Fintech

McFarlane Lake Mining Limited Completes Reverse Takeover Transaction

Sudbury, Ontario–(Newsfile Corp. – January 14, 2022) – McFarlane Lake Mining Limited (“McFarlane” or the “Company“) (formerly 1287401 B.C. Ltd. (“128“)) is pleased to announce the completion of its previously announced reverse takeover transaction (the “RTO” or “Transaction“) with McFarlane Lake Mining Incorporated (“MCFL“), a privately held mineral exploration company incorporated under the laws of the Province of Ontario, by way of a three-cornered amalgamation (the “Amalgamation“).

In connection with the completion of the Transaction, the NEO Exchange Inc. (the “Exchange“) has conditionally approved the listing of the MLM Shares (as defined below). The MLM Shares are expected to commence trading on the Exchange under the symbol “MLM” on or about January 26, 2022. Listing will be subject to the Company meeting all of the Exchange’s listing requirements. A further press release will be issued once trading has commenced.

The Transaction

Prior to the completion of the Transaction, the Company: (i) completed a share split of its issued and outstanding common shares on the basis of 1.20967742 post-split shares for each 1 pre-split share; and (ii) approved the name change from “1287401 B.C. Ltd.” to “McFarlane Lake Mining Limited” (the “Name Change“).

The Transaction was completed according to the terms of a business combination agreement dated January 12, 2022 (the “Business Combination Agreement“). Pursuant to the Business Combination Agreement, on the date hereof, MCFL and 1000034047 Ontario Inc. (“Subco“) (a wholly-owned subsidiary of the Company incorporated under the laws of the Province of Ontario for the purpose of completing the Transaction) amalgamated in accordance with the provisions of the Business Corporations Act (Ontario) and continued operating under the name “McFarlane Lake Mining Incorporated” (“Amalco“).

In connection with the Transaction: (i) the holders of the 75,582,313 issued and outstanding common shares of MCFL (each a “Target Share“) received one common share of the Company (each a “MLM Share“) for each Target Share held; (ii) the holders of the 65,500 issued and outstanding common shares of Subco (each a “Subco Share“) received one MLM Share for each Subco Share held; (iii) as consideration for the issuance of the MLM Shares to effect the Amalgamation, the Company received one common share of Amalco for each MLM Share issued to holders of Target Shares and Subco Shares; and (iv) each Subco Share issued to the Company on incorporation was cancelled.

Additionally, the Company issued approximately 4,206,156 replacement warrants (the “MLM Warrants“) to existing holders of common share purchase warrants in MCFL and Subco on a 1:1 basis. Concurrently with the completion of the Transaction, the Company has: (i) granted an aggregate of 5,500,000 replacement options (“MLM Options“) to the directors and officers of MCFL, to purchase common shares (the “Option Shares“) of the Company, exercisable at a price of $0.10 per Option Share until May 31, 2026; and (ii) issued 834,575 replacement broker warrants and 262,500 replacement advisory warrants to Canaccord Genuity Corp. (“Canaccord“) on the same terms and conditions as the broker warrants and advisory warrants issued to Canaccord for services provided in connection with MCFL’s previously completed brokered and non-brokered offerings of units and flow-through common shares (together, the “Offerings“) (see the Company’s press release dated December 10, 2021 for further information regarding the Offerings).

In the near future, the Company plans on filing articles of continuance to continue from the Province of British Columbia into the Province of Ontario, subject to regulatory approvals.

A summary of material changes resulting from the Transaction are provided herein. For further information, readers are referred to the filing statement of the Company dated January 14, 2022 (the “Filing Statement“) which was prepared in accordance with the requirements of the Exchange and filed under the Company’s SEDAR profile at www.SEDAR.com. Included in the Filing Statement is a summary of the National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101“) technical report prepared pursuant to NI 43-101, prepared by Sears, Barry & Associates Limited partner Seymour M. Sears titled “NI 43-101 Technical Report on the High Lake and West Hawk Lake, Canada” with an effective date of May 25, 2021 (the “Technical Report“). The full version of the Technical Report is also available on the Company’s SEDAR profile at www.SEDAR.com.

Board and Management

Immediately after the completion of the Transaction, the Company reconstituted its board of directors to consist of seven (7) nominees of MCFL, and all existing officers of the Company resigned and were replaced by nominees of MCFL.

Consolidated Capitalization

After completion of the Transaction, there are: (i) 79,397,813 MLM Shares issued and outstanding; (ii) 4,206,156 MLM Warrants issued and outstanding, with each MLM Warrant being exercisable for a MLM Share at an exercise price of $0.60 and having an expiry date of December 9, 2024; and (iii) 5,500,000 MLM Options, with each MLM Option being exercisable for a MLM Share at a price of $0.10 until May 31, 2026.

Escrowed Securities

Pursuant to the requirements of the Exchange, upon listing of the MLM Shares, all securities of the Company that are held by “principals” of the Company (collectively, the “Escrowed Securityholders“) will be placed into escrow. Upon completion of the Transaction, there are an aggregate of 30,345,400 MLM Shares, 131,250 MLM Warrants and 5,000,000 MLM Options (collectively, the “Escrowed Securities“) held in escrow pursuant to a security escrow agreement (“Resulting Issuer Escrow Agreement“) entered into among TSX Trust Company, as the escrow agent, the Company, and the Escrowed Securityholders.

Subject to the Resulting Issuer Escrow Agreement, 25% of the Escrowed Securities held by the Escrowed Shareholders shall be released from escrow on the date the MLM Shares are listed on the Exchange (“Listing“), 25% shall be released from escrow 6 months after Listing, 25% shall be released from escrow 12 months after Listing, and the remaining 25% shall be released from escrow 18 months following Listing.

Directors and Officers

In connection with the Transaction, the following individuals were elected to serve as members of the board of directors of the Company or appointed as officers. The following information is as furnished by such directors and officers.

Mark Trevisiol, 60 – Chief Executive Officer, President and Director

Mr. Trevisiol is a professional engineer with 30 years of experience in mineral processing, mining, capital projects and executive management. Mr. Trevisiol spent over 20 years with Glencore predecessor companies Falconbridge Ltd. and Xstrata Nickel, where he was General Manager of Business Development and Strategy, General Manager of the Sudbury Smelter Business Unit, Manager of Smelter Operations and Superintendent of the Kidd Creek Zinc Plant. More recently, Mark held a number of executive leadership and board positions, including CEO positions at Crow flight Minerals and Silver Bear Resources. During his career, Mr. Trevisiol has had responsibility in mining and mineral processing for teams of up to 300 people, with responsibility for operations, safety & environment, custom feed, engineering, maintenance and technology. He has worked across several commodities, including nickel, cobalt, zinc, copper, lithium, gold, and silver. Mr. Trevisiol holds an Engineering degree from the University of Waterloo.

Charles Lilly, 63 – Chief Financial Officer, Corporate Secretary and Director

Mr. Lilly is a partner in the public accounting firm of Sostarich, Ross, Wright & Cecutti, LLP. He has a B. Comm from Laurentian University, where he graduated Summa Cum Laude, and an M.B.A. from the University of Toronto. Mr. Lilly has served as an officer or a director of a number of public corporations listed on the Toronto Stock Exchange and the Toronto Venture Stock Exchange.

Roger Emdin, 63 – Chief Operating Officer and Director

Mr. Emdin is a Professional Mining Engineer with more than 30 years of global experience in Operations, Projects, Engineering and Sustainable Development in both base metal and gold mining environments. Mr. Emdin started out in gold with the Dome and Canamax Resources in Ontario before turning to base metals in Zambia, returning to Canada but working globally as a consultant. Joined Glencore (Falconbridge) filling various roles including, Engineering Superintendent, Mine Manager (Craig & Nickel Rim South) and of Manager Sustainable Development for Sudbury Operations before coming back to gold in 2015 as the Vice President of Operations for Harte Gold. Mr. Emdin served as the Industry Co-Chair for the Mining Legislative Review Committee for 7 years, was active in the Ontario Mining Association and served as the Chair of the Board of Directors for the Centre for Excellence in Mining Innovation (CEMI). Mr. Emdin also participated with the Ontario government as a member of the Advisory Group to the Mining Health and Safety Prevention Review and was a member of the Board for Cambrian College for six years including roles of Chair of the Audit Committee and Chair.

