Fintech

Acting Enforcement Director Marc P. Berger to Depart the Commission

Washington, D.C.–(Newsfile Corp. – January 12, 2021) – The Securities and Exchange Commission today announced that Marc P. Berger, Acting Director of the Division of Enforcement, will conclude his tenure at the agency this month. Mr. Berger joined the Commission as Director of the New York Regional Office in December 2017 and was named Deputy Director of the Division of Enforcement in August 2020.

Under Mr. Berger’s leadership, Enforcement staff pursued significant cases across the entire spectrum of the securities industry, with a focus on impactful and timely actions that protected investors and promoted market integrity. Mr. Berger focused on enhancing the efficiency and effectiveness of the Enforcement Division as well as the Division of Examinations programs in New York, better positioning the staff in both Divisions to address emerging threats and pursue misconduct. Mr. Berger prioritized the promotion of diversity and inclusion across the Enforcement Division and New York Regional Office, fostering a culture of teamwork and integrity and implementing changes to help the SEC continue building and maintaining a diverse workforce. He also facilitated investor outreach and encouraged coordination with the SEC’s federal and state partners.

“Marc has been an outstanding leader at the Commission, always bringing integrity and excellent judgment, as well as his experience from his many years as a federal prosecutor, to each of the matters under his leadership,” said Acting Chairman Elad L. Roisman. “Throughout his tenure, Marc maintained an impressive focus on aggressively pursuing bad actors and finding the best outcome for harmed investors and for the greater investing public. Marc is widely respected throughout the Commission not only for his significant efforts to advance the SEC’s mission, but also for his dedication to each of the attorneys, examiners, accountants, analysts, administrative and support staff, and other professionals who he has worked beside each day of his tenure.”

“The Commission staff’s unwavering commitment to protecting investors and maintaining market integrity, and their passion for the work we do, will forever inspire me,” said Mr. Berger. “I am honored to have had the opportunity to work alongside them — in New York and throughout the country — and I am proud of what we have accomplished together.”

Impactful cases to protect investors and preserve market integrity

Under Mr. Berger’s leadership, the Division of Enforcement focused on addressing misconduct involving market integrity and market structure for the protection of investors. Notable actions included an action against Robinhood Financial LLC for misstatements involving the receipt of payment for order flow and violations of the duty to seek best execution, as well as actions against Credit Suisse Securities (USA) LLC in connection with the handling of certain customer orders and against the New York Stock Exchange and two affiliated exchanges for regulatory failures, including the first-ever charged violation of Regulation SCI.

The Division also pursued abusive trading practices under Mr. Berger’s leadership, including an action against J.P. Morgan Securities LLC for engaging in manipulative trading of U.S. Treasury securities, and an action for insider trading involving companies that were going to be added to or removed from a popular stock market index. Mr. Berger oversaw jury trials in the Southern District of New York involving a broker charged with fraud for excessively trading customer accounts and a brokerage firm and two of its executives in connection with misrepresentations and omissions in a private placement offering.

During his tenure, reflecting the focus on investor protections, particularly involving the evaluation of complex products, the Commission brought actions against three investment advisory firms and two dually registered broker-dealer and advisory firms through its Exchange-Traded Products Initiative. The initiative utilized trading data analytics to uncover securities law violations involving unsuitable sales of complex exchange-traded products.

Pursuing violations of the Foreign Corrupt Practices Act

The Division continued to focus on areas that have traditionally been an important part of its enforcement efforts, including actions under Mr. Berger’s leadership for violations of the Foreign Corrupt Practices Act. These included actions against Deutsche Bank AG for violations related to third-party intermediaries, against Herbalife Nutrition Ltd. for payments to Chinese officials in connection with obtaining sales licenses, and against Stryker Corp. for inadequate internal accounting controls related to overseas sales.

Focus on financial fraud and issuer disclosure

The Division also maintained its ongoing focus on identifying and investigating securities laws violations involving the integrity and accuracy of the financial statements of public companies, including violations by individuals. Notable actions include those against Luckin Coffee, General Electric, Hertz and its former CEO, Lumber Liquidators, PPG Industries, Inc. as well as Brixmor Property Group and certain former executives.

