Fintech

Dr. Peter H. Smith Responds to the Frivolous Smear Campaign Made by the Incumbent Board and Management of Fancamp Exploration Ltd.

- Dr. Peter H. Smith finally speaks about the frivolous and baseless litigation commenced against him by the incumbent board and management of Fancamp as a mode of intimidation for opposing the ScoZinc Transaction and forcing them to hold the 2020 annual general meeting before the TSXV will give their signoff on the Transaction with ScoZinc.

Montreal, Quebec–(Newsfile Corp. – May 25, 2021) – Incumbent director of Fancamp, Peter H. Smith, who, together with joint actors James Hunter and his affiliates, Mark Fekete and Heather Hannan, (the “Concerned Shareholders) hold in aggregate, directly and indirectly an aggregate of 21,994,597 shares, representing approximately 13.25% of Fancamp Exploration Ltd.’s (“Fancamp” or the “Company”) issued and outstanding common shares have decided to set the record straight to the true owners of Fancamp (the “Shareholders”), with respect to the numerous false allegations that the incumbent board and management of the Company have stated in their press releases dated May 12 and May 14, 2021.

To say that Dr. Smith is disappointed is a massive understatement. These actions by the Fancamp board and management, show what desperation can cause seemingly rational individuals to do. It shows the great lengths one would go to attempt to entrench themselves further in positions and roles that they no longer deserve. Additionally, it shows when bullies are challenged that they will try to impugn and ruin a man’s reputation and question his integrity all because that one man stood up to them to ask the question that always needs to be asked when one is a fiduciary – is this in the best interest of the Company and the shareholders who are the true owners of the Company?

When a group of individuals forget where their duties lie and they are conflicted, this board and management team have shown they are willing to cross that line and impugn their own integrity so it should not surprise anyone one bit that the incumbent board and management comprised of Ashwath Mehra, Mark Billings, Paul Ankorn, Rajesh Sharma and Debra Chapman are willing to do whatever they can, which, in this case are telling outright blatant lies about what Dr. Smith has done while with the Company since 1986.

Dr. Smith stated:

“From the very first instance in October 2020, when I informed the Chairman of the Company that I would be running an opposing slate of directors, the incumbent board and management began an immediate campaign of delay tactics, entrenchment and propagating falsehoods at the expense of Fancamp shareholders. Knowing full well that I have a large following and shareholder support, they knew that having the AGM when it was due to be held, on or before December 31, 2020, would bring about a guaranteed loss of their positions and election of and a new and refreshed board. In the face of this threat, they used the excuse of the pandemic to obtain an unjustified, unwarranted exemption to delay the holding of the 2020 AGM to be held before June 30, 2021. They then created this scheme to close this ill-advised business combination with ScoZinc Mining Ltd. (‘ScoZinc’) (the ‘Transaction’) to dilute the current shareholders of the Company to ensure that they would have support to entrench themselves for the foreseeable future. However, they did not anticipate that I would put up any opposition and question why they would attempt this without receiving Fancamp shareholder approval.

However, the incumbent board and management are used to having their way, so as an act of retribution, the incumbent board and management then decided to make it personal and attempt to intimidate, bully and coerce me into submission. At a board meeting, I was advised that if I continued what was called a “crusade”, for shareholders, I could expect a ‘harsh’, ‘bloody’, ‘brutal’ proxy battle that will financially ruin me. I was told that I should not engage in such an endeavour at my age. I felt this was an attempt to intimidate me into ceasing my actions opposing the proposed ScoZinc Transaction or replacing the Board. That Failed. Due to the enormous support and pressure from Shareholders and legal counsel, the TSXV has informed the incumbent board and management that the Transaction cannot be closed until the 2020 AGM is held. This was wholly unexpected by the incumbent board and management when they hatched their scheme. As their entrenchment is increasingly looking less likely, the incumbent board and management have now gone all in on their strategy to attempt to ruin my reputation and question my integrity.

On May 12, 2021, Fancamp announced that it had formed a Special Committee who are ‘disinterested’ in the ScoZinc Transaction; however, it includes Mark Billings who resigned from the ScoZinc board only two days before the first vote by the Fancamp board on the transaction, having been re-elected to the ScoZinc board one month earlier. The news release states that the Company intends to engage a third-party forensic accountant to assist with the investigation. In that news release they further state that Fancamp will consider all such measures ‘including through the courts as appropriate’. What the news release does not say is that two days earlier on May 10, the Company had already commenced an action, which it then disclosed on May 14. If the Company truly wanted to determine the results of the alleged wrongdoings, it would have waited for the results of the Special Committee investigation, rather than commencing litigation two days prior to announcing that the Special Committee had been formed. It is evident that the formation of the Special Committee, which also has a mandate to govern the affairs of the Company and in particular all matters relating to the Meeting was intended to block me from accessing any further information with respect to Fancamp and to provide the unjustified appearance of due process.

