Fintech

Helio Lending (a CYIOS Corp. Subsidiary) and Propy Inc. Partner to Offer First Ever Crypto Loan Utilizing NFT Real Estate Asset as Collateral

Boca Raton, Florida–(Newsfile Corp. – June 10, 2021) – Propy Inc., a leading real estate innovator in the automation of transactions using blockchain technology that just made history selling the world’s first Real Estate NFT with ownership transfer and Helio Lending (a wholly owned subsidiary of CYIOS Corp. (OTC Pink: CYIO), a CeFi aggregator focused on crypto-lending/deposits, today announced that the companies are partnering to enable real estate NFT’s to be used as collateral for loans, similar to a cryptocurrency backed loan. This new type of financing allows NFT property owners to leverage their assets as they would if it were physical property with a traditional bank or financial institution.

Ms.Natalia Karayaneva, CEO of Propy, commented, “We are super proud to have completed a historic milestone with the very first NFT Real Estate transaction successfully being transacted this week resulting in change of ownership of an apartment in Kiev, Ukraine, formerly owned by TechCrunch Founder Michael Arriginton. This property previously made history as the first-ever blockchain-based real estate sale. Now, we are excited to partner with Helio Lending to make history again, as we look to facilitate the first ever NFT real estate loan collateralized by the NFT. By combining Helio and Propy resources and expertise, it allows us to leverage the promise of blockchain technology and non-fungible tokens (NFT) to achieve self-driving real estate transactions and open new lending opportunities. Real estate as an asset class will become a part of the decentralized finance economy. The world real estate market is worth $217 trillion and makes up more than half the value of all mainstream assets worldwide. We are only just at the very beginning of what we believe to one of the biggest disruptions in recent history for the real estate market and we believe we are well positioned to participate and take a leadership role in the space.”

Michael Arrington, CEO of Arrington XRP Capital and Propy investor added: “This partnership between Helio and Propy represents an important first transaction, proof of concept whereby you have the NFT Real Estate being used as collateral for a loan, which has not been done before. Coming at this from a crypto angle, we have seen what happens how DeFi gets plugged into credit markets. If I have an NFT or any DeFi asset I can then borrow against it, without a middleman. Right now, if I have a real piece of real estate, there is no way for me to borrow against it, without a middleman, because I must go through a bank and get a mortgage or whatever. And it is also the friction, all of the costs in terms of speed and how long it takes. If we can find a way to plug real estate and other real-world assets into DeFi, I think that the amount of credit that can be created around that is in the trillions, eventually.”

John O’Shea, Founder of Helio Lending and Chairman of CYIOS Corp. commented, “The partnership between Propy and Helio looks to change the way you can fund real estate purchased and gain maximum diversification of your crypto assets and real estate assets. Having a solution to put your real estate holdings on to a NFT and being able to get a loan against that asset is truly unique and can change the landscape of real estate. The process works like this: the seller signs proprietary-developed legal papers for NFTs to transfer ownership to a future buyer, carries out an NFT auction, and receives payment in cryptocurrency. This transaction is enabled through the Propy platform. Then, the owner or buyer can use their NFT as collateral, to receive anywhere between 20% – 70% of the value in cash. The benefits of this loan include no margin calls, competitive interest rates, no rehypothication, no credit checks, nonrecourse, no mortgage costs and/or timely delays due to lengthy approval and closing process. If the NFT is unencumbered property via an LLC, which can be borrowed against as a business loan through Helio Lending, you may be able to receive up to 70% of the NFT value to receive in USD. We look forward to working with Propy, and together pioneering new business opportunities evolving from the world of DeFi.”

CONTACT INFORMATION

For Propy: Lisa Fettner, [email protected]

Follow us on Twitter: twitter.com/PropyInc

For Helio/CYIOS

Public Relations:

Marko Radisic, [email protected]

www.twitter.com/cyioscorp

Follow Helio Lending:

https://heliolending.com/

https://twitter.com/heliolending

About Propy

Propy is a leading innovator in the real estate industry, building self-driving transactions. Propy makes property purchase transactions easier by bringing agents and consumers together in a secure environment. Propy Offers help agents and consumers win offers; and Propy Transaction Platform enables agents, consumers and title companies to easily manage all phases of a sale online. Purchase offers, payments and deeds are processed on the immutable blockchain. Worldwide, the Company has assisted in over 1,000 real estate transfers. Closing deals via NFT-ing property ownership can ease the life of the consumer and the agent and unlock the equity liquidity. Propy is backed by blockchain investor Tim Draper, and has helped thousands of agents and homebuyers make offers and complete over $1bn worth of transactions via their easy-to-use and secure online platform. Learn more at www.Propy.com.

