Fintech PR

AIM Congress 2025 to Spotlight AI’s Role in Business, Society, and Innovation with a Three-Day Conference

ABU DHABI, UAE, March 28, 2025 /PRNewswire/ — AIM Congress 2025, one of the world’s leading investment and economic forums, will feature a special three-day conference on Artificial Intelligence from April 7–9, 2025, bringing together global leaders, industry pioneers, and decision-makers. The AI World Championship 2025 will explore how AI is shaping industries, improving daily life, and opening new opportunities for businesses, governments, and communities.

A Three-Day Program Covering Business, Society & the Future of AI

- Day 1: The Business of AI – Finance, Governance & UAE’s AI Roadmap

The conference will open with a keynote by Ilya Churakov, CEO of AI World Championship, followed by sessions on how AI is reshaping finance, making transactions more secure and personal, and helping businesses manage risk. Discussions will also cover the future of governance, with experts exploring how AI can support public services and policy-making. A key highlight will be a deep dive into the UAE’s AI Strategy 2031, showcasing the country’s vision to lead in AI-driven investments and technology.

- Day 2: AI in Everyday Life – Media, Healthcare & Logistics

The second day will focus on the AI we interact with every day, from entertainment and e-commerce to healthcare and logistics. Industry leaders will discuss how AI is influencing content creation, online shopping, and customer service, making digital experiences more tailored. Other sessions will cover medical advancements, supply chain efficiency, and sustainable farming, showing how AI is improving essential industries and services.

- Day 3: AI for the Future – Robotics, Social Good & Cybersecurity

The final day will look ahead, discussing AI-powered robotics, self-driving vehicles, and automation in industries like healthcare and manufacturing. Experts will also explore AI’s role in education, smart cities, and sustainability, alongside discussions on cybersecurity and protecting digital systems. The event will wrap up with a visionary talk on the future of AI, setting the stage for AI World Championship 2026.

High-level roundtables

AIM Congress will feature high-level roundtable discussions tackling the most pressing global investment challenges. Among the key roundtables are Ministerial Roundtable on Investment, Ministerial Roundtable on Investment in Tourism, Heads of Stock Exchange Markets’ Roundtable, Heads of Central Banks’ Roundtable, and Chambers’ Talks.

Hosting Global forums

AIM Congress 2025 will host a diverse lineup of events which will cover a wide range of topics, including local production, trade technology, health equity, and regional investment prospects.

Among the standout forums are TradeTech Forum with the World Economic Forum, and dedicated investment forums for India, Japan, China, and Russia.

Regional focus forums will also address opportunities across Africa, Europe, Latin America, North America, and the Arab world.

AIM Congress works closely with prominent international organizations such as UNCTAD, IRENA, UNIDO, and the UN World Tourism Organization, reflecting its growing influence as a platform that fosters dialogue, builds partnerships, and unlocks investment potential.

AIM Congress 2025 – Bringing AI to Business & Society

By hosting the AI World Championship as part of AIM Congress 2025, this conference will provide valuable insights, real-world applications, and opportunities for global collaboration. With experts from the USA, UAE, Russia, Europe, and Asia, AIM Congress 2025 is the perfect place to understand how AI is shaping the future of business, investment, and society.

AIM Congress 2025, an initiative of the AIM Global Foundation, is set to offer a wide range of activities, including events, forums, dialogue sessions, workshops, high-level meetings, the AIM Investment Awards and Exhibition, a startups competition, AI Champion and showcase country-specific investment opportunities, highlighting eight key portfolios: Foreign Direct Investment (FDI), Global Trade, Startups and Unicorns, Future Cities, Future Finance, Global Manufacturing, Digital Economy, and Entrepreneurs.

