Fintech PR

NORTH AMERICAN MANUFACTURERS BEGIN STOCKPILING TO BUFFER AGAINST TARIFFS WHILE ASIAN SUPPLIERS RECORD RENEWED GROWTH AS CHINESE MANUFACTURING REBOUNDS, DRIVEN BY STIMULUS AND EXPORTS: GEP GLOBAL SUPPLY CHAIN VOLATILITY INDEX

- Increased safety stockpiling reported by North American manufacturers, led by the U.S., as firms anticipate higher imported costs

- Asian factories’ purchasing of inputs rises at the fastest rate in three-and-a-half years as firms, particularly in China, ramp up production to meet stronger orders, reflecting domestic stimulus measures and advanced buying ahead of possible tariffs

- By contrast, Europe’s industrial recession worsens in November, in large part due to Germany’s deepening manufacturing downturn

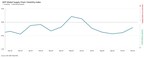

CLARK, N.J., Dec. 16, 2024 /PRNewswire/ — The GEP Global Supply Chain Volatility Index — a leading indicator tracking demand conditions, shortages, transportation costs, inventories and backlogs based on a monthly survey of 27,000 businesses — signaled the smallest level of spare capacity in global supply chains since June in November, as the index rose to -0.20, from -0.39 previously.

Driving this increase was Asia, as suppliers to the region reported stretched capacity for the first time since July. This was caused by a surge in procurement activity by manufacturers in the continent, and especially China, as new orders rebounded sharply. This could reflect greater production requirements stemming from domestic stimulus measures, as well as from international clients, who may be stockpiling to mitigate the risk of higher import costs under the Trump administration. Only India reported a greater rise in raw material purchases than China in November. Preparations to ramp up production further were evidenced by our data showing factory procurement activity across Asia rising at its fastest pace for three-and-a-half years.

Indeed, in North America, reports of safety stockpiling were at their most pronounced since July, highlighting how procurement managers have already implemented changes to their inventory strategies as a result of the incoming US administration’s public commitment to impose significant tariffs. Subsequently, a pickup in activity across North American supply chains resulted in fewer vendors with idle capacity. In fact, our index tracking the region’s supply chain activity hit a four-month high in November.

Meanwhile, in Europe, suppliers feeding this part of the world saw spare capacity rise further — a contrast to elsewhere — primarily because of the continent’s worsening industrial recession. Factories went deeper into retrenchment mode, according to our data, as demand for inputs from manufacturers here was its weakest since December 2023. Germany continues to be at the forefront of this prolonged and significant slowdown.

“In November, U.S. manufacturers, particularly in the consumer goods sector, increased their safety stocks to help blunt any immediate tariff increases,” said John Piatek, vice president, GEP. “In contrast, Chinese manufacturers are getting busier as a result of government stimulus and growth in exports, led by automotives and technology products. Strategically, many global companies have a wait-and-hope approach, while simultaneously planning to remake their global supply chains to respond to a tariff and trade war in 2025 and beyond.”

NOVEMBER 2024 KEY FINDINGS

- DEMAND: Demand for raw materials, commodities and components is rising after a sustained period of weakness. Although our tracker remains slightly below its long-term average, it picked up again in November. This was principally driven by Asia, as procurement activity surged due to companies, particularly in China, preparing to ramp up production to meet new orders from clients.

- INVENTORIES: The stockpiling indicator, which measures to what extent companies are building safety buffers into their inventories to mitigate against risks such as shortages or price rises, ticked higher in November. Most notable was a rise in safety stockpiling from manufacturers in both North America and Asia.

- MATERIAL SHORTAGES: The item shortages indicator continued to show robust global supply levels in November, with the frequency at which businesses reported poor availability remaining historically low.

- LABOR SHORTAGES: Reports of manufacturers’ backlogs rising due to staff shortages were at historically typical levels during November. Therefore, the data does not suggest that labor capacity is a limiting factor for goods producers.

- TRANSPORTATION: The transportation cost indicator remained anchored at its long-term average value in November.

REGIONAL SUPPLY CHAIN VOLATILITY

- NORTH AMERICA: Index went up to -0.36, from -0.72, its highest level since July, signaling the smallest amount of slack in the region’s supply chains in four months. Stockpiling activity ticked higher in North America in November.

- EUROPE: Index fell to -0.72, from -0.52, close to its lowest level year-to-date, signaling a worsening of the continent’s industrial recession.

- U.K.: Index ticked up to -0.12, from -0.40. However, input demand at U.K. factories worsened in November, indicating spillover effects from weakness in mainland Europe.

- ASIA: Index rose to a four-month high of 0.15, from -0.20. Crucially, the index signaled stretched capacity for the first time since the summer as a surge in procurement activity, particularly in China, squeezed vendors.

For more information, visit www.gep.com/volatility.

Note: Full historical data dating back to January 2005 is available for subscription. Please contact [email protected].

The next release of the GEP Global Supply Chain Volatility Index will be 8 a.m. ET, Jan. 13, 2025.

About the GEP Global Supply Chain Volatility Index

The GEP Global Supply Chain Volatility Index is produced by S&P Global and GEP. It is derived from S&P Global’s PMI® surveys, sent to companies in over 40 countries, totaling around 27,000 companies. The headline figure is a weighted sum of six sub-indices derived from PMI data, PMI Comments Trackers and PMI Commodity Price & Supply Indicators compiled by S&P Global.

- A value above 0 indicates that supply chain capacity is being stretched and supply chain volatility is increasing. The further above 0, the greater the extent to which capacity is being stretched.

- A value below 0 indicates that supply chain capacity is being underutilized, reducing supply chain volatility. The further below 0, the greater the extent to which capacity is being underutilized.

A Supply Chain Volatility Index is also published at a regional level for Europe, Asia, North America and the U.K. For more information about the methodology, click here.

About GEP

GEP® delivers AI-powered procurement and supply chain solutions that help global enterprises become more agile and resilient, operate more efficiently and effectively, gain competitive advantage, boost profitability and increase shareholder value. Fresh thinking, innovative products, unrivaled domain expertise, smart, passionate people — this is how GEP SOFTWARE™, GEP STRATEGY™ and GEP MANAGED SERVICES™ together deliver procurement and supply chain solutions of unprecedented scale, power and effectiveness. Our customers are the world’s best companies, including more than 1,000 Fortune 500 and Global 2000 industry leaders who rely on GEP to meet ambitious strategic, financial and operational goals. A leader in multiple Gartner Magic Quadrants, GEP’s cloud-native software and digital business platforms consistently win awards and recognition from industry analysts, research firms and media outlets, including Gartner, Forrester, IDC, ISG, and Spend Matters. GEP is also regularly ranked a top procurement and supply chain consulting and strategy firm, and a leading managed services provider by ALM, Everest Group, NelsonHall, IDC, ISG and HFS, among others. Headquartered in Clark, New Jersey, GEP has offices and operations centers across Europe, Asia, Africa and the Americas. To learn more, visit www.gep.com.

About S&P Global

S&P Global (NYSE: SPGI) S&P Global provides essential intelligence. We enable governments, businesses and individuals with the right data, expertise and connected technology so that they can make decisions with conviction. From helping our customers assess new investments to guiding them through ESG and energy transition across supply chains, we unlock new opportunities, solve challenges and accelerate progress for the world. We are widely sought after by many of the world’s leading organizations to provide credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help the world’s leading organizations plan for tomorrow, today.

Media Contacts

|

Derek Creevey |

Email: |

|||

|

Director, Public Relations |

Joe Hayes |

|||

|

GEP |

Principal Economist |

S&P Global Market Intelligence |

||

|

Phone: +1 646-276-4579 |

S&P Global Market Intelligence |

Email: [email protected] |

||

|

Email: |

Phone: +44-1344-328-099 |

|||

Photo – https://mma.prnewswire.com/media/2581114/GEP_Volatility_P1.jpg

Photo – https://mma.prnewswire.com/media/2581115/GEP_Volatility_P2.jpg

Logo – https://mma.prnewswire.com/media/518346/GEP_Logo.jpg

Fintech PR

Evolution Power Tools reveals: DIY hacks to save £400 on everyday household repairs

- Homeowners are wasting £100s on professional household repairs

- Going DIY on chair and fence fixes could save Brits up to £400

- Evolution Power Tools reveals where to pick up FREE wood & cut costs down

SHEFFIELD, England, Dec. 18, 2024 /PRNewswire/ — Nobody likes being faced with worn, damaged or faulty objects around the house – but before Brits rush out and spend £100s on replacements or repairs, it’s worth considering the DIY approach.