About Helio Lending, PTY LTD. (wholly owned subsidiary of publicly traded CYIOS Corp.: CYIOS)

Founded in 2018, Helio Lending has developed a CeFi cryptocurrency lending platform, with headquarters in Australia. Recognized as the first to market in Australia, Helio Lending was the first independent crypto lending company to actively lend within Australia. Helio has since evolved and positioned itself as the first CeFi (centralized finance) aggregator worldwide. Helio has a large panel of partners providing access to the best rates and offers for crypto loan providers as well as offering a competitive yield generating platform. Helio Lending provides holders of cryptocurrency (such as Bitcoin, Bitcoin Cash, Ethereum, Litecoin and Ripple) with a safe and secure way to access fiat funds at the best rates, without selling any of their cryptocurrency. Helio also allows holders to earn rates on their cryptocurrency. For more information, please visit www.cyioscorporation.com.

FORWARD-LOOKING STATEMENTS: This release contains “forward-looking statements”. Forward-looking statements also may be included in other publicly available documents issued by the Company and in oral statements made by our officers and representatives from time to time. These forward-looking statements are intended to provide management’s current expectations or plans for our future operating and financial performance, based on assumptions currently believed to be valid. They can be identified by the use of words such as “anticipate,” “intend,” “plan,” “goal,” “seek,” “believe,” “project,” “estimate,” “expect,” “strategy,” “future,” “likely,” “may,” “should,” “would,” “could,” “will” & other words of similar meaning in connection with a discussion of future operating or financial performance. Examples of forward-looking statements include, among others, statements relating to future sales, earnings, cash flows, results of operations, uses of cash and other measures of financial performance. Because forward-looking statements relate to the future, they are subject to inherent risks, uncertainties and other factors that may cause the Company’s actual results and financial condition to differ materially from those expressed or implied in the forward-looking statements. Such risks, uncertainties and other factors include, among others such as, but not limited to economic conditions, changes in the laws or regulations, demand for products and services of the company, the effects of competition and other factors that could cause actual results to differ materially from those projected or represented in the forward-looking statements. Any forward-looking information provided in this release should be considered w/ these factors in mind. We assume no obligation to update any forward-looking statements contained in this report.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/87202

Fintech

How to identify authenticity in crypto influencer channels

Modern brands stake on influencer marketing, with 76% of users making a purchase after seeing a product on social media.The cryptocurrency industry is no exception to this trend. However, promoting crypto products through influencer marketing can be particularly challenging. Crypto influencers pose a significant risk to a brand’s reputation and ROI due to rampant scams. Approximately 80% of channels provide fake statistics, including followers counts and engagement metrics. Additionally, this niche is characterized by high CPMs, which can increase the risk of financial loss for brands.

In this article Nadia Bubennnikova, Head of agency Famesters, will explore the most important things to look for in crypto channels to find the perfect match for influencer marketing collaborations.

-

Comments

There are several levels related to this point.

LEVEL 1

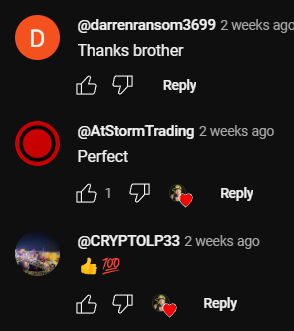

Analyze approximately 10 of the channel’s latest videos, looking through the comments to ensure they are not purchased from dubious sources. For example, such comments as “Yes sir, great video!”; “Thanks!”; “Love you man!”; “Quality content”, and others most certainly are bot-generated and should be avoided.

Just to compare:

LEVEL 2

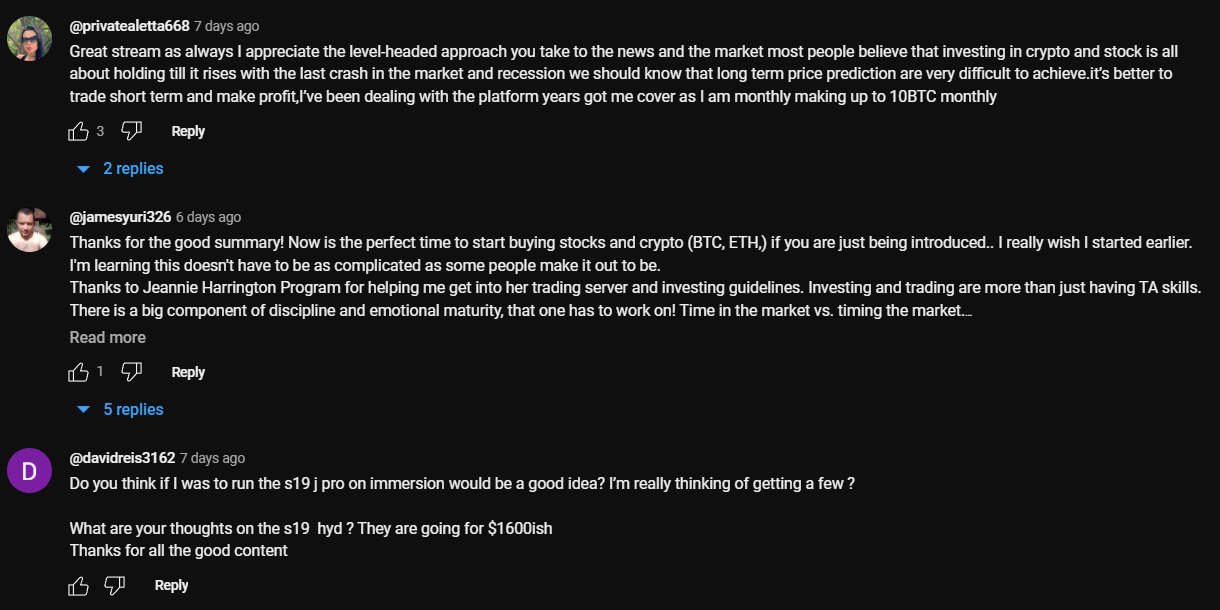

Don’t rush to conclude that you’ve discovered the perfect crypto channel just because you’ve come across some logical comments that align with the video’s topic. This may seem controversial, but it’s important to dive deeper. When you encounter a channel with logical comments, ensure that they are unique and not duplicated under the description box. Some creators are smarter than just buying comments from the first link that Google shows you when you search “buy YouTube comments”. They generate topics, provide multiple examples, or upload lists of examples, all produced by AI. You can either manually review the comments or use a script to parse all the YouTube comments into an Excel file. Then, add a formula to highlight any duplicates.

LEVEL 3

It is also a must to check the names of the profiles that leave the comments: most of the bot-generated comments are easy to track: they will all have the usernames made of random symbols and numbers, random first and last name combinations, “Habibi”, etc. No profile pictures on all comments is also a red flag.

LEVEL 4

Another important factor to consider when assessing comment authenticity is the posting date. If all the comments were posted on the same day, it’s likely that the traffic was purchased.

2. Average views number per video

This is indeed one of the key metrics to consider when selecting an influencer for collaboration, regardless of the product type. What specific factors should we focus on?

First & foremost: the views dynamics on the channel. The most desirable type of YouTube channel in terms of views is one that maintains stable viewership across all of its videos. This stability serves as proof of an active and loyal audience genuinely interested in the creator’s content, unlike channels where views vary significantly from one video to another.

Many unauthentic crypto channels not only buy YouTube comments but also invest in increasing video views to create the impression of stability. So, what exactly should we look at in terms of views? Firstly, calculate the average number of views based on the ten latest videos. Then, compare this figure to the views of the most recent videos posted within the past week. If you notice that these new videos have nearly the same number of views as those posted a month or two ago, it’s a clear red flag. Typically, a YouTube channel experiences lower views on new videos, with the number increasing organically each day as the audience engages with the content. If you see a video posted just three days ago already garnering 30k views, matching the total views of older videos, it’s a sign of fraudulent traffic purchased to create the illusion of view stability.

