Fintech

Platform 9 Capital Corp. Announces Qualifying Transaction with Sol Cuisine Inc.

Toronto, Ontario–(Newsfile Corp. – March 8, 2021) – Platform 9 Capital Corp. (TSXV: PN.P) (the “Company” or “Platform 9“) is pleased to announce that it has entered into of a Letter of Intent dated March 5, 2021 with Sol Cuisine Inc. (“Sol Cuisine“) to enable Sol Cuisine to complete a going-public transaction in Canada (the “Proposed Transaction“).

ABOUT SOL CUISINE

Sol Cuisine is a fast-growing producer of branded, consumer-preferred plant-based protein offerings across key center-of-plate and appetizer categories. Sol Cuisine’s products are offered through an established omni-channel distribution platform in Canada and the U.S. and are available in over 11,000 stores and more than 41,000 unique points of distribution. Over a history of 20+ years, Sol Cuisine has consistently demonstrated an ability to innovate and delight customers in Canada and the U.S., while remaining true to its commitment to producing great tasting products that are nutritionally superior both to meat-based offerings and to competitive plant-based products. Sol Cuisine’s taste and nutritional superiority has also resulted in private label contracts with some of the most recognized grocery retailers in North America. These products are all produced at a state of the art, 35,000 square foot facility in Mississauga, Ontario, capable of supporting up to 10 million kilograms of volume per annum. Sol Cuisine is incorporated under the laws of Canada.

In conjunction with, and prior to the closing of the Proposed Transaction, Sol Cuisine intends to complete a brokered private placement offering of subscription receipts of Sol Cuisine (each, a “Subscription Receipt“) for gross proceeds of $30.0 million, led by Canaccord Genuity Corp. (the “Private Placement“), with an option to be granted to the agents to increase the size of the Private Placement by up to $4.5 million for total gross proceeds of $34.5 million. It is anticipated that each Subscription Receipt will be automatically exchanged for one common share of Sol Cuisine (each, a “Sol Cuisine Share“) upon the satisfaction of specified escrow release conditions, which will include, among other things, the completion or waiver of all conditions precedent to the Proposed Transaction and the conditional approval for listing of the common shares of the resulting issuer (the “Resulting Issuer“) on the TSX Venture Exchange (the “TSXV“).

ADDITIONAL TERMS OF THE PROPOSED TRANSACTION

For the purposes of the Proposed Transaction, the deemed value of each outstanding common share of Platform 9 will be approximately $0.1327 (on a pre-consolidation basis). Pursuant to the Proposed Transaction, it is currently intended that: (i) the outstanding common shares of Platform 9 will be consolidated at a consolidation ratio to be determined by the parties to the Proposed Transaction based on the price per Subscription Receipt of the Private Placement (the “Consolidation“); and (ii) the holders of Sol Cuisine Shares (including those investors in the Private Placement) will receive one (1) common share of the Resulting Issuer (on a post-Consolidation basis) in exchange for each outstanding Sol Cuisine Share. Following the completion of the Proposed Transaction, the securityholders of Sol Cuisine (including those investors under the Private Placement) will hold a significant majority of the outstanding common shares of the Resulting Issuer.

Platform 9 intends that the Proposed Transaction will constitute its “Qualifying Transaction” under Policy 2.4 – Capital Pool Companies of the TSXV. The Proposed Transaction will be an arm’s length transaction.

A comprehensive news release with further particulars relating to the Proposed Transaction, financial particulars, transaction structure, descriptions of the proposed management and directors of the Resulting Issuer, terms of any sponsorship, if applicable, among other particulars, will follow in accordance with the policies of the TSXV.

Completion of the Proposed Transaction is subject to a number of conditions including, but not limited to: (a) completion of satisfactory due diligence; (b) execution of a definitive agreement; (c) receipt of regulatory approvals; (d) acceptance of the Proposed Transaction as Platform 9’s Qualifying Transaction by the TSXV; (e) receipt of approval for the listing of the common shares of the Resulting Issuer by the TSXV; (f) shareholders of Platform 9 approving certain matters ancillary to the Proposed Transaction, including the Consolidation, the appointment of new director nominees of Sol Cuisine and a change in name of Platform 9 to include “Sol Cuisine”, all subject to the completion of the Proposed Transaction. There can, however, be no assurance that the Proposed Transaction will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the filing statement to be prepared in connection with the Proposed Transaction, any information released or received with respect to the Proposed Transaction may not be accurate or complete and should not be relied upon.

Trading in securities of a capital pool company should be considered highly speculative. Shares of Platform 9 are currently halted from trading on the TSXV, and trading is not expected to resume until closing of the Proposed Transaction.

This press release is not an offer of securities for sale in the United States. The securities described in this press release have not been registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States or to, or for the account or benefit of, U.S. persons (as defined in Regulation S under the U.S. Securities Act of 1933, as amended) absent registration or an exemption from registration. This press release shall not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of the securities in any jurisdiction where such offer, solicitation, or sale would be unlawful.

The TSX Venture Exchange Inc. has in no way passed upon the merits of the Proposed Transaction and has neither approved nor disapproved the contents of this press release.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

FORWARD-LOOKING STATEMENTS

This press release includes forward-looking information within the meaning of Canadian securities laws regarding Platform 9, Sol Cuisine and their respective businesses, which may include, but are not limited to, statements with respect to the completion of the Proposed Transaction, the terms on which the Proposed Transaction is intended to be completed, the ability to obtain regulatory and shareholder approvals and other factors. Often but not always, forward-looking information can be identified by the use of words such as “expect”, “intends”, “anticipated”, “believes” or variations (including negative variations) of such words and phrases, or state that certain actions, events or results “may”, “could”, “would” or “will” be taken, occur or be achieved. Such statements are based on the current expectations and views of future events of the management of each entity, and are based on assumptions and subject to risks and uncertainties. Although the management of each entity believes that the assumptions underlying these statements are reasonable, they may prove to be incorrect. The forward-looking events and circumstances discussed in this press release, including completion of the Proposed Transaction (and the proposed terms upon which the Proposed Transaction is proposed to be completed), may not occur and could differ materially as a result of known and unknown risk factors and uncertainties affecting the companies, including risks regarding the industry, market conditions, economic factors, management’s ability to manage and to operate the business of the Resulting Issuer and the equity markets generally. Although Platform 9 and Sol Cuisine have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on any forward-looking statements or information. No forward-looking statement can be guaranteed. Except as required by applicable securities laws, forward-looking statements speak only as of the date on which they are made and neither Platform 9 and Sol Cuisine undertake any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise.

About Platform 9 Capital Corp.

Platform 9 Capital Corp. is incorporated under the laws of the Province of Ontario and is a Capital Pool Company listed on the TSXV. It has not commenced commercial operations and has no assets other than cash. For further information, please see the final prospectus of the Company dated May 17, 2018 filed on SEDAR at www.sedar.com.

For more information please contact:

John Travaglini, Chief Executive Officer

Platform 9 Capital Corp.

Telephone: (416) 861-1100

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/76380

Fintech

How to identify authenticity in crypto influencer channels

Modern brands stake on influencer marketing, with 76% of users making a purchase after seeing a product on social media.The cryptocurrency industry is no exception to this trend. However, promoting crypto products through influencer marketing can be particularly challenging. Crypto influencers pose a significant risk to a brand’s reputation and ROI due to rampant scams. Approximately 80% of channels provide fake statistics, including followers counts and engagement metrics. Additionally, this niche is characterized by high CPMs, which can increase the risk of financial loss for brands.

In this article Nadia Bubennnikova, Head of agency Famesters, will explore the most important things to look for in crypto channels to find the perfect match for influencer marketing collaborations.

-

Comments

There are several levels related to this point.

LEVEL 1

Analyze approximately 10 of the channel’s latest videos, looking through the comments to ensure they are not purchased from dubious sources. For example, such comments as “Yes sir, great video!”; “Thanks!”; “Love you man!”; “Quality content”, and others most certainly are bot-generated and should be avoided.

Just to compare:

LEVEL 2

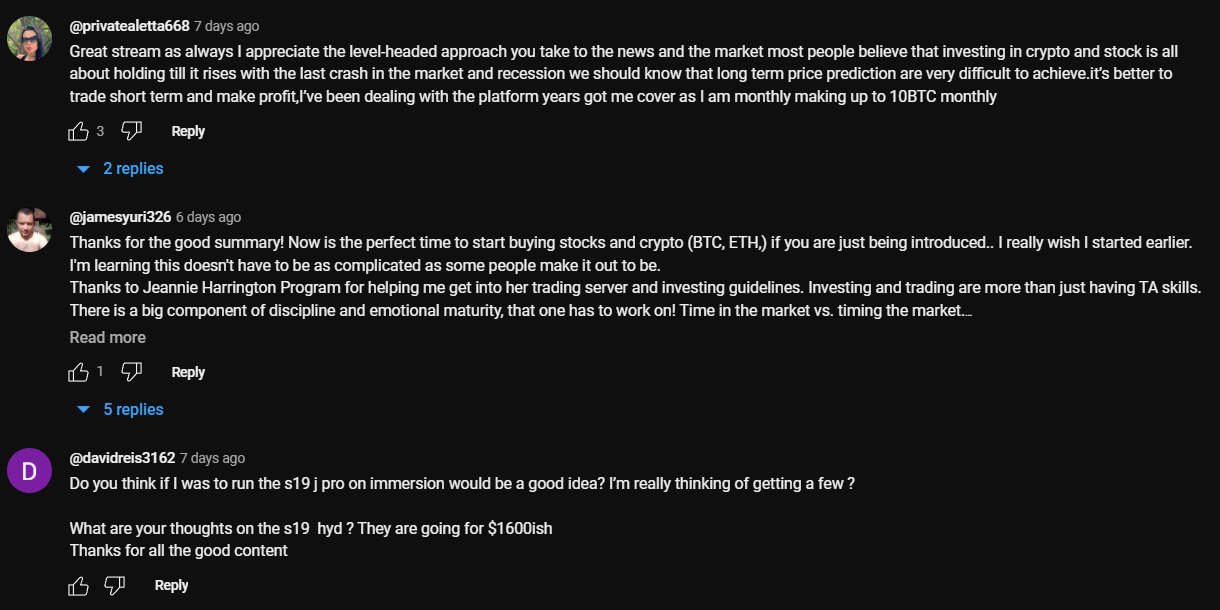

Don’t rush to conclude that you’ve discovered the perfect crypto channel just because you’ve come across some logical comments that align with the video’s topic. This may seem controversial, but it’s important to dive deeper. When you encounter a channel with logical comments, ensure that they are unique and not duplicated under the description box. Some creators are smarter than just buying comments from the first link that Google shows you when you search “buy YouTube comments”. They generate topics, provide multiple examples, or upload lists of examples, all produced by AI. You can either manually review the comments or use a script to parse all the YouTube comments into an Excel file. Then, add a formula to highlight any duplicates.

LEVEL 3

It is also a must to check the names of the profiles that leave the comments: most of the bot-generated comments are easy to track: they will all have the usernames made of random symbols and numbers, random first and last name combinations, “Habibi”, etc. No profile pictures on all comments is also a red flag.

LEVEL 4

Another important factor to consider when assessing comment authenticity is the posting date. If all the comments were posted on the same day, it’s likely that the traffic was purchased.

2. Average views number per video

This is indeed one of the key metrics to consider when selecting an influencer for collaboration, regardless of the product type. What specific factors should we focus on?

First & foremost: the views dynamics on the channel. The most desirable type of YouTube channel in terms of views is one that maintains stable viewership across all of its videos. This stability serves as proof of an active and loyal audience genuinely interested in the creator’s content, unlike channels where views vary significantly from one video to another.

Many unauthentic crypto channels not only buy YouTube comments but also invest in increasing video views to create the impression of stability. So, what exactly should we look at in terms of views? Firstly, calculate the average number of views based on the ten latest videos. Then, compare this figure to the views of the most recent videos posted within the past week. If you notice that these new videos have nearly the same number of views as those posted a month or two ago, it’s a clear red flag. Typically, a YouTube channel experiences lower views on new videos, with the number increasing organically each day as the audience engages with the content. If you see a video posted just three days ago already garnering 30k views, matching the total views of older videos, it’s a sign of fraudulent traffic purchased to create the illusion of view stability.

3. Influencer’s channel statistics

The primary statistics of interest are region and demographic split, and sometimes the device types of the viewers.

LEVEL 1

When reviewing the shared statistics, the first step is to request a video screencast instead of a simple screenshot. This is because it takes more time to organically edit a video than a screenshot, making it harder to manipulate the statistics. If the creator refuses, step two (if only screenshots are provided) is to download them and check the file’s properties on your computer. Look for details such as whether it was created with Adobe Photoshop or the color profile, typically Adobe RGB, to determine if the screenshot has been edited.

LEVEL 2

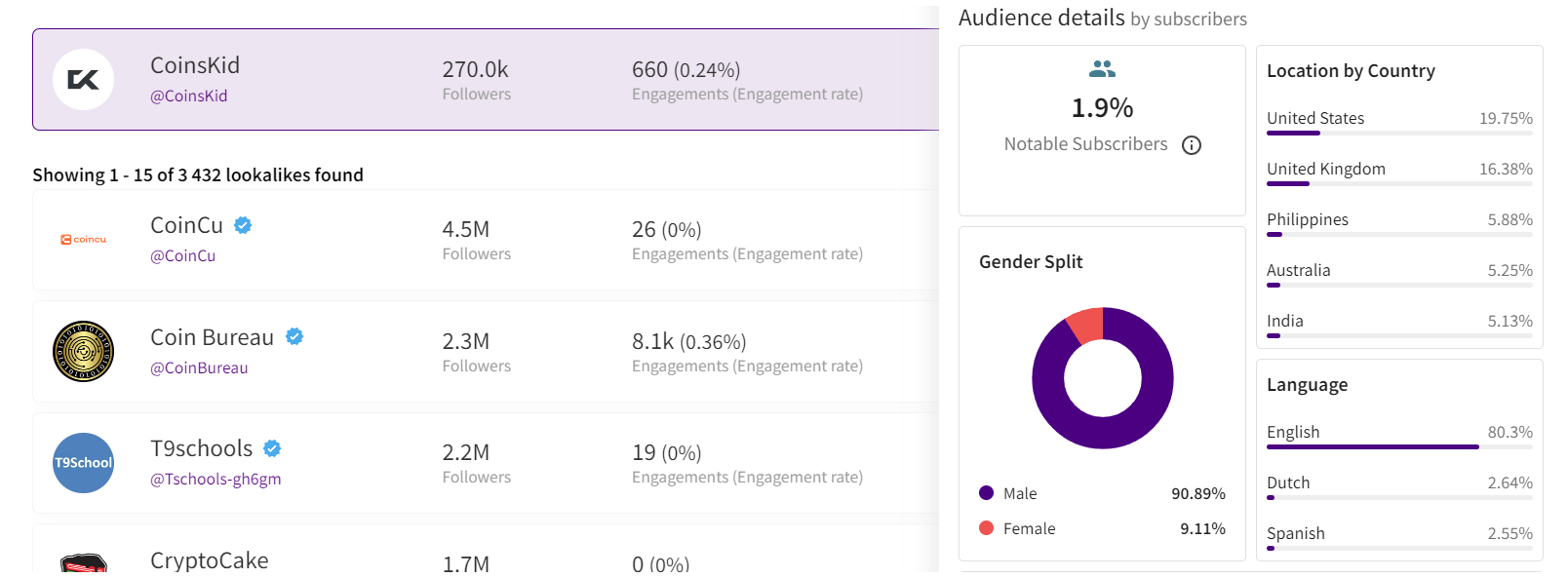

After confirming the authenticity of the stats screenshot, it’s crucial to analyze the data. For instance, if you’re examining a channel conducted in Spanish with all videos filmed in the same language, it would raise concerns to find a significant audience from countries like India or Turkey. This discrepancy, where the audience doesn’t align with regions known for speaking the language, is a red flag.

If we’re considering an English-language crypto channel, it typically suggests an international audience, as English’s global use for quality educational content on niche topics like crypto. However, certain considerations apply. For instance, if an English-speaking channel shows a significant percentage of Polish viewers (15% to 30%) without any mention of the Polish language, it could indicate fake followers and views. However, if the channel’s creator is Polish, occasionally posts videos in Polish alongside English, and receives Polish comments, it’s important not to rush to conclusions.

Example of statistics

Example of statistics

Wrapping up

These are the main factors to consider when selecting an influencer to promote your crypto product. Once you’ve launched the campaign, there are also some markers to show which creators did bring the authentic traffic and which used some tools to create the illusion of an active and engaged audience. While this may seem obvious, it’s still worth mentioning. After the video is posted, allow 5-7 days for it to accumulate a basic number of views, then check performance metrics such as views, clicks, click-through rate (CTR), signups, and conversion rate (CR) from clicks to signups.

If you overlooked some red flags when selecting crypto channels for your launch, you might find the following outcomes: channels with high views numbers and high CTRs, demonstrating the real interest of the audience, yet with remarkably low conversion rates. In the worst-case scenario, you might witness thousands of clicks resulting in zero to just a few signups. While this might suggest technical issues in other industries, in crypto campaigns it indicates that the creator engaged in the campaign not only bought fake views and comments but also link clicks. And this happens more often than you may realize.

Summing up, choosing the right crypto creator to promote your product is indeed a tricky job that requires a lot of resources to be put into the search process.

Author

Nadia Bubennikova, Head of agency at Famesters

Fintech

Central banks and the FinTech sector unite to change global payments space

The BIS, along with seven leading central banks and a cohort of private financial firms, has embarked on an ambitious venture known as Project Agorá.

Named after the Greek word for “marketplace,” this initiative stands at the forefront of exploring the potential of tokenisation to significantly enhance the operational efficiency of the monetary system worldwide.

Central to this pioneering project are the Bank of France (on behalf of the Eurosystem), the Bank of Japan, the Bank of Korea, the Bank of Mexico, the Swiss National Bank, the Bank of England, and the Federal Reserve Bank of New York. These institutions have joined forces under the banner of Project Agorá, in partnership with an extensive assembly of private financial entities convened by the Institute of International Finance (IIF).

At the heart of Project Agorá is the pursuit of integrating tokenised commercial bank deposits with tokenised wholesale central bank money within a unified, public-private programmable financial platform. By harnessing the advanced capabilities of smart contracts and programmability, the project aspires to unlock new transactional possibilities that were previously infeasible or impractical, thereby fostering novel opportunities that could benefit businesses and consumers alike.

The collaborative effort seeks to address and surmount a variety of structural inefficiencies that currently plague cross-border payments. These challenges include disparate legal, regulatory, and technical standards; varying operating hours and time zones; and the heightened complexity associated with conducting financial integrity checks (such as anti-money laundering and customer verification procedures), which are often redundantly executed across multiple stages of a single transaction due to the involvement of several intermediaries.

As a beacon of experimental and exploratory projects, the BIS Innovation Hub is committed to delivering public goods to the global central banking community through initiatives like Project Agorá. In line with this mission, the BIS will soon issue a call for expressions of interest from private financial institutions eager to contribute to this ground-breaking project. The IIF will facilitate the involvement of private sector participants, extending an invitation to regulated financial institutions representing each of the seven aforementioned currencies to partake in this transformative endeavour.

Source: fintech.globa

The post Central banks and the FinTech sector unite to change global payments space appeared first on HIPTHER Alerts.

Fintech

TD Bank inks multi-year strategic partnership with Google Cloud

TD Bank has inked a multi-year deal with Google Cloud as it looks to streamline the development and deployment of new products and services.

The deal will see the Canadian banking group integrate the vendor’s cloud services into a wider portion of its technology solutions portfolio, a move which TD expects will enable it “to respond quickly to changing customer expectations by rolling out new features, updates, or entirely new financial products at an accelerated pace”.

This marks an expansion of the already established relationship between TD Bank and Google Cloud after the group previously adopted the vendor’s Google Kubernetes Engine (GKE) for TD Securities Automated Trading (TDSAT), the Chicago-based subsidiary of its investment banking unit, TD Securities.

TDSAT uses GKE for process automation and quantitative modelling across fixed income markets, resulting in the development of a “data-driven research platform” capable of processing large research workloads in trading.

Dan Bosman, SVP and CIO of TD Securities, claims the infrastructure has so far supported TDSAT with “compute-intensive quantitative analysis” while expanding the subsidiary’s “trading volumes and portfolio size”.

TD’s new partnership with Google Cloud will see the group attempt to replicate the same level of success across its entire portfolio.

Source: fintechfutures.com

The post TD Bank inks multi-year strategic partnership with Google Cloud appeared first on HIPTHER Alerts.

-

Fintech5 days ago

Fintech5 days agoHow to identify authenticity in crypto influencer channels

-

Latest News4 days ago

HSBC-backed fintech Monese is considering splitting its operations as it grapples with increasing losses.

-

Latest News4 days ago

EverBank has announced a groundbreaking partnership with Finzly, poised to revolutionize payment processing.

-

Latest News4 days ago

FinTech leaders express caution regarding the promises made in #Budget2024 concerning open banking, stating that the “devil is in the details.”

-

Latest News4 days ago

Gotion High-tech’s operating profit up 391% in 2023, nearly RMB 2.8 billion invested in R&D for the year

-

Latest News4 days ago

Wells Fargo, a leading financial institution, is set to revolutionize its trade finance operations by incorporating artificial intelligence (AI) technology through its collaboration with TradeSun.

-

Latest News3 days ago

Aurionpro Solutions acquires Arya.ai, to power next generation Enterprise AI platforms for Financial Institutions

-

Latest News4 days ago

Latvian Fintech inGain Raises €650,000 for No-Code SaaS Loan Management System