The frivolous lawsuit and baseless claims against me are just another attempt to try to confuse Shareholders and take the focus off of the many failings of the incumbent board and management as they continue to use corporate funds to harass me. These unwarranted actions further highlight that the board needs an immediate change as they would have to be ‘sleeping at the wheel’ if any of these baseless allegations were to be true. Below are some examples of how ludicrous their claims are:

- The incumbent board and management are going as far back as 1986 to attempt to smear my reputation.

- The complaint relating to Magpie Mines dates back to 2007 and the transaction was conducted under the oversight of the Company’s present corporate counsel. The factual basis set out in the claim is simply wrong.

- They state that I sold Champion shares without their knowledge when the sales were made on an ongoing basis, were consistently reported to the board, were publicly disclosed (in financial statements) and were knowingly used to fund the Company’s expenditures to avoid dilution to the Shareholders. Ironically, it was through staking activities that I was responsible for, that the Company obtained the CIA shares in the first place. This is the primary basis of their complaint which alleges that the Company could have made $3 million more if it had sold at a different time.

- They falsely claim that I withheld information. The Company is creating a feigned urgency for information. On May 3, 2021 my counsel responded to the requests for information directing the Company to where it could locate the information, mostly through the Company’s consulting geologists who generated the technical information and through Debra Chapman, the CFO for 35 years. Their unreasonable requests made no attempt to limit the 35-year time period and were of a burdensome nature including phone and fax records and all details relating to personal expenses, demonstrating this was nothing more than a fishing expedition to attempt to attack me in the proxy fight. Nevertheless, my counsel offered the Company to send a courier to pick up banker’s boxes that were a duplicate of materials and we offered to gather the data from a third-party service provider that hosted electronic data. Moreover, my counsel invited the Company to identify if there was specific discreet information it would like prioritized or be directed to. There was no response to that letter until Sunday May 9, 2021 on Mother’s Day, when Fancamp’s corporate counsel advised it would like to retrieve the data within the next 48 hours. In the late evening on Mother’s Day, Fancamp’s litigation counsel requested preservation of all documents and confirmation by 4:00 pm the following day that I would cooperate with the Special Committee investigation. Nevertheless, Fancamp’s litigation counsel filed the action the following day and served my counsel at 4:06 p.m.

- They falsely claim and point the finger at me to say that I have a self-serving agenda to take over the Company and destroy shareholder value and that I have failed to comply with duty of confidentiality. The truth is ever since I first requested and demanded that the board and management of Fancamp consider shareholders’ interests and rights with respect to the highly dilutive Transaction, the Fancamp board and management stopped paying me as per the terms of my consulting agreement as a part of their continued bully tactics and threats that verge on intimidation if I was not going to align myself with THEIR self-serving agenda.

I have always believed that the Company’s long-term shareholders will be rewarded for their support and I have endeavoured to keep the Company’s assets intact and under one roof. Their description of my work with the current directors over the better part of eight years, and work alongside Debra Chapman, CFO, for 35 years is unrecognizable. Anyone that has worked with me, invested with me over the past three decades will surely attest that the picture they are trying to paint of me is so inaccurate it is laughable and if any of their frivolous claims were true, what does it say about them as they have worked alongside me for a number of years and not once ever had an issue. Furthermore, if any of these claims were true it would bring to question the role of the CFO and other board members for not being true fiduciaries of the Company. Basically, if any of their claims are true it would be a logical conclusion that the incumbent board and management lied to regulators, auditors and YOU the Shareholders.

I would like to thank the number of shareholders that have contacted me, the Concerned Shareholders, the TSXV and our strategic advisors Gryphon Advisors Inc. (‘Gryphon’) to express their support and sharing stories of inappropriate behaviour exhibited by members of the incumbent board and management. I look forward to engaging with you further in the very near future.”

The Concerned Shareholders are not soliciting proxies in connection with the 2020 AGM currently scheduled for June 29, 2021 (the “Meeting”) at this time. The Concerned Shareholders have retained Gryphon as it strategic shareholder communications and proxy advisor. Gryphon’s responsibility will include providing strategic advice and advising the Concerned Shareholders with respect to the Meeting and proxy protocol. Gryphon’s responsibilities will also include soliciting shareholders should the Concerned Shareholders commence a formal solicitation of proxies. Dr. Smith has also retained Farris LLP as legal counsel.

For more information regarding the Concerned Shareholders’ position please contact:

Gryphon Advisors Inc.

Tel: 1-833-461-3651

Email: [email protected]

Information in Support of Public Broadcast Solicitation

The information contained in this press release does not and is not meant to constitute a solicitation of a proxy within the meaning of applicable securities laws. Although the Concerned Shareholders have announced nominees for election to the Company’s board of directors at the Meeting, the record date for the Meeting has not yet occurred and shareholders are not being asked at this time to execute a proxy in favour of any matter. In connection with the Meeting, the Concerned Shareholders may file a dissident information circular in due course in compliance with applicable securities laws.

The information contained herein, and any solicitation made by the Concerned Shareholders in advance of the Meeting, is or will be, as applicable, made by the Concerned Shareholders and not by or on behalf of the management of Fancamp. All costs incurred for any solicitation will be borne by the Concerned Shareholders, provided that, subject to applicable law, the Concerned Shareholders may seek reimbursement from Fancamp of the Concerned Shareholders’ out-of-pocket expenses, including proxy solicitation expenses and legal fees, incurred in connection with a successful reconstitution of the Company’s board of directors. The Concerned Shareholders are not soliciting proxies in connection with a general meeting of shareholders of the Company at this time.

The Concerned Shareholders may engage the services of one or more agents and authorize other persons to assist in soliciting proxies on behalf of the Concerned Shareholders. Any proxies solicited by or on behalf of the Concerned Shareholders, including by any other agent retained by the Concerned Shareholders, may be solicited pursuant to a dissident information circular or by way of public broadcast, including through press releases, speeches or publications and by any other manner permitted under Canadian corporate and securities laws. Any such proxies may be revoked by instrument in writing executed by a shareholder or by his or her attorney authorized in writing or, if the shareholder is a body corporate, by an officer or attorney thereof duly authorized or by any other manner permitted by law.

The registered address of Fancamp is located at 7290 Gray Avenue, Burnaby, British Columbia V5J 3Z2. A copy of this press release may be obtained on Fancamp’ SEDAR profile at www.sedar.com.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/85158

Fintech

How to identify authenticity in crypto influencer channels

Modern brands stake on influencer marketing, with 76% of users making a purchase after seeing a product on social media.The cryptocurrency industry is no exception to this trend. However, promoting crypto products through influencer marketing can be particularly challenging. Crypto influencers pose a significant risk to a brand’s reputation and ROI due to rampant scams. Approximately 80% of channels provide fake statistics, including followers counts and engagement metrics. Additionally, this niche is characterized by high CPMs, which can increase the risk of financial loss for brands.

In this article Nadia Bubennnikova, Head of agency Famesters, will explore the most important things to look for in crypto channels to find the perfect match for influencer marketing collaborations.

-

Comments

There are several levels related to this point.

LEVEL 1

Analyze approximately 10 of the channel’s latest videos, looking through the comments to ensure they are not purchased from dubious sources. For example, such comments as “Yes sir, great video!”; “Thanks!”; “Love you man!”; “Quality content”, and others most certainly are bot-generated and should be avoided.

Just to compare:

LEVEL 2

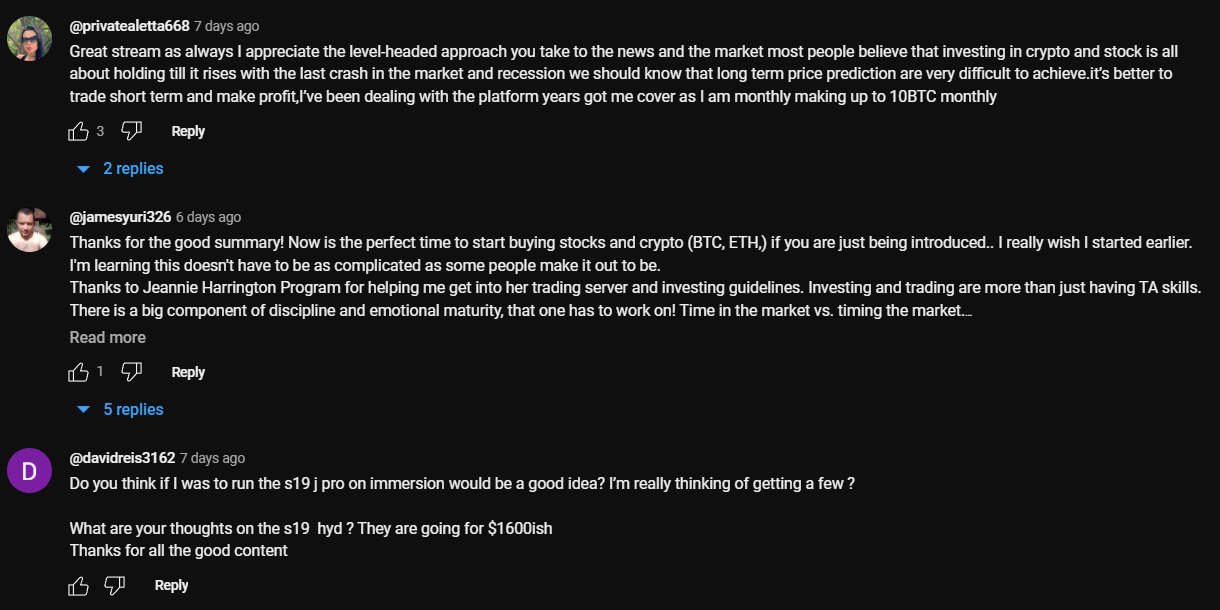

Don’t rush to conclude that you’ve discovered the perfect crypto channel just because you’ve come across some logical comments that align with the video’s topic. This may seem controversial, but it’s important to dive deeper. When you encounter a channel with logical comments, ensure that they are unique and not duplicated under the description box. Some creators are smarter than just buying comments from the first link that Google shows you when you search “buy YouTube comments”. They generate topics, provide multiple examples, or upload lists of examples, all produced by AI. You can either manually review the comments or use a script to parse all the YouTube comments into an Excel file. Then, add a formula to highlight any duplicates.

LEVEL 3

It is also a must to check the names of the profiles that leave the comments: most of the bot-generated comments are easy to track: they will all have the usernames made of random symbols and numbers, random first and last name combinations, “Habibi”, etc. No profile pictures on all comments is also a red flag.

LEVEL 4

Another important factor to consider when assessing comment authenticity is the posting date. If all the comments were posted on the same day, it’s likely that the traffic was purchased.

2. Average views number per video

This is indeed one of the key metrics to consider when selecting an influencer for collaboration, regardless of the product type. What specific factors should we focus on?

First & foremost: the views dynamics on the channel. The most desirable type of YouTube channel in terms of views is one that maintains stable viewership across all of its videos. This stability serves as proof of an active and loyal audience genuinely interested in the creator’s content, unlike channels where views vary significantly from one video to another.

Many unauthentic crypto channels not only buy YouTube comments but also invest in increasing video views to create the impression of stability. So, what exactly should we look at in terms of views? Firstly, calculate the average number of views based on the ten latest videos. Then, compare this figure to the views of the most recent videos posted within the past week. If you notice that these new videos have nearly the same number of views as those posted a month or two ago, it’s a clear red flag. Typically, a YouTube channel experiences lower views on new videos, with the number increasing organically each day as the audience engages with the content. If you see a video posted just three days ago already garnering 30k views, matching the total views of older videos, it’s a sign of fraudulent traffic purchased to create the illusion of view stability.