For more information, visit: https://www.aimcongress.com

Contact

Shereen Al Musallami

+ 971 52 699 8032

shereen.almusallami@aimcongress.com

Photo: https://mma.prnewswire.com/media/2652525/AIM_CONGRESS.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/aim-congress-2025-to-spotlight-ais-role-in-business-society-and-innovation-with-a-three-day-conference-302414153.html

View original content:https://www.prnewswire.co.uk/news-releases/aim-congress-2025-to-spotlight-ais-role-in-business-society-and-innovation-with-a-three-day-conference-302414153.html

Fintech PR

Bybit x Block Scholes: BTC fell after touching $88K but bearish derivatives trend holds

DUBAI, UAE, April 1, 2025 /PRNewswire/ — Bybit, the world’s second-largest cryptocurrency exchange by trading volume, released the latest weekly crypto derivatives analytics report in collaboration with Block Scholes. The report provides insights into macroeconomic developments, the state of crypto spot and derivatives markets, and emerging trading signals.

Key insights

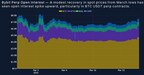

Since bottoming out on March 11, crypto asset prices have climbed steadily over a two-week period, with BTC briefly surpassing $87,000 and ETH recovering above $2,000. XRP has remained relatively stable, while BTC, ETH, and SOL continue to trade below their year-opening levels. SOL, which hit an all-time high in January following Cboe’s Solana Spot ETF filing, also remains down year-to-date. While the broader market has shown signs of recovery, derivatives activity reflects lingering caution. Demand for BTC and ETH put options remains elevated, signaling ongoing hedging behavior.

Cautious rebound in perpetuals

Perpetual open interest stayed flat for most of the week, underscoring a cautious, risk-off tone. A brief market rebound saw BTC rise to $88,000 — a two-week high — triggering modest increases in perpetual trade volume, primarily driven by BTC. Still, volumes remain significantly below those recorded earlier this month, when U.S. President Donald Trump proposed a national crypto reserve centered on the four largest tokens.

Funding rates suggest persistent bearish sentiment

Despite lower realized volatility and positive price movement among major assets, BTC and ETH perpetual contracts continued to post negative funding rates. This indicates that short sellers are still paying long positions, an ongoing sign of bearish sentiment. In contrast, large-cap altcoins showed more mixed positioning, with funding rates fluctuating between positive and negative without a clear directional bias.

Volatility retreats to yearly lows

Implied volatility declined by 3 to 5 points over the past week, with 30-day options now trading at their lowest levels since the beginning of the year. Realized volatility is also nearing the 30% floor last seen in February. As typically observed in low-volatility periods, options market activity has slowed, with open interest remaining low and relatively balanced between puts and calls. Around $40 million in options expired during the week.

Access the full report

For detailed insights, readers may download the full report.

#Bybit / #TheCryptoArk /#BybitResearch

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving a global community of over 60 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at Bybit.com.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: media@bybit.com

For updates, please follow: Bybit’s Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

Photo – https://mma.prnewswire.com/media/2654983/Sources_Bybit_Block_Scholes.jpg

Logo – https://mma.prnewswire.com/media/2267288/Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/bybit-x-block-scholes-btc-fell-after-touching-88k-but-bearish-derivatives-trend-holds-302416731.html

View original content:https://www.prnewswire.co.uk/news-releases/bybit-x-block-scholes-btc-fell-after-touching-88k-but-bearish-derivatives-trend-holds-302416731.html

Fintech PR

YOFC Unveils Game-Changing Hollow-Core Fibre Advances at OFC 2025

SAN FRANCISCO, April 1, 2025 /PRNewswire/ — At the OFC Conference, from March 30 to April 3, 2025, at San Francisco’s Moscone Center, Yangtze Optical Fibre and Cable Joint Stock Limited Company (YOFC) (stock tickers: 601869. SH, 06869.HK) highlighted several new developments in hollow-core fibre technology. During a workshop entitled “How will future submarine systems look like”, Dr. LUO Jie, YOFC’s Chief Technology Officer, presented groundbreaking advances in the field of hollow-core fibre technology.

