Fintech

TRU Strengthens Critical Minerals Potential at Golden Rose with Copper-Gold-Zinc Soil Sampling Results

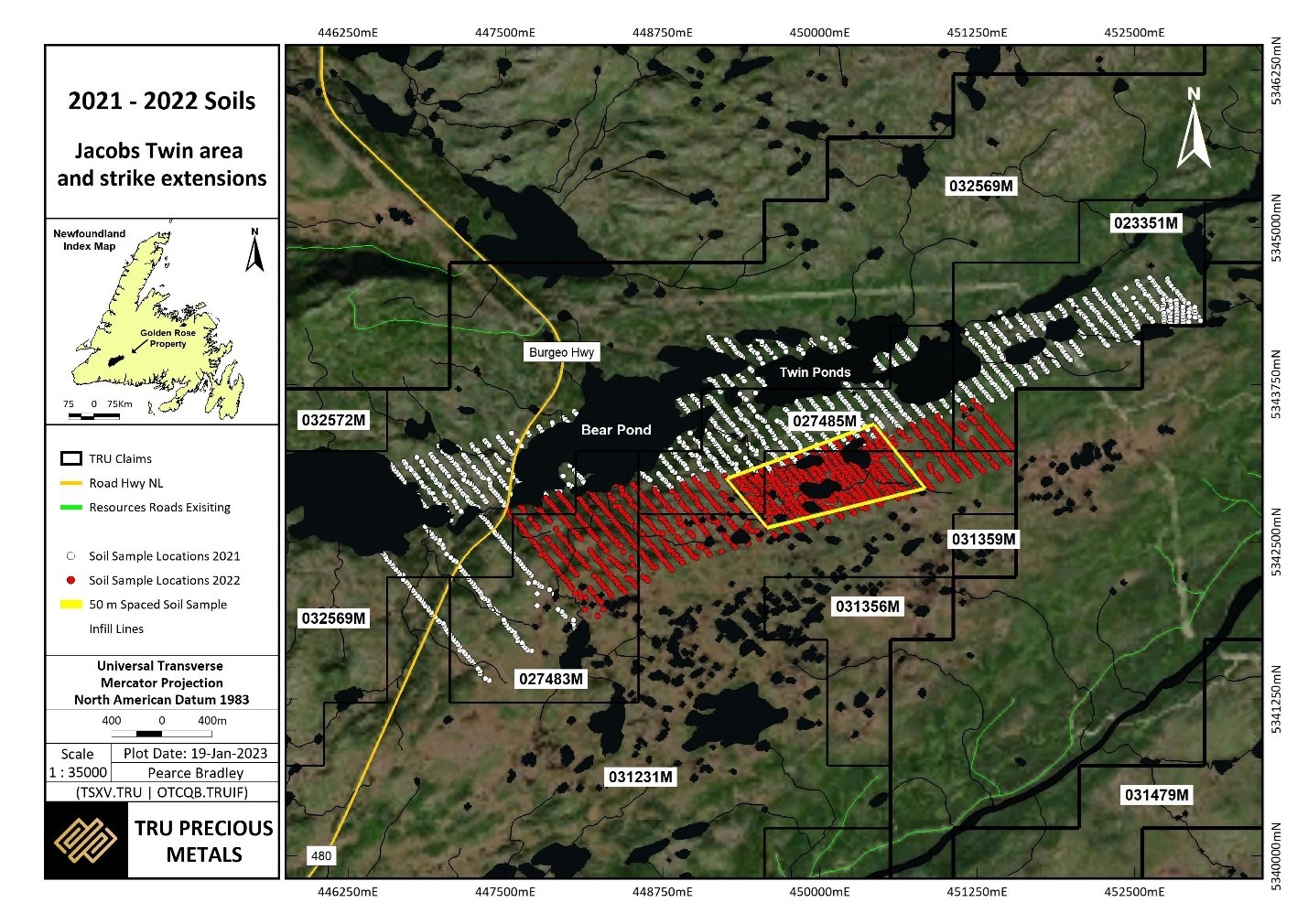

Toronto, Ontario–(Newsfile Corp. – January 26, 2023) – TRU Precious Metals Corp. (TSXV: TRU) (OTCQB: TRUIF) (“TRU” or the “Company”) is pleased to announce the results from its soil sampling programs completed along the Jacob’s Pond trend (“Jacob’s Pond”) (Figure 1) at its 100% owned Golden Rose Project (“Golden Rose” or the “Project”) located in the highly prospective Central Newfoundland Gold Belt.

A total of 1,903 soil samples were collected in this region and include sampling completed during the 2022 field season to infill gaps in historical soil sampling coverage. The soil sampling programs were designed to identify new copper-zinc-lead and gold-silver mineralization and provide additional targets for TRU’s 2023 exploration and drilling programs along Jacob’s Pond. This target extends over 4 km and includes low- to high-grade critical minerals and gold-silver occurrences which have strong Induced Potential (IP) geophysical and soil anomalies.