Combating unregistered initial coin offerings

The Commission brought significant enforcement actions under Mr. Berger’s leadership involving unregistered initial coin offerings that deprived investors of key long-standing protections important to our public market system. These included an action against Telegram Group Inc., which agreed to return more than $1.2 billion to investors. They also include an ongoing action against Ripple Labs Inc. and two of its executives. Enforcement staff has also pursued issuers for conducting fraudulent ICOs.

Pursuing meaningful relief, combating affinity fraud, and engaging in effective outreach

Enforcement staff under Mr. Berger’s leadership focused on obtaining meaningful relief for investors. Notable recent actions include an action against investment adviser BlueCrest Capital Management Limited, which will result in the return of $170 million to harmed investors, and actions involving asset freezes in connection with a cryptocurrency trading fund and an offering of digital securities.

Mr. Berger also placed particular focus on combating fraud targeting potential victims based on race, ethnicity, religion, gender, age, and other associations. Illustrative examples include actions involving conduct targeting members of the Haitian, Hispanic, and Deaf, Hard of Hearing, and Hearing Loss communities, among others, and Mr. Berger’s participation in an educational video from the Retail Strategy Task Force encouraging investors in the Deaf, Hard of Hearing, and Hearing Loss communities to learn more about how to protect themselves from investment fraud.

Engagement with investors has been an important aspect of Mr. Berger’s tenure at the SEC, including through personal outreach at numerous public community events. Under his leadership, the New York Regional Office hosted a conference with Fordham University on combating community-based financial fraud, featuring speakers from our federal and state partners. It also spearheaded an Investor Outreach Committee which focuses on local outreach to, and education for, teachers, military and veterans, police and firefighters, senior center residents, religious organizations, and community schools and colleges, among other groups.

Meaningful action in response to COVID-19

In response to COVID-19, the Division continued its existing caseload, while also focusing on pursuing potential misconduct that arose as a result of COVID-19 and educating investors alongside our criminal and regulatory counterparts about COVID-related fraud. Under Mr. Berger’s leadership, the Commission issued trading suspensions in the securities of numerous issuers that made claims related to COVID-19. The Division brought fraud charges against Applied BioSciences Corp. for the company’s alleged false claims that it had begun offering finger-prick COVID-19 tests and against Decision Diagnostics Corp. and its CEO alleging false and misleading claims regarding a purported breakthrough technology to detect COVID-19 through a quick blood test.

The Commission also brought an action against The Cheesecake Factory for making misleading disclosures about the impact of the COVID-19 pandemic on its business operations and financial condition – failing to publicly disclose material information that it shared with potential private investors and lenders — which is the first case charging a public company for misleading investors about the financial effects of the pandemic.

Promoting and fostering diversity and inclusion

Mr. Berger brought a personal commitment to diversity and inclusion to each of his roles at the Commission, working with the Office of Minority and Women Inclusion, employee affinity groups, and others to foster efforts to promote diversity and inclusion and to foster collaboration, teamwork, and diversity of thought. In the New York Regional Office, Mr. Berger launched a Diversity Committee to provide a forum to discuss issues related to diversity, to assist with recruitment initiatives, and to promote fellowship among coworkers, including through impactful events in coordination with other affinity groups. Mr. Berger similarly focused on diversity and inclusion across the Division, encouraging meaningful improvements to enhance diversity and inclusion in the workplace.

Making a lasting impact on the Commission through enhancing efficiencies and effectiveness

Mr. Berger assisted the creation and implementation of the Event and Emerging Risk Examination Team in the Division of Examinations. The team proactively engages with financial firms about emerging threats and current market events and provides expertise and resources across the SEC when critical matters arise.

Mr. Berger also brought innovation to the New York Regional Office’s Investment Adviser/Investment Company and Broker-Dealer and Exchange Examinations Programs, enhancing the process for making and evaluating referrals from the Division of Examinations to the Division of Enforcement, improving coordination of examinations of dually registered broker-dealer and advisory firms, and initiating a series of Investment Adviser Compliance Outreach Netcasts to increase information flow to SEC registrants.

Prior to joining the SEC, Mr. Berger was the Global Co-Head of Ropes & Gray LLP’s Securities and Enforcement Practice. From 2002 to 2014, Mr. Berger served as an Assistant United States Attorney in the Southern District of New York. He was Chief of the Office’s Securities and Commodities Fraud Task Force, where he supervised the investigation and prosecution of many of the nation’s highest profile financial and investment fraud cases, including the largest crackdown on hedge fund insider trading in U.S. history. Mr. Berger received his bachelor’s degree with distinction from Cornell University and earned his law degree from the University of Virginia School of Law. He served as a law clerk to the Honorable Richard M. Berman, U.S. District Judge, Southern District of New York.

Fintech

How to identify authenticity in crypto influencer channels

Modern brands stake on influencer marketing, with 76% of users making a purchase after seeing a product on social media.The cryptocurrency industry is no exception to this trend. However, promoting crypto products through influencer marketing can be particularly challenging. Crypto influencers pose a significant risk to a brand’s reputation and ROI due to rampant scams. Approximately 80% of channels provide fake statistics, including followers counts and engagement metrics. Additionally, this niche is characterized by high CPMs, which can increase the risk of financial loss for brands.

In this article Nadia Bubennnikova, Head of agency Famesters, will explore the most important things to look for in crypto channels to find the perfect match for influencer marketing collaborations.

-

Comments

There are several levels related to this point.

LEVEL 1

Analyze approximately 10 of the channel’s latest videos, looking through the comments to ensure they are not purchased from dubious sources. For example, such comments as “Yes sir, great video!”; “Thanks!”; “Love you man!”; “Quality content”, and others most certainly are bot-generated and should be avoided.

Just to compare:

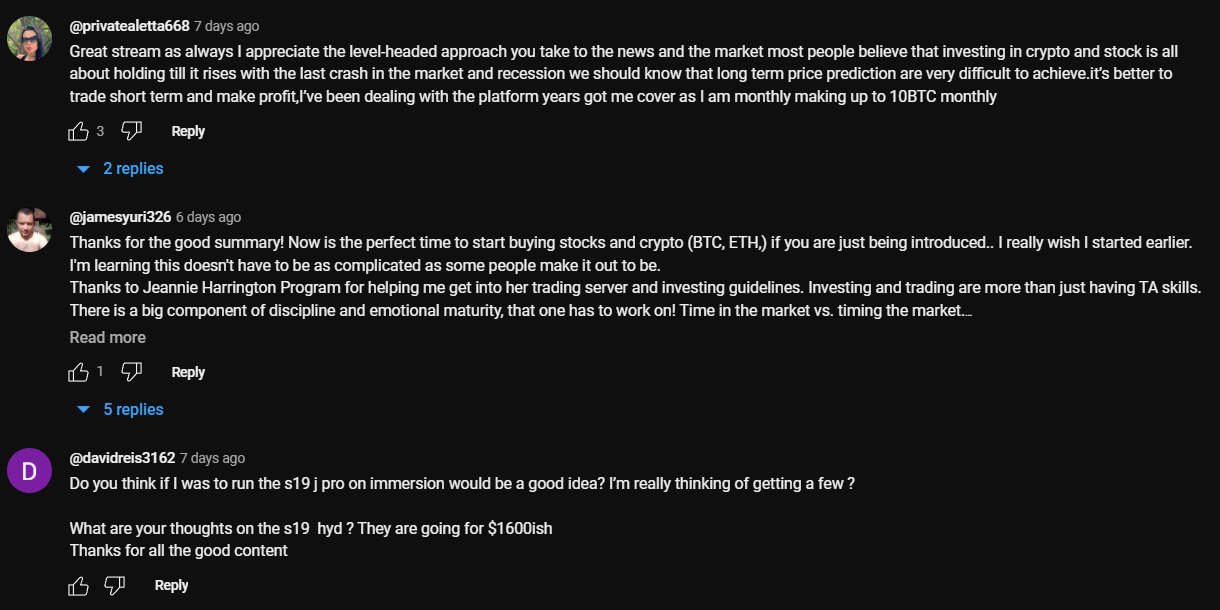

LEVEL 2

Don’t rush to conclude that you’ve discovered the perfect crypto channel just because you’ve come across some logical comments that align with the video’s topic. This may seem controversial, but it’s important to dive deeper. When you encounter a channel with logical comments, ensure that they are unique and not duplicated under the description box. Some creators are smarter than just buying comments from the first link that Google shows you when you search “buy YouTube comments”. They generate topics, provide multiple examples, or upload lists of examples, all produced by AI. You can either manually review the comments or use a script to parse all the YouTube comments into an Excel file. Then, add a formula to highlight any duplicates.

LEVEL 3

It is also a must to check the names of the profiles that leave the comments: most of the bot-generated comments are easy to track: they will all have the usernames made of random symbols and numbers, random first and last name combinations, “Habibi”, etc. No profile pictures on all comments is also a red flag.

LEVEL 4

Another important factor to consider when assessing comment authenticity is the posting date. If all the comments were posted on the same day, it’s likely that the traffic was purchased.

2. Average views number per video

This is indeed one of the key metrics to consider when selecting an influencer for collaboration, regardless of the product type. What specific factors should we focus on?

First & foremost: the views dynamics on the channel. The most desirable type of YouTube channel in terms of views is one that maintains stable viewership across all of its videos. This stability serves as proof of an active and loyal audience genuinely interested in the creator’s content, unlike channels where views vary significantly from one video to another.

Many unauthentic crypto channels not only buy YouTube comments but also invest in increasing video views to create the impression of stability. So, what exactly should we look at in terms of views? Firstly, calculate the average number of views based on the ten latest videos. Then, compare this figure to the views of the most recent videos posted within the past week. If you notice that these new videos have nearly the same number of views as those posted a month or two ago, it’s a clear red flag. Typically, a YouTube channel experiences lower views on new videos, with the number increasing organically each day as the audience engages with the content. If you see a video posted just three days ago already garnering 30k views, matching the total views of older videos, it’s a sign of fraudulent traffic purchased to create the illusion of view stability.

3. Influencer’s channel statistics

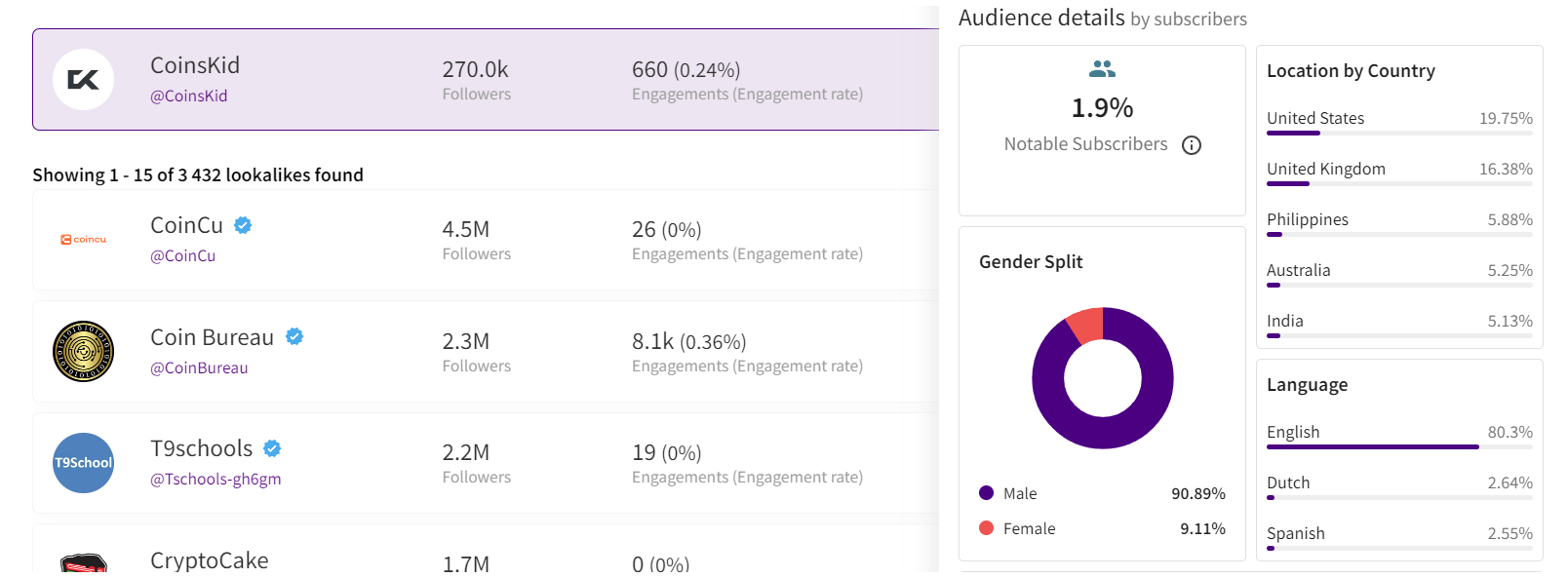

The primary statistics of interest are region and demographic split, and sometimes the device types of the viewers.

LEVEL 1

When reviewing the shared statistics, the first step is to request a video screencast instead of a simple screenshot. This is because it takes more time to organically edit a video than a screenshot, making it harder to manipulate the statistics. If the creator refuses, step two (if only screenshots are provided) is to download them and check the file’s properties on your computer. Look for details such as whether it was created with Adobe Photoshop or the color profile, typically Adobe RGB, to determine if the screenshot has been edited.

LEVEL 2

After confirming the authenticity of the stats screenshot, it’s crucial to analyze the data. For instance, if you’re examining a channel conducted in Spanish with all videos filmed in the same language, it would raise concerns to find a significant audience from countries like India or Turkey. This discrepancy, where the audience doesn’t align with regions known for speaking the language, is a red flag.

If we’re considering an English-language crypto channel, it typically suggests an international audience, as English’s global use for quality educational content on niche topics like crypto. However, certain considerations apply. For instance, if an English-speaking channel shows a significant percentage of Polish viewers (15% to 30%) without any mention of the Polish language, it could indicate fake followers and views. However, if the channel’s creator is Polish, occasionally posts videos in Polish alongside English, and receives Polish comments, it’s important not to rush to conclusions.

Example of statistics

Example of statistics

Wrapping up

These are the main factors to consider when selecting an influencer to promote your crypto product. Once you’ve launched the campaign, there are also some markers to show which creators did bring the authentic traffic and which used some tools to create the illusion of an active and engaged audience. While this may seem obvious, it’s still worth mentioning. After the video is posted, allow 5-7 days for it to accumulate a basic number of views, then check performance metrics such as views, clicks, click-through rate (CTR), signups, and conversion rate (CR) from clicks to signups.

If you overlooked some red flags when selecting crypto channels for your launch, you might find the following outcomes: channels with high views numbers and high CTRs, demonstrating the real interest of the audience, yet with remarkably low conversion rates. In the worst-case scenario, you might witness thousands of clicks resulting in zero to just a few signups. While this might suggest technical issues in other industries, in crypto campaigns it indicates that the creator engaged in the campaign not only bought fake views and comments but also link clicks. And this happens more often than you may realize.

Summing up, choosing the right crypto creator to promote your product is indeed a tricky job that requires a lot of resources to be put into the search process.

Author

Nadia Bubennikova, Head of agency at Famesters

Fintech

Central banks and the FinTech sector unite to change global payments space

The BIS, along with seven leading central banks and a cohort of private financial firms, has embarked on an ambitious venture known as Project Agorá.

Named after the Greek word for “marketplace,” this initiative stands at the forefront of exploring the potential of tokenisation to significantly enhance the operational efficiency of the monetary system worldwide.

Central to this pioneering project are the Bank of France (on behalf of the Eurosystem), the Bank of Japan, the Bank of Korea, the Bank of Mexico, the Swiss National Bank, the Bank of England, and the Federal Reserve Bank of New York. These institutions have joined forces under the banner of Project Agorá, in partnership with an extensive assembly of private financial entities convened by the Institute of International Finance (IIF).

At the heart of Project Agorá is the pursuit of integrating tokenised commercial bank deposits with tokenised wholesale central bank money within a unified, public-private programmable financial platform. By harnessing the advanced capabilities of smart contracts and programmability, the project aspires to unlock new transactional possibilities that were previously infeasible or impractical, thereby fostering novel opportunities that could benefit businesses and consumers alike.

The collaborative effort seeks to address and surmount a variety of structural inefficiencies that currently plague cross-border payments. These challenges include disparate legal, regulatory, and technical standards; varying operating hours and time zones; and the heightened complexity associated with conducting financial integrity checks (such as anti-money laundering and customer verification procedures), which are often redundantly executed across multiple stages of a single transaction due to the involvement of several intermediaries.

As a beacon of experimental and exploratory projects, the BIS Innovation Hub is committed to delivering public goods to the global central banking community through initiatives like Project Agorá. In line with this mission, the BIS will soon issue a call for expressions of interest from private financial institutions eager to contribute to this ground-breaking project. The IIF will facilitate the involvement of private sector participants, extending an invitation to regulated financial institutions representing each of the seven aforementioned currencies to partake in this transformative endeavour.

Source: fintech.globa

The post Central banks and the FinTech sector unite to change global payments space appeared first on HIPTHER Alerts.

Fintech

TD Bank inks multi-year strategic partnership with Google Cloud

TD Bank has inked a multi-year deal with Google Cloud as it looks to streamline the development and deployment of new products and services.

The deal will see the Canadian banking group integrate the vendor’s cloud services into a wider portion of its technology solutions portfolio, a move which TD expects will enable it “to respond quickly to changing customer expectations by rolling out new features, updates, or entirely new financial products at an accelerated pace”.

This marks an expansion of the already established relationship between TD Bank and Google Cloud after the group previously adopted the vendor’s Google Kubernetes Engine (GKE) for TD Securities Automated Trading (TDSAT), the Chicago-based subsidiary of its investment banking unit, TD Securities.

TDSAT uses GKE for process automation and quantitative modelling across fixed income markets, resulting in the development of a “data-driven research platform” capable of processing large research workloads in trading.

Dan Bosman, SVP and CIO of TD Securities, claims the infrastructure has so far supported TDSAT with “compute-intensive quantitative analysis” while expanding the subsidiary’s “trading volumes and portfolio size”.

TD’s new partnership with Google Cloud will see the group attempt to replicate the same level of success across its entire portfolio.

Source: fintechfutures.com

The post TD Bank inks multi-year strategic partnership with Google Cloud appeared first on HIPTHER Alerts.

-

Latest News7 days ago

“The Hainan FTP and Me”: Looking at Hainan’s Transformations

-

Latest News5 days ago

Millions of people unite around doing good on the 18th International Good Deeds Day held yesterday worldwide

-

Latest News5 days ago

Banxso Acquires Australian ASIC License, Enhancing Its Global Trading Operations

-

Latest News4 days ago

BMO Announces Election of Board of Directors

-

Latest News5 days ago

135th Canton Fair Launches a Showcase of Innovative Products of New Collection to Lead Global Market Trends

-

Latest News6 days ago

BII and FMO back BECIS with joint US$50 million financing facility supporting commercial and industrial renewables sector in South-East Asia

-

Fintech1 day ago

Fintech1 day agoHow to identify authenticity in crypto influencer channels

-

Latest News4 days ago

HaloWallet Rebrands To Halo: Integrating SocialFi & AI To Revolutionize Social Influence Monetization