YOFC’s presentation focused on its latest strides in reducing attenuation to a record-low of 0.05dB/km and extending the manufacturing length of single fibres to over 20 kilometers—achievements that not only set new global benchmarks but also starkly outperform traditional solid-core fibres. These technological advancements were demonstrated through a 21.7 km long hollow-core fibre with a proprietary supporting tube structure (ST-HCF). This drew considerable attention at the exhibition for its potential implications in optical communications.

Hollow-core fibre technology represents a paradigm shift in optical communications, enabling light to be transmitted through an air core. The design facilitates a 47% increase in transmission speed and a 31% reduction in latency compared to conventional fibres, showcasing the significant potential for applications requiring rapid and efficient data transmission such as in data centers, AI models, and financial trading. Additionally, the technology’s exceptionally low attenuation and nonlinearity could potentially address the capacity bottlenecks faced by submarine communication networks and long-distance terrestrial communication lines.

In his presentation, Dr. LUO Jie explored both the practical and theoretical enhancements that hollow-core fibres could bring to submarine cable systems, emphasizing their ability to increase data throughput and reduce transmission times in future deployments.

YOFC has been at the forefront of hollow-core fibre technology development, leveraging its comprehensive research capabilities and autonomous raw material research system to overcome significant industrial challenges. As the digital economy grows, YOFC’s continued innovation in hollow-core fibre technology is set to play a crucial role in supporting the evolution of global digital infrastructure, ensuring it is robust, efficient, and equipped to meet future demands.

View original content:https://www.prnewswire.co.uk/news-releases/yofc-unveils-game-changing-hollow-core-fibre-advances-at-ofc-2025-302416716.html

Fintech PR

Why Are There No New Users in the Crypto Market? How Multi-Asset Trading Wallet BiyaPay Is Finding New Solutions Amidst Fierce Competition and User Confusion ?

SINGAPORE, March 31, 2025 /PRNewswire/ —

Introduction

In recent years, the cryptocurrency market has undergone a dramatic shift from euphoria to calm. At one point, Bitcoin and Ethereum prices hit new highs, and concepts like NFTs and the Metaverse rapidly gained traction, attracting a flood of new users. However, as the market cooled down, the growth of new users slowed significantly, even showing signs of stagnation. This phenomenon has caused concern within the industry: why is the crypto market struggling to attract new participants? Despite continuous technological innovation and an abundance of new projects, public interest has not kept pace. The challenges faced by the crypto market are rooted in increasing competition and a more complex ecosystem, which has left new users confused. This article will explore why the crypto market is experiencing a lack of significant new user growth and discuss how, in the midst of intense competition and user confusion, companies like BiyaPay, a leading multi-asset trading wallet, are finding new ways to drive growth in the crypto industry.

Market Situation Analysis

The competition in the crypto market has intensified, and the ecosystem has become increasingly saturated. From public chains to sidechains, to Layer 2 networks and various decentralized applications (dApps), the number of projects has exploded. According to statistics, over 350 active blockchain networks exist worldwide, and the number of new tokens issued each day reaches tens of thousands. The fragmentation of the market has intensified, and users are now faced with an overwhelming number of choices. However, despite the continuous increase in projects, user growth has not followed suit. Indicators like Total Value Locked (TVL) show that the current cycle has not surpassed previous market highs. The decline in search interest for the term “crypto” on Google Trends also reflects the cyclical decrease in public interest. For beginners, entering the crypto world is far from simple: hundreds of blockchains, wallets, and various protocols and applications make the decision process overwhelming, and the sheer number of options raises the cognitive and usability barriers.

The stagnation in new user growth is driven by multiple factors. First, the user experience of crypto products is significantly more complex than that of traditional internet applications. New users must not only install digital wallets, back up recovery phrases, purchase digital currencies, and pay miner fees but also switch between different blockchain networks, which is particularly daunting for those with no prior exposure to crypto technology. Second, market fragmentation is severe. The ecosystems of various public chains are isolated, making asset interoperability a challenge. This means users need to switch between platforms, for example, dApps on Ethereum have high transaction fees, and users seeking cheaper alternatives often have to learn new wallets and operational logic. The lack of unified standards and interoperability creates friction in user experiences. Lastly, information overload exacerbates user confusion. With thousands of token projects, new users often struggle to distinguish valuable projects from fraudulent ones. The complexity of the experience and the overload of information discourage potential users from entering the market.

Beyond the complexity of the user experience, external factors also contribute to the hesitation of new users entering the crypto market. One significant challenge is regulatory uncertainty. Different countries have vastly differing attitudes toward cryptocurrencies, and their regulations are subject to frequent changes. Some countries have welcomed crypto innovation only to suddenly impose strict regulations, while others have yet to define clear regulations. This uncertainty makes it difficult for crypto companies to operate compliantly, and users feel uneasy about investing in crypto due to the risk of sudden regulatory crackdowns. Another challenge is the frequent occurrence of security incidents, which has damaged the public image of the industry. Events such as exchange bankruptcies, project founders running off with funds, and hacking incidents have shaken user confidence in the safety of crypto platforms. The media’s coverage of crypto scams, money laundering, and other criminal activities has further exacerbated the industry’s reputation crisis. These events make ordinary users wary of entering the crypto space, as they fear losing their funds or getting caught up in illegal activities. Trust issues have become the most significant psychological barrier preventing new users from entering the market.

Core Barriers to User Growth

The target audience for the crypto industry is not homogeneous but highly diversified. Developers, ordinary users, investors, and institutions all have different needs, contributing to the fragmentation of the market. For example, public chain projects primarily target developers, as only developers can build applications that attract end users and grow the ecosystem. Therefore, public chains need to focus on “developer marketing” and technical documentation to encourage developers to adopt their chains. However, these efforts may not directly translate into growth for the average user base. For dApp applications, which should ideally focus on end users, many instead focus on attracting token holders and speculative funds. Sometimes token holders are not actual users of the product but engage in speculative arbitrage, which does not contribute to real user growth. Venture capitalists and institutional investors are primarily focused on return on investment (ROI), and they invest in projects with the expectation that token prices will appreciate. This often leads projects to prioritize token price management and exchange partnerships over improving the product’s appeal to everyday users. Meanwhile, retail speculators are more concerned with short-term price fluctuations and lack patience for long-term value, which makes it difficult to cultivate a loyal user base. Technical partners, such as cross-chain bridges and wallet plugins, form another isolated group. The diverse interests of these stakeholders contribute to the fragmentation of the market, making it harder to target and grow a unified user base.

The high technical complexity of crypto technology is another significant barrier to user adoption. Many ordinary people have heard of Bitcoin but find it difficult to understand blockchain principles, private key signing, or how to manage a string of characters on their own. The high technical threshold leads to mistakes or discomfort when users first experience the technology. For example, a user might accidentally enter the wrong address during a transaction, resulting in the loss of their assets. The high transaction fees, especially during Ethereum’s peak, also discourage small investors and beginners from participating in the market. These issues highlight that blockchain infrastructure is still far from being ready for large-scale commercial adoption. At the same time, the lack of trust has worsened the problem. The 2021 bull market attracted a wave of mainstream users, especially with celebrities endorsing NFTs, but many new users withdrew after the market crash in 2022. Exchange collapses and project failures have left people with negative perceptions of the industry. When the media frequently reports on Bitcoin’s “death” or the collapse of major crypto projects, it reinforces this negative view. Therefore, when technical complexity and trust issues are combined, convincing new users to enter the market becomes an uphill battle. They are either discouraged by the high barriers to entry or deterred by security concerns.

