been submitted to the United Nations’ Principles for Responsible Management Education (PRME), a platform designed to promote responsible management practices for the benefit of society and our planet. It is now available for download on CKGSB’s website.

Looking forward, CKGSB will continue driving progress on responsible management education and contribute to a more sustainable and equitable future.

About CKGSB

Established in Beijing in November 2002, CKGSB is China’s first privately-funded and research-driven business school. The school aims to cultivate transformative business leaders with a global vision, sense of social responsibility, innovative mindset, and ability to lead with empathy and compassion. To learn more about CKGSB, please visit: https://english.ckgsb.edu.cn/

View original content:https://www.prnewswire.co.uk/news-releases/ckgsb-publishes-2024-esg-and-social-innovation-report-showcasing-progress-on-driving-responsible-management-education-302314000.html

-

Fintech PR6 days ago

Fintech PR6 days agoSustainable Infrastructure Holding Company (“SISCO”) Q3FY24 revenue (excluding accounting construction revenue) increases by 23.8% to 341.8 million

-

Fintech2 days ago

Fintech2 days agoFintech Pulse: Industry Updates, Innovations, and Strategic Moves

-

Fintech PR7 days ago

Fintech PR7 days agoHealthcare leaders gather at House of Commons to discuss productivity-boosting tech with MyStaff app

-

Fintech7 days ago

Fintech7 days agoPlug and Play and GIFT City Launch “IFIH,” a Global Fintech Incubator and Accelerator

-

Fintech PR7 days ago

Fintech PR7 days agoThunderSoft Partners with HERE Technologies to Enhance Intelligent Navigation Solutions

-

Fintech PR6 days ago

Fintech PR6 days agoLaunch of Al Faisal Al Baladi Holding

-

Fintech PR7 days ago

Fintech PR7 days agoBybit Crypto Titans: November Arena Boasts 55,000 USDT in Rewards

-

Fintech PR2 days ago

Fintech PR2 days agoROLLER Releases 2025 Attractions Industry Benchmark Report, Unveiling Key Trends and Revenue Strategies