Fintech

Global Plant-Based Food Market Expected to Reach a Market Value Of $37.9 Billion by 2027

Reading Time: 7 minutes

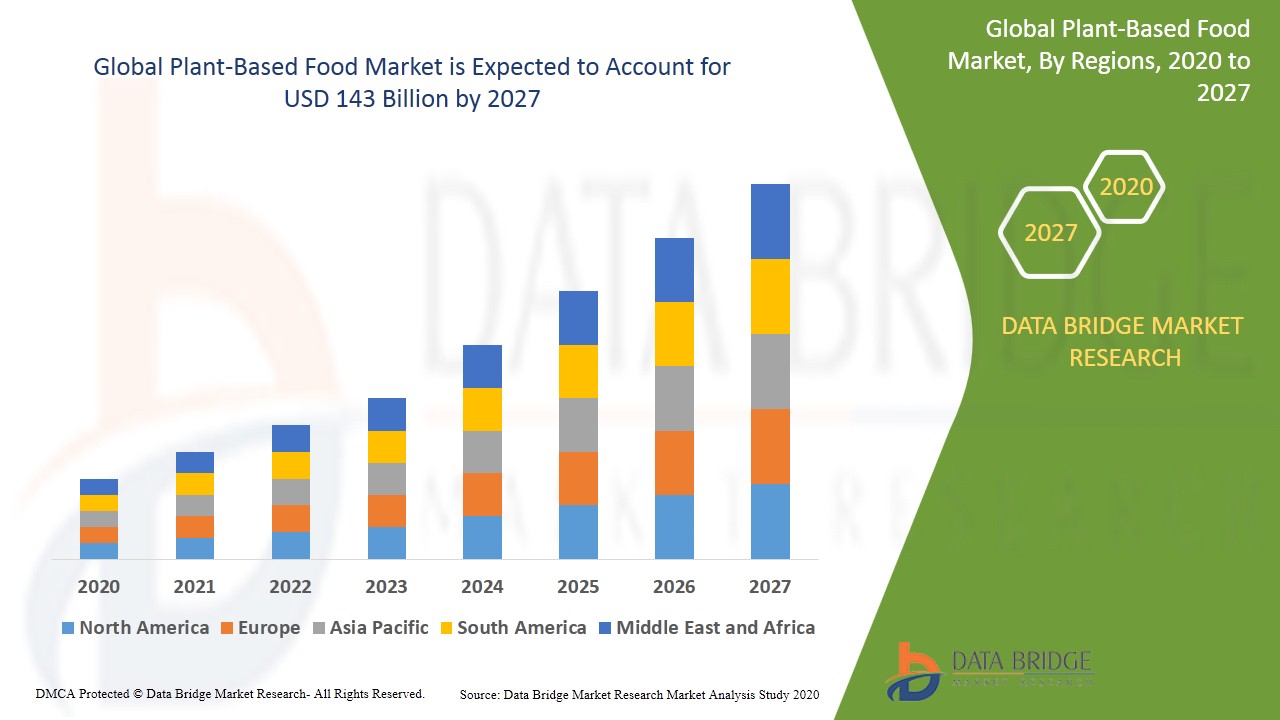

FinancialNewsMedia.com News Commentary – The outbreak of COVID-19 has brought a positive impact on the plant-based food market due to the increased consumption of plant-based nutrition to boost immunity. The market witnessed a rise due to the reluctance to consume meat owing to the outbreak and the demand for plant-based food rose significantly. The e-commerce platform is likely to play a salient role in driving market growth in the COVID-19 era. The market witnessed a rise in demand for food products such as beans, legumes, and others. A report from Market Research Future (MRFR) evaluates that the Global Plant-Based Food Market is expected to acquire a market value of USD 37,981.6 Million while recording a CAGR of 10.20% by 2027. Plant-based food refers to food such as legumes, fruits, vegetables, nuts, grains, and others, that are derived from plants. The plant-based market is likely to procure significant opportunities for expansion in developing countries in the coming time. Active Companies in the markets today include Plant Veda Foods Ltd. (OTCPK: PLVFF) (CSE: MILK), Tyson Foods (NYSE: TSN), McDonald’s Corporation (NYSE: MCD), Yum! Brands, Inc. (NYSE: YUM), Conagra Brands, Inc. (NYSE: CAG).

The report said: “The growing demand for plant-based food due to increasing awareness about veganism is anticipated to be a significant factor that can drive the global market during the forecast period. The rising cases of lactose intolerance across the globe are likely to enhance demand for non-dairy products, which is predicted to increase demand for such food, thereby benefitting the industry in the coming time. Apart from these, the rising concern towards the protection of the environment and increasing efforts to reduce carbon footprint are other salient factors that are likely to drive the industry in the analysis timeframe. In addition, the increasing initiatives to incorporate innovation in food products can also aid in strengthening the market expansion in the coming time. In the recent most example, Las Vegas, in January 2021, announced that now it has a Vegan Food Bank which would offer food to the needy. Another crucial factor that is likely to positively impact the plant-based industry is the endorsement of veganism by popular actors such as Beyonce, Zac Efron, Benedict Cumberbatch, Jason Mraz, Jacqueline Fernandez, among others.”

Plant Veda Foods Ltd. (OTCPK: PLVFF) (CSE: MILK) BREAKING NEWS: Plant Veda Wraps 2021 and Expects a Prosperous 2022 – Plant Veda Recaps 2021 and Looks Towards 2022 — Plant Veda Foods Ltd. ((the “Company” or “Plant Veda”), an award-winning dairy-alternative food manufacturer, is pleased to provide an overview of its business achievements of 2021 and its plans for 2022.

In 2021, the Company implemented its business strategies across all divisions, including distribution, manufacturing, and corporate structure. These milestones include but are not limited to, winning the Cleanchoice Award from Clean Eating Magazine and finalist for the Product of the Year Award by BC Food and Beverage Association.

The Company was able to double its retail presence, working with institutions such as Sysco Corp., America’s biggest wholesale food distributor, and the Canadian subsidiary of United Natural Foods, Inc. with its network of more than 5,000 Canadian retail stores. Additional retail stores onboarded included Nesters Markets, Buy-Low Foods, IGA and Sungiven Foods, and others.

The Company launched its new product line of spoonable yogurt “PlantGurt” and a new Sampler Box available on Plant Veda’s e-commerce store. Plant Veda products were also featured at both TEDMonterey and TEDWomen.

Corporately during 2021, Plant Veda commenced trading on the Canadian Securities Exchange under the ticker symbol MILK, the Frankfurt Exchange on July 2021 under the ticker symbol A3CS6B, and the OTC Markets in the USA under the symbol PLVFF. The Company strengthened its management by adding Deanna Embury, former Be Fresh CEO, and Wilson K. Lee, an award-winning restaurant entrepreneur, to its Board of Advisors. Plant Veda also appointed production and quality expert Mr. Mehdi Gohardehi as New Plant Manager.

Plant Veda secured its new home of a 25,000 square foot manufacturing facility in Delta, B.C., Canada, and received its production license from the Canadian Food Inspection Agency for both the Canadian and export markets. The Company also successfully registered with the U.S. FDA for product importation.

“The Plant Veda team made remarkable progress in 2021 laying the foundations for a prosperous 2022,” said Sunny Gurnani, CEO of Plant Veda. “The initial phase one expansion of our new state-of-the-art facility will allow for an annual production capacity of 2.5M litres, enabling us to further develop our current distribution channels while establishing new ones.” “In 2022 we have defined goals, including additional product launches, completion of phase one capacity expansion, and accelerated revenue growth. We have always faced production constraints in our previous location, which limited growth. Now, thanks to the hard work of the entire Plant Veda team, 2022 is expected to allow the expansion we have been planning for. We, again, thank our team, our partners and our supporters for all their assistance in 2021. We look forward to an exciting and prosperous 2022.” CONTINUED… Read this full release for Plant Veda Foods Ltd. at: https://www.plantveda.com/pages/news

Other recent developments in the markets include:

Tyson Foods (NYSE: TSN) is taking another step in its efforts to become the most sought-after place to work by providing greater access to affordable childcare for frontline workers and their families. The company recently said it plans to build an on-site childcare and learning facility at its new Humboldt, Tennessee, poultry processing plant, and recently announced a program at its Amarillo, Texas, beef plant, to work with two local providers to provide free childcare to the children of second shift workers.

The $3.5 million Humboldt facility, expected to be operational in 2023, will support up to 100 children, five years of age and younger, and employ a staff of 18. Called Tyson Tykes, it will be operated as an early childhood learning center by KinderCare and subsidized by the company to lower the cost for Tyson team members.

A study by the Center for American Progress states the national average cost of care for one child in a center amounts to about $10,000 per year, which exceeds what most families with young children can afford. Research also shows children enrolled in early childhood education programs have greater high school graduation rates, increased IQ scores, higher career earnings, and are less likely to commit a crime as they enter adulthood.

McDonald’s Corporation (NYSE: MCD) recently announced results for the third quarter ended September 30, 2021. “Our third-quarter results are a testament to our unparalleled scale and agility,” said McDonald’s President and Chief Executive Officer, Chris Kempczinski. “Our global comparable sales increased 10% over 2019, which was delivered across an omnichannel experience that is focused on meeting the needs of our customers. We continue to execute our strategic growth plan and run great restaurants so that we can drive long-term, sustainable growth for all of our stakeholders.”

Third-quarter financial performance was: Global comparable sales increased 12.7% (10.2% on a 2-year basis), reflecting positive comparable sales across all segments: Consolidated revenues increased 14% (13% in constant currencies) to $6,201 million; Systemwide sales increased 16% (14% in constant currencies) to $29,948 million; Consolidated operating income increased 18% (17% in constant currencies) to $2,987 million and included $106 million of strategic gains related to the sale of McDonald’s Japan stock; Diluted earnings per share was $2.86. Excluding strategic gains of $0.10 per share in 2021 and $0.13 per share in 2020, diluted earnings per share for the quarter was $2.76, an increase of 24% (23% in constant currencies); and The Company declared a 7% increase in its quarterly cash dividend to $1.38 per share and also announced the resumption of its share repurchase program.

Yum! Brands, Inc. (NYSE: YUM) recently reported results for the third quarter ended September 30, 2021. Worldwide system sales excluding foreign currency translation grew 8%, with 5% same-store sales and 4% unit growth. Third-quarter GAAP EPS was $1.75, an increase of 90% over the prior-year quarter. Third-quarter EPS excluding Special Items was $1.22, an increase of 21% over the prior-year quarter.

David Gibbs, the CEO, said “Our third-quarter results, led by record-breaking unit development and

sustained momentum in digital sales is a testament to the strength of our Brands and the unmatched commitment and capability of our best-in-class franchise partners. I am proud that each of our global divisions contributed to delivering 760 net-new units in the quarter. Our 5% same-store sales growth for the third quarter, or 3% same-store sales growth on a 2-year basis, demonstrates the resilience of our diversified global business model despite the headwind of the Delta variant in certain key markets. Conagra Brands, Inc. (NYSE: CAG) recently announced that its board of directors approved a quarterly dividend payment of $0.3125per share of CAG common stock to be paid on March 2, 2022, to stockholders of record as of the close of business on January 31, 2022.

Conagra Brands, Inc., headquartered in Chicago, is one of North America’s leading branded food companies. Guided by an entrepreneurial spirit, Conagra Brands combines a rich heritage of making great food with a sharpened focus on innovation. The company’s portfolio is evolving to satisfy people’s changing food preferences. Conagra’s iconic brands, such as Birds Eye®, Marie Callender’s®, Banquet®, Healthy Choice®, Slim Jim®, Reddi-wip®, and Vlasic®, as well as emerging brands, including Angie’s® BOOMCHICKAPOP®, Duke’s®, Earth Balance®, Gardein®, and Frontera®, offer choices for every occasion.

DISCLAIMER: FN Media Group LLC (FNM), which owns and operates FinancialNewsMedia.com and MarketNewsUpdates.com, is a third-party publisher and news dissemination service provider, which disseminates electronic information through multiple online media channels. FNM is NOT affiliated in any manner with any company mentioned herein. FNM and its affiliated companies are a news dissemination solutions provider and are NOT a registered broker/dealer/analyst/adviser, hold no investment licenses and may NOT sell, offer to sell, or offer to buy any security. FNM’s market updates, news alerts, and corporate profiles are NOT a solicitation or recommendation to buy, sell or hold securities. The material in this release is intended to be strictly informational and is NEVER to be construed or interpreted as research material. All readers are strongly urged to perform research and due diligence on their own and consult =a licensed financial professional before considering any level of investing in stocks. All material included herein is republished content and details which were previously disseminated by the companies mentioned in this release. FNM is not liable for any investment decisions by its readers or subscribers. Investors are cautioned that they may lose all or a portion of their investment when investing in stocks. For current services, performed FNM has been compensated twenty-five hundred dollars for news coverage of the current press releases issued by Plant Veda Foods Ltd. by a non-affiliated third party. FNM HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E the Securities Exchange Act of 1934, as amended, and such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. “Forward-looking statements” describe future expectations, plans, results, or strategies and are generally preceded by words such as “may”, “future”, “plan” or “planned”, “will” or “should”, “expected,” “anticipates”, “draft”, “eventually” or “projected”. You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements as a result of various factors, and other risks identified in a company’s annual report on Form 10-K or 10-KSB and other filings made by such company with the Securities and Exchange Commission. You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. The forward-looking statements in this release are made as of the date hereof and FNM undertakes no obligation to update such statements.

SOURCE: Financialnewsmedia.com

Fintech

Fintech Pulse: Your Daily Industry Brief (Chime, ZBD, MiCA)

As we close out 2024, the fintech industry continues to deliver headlines that underscore its dynamism and innovation. From IPO aspirations to groundbreaking regulatory milestones, today’s updates highlight the transformative power of fintech partnerships, regulatory evolution, and disruptive technologies. Here’s what you need to know.

Chime’s Quiet Step Toward Public Markets

Chime, the U.S.-based financial technology startup best known for its digital banking services, has taken a significant step by filing confidential paperwork for an initial public offering (IPO). As one of the most valuable private fintechs in the U.S., Chime’s move could potentially signal a renewed appetite for fintech IPOs in a market that has been cautious following fluctuating valuations across the tech sector.

With a valuation that reportedly exceeded $25 billion in its last funding round, Chime’s IPO could set a new benchmark for the industry. Observers note that its strong customer base and revenue growth may make it an appealing choice for investors seeking to capitalize on the digital banking boom. However, the timing and success of the IPO will depend on broader market conditions and the regulatory landscape.

Source: Bloomberg

ZBD’s Pioneering Achievement: EU MiCA License Approval

ZBD, a fintech company specializing in Bitcoin Lightning network solutions, has made history by becoming the first to secure an EU MiCA (Markets in Crypto-Assets Regulation) license. This landmark approval by the Dutch regulator positions ZBD at the forefront of compliant crypto-fintech operations in Europe.

MiCA, which aims to harmonize the regulatory framework for crypto-assets across the EU, has been a focal point for industry players aiming to establish legitimacy and expand their offerings. ZBD’s achievement not only validates its operational rigor but also sets a precedent for other fintech firms navigating the evolving regulatory landscape.

Industry insiders view this as a strategic advantage for ZBD as it broadens its footprint in Europe. By leveraging its regulatory approval, the company can accelerate its product deployment and establish trust with institutional and retail users alike.

Source: Coindesk, PR Newswire

The Fintech-Credit Union Synergy: A Blueprint for Innovation

The convergence of fintechs and credit unions continues to reshape the financial services ecosystem. Collaborative initiatives, such as the one highlighted in the recent partnership between fintech innovators and credit unions, are proving to be a potent force in delivering tailored financial solutions.

This “dream team” approach allows credit unions to leverage fintech’s technological expertise while maintaining their community-focused ethos. Key areas of collaboration include digital payments, personalized financial management tools, and enhanced loan processing capabilities. These partnerships not only enhance member engagement but also enable credit unions to remain competitive in an increasingly digital-first financial environment.

Industry analysts emphasize that such collaborations underscore a broader trend of traditional financial institutions embracing fintech-driven solutions to bridge service gaps and foster innovation.

Source: PYMNTS

Tackling Student Loan Debt: A Fintech’s Mission

Student loan debt remains a pressing issue for millions of Americans, and a Rochester-based fintech aims to offer relief through its cloud-based platform. This innovative solution is designed to simplify loan management and provide borrowers with actionable insights to reduce their debt burden.

The platform’s features include repayment optimization tools, personalized financial education, and seamless integration with loan servicers. By addressing the complexities of student loan management, this fintech is empowering borrowers to make informed decisions and achieve financial stability.

As the student loan crisis continues to evolve, solutions like this highlight the critical role fintech can play in addressing systemic financial challenges while fostering financial literacy and inclusion.

Source: RBJ

Industry Implications and Takeaways

Today’s updates underscore several key themes shaping the fintech landscape:

- Regulatory Milestones: ZBD’s MiCA license approval exemplifies the importance of regulatory compliance in unlocking growth opportunities.

- Strategic Partnerships: The collaboration between fintechs and credit unions demonstrates the value of combining technological innovation with traditional financial models to drive customer-centric solutions.

- Market Opportunities: Chime’s IPO move reflects a potential revival in fintech public offerings, signaling confidence in the sector’s long-term prospects.

- Social Impact: Fintech’s ability to tackle systemic issues, such as student loan debt, showcases its role as a force for positive change.

The post Fintech Pulse: Your Daily Industry Brief (Chime, ZBD, MiCA) appeared first on News, Events, Advertising Options.

Fintech

SPAYZ.io prepares for iFX EXPO Dubai 2025

Leading global payments platform SPAYZ.io has confirmed it will be attending iFX EXPO Dubai 2025 on 14 to 16 January. Exhibiting at Stand 64 at Trade Centre Dubai, SPAYZ.io’s team of professionals will be on hand providing live demonstrations of its renowned payment services for payment providers. Attendees will also receive exclusive insight into SPAYZ.io’s plans for 2025 alongside early early access to its upcoming plans for the new year.

SPAYZ.io delivers a host of payment solutions that leverage the latest technological innovations and open access to the fastest growing emerging markets across Africa, Europe and Asia. Over the past year, there has been huge demand for its Open Banking and local payment method services, alongside bank transfers, mass payouts, online banking and e-wallets.

Yana Thakurta, Head of Business Development at SPAYZ.io commented: “We look forward to once again participating at iFX Dubai to expand our network of partners and clients. It’s a fantastic way to kick off the year, connecting with thousands of industry leaders from FOREX platforms to trading companies, and everything in between.

“Our key goal for iFX Dubai EXPO 2025 is to expand our portfolio of solutions and geographies. We’re using this as an opportunity to partner with like-minded entities who share our ambition to provide payment solutions that are truly global.”

Come meet SPAYZ.io’s team at the Trade Centre Dubai at Stand 64. You can also book a meeting slot with a member of a team.

The post SPAYZ.io prepares for iFX EXPO Dubai 2025 appeared first on News, Events, Advertising Options.

Fintech

Airtm Enhances Its Board of Directors with Two Strategic Appointments

Airtm, the most connected digital dollar account in the world, is proud to announce the addition of two distinguished industry leaders to its Board of Directors: Rafael de la Vega, Global SVP of Partnerships at Auctane, and Shivani Siroya, CEO & Founder of Tala. These appointments reflect Airtm’s commitment to innovation and financial inclusion as the company enters its next phase of growth.

“We are thrilled to welcome Rafael and Shivani to Airtm’s Board of Directors,” said Ruben Galindo Steckel, Co-founder and CEO of Airtm. “Their unique perspectives and proven track records will be invaluable as we continue scaling our platform to empower individuals and businesses in emerging markets. Together, we’ll push the boundaries of financial inclusion and innovation to create a more connected and equitable global economy. Rafael and Shivani bring a wealth of experience and strategic insight that will strengthen Airtm’s mission to connect emerging economies with the global market.”

Rafael de la Vega, a seasoned leader in fintech global partnerships and technology innovation, is currently the Global SVP of Partnerships at Auctane. With a proven track record of delivering scalable, impactful solutions at the intersection of fintech, innovation, and commerce, Rafael’s expertise will be pivotal as Airtm continues to grow. “Airtm has built a platform that breaks down barriers and opens up opportunities for people in emerging economies to connect to global markets. I am excited to contribute to its growth and help further its mission of fostering financial inclusion on a global scale,” said Rafael.

Shivani Siroya, CEO and Founder of Tala, is a pioneer in financial technology, renowned for empowering underserved communities through access to credit and essential financial tools. Her leadership in leveraging data-driven innovation aligns seamlessly with Airtm’s vision of creating more equitable financial opportunities. “Empowering underserved communities has always been at the core of my work, and Airtm’s mission resonates deeply with me. I’m thrilled to join the Board and work alongside such a dynamic team to expand access to financial tools that truly make a difference in people’s lives,” said Shivani.

The post Airtm Enhances Its Board of Directors with Two Strategic Appointments appeared first on News, Events, Advertising Options.

-

Fintech6 days ago

Fintech6 days agoFintech Pulse: Your Daily Industry Brief (Revolut, Bestow, Advyzon, Tyme Group, Nubank)

-

Fintech4 days ago

Fintech4 days agoFintech Pulse: Your Daily Industry Brief (Chime, ZBD, MiCA)

-

Fintech7 days ago

Fintech7 days agoAsian Financial Forum returns as region’s first major international financial assembly in 2025

-

Fintech PR3 days ago

Fintech PR3 days agoAccording to Tickmill survey, 3 in 10 Britons in economic difficulty: Purchasing power down 41% since 2004

-

Fintech5 days ago

Fintech5 days agoAirtm Enhances Its Board of Directors with Two Strategic Appointments

-

Fintech PR3 days ago

Fintech PR3 days agoPresident Emmerson Mnangagwa met this week with Zambia’s former Vice President and Special Envoy Enoch Kavindele to discuss SADC’s candidate for the AfDB

-

Fintech5 days ago

Fintech5 days agoSPAYZ.io prepares for iFX EXPO Dubai 2025

-

Fintech PR3 days ago

Fintech PR3 days agoStay Cyber Safe This Holiday Season: Heimdal’s Checklist for Business Security