Fintech

TRU Precious Metals Identifies Drill Target at Twilite Gold Project

Fredericton, New Brunswick–(Newsfile Corp. – December 8, 2020) – TRU Precious Metals Corp. (TSXV: TRU) (OTCQB: TRUIF) (“TRU” or the “Company”) is pleased to announce that a promising geophysical target has been identified as an expected starting point for drilling activity in early 2021 at TRU’s 100%-owned flagship Twilite Gold Project (“Twilite Gold”) in the Central Newfoundland Gold Belt. The target was identified by certain of TRU’s advisors following completion of a preliminary phase 1 geophysical survey.

Twilite Gold is strategically located on the mapped extension of the Cape Ray – Valentine Lake Shear Zone. Numerous advanced-stage gold exploration projects are currently underway along this district-scale shear zone, including Marathon Gold’s multi-million ounce deposit at Valentine Lake, and Matador Mining’s Cape Ray deposit. Twilite Gold is also located only 15 kilometres south of Grand Falls-Windsor, a town of approximately 15,000 which is the service and supply centre for central Newfoundland. Twilite Gold is easily accessible with an all-weather gravel road leading directly to the prospect.

TRU Co-Founder and CEO Joel Freudman commented: “We are excited for work to commence at Twilite Gold. In early November we acquired this drill-ready property, and based on historical data we have funded some ground-level initiatives at Twilite Gold before the winter months. Our Exploration Advisor Barry Greene, who is very familiar with the property, is spearheading our disciplined incremental expenditure. Identifying this target will position us for a head start on our 2021 plans to unearth value at Twilite Gold. At the same time, our Technical Committee is currently evaluating an overarching exploration plan and budget for our Newfoundland Gold Exploration properties for 2021.”

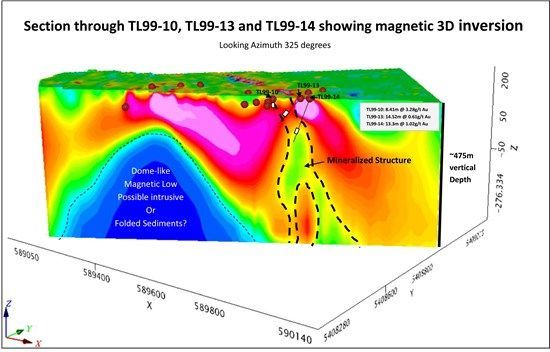

In mid-November, TRU engaged RDF Consulting Ltd. to undertake a limited-scope, high-resolution magnetic survey covering approximately 24 line-kilometres around known historical gold occurrences at Twilite Gold. The detailed ground magnetics survey covered the known gold prospects, including the Discovery, Spring Pit, 320 Vein and Paddy’s Pit prospects. Modeling of the geophysical data, incorporating historical diamond drilling data, reveals that the structurally controlled gold mineralization near the Spring Pit correlates directly with prominent magnetic low that continues to depth (Figure 1). The modeling also indicates that the magnetic low associated with the mineralized structure continues in a northwesterly direction for at least 600 m to the limit of the current magnetic survey (Figure 2).

The mineralized structure was intersected by three shallow diamond drill holes in a 1999 drilling program by Fort Knox Gold Resources, and all such holes contained gold mineralization. Notably, drill hole TH-99-10 intersected 8.41m @ 3.28 g/t gold at the top of the structure. The deepest hole to date on this structure intersected 13.3m @ 1.02 g/t gold.

TRU Exploration Advisor Barry Greene commented: “Magnetic lows are often associated with areas of quartz veining, brecciation and alteration, all of which was intersected in historic drilling on this structure. It is encouraging that the modeling predicts a depth continuity of the gold mineralized structure, and an intriguing domal shaped magnetic low which flanks the mineralized structure, which has not previously been drill tested. These features will be considered priority phase 1 drill targets. Also of interest is how the magnetic modeling suggests that the mineralized structure has continuity in its lateral extent, opening up an expanded area for drill targeting. We are eagerly awaiting the opportunity to see drilling on this property.”

Figure 2: Twilite Gold Magnetic Inversion

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/5993/69716_f670b36c94315bc2_002full.jpg

TRU has not verified the historical drill intervals contained in this press release and is not relying on them as current mineral resources or mineral reserves. Note that drill hole results are select samples and are not necessarily representative of overall mineralization on Twilite Gold. Readers are cautioned that these potential grades are conceptual in nature; there has been insufficient exploration by or on behalf of the Company or its qualified person at Twilite Gold to define a mineral resource or mineral reserve, and it is uncertain whether further exploration will result in these targets being delineated as a mineral resource or mineral reserve.

Qualified Person

Barry Greene, P.Geo. is a qualified person as defined by the Canadian Securities Administrators’ National Instrument 43-101, and has reviewed and approved the contents and technical disclosures in this press release. Mr. Greene is the Exploration Advisor to the Company and owns securities of the Company.

About TRU Precious Metals Corp.

TRU seeks unique value-creation opportunities and has recently assembled a portfolio of gold exploration properties in the Central Newfoundland Gold Belt. The Company’s common shares trade on the TSX Venture Exchange under the symbol “TRU”, and on the OTCQB Venture Market under the symbol “TRUIF”.

TRU is a portfolio company of Resurgent Capital Corp. (“Resurgent”), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization Canadian companies.

For further information, please contact:

Joel Freudman

Co-Founder, President & CEO

TRU Precious Metals Corp.

Phone: (647) 880-6414

Website: www.trupreciousmetals.com

Julie Hajduk

President and CEO

Purple Crown Communications Corp.

Phone: (604) 609-6169

Email: [email protected]

Website: https://purplecrown.ca/

Cautionary Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release contains certain forward-looking statements, including those relating to exploring and monetizing Twilite Gold and the Company’s other mineral exploration investments in Newfoundland. These statements are based on numerous assumptions regarding exploration results that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation: mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on Twilite Gold; drill hole results are select samples and are not necessarily representative of overall mineralization on Twilite Gold; the exploration or monetization potential of Twilite Gold; risks inherent in mineral exploration activities and investments in the mineral exploration sector; volatility in financial markets, economic conditions, and precious metals prices; challenges in attracting and retaining qualified personnel; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

Fintech

Central banks and the FinTech sector unite to change global payments space

The BIS, along with seven leading central banks and a cohort of private financial firms, has embarked on an ambitious venture known as Project Agorá.

Named after the Greek word for “marketplace,” this initiative stands at the forefront of exploring the potential of tokenisation to significantly enhance the operational efficiency of the monetary system worldwide.

Central to this pioneering project are the Bank of France (on behalf of the Eurosystem), the Bank of Japan, the Bank of Korea, the Bank of Mexico, the Swiss National Bank, the Bank of England, and the Federal Reserve Bank of New York. These institutions have joined forces under the banner of Project Agorá, in partnership with an extensive assembly of private financial entities convened by the Institute of International Finance (IIF).

At the heart of Project Agorá is the pursuit of integrating tokenised commercial bank deposits with tokenised wholesale central bank money within a unified, public-private programmable financial platform. By harnessing the advanced capabilities of smart contracts and programmability, the project aspires to unlock new transactional possibilities that were previously infeasible or impractical, thereby fostering novel opportunities that could benefit businesses and consumers alike.

The collaborative effort seeks to address and surmount a variety of structural inefficiencies that currently plague cross-border payments. These challenges include disparate legal, regulatory, and technical standards; varying operating hours and time zones; and the heightened complexity associated with conducting financial integrity checks (such as anti-money laundering and customer verification procedures), which are often redundantly executed across multiple stages of a single transaction due to the involvement of several intermediaries.

As a beacon of experimental and exploratory projects, the BIS Innovation Hub is committed to delivering public goods to the global central banking community through initiatives like Project Agorá. In line with this mission, the BIS will soon issue a call for expressions of interest from private financial institutions eager to contribute to this ground-breaking project. The IIF will facilitate the involvement of private sector participants, extending an invitation to regulated financial institutions representing each of the seven aforementioned currencies to partake in this transformative endeavour.

Source: fintech.globa

The post Central banks and the FinTech sector unite to change global payments space appeared first on HIPTHER Alerts.

Fintech

TD Bank inks multi-year strategic partnership with Google Cloud

TD Bank has inked a multi-year deal with Google Cloud as it looks to streamline the development and deployment of new products and services.

The deal will see the Canadian banking group integrate the vendor’s cloud services into a wider portion of its technology solutions portfolio, a move which TD expects will enable it “to respond quickly to changing customer expectations by rolling out new features, updates, or entirely new financial products at an accelerated pace”.

This marks an expansion of the already established relationship between TD Bank and Google Cloud after the group previously adopted the vendor’s Google Kubernetes Engine (GKE) for TD Securities Automated Trading (TDSAT), the Chicago-based subsidiary of its investment banking unit, TD Securities.

TDSAT uses GKE for process automation and quantitative modelling across fixed income markets, resulting in the development of a “data-driven research platform” capable of processing large research workloads in trading.

Dan Bosman, SVP and CIO of TD Securities, claims the infrastructure has so far supported TDSAT with “compute-intensive quantitative analysis” while expanding the subsidiary’s “trading volumes and portfolio size”.

TD’s new partnership with Google Cloud will see the group attempt to replicate the same level of success across its entire portfolio.

Source: fintechfutures.com

The post TD Bank inks multi-year strategic partnership with Google Cloud appeared first on HIPTHER Alerts.

Fintech

MAS launches transformative platform to combat money laundering

The MAS has unveiled Cosmic, an acronym for Collaborative Sharing of Money Laundering/Terrorism Financing Information and Cases, a new money laundering platform.

According to Business Times, launched on April 1, Cosmic stands out as the first centralised digital platform dedicated to combating money laundering, terrorism financing, and proliferation financing on a worldwide scale. This move follows the enactment of the Financial Services and Markets (Amendment) Act 2023, which, along with its subsidiary legislation, commenced on the same day to provide a solid legal foundation and safeguards for information sharing among financial institutions (FIs).

Cosmic enables participating FIs to exchange customer information when certain “red flags” indicate potential suspicious activities. The platform’s introduction is a testament to MAS’s commitment to ensuring the integrity of the financial sector, mandating participants to establish stringent policies and operational safeguards to maintain the confidentiality of the shared information. This strategic approach allows for the efficient exchange of intelligence on potential criminal activities while protecting legitimate customers.

Significantly, Cosmic was co-developed by MAS and six leading commercial banks in Singapore—OCBC, UOB, DBS, Citibank, HSBC, and Standard Chartered—which will serve as participant FIs during its initial phase. The initiative emphasizes voluntary information sharing focused on addressing key financial crime risks within the commercial banking sector, such as the misuse of legal persons, trade finance, and proliferation financing.

Loo Siew Yee, assistant managing director for policy, payments, and financial crime at MAS, highlighted that Cosmic enhances the existing collaboration between the industry and law enforcement authorities, fortifying Singapore’s reputation as a well-regulated and trusted financial hub. Similarly, Pua Xiao Wei of Citi Singapore and Loretta Yuen of OCBC have expressed their institutions’ support for Cosmic, noting its potential to ramp up anti-money laundering efforts and its significance as a development in the banking sector’s ability to combat financial crimes efficiently. DBS’ Lam Chee Kin also praised Cosmic as a “game changer,” emphasizing the careful balance between combating financial crime and ensuring legitimate customers’ access to financial services.

Source: fintech.global

The post MAS launches transformative platform to combat money laundering appeared first on HIPTHER Alerts.

-

Latest News6 days ago

DEMAND AT ASIAN FACTORIES RISES AT STRONGEST RATE IN OVER 2 YEARS, IMPROVING NEAR-TERM GROWTH OUTLOOK FOR MANUFACTURING WORLDWIDE: GEP GLOBAL SUPPLY CHAIN VOLATILITY INDEX

-

Latest News6 days ago

Bitrue Gears Up for 2024 Bitcoin Halving with Trading Competition

-

Latest News6 days ago

Global Airlines Appoints New Head of Finance from KPMG

-

Latest News5 days ago

“The Hainan FTP and Me”: Looking at Hainan’s Transformations

-

Latest News6 days ago

BtcTurk Organizes Half Marathon in Istanbul to Celebrate Halving Period

-

Latest News6 days ago

Spendesk combines procurement with spend management through Okko acquisition

-

Latest News4 days ago

Millions of people unite around doing good on the 18th International Good Deeds Day held yesterday worldwide

-

Latest News6 days ago

Bitget to Take Center Stage at Blockchain Life and Token2049 Dubai