Perry Dellelce, 58 – Director

Mr. Dellelce is a founder and the managing partner of Wildeboer Dellelce LLP, one of Canada’s leading corporate finance and transactional law firms. Mr. Dellelce practices in the areas of securities, corporate finance and mergers and acquisitions. Mr. Dellelce serves on the boards of many of Canada’s leading businesses, including but not limited to, Mount Logan Capital Inc. and Lendified Inc. Mr. Dellelce is the past chair and a current member of the board of directors of the Sunnybrook Foundation and the current chair of the NEO Exchange Inc. and Canadian Olympic Foundation. Mr. Dellelce holds a BA from Western University, a LLB from the University of Ottawa and an MBA degree from the University of Notre Dame.

Amanda Fullerton, 41 – Director

Ms. Fullerton has been the Vice-President, Legal & Corporate Secretary of GCM Mining Corp. since March 25, 2019. She has also been the Corporate Secretary at Denarius Silver Corp. since February 2021. She was a Vice President, Legal (and prior thereto, Associate, Legal) of Macquarie Capital Markets Canada Ltd. from March 24, 2014, to March 22, 2019. Prior thereto, Ms. Fullerton was an associate with Fasken Martineau DuMoulin LLP from September 2008 to March 2011 and MacLeod Dixon LLP (now Norton Rose Fulbright LLP) from March 2011 to March 2014 and practiced in the areas of corporate finance, mergers and acquisitions and corporate/commercial law, focused primarily on the mining industry.

Guy Mahaffy, 50 – Director

Mr. Mahaffy is the managing director of W.G. Mahaffy Limited, a financial advisory firm. He holds the professional designations of Chartered Accountant, Chartered Professional Accountant and Chartered Financial Analyst. He has over 25 years of experience, with the past 15 years focused on the junior resource sector. He has served as an officer and director of mineral resources exploration companies on both the Toronto Stock Exchange and the TSX Venture Exchange, including previously having served as a director and as the chief financial officer of Manitou Gold Inc. from June 2009 to June 2012. Mr. Mahaffy was reappointed to the board of directors of Manitou Gold in 2015 and currently serves as the Chair of that company’s board of directors. He is also currently the Chief Financial Officer of SPC Nickel Corp.

Fergus Kerr, 79 – Director

Mr. Kerr is a Professional Mining Engineer and is currently self employed as a consultant. Mr. Fergus Kerr is a graduate of the Royal School of Mines and a mining engineer with over 35 years of experience, including 14 years at Denison Mine’s Elliot Lake uranium mine, where he served as General Manager for five years. Subsequent to Denison, Mr. Kerr served as Sector Director at Workplace Safety & Insurance Board, and Mine Manager, Sudbury Operations at Inco LLC Area Manager at Inco’s Sudbury operations. Mr. Kerr is sought after health and safety specialist consulting globally with recent assignments in Mongolia, Indonesia and Australia.

Robert Kusins, 66 – Vice President, Geology

Mr. Kusins B.Sc., P Geo has over 35 years of mining, exploration and consulting experience. Mr. Kusins has spent his career involved with exploring, developing, validating and mining of a number of deposits including the Golden Giant Mine (Newmont Canada), Holloway Mine (Newmont Canada), Tundra Project (Noranda), Timmins West Mine Complex (Lake Shore Gold – Pan American Silver) and most recently the Sugar Zone Mine (Harte Gold). Mr. Kusins has worked in the capacity of Chief Geologist, Chief Resource Geologist and Geology Manager at producing mines where he has co-authored several NI 43-101 Technical Reports. Previous to working for Harte, Mr. Kusins was employed by SRK as a Principal Consultant (Geology) in the Sudbury office. Proficient in GEOVIA GEMS with expertise in three-dimensional geological modeling, developing and managing exploration programs, data management and mineral resource estimation.

Exchange Approval

The MLM Shares are expected to be listed for trading on the Exchange on or about January 26, 2022. The Listing remains subject to the final approval by the Exchange and fulfillment of all the requirements of the Exchange in order to obtain such approval including, among other things, submission and acceptance of all documents requested by the Exchange in its conditional acceptance letter and payment of all outstanding fees to the Exchange.

