Fintech

22NW Prevails Against Complaints by DIRTT’s Board

Seattle, Washington–(Newsfile Corp. – March 4, 2022) – 22NW Fund, LP (“22NW” or “we“) today provided an update on its efforts to bring change to DIRTT Environmental Solutions Ltd. (“DIRTT“). On November 16, 2021, 22NW, the largest shareholder of DIRTT, holding almost 19% of DIRTT’s outstanding shares, requisitioned a special meeting of the shareholders of DIRTT (the “Requisition“) to remove six of the current members of the board of directors of DIRTT (the “Board“) and replace them with six highly-qualified individuals.

22NW Prevails Against the Board Before the Alberta Securities Commission

On January 20, 2022, the Board brought an application (the “Application“) before the Alberta Securities Commission (the “ASC“) seeking various orders against 22NW, another major DIRTT shareholder and certain of their principals. 22NW believes that the Board filed the Application and made various related complaints against it to the ASC as a tactic to entrench itself against the Requisition, damage the business reputations of 22NW and its principals and avoid accountability to DIRTT’s shareholders.

We are pleased to announce that today the ASC has dismissed all claims brought against 22NW by the Board. In dismissing the Application, the ASC stated in oral reasons that it was “dismayed” that the Application had been brought in the first place, and that it was “ill conceived” and an “imprudent use” of DIRTT’s resources.

On November 26, 2021, within nine days of the delivery of the Requisition, 22NW’s Canadian counsel received a letter from DIRTT’s counsel accusing 22NW and another major DIRTT shareholder of a variety of alleged breaches of Canadian securities laws. On December 8, 2021, and again on December 31, 2021, the Board complained to staff of the ASC (“ASC Staff“) about 22NW and another major DIRTT shareholder. On January 20, 2022, the Board filed the Application with the ASC.

22NW believes that the Board has taken steps to confuse the market with its misleading public disclosures concerning the Application. DIRTT’s shareholders deserve to know the truth:

- Since Aron English’s initial meeting in September 2021 with Kevin O’Meara and Todd Lillibridge to discuss Mr. English’s potential membership on the Board, the Board has pursued a series of apparent delay tactics specifically designed to deny 22NW’s reasonable request, while insisting on a burdensome candidate review process for 22NW’s board candidates that was not applied to any of the other recently added Board members. Only during the Application process did 22NW learn that the Board was apparently preparing its entrenchment strategy before it even met with Mr. English for the first time to discuss his potential membership on the Board. We were disappointed to learn this, given that 22NW had previously sought to engage with the Board in a constructive and friendly manner, until 22NW felt it had no choice but to deliver the Requisition.

- 22NW had additional calls with the Board in October and November of 2021 to discuss Mr. English’s potential membership on the Board, which we believe is a reasonable request for a shareholder that owns nearly a fifth of DIRTT’s outstanding shares. However, the Board continued to make excuses and deny 22NW’s request for shareholder representation on the Board during this time. DIRTT then reported exceptionally weak 2021 Q3 results and pursued what we view as an unnecessary dilutive offering, not to mention its second dilutive offering within 12 months. It then became clear to 22NW that the Board was seeking to avoid accountability during a period of alarmingly poor operating results, necessitating immediate shareholder representation on the Board.

- On November 5, 2021, Mr. Lillibridge and Denise Karkainnen called Mr. English and once again declined to add him to the Board. Mr. English stated that 22NW would requisition a special meeting and replace a majority of the Board if 22NW and the Board could not quickly come to a negotiated arrangement that would provide for immediate shareholder representation on the Board. In our view, the Board had ample notice and warning of the actions 22NW intended to take and the Board’s own intransigence and desire for avoiding accountability to shareholders forced 22NW to make the Requisition when it became clear an amicable arrangement could not be reached.

- We believe that the proper course of action for a board of directors in the Board’s situation would have been to attempt to settle the matter with its largest shareholder to avoid an expensive and unnecessary distraction. To 22NW’s surprise, the Board never attempted to settle with 22NW and in fact did not even contact 22NW’s representatives after the Requisition was delivered to DIRTT. Instead, the Board “conducted extensive interviews” and determined within just nine days of receipt of the Requisition to pursue an apparent entrenchment strategy through its complaints to ASC Staff and ultimately the ASC. In fact, once the Application process began, it became clear that the Board had no substantive evidentiary justification for making the Application and it was filed for tactical reasons. 22NW estimates that the Board’s decision to pursue this entrenchment strategy has cost DIRTT hundreds of thousands of dollars in unnecessary legal fees, if not more.

- We did not understand why the Board refused to even entertain a settlement with us until we learned that the Special Committee of the Board formed to evaluate the Requisition was exclusively composed of Board members that 22NW sought to replace through the Requisition. Unsurprisingly, within mere days of the Special Committee’s formation, its four members, Mr. Lillibridge, Ms. Karkainnen, Shauna King and Diana Rhoten, who have no public investing experience between them, instead wrongly concluded that 22NW was acting jointly with another shareholder and caused DIRTT to send 22NW a letter threatening it with various alleged violations of Canadian securities laws. Mr. Lillibridge and Ms. Karkainnen, it should be remembered, were involved in the initial discussions with Mr. English regarding his potential appointment to the Board, representing two of the three members of the Board’s Nomination and Governance Committee.

- On December 9, 2021, 22NW delivered a proposed settlement term sheet to the Board that we believe was materially more favorable to the Board than the reconstitution of the Board put forward in the Requisition, seeking the removal of Mr. Lillibridge, Ms. Karkainnen and Steven Parry. 22NW’s settlement proposal was summarily ignored, while at the same time the Board made no counter proposal. Instead, the Board issued a series of press releases that in our view were misleading and highly inflammatory about 22NW and its principals.

- In January 2022, the Board contacted 22NW to initiate potential settlement discussions. 22NW responded by saying that it would agree to have discussions provided the Board ceased its complaints to regulators about 22NW. The Board refused and submitted the Application shortly thereafter.

- More troubling than this history of unconstructive and distracting dealings with 22NW is the apparent damage the Board is inflicting upon DIRTT and its shareholders as a result of its entrenchment strategy. On January 7, 2022, 22NW filed its definitive proxy statement with the U.S. Securities and Exchange Commission (the “SEC“) and on January 14, 2022, 22NW delivered to the Board non-binding indications of support from 22NW shareholders who 22NW believed totaled over 50% of DIRTT’s outstanding shares.[1] In what 22NW believes was a direct response to the receipt of this evidentiary support for 22NW, the Board terminated Mr. O’Meara as Chief Executive Officer and replaced him with Mr. Lillibridge, who was granted a generous compensation package. Remarkably, the Board’s Compensation Committee approved a one-time RSU grant of 230,414 DIRTT shares and about $42,000 worth of RSUs per month to Mr. Lillibridge. Two days later, the Board filed the Application.

- Notably during the Application process, Mr. O’Meara did not sign an affidavit or provide testimony, nor did Geoff Krause, DIRTT’s current Chief Financial Officer.

- In fact, the Board’s primary evidence supporting the Application came from Mr. Lillibridge, with whom Mr. English had only met once and had only spoken to a handful of times in October and November related to 22NW’s request for Mr. English’s appointment to the Board. Remarkably, during the Application proceedings, Mr. Lillibridge admitted that he was not present for most of the discussions referenced in his affidavit and that he had no direct knowledge of many of the claims the Board put forth as evidence for the Application. Furthermore, neither Mr. Lillibridge nor Kim MacEachern, DIRTT’s head of investor relations and the only other person who provided an affidavit in support of DIRTT’s claims during the Application process, ever expressed concerns about the actions or ownership disclosures of 22NW prior to delivery of the Requisition.

- Despite the Board’s entrenching tactic of repeatedly refusing to provide 22NW with a list of beneficial US shareholders, 22NW believes it has the overwhelming support of a majority of DIRTT’s shareholders. In its press release dated January 20, 2022, and during the Application process, the Board has tried in unconvincing ways to undermine and diminish the supportive indications of interest already delivered to 22NW, clearly missing the broader point that DIRTT’s shareholders have expressed a clear desire for change.

- The Board seems to have taken the position that any shareholder who is unsupportive of the Board is engaging in a conspiracy if that shareholder communicates its views with other shareholders. 22NW believes that the reality of the situation is that DIRTT’s shareholders have lost confidence in the Board. 22NW has dealt with this reality by seeking to force accountability on the Board through the Requisition.

- Instead of waiting until the ASC ruled on the Application and being open and transparent about these proceedings with its shareholders, the Board has filed a preliminary proxy statement with the SEC that contained numerous misrepresentations and omissions regarding 22NW and the Application process that appear calculated to damage 22NW and the reputation of its principals.

