Fintech

Early Drill Results Intersect High Grade Gold – Expands Historic Mining Zone at McFarlane Lake Mining’s West Hawk Lake Property

Toronto, Ontario–(Newsfile Corp. – April 21, 2022) – McFarlane Lake Mining Limited (NEO: MLM) (“McFarlane” or the “Company“), a Canadian mineral exploration and development company, is pleased to provide an update of the progress made at the Company’s West Hawk Lake property in Manitoba, near the Ontario-Manitoba Border. A technical report (the “Technical Report“) prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101“) with respect to the West Hawk Lake and High Lake properties is available under the Company’s profile on SEDAR at www.SEDAR.com and on the Company’s website at https://mcfarlanelakemining.com/.

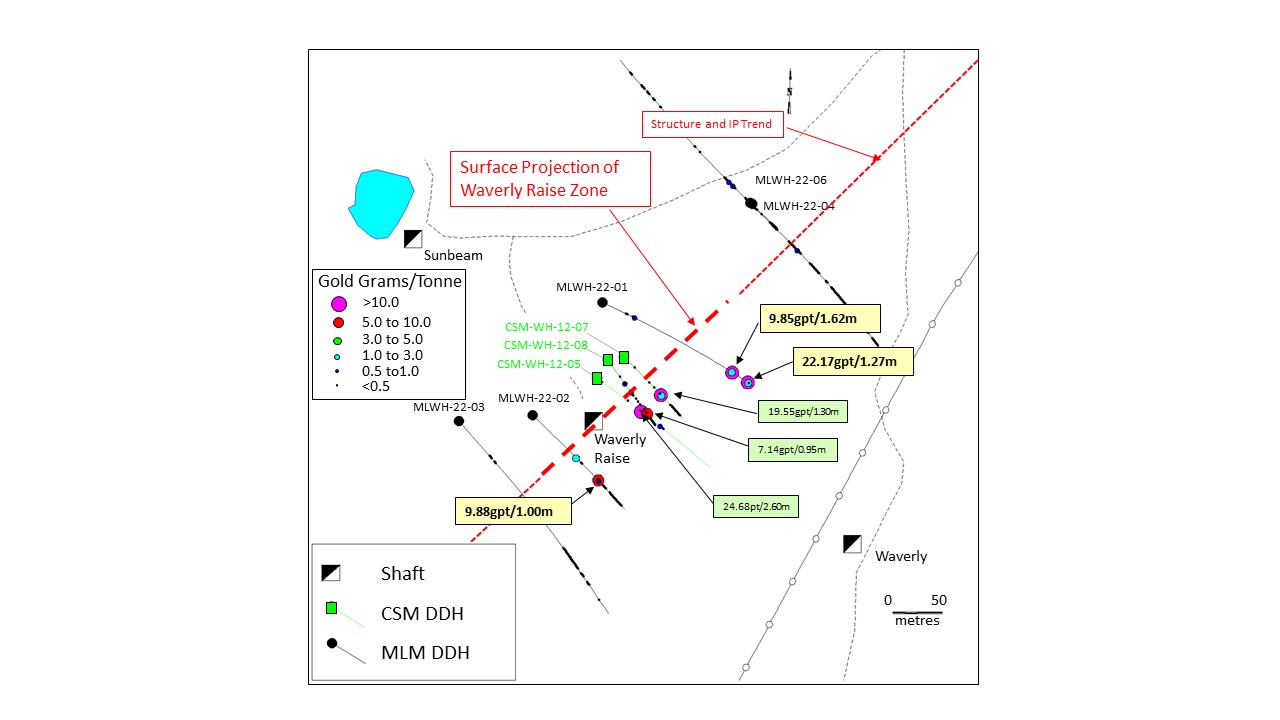

The first two drill holes of McFarlane’s 3,000m drill program conducted this year have successfully intersected the historic Waverly Raise Zone and expanded the zone laterally with intersections in both MLWH-22-01 and MLWH-22-02.

2022 Drilling Highlights of Waverly Raise Zone include:

- MLWH-22-01 intersected two zones, 22.17g/t gold over 1.27m including 49.4g/t gold over 0.55m, and 9.85g/t gold over 1.62m.

- MLWH-22-02 intersected a single zone of 9.88g/t over 1.0m.

Past Drilling (2012) Highlights in Waverly Raise Zone include:

- CSM WH-12-05 intersected 24.68 g/t over 2.6 m.