Early Warning

In connection with the Transaction, each of Perry Dellelce and Mark Trevisiol acquired ownership, control, or direction over MLM Shares requiring disclosure pursuant to the early warning requirements of applicable securities laws.

Mr. Dellelce, in exchange for his holdings of Target Shares, acquired 11,550,000 MLM Shares representing approximately 14.55% of the Company’s issued and outstanding shares on a non-diluted basis. Mr. Trevisiol directly and indirectly owns or controls 12,350,000 MLM Shares, which represents approximately 15.55% of the Company’s issued and outstanding shares on a non-diluted basis.

The securities of the Company acquired by each of Mr. Dellelce and Mr. Trevisiol are presently being held only for investment purposes. Subject to regulatory approval, each holder may from time to time in the future increase or decrease their ownership, control, or direction over securities of the Company held by each of them, through market transactions, private agreements or otherwise, the whole depending on market conditions, the business and prospects of the Company and other relevant factors.

A copy of each early warning report (the “Early Warning Report“) will be filed by each of Mr. Dellelce and Mr. Trevisiol, respectively, pursuant to applicable securities laws in connection with the completion of the Transaction. A copy of each Early Warning Report to which this press release relates will be available under the Company’s profile on SEDAR www.SEDAR.com.

The MLM Shares acquired by each of Mr. Dellelce and Mr. Trevisiol are held in escrow pursuant to the Resulting Issuer Escrow Agreement described above under “Escrowed Securities“.

Additional information on McFarlane can be found by reviewing its profile on SEDAR at www.sedar.com.

About McFarlane Lake Mining Limited

McFarlane’s wholly owned subsidiary McFarlane Lake Mining Incorporated, a corporation incorporated under the laws of the Province of Ontario, has entered into a definitive purchase agreement dated effective December 30, 2021 with Canadian Star Minerals Ltd. (“CSM“) to purchase all of CSM’s right, title and interest in the High Lake mineral property located immediately east of the Ontario-Manitoba border, the West Hawk Lake mineral property located immediately west of the Ontario-Manitoba border and the McMillan mineral property located 13km south of Espanola . In addition, McFarlane Lake Mining Incorporated holds options to purchase the Michaud/Munro mineral property and the Mongowin mineral property. McFarlane is a “reporting issuer” under applicable securities legislation in the provinces of British Columbia and Alberta.

Additional information on McFarlane can be found by reviewing its profile on SEDAR at www.SEDAR.com.

Qualified Persons

McFarlane engaged Sears, Barry & Associates Limited partner Seymour M. Sears (the “Author“) to prepare the Technical Report. The Author is a “qualified person” and considered “independent”, as such terms are defined in NI 43-101. All of the scientific and technical mining disclosure contained in this news release and the Filing Statement regarding the High Lake Property and West Hawk Lake Property has been reviewed and approved by the Author. The materials in Part IV – Information Concerning McFarlane – Material Mineral Project | High Lake – West Hawk Lake Project” in the Filing Statement comprise the “Summary” section of the Penouta Project Technical Report.

Cautionary Note Regarding Forward-Looking Information:

This news release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements of McFarlane to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could cause actual results to differ materially from those anticipated in these forward-looking statements are described under the caption “Risks and Uncertainties” in the Filing Statement dated as of January 14, 2022 which is available for view on SEDAR at www.sedar.com. Forward-looking statements contained herein are made as of the date of this press release and McFarlane disclaims, other than as required by law, any obligation to update any forward-looking statements whether as a result of new information, results, future events, circumstances, or if management’s estimates or opinions should change, or otherwise. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, the reader is cautioned not to place undue reliance on forward-looking statements.

McFarlane’s operations could be significantly adversely affected by the effects of a widespread global outbreak of a contagious disease, including the recent outbreak of illness caused by COVID-19. It is not possible to accurately predict the impact COVID-19 will have on operations and the ability of others to meet their obligations, including uncertainties relating to the ultimate geographic spread of the virus, the severity of the disease, the duration of the outbreak, and the length of travel and quarantine restrictions imposed by governments of affected countries. In addition, a significant outbreak of contagious diseases in the human population could result in a widespread health crisis that could adversely affect the economies and financial markets of many countries, resulting in an economic downturn that could further affect operations and the ability to finance its operations.

