Fintech

Fission 3.0 Starts Follow Up Drilling of Off-Scale Mineralization at PLN and Presents Winter 2022 Drill Results

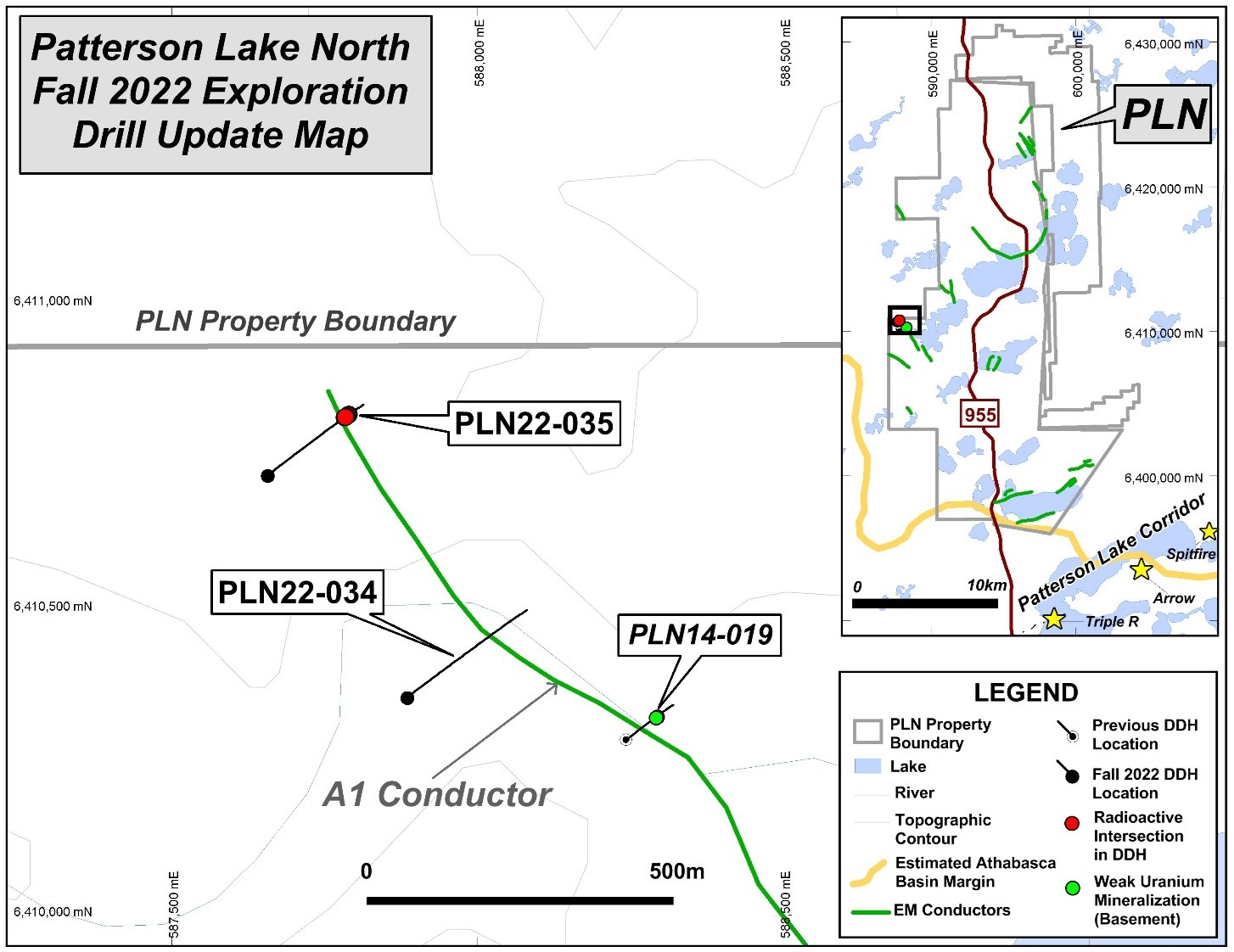

Kelowna, British Columbia–(Newsfile Corp. – November 28, 2022) – FISSION 3.0 CORP (TSXV: FUU) (OTCQB: FISOF) (“Fission 3” or “the Company”) is pleased to announce that follow up drilling of the new high grade discovery on the A1 conductor has begun where hole PLN22-035 intersected extremely radioactive and off-scale (>65,000 cps) mineralization.