It is now abundantly clear to 22NW that the Board has little regard for working constructively with its shareholders, has wasted hundreds of thousands of dollars (possibly more), damaged DIRTT and its shareholders at a critical time, attempted to damage the business reputations of its largest shareholders and taken a number of steps to entrench itself.

The Track Record of the Board is Abysmal

The Board has communicated to the market that it has a “well-defined strategic plan” to address DIRTT’s core issues, which now includes identifying a replacement for Mr. O’Meara, who was terminated in the middle of 22NW’s campaign to reconstitute the Board.

We wonder how the Board measures success, because by many objective measures we believe the Board’s tenure has been a clear failure. Below are some key facts we use to measure the Board’s success, and why we have no faith in the Board to, in its own words, “Do It Right This Time”:

- Mr. Lillibridge, Ms. Karkainnen and Mr. Parry were added to the Board in August 2017, August 2015 and December 2011, respectively. Since being added to the Board, DIRTT’s stock price has returned -58.0%, -57.5%, and -14.9%, respectively, significantly underperforming its publicly traded peer group.[2]

- We believe Mr. Lillibridge, Ms. Karkainnen and Mr. Parry were primarily responsible for DIRTT cycling through four different Chief Executive Officers in about four years. Over the same period, these same individuals have been on the Board while it has received requisitions for special meetings from at least two different, frustrated shareholders.

- Mr. Lillibridge and Ms. Karkainnen were both members of the three-member Board Compensation Committee (the “Compensation Committee“) in 2018, 2019, 2020 and for part of 2021. Both were responsible for hiring Mr. O’Meara, establishing his compensation terms and working with him to establish the previous strategic plan. In 2020 and 2021, Mr. O’Meara received 2.5x and at least 3.0x his base salary in additional compensation, suggesting his performance was exceeding the measurements of success set by the Compensation Committee. Curiously, Mr. O’Meara’s performance only became an issue to the Board after the Requisition was delivered to DIRTT, and Mr. O’Meara was terminated as Chief Executive Officer just two days before the Board filed the Application. Approximately two weeks later, DIRTT reported operating results in line with Mr. O’Meara’s guidance. It is an astounding omission for the Board to suggest that it terminated Mr. O’Meara’s employment over performance related concerns within weeks of paying Mr. O’Meara a large incentive bonus, when the timeline indicates that the Board fired Mr. O’Meara immediately after receiving written confirmation that 22NW had obtained executed non-binding indications of support from holders who we believe hold over 50% of DIRTT’s outstanding shares.

- We believe the current “board refresh” the Board refers to is less of a strategic decision and more of a necessity in the face of widespread shareholder discontent. 22NW believes that the gaps being filled on the Board were caused primarily by the mismanagement of the three legacy members, Mr. Lillibridge, Ms. Karkainnen and Mr. Parry. Mr. Lillibridge’s “expertise” in the healthcare sector is frequently cited by the Board in granting him his initial board seat, appointing him chairman of the Board and appointing him as interim Chief Executive Officer. We believe his “expertise” has not translated into success for DIRTT. Since Mr. Lillibridge was added to the Board in 2017 Q3, DIRTT’s total revenues have declined approximately 36%.[3] Over the same period, DIRTT’s net income declined from CAD$4 million to about negative CAD$20 million and DIRTT’s health care revenues declined 68%.[4] Given the incredibly large opportunity within the broader market and the healthcare industry, we are shocked at Mr. Lillibridge’s inability to successfully generate value at DIRTT. We believe that he should not be given another opportunity to form a new plan to correct his historical shortfalls and that he is wholly-unqualified to serve as DIRTT’s interim Chief Executive Officer.

We also believe it is obvious that Mr. Lillibridge, Ms. Karkainnen and Mr. Parry, along with the rest of the Board, have no tangible record of success at DIRTT.

Correcting Misrepresentations by the Board

In our view, the Board has made several misrepresentations about 22NW, its intentions and actions. To be clear:

- 22NW has no intention to take DIRTT “private.” 22NW has never acquired any of its portfolio companies and does not intend to do so here.

- The ASC has clearly rejected the Board’s allegation that 22NW acted jointly or in concert with other DIRTT shareholders. Its public filings regarding DIRTT have been made in good faith and in compliance with applicable securities laws.

- The Board’s description of events surrounding DIRTT’s recent convertible debenture issuance relating to 22NW in its preliminary proxy statement are highly misleading and factually incorrect. 22NW had no knowledge of this financing, and merely assumed a dilutive capital raise was imminent after speaking with DIRTT’s management and simply conveyed its opposition to any dilutive financing.

22NW Will Ensure that the Board is Held Accountable

22NW fully intends to pursue all actions and reserves all rights with respect to the Requisition. Further, it intends to continue to solicit shareholders for the election of its director candidates at the upcoming annual and special meeting, in an effort to reconstitute the Board. 22NW demands that the Board discontinue its harmful actions and not pursue any additional delay tactics or unnecessary wasteful expenditures.

22NW is extremely frustrated how the Board, which collectively owns less than 1.0% of DIRTT’s outstanding shares, chose to handle the Requisition. 22NW believes that the Board has acted in bad faith and been inexcusably careless in carrying out its responsibilities, as illustrated by the hasty decision to replace Mr. O’Meara.

Should the Board attempt to change the meeting date from April 26th or further harm shareholders or 22NW in any way, 22NW intends to take immediate legal action.

Finally, 22NW wants to express its support for DIRTT’s employees, distribution partners and customers. 22NW is committed to bringing positive change to DIRTT.

FOR MORE INFORMATION

For further information or to receive a copy of the report filed in connection with this press release, please see DIRTT’s profile on the SEDAR website (http://www.sedar.com) and its US proxy materials that are available at no charge on the SEC’s website (http://www.sec.gov), or contact Aron English at 206-227-3078 or [email protected].

[1] In its preliminary proxy statement filed with the SEC on February 25, 2022, the Company has disclosed that the record date for the annual and special meeting of shareholders will be March 7, 2022 (the “Record Date“). As the Record Date has not yet occurred and the Company has not yet disclosed the number of shares outstanding as of the Record Date, we cannot verify the exact percentage of support received.

[2] Measured using TSX: DRT and Capital IQ as the data source. Measurement period includes the last day of the month each director was added through February 28, 2022. Calculation for Mr. Parry using 11/29/2013 as the first measurement day. The peer group was defined as the S&P 600 Building Products Index, which returned +106%, +168% and +219% over the course of Mr. Lillibridge’s, Ms. Karkainnen’s and Mr. Parry’s tenures, respectively.

[3] Per DIRTT’s public filings, assuming a currency conversion rate of 1.25 CAD for 1 USD.