Further Information

For further information regarding the Transaction, please contact:

Mark Trevisiol, Chief Executive Officer, President and Director

McFarlane Lake Mining Limited

[email protected]

Al Wiens

Wildeboer Dellelce LLP

[email protected]

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/110310

Fintech

How to identify authenticity in crypto influencer channels

Modern brands stake on influencer marketing, with 76% of users making a purchase after seeing a product on social media.The cryptocurrency industry is no exception to this trend. However, promoting crypto products through influencer marketing can be particularly challenging. Crypto influencers pose a significant risk to a brand’s reputation and ROI due to rampant scams. Approximately 80% of channels provide fake statistics, including followers counts and engagement metrics. Additionally, this niche is characterized by high CPMs, which can increase the risk of financial loss for brands.

In this article Nadia Bubennnikova, Head of agency Famesters, will explore the most important things to look for in crypto channels to find the perfect match for influencer marketing collaborations.

-

Comments

There are several levels related to this point.

LEVEL 1

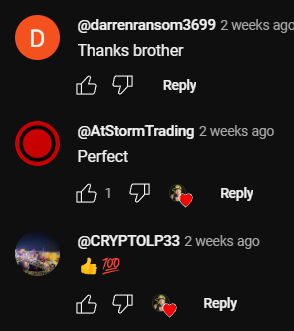

Analyze approximately 10 of the channel’s latest videos, looking through the comments to ensure they are not purchased from dubious sources. For example, such comments as “Yes sir, great video!”; “Thanks!”; “Love you man!”; “Quality content”, and others most certainly are bot-generated and should be avoided.

Just to compare:

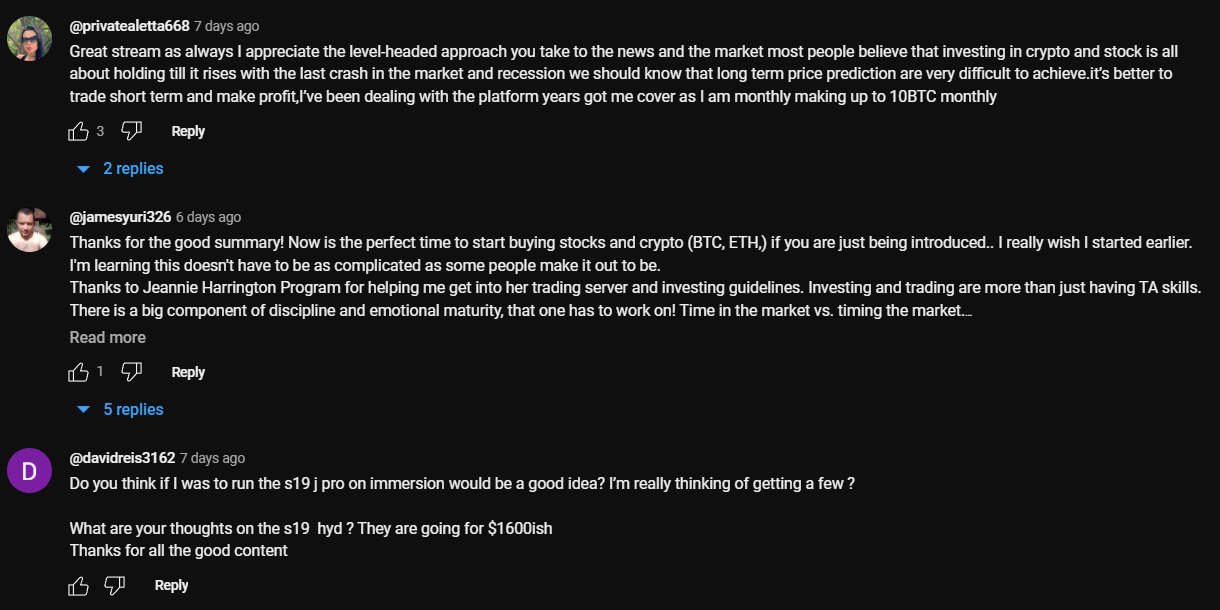

LEVEL 2

Don’t rush to conclude that you’ve discovered the perfect crypto channel just because you’ve come across some logical comments that align with the video’s topic. This may seem controversial, but it’s important to dive deeper. When you encounter a channel with logical comments, ensure that they are unique and not duplicated under the description box. Some creators are smarter than just buying comments from the first link that Google shows you when you search “buy YouTube comments”. They generate topics, provide multiple examples, or upload lists of examples, all produced by AI. You can either manually review the comments or use a script to parse all the YouTube comments into an Excel file. Then, add a formula to highlight any duplicates.

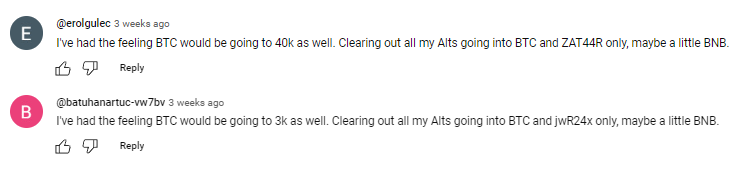

LEVEL 3

It is also a must to check the names of the profiles that leave the comments: most of the bot-generated comments are easy to track: they will all have the usernames made of random symbols and numbers, random first and last name combinations, “Habibi”, etc. No profile pictures on all comments is also a red flag.

LEVEL 4

Another important factor to consider when assessing comment authenticity is the posting date. If all the comments were posted on the same day, it’s likely that the traffic was purchased.

2. Average views number per video

This is indeed one of the key metrics to consider when selecting an influencer for collaboration, regardless of the product type. What specific factors should we focus on?

First & foremost: the views dynamics on the channel. The most desirable type of YouTube channel in terms of views is one that maintains stable viewership across all of its videos. This stability serves as proof of an active and loyal audience genuinely interested in the creator’s content, unlike channels where views vary significantly from one video to another.

Many unauthentic crypto channels not only buy YouTube comments but also invest in increasing video views to create the impression of stability. So, what exactly should we look at in terms of views? Firstly, calculate the average number of views based on the ten latest videos. Then, compare this figure to the views of the most recent videos posted within the past week. If you notice that these new videos have nearly the same number of views as those posted a month or two ago, it’s a clear red flag. Typically, a YouTube channel experiences lower views on new videos, with the number increasing organically each day as the audience engages with the content. If you see a video posted just three days ago already garnering 30k views, matching the total views of older videos, it’s a sign of fraudulent traffic purchased to create the illusion of view stability.

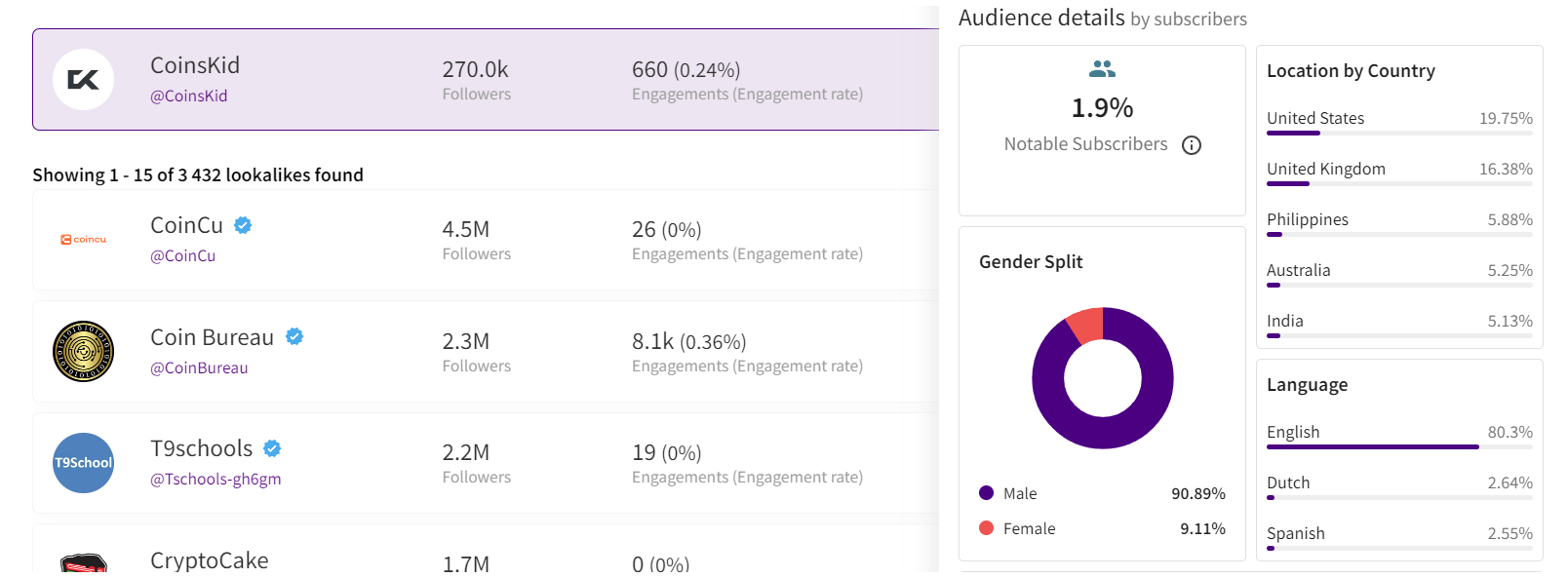

3. Influencer’s channel statistics

The primary statistics of interest are region and demographic split, and sometimes the device types of the viewers.

LEVEL 1

When reviewing the shared statistics, the first step is to request a video screencast instead of a simple screenshot. This is because it takes more time to organically edit a video than a screenshot, making it harder to manipulate the statistics. If the creator refuses, step two (if only screenshots are provided) is to download them and check the file’s properties on your computer. Look for details such as whether it was created with Adobe Photoshop or the color profile, typically Adobe RGB, to determine if the screenshot has been edited.

LEVEL 2

After confirming the authenticity of the stats screenshot, it’s crucial to analyze the data. For instance, if you’re examining a channel conducted in Spanish with all videos filmed in the same language, it would raise concerns to find a significant audience from countries like India or Turkey. This discrepancy, where the audience doesn’t align with regions known for speaking the language, is a red flag.

If we’re considering an English-language crypto channel, it typically suggests an international audience, as English’s global use for quality educational content on niche topics like crypto. However, certain considerations apply. For instance, if an English-speaking channel shows a significant percentage of Polish viewers (15% to 30%) without any mention of the Polish language, it could indicate fake followers and views. However, if the channel’s creator is Polish, occasionally posts videos in Polish alongside English, and receives Polish comments, it’s important not to rush to conclusions.

Example of statistics

Example of statistics

Wrapping up

These are the main factors to consider when selecting an influencer to promote your crypto product. Once you’ve launched the campaign, there are also some markers to show which creators did bring the authentic traffic and which used some tools to create the illusion of an active and engaged audience. While this may seem obvious, it’s still worth mentioning. After the video is posted, allow 5-7 days for it to accumulate a basic number of views, then check performance metrics such as views, clicks, click-through rate (CTR), signups, and conversion rate (CR) from clicks to signups.

If you overlooked some red flags when selecting crypto channels for your launch, you might find the following outcomes: channels with high views numbers and high CTRs, demonstrating the real interest of the audience, yet with remarkably low conversion rates. In the worst-case scenario, you might witness thousands of clicks resulting in zero to just a few signups. While this might suggest technical issues in other industries, in crypto campaigns it indicates that the creator engaged in the campaign not only bought fake views and comments but also link clicks. And this happens more often than you may realize.

Summing up, choosing the right crypto creator to promote your product is indeed a tricky job that requires a lot of resources to be put into the search process.

Author

Nadia Bubennikova, Head of agency at Famesters

Fintech

Central banks and the FinTech sector unite to change global payments space

The BIS, along with seven leading central banks and a cohort of private financial firms, has embarked on an ambitious venture known as Project Agorá.

