Fintech

Cerrado Gold Reports After Tax NPV5% of US$617 Million with IRR of 94.8% in Its Updated Preliminary Economic Assessment at Its Monte do Carmo Gold Project in Brazil

Cerrado Gold Conference Call: Sep 1, 2021: 11:00 AM Eastern Time (Details below)

Highlights:

- Average annual gold production of 149,000 ozs over first 5 years and 131,000 ozs over LOM 8 years

- Annual Average Free cash flow of US$150 million over the first 5 years

- Total cumulative, after tax, free cash flow estimated US$901 million over 8 years

- Average AISC of US$431/oz over the first 5 years

- Low Initial Capex of US$126 million (including US$25 million contingency)

- Payback of 1.3 years

- Further upside potential from continued exploration drilling & resource expansion

- Development program including Feasibility Study to begin immediately, EIS Underway

PEA Summary Results

| PEA Summary Table All Figures in US$ unless otherwise noted |

2021 | 2020 | ||||

| NPV @ 5% After Tax | $ millions | $617 | $432 | |||

| IRR After Tax | % | 94.8% | 76.4% | |||

| Long Term Gold Price (US$/troy oz.) | US$/oz Au | $1,600 | $1,550 | |||

| Initial Capex | $ millions | $126 | $110 | |||

| Life of Mine | years | 8 | 7 | |||

| Payback time (years) | years | 1.3 | 1.5 | |||

| LOM average annual Au production | koz | 131.0 | 103.5 | |||

| LOM annual tonnes mined | MM tonnes | 2.600 | 1.888 | |||

| Opex | $/t | $33.04 | $26.39 | |||

| Avg Cash Cost | US$/oz Au | $583 | $480 | |||

| Avg LOM AISC | US$/oz Au | $612 | $498 | |||

| Sustaining LOM Capital | $ millions | 13.5 | 1.6 | |||

| LOM Stripping Ratio | waste:ore | 10.9:1 | 7.79:1 | |||

| Royalties | % | 1% | 3% | |||

| Mine Closure | $ millions | $16.8 | $11.25 | |||

Toronto, Ontario–(Newsfile Corp. – August 23, 2021) – CERRADO GOLD (TSXV: CERT) (OTCQX: CRDOF) (“Cerrado” or the “Company”) is very pleased to announce the results of its new NI 43-101 Preliminary Economic Assessment (“PEA”) based upon the recently expanded 43-101 resources defined at the Serra Alta deposit at its Monte do Carmo gold project in Tocantins State, Brazil. The work has been completed by GE21 Consultoria Mineral Ltda (“GE21”) and is based upon the NI 43-101 Mineral Resource Estimate produced by MICON International dated July 21, 2021. The final PEA report is expected to be completed and available on SEDAR by the end of September 2021.

Mark Brennan, CEO of Cerrado Gold, commented, “We are extremely pleased with the results of the PEA. The results demonstrate the tremendous economic potential offered by the development of the Serra Alta deposit as the initial cornerstone operation at our Monte do Carmo project. We continue to explore Serra Alta and regional satellite analogue deposits to determine the full potential of the Monte do Carmo gold district.” He continued “The robust production and cash flow generation in the initial years allows for a rapid pay back and generates significant cash flows to continue to grow the resource potential to materially extend the mine life.”

Project Summary

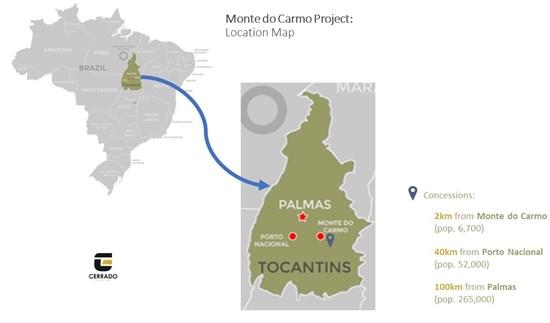

The Monte do Carmo (MDC) Gold Project is located in the state of Tocantins, Brazil; 2 kilometres east of the town of Monte do Carmo which is 40Km from Porto Nacional (50,000 inhabitants) and 100Km from Palmas, the Capital of Tocantins State (250,000 inhabitants). The Serra Alta deposit has been the main focus of exploration at the project until recently where Cerrado has drilled numerous analogue satellite deposits to expand the existing resource. The project has good access to all necessary infrastructure: paved roads, energy, a 69 kV electric power line, water supply and an international airport, and is well supported by the local community.