[4] Ibid.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/115728

Fintech

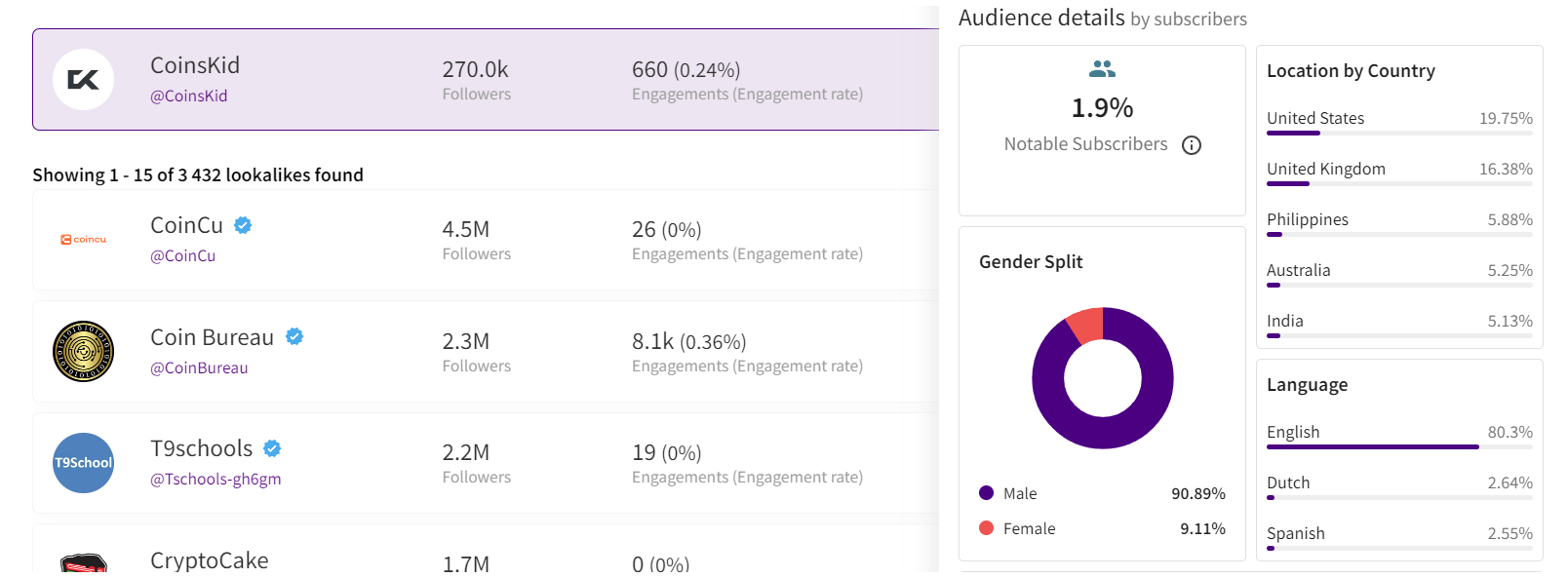

How to identify authenticity in crypto influencer channels

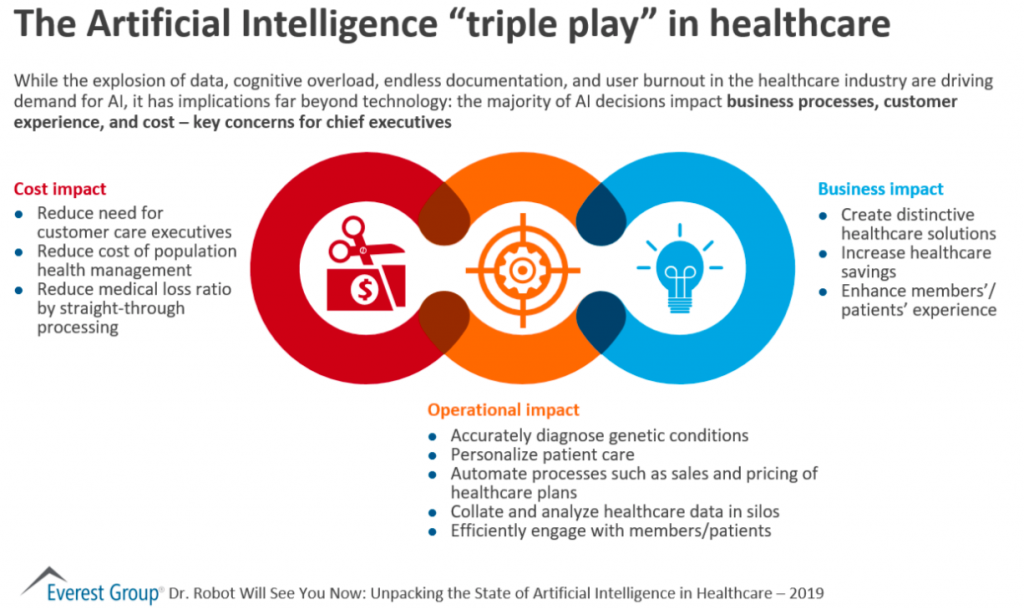

Modern brands stake on influencer marketing, with 76% of users making a purchase after seeing a product on social media.The cryptocurrency industry is no exception to this trend. However, promoting crypto products through influencer marketing can be particularly challenging. Crypto influencers pose a significant risk to a brand’s reputation and ROI due to rampant scams. Approximately 80% of channels provide fake statistics, including followers counts and engagement metrics. Additionally, this niche is characterized by high CPMs, which can increase the risk of financial loss for brands.

In this article Nadia Bubennnikova, Head of agency Famesters, will explore the most important things to look for in crypto channels to find the perfect match for influencer marketing collaborations.

-

Comments

There are several levels related to this point.

LEVEL 1

Analyze approximately 10 of the channel’s latest videos, looking through the comments to ensure they are not purchased from dubious sources. For example, such comments as “Yes sir, great video!”; “Thanks!”; “Love you man!”; “Quality content”, and others most certainly are bot-generated and should be avoided.

Just to compare:

LEVEL 2

Don’t rush to conclude that you’ve discovered the perfect crypto channel just because you’ve come across some logical comments that align with the video’s topic. This may seem controversial, but it’s important to dive deeper. When you encounter a channel with logical comments, ensure that they are unique and not duplicated under the description box. Some creators are smarter than just buying comments from the first link that Google shows you when you search “buy YouTube comments”. They generate topics, provide multiple examples, or upload lists of examples, all produced by AI. You can either manually review the comments or use a script to parse all the YouTube comments into an Excel file. Then, add a formula to highlight any duplicates.

LEVEL 3

It is also a must to check the names of the profiles that leave the comments: most of the bot-generated comments are easy to track: they will all have the usernames made of random symbols and numbers, random first and last name combinations, “Habibi”, etc. No profile pictures on all comments is also a red flag.

LEVEL 4

Another important factor to consider when assessing comment authenticity is the posting date. If all the comments were posted on the same day, it’s likely that the traffic was purchased.

2. Average views number per video

This is indeed one of the key metrics to consider when selecting an influencer for collaboration, regardless of the product type. What specific factors should we focus on?

First & foremost: the views dynamics on the channel. The most desirable type of YouTube channel in terms of views is one that maintains stable viewership across all of its videos. This stability serves as proof of an active and loyal audience genuinely interested in the creator’s content, unlike channels where views vary significantly from one video to another.

Many unauthentic crypto channels not only buy YouTube comments but also invest in increasing video views to create the impression of stability. So, what exactly should we look at in terms of views? Firstly, calculate the average number of views based on the ten latest videos. Then, compare this figure to the views of the most recent videos posted within the past week. If you notice that these new videos have nearly the same number of views as those posted a month or two ago, it’s a clear red flag. Typically, a YouTube channel experiences lower views on new videos, with the number increasing organically each day as the audience engages with the content. If you see a video posted just three days ago already garnering 30k views, matching the total views of older videos, it’s a sign of fraudulent traffic purchased to create the illusion of view stability.

3. Influencer’s channel statistics

The primary statistics of interest are region and demographic split, and sometimes the device types of the viewers.

LEVEL 1

When reviewing the shared statistics, the first step is to request a video screencast instead of a simple screenshot. This is because it takes more time to organically edit a video than a screenshot, making it harder to manipulate the statistics. If the creator refuses, step two (if only screenshots are provided) is to download them and check the file’s properties on your computer. Look for details such as whether it was created with Adobe Photoshop or the color profile, typically Adobe RGB, to determine if the screenshot has been edited.

LEVEL 2

After confirming the authenticity of the stats screenshot, it’s crucial to analyze the data. For instance, if you’re examining a channel conducted in Spanish with all videos filmed in the same language, it would raise concerns to find a significant audience from countries like India or Turkey. This discrepancy, where the audience doesn’t align with regions known for speaking the language, is a red flag.

If we’re considering an English-language crypto channel, it typically suggests an international audience, as English’s global use for quality educational content on niche topics like crypto. However, certain considerations apply. For instance, if an English-speaking channel shows a significant percentage of Polish viewers (15% to 30%) without any mention of the Polish language, it could indicate fake followers and views. However, if the channel’s creator is Polish, occasionally posts videos in Polish alongside English, and receives Polish comments, it’s important not to rush to conclusions.

Example of statistics

Example of statistics

Wrapping up

These are the main factors to consider when selecting an influencer to promote your crypto product. Once you’ve launched the campaign, there are also some markers to show which creators did bring the authentic traffic and which used some tools to create the illusion of an active and engaged audience. While this may seem obvious, it’s still worth mentioning. After the video is posted, allow 5-7 days for it to accumulate a basic number of views, then check performance metrics such as views, clicks, click-through rate (CTR), signups, and conversion rate (CR) from clicks to signups.

If you overlooked some red flags when selecting crypto channels for your launch, you might find the following outcomes: channels with high views numbers and high CTRs, demonstrating the real interest of the audience, yet with remarkably low conversion rates. In the worst-case scenario, you might witness thousands of clicks resulting in zero to just a few signups. While this might suggest technical issues in other industries, in crypto campaigns it indicates that the creator engaged in the campaign not only bought fake views and comments but also link clicks. And this happens more often than you may realize.

Summing up, choosing the right crypto creator to promote your product is indeed a tricky job that requires a lot of resources to be put into the search process.

Author

Nadia Bubennikova, Head of agency at Famesters

Fintech

Central banks and the FinTech sector unite to change global payments space

The BIS, along with seven leading central banks and a cohort of private financial firms, has embarked on an ambitious venture known as Project Agorá.

Named after the Greek word for “marketplace,” this initiative stands at the forefront of exploring the potential of tokenisation to significantly enhance the operational efficiency of the monetary system worldwide.

Central to this pioneering project are the Bank of France (on behalf of the Eurosystem), the Bank of Japan, the Bank of Korea, the Bank of Mexico, the Swiss National Bank, the Bank of England, and the Federal Reserve Bank of New York. These institutions have joined forces under the banner of Project Agorá, in partnership with an extensive assembly of private financial entities convened by the Institute of International Finance (IIF).

At the heart of Project Agorá is the pursuit of integrating tokenised commercial bank deposits with tokenised wholesale central bank money within a unified, public-private programmable financial platform. By harnessing the advanced capabilities of smart contracts and programmability, the project aspires to unlock new transactional possibilities that were previously infeasible or impractical, thereby fostering novel opportunities that could benefit businesses and consumers alike.

The collaborative effort seeks to address and surmount a variety of structural inefficiencies that currently plague cross-border payments. These challenges include disparate legal, regulatory, and technical standards; varying operating hours and time zones; and the heightened complexity associated with conducting financial integrity checks (such as anti-money laundering and customer verification procedures), which are often redundantly executed across multiple stages of a single transaction due to the involvement of several intermediaries.

As a beacon of experimental and exploratory projects, the BIS Innovation Hub is committed to delivering public goods to the global central banking community through initiatives like Project Agorá. In line with this mission, the BIS will soon issue a call for expressions of interest from private financial institutions eager to contribute to this ground-breaking project. The IIF will facilitate the involvement of private sector participants, extending an invitation to regulated financial institutions representing each of the seven aforementioned currencies to partake in this transformative endeavour.

Source: fintech.globa

The post Central banks and the FinTech sector unite to change global payments space appeared first on HIPTHER Alerts.

Fintech

TD Bank inks multi-year strategic partnership with Google Cloud

TD Bank has inked a multi-year deal with Google Cloud as it looks to streamline the development and deployment of new products and services.

The deal will see the Canadian banking group integrate the vendor’s cloud services into a wider portion of its technology solutions portfolio, a move which TD expects will enable it “to respond quickly to changing customer expectations by rolling out new features, updates, or entirely new financial products at an accelerated pace”.

This marks an expansion of the already established relationship between TD Bank and Google Cloud after the group previously adopted the vendor’s Google Kubernetes Engine (GKE) for TD Securities Automated Trading (TDSAT), the Chicago-based subsidiary of its investment banking unit, TD Securities.

TDSAT uses GKE for process automation and quantitative modelling across fixed income markets, resulting in the development of a “data-driven research platform” capable of processing large research workloads in trading.

Dan Bosman, SVP and CIO of TD Securities, claims the infrastructure has so far supported TDSAT with “compute-intensive quantitative analysis” while expanding the subsidiary’s “trading volumes and portfolio size”.

TD’s new partnership with Google Cloud will see the group attempt to replicate the same level of success across its entire portfolio.

Source: fintechfutures.com

The post TD Bank inks multi-year strategic partnership with Google Cloud appeared first on HIPTHER Alerts.

-

Latest News6 days ago

HSBC-backed fintech Monese is considering splitting its operations as it grapples with increasing losses.

-

Latest News6 days ago

EverBank has announced a groundbreaking partnership with Finzly, poised to revolutionize payment processing.

-

Latest News6 days ago

FinTech leaders express caution regarding the promises made in #Budget2024 concerning open banking, stating that the “devil is in the details.”

-

Latest News6 days ago

Gotion High-tech’s operating profit up 391% in 2023, nearly RMB 2.8 billion invested in R&D for the year

-

Latest News6 days ago

Aurionpro Solutions acquires Arya.ai, to power next generation Enterprise AI platforms for Financial Institutions

-

Latest News6 days ago

Wells Fargo, a leading financial institution, is set to revolutionize its trade finance operations by incorporating artificial intelligence (AI) technology through its collaboration with TradeSun.

-

Latest News6 days ago

Latvian Fintech inGain Raises €650,000 for No-Code SaaS Loan Management System

-

Latest News6 days ago

Credit card fintech Pliant lands €18m Series A extension led by PayPal Ventures