Fission 3.0 currently has two diamond drills on the property and will be drilling a total of up to 7 holes prior to the Christmas break. A sonic drill is being used to penetrate the overburden allowing for shallow angled holes to be drilled so that the reported intervals from steeply dipping lithologies are closer to true thickness.

The split core samples from discovery hole PLN22-035 are scheduled for shipping from site to SRC Geoanalytical Laboratories in Saskatoon, SK for rush analysis.

Drilling Highlights from Discovery Hole:

PLN22-035 (line 00N)

- 15.0 m total composite mineralization >300 cps over a 15.5 m interval (between 257.0 m to 272.5 m), including

- 5.62 m of total composite mineralization >10,000 cps over a 6.3 m interval (between 259.0 m and 265.3 m including

- 1.5 m of total off scale radioactivity (>65,000 cps) over a 2.0 m interval (between 262.0 m and 264.0 m)

- 5.62 m of total composite mineralization >10,000 cps over a 6.3 m interval (between 259.0 m and 265.3 m including

- the hole was terminated at 350.0 m without any further anomalous radioactivity being intersected.

(See News Release November 21, 2022 for Drill Hole Summary Table)

Raymond Ashley, Vice President Exploration, commented:

“The drill program has been amended to delineate the new off-scale mineralization within the 15.0m wide hydrothermally altered structure. Plans are for up to three step out holes to be drilled in the current program in close proximity to the mineralization in discovery hole PLN22-035 to test for continuity of the mineralization and to begin to determine its orientation and geometry. These are thrilling times for the entire team as we set about to establish the size potential of this exciting new discovery.”

Patterson Lake North

Fall 2022 Exploration

Drill Update Map

To view an enhanced version of this Map, please visit:

https://images.newsfilecorp.com/files/8110/145873_0682a2cdc4b289ee_003full.jpg

Note that there was a scale bar error in the Nov 21, 2022 Press Release where this map first appeared.

Geochemistry Results from Winter 2022 Broach Lake and N Conductor Drilling:

The Company is pleased to report the results of the drilling program carried out earlier this year at the previously untested N Conductor and Broach Lake targets. The Broach Lake conductors and the N Conductors are located ~15 km southeast of the A1 conductor and ~15km north northeast of the A1 conductor, respectively, and are completely different conductor systems to the A1 Conductor where radioactive off-scale mineralization was intersected.

Maps and cross sections can be viewed at https://www.fission3corp.com/projects/athabasca-basin/pls-area-projects/patterson-lake-north-pln/

Key Program Details:

- Drill hole PLN22-029 which was the first test of the N Conductor Complex in the northeast part of the property intersected highly elevated boron values over a 70 m interval within Athabasca sandstone averaging 1051 ppm boron from 550.0 – 620.0 m, including a 10 m interval averaging 1780 ppm boron, above graphitic faults in the basement. This is considered highly anomalous due to both the significant width of the intersection and the highly elevated concentrations. Boron is an important pathfinder element as it occurs along the structural corridors which host the uranium deposits in the Athabasca Basin. Concentrations of boron in the sandstone of more than approximately 300 ppm are normally considered anomalous.

- At Broach Lake dravite was visually identified in holes PLN22-028 and 030B along the NE trending conductor (see New Release March 2, 2022) approximately 20 m below the unconformity at 280 m depth. Geochemical analyses from these intervals returned 398 ppm boron and 229 ppm boron over 0.5 m respectively. Dravite is a boron-bearing tourmaline mineral often found in association with uranium mineralization.

- A total of 3908 m of diamond drilling was completed in 6 holes one hole testing the N Conductor and 5 holes testing the Broach Lake Conductors located 9 km north of the Patterson Lake South structural corridor.

Raymond Ashley, VP Exploration for Fission 3.0 commented:

“The winter program was a successful first test of the Broach Lake and N Conductor Targets. The highly anomalous boron anomalies in the overlying sandstone at the N Conductor complex, above graphitic basement structures with elevated values of pathfinder elements commonly associated with Athabasca uranium mineralization, identify the deep N Conductor Complex as a new structural corridor with strong uranium potential. The confirmation of dravite in graphite and sulphide rich altered structures speaks to the uranium potential along the Broach Lake conductors.”

Summary of Drilling:

Table 1 below summarizes the 6 holes completed winter 2022 program

| Target | Hole ID | Easting | Northing | Azimuth | Dip | Athabasca Unconformity Depth (m) | Total Depth (m) |

| Broach Lake | PLN22-028 | 599774 | 6399587 | 315 | -66 | 251.6 | 401.0 |

| N Conductors | PLN22-029 | 595959 | 6422603 | 60 | -75 | 676.0 | 1157.0 |

| Broach Lake | PLN22-030 | 599983 | 6399955 | 93 | -77 | 131.0 | |

| Broach Lake | PLN22-030A | 599983 | 6399956 | 93 | -77 | 250.9 | 366.0 |

| Broach Lake | PLN22-030B | 599983 | 6399956 | 93 | -77 | 281.0 | |

| Broach Lake | PLN22-031 | 600721 | 6400609 | 355 | -70 | 293.6 | 620.0 |

| Broach Lake | PLN22-032 | 601024 | 6400630 | 2 | -68 | 299.6 | 575.0 |

| Broach Lake | PLN22-033 | 599983 | 6399960 | n.a. | -90 | 242.0 | 377.0 |

| Program Total | 3908 |

Drill collar locations in UTM NAD 83 coordinates

N Conductor Drilling:

The N Conductor Complex is located 22 km north of Broach Lake in the northeast part of the property. Angled drill hole (PLN22-029) was designed to test the west side of the 1 km-wide N Conductor complex which is defined by multiple parallel northeast trending basement EM conductors with an overlying resistivity low. A highly anomalous 70 m wide interval of sandstone was intersected with an average of 1051 ppm boron from 550.0 – 620.0 m, including a 10 m interval averaging 1780 ppm boron, above multiple graphite and sulphide rich fault structures within a 91 m core interval in the basement. Geochemical results outlined anomalous values for pathfinder elements associated with unconformity style uranium mineralization within the graphitic and sulphide rich structures.

PLN22-029: Angled hole intersected the Athabasca Unconformity at 676.0 m. The geochemistry displayed significant enrichment of 1051 ppm boron over a 70 m interval of Athabasca sandstone from 550.0 – 620.0 m. The bottom 28.5 m of sandstone was unconsolidated and altered corresponding with the resistivity anomaly in the lower sandstone (See News Release Jan 10, 2022). The basement rocks were comprised of Quartz-Feldspar-Biotite Gneiss and Granitoids; a strongly graphitic unit with patches of disseminated sulphides intersected from 773.1 – 779.9 m returned analytical values suggesting pathfinder element enrichment of nickel, lead and uranium. Weakly anomalous radioactivity with a peak of 300 cps was measured on drill core at a depth of 783.8 m (see News Release March 2, 2022). Geochemical analysis returned values of <2 ppm uranium and 141 ppm thorium from 783.5 – 784.0 m indicating elevated thorium concentrations. Multiple graphite and sulphide rich structures were intersected from 997.2 – 1000.3 m, 1044.0 – 1045.5 m, 1048.3 – 1049.2 m and 1085.2 – 1088.0 m with moderate to strong silicification and clay alteration displaying cataclastic and mylonitic textures indicating brittle ductile structures. Anomalous pathfinder elements, including uranium, are associated with some of the basement structures. The graphitic and sulphide rich basement structures correspond to electromagnetic responses. The hole was originally planned to 750 m but was extended at depth to test as much geology as possible laterally towards the centre of the N Conductor corridor. The downhole gamma log stopped at 972 m, the depth limit of the logging cable. The hole was terminated at 1157.0 m.