Highlights

-

TRU has identified strong copper-zinc and gold soil anomalies across Jacob’s Pond, which correspond well with the 2022 diamond drilling results at the Jacob’s Twin sub-target along trend. For example, hole JP-22-10 intersected several mineralized zones containing quartz-carbonate veining and copper mineralization, one of which assayed 1.03% copper (Cu), 0.71 g/t gold (Au), and 24.95 g/t silver (Ag) over 3.0m from 193.45 m to 196.45 m hole depth (refer to news release dated September 22, 2022 – “TRU Opens Up New Copper-Gold-Silver Discovery at Golden Rose”).

-

These soil sampling results also appear to correlate well with a high chargeability IP anomaly near the sheared contact with a flow banded rhyolite, and combined, these datasets have defined a new copper target between 750 m to 1.2 km southwest of the Jacob’s Twin target.

-

Soil sampling results have identified at least 8 strong copper and gold soil anomalies up to 3 km west of Jacob’s Pond, potentially defining a prominent southwest-trending mineralized fault structure that will be a major focus for additional prospecting, trenching, and drilling to confirm mineralization in bedrock.

Joel Freudman, Co-Founder and CEO of TRU, commented, “We are very pleased with the results of our recent soil sampling programs completed along Jacob’s Pond, which clearly indicate the critical minerals and gold mineralization potential along this promising structural trend. Prominent copper and zinc soil anomalies identified southwest of Jacob’s Pond will be a major focus of our 2023 exploration plan in this region. With current projections for significantly increased demand for critical minerals far overwhelming current supply, we are excited at what may be the beginning stages of TRU being a real participant in Canada’s critical minerals strategy.”

Figure 2: Copper-In-Soil Anomaly Map

To view an enhanced version of Figure 2, please visit:

Figure 4: Zinc-In-Soil Anomaly Map

To view an enhanced version of Figure 4, please visit:

https://images.newsfilecorp.com/files/5993/152555_0544871a6496f9b5_009full.jpg

Sampling and Analytical Procedures

The soil samples were collected at 25 to 50 m spacing along 100 m spaced lines, and wherever possible soil samples were collected from the B-horizon soil layer. Each soil sample location was recorded using a hand-held GPS and the sample placed in a plastic bag with a unique sample ID tag. Soil samples were dropped off at either the SGS Canada (“SGS”) laboratory in Grand Falls-Windsor, NL or the Eastern Analytical Limited (“EAL”) laboratory in Springdale, NL for sample preparation, gold fire assay, and 34-element ICP analysis. Both laboratories are independent of TRU.

The TRU exploration programs are designed to be consistent with mining industry best practices and the programs are supervised by Qualified Persons employing exploration procedures consistent with requirements under the CIM Mineral Exploration Best Practice Guidelines (2018) and National Instrument 43-101 (“NI 43-101”).

Readers are cautioned that the soil sampling results and descriptions of mineralization reported in this news release are preliminary and/or early-stage results. While these results are considered encouraging, there is no guarantee that they indicate significant mineralization will be intersected in future drilling programs.

Qualified Person Statement and Data Verification

The scientific and technical information disclosed in this news release has been prepared and approved by Paul Ténière, M.Sc., P.Geo., Vice President of Exploration for TRU, and a Qualified Person as defined in NI 43-101.

Mr. Ténière has verified all scientific and technical data disclosed in this news release including the soil sampling assay results underlying the technical information disclosed. Mr. Ténière noted no errors or omissions during the data verification process. The Company and Mr. Ténière do not recognize any factors of sampling or recovery that could materially affect the accuracy or reliability of the data disclosed in this news release.

About TRU Precious Metals Corp.

TRU (TSXV: TRU) (OTCQB: TRUIF) is on a mission to build long-term shareholder value, through prudent natural resource property development and transactions. TRU is exploring for gold and copper in the highly prospective Central Newfoundland Gold Belt on its 100%-owned Golden Rose Project, originally optioned from TSX-listed Altius Minerals. Golden Rose is a regional-scale 239.5 km2 land package, including a recently-discovered 20 km district-scale structure, and an additional 45 km of strike length along the deposit-bearing Cape Ray – Valentine Lake Shear Zone, directly between Marathon Gold’s Valentine Gold Project and Matador Mining’s Cape Ray Gold Project. In addition, TRU has an option to acquire up to an aggregate 65% ownership interest in two claim packages covering 33.25 km2 including a 12 km strike length along the Shear Zone within Golden Rose.

TRU is a portfolio company of Resurgent Capital Corp. (“Resurgent”), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization companies listing on Canadian stock exchanges. For more information on Resurgent and its portfolio companies, please visit Resurgent’s website at https://www.resurgentcapital.ca/ or follow Resurgent on LinkedIn at https://ca.linkedin.com/company/resurgent-capital-corp.

For further information about TRU, please contact:

Joel Freudman

Co-Founder & CEO

TRU Precious Metals Corp.

Phone: 1-855-760-2TRU (2878)

Email: [email protected]

To connect with TRU via social media, below are links:

Twitter

https://twitter.com/corp_tru

LinkedIn

https://www.linkedin.com/company/tru-precious-metals-corp

YouTube

https://www.youtube.com/channel/UCHghHMDQaYgS1rDHiZIeLUg/

Acknowledgement

TRU would like to thank the Government of Newