Fintech

Concerned Shareholders of Fancamp Welcome the Long Overdue 2020 AGM

- 2020 annual general meeting of Fancamp shareholders to take place on Tuesday, October 5, 2021 at 10:00 a.m. ET after 12 month delay

- Shareholders as of the record date of Friday, May 28, 2021, will be eligible to vote at the AGM

- Strongly recommend shareholders vote only the GREEN proxy FOR all five of the Concerned Shareholders’ Nominee’s Slate no later than FRIDAY, OCTOBER 1, 2021 AT 10:00 A.M. ET

- Voting for the Concerned Shareholders’ Nominee’s Slate is voting AGAINST the dilutive ScoZinc Transaction which may have been postponed but not cancelled

- Voting for the Concerned Shareholders’ Nominee’s Slate is voting FOR good corporate governance and a clear strategy for exploration, marketing and value accretion

- Shareholders with questions on voting should contact Gryphon Advisors Inc. at 1-833-461-3651 toll free in North America (1-416-902-5565 by collect call) or email us at [email protected].

Montreal, Quebec–(Newsfile Corp. – September 27, 2021) – Incumbent director of Fancamp, Peter H. Smith, who, together with joint actors James Hunter and his affiliates, Mark Fekete and Heather Hannan, (the “Concerned Shareholders”) hold in aggregate, directly and indirectly an aggregate of 22,285,597 shares, representing approximately 12.63% of Fancamp Exploration Ltd.’s (“Fancamp” or the “Company”) outstanding share capital, continue to solicit proxies in connection with the AGM and encourage shareholders to continue to vote the GREEN form of proxy. For those of you that have not voted, you can still vote your GREEN proxy. Even if you have already voted using the Gold proxy form you have every right to change your vote to GREEN. Only the later dated proxy or voting instruction form will be counted at the AGM.

VOTE YOUR GREEN PROXY – DEADLINE: FRIDAY, OCTOBER 1, 2021 AT 10:00 A.M. ET

The Concerned Shareholders would like to thank the true owners of the Company for their tremendous support to date. We urge you to stay the course, despite management’s desperate and unethical attempts to entrench themselves at your expense. Their days are numbered.

It has been almost 24 months since the last annual general meeting (“AGM”) was held and after a disgraceful twelve-month campaign of coercion, intimidation and manipulation, the entrenched board and management (the “Entrenched Board and Management”) now feel they have the winning conditions to elect their slate of directors at the AGM. This Entrenched Board and Management group including former director Paul Ankcorn and CFO Debra Chapman started with only 1,800,000 shares or 1.1% of the issued and outstanding share capital in October 2020 when the AGM would normally have been called. Over the past 12 months they have worked every angle to create favourable conditions for the forthcoming AGM to further entrench themselves at the expense of the Company and shareholders. Unfortunately, one of our director nominees, Greg Ferron, was incentivized to jump ship (more on that below). The chronology of this shameful strategy to deny Fancamp shareholders a timely and fair opportunity to elect a board of directors of their choosing is as follows.

- October 15, 2020 – Rajesh Sharma is appointed as a director only after Chairman Mark Billings exercised a casting vote to override a tie vote. This tactic to stack the board by appointing Mr. Sharma had been blocked by a tie vote at a previous board meeting held only two weeks earlier.

- November 20, 2020 – Fancamp announces delay of AGM on the false pretext of issues related to COVID-19. Fancamp announces that it intended to hold the AGM in the first quarter of 2021.

- December 31, 2020 – Fancamp closes dilutive private placement financing of 6,666,667 flow-through shares (see July 19, 2021).

- February 18, 2021 – Fancamp and ScoZinc Mining Ltd. (“ScoZinc”) announce business combination (the “Transaction”) whereby Fancamp would have issued approximately 84.5 million shares to ScoZinc shareholders representing dilution to existing Fancamp shareholders of 33.7%. On a fully diluted basis existing Fancamp Shareholders would have given up 44.3% of their company to ScoZinc shareholders and the share structure would have blown out to 317.0 million shares! The Transaction was set up as a plan of arrangement whereby Fancamp shareholders did not have the opportunity vote on it. The single largest beneficiary if the Transaction had closed would have been Ashwath Mehra who would have gained 9,230,004 Fancamp shares, 8,030,004 purchase warrants and 240,000 options

- March 10, 2021 – Fancamp announces further delay to AGM on false pretext of issues related to COVID-19 and the completion of its business review which was complete by that time. Fancamp announces it would hold its AGM in the second quarter of 2021.