2020 Projected Pit Shell PEA GE21

To view an enhanced version of this graphic, please visit:

To view an enhanced version of this table, please visit:

To view an enhanced version of this table, please visit:

Free Cash Flow Evolution

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/6185/94132_freecashflow.jpg

The chart below highlights the NPV sensitivity to changes in capital costs, various input costs and gold price assumptions

Sensitivity Analysis – NPV

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/6185/94132_48e43469b406cbdc_012full.jpg

Mineral Resource Estimate

The PEA is based on the current NI 43-101 compliant Mineral Resource Estimate completed by MICON International Limited, with an effective date of July 21, 2021. It should be noted that Mineral resources which are not mineral reserves do not have demonstrated economic viability. It should also be noted drilling continues at Serra Alta to further expand and upgrade the resource as the company makes plans to move towards feasibility. In addition to Serra Alta the company is also undertaking a more regional exploration program on the larger Monte Do Carmo property to define potential satellite deposits which could significantly enhance the mine life of the installed asset base

The significant addition of Mineral Resources and the rise on confidence level represented by the maiden indicated resources are supported by the total amount of drilling invested and numerous technologies implemented on site; Oriented cores, structural data collection, low angle rigs, electronical cloud drilling database allows to extract the maximum information of the cores and makes the drilling program more efficient.

Table 1. Serra Alta Mineral Resource Statement – Effective Date July 21, 2021

| Mining Method | Cut-off Grade (g/t Au) | Resource Category |

Tonnage (kt) |

Avg. Au Grade (g/t) | Metal Content (koz) |

| Open Pit | 0.30 | Indicated | 9,063 | 1.85 | 539 |

| Inferred | 12,128 | 1.82 | 708 | ||

| Underground | 1.10 | Indicated | 45 | 1.66 | 2 |

| Inferred | 1,069 | 2.10 | 72 | ||

| OP + UG | Indicated | 9,108 | 1.85 | 541 | |

| Inferred | 13,197 | 1.84 | 780 |

Estimate Notes:

1. Mineral resources were estimated by Mr. B. Terrence Hennessey, P.Geo. and Mr. Alan J. San Martin, MAusIMM (CP) of Micon International Limited. (“Micon”), a Toronto based consulting company, independent of Cerrado Gold. Both Mr. Hennessey and Mr. San Martin meet the requirements of a “Qualified Person” as established by the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves (May 2014) (“the CIM Standards”).

2. Mineral resources are not mineral reserves and therefore do not have demonstrated economic viability.

3. The Serra Alta estimate has been completed entirely using Leapfrog Geo – EDGE software.

4. The estimate is based on a long-term gold price of US$ 1,600 per ounce and economic cut-off grades 0.30 g/t Au (Open Pit) and 1.10 g/t (Underground).

5. Open Pit constrained resources are reported within an optimized pit shell; underground resources are reported within continuous and contiguous shapes which lie adjacent to and below the ultimate open pit shell and interpreted to be recoverable utilizing standard underground mining methods.

6. The mineral resource estimate has an effective date of July 21, 2021.

7. The Serra Alta gold deposit was modelled by Cerrado using a wireframe constructed based on a 0.1 g/t Au cut-off grade and a few vein interpretations.

8. Rock density was assigned to different lithologies based on the geological and mineralization models, using calculated average values of 2.624 g/cm3 in granite, 2.65 g/cm3 in volcanics and 2.60 g/cm3 inside mineralization wireframes.

9. Grade capping was used to control the influence of outliers in the estimate, raw assays were composited to 1.0 m and then assessed for capping. Grade capping used throughout the deposit was 45 g/t Au for the main broad envelope and 8.0 g/t Au for the interpreted veins.

10. The block model gold grades were estimated using the Ordinary Kriging interpolation method with searching parameters derived from geostatistical analysis performed within the mineralization wireframes. Variogram ranges go from 90 m to 150 m in the major axis.

11. The estimate assumes a metallurgical recovery of 98.5% gold, based on completed test-work to date.

12. The estimate assumes the following costs: Mining (Pit) US$ 2.00/t, Mining (Pit Waste) US$ 1.70/t, Mining (Underground) US$ 40.00/t, Processing US$10.78/t, and G&A of US$ 2.00/t.

13. The pit constrained resource is reported within an optimized pit shell that assumed a maximum slope angle of 55 degrees. Open pit mining recovery was assumed to be 100%. Open pit dilution was assumed to be 0%. Underground mining recovery was assumed to be 100%. Underground dilution was assumed to be 0%.

14. Micon has not identified any legal, political, environmental, or other risks that could materially affect the potential development of the mineral resource estimate.

15. The mineral resource estimates are classified according to the CIM Standards which define a Mineral Resource as “a concentration or occurrence of solid material of economic interest in or on the earth’s crust in such form, grade or quality and quantity that there are reasonable prospects for eventual economic extraction. The location, quantity, grade or quality, continuity and other characteristics of a mineral resource are known, estimated, or interpreted from specific geological evidence and knowledge including sampling.

16. The mineral resource was categorized based on the geological confidence of the deposit into inferred and indicated categories. An inferred mineral resource has the lowest level of confidence. An indicated mineral resource has a higher level of confidence than an inferred mineral resource. It is reasonably expected that the portions of the inferred mineral resources could be upgraded to indicated mineral resources with additional infill drilling.

17. All procedures, methodologies and key assumptions supporting this mineral resource estimate are included in a NI 43-101F1 Technical Report which will be available at www.sedar.com.

Technical Disclosure

The reader is advised that the PEA summarized in this press release is intended to provide only an initial, high-level review of the project potential and design options. The PEA mine plan and economic model include numerous assumptions and the use of Inferred Mineral Resources. Inferred Mineral Resources are considered to be too speculative to be used in an economic analysis except as allowed for by Canadian Securities Administrators’ National Instrument 43-101 in PEA studies. There is no guarantee the project economics described herein will be achieved.

Cerrado Gold Inc. will within 45 days, publish a Technical Report on SEDAR prepared in accordance with NI 43-101 that documents the PEA study and supports the current disclosure.

Independent Qualified Persons

Porfírio Cabaleiro Rodriguez, Mining Engineer, BSc (Mine Eng), MAIG, director of GE21 Consultoria Mineral Ltda and B. Terrence Hennessey, P.Geo., Vice President of MICON International Limited, are the Qualified Persons as defined in NI 43-101 responsible for the Technical Report and are both independent of the Company.

Quality Assurance Quality Control:

The scientific and technical information in this press release has been reviewed and approved by Porfírio Cabaleiro Rodriguez, Mining Engineer, BSc (Mine Eng), MAIG, director of GE21 Consultoria Mineral Ltda, and B. Terrence Hennessey, P.Geo., Vice President of MICON International Limited, both of whom are Qualified Persons as defined in NI 43-101.

About GE21

GE21 is a specialized and independent mineral consulting firm based on a multi-disciplinary technical team, which offers services covering most project development stages in the mining sector.

The senior staff and Board of Directors have extensive technical and operational experience, based on collaboration with relevant companies in the fields of exploration and mineral consulting in Brazil going back to the 1980’s.

GE21’s services cover the entire mining cycle, from business strategies and target generation and investments to mine closure. GE21 routinely provides services for mineral exploration, project development, geological valuations, and resource and reserve estimation and certification according to international standards, including JORC and NI 43- 101. In addition, GE21 also serves the mining industry by working with operators in connection with mine planning and mine optimization, technical and economic studies as well as technical audits and the application of best market practices advocated by various international codes.

Cerrado Gold Conference Call

Time: Sep 1, 2021 11:00 AM Eastern Time (US and Canada)

Join Zoom Meeting

https://us06web.zoom.us/j/89298038195?pwd=VG1EMTByanRZdGxNV1BhbDEvOUhPdz09

Meeting ID: 892 9803 8195

Passcode: 843775

One tap mobile

+13017158592,,89298038195#,,,,*843775# US (Washington DC)

+13126266799,,89298038195#,,,,*843775# US (Chicago)

Dial by your location

+1 301 715 8592 US (Washington DC)

+1 312 626 6799 US (Chicago)

+1 346 248 7799 US (Houston)

+1 669 900 6833 US (San Jose)

+1 929 205 6099 US (New York)

+1 253 215 8782 US (Tacoma)

Meeting ID: 892 9803 8195

Passcode: 843775

Find your local number: https://us06web.zoom.us/u/kcKijwsdgJ

For further information please contact

Mark Brennan

CEO and Co Chairman

Tel: +1-647-796-0023

[email protected]

Nicholas Campbell, CFA

Director, Corporate Development

Tel.: +1-905-630-0148

[email protected]

About Cerrado Gold

Cerrado Gold is a public gold producer and exploration company with gold production derived from its 100% owned Minera Don Nicolás mine in Santa Cruz province, Argentina. It also owns 100% of the assets of Minera Mariana in Santa Cruz province, Argentina. The company is also undertaking exploration at its 100% owned Monte Do Carmo project located in Tocantins, Brazil. For more information about Cerrado Gold please visit our website at: www.cerradogold.com.

Disclaimer

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains statements that constitute “forward-looking information” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation, all statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado Gold. In making the forward- looking statements contained in this press release, Cerrado Gold has made certain assumptions, including, but not limited to ability of Cerrado to expand its drilling program at its Minera Don Nicolas Project and increase its resources and to progressing the recommendations under the PEA regarding the Monte Do Carmo Gold Project. Although Cerrado Gold believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political, and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, Cerrado Gold disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/94132

Fintech

Fintech Pulse: Your Daily Industry Brief (Chime, ZBD, MiCA)

As we close out 2024, the fintech industry continues to deliver headlines that underscore its dynamism and innovation. From IPO aspirations to groundbreaking regulatory milestones, today’s updates highlight the transformative power of fintech partnerships, regulatory evolution, and disruptive technologies. Here’s what you need to know.

Chime’s Quiet Step Toward Public Markets

Chime, the U.S.-based financial technology startup best known for its digital banking services, has taken a significant step by filing confidential paperwork for an initial public offering (IPO). As one of the most valuable private fintechs in the U.S., Chime’s move could potentially signal a renewed appetite for fintech IPOs in a market that has been cautious following fluctuating valuations across the tech sector.

With a valuation that reportedly exceeded $25 billion in its last funding round, Chime’s IPO could set a new benchmark for the industry. Observers note that its strong customer base and revenue growth may make it an appealing choice for investors seeking to capitalize on the digital banking boom. However, the timing and success of the IPO will depend on broader market conditions and the regulatory landscape.

Source: Bloomberg

ZBD’s Pioneering Achievement: EU MiCA License Approval

ZBD, a fintech company specializing in Bitcoin Lightning network solutions, has made history by becoming the first to secure an EU MiCA (Markets in Crypto-Assets Regulation) license. This landmark approval by the Dutch regulator positions ZBD at the forefront of compliant crypto-fintech operations in Europe.

MiCA, which aims to harmonize the regulatory framework for crypto-assets across the EU, has been a focal point for industry players aiming to establish legitimacy and expand their offerings. ZBD’s achievement not only validates its operational rigor but also sets a precedent for other fintech firms navigating the evolving regulatory landscape.

Industry insiders view this as a strategic advantage for ZBD as it broadens its footprint in Europe. By leveraging its regulatory approval, the company can accelerate its product deployment and establish trust with institutional and retail users alike.

Source: Coindesk, PR Newswire

The Fintech-Credit Union Synergy: A Blueprint for Innovation

The convergence of fintechs and credit unions continues to reshape the financial services ecosystem. Collaborative initiatives, such as the one highlighted in the recent partnership between fintech innovators and credit unions, are proving to be a potent force in delivering tailored financial solutions.

This “dream team” approach allows credit unions to leverage fintech’s technological expertise while maintaining their community-focused ethos. Key areas of collaboration include digital payments, personalized financial management tools, and enhanced loan processing capabilities. These partnerships not only enhance member engagement but also enable credit unions to remain competitive in an increasingly digital-first financial environment.

Industry analysts emphasize that such collaborations underscore a broader trend of traditional financial institutions embracing fintech-driven solutions to bridge service gaps and foster innovation.

Source: PYMNTS

Tackling Student Loan Debt: A Fintech’s Mission

Student loan debt remains a pressing issue for millions of Americans, and a Rochester-based fintech aims to offer relief through its cloud-based platform. This innovative solution is designed to simplify loan management and provide borrowers with actionable insights to reduce their debt burden.

The platform’s features include repayment optimization tools, personalized financial education, and seamless integration with loan servicers. By addressing the complexities of student loan management, this fintech is empowering borrowers to make informed decisions and achieve financial stability.

As the student loan crisis continues to evolve, solutions like this highlight the critical role fintech can play in addressing systemic financial challenges while fostering financial literacy and inclusion.

Source: RBJ

Industry Implications and Takeaways

Today’s updates underscore several key themes shaping the fintech landscape:

- Regulatory Milestones: ZBD’s MiCA license approval exemplifies the importance of regulatory compliance in unlocking growth opportunities.

- Strategic Partnerships: The collaboration between fintechs and credit unions demonstrates the value of combining technological innovation with traditional financial models to drive customer-centric solutions.

- Market Opportunities: Chime’s IPO move reflects a potential revival in fintech public offerings, signaling confidence in the sector’s long-term prospects.

- Social Impact: Fintech’s ability to tackle systemic issues, such as student loan debt, showcases its role as a force for positive change.

The post Fintech Pulse: Your Daily Industry Brief (Chime, ZBD, MiCA) appeared first on News, Events, Advertising Options.

Fintech

SPAYZ.io prepares for iFX EXPO Dubai 2025

Leading global payments platform SPAYZ.io has confirmed it will be attending iFX EXPO Dubai 2025 on 14 to 16 January. Exhibiting at Stand 64 at Trade Centre Dubai, SPAYZ.io’s team of professionals will be on hand providing live demonstrations of its renowned payment services for payment providers. Attendees will also receive exclusive insight into SPAYZ.io’s plans for 2025 alongside early early access to its upcoming plans for the new year.

SPAYZ.io delivers a host of payment solutions that leverage the latest technological innovations and open access to the fastest growing emerging markets across Africa, Europe and Asia. Over the past year, there has been huge demand for its Open Banking and local payment method services, alongside bank transfers, mass payouts, online banking and e-wallets.

Yana Thakurta, Head of Business Development at SPAYZ.io commented: “We look forward to once again participating at iFX Dubai to expand our network of partners and clients. It’s a fantastic way to kick off the year, connecting with thousands of industry leaders from FOREX platforms to trading companies, and everything in between.

“Our key goal for iFX Dubai EXPO 2025 is to expand our portfolio of solutions and geographies. We’re using this as an opportunity to partner with like-minded entities who share our ambition to provide payment solutions that are truly global.”

Come meet SPAYZ.io’s team at the Trade Centre Dubai at Stand 64. You can also book a meeting slot with a member of a team.

The post SPAYZ.io prepares for iFX EXPO Dubai 2025 appeared first on News, Events, Advertising Options.

Fintech

Airtm Enhances Its Board of Directors with Two Strategic Appointments

Airtm, the most connected digital dollar account in the world, is proud to announce the addition of two distinguished industry leaders to its Board of Directors: Rafael de la Vega, Global SVP of Partnerships at Auctane, and Shivani Siroya, CEO & Founder of Tala. These appointments reflect Airtm’s commitment to innovation and financial inclusion as the company enters its next phase of growth.

“We are thrilled to welcome Rafael and Shivani to Airtm’s Board of Directors,” said Ruben Galindo Steckel, Co-founder and CEO of Airtm. “Their unique perspectives and proven track records will be invaluable as we continue scaling our platform to empower individuals and businesses in emerging markets. Together, we’ll push the boundaries of financial inclusion and innovation to create a more connected and equitable global economy. Rafael and Shivani bring a wealth of experience and strategic insight that will strengthen Airtm’s mission to connect emerging economies with the global market.”

Rafael de la Vega, a seasoned leader in fintech global partnerships and technology innovation, is currently the Global SVP of Partnerships at Auctane. With a proven track record of delivering scalable, impactful solutions at the intersection of fintech, innovation, and commerce, Rafael’s expertise will be pivotal as Airtm continues to grow. “Airtm has built a platform that breaks down barriers and opens up opportunities for people in emerging economies to connect to global markets. I am excited to contribute to its growth and help further its mission of fostering financial inclusion on a global scale,” said Rafael.

Shivani Siroya, CEO and Founder of Tala, is a pioneer in financial technology, renowned for empowering underserved communities through access to credit and essential financial tools. Her leadership in leveraging data-driven innovation aligns seamlessly with Airtm’s vision of creating more equitable financial opportunities. “Empowering underserved communities has always been at the core of my work, and Airtm’s mission resonates deeply with me. I’m thrilled to join the Board and work alongside such a dynamic team to expand access to financial tools that truly make a difference in people’s lives,” said Shivani.

The post Airtm Enhances Its Board of Directors with Two Strategic Appointments appeared first on News, Events, Advertising Options.

-

Fintech6 days ago

Fintech6 days agoFintech Pulse: Your Daily Industry Brief (Chime, ZBD, MiCA)

-

Fintech PR5 days ago

Fintech PR5 days agoAccording to Tickmill survey, 3 in 10 Britons in economic difficulty: Purchasing power down 41% since 2004

-

Fintech7 days ago

Fintech7 days agoSPAYZ.io prepares for iFX EXPO Dubai 2025

-

Fintech7 days ago

Fintech7 days agoAirtm Enhances Its Board of Directors with Two Strategic Appointments

-

Fintech PR5 days ago

Fintech PR5 days agoPresident Emmerson Mnangagwa met this week with Zambia’s former Vice President and Special Envoy Enoch Kavindele to discuss SADC’s candidate for the AfDB

-

Fintech PR3 days ago

Fintech PR3 days agoGCL Energy Technology and Ant Digital Technologies Launch First Blockchain-Based RWA Project in Photovoltaic Industry

-

Fintech PR5 days ago

Fintech PR5 days agoStay Cyber Safe This Holiday Season: Heimdal’s Checklist for Business Security

-

Fintech PR6 days ago

Fintech PR6 days agoMedicilon Appoints Dr. Lilly Xu as Chief Technology Officer