3. Influencer’s channel statistics

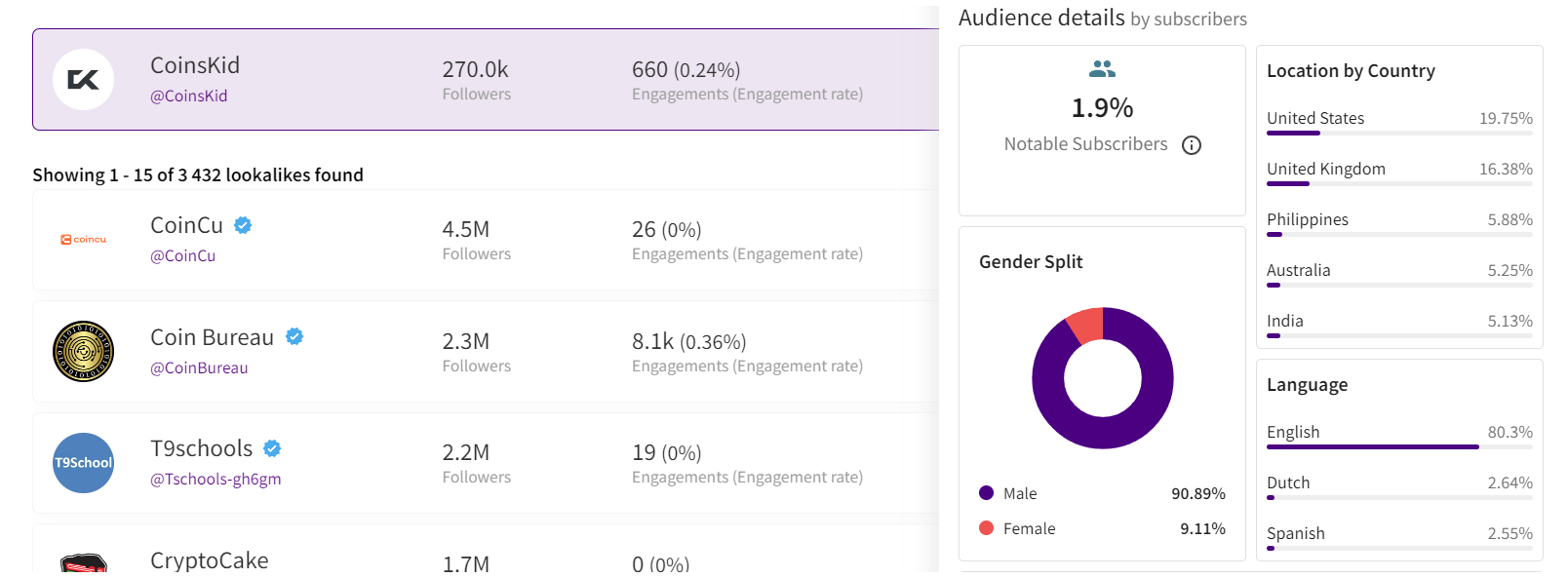

The primary statistics of interest are region and demographic split, and sometimes the device types of the viewers.

LEVEL 1

When reviewing the shared statistics, the first step is to request a video screencast instead of a simple screenshot. This is because it takes more time to organically edit a video than a screenshot, making it harder to manipulate the statistics. If the creator refuses, step two (if only screenshots are provided) is to download them and check the file’s properties on your computer. Look for details such as whether it was created with Adobe Photoshop or the color profile, typically Adobe RGB, to determine if the screenshot has been edited.

LEVEL 2

After confirming the authenticity of the stats screenshot, it’s crucial to analyze the data. For instance, if you’re examining a channel conducted in Spanish with all videos filmed in the same language, it would raise concerns to find a significant audience from countries like India or Turkey. This discrepancy, where the audience doesn’t align with regions known for speaking the language, is a red flag.

If we’re considering an English-language crypto channel, it typically suggests an international audience, as English’s global use for quality educational content on niche topics like crypto. However, certain considerations apply. For instance, if an English-speaking channel shows a significant percentage of Polish viewers (15% to 30%) without any mention of the Polish language, it could indicate fake followers and views. However, if the channel’s creator is Polish, occasionally posts videos in Polish alongside English, and receives Polish comments, it’s important not to rush to conclusions.

Example of statistics

Example of statistics

Wrapping up

These are the main factors to consider when selecting an influencer to promote your crypto product. Once you’ve launched the campaign, there are also some markers to show which creators did bring the authentic traffic and which used some tools to create the illusion of an active and engaged audience. While this may seem obvious, it’s still worth mentioning. After the video is posted, allow 5-7 days for it to accumulate a basic number of views, then check performance metrics such as views, clicks, click-through rate (CTR), signups, and conversion rate (CR) from clicks to signups.

If you overlooked some red flags when selecting crypto channels for your launch, you might find the following outcomes: channels with high views numbers and high CTRs, demonstrating the real interest of the audience, yet with remarkably low conversion rates. In the worst-case scenario, you might witness thousands of clicks resulting in zero to just a few signups. While this might suggest technical issues in other industries, in crypto campaigns it indicates that the creator engaged in the campaign not only bought fake views and comments but also link clicks. And this happens more often than you may realize.

Summing up, choosing the right crypto creator to promote your product is indeed a tricky job that requires a lot of resources to be put into the search process.

Author

Nadia Bubennikova, Head of agency at Famesters

Fintech

Central banks and the FinTech sector unite to change global payments space

The BIS, along with seven leading central banks and a cohort of private financial firms, has embarked on an ambitious venture known as Project Agorá.

Named after the Greek word for “marketplace,” this initiative stands at the forefront of exploring the potential of tokenisation to significantly enhance the operational efficiency of the monetary system worldwide.

Central to this pioneering project are the Bank of France (on behalf of the Eurosystem), the Bank of Japan, the Bank of Korea, the Bank of Mexico, the Swiss National Bank, the Bank of England, and the Federal Reserve Bank of New York. These institutions have joined forces under the banner of Project Agorá, in partnership with an extensive assembly of private financial entities convened by the Institute of International Finance (IIF).

At the heart of Project Agorá is the pursuit of integrating tokenised commercial bank deposits with tokenised wholesale central bank money within a unified, public-private programmable financial platform. By harnessing the advanced capabilities of smart contracts and programmability, the project aspires to unlock new transactional possibilities that were previously infeasible or impractical, thereby fostering novel opportunities that could benefit businesses and consumers alike.

The collaborative effort seeks to address and surmount a variety of structural inefficiencies that currently plague cross-border payments. These challenges include disparate legal, regulatory, and technical standards; varying operating hours and time zones; and the heightened complexity associated with conducting financial integrity checks (such as anti-money laundering and customer verification procedures), which are often redundantly executed across multiple stages of a single transaction due to the involvement of several intermediaries.

As a beacon of experimental and exploratory projects, the BIS Innovation Hub is committed to delivering public goods to the global central banking community through initiatives like Project Agorá. In line with this mission, the BIS will soon issue a call for expressions of interest from private financial institutions eager to contribute to this ground-breaking project. The IIF will facilitate the involvement of private sector participants, extending an invitation to regulated financial institutions representing each of the seven aforementioned currencies to partake in this transformative endeavour.

Source: fintech.globa

The post Central banks and the FinTech sector unite to change global payments space appeared first on HIPTHER Alerts.

Fintech

TD Bank inks multi-year strategic partnership with Google Cloud

TD Bank has inked a multi-year deal with Google Cloud as it looks to streamline the development and deployment of new products and services.

The deal will see the Canadian banking group integrate the vendor’s cloud services into a wider portion of its technology solutions portfolio, a move which TD expects will enable it “to respond quickly to changing customer expectations by rolling out new features, updates, or entirely new financial products at an accelerated pace”.

This marks an expansion of the already established relationship between TD Bank and Google Cloud after the group previously adopted the vendor’s Google Kubernetes Engine (GKE) for TD Securities Automated Trading (TDSAT), the Chicago-based subsidiary of its investment banking unit, TD Securities.

TDSAT uses GKE for process automation and quantitative modelling across fixed income markets, resulting in the development of a “data-driven research platform” capable of processing large research workloads in trading.

Dan Bosman, SVP and CIO of TD Securities, claims the infrastructure has so far supported TDSAT with “compute-intensive quantitative analysis” while expanding the subsidiary’s “trading volumes and portfolio size”.

TD’s new partnership with Google Cloud will see the group attempt to replicate the same level of success across its entire portfolio.

Source: fintechfutures.com

The post TD Bank inks multi-year strategic partnership with Google Cloud appeared first on HIPTHER Alerts.

-

Latest News7 days ago

DEMAND AT ASIAN FACTORIES RISES AT STRONGEST RATE IN OVER 2 YEARS, IMPROVING NEAR-TERM GROWTH OUTLOOK FOR MANUFACTURING WORLDWIDE: GEP GLOBAL SUPPLY CHAIN VOLATILITY INDEX

-

Latest News6 days ago

“The Hainan FTP and Me”: Looking at Hainan’s Transformations

-

Latest News7 days ago

Spendesk combines procurement with spend management through Okko acquisition

-

Latest News4 days ago

Millions of people unite around doing good on the 18th International Good Deeds Day held yesterday worldwide

-

Latest News4 days ago

Banxso Acquires Australian ASIC License, Enhancing Its Global Trading Operations

-

Latest News4 days ago

135th Canton Fair Launches a Showcase of Innovative Products of New Collection to Lead Global Market Trends

-

Latest News3 days ago

BMO Announces Election of Board of Directors

-

Latest News5 days ago

BII and FMO back BECIS with joint US$50 million financing facility supporting commercial and industrial renewables sector in South-East Asia