DIY enthusiasts from Evolution Power Tools reveal how common household issues can easily be fixed – without needing to spend much on multiple tools and materials in the process.

“With just weeks until Christmas, we’d much rather spend our money on gifts for loved ones instead of forking out for furniture repairs.

“We always encourage homeowners to repair and not replace. What’s more, repairing furniture yourself can be a rewarding experience and doesn’t have to cost as much as you might think.

“For example, when your chair has wobbly legs, it’s tempting to buy a replacement – or pay for professional repairs.

“It might sound cost-savvy to get a repair, but getting the professionals in can cost more than you’d think.

“The average professional chair leg repair can cost up to £300.

“But by using a mitre saw, timber, screws, glue and sandpaper, you can get the job done yourself for a fraction of the price.

“If you don’t have a saw of your own, ask friends and family if you can borrow one.

“Plus, did you know you can pick up timber for free by browsing Facebook Marketplace or asking local construction sites if they have any scraps going?

“Then you can pick up screws, wood glue and sandpaper from B&Q for under £20 – saving you over £280!

“Similarly, a broken fence can feel like a nightmare – but you don’t have to call in a professional and pay in the region of £150.

“One solution is getting hold of some pallet wood – and this doesn’t have to cost a penny.

“Depending on where you live, your local IKEA may be getting rid of excess supplies – so you may find wood available to pick up for free.

“Then all you need is a hand saw or circular saw – which you may have, or could borrow – plus a hammer and nails, measuring tape and a level.

“Most people will have these supplies at home – which means you could save the best part of £150!”

Top 5 tips for picking up free wood

- Ask local businesses. If you see a supermarket worker emptying a pallet of products, ask if the wood is being thrown away. If so, you may be able to grab it for free.

- Go to your local recycling facility. Many people will dispose of excess materials, including wood, by taking it to the tip. All you have to do is ask the staff if you can take it.

- Visit IKEA. Certain branches will make their surplus materials available for free. The scheme isn’t always running, but it’s worth keeping an eye out!

- Check online marketplaces. Sites like Facebook Marketplace have a surprising amount of supplies going for free, as people just want to get rid of it.

- Construction sites. These places may be glad to have someone pick up excess materials, as it saves them having to dispose of it.

“If you’ve got multiple furniture repairs to carry out, it can be cost-efficient to buy a tool with a multi-material cutting blade.

“Featuring a Japanese Tungsten Carbide Teeth blade, these versatile tools will simplify your toolkit, while allowing you to carry out DIY projects with ease

“Our multi-material cutting tools provide clean and accurate cuts through a variety of materials, including wood, metal, plastics and even wood with nails,

“Gone are the days of homeowners needing to constantly swap blades or purchase specialist equipment. Now, you can rely on one tool to do it all, making DIY much more efficient and enjoyable.

“By investing in versatile tools or borrowing existing equipment, you can avoid unnecessary costs and breathe new life into your household items at a fraction of the price.”

About the company: Evolution Power Tools is a global leader in multi-material technology, with over 30 years in the industrial power tool market.

They are part of a growing movement which encourages homeowners to feel empowered when carrying out DIY, and as such, design tools that help to tackle a variety of tasks without the need for expertise.

Evolution Power Tools never compromise on performance, and their patented technology is no exception, it is reliable with a 3 guarantee, accurate, ergonomic, and powerful for the most precise cuts on a multitude of materials.

- Pricing information accurate at the time of submission

- Cost of smaller supplies for DIY fixes have been sourced from B&Q

- We would appreciate a link to the Evolution Power Tools website within the copy, if you decide to publish the article

- Evolution Power Tools is based in the steel city of Sheffield and has a worldwide reputation for premium and professional tools.

- Their tools have been featured on TV shows including Top Gear, DIY SOS, and Grand Designs

Photo: https://mma.prnewswire.com/media/2583046/Evolution_Power_Tools.jpg

![]() View original content to download multimedia:https://www.prnewswire.co.uk/news-releases/evolution-power-tools-reveals-diy-hacks-to-save-400-on-everyday-household-repairs-302335209.html

View original content to download multimedia:https://www.prnewswire.co.uk/news-releases/evolution-power-tools-reveals-diy-hacks-to-save-400-on-everyday-household-repairs-302335209.html

Fintech PR

ZBD BECOMES FIRST TO RECEIVE EU MICAR LICENSE APPROVAL

– Approval positions the FinTech as a leader in crypto-asset innovation and compliance in the EU, allowing it to expand its transformative digital-native payments platform and enter new markets –

AMSTERDAM, Dec. 18, 2024 /PRNewswire/ — ZBD, the innovative payments company at the forefront of digital economies, today announced it has become the first company to receive approval for the new European Union (EU) crypto-asset service provider license under MiCAR (Markets in Crypto-Assets Regulation). This landmark achievement represents a major milestone both in crypto-asset regulation in the EU and in ZBD’s journey to build a digital-native payments platform on top of the Bitcoin Lightning Network.

The Dutch Authority for the Financial Markets (AFM) has approved ZBD’s license application under MiCAR, and will issue its license when MiCAR takes effect on 30th December 2024. MiCAR is a new regulatory framework that all crypto-asset service providers in the EU must comply with. Securing a license under MiCAR allows ZBD to expand its capabilities by offering a wide range of services including crypto-asset custody, administration, transfers, and—crucially—fiat-to-crypto and crypto-to-fiat exchange. It also demonstrates a strict adherence to the highest standards of compliance and consumer protection for ZBD’s EU users.

While many companies, including the world’s largest exchanges, are struggling to navigate MiCAR’s stringent requirements, ZBD’s comprehensive and proactive approach to compliance has positioned it to lead the way in crypto-asset innovation and better serve customers across the EU. MiCAR therefore presents a unique opportunity for ZBD as it begins its expansion into the EU market after establishing a strong presence in the US.

“Being the first to have received MiCAR license approval is a major leap forward for us,” says Marca Wosoba, COO of ZBD. “We’ve built a culture where compliance is at the forefront of what we do, and we see it as an enabler for new functionality, not a blocker. MiCAR gave us an opportunity to obtain licensing across all of the EU and facilitate our expansion in the region.”

This milestone aligns with ZBD’s broader vision to build digital-native payments infrastructure for the gaming and entertainment industries. Unlike traditional FinTech companies, which typically start with a fiat-first model and then add on crypto functionality, ZBD flips the script—building on Bitcoin’s Lightning Network to enable fast, low-cost, and globally scalable payments. This flexibility allows the company to find product market-fit in the gaming space, serving use cases that are simply not possible with traditional finance, such as instant reward payouts with no minimums – gamers can earn money playing games and cash out as soon as they’ve earned even a fraction of a cent.

“Having already built a stable revenue-generating business gives us a great entry point to expand what we do and move towards our vision of building a payments company that can instantly move money in any currency,” added Wosoba. “It’s not about being a crypto or Bitcoin business, it’s about being a digital-native payments business that happens to use Bitcoin on the Lightning Network as a core technology in our internal tech stack.”

ZBD took a proactive and strategic approach in anticipation of the new regulation, submitting its MiCAR registration application at the earliest opportunity. Its strong, collaborative relationship with The Dutch Authority for the Financial Markets (AFM), which was the first in the EU to accept and process applications, was also instrumental in achieving this significant milestone.

The license under MiCAR primes ZBD to launch more complex payment products built around Bitcoin, as well as grow rapidly in the EU in 2025. It also brings ZBD one step closer to achieving its ambitious vision as a transformative digital-native payments company. Following its ethos of building crypto-first and then adding complementary fiat functionality, the company is also in the final stages of receiving an Electronic Money Institution (EMI) license, which will complement the range of services ZBD can offer under MiCAR, by also granting it license to perform a wide range of fiat payments services in the EU.

About ZBD

ZBD is a leader in payments innovation, pushing the boundaries of how we move money across the internet. Within gaming, ZBD has made a name for itself by powering instant real-money rewards for partners ranging from Square Enix to 1047 Games. Beyond gaming, ZBD enables unique payments-based use cases across interactive entertainment and adjacent industries. Whether it’s streaming money alongside audio in podcasting apps like Fountain, or implementing instant revenue sharing for each ad impression for adtech innovators like Slice and AdInMo, ZBD makes money move online as seamlessly as information.

To learn more, visit https://zbd.gg/

Photo: https://mma.prnewswire.com/media/2584112/ZBD.jpg

Logo: https://mma.prnewswire.com/media/2583320/ZBD_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/zbd-becomes-first-to-receive-eu-micar-license-approval-302335116.html

View original content:https://www.prnewswire.co.uk/news-releases/zbd-becomes-first-to-receive-eu-micar-license-approval-302335116.html

Fintech PR

Klarpay AG has officially transitioned to Bivial AG

ZUG, Switzerland, Dec. 18, 2024 /PRNewswire/ — Bivial AG is proud to announce the successful completion of its rebranding from Klarpay AG. This transformation represents a major milestone in the company’s journey, aligning its identity with its vision to become a global leader in comprehensive financial solutions for digital businesses.

The name ” Bivial ” encapsulates the company’s commitment to enabling seamless multidirectional financial flows, a core principle that has guided its evolution. This new identity underscores the company’s dedication to innovation and trust while expanding its capabilities.

With the rebrand complete, Bivial AG is poised to enhance its services beyond its established expertise in cross-border corporate payments. The company is actively working to broaden its portfolio with a range of financial and treasury solutions tailored to meet the needs of modern online businesses. This strategic shift underscores Bivial’s commitment to becoming a one-stop financial partner for its clients.

“The transition to Bivial reflects not just a change in name but an expansion with purpose,” said Martynas Bieliauskas, CEO of Bivial AG. “Our clients can expect the same innovative and reliable service they’ve always trusted, now complemented by a broader suite of offerings designed to support their growth in an interconnected world.”

As part of its growth strategy, Bivial is seeking to extend its regulatory footprint. Building on its existing regulatory framework under the Swiss Federal Banking Act Art 1b, the company has initiated processes to secure additional regulatory approvals in Switzerland.

Bivial’s rebrand signals a bold vision for the future of business finance. By integrating new technologies, expanding its regulatory reach, and broadening its offerings, the company is uniquely positioned to lead the way in financial services.

For more information about Bivial AG, visit www.bivial.ch.

About Bivial AG.

Bivial AG, formerly Klarpay AG, is a deposit-taking financial institution authorised and regulated by the Swiss Financial Market Supervisory Authority (FINMA) under the Swiss Federal Banking Act, Article 1b, offering modern Swiss accounts and cross-border payment solutions for digital businesses. Headquartered in Zug, Switzerland, Bivial AG specialises in offering online businesses access to multi-currency IBAN accounts, global payment acceptance, and digital disbursement solutions. As the first Swiss-licensed fintech company to work exclusively with e-commerce, digital entrepreneurs, and social media influencers, Bivial seeks to empower digital businesses through borderless, scalable, bespoke business accounts and payment solutions.

CONTACT: [email protected], + 41 41 552 0093

Logo: https://mma.prnewswire.com/media/2584116/Bivial_AG_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/klarpay-ag-has-officially-transitioned-to-bivial-ag-302335084.html

View original content:https://www.prnewswire.co.uk/news-releases/klarpay-ag-has-officially-transitioned-to-bivial-ag-302335084.html

-

Fintech7 days ago

Fintech7 days agoFintech Pulse: Your Daily Industry Brief (IBANera, FIS, Citigroup, Gen Digital, Mynt)

-

Fintech6 days ago

Fintech6 days agoFintech Pulse: Your Daily Industry Brief (Nuvei, Google, Upvest, Gen Digital, MoneyLion)

-

Fintech PR5 days ago

Fintech PR5 days agoCathay Financial Holdings Calls for Climate Finance Mobilization to Drive the Climate Industrial Revolution

-

Fintech PR5 days ago

Fintech PR5 days agoA New Era of $WUSD — Revolutionizing Stablecoins with Unmatched Security, Stability and Next-Gen Innovation

-

Fintech2 days ago

Fintech2 days agoFintech Pulse: Your Daily Industry Brief (Synapse, Shenzhen Institute, Visa, AutomatIQ, MeridianLink)

-

Fintech PR5 days ago

Fintech PR5 days agoLanistar launches new gaming sites in Brazil as secures right to operate pending final approval on its licence

-

Fintech PR5 days ago

Fintech PR5 days agoHealthcare Revenue Cycle Management (RCM) Market Surges to USD 658.7 Billion by 2030, Propelled by 24% CAGR – Verified Market Reports®

-

Fintech PR5 days ago

Fintech PR5 days agoInternational Communication Forum: Pathways To A Sustainable Future