Geochemical analysis returned the following enrichment in pathfinder elements:

- 1051 ppm boron from 550.0 m-620.0 m with a peak of 1780 ppm boron (570.0 – 580.0 m) in Athabasca sandstone

- 408 ppm nickel from 773.0 – 779.5 m with a peak of 668 ppm (775.5 – 776.0 m), 25 ppm lead with a peak of 46 ppm lead (774.0 – 774.50 m), 18 ppm uranium with a peak of 26 ppm uranium (775.5 – 776.0 m) in the graphite and sulphide rich unit

- 459 ppm copper from 997.0 – 1000.5 m with a peak of 1380 ppm copper (998.0 – 998.5 m) in the ductile shear zone

Broach Lake Drilling:

The Broach Lake Conductors are located in the south-east region of the property, situated 9 km to the north and adjacent and parallel to EM conductors of the Patterson Lake Corridor, host to Fission Uranium’s Triple R deposit and NexGen’s Arrow Deposit. Three holes tested the NE-trending conductor, and two holes tested the more easterly trending conductor located to the north. All holes intersected variable intervals of strong chlorite, clay, and silica alteration as well as bleaching and intense hematite alteration.

PLN22-028: Angled hole to test the NE-trending ground EM conductor near the east end of Broach Lake. The Athabasca unconformity was intersected at 251.6 m. Visible dravite was observed in fractures and faults at 263 m, 272 m and 278 m with more possible minor dravite in other fractures in this section. Geochemical analyses in these samples were elevated ranging up to 398 ppm boron. No anomalous radioactivity was intersected in the drill hole which was terminated at 401.0 m depth.

Geochemical analysis identified anomalous boron (352 ppm) from 247.5 – 251.0 m with a peak of 798 ppm (248.5 – 249.0 m) in the Athabasca sandstone

PLN22-030: Angled hole targeting the NE-trending ground EM conductor was a 400 m step out from hole PLN22-028 to test the N-S trending resistivity low in the basement. The hole was lost at 131.0 m.

PLN22-030A: Restart of hole PLN22-030. The Athabasca unconformity was intersected at 250.9 m. A 40.8 m core interval with strong hematite and silica alteration and bleaching was intersected from 271.6 – 312.4 m. Geochemical analyses showed several samples with elevated boron in this alteration zone ranging up to 257 ppm boron over 0.5m. At the bottom of the zone a quartz-rich brittle fault was intersected from 306.2 – 307.8 m, immediately followed by a ductile shear zone with graphite, sulphides, clay, and strong hematite alteration to 312.4 m depth. These structures correspond to the ground EM conductor. No radioactivity was observed in core or in the down hole gamma probe which stopped at 240 m due to a hole blockage. The hole caved at 366.0 m and was continued as PLN22-030B.

Geochemical analysis identified:

- anomalous boron (401 ppm) from 200.0 -210.0 m in the Athabasca sandstone

PLN22-030B: Restart of hole PLN22-030A. Strong hematite alteration with bleaching was intersected over a 31.7 m interval from 274.1 – 305.8 m, which corresponds to the intersection from 271.6 – 312.4 m in hole PLN22-30A. Geochemical analyses identified elevated boron throughout this alteration zone ranging up to 314 ppm over 0.5 m, including 276 ppm boron from 274.0 – 276.0 m. The visually identified dravite at 280 m returned geochemical analyses of 229 ppm boron from 280.25 – 280.75 m. The hole was terminated at a depth of 545.0 m.

