Fintech

RETRANSMISSION: Cerrado Gold Reports True Thickness of 42 Metres at 1.82 g/t Au and 14 Metres at 5.98 g/t Au and 2 Metres at 37.85 g/t Au from Its Ongoing Phase I Drill Program at Its Monte Do Carmo Project in Brazil

- Current drill results continue to expand Serra Alta resource by intersecting strong values with significant visible gold over broad zones of mineralization.

- Cerrado to start trading Thursday February 25th on TSX Venture Exchange:

Symbol: (TSXV: CERT)

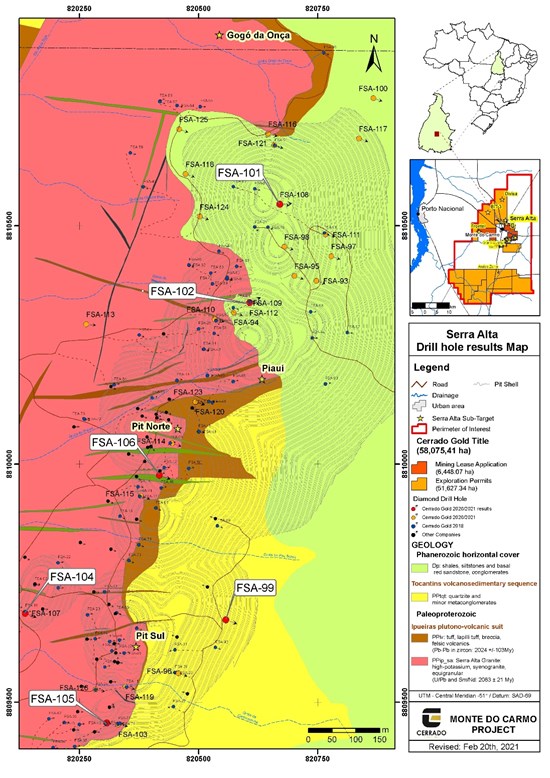

Toronto, Ontario–(Newsfile Corp. – February 25, 2021) – Cerrado Gold Inc. (TSXV: CERT) (“Cerrado” or the “Company”) is very pleased to announce additional drill results from a further six drill holes from its ongoing 17,000-metre definition drilling program at the Serra Alta deposit, at its Monte do Carmo (“MDC”) Project located in Tocantins State, Brazil. The drill results highlighted in this release are from drill holes: FSA 99, FSA101, FSA102, FSA104, FSA 105 and FSA 106. Additional drill results will be announced as assays are made available over the next few months.

Drill Hole Highlights:

FSA102

- True thickness 41.96 metres at 1.82g/t Au, from 114.30m to 161.60m

- including true thickness 11.44 metres at 4.86g/t Au, from 129.70m to 142.60m,

FSA105

- True thickness 6.30 metres at 3.09g Au/t, from 37.60 to 43.90m

FSA106

- True thickness 14.15 metres at 5.98g/t Au, from 103.85m to 118.00m

- including true thickness 2.00 metres at 37.85g/t Au, from 116.00m to 118.00m

Mark Brennan, Co-Chairman and CEO commented: “Based upon the exceptional mineralization intersected to date, we remain highly confident that the drill program continues to support our objective of expanding and upgrading the known resource at Serra Alta. We expect the results from this Phase 1 drill program should support the Company’s target to grow the resource at Serra Alta to our 1.5MM ounce target by the end of March 2021. A Phase 2 drill program is expected to commence immediately following this program in April and is targeted to grow the resource base to between 2.0-2.5MM oz by year end. ”

He continued, “In addition, ongoing regional surface mapping and other work continues to develop additional targets within the same geological environment to expand the overall resource potential on the greater Monte Do Carmo property. We plan to drill a good number of these regional targets in the Phase 2 program, which we believe will demonstrate the compelling district potential that we see clearly at Monte Do Carmo.”

The drill results reported in this press release were received through February 20th, 2020 and represent complete results for FSA 99, FSA 101, FSA102, FSA 104, FSA 105 and FSA106. The results indicate that these drill holes have been successful in confirming and expanding the mineralization. As of Friday February 19th, 2021, Cerrado has completed 12,231 metres of its ongoing Phase I drill program targeting 17,000-metres and is on track to complete the program by the end of March 2021. Subsequent to the completion of this Phase 1 drill program, the company anticipates that it will commence a further 14,000-metre, Phase 2 drill program, focused on further resource expansion and the drilling of several satellite targets with the aim to further expand the resource potential at the Monte Do Carmo project.

The current drill holes intersected broad zones of hydrothermal alteration with abundant points of visible gold. The alteration is typical for the Serra Alta deposit, including the abundance of quartz veinlets, potassic & chloritic alteration, including sulphides (pyrite, sphalerite, and galena) with visible gold.

To date, the bulk of the drill results reported fall within the limits of the open pit outlined in the Preliminary Economic Assessment (“PEA”), to constrain the current resources defined at the Serra Alta deposit at its Monte Do Carmo gold project in Tocantins State, Brazil (See SEDAR filing December 6, 2018).

To view an enhanced version of this Table, please visit:

https://orders.newsfilecorp.com/files/6185/75460_f05896091491286f_003full.jpg

Quality Assurance and Quality Control

Analytical work was carried out by ALS international lab (ALS). The facilities of the prep lab are located in Goiânia, Brazil 835 km from MDC and alternatively in Belo Horizonte, Brazil 1,110 Km from the MDC project. MDC sends out their samples to ALS international labs (ALS) with the prep lab located in Goiânia or alternatively in Belo Horizonte. ALS lab sends the prepared aliquots for analytical assay to their lab in Lima, Peru where the prepared samples are systematically analyzed for gold (ppm) by fire assay (Au-AA24) or gold (ppm) by metallic screen (Au-SCR24)). Randomly the ICP (Inductively coupled plasma mass spectrometry) is done for trace elements in 4 acids (hydrofluoric, perchloric, nitric and hydrochloric) digestion (ME-MS-61).

ALS has routine quality control procedures which ensure that every batch of samples includes three sample repeats and at least two commercial standards and two blanks. Cerrado used standard QA/QC procedures, when inserting reference standards and blanks, for the drilling program. The Reference material used are from CDN Resource Laboratories Ltd. and ITAK (Instituto de Tecnologia August Kekulé Ltda.) Brazilian supplier included in the batches following MDC internal protocols.

Review of Technical Information

The scientific and technical information in this press release has been reviewed and approved by Robert Campbell, P.Geo., Vice President, Exploration for Cerrado Gold Inc., who is a Qualified Person as defined in National Instrument 43-101.

For further information please contact:

Mark Brennan

CEO and Co Chairman

Tel: +1-647-796-0023

[email protected]

Nicholas Campbell, CFA

Director, Corporate Development

Tel: +1-905-630-0148

[email protected]

About Cerrado Gold

Cerrado Gold is a private gold production and exploration company with gold production derived from its 100% owned Minera Don Nicolas mine in Santa Cruz province, Argentina. The company is also undertaking exploration at its 100% owned Monte Do Carmo project located in Tocantins, Brazil. For more information about Cerrado Gold please visit our website at www.cerradogold.com.

Disclaimer

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains statements that constitute “forward-looking information” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation, All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado Gold. In making the forward- looking statements contained in this press release, Cerrado Gold has made certain assumptions, including, but not limited to the potential to expand and upgrade the known mineral resources at its Serra Alta project. Although Cerrado Gold believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, Cerrado Gold disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/75460

Fintech

Central banks and the FinTech sector unite to change global payments space

The BIS, along with seven leading central banks and a cohort of private financial firms, has embarked on an ambitious venture known as Project Agorá.

Named after the Greek word for “marketplace,” this initiative stands at the forefront of exploring the potential of tokenisation to significantly enhance the operational efficiency of the monetary system worldwide.

Central to this pioneering project are the Bank of France (on behalf of the Eurosystem), the Bank of Japan, the Bank of Korea, the Bank of Mexico, the Swiss National Bank, the Bank of England, and the Federal Reserve Bank of New York. These institutions have joined forces under the banner of Project Agorá, in partnership with an extensive assembly of private financial entities convened by the Institute of International Finance (IIF).

At the heart of Project Agorá is the pursuit of integrating tokenised commercial bank deposits with tokenised wholesale central bank money within a unified, public-private programmable financial platform. By harnessing the advanced capabilities of smart contracts and programmability, the project aspires to unlock new transactional possibilities that were previously infeasible or impractical, thereby fostering novel opportunities that could benefit businesses and consumers alike.

The collaborative effort seeks to address and surmount a variety of structural inefficiencies that currently plague cross-border payments. These challenges include disparate legal, regulatory, and technical standards; varying operating hours and time zones; and the heightened complexity associated with conducting financial integrity checks (such as anti-money laundering and customer verification procedures), which are often redundantly executed across multiple stages of a single transaction due to the involvement of several intermediaries.

As a beacon of experimental and exploratory projects, the BIS Innovation Hub is committed to delivering public goods to the global central banking community through initiatives like Project Agorá. In line with this mission, the BIS will soon issue a call for expressions of interest from private financial institutions eager to contribute to this ground-breaking project. The IIF will facilitate the involvement of private sector participants, extending an invitation to regulated financial institutions representing each of the seven aforementioned currencies to partake in this transformative endeavour.

Source: fintech.globa

The post Central banks and the FinTech sector unite to change global payments space appeared first on HIPTHER Alerts.

Fintech

TD Bank inks multi-year strategic partnership with Google Cloud

TD Bank has inked a multi-year deal with Google Cloud as it looks to streamline the development and deployment of new products and services.

The deal will see the Canadian banking group integrate the vendor’s cloud services into a wider portion of its technology solutions portfolio, a move which TD expects will enable it “to respond quickly to changing customer expectations by rolling out new features, updates, or entirely new financial products at an accelerated pace”.

This marks an expansion of the already established relationship between TD Bank and Google Cloud after the group previously adopted the vendor’s Google Kubernetes Engine (GKE) for TD Securities Automated Trading (TDSAT), the Chicago-based subsidiary of its investment banking unit, TD Securities.

TDSAT uses GKE for process automation and quantitative modelling across fixed income markets, resulting in the development of a “data-driven research platform” capable of processing large research workloads in trading.

Dan Bosman, SVP and CIO of TD Securities, claims the infrastructure has so far supported TDSAT with “compute-intensive quantitative analysis” while expanding the subsidiary’s “trading volumes and portfolio size”.

TD’s new partnership with Google Cloud will see the group attempt to replicate the same level of success across its entire portfolio.

Source: fintechfutures.com

The post TD Bank inks multi-year strategic partnership with Google Cloud appeared first on HIPTHER Alerts.

Fintech

MAS launches transformative platform to combat money laundering

The MAS has unveiled Cosmic, an acronym for Collaborative Sharing of Money Laundering/Terrorism Financing Information and Cases, a new money laundering platform.

According to Business Times, launched on April 1, Cosmic stands out as the first centralised digital platform dedicated to combating money laundering, terrorism financing, and proliferation financing on a worldwide scale. This move follows the enactment of the Financial Services and Markets (Amendment) Act 2023, which, along with its subsidiary legislation, commenced on the same day to provide a solid legal foundation and safeguards for information sharing among financial institutions (FIs).

Cosmic enables participating FIs to exchange customer information when certain “red flags” indicate potential suspicious activities. The platform’s introduction is a testament to MAS’s commitment to ensuring the integrity of the financial sector, mandating participants to establish stringent policies and operational safeguards to maintain the confidentiality of the shared information. This strategic approach allows for the efficient exchange of intelligence on potential criminal activities while protecting legitimate customers.

Significantly, Cosmic was co-developed by MAS and six leading commercial banks in Singapore—OCBC, UOB, DBS, Citibank, HSBC, and Standard Chartered—which will serve as participant FIs during its initial phase. The initiative emphasizes voluntary information sharing focused on addressing key financial crime risks within the commercial banking sector, such as the misuse of legal persons, trade finance, and proliferation financing.

Loo Siew Yee, assistant managing director for policy, payments, and financial crime at MAS, highlighted that Cosmic enhances the existing collaboration between the industry and law enforcement authorities, fortifying Singapore’s reputation as a well-regulated and trusted financial hub. Similarly, Pua Xiao Wei of Citi Singapore and Loretta Yuen of OCBC have expressed their institutions’ support for Cosmic, noting its potential to ramp up anti-money laundering efforts and its significance as a development in the banking sector’s ability to combat financial crimes efficiently. DBS’ Lam Chee Kin also praised Cosmic as a “game changer,” emphasizing the careful balance between combating financial crime and ensuring legitimate customers’ access to financial services.

Source: fintech.global

The post MAS launches transformative platform to combat money laundering appeared first on HIPTHER Alerts.

-

Latest News6 days ago

DEMAND AT ASIAN FACTORIES RISES AT STRONGEST RATE IN OVER 2 YEARS, IMPROVING NEAR-TERM GROWTH OUTLOOK FOR MANUFACTURING WORLDWIDE: GEP GLOBAL SUPPLY CHAIN VOLATILITY INDEX

-

Latest News7 days ago

Bitrue Gears Up for 2024 Bitcoin Halving with Trading Competition

-

Latest News7 days ago

Global Airlines Appoints New Head of Finance from KPMG

-

Latest News5 days ago

“The Hainan FTP and Me”: Looking at Hainan’s Transformations

-

Latest News6 days ago

Spendesk combines procurement with spend management through Okko acquisition

-

Latest News7 days ago

BtcTurk Organizes Half Marathon in Istanbul to Celebrate Halving Period

-

Latest News4 days ago

Millions of people unite around doing good on the 18th International Good Deeds Day held yesterday worldwide

-

Latest News7 days ago

Bitget to Take Center Stage at Blockchain Life and Token2049 Dubai