- CSM WH-12-07 intersected 19.55 g/t over 1.3 m.

The intersections have expanded upon the previous drilling program conducted by Canadian Star Minerals Ltd. (“CSM”) in 2012 at the Waverly Raise Zone, outlined in the Technical Report. The drill program has expanded the Waverly Raise Zone for a total length of 150m with the Waverly Raise Zone remaining open to depth and discovery of additional shoots along the established structural corridor and IP geophysics trend (Figure 1).

Drilling Program at West Hawk Lake

McFarlane initiated a 3,000m drill program in January 2022 to confirm past reported gold mineralization and to follow up on geophysical targets. Assay results from the first six holes have been received from the fifteen-hole program (which includes one abandoned hole). The drill program has confirmed prospective trends established by previous drilling and the recently completed IP survey, which outlined a number of favourable trends and anomalies (please refer to McFarlane’s news release dated March 21, 2022).

Drilling has intersected zones of sheared and altered quartz monzonite with local sections of quartz veining mineralized with fine pyrite, arsenopyrite and locally minor chalcopyrite and sphalerite. Gold mineralization often occurs within these more mineralized intervals. Thin mafic dikes frequently intrude these sheared sections and the dikes are subsequently sheared, altered and mineralized.

Figure 1: Waverly Raise Zone Drilling – Plan View – West Hawk Lake Project

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/8133/121108_688d642554a629ca_002full.jpg

Significant intersections are summarized in Table 1. Collar locations and details of the holes with assays received are summarized in Table 2.

Table 1: Significant Intersections.

| Hole ID | From metres |

To metres |

Length metres |

Gold grams/tonne |

| MLWH-22-01 | 154.78 | 156.40 | 1.62 | 9.85 |

| including | 155.60 | 156.40 | 0.80 | 17.50 |

| 174.63 | 175.90 | 1.27 | 22.17 | |

| including | 174.63 | 175.18 | 0.55 | 49.40 |

| MLWH-22-02 | 94.60 | 95.60 | 1.00 | 9.88 |

Because insufficient drilling has been conducted to determine true width, the results are reported as core length.

Table 2: Collar Location Details (NAD83 Zone 15).

| Hole ID | Easting (mE) |

Northing (mN) |

Elevation masl |

Azimuth Deg. |

Dip Deg. |

Length m |

| MLWH-22-01 | 337546 | 5511531 | 354.2 | 115.7 | -45.9 | 181.0 |

| MLWH-22-02 | 337494 | 5511446 | 351.0 | 133.6 | -44.0 | 133.6 |

| MLWH-22-03 | 337439 | 5511442 | 352.1 | 140.0 | -43.2 | 240.0 |

| MLWH-22-04 | 337658 | 5511604 | 355.3 | 135.0 | -45.0 | 37.5 |

| MLWH-22-04A | 337656 | 5511605 | 355.3 | 135.0 | -45.3 | 200.0 |

| MLWH-22-06 | 337656 | 5511605 | 355.3 | 314.3 | -44.3 | 200.0 |

Results from the remaining nine holes of the drill program have been submitted to the lab and will be reported upon completion.

QA/QC Control Procedures

McFarlane has implemented a Quality Assurance/ Quality Control (“QA/QC“) program consistent with industry best practices. The drill core is being logged and sampled at a nearby facility with sawn half core samples, including QA/QC samples, being sent to an accredited lab (Actlabs) in Thunder Bay for processing. The remaining half core has been retained in a locked facility for future examination. Certified reference material standards and blanks are inserted every 10 samples into the sample stream. Gold was analyzed by 30-gram fire assay with AA-finish. Samples above 5 grams per tonne were re-assayed for gold with a gravimetric finish, while those above 10 grams per tonne were re-assayed utilizing the pulp metallic method.

Qualified Person

The scientific and technical contents included in this news release have been reviewed, verified and approved by Robert Kusins, Vice President of Geology of McFarlane. Mr. Kusins is a qualified person as defined by NI 43-101. However, Mr. Kusins is not independent of the Company by virtue of his position.

About McFarlane Lake Mining Limited

McFarlane is a mineral exploration company focused on the exploration and development of the High Lake mineral property located immediately east of the Ontario-Manitoba border and the West Hawk Lake mineral property located immediately west of the Ontario-Manitoba border. In addition, McFarlane holds the McMillan and Mongowin mineral property located 70 km east of Sudbury and holds options to purchase the Michaud/Munro mineral property 115 km east of Timmins. McFarlane is a “reporting issuer” under applicable securities legislation in the provinces of Ontario, British Columbia and Alberta.