PLN22-031: Angled hole to test the east trending ground conductor northeast of Broach Lake. The Athabasca unconformity was reached at 293.6 m. Anomalous radioactivity of 220 cps was measured with the handheld spectrometer, with a peak of 1077 cps on the down hole gamma probe, in Quartz-Feldspar-Biotite-Gneiss. Geochemical analyses from this interval returned 38 ppm uranium from 345.5 – 345.75 m. Anomalous radioactivity with a maximum of 510 cps measured with the handheld spectrometer, and a peak of 2,383 cps with the down hole gamma probe, was observed in drill core in a brittle fault with brecciated textures from 373.6 – 373.9 m (see News Release March 2, 2022). Geochemical analysis returned 460 ppm thorium and <2 ppm uranium from 373.5 – 374.0 m indicating elevated thorium. The conductor was explained by a significant 30 m wide graphite, clay and quartz rich ductile structure intersected from 508.1 – 538.8 m, followed by a 4 m wide graphitic and clay altered brittle fault from 556.8 – 560.8 m. The hole was terminated at 620.0 m depth.

Geochemical results indicated:

- 38 ppm uranium over 0.5 m from 345.25 – 345.75 m in Quartz-Feldspar-Biotite-Garnet Gneiss.

- weakly elevated copper (211 ppm) from 514.5 – 515.5 m is associated with the graphitic and altered structure.

PLN22-032: Angled hole to test east trending ground EM conductor northeast of Broach Lake was a 300 m step out to the east from hole PLN22-031 where it intersects a coinciding NE trending resistivity low feature. The Athabasca unconformity was reached at 299.6 m. A 3.7 m interval of clay altered mylonite from 431.7 m-435.4 m with minor graphite is interpreted to be the continuation of the EM conductor. Anomalous radioactivity with a peak of 330 cps with the handheld spectrometer was observed in core from 558.5 – 559.0 m in chlorite altered gneiss. Geochemical analysis returned values of <2 ppm uranium and 141 ppm thorium from this interval indicating elevated thorium concentrations. The hole was terminated at a depth of 575.0 m.

PLN22-033: Vertical hole on same drill pad as PLN22-030, PLN22-030A and PLN22-030B was designed test the alteration observed in hole PLN22-030A and PLN22-30B up dip, closer to the unconformity. The Athabasca unconformity was intersected at a depth of 242.0 m. A clay and hematite altered ductile shear zone was intersected from 246.0 – 254.4 m. As expected, strong hematite alteration was intersected from 258.8 – 263.1 m similar to that seen in PLN22-030A and 30B with the accompanying dravite. A clay altered and pyrite bearing shear zone was intersected from 308.00 – 319.6 m. No anomalous radioactivity was observed in the drill hole which was terminated at 377.0 m.

Geochemical results returned:

- anomalous boron (393 ppm) from 200.0 – 210.0 m in the Athabasca sandstone

- elevated copper associated with the lower ductile shear zone ranging from 79 ppm to 798 ppm in the interval from 305.5 – 318.5 m.

Natural gamma radiation in the drill core that is reported in this news release was measured in counts per second (cps) using a handheld Radiation Solutions RS-125 scintillometer. The Company considers greater than 300 cps on the handheld spectrometer as anomalous, >10,000 cps as high grade and greater than 65,000 cps as off-scale. The reader is cautioned that scintillometer readings are not directly or uniformly related to uranium grades of the rock sample measured and should be used only as a preliminary indication of the presence of radioactive materials. All depth measurements reported are down-hole and true thickness are yet to be determined. Samples from the drill core are split in half on site and are standardized at 0.5 m lengths. One half of the split sample will be submitted to SRC Geoanalytical Laboratories (an SCC ISO/IEC 17025: 2005 Accredited Facility) in Saskatoon, SK. for lithogeochemical analysis using their “Uranium Package”.