Named after the Greek word for “marketplace,” this initiative stands at the forefront of exploring the potential of tokenisation to significantly enhance the operational efficiency of the monetary system worldwide.

Central to this pioneering project are the Bank of France (on behalf of the Eurosystem), the Bank of Japan, the Bank of Korea, the Bank of Mexico, the Swiss National Bank, the Bank of England, and the Federal Reserve Bank of New York. These institutions have joined forces under the banner of Project Agorá, in partnership with an extensive assembly of private financial entities convened by the Institute of International Finance (IIF).

At the heart of Project Agorá is the pursuit of integrating tokenised commercial bank deposits with tokenised wholesale central bank money within a unified, public-private programmable financial platform. By harnessing the advanced capabilities of smart contracts and programmability, the project aspires to unlock new transactional possibilities that were previously infeasible or impractical, thereby fostering novel opportunities that could benefit businesses and consumers alike.

The collaborative effort seeks to address and surmount a variety of structural inefficiencies that currently plague cross-border payments. These challenges include disparate legal, regulatory, and technical standards; varying operating hours and time zones; and the heightened complexity associated with conducting financial integrity checks (such as anti-money laundering and customer verification procedures), which are often redundantly executed across multiple stages of a single transaction due to the involvement of several intermediaries.

As a beacon of experimental and exploratory projects, the BIS Innovation Hub is committed to delivering public goods to the global central banking community through initiatives like Project Agorá. In line with this mission, the BIS will soon issue a call for expressions of interest from private financial institutions eager to contribute to this ground-breaking project. The IIF will facilitate the involvement of private sector participants, extending an invitation to regulated financial institutions representing each of the seven aforementioned currencies to partake in this transformative endeavour.

Source: fintech.globa

The post Central banks and the FinTech sector unite to change global payments space appeared first on HIPTHER Alerts.

Fintech

TD Bank inks multi-year strategic partnership with Google Cloud

TD Bank has inked a multi-year deal with Google Cloud as it looks to streamline the development and deployment of new products and services.

The deal will see the Canadian banking group integrate the vendor’s cloud services into a wider portion of its technology solutions portfolio, a move which TD expects will enable it “to respond quickly to changing customer expectations by rolling out new features, updates, or entirely new financial products at an accelerated pace”.

This marks an expansion of the already established relationship between TD Bank and Google Cloud after the group previously adopted the vendor’s Google Kubernetes Engine (GKE) for TD Securities Automated Trading (TDSAT), the Chicago-based subsidiary of its investment banking unit, TD Securities.

TDSAT uses GKE for process automation and quantitative modelling across fixed income markets, resulting in the development of a “data-driven research platform” capable of processing large research workloads in trading.

Dan Bosman, SVP and CIO of TD Securities, claims the infrastructure has so far supported TDSAT with “compute-intensive quantitative analysis” while expanding the subsidiary’s “trading volumes and portfolio size”.

TD’s new partnership with Google Cloud will see the group attempt to replicate the same level of success across its entire portfolio.

Source: fintechfutures.com

The post TD Bank inks multi-year strategic partnership with Google Cloud appeared first on HIPTHER Alerts.

-

Fintech7 days ago

Fintech7 days agoHow to identify authenticity in crypto influencer channels

-

Latest News6 days ago

HSBC-backed fintech Monese is considering splitting its operations as it grapples with increasing losses.

-

Latest News6 days ago

EverBank has announced a groundbreaking partnership with Finzly, poised to revolutionize payment processing.

-

Latest News6 days ago

FinTech leaders express caution regarding the promises made in #Budget2024 concerning open banking, stating that the “devil is in the details.”

-

Latest News6 days ago

Gotion High-tech’s operating profit up 391% in 2023, nearly RMB 2.8 billion invested in R&D for the year

-

Latest News5 days ago

Aurionpro Solutions acquires Arya.ai, to power next generation Enterprise AI platforms for Financial Institutions

-

Latest News6 days ago

Wells Fargo, a leading financial institution, is set to revolutionize its trade finance operations by incorporating artificial intelligence (AI) technology through its collaboration with TradeSun.

-

Latest News6 days ago

Latvian Fintech inGain Raises €650,000 for No-Code SaaS Loan Management System