Additional information on McFarlane can be found by reviewing its profile on SEDAR at www.SEDAR.com.

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release, including without limitation; anticipated results of geophysical surveys or drilling programs, estimated timing, geological interpretations and potential mineral recovery processes. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements of McFarlane to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could cause actual results to differ materially from those anticipated in these forward-looking statements are described under the caption “Risk Factors” in the Filing Statement dated as of January 14, 2022 which is available for view on SEDAR at www.SEDAR.com. Forward-looking statements contained herein are made as of the date of this press release and McFarlane disclaims, other than as required by law, any obligation to update any forward-looking statements whether as a result of new information, results, future events, circumstances, or if management’s estimates or opinions should change, or otherwise. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, the reader is cautioned not to place undue reliance on forward-looking statements.

McFarlane’s operations could be significantly adversely affected by the effects of a widespread global outbreak of a contagious disease, including the recent outbreak of illness caused by COVID-19. It is not possible to accurately predict the impact COVID-19 will have on operations and the ability of others to meet their obligations, including uncertainties relating to the ultimate geographic spread of the virus, the severity of the disease, the duration of the outbreak, and the length of travel and quarantine restrictions imposed by governments of affected countries. In addition, a significant outbreak of contagious diseases in the human population could result in a widespread health crisis that could adversely affect the economies and financial markets of many countries, resulting in an economic downturn that could further affect operations and the ability to finance its operations.

Further Information

For further information regarding this press release, please contact:

Roger Emdin, Chief Operating Officer

McFarlane Lake Mining Limited

(705) 562-8520

[email protected]

Ryan Volk

NATIONAL Public Relations Inc.

(416) 689-8655

[email protected]

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/121108

Fintech

Fintech Pulse: Your Daily Industry Brief (Plaid, Warner Bros., TransUnion, Monevo, FinVolution, CreditTech, Glenbrook Partners)

Op-Ed: The Dawn of a Fintech Spring

As the financial technology sector continues to navigate the complex post-pandemic landscape, recent developments suggest a revitalized period of growth and innovation. Key players are making bold moves, partnerships are forming, and underserved markets are gaining attention. In this briefing, we explore the latest headlines and what they reveal about the industry’s trajectory.

Plaid Reports Growth in Revenue and Usage Rates

Plaid, the connective tissue of the fintech ecosystem, has shown remarkable resilience and growth. The company’s CEO recently highlighted a surge in both revenue and usage rates, describing the current period as a “fintech spring.” This growth comes as consumer demand for seamless financial solutions remains high, despite macroeconomic challenges.

Plaid’s ability to maintain relevance is tied to its strategic partnerships and continuous innovation. By enabling applications like Venmo and Robinhood to thrive, Plaid underscores the importance of integration in fostering user trust and utility.

Source: Bloomberg

Warner Bros. Discovery Strengthens Board with Fintech Leadership

Warner Bros. Discovery is diversifying its board by bringing in SoFi CEO Anthony Noto and outgoing IAC Chief Executive Joseph Levin. This move signals the increasing influence of fintech expertise beyond traditional financial sectors. With Noto’s leadership in digital banking and Levin’s extensive background in technology-driven enterprises, Warner Bros. Discovery is positioning itself for a future that seamlessly blends media and financial technology.

This cross-industry synergy could lead to innovative offerings, bridging gaps between entertainment platforms and fintech applications, such as micro-investing and personalized financial recommendations for content consumers.

Source: Reuters

TransUnion to Acquire Monevo

Credit reporting agency TransUnion has announced its plans to acquire Monevo, a leading credit prequalification and distribution platform. This acquisition aims to enhance TransUnion’s capabilities in the credit technology space, allowing it to offer more personalized and accessible financial solutions to consumers.

By integrating Monevo’s platform, TransUnion is expected to provide lenders with advanced tools to better assess creditworthiness while empowering consumers with prequalified loan offers. This development is particularly timely as consumers increasingly seek transparency and efficiency in credit processes.

Source: TransUnion Press Release

FinVolution Highlights CreditTech Opportunities in Southeast Asia

Ming Gu, Senior Vice President of FinVolution, emphasized the transformative potential of CreditTech in Southeast Asia during his address at the Asian Financial Forum. With a significant portion of the region’s population still underserved by traditional financial institutions, CreditTech presents a unique opportunity to bridge the gap.

Gu pointed out that leveraging AI and data analytics can help tailor credit solutions for diverse needs, ultimately fostering financial inclusion and economic growth in these emerging markets. FinVolution’s insights reaffirm the critical role of fintech in empowering underserved communities.

Source: PR Newswire

Glenbrook Partners Launches On-Demand Learning Program

Payments consultancy Glenbrook Partners has introduced an on-demand learning platform designed to educate professionals in the payments industry. This initiative is expected to address the growing need for skilled talent as digital payment ecosystems expand globally.

The program offers modular content covering foundational and advanced topics, catering to professionals at various stages of their careers. By equipping individuals with in-depth knowledge, Glenbrook is contributing to the industry’s sustainability and growth.

Source: PR Newswire

Analysis and Takeaways

These stories collectively highlight a few key trends shaping the fintech landscape:

- Resilient Growth: Plaid’s trajectory reaffirms that consumer-centric innovations drive sector resilience even during economic uncertainties.

- Cross-Industry Integration: Warner Bros. Discovery’s board appointments underline fintech’s permeation into traditionally non-financial domains.

- Strategic Acquisitions: TransUnion’s acquisition of Monevo showcases how established players are leveraging fintech to enhance service offerings.

- Global Inclusivity: Efforts by FinVolution and others highlight the role of fintech in addressing global financial disparities.

- Education and Skill Development: Initiatives like Glenbrook’s program reflect a proactive approach to fostering a knowledgeable workforce.

The post Fintech Pulse: Your Daily Industry Brief (Plaid, Warner Bros., TransUnion, Monevo, FinVolution, CreditTech, Glenbrook Partners) appeared first on News, Events, Advertising Options.

Fintech

io.finnet and Cede Labs Partner to Transform Multi-Exchange Portfolio Management for Institutions

io.finnet, a leader in digital asset infrastructure, has partnered with Cede Labs, to introduce a solution for centralized exchange (CEX) connectivity. This collaboration provides institutional clients with a streamlined, secure platform for comprehensive multi-exchange portfolio management. Through this integration, io.finnet clients can now access leading exchanges such as Binance, Coinbase, Bybit, OKX, Kraken and more with features tailored for institutional-grade governance and operational efficiency.

Institutional digital asset management faces increasing complexity as businesses demand more secure and efficient tools to oversee diverse portfolios. With 70% of institutional investors expecting a surge in digital asset-focused funds, the need for secure and efficient multi-exchange solutions has never been greater.

“Businesses require solutions that simplify the complexity of managing assets across exchanges while maintaining the highest standards of security.” said Jacob Plaster, CTO of io.finnet. “Through our partnership with Cede Labs, clients can seamlessly connect their exchange accounts and manage their entire portfolio within a unified, secure environment.”

Unlike traditional offerings, io.finnet’s integration with Cede Labs introduces secure account-linking capabilities, allowing clients to effortlessly connect and unlink their exchange accounts while adhering to strict governance protocols. Unified tracking capabilities further enhance this solution, enabling users to monitor their portfolios across all connected exchanges in real-time. This includes the ability to oversee spot and trading wallets, derivatives positions, and sub-accounts under a single pane of glass, a feature few competitors offer at this scale.

Pierre Ni, CEO of Cede Labs, highlighted the impact on institutional workflows: “We are proud to collaborate with io.finnet to redefine digital asset custody and management. By unlocking new use cases for corporates, market makers, liquid funds, foundations, and fintechs through CEX connectivity, we believe io.finnet can grow to become one of the top self-custody players.”

This partnership is particularly timely as market demand for interoperable solutions continues to rise. The integration will eliminate the need to navigate multiple platforms and provide institutions with real-time visibility across their digital asset holdings, enabling seamless exchange connectivity and enhanced risk management.

io.finnet is committed to enhancing its exchange connectivity capabilities with deposits, withdrawals, trades, and sub-account transfers to further streamline asset management workflows. Stay tuned for exciting updates as we expand the possibilities of our Exchange Connectivity feature.

The post io.finnet and Cede Labs Partner to Transform Multi-Exchange Portfolio Management for Institutions appeared first on News, Events, Advertising Options.

Fintech

Blocks & Headlines: Today in Blockchain (

Welcome to Blocks & Headlines, your comprehensive daily briefing on the transformative world of blockchain. Today, we explore groundbreaking partnerships, economic innovations, and blockchain-powered initiatives redefining the future.

Sony Ventures Into Blockchain With New Identity Solutions

Sony has unveiled its latest blockchain-based digital identity solution designed to enhance privacy and security in the online space. This innovative system uses decentralized technology to manage digital credentials, making identity verification seamless and secure.

Sony’s venture reflects a broader trend among tech giants exploring blockchain’s potential to reshape data privacy and authentication systems.

Source: Sony Press Release

TRON’s Daily Revenue Skyrockets 119% in 2024

TRON has reported a staggering 119% increase in daily revenue, a testament to its innovative blockchain economic models. By leveraging smart contracts and a scalable infrastructure, TRON continues to attract developers and businesses seeking cost-efficient blockchain solutions.

This growth positions TRON as a leading player in the competitive blockchain ecosystem, setting benchmarks for others to follow.

Source: Bitcoin.com

MIGMIG Partners With XT.com to Bring Blockchain Rewards

MIGMIG, a blockchain gaming and rewards platform, has partnered with XT.com to expand its reach and user engagement. This collaboration aims to deliver unique blockchain-powered rewards while enhancing the gaming experience for users worldwide.

The partnership highlights the increasing intersection of blockchain technology and entertainment, opening new avenues for user interaction.

Source: Bitcoinist

Nano Labs Supports the Inaugural Presidential Crypto Ball

Nano Labs has announced a partnership with the Inaugural Presidential Crypto Ball, emphasizing its commitment to fostering blockchain awareness. This high-profile event aims to bridge the gap between blockchain innovators and policymakers, paving the way for broader adoption.

The initiative underscores the importance of collaboration between the blockchain community and governmental bodies to shape the future of digital assets.

Source: PR Newswire

Bybit Card Partners With EnTravel for Luxury Travel Perks

Bybit has teamed up with EnTravel to offer its cardholders exclusive discounts on luxury travel experiences. This partnership integrates blockchain-powered payment solutions with high-end travel services, providing users with unparalleled convenience and value.

The move exemplifies how blockchain technology can enhance traditional industries, offering innovative solutions tailored to modern consumer needs.

Source: PR Newswire

Key Insights and Industry Trends

- Decentralized Identity: Sony’s blockchain-based solution addresses growing concerns over online security and privacy.

- Economic Innovations: TRON’s revenue surge highlights the profitability of scalable blockchain networks.

- Gaming and Blockchain: Partnerships like MIGMIG and XT.com showcase the potential of blockchain in entertainment.

- Policy and Collaboration: Nano Labs’ involvement in the Crypto Ball underscores the importance of industry-government dialogue.

- Luxury Integration: Bybit and EnTravel demonstrate blockchain’s ability to enhance traditional services.

The post Blocks & Headlines: Today in Blockchain ( appeared first on News, Events, Advertising Options.

-

Fintech PR6 days ago

Fintech PR6 days agoHTX 2025 Outlook: Five Sectors to Look Forward to, and How Trump’s Policy Will Affect Crypto Industry

-

Fintech PR6 days ago

Fintech PR6 days agoNovo Holdings invests in $200M Series A for Windward Bio launch to advance long-acting treatments for asthma and COPD

-

Fintech PR6 days ago

Fintech PR6 days agoAZZURRI GROUP LAUNCHES ITS 2024 SUSTAINABLE DINING REPORT AND ACHIEVES FURTHER REDCUTIONS IN CARBON EMISSIONS

-

Fintech PR6 days ago

Fintech PR6 days agoFintech nsave launches investment platform, offering people from distressed economies protection from inflation with compliant and safe investments abroad

-

Fintech PR6 days ago

Fintech PR6 days agoAmrop, a Leading Global Executive Search and Leadership Consulting Firm, Announces New Office in Japan

-

Fintech1 day ago

Fintech1 day agoFintech Pulse: Your Daily Industry Brief (Float Financial, Alza Fintech, Thrive Capital, Stripe, Unzer, Agora Data)

-

Fintech PR6 days ago

Fintech PR6 days ago2024 Marks Breakout Year for China’s ETF Market with Unprecedented Growth

-

Fintech1 day ago

Fintech1 day agoFintech Pulse: Your Daily Industry Brief (Orion, Envestnet, Chime, Plaid, Brex, Dave, Fincover.com)