- March 12, 2021 – Fancamp grants 2,500,000 stock options to the Entrenched Board and Management (excluding Dr. Smith).

- April 1, 2021 – Fancamp terminates the consulting agreement with incumbent director Dr. Smith citing baseless accusations for cause to intimidate him, disparage his reputation and ruin him financially all to discourage the Concerned Shareholders from proceeding with the proxy fight.

- May 14, 2021 – Fancamp files civil claim against Dr. Smith in an aggressive and costly effort by the Entrenched Board and Management to further entrench themselves at the expense of the Company and shareholders. The interim financial statements due at the end of September will undoubtedly show that vastly higher sums have been committed to this legal campaign.

- May 27, 2021 – Fancamp is granted second extension of time to hold AGM by BC Registrar of Companies under false pretext of issues related to COVID-19 without disclosing this to shareholders. This extension was clearly obtained only to be used tactically to delay the AGM if the voting was not going in favour of the Entrenched Board and Management slate.

- May 27, 2021 – With insider knowledge of the BC Registrar of Companies extension (which had not been released to the public), the Entrenched Board and Management exercised their entire cumulative 9,350,000 stock options including the recently issued 2,500,000 stock options .

- May 28, 2020 – Fancamp sets record date for AGM to be held June 29, 2021.

- June 19, 2021 – Fancamp postpones AGM once the Entrenched Board and Management realize that their proposed slate of directors will not be elected if the AGM originally scheduled for June 29, 2021 proceeds.

- July 13, 2021 – Sale of Fancamp’s Fermont Iron assets to Champion Iron Ltd. for a paltry $1.3 million.

- July 15, 2021 – Subsequent purchase of 22,000,000 Fancamp shares from Champion by ASTOR Management AG, a company controlled by Ashwath Mehra.

- July 19, 2021 – Additional purchase of 6,668,000 Fancamp shares by ASTOR Management AG, a company controlled by Mr. Mehra.

- September 16, 2021 – An agreement involving several shareholders including Greg Ferron, formally a nominee for the dissenting Concerned Shareholders slate (the “Ferron Agreement”), whereby board seats are to be traded for votes in favour of the Entrenched Board and Management slate. The Ferron Agreement was reached without the knowledge or consent of the other nominees for the Green slate. Mr. Ferron has withdrawn his consent to act as a nominee for the Green slate and any votes cast for Mr. Ferron will not be counted.

- September 23, 2021 – Fancamp and ScoZinc agree to “terminate” the ScoZinc Transaction one day prior to its expiry in order to trigger a break fee. Fancamp shareholders are forced to endure a private placement of 1,969,697 common shares of ScoZinc at $0.66 per share for $1,300,000 and lose the $250,000 previously loaned to ScoZinc by accepting 378,788 shares for the debt. This hefty investment into a low-grade deposit is ample proof that there is no intention of Fancamp cancelling the ScoZinc Transaction once and for all. This is simply a strategic retreat. ScoZinc will eventually make its way back to Fancamp’s board room if the Entrenched Board and Management is not replaced. If the Green team is elected, it does not intend to complete the private placement, which as structured, is not in accordance with the policies of the TSX Venture Exchange and will terminate any potential transaction with ScoZinc once and for all.

The events noted above highlight the extent to which the Entrenched Board and Management are willing to go to maintain their positions with no care for the financial damage to the Company or the downward pressure on the share price. During the last twelve months, very little effort or money has been put into exploration, marketing, promotion or property transactions. Almost all energy and funds have been dedicated to creating conditions that will allow the Entrenched Board and Management slate to be elected at the AGM. As shareholders is this who you want to lead your Company and manage your money?

The Entrenched Board and Management have manipulated rules, regulations and policies that are there to protect shareholders to mockingly deny you the true owners of Fancamp the right to have your voices heard at a fair AGM. It is disappointing to see that Greg Ferron and his followers have withdrawn support for the Concerned Shareholders and surrendered their votes to the inducements of board seats and false promises of a flawed corporate strategy. What they did not count on is that there is still strong shareholder support to hold the Entrenched Board and Management accountable for the harm done to Fancamp’s finances and share price.

VOTE YOUR GREEN PROXY – DEADLINE: FRIDAY, OCTOBER 1, 2021 AT 10:00 A.M. ET

If you have any questions or require any assistance in executing your proxy or voting instruction form, please contact Gryphon Advisors Inc. at 1-833-461-3651 or email [email protected] Shareholders are also encouraged to visit https://www.newsfilecorp.com/company/7723/Concerned-Shareholders-of-Fancamp-exploration-Ltd to read the Concerned Shareholders press releases issued to date.

The Concerned Shareholders would like to thank the true owners of the Company for their tremendous support to date. We urge you to stay the course, despite managements desperate and unethical attempts to entrench themselves at your expense, their days are numbered.

Advisors:

The Concerned Shareholders have retained Gryphon as its strategic shareholder communications and proxy advisor. Gryphon’s responsibility will include providing strategic advice and advising the Concerned Shareholders with respect to the Meeting and proxy protocol. Gryphon’s responsibilities will also include soliciting shareholders should the Concerned Shareholders commence a formal solicitation of proxies. Dr. Smith has also retained Farris LLP as legal counsel.

The registered address of Fancamp is located at 3200 – 650 West Georgia St. Vancouver, BC, V6B 4P7. The mailing and head office address of Fancamp is 7290 Gray Avenue, Burnaby, British Columbia V5J 3Z2. A copy of this press release may be obtained on Fancamp’ SEDAR profile at www.sedar.com.

For more information regarding the Concerned Shareholders’ position please contact:

Gryphon Advisors Inc.

Tel: 1-833-461-3651

Email: [email protected]

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/97753.

Fintech

How to identify authenticity in crypto influencer channels

Modern brands stake on influencer marketing, with 76% of users making a purchase after seeing a product on social media.The cryptocurrency industry is no exception to this trend. However, promoting crypto products through influencer marketing can be particularly challenging. Crypto influencers pose a significant risk to a brand’s reputation and ROI due to rampant scams. Approximately 80% of channels provide fake statistics, including followers counts and engagement metrics. Additionally, this niche is characterized by high CPMs, which can increase the risk of financial loss for brands.

In this article Nadia Bubennnikova, Head of agency Famesters, will explore the most important things to look for in crypto channels to find the perfect match for influencer marketing collaborations.

-

Comments

There are several levels related to this point.

LEVEL 1

Analyze approximately 10 of the channel’s latest videos, looking through the comments to ensure they are not purchased from dubious sources. For example, such comments as “Yes sir, great video!”; “Thanks!”; “Love you man!”; “Quality content”, and others most certainly are bot-generated and should be avoided.

Just to compare:

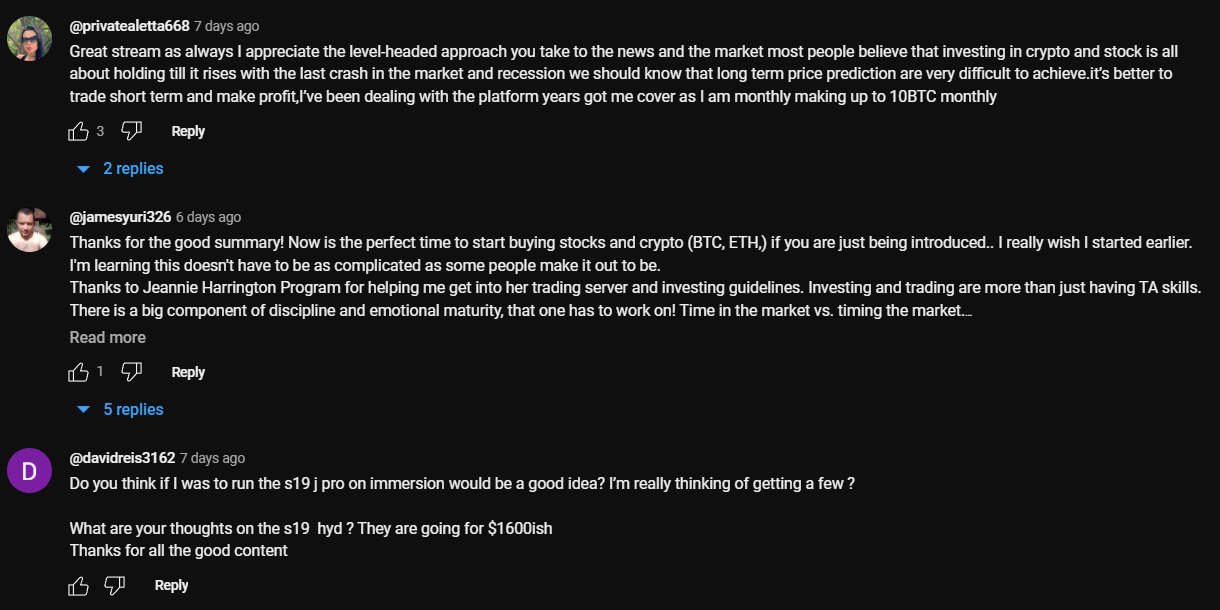

LEVEL 2

Don’t rush to conclude that you’ve discovered the perfect crypto channel just because you’ve come across some logical comments that align with the video’s topic. This may seem controversial, but it’s important to dive deeper. When you encounter a channel with logical comments, ensure that they are unique and not duplicated under the description box. Some creators are smarter than just buying comments from the first link that Google shows you when you search “buy YouTube comments”. They generate topics, provide multiple examples, or upload lists of examples, all produced by AI. You can either manually review the comments or use a script to parse all the YouTube comments into an Excel file. Then, add a formula to highlight any duplicates.

LEVEL 3

It is also a must to check the names of the profiles that leave the comments: most of the bot-generated comments are easy to track: they will all have the usernames made of random symbols and numbers, random first and last name combinations, “Habibi”, etc. No profile pictures on all comments is also a red flag.

LEVEL 4

Another important factor to consider when assessing comment authenticity is the posting date. If all the comments were posted on the same day, it’s likely that the traffic was purchased.

2. Average views number per video

This is indeed one of the key metrics to consider when selecting an influencer for collaboration, regardless of the product type. What specific factors should we focus on?

First & foremost: the views dynamics on the channel. The most desirable type of YouTube channel in terms of views is one that maintains stable viewership across all of its videos. This stability serves as proof of an active and loyal audience genuinely interested in the creator’s content, unlike channels where views vary significantly from one video to another.

Many unauthentic crypto channels not only buy YouTube comments but also invest in increasing video views to create the impression of stability. So, what exactly should we look at in terms of views? Firstly, calculate the average number of views based on the ten latest videos. Then, compare this figure to the views of the most recent videos posted within the past week. If you notice that these new videos have nearly the same number of views as those posted a month or two ago, it’s a clear red flag. Typically, a YouTube channel experiences lower views on new videos, with the number increasing organically each day as the audience engages with the content. If you see a video posted just three days ago already garnering 30k views, matching the total views of older videos, it’s a sign of fraudulent traffic purchased to create the illusion of view stability.

3. Influencer’s channel statistics

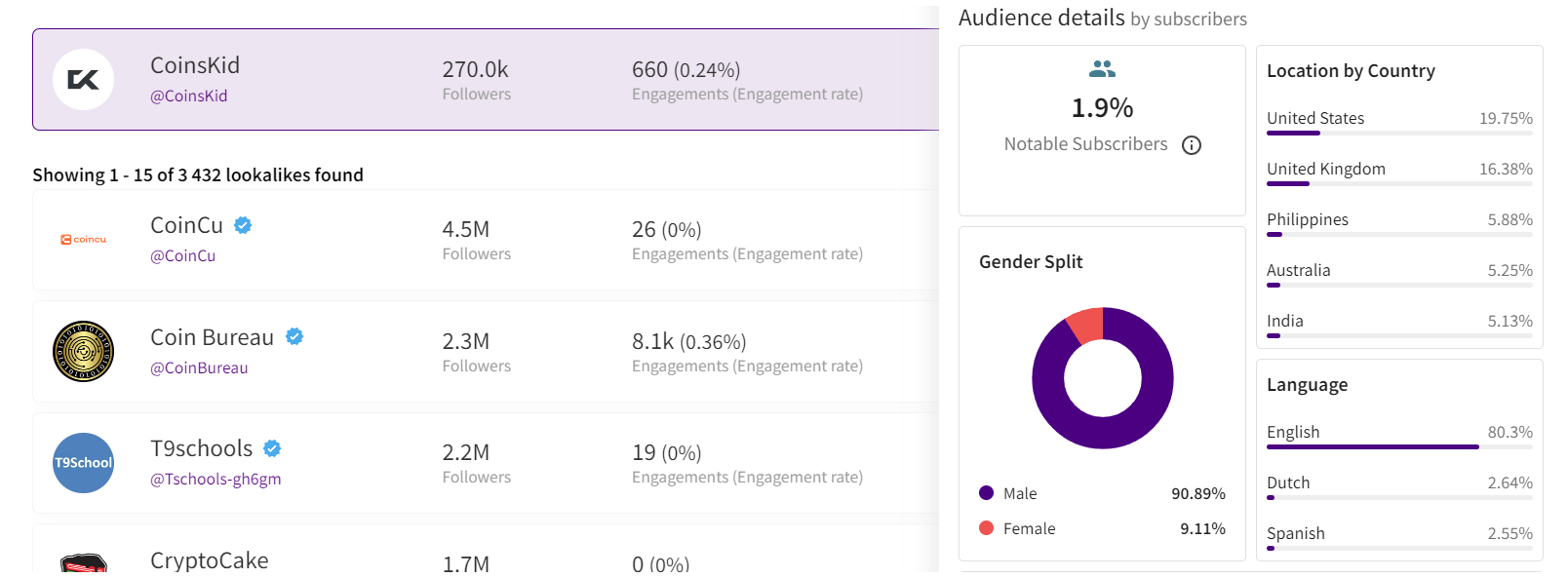

The primary statistics of interest are region and demographic split, and sometimes the device types of the viewers.

LEVEL 1

When reviewing the shared statistics, the first step is to request a video screencast instead of a simple screenshot. This is because it takes more time to organically edit a video than a screenshot, making it harder to manipulate the statistics. If the creator refuses, step two (if only screenshots are provided) is to download them and check the file’s properties on your computer. Look for details such as whether it was created with Adobe Photoshop or the color profile, typically Adobe RGB, to determine if the screenshot has been edited.

LEVEL 2

After confirming the authenticity of the stats screenshot, it’s crucial to analyze the data. For instance, if you’re examining a channel conducted in Spanish with all videos filmed in the same language, it would raise concerns to find a significant audience from countries like India or Turkey. This discrepancy, where the audience doesn’t align with regions known for speaking the language, is a red flag.

If we’re considering an English-language crypto channel, it typically suggests an international audience, as English’s global use for quality educational content on niche topics like crypto. However, certain considerations apply. For instance, if an English-speaking channel shows a significant percentage of Polish viewers (15% to 30%) without any mention of the Polish language, it could indicate fake followers and views. However, if the channel’s creator is Polish, occasionally posts videos in Polish alongside English, and receives Polish comments, it’s important not to rush to conclusions.

Example of statistics

Example of statistics

Wrapping up

These are the main factors to consider when selecting an influencer to promote your crypto product. Once you’ve launched the campaign, there are also some markers to show which creators did bring the authentic traffic and which used some tools to create the illusion of an active and engaged audience. While this may seem obvious, it’s still worth mentioning. After the video is posted, allow 5-7 days for it to accumulate a basic number of views, then check performance metrics such as views, clicks, click-through rate (CTR), signups, and conversion rate (CR) from clicks to signups.

If you overlooked some red flags when selecting crypto channels for your launch, you might find the following outcomes: channels with high views numbers and high CTRs, demonstrating the real interest of the audience, yet with remarkably low conversion rates. In the worst-case scenario, you might witness thousands of clicks resulting in zero to just a few signups. While this might suggest technical issues in other industries, in crypto campaigns it indicates that the creator engaged in the campaign not only bought fake views and comments but also link clicks. And this happens more often than you may realize.

Summing up, choosing the right crypto creator to promote your product is indeed a tricky job that requires a lot of resources to be put into the search process.

Author

Nadia Bubennikova, Head of agency at Famesters

Fintech

Central banks and the FinTech sector unite to change global payments space

The BIS, along with seven leading central banks and a cohort of private financial firms, has embarked on an ambitious venture known as Project Agorá.

Named after the Greek word for “marketplace,” this initiative stands at the forefront of exploring the potential of tokenisation to significantly enhance the operational efficiency of the monetary system worldwide.

Central to this pioneering project are the Bank of France (on behalf of the Eurosystem), the Bank of Japan, the Bank of Korea, the Bank of Mexico, the Swiss National Bank, the Bank of England, and the Federal Reserve Bank of New York. These institutions have joined forces under the banner of Project Agorá, in partnership with an extensive assembly of private financial entities convened by the Institute of International Finance (IIF).

At the heart of Project Agorá is the pursuit of integrating tokenised commercial bank deposits with tokenised wholesale central bank money within a unified, public-private programmable financial platform. By harnessing the advanced capabilities of smart contracts and programmability, the project aspires to unlock new transactional possibilities that were previously infeasible or impractical, thereby fostering novel opportunities that could benefit businesses and consumers alike.

The collaborative effort seeks to address and surmount a variety of structural inefficiencies that currently plague cross-border payments. These challenges include disparate legal, regulatory, and technical standards; varying operating hours and time zones; and the heightened complexity associated with conducting financial integrity checks (such as anti-money laundering and customer verification procedures), which are often redundantly executed across multiple stages of a single transaction due to the involvement of several intermediaries.

As a beacon of experimental and exploratory projects, the BIS Innovation Hub is committed to delivering public goods to the global central banking community through initiatives like Project Agorá. In line with this mission, the BIS will soon issue a call for expressions of interest from private financial institutions eager to contribute to this ground-breaking project. The IIF will facilitate the involvement of private sector participants, extending an invitation to regulated financial institutions representing each of the seven aforementioned currencies to partake in this transformative endeavour.

Source: fintech.globa

The post Central banks and the FinTech sector unite to change global payments space appeared first on HIPTHER Alerts.

Fintech

TD Bank inks multi-year strategic partnership with Google Cloud

TD Bank has inked a multi-year deal with Google Cloud as it looks to streamline the development and deployment of new products and services.

The deal will see the Canadian banking group integrate the vendor’s cloud services into a wider portion of its technology solutions portfolio, a move which TD expects will enable it “to respond quickly to changing customer expectations by rolling out new features, updates, or entirely new financial products at an accelerated pace”.

This marks an expansion of the already established relationship between TD Bank and Google Cloud after the group previously adopted the vendor’s Google Kubernetes Engine (GKE) for TD Securities Automated Trading (TDSAT), the Chicago-based subsidiary of its investment banking unit, TD Securities.

TDSAT uses GKE for process automation and quantitative modelling across fixed income markets, resulting in the development of a “data-driven research platform” capable of processing large research workloads in trading.

Dan Bosman, SVP and CIO of TD Securities, claims the infrastructure has so far supported TDSAT with “compute-intensive quantitative analysis” while expanding the subsidiary’s “trading volumes and portfolio size”.

TD’s new partnership with Google Cloud will see the group attempt to replicate the same level of success across its entire portfolio.

Source: fintechfutures.com

The post TD Bank inks multi-year strategic partnership with Google Cloud appeared first on HIPTHER Alerts.

-

Latest News6 days ago

“The Hainan FTP and Me”: Looking at Hainan’s Transformations

-

Latest News5 days ago

Millions of people unite around doing good on the 18th International Good Deeds Day held yesterday worldwide

-

Latest News4 days ago

Banxso Acquires Australian ASIC License, Enhancing Its Global Trading Operations

-

Latest News3 days ago

BMO Announces Election of Board of Directors

-

Latest News5 days ago

135th Canton Fair Launches a Showcase of Innovative Products of New Collection to Lead Global Market Trends

-

Latest News5 days ago

BII and FMO back BECIS with joint US$50 million financing facility supporting commercial and industrial renewables sector in South-East Asia

-

Latest News3 days ago

Vantage Markets Wins “Most Innovative Broker” Award from FXBT; Redefines Trader Empowerment

-

Latest News4 days ago

Bybit CEO: “Institutions Driving Today’s Crypto Bull Market” – At Blockchain Life 2024 Dubai