3. Influencer’s channel statistics

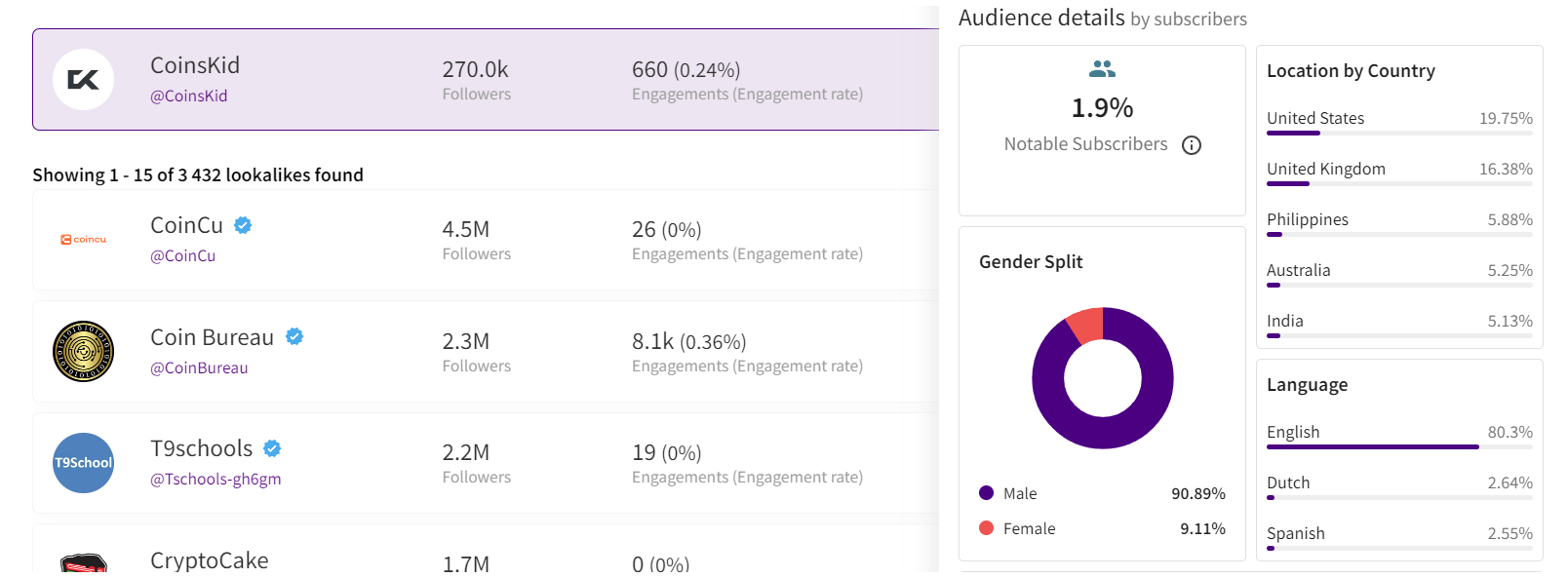

The primary statistics of interest are region and demographic split, and sometimes the device types of the viewers.

LEVEL 1

When reviewing the shared statistics, the first step is to request a video screencast instead of a simple screenshot. This is because it takes more time to organically edit a video than a screenshot, making it harder to manipulate the statistics. If the creator refuses, step two (if only screenshots are provided) is to download them and check the file’s properties on your computer. Look for details such as whether it was created with Adobe Photoshop or the color profile, typically Adobe RGB, to determine if the screenshot has been edited.

LEVEL 2

After confirming the authenticity of the stats screenshot, it’s crucial to analyze the data. For instance, if you’re examining a channel conducted in Spanish with all videos filmed in the same language, it would raise concerns to find a significant audience from countries like India or Turkey. This discrepancy, where the audience doesn’t align with regions known for speaking the language, is a red flag.

If we’re considering an English-language crypto channel, it typically suggests an international audience, as English’s global use for quality educational content on niche topics like crypto. However, certain considerations apply. For instance, if an English-speaking channel shows a significant percentage of Polish viewers (15% to 30%) without any mention of the Polish language, it could indicate fake followers and views. However, if the channel’s creator is Polish, occasionally posts videos in Polish alongside English, and receives Polish comments, it’s important not to rush to conclusions.

Example of statistics

Example of statistics

Wrapping up

These are the main factors to consider when selecting an influencer to promote your crypto product. Once you’ve launched the campaign, there are also some markers to show which creators did bring the authentic traffic and which used some tools to create the illusion of an active and engaged audience. While this may seem obvious, it’s still worth mentioning. After the video is posted, allow 5-7 days for it to accumulate a basic number of views, then check performance metrics such as views, clicks, click-through rate (CTR), signups, and conversion rate (CR) from clicks to signups.

If you overlooked some red flags when selecting crypto channels for your launch, you might find the following outcomes: channels with high views numbers and high CTRs, demonstrating the real interest of the audience, yet with remarkably low conversion rates. In the worst-case scenario, you might witness thousands of clicks resulting in zero to just a few signups. While this might suggest technical issues in other industries, in crypto campaigns it indicates that the creator engaged in the campaign not only bought fake views and comments but also link clicks. And this happens more often than you may realize.

Summing up, choosing the right crypto creator to promote your product is indeed a tricky job that requires a lot of resources to be put into the search process.

Author

Nadia Bubennikova, Head of agency at Famesters

Fintech

Central banks and the FinTech sector unite to change global payments space

The BIS, along with seven leading central banks and a cohort of private financial firms, has embarked on an ambitious venture known as Project Agorá.

Named after the Greek word for “marketplace,” this initiative stands at the forefront of exploring the potential of tokenisation to significantly enhance the operational efficiency of the monetary system worldwide.

Central to this pioneering project are the Bank of France (on behalf of the Eurosystem), the Bank of Japan, the Bank of Korea, the Bank of Mexico, the Swiss National Bank, the Bank of England, and the Federal Reserve Bank of New York. These institutions have joined forces under the banner of Project Agorá, in partnership with an extensive assembly of private financial entities convened by the Institute of International Finance (IIF).

At the heart of Project Agorá is the pursuit of integrating tokenised commercial bank deposits with tokenised wholesale central bank money within a unified, public-private programmable financial platform. By harnessing the advanced capabilities of smart contracts and programmability, the project aspires to unlock new transactional possibilities that were previously infeasible or impractical, thereby fostering novel opportunities that could benefit businesses and consumers alike.

The collaborative effort seeks to address and surmount a variety of structural inefficiencies that currently plague cross-border payments. These challenges include disparate legal, regulatory, and technical standards; varying operating hours and time zones; and the heightened complexity associated with conducting financial integrity checks (such as anti-money laundering and customer verification procedures), which are often redundantly executed across multiple stages of a single transaction due to the involvement of several intermediaries.

As a beacon of experimental and exploratory projects, the BIS Innovation Hub is committed to delivering public goods to the global central banking community through initiatives like Project Agorá. In line with this mission, the BIS will soon issue a call for expressions of interest from private financial institutions eager to contribute to this ground-breaking project. The IIF will facilitate the involvement of private sector participants, extending an invitation to regulated financial institutions representing each of the seven aforementioned currencies to partake in this transformative endeavour.

Source: fintech.globa

The post Central banks and the FinTech sector unite to change global payments space appeared first on HIPTHER Alerts.

Fintech

TD Bank inks multi-year strategic partnership with Google Cloud

TD Bank has inked a multi-year deal with Google Cloud as it looks to streamline the development and deployment of new products and services.

The deal will see the Canadian banking group integrate the vendor’s cloud services into a wider portion of its technology solutions portfolio, a move which TD expects will enable it “to respond quickly to changing customer expectations by rolling out new features, updates, or entirely new financial products at an accelerated pace”.

This marks an expansion of the already established relationship between TD Bank and Google Cloud after the group previously adopted the vendor’s Google Kubernetes Engine (GKE) for TD Securities Automated Trading (TDSAT), the Chicago-based subsidiary of its investment banking unit, TD Securities.

TDSAT uses GKE for process automation and quantitative modelling across fixed income markets, resulting in the development of a “data-driven research platform” capable of processing large research workloads in trading.

Dan Bosman, SVP and CIO of TD Securities, claims the infrastructure has so far supported TDSAT with “compute-intensive quantitative analysis” while expanding the subsidiary’s “trading volumes and portfolio size”.

TD’s new partnership with Google Cloud will see the group attempt to replicate the same level of success across its entire portfolio.

Source: fintechfutures.com

The post TD Bank inks multi-year strategic partnership with Google Cloud appeared first on HIPTHER Alerts.

-

Latest News7 days ago

DEMAND AT ASIAN FACTORIES RISES AT STRONGEST RATE IN OVER 2 YEARS, IMPROVING NEAR-TERM GROWTH OUTLOOK FOR MANUFACTURING WORLDWIDE: GEP GLOBAL SUPPLY CHAIN VOLATILITY INDEX

-

Latest News7 days ago

Global Airlines Appoints New Head of Finance from KPMG

-

Latest News6 days ago

“The Hainan FTP and Me”: Looking at Hainan’s Transformations

-

Latest News7 days ago

Spendesk combines procurement with spend management through Okko acquisition

-

Latest News4 days ago

Millions of people unite around doing good on the 18th International Good Deeds Day held yesterday worldwide

-

Latest News7 days ago

IMC Pan Asia Alliance Is Now Known as Tsao Pao Chee Group

-

Latest News7 days ago

Bitget to Take Center Stage at Blockchain Life and Token2049 Dubai

-

Latest News7 days ago

Sopra Steria establishes itself in Canada