About Patterson Lake North:

The Company’s large 39,946 hectare 100% owned Patterson Lake North property (PLN) is located just within the south-western edge of the Athabasca Basin in proximity to Fission Uranium’s Triple R and NexGen Energy’s Arrow high-grade world class uranium deposits which is poised to become the next major area of development for new uranium operations in northern Saskatchewan. PLN is accessed by Provincial Highway 955, which transects the property.

Qualified Person

The technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 and approved on behalf of the company by Raymond Ashley, P.Geo., Vice President, Exploration of Fission 3.0 Corp., a Qualified Person. Mr. Ashley has verified the data disclosed.

About Fission 3.0 Corp.

Fission 3 is a uranium project generator and exploration company, focusing on projects in the Athabasca Basin, home to some of the world’s largest high grade uranium discoveries. Fission 3 currently has 16 projects in the Athabasca Basin. Several of Fission 3’s projects are near large uranium discoveries, including, Arrow, Triple R and Hurricane deposits.

Forward Looking Statements

This news release contains certain forward-looking statements within the meaning of applicable securities laws. All statements that are not historical facts, including without limitation, statements regarding future estimates, plans, programs, forecasts, projections, objectives, assumptions, expectations or beliefs of future performance, including statements regarding the suitability of the Properties for mining exploration, future payments, issuance of shares and work commitment funds, entry into of a definitive option agreement respecting the Properties, are “forward-looking statements.” These forward-looking statements reflect the expectations or beliefs of management of the Company based on information currently available to it. Forward-looking statements are subject to a number of risks and uncertainties, including those detailed from time to time in filings made by the Company with securities regulatory authorities, which may cause actual outcomes to differ materially from those discussed in the forward-looking statements. These factors should be considered carefully and readers are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements and information contained in this news release are made as of the date hereof and the Company undertakes no obligation to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws.

The TSX Venture Exchange and the Canadian Securities Exchange have not reviewed, approved or disapproved the contents of this press release, and do not accept responsibility for the adequacy or accuracy of this release.

Fission 3.0 Corp. Contact Information

Investor Relations

Telephone: 778 484 8030

Email: [email protected]

ON BEHALF OF THE BOARD

“Dev Randhawa”

Dev Randhawa, CEO

Cautionary Statement: Certain information contained in this press release constitutes “forward-looking information”, within the meaning of Canadian legislation. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur”, “be achieved” or “has the potential to”. Forward looking statements contained in this press release may include statements regarding the future operating or financial performance of Fission 3.0 Corp. which involve known and unknown risks and uncertainties which may not prove to be accurate. Actual results and outcomes may differ materially from what is expressed or forecasted in these forward-looking statements. Such statements are qualified in their entirety by the inherent risks and uncertainties surrounding future expectations. Among those factors which could cause actual results to differ materially are the following: market conditions and other risk factors listed from time to time in our reports filed with Canadian securities regulators on SEDAR at www.sedar.com. The forward-looking statements included in this press release are made as of the date of this press release and Fission 3 Corp. disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable sec

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/145873

Fintech

Plug and Play and GIFT City Launch “IFIH,” a Global Fintech Incubator and Accelerator

Plug and Play, a global accelerator platform and one of the most active early-stage investors globally, has announced a strategic partnership with Gujarat International Finance Tec-City (GIFT City). Through the partnership, Plug and Play will establish and run the International Fintech Innovation Hub (IFIH), GIFT City’s FinTech Incubator and Accelerator, which aims to foster research and innovation in financial technology, reinforcing GIFT City’s role as a premier global fintech hub.

GIFT City’s MD and Group CEO, Mr. Tapan Ray, said, “Our vision at GIFT City is to drive fintech innovation by creating a climate-resilient, inclusive ecosystem that empowers diverse entrepreneurs and builds workforce competitiveness in emerging technologies. With the support of prominent partners in fintech education and incubation, we are committed to nurturing a new generation of talent that will be well-equipped to meet the needs of an evolving global economy.”

Manav Narang, Head of Financial Services for Plug and Play APAC and Program Lead for the GIFT Incubator and Accelerator added, “We are thrilled to bring Plug and Play’s global expertise to GIFT City. Our vision is to create India’s largest industry-wide fintech program – a collaborative platform where banks, payments corporations, venture capital and corporate venture capital firms, accelerators, and ecosystem partners unite. Together, we aim to catalyze transformative fintech solutions and nurture fintech unicorns that will shape the future of finance in India.”

The program will support fintech startups with resources, mentorship, capital, and networking to navigate and excel globally in the dynamic fintech landscape. The first batch of startups will be unveiled in January 2025.

The post Plug and Play and GIFT City Launch “IFIH,” a Global Fintech Incubator and Accelerator appeared first on .

Fintech

Doo Financial Now in Indonesia: Offering Local Investors A Gateway to Global Markets

Doo Group’s brokerage brand, Doo Financial is thrilled to announce its expansion into Indonesia by acquiring a reputable Indonesian broker to expand the business. This move brings its global investment services to local investors. Backed by the strength of Doo Group’s extensive international presence, cutting-edge technology, and 10 years of expertise, Doo Financial is well positioned to support investors at every level.

As a brand encompassing investment services offered by various legal entities within the Doo Group, Doo Financial provides a comprehensive range of global brokerage services. This wide range of products empowers investors to pursue their financial goals.

With a diversified portfolio, Doo Financial empowers investors to navigate various market conditions effectively, manage risks, and focus on long-term growth. This entry into the Indonesian market reflects Doo Financial’s commitment to supporting investors with flexible, high-quality investment options tailored to today’s dynamic financial landscape.

Supervision by International Regulatory Institutions to Ensure Top-Tier Safety

As a global leading finance group, Doo Group has licensed entities regulated by top regulatory authorities worldwide, ensuring a secure and reliable trading environment.

Our global credentials include licenses from the U.S. Securities and Exchange Commission (US SEC), the Financial Industry Regulatory Authority (US FINRA) in the U.S., the Financial Conduct Authority (UK FCA) in the UK, the Australian Securities and Investments Commission (ASIC), the Hong Kong Securities and Futures Commission (HK SFC), Badan Pengawas Perdagangan Berjangka Komoditi (BAPPEBTI) in Indonesia. These licenses enable us to provide secure and reliable financial services globally.

Dedication to Shape the Industry with Innovative Solutions

Doo Financial’s expansion into Indonesia brings advanced technology and a global perspective to empower local investors. As an international investment firm committed to secure and seamless trading, Doo Financial offers a diverse range of products and services to help diversify portfolios and open up new opportunities.

This growth elevates opportunities for Indonesian investors by offering seamless access to global markets and advanced trading platforms within a secure and regulated environment. It broadens investment choices and enhances the trading experience, aligning it with international standards and empowering local investors with comprehensive tools and resources for success.

Driven by unwavering commitment, this growth marks a significant milestone in Indonesia’s investment landscape, equipping our clients with the tools to navigate global markets. We remain dedicated to delivering exceptional service, exploring new opportunities, and driving future breakthroughs. With continued support from the FinTech community, we are excited to innovate and shape the future of finance.

Stay updated with the latest insights from Doo Financial. Join our community of empowered investors and let us be your trusted partner!

E-mail: [email protected]

The post Doo Financial Now in Indonesia: Offering Local Investors A Gateway to Global Markets appeared first on .

Fintech

Fintech Pulse: Evolving Fintech Investments and Partnerships Signal Industry Transformation

Fintech is on an accelerated trajectory of investment, collaboration, and innovation. This pulse tracks the most significant developments in the sector, from high-profile investments to global platform expansions. Each update in this briefing serves as a key indicator of where the industry is headed.