The high cost and complex entry process are additional hurdles for new users. For many newcomers, buying cryptocurrencies is already a significant barrier. Fiat-to-crypto channels are limited, and transaction fees can be high. Through third-party payment methods, users might face additional fees of 2-5%, discouraging small-scale users. Additionally, the volatility of crypto asset prices often causes new users to fear that they will “get stuck” as soon as they enter the market, adding to the psychological cost. Transaction costs are also significant, including high fees for blockchain Gas and additional charges for withdrawal and exchange transactions. Furthermore, the onboarding process is complex. Traditional financial account opening may only require identification documents, but in the crypto world, new users often face multiple steps: registering on exchanges, completing KYC (Know Your Customer) verification, linking bank accounts or wallets, depositing fiat currency to purchase USDT or BTC, and finally transferring funds to personal wallets. This process involves several platforms, and each step introduces new concepts (KYC, wallet addresses, private keys) that users need to understand. Some users may abandon the process midway or fall victim to phishing sites that steal recovery phrases. In comparison, Web2 applications have far simpler onboarding processes. The cumbersome entry process further reduces the attractiveness of crypto products to new users.

Where Is the Breakthrough?

To overcome these barriers, the crypto industry must focus on lowering entry barriers, building trust, and enhancing practical functionality. One company leading the way in this regard is BiyaPay, a global multi-asset trading wallet that offers potential solutions through its product features and service model.

BiyaPay’s standout feature is its multi-asset trading function, which allows users to manage various financial assets, including digital currencies, U.S. stocks, Hong Kong stocks, and more, all within a single platform. This “one-stop” design significantly reduces the entry barrier for new users. Firstly, new users no longer need to download multiple apps or switch between platforms. Traditionally, users needed to open a securities account to trade stocks and register with a crypto exchange for digital currencies. With BiyaPay, users can trade both stocks and crypto assets in one wallet, greatly simplifying the process. For traditional investors, they can now access digital currencies through a familiar stock trading platform, while crypto users can easily engage in traditional asset trading. Secondly, this multi-asset integration makes cross-market operations much more convenient. Users can exchange stablecoins for U.S. dollars and trade U.S. or Hong Kong stocks without the need for complex cross-border transfers or opening offshore accounts. BiyaPay supports converting USDT or other digital assets into fiat currencies and then using them to buy and sell U.S. or Hong Kong stocks, all without the hassle of opening offshore bank accounts. The platform allows for rapid account opening in just five minutes and seamless asset exchange, making global financial markets easily accessible. This simplified experience greatly reduces the psychological barriers for new users, making them more likely to engage with different features.

Another breakthrough offered by BiyaPay is its global payment and remittance services, which solve the difficulties associated with cross-border transactions. The platform supports real-time exchange and remittance for over twenty fiat currencies and more than ten major cryptocurrencies at very low costs. For example, a user working overseas can easily send funds to their family by exchanging digital assets into the local fiat currency on BiyaPay and transferring the funds to a recipient’s account. The low fees (around 0.5%) and the elimination of complex intermediary steps provide a significant advantage over traditional remittance services, which can take days to process and have high fees. This service meets real-world financial needs, attracting users who may not be interested in crypto technology itself but need a convenient cross-border payment solution. For instance, in countries experiencing high inflation, residents can use BiyaPay to convert their local currency into stablecoins for value preservation and then exchange them back into fiat currency when needed. This new use case for crypto is a major breakthrough for the industry, as it shifts the focus from speculative trading to practical financial solutions, making the crypto world more accessible.

BiyaPay also builds user trust by operating in a fully compliant and secure manner. It is headquartered in Singapore, with subsidiaries in the U.S., Canada, and Hong Kong, holding comprehensive financial licenses to ensure legal and compliant operations. BiyaPay emphasizes its “complete licensing, safe and reliable” credentials, which help build trust, especially during times of regulatory uncertainty. Users are more likely to trust a regulated platform with legitimate licenses rather than an anonymous underground exchange. In addition to regulatory compliance, BiyaPay also focuses on security, using bank-grade encryption and multi-factor authentication mechanisms to safeguard user assets and data. This focus on security and risk management ensures that users can make secure transactions without worrying about their funds being frozen or confiscated, a common concern among crypto users.

BiyaPay’s multi-asset strategy not only lowers entry barriers but also broadens its potential user base. By offering both traditional financial assets and cryptocurrencies on the same platform, BiyaPay appeals to a diverse range of investors. Traditional investors who are interested in global markets can use BiyaPay to access cryptocurrency markets easily, while crypto investors can use the platform to diversify their portfolios into traditional assets. This cross-pollination between the “stock” and “crypto” communities significantly expands BiyaPay’s user base.

Future Trends and Outlook

Looking ahead, the emergence of Web3 technologies offers new growth opportunities for the crypto market. Social finance, NFTs, and the Metaverse are emerging fields that could drive the next wave of user growth. BiyaPay can tap into these trends by supporting features such as NFT asset management and Metaverse payment solutions, which would cater to users’ needs in these new areas.

In addition to technological innovation, the crypto industry needs to invest in branding and user education to truly reach new audiences. Clear marketing messages and user education efforts can break down existing barriers to entry. By promoting simple, relatable messages such as “blockchain makes cross-border payments as easy as texting,” crypto platforms like BiyaPay can resonate with mainstream users and reduce the cognitive hurdles new users face.

Conclusion

The slowdown in new user growth in the crypto market is due to a combination of factors, including technological complexity, market fragmentation, and trust issues. However, by improving the user experience, strengthening compliance and security, and expanding practical use cases, the market can overcome these barriers. BiyaPay, as a leading multi-asset trading wallet, demonstrates a successful approach by offering integrated services, global payment solutions, and strong regulatory compliance. The future of the crypto industry looks promising, with the potential to attract new users through innovative products and improved user experiences.

About BiyaPay

BiyaPay is a global multi-asset trading wallet that supports instant exchange of more than 30 fiat currencies and more than 200 digital currencies, and provides USDT direct advertising US stocks, Hong Kong stocks and digital currency spot and contract trading services. Its compliance withdrawal channel and one-stop financial ecosystem are trusted by users around the world.

Learn more information

BiyaPay official website: www.biyapay.com

Customer service email: service@biyapay.com

Telegram supports: https://t.me/biyapay001

Logo – https://mma.prnewswire.com/media/2568572/image_5031329_39789762_Logo.jpg

-

Fintech5 days ago

Fintech5 days agoFintech Pulse: Your Daily Industry Brief – March 26, 2025 | Featuring Chime, Klarna, Unlock Technologies, Fenergos

-

Fintech PR5 days ago

Fintech PR5 days agoPublic Sector Pension Investment Board announces new Chief Financial Officer and new Chief Risk Officer

-

Fintech PR4 days ago

Fintech PR4 days agoTransactions for persons discharging managerial responsibilities – CEO Jörg Brinkmann have purchased shares in H+H International A/S

-

Fintech PR6 days ago

Fintech PR6 days agoSTARCOMPLIANCE SUPPORTS COMPLIANCE TEAMS AMID RISING REGULATORY DEMANDS

-

Fintech6 days ago

Fintech6 days agoFintech Pulse: Your Daily Industry Brief – March 25, 2025 | Rockfi, Bankwell Bank, Louis Limited

-

Fintech PR4 days ago

Fintech PR4 days agoBybit Launches ‘Foolproof Fortune’ Event with 100,000 USDT Prize Pool and a Chance to Win a Luxury Watch

-

Fintech3 days ago

Fintech3 days agoFintech Pulse: Your Daily Industry Brief – March 27, 2025 | Almond Fintech, Maplerad & More

-

Fintech PR7 days ago

Fintech PR7 days agoFounders Future opens its share capital to MACSF, the Dassault and CMA CGM Group to accelerate growth and international expansion