1. European Fintechs Face Regulatory Pressures Amid New Investment Surge

The European fintech sector finds itself at a crossroads with increasing scrutiny and rising costs due to stringent regulations. While investments continue to flow into the continent’s financial technology companies, challenges in meeting new compliance requirements, especially around data privacy and cybersecurity, create a complex landscape for scaling. This tension between opportunity and operational limitations might affect European fintechs’ growth strategies.

Source: Financial Times

2. Shopify, Slack Founders Join Peter Thiel in Fintech Investment Push

Tobi Lütke of Shopify and Stewart Butterfield of Slack, along with investor Peter Thiel, have co-invested in a new fintech initiative that aims to bolster small business access to capital. By merging technology with a streamlined funding model, this new initiative targets underserved SMBs, highlighting a broader trend of high-profile tech leaders pivoting to fintech investment. The participation of Lütke and Butterfield signals increased cross-sector collaboration in fintech, bringing expertise from e-commerce and communication technology into the financial arena.

Source: Yahoo Finance

3. Lean Technologies Raises $67.5 Million to Drive Fintech Innovation in the Middle East

Riyadh-based fintech platform Lean Technologies recently secured a $67.5 million Series B investment round, aiming to expand its operations across the Middle East. This funding reflects growing investor interest in emerging markets and the potential of Middle Eastern fintech to bridge regional gaps in financial services access. As Lean Technologies broadens its service offerings, the funding will support further technological integration and scalability across financial ecosystems in the region.

Source: Fintech Global

4. Apollo Global Management Invests in Fintech for Private Offerings Support

Apollo Global Management has taken steps to enhance its services for private offerings by investing in specialized fintech solutions. This development signifies a growing trend among private equity firms to adopt fintech as a core component in their service expansion, particularly for personalized client services. Apollo’s strategy of integrating fintech solutions into private offerings marks a strategic shift toward digitalization within traditional financial sectors.

Source: Bloomberg

5. Juniper Research Names 2025’s Future Leaders in Fintech

Juniper Research has revealed its picks for the top future leaders in fintech for 2025. This list emphasizes innovation in fields such as AI, open banking, and decentralized finance, highlighting startups that exhibit potential for reshaping industry standards. As these up-and-coming firms push the boundaries of traditional finance, they exemplify the rising tide of next-generation financial technology poised to become industry mainstays.

Source: Globe Newswire

Conclusion

The convergence of seasoned tech giants with fintech, new funding rounds for region-specific platforms, and the rise of future industry leaders underscore the momentum of the fintech sector. Each of these stories reflects a broader narrative: fintech is not only diversifying in services but also rapidly integrating into traditional finance and tech, paving the way for a transformative era.

The post Fintech Pulse: Evolving Fintech Investments and Partnerships Signal Industry Transformation appeared first on HIPTHER Alerts.

-

Fintech4 days ago

Fintech4 days agoFintech Pulse: Industry Innovations and Partnerships Drive Global Fintech Forward

-

Fintech3 days ago

Fintech3 days agoFintech Pulse: Evolving Fintech Investments and Partnerships Signal Industry Transformation

-

Fintech PR6 days ago

Fintech PR6 days agoStatement From Universal Music Group N.V.

-

Fintech PR2 days ago

Fintech PR2 days agoCayman Enterprise City Receives Two Prestigious Awards from the Financial Times’ fDi Intelligence Global Free Zones of the Year 2024

-

Fintech PR1 day ago

Fintech PR1 day agoUniversal Consulting Opportunities (UCO), a Stellar MLS Subsidiary, Signs Agreement with NAR India As Advisor to Develop a National MLS

-

Fintech PR2 days ago

Fintech PR2 days agoBlockchain for Good Alliance Hosts Web3 Oscar, Celebrating Innovators Advancing UN’s Sustainable Development Goals

-

Fintech PR1 day ago

Fintech PR1 day agoNoble Corporation plc announces submission of request for removal from trading and official listing on Nasdaq Copenhagen

-

Fintech PR2 days ago

Fintech PR2 days agoEY announces alliance with Regnology to drive modernization of regulatory and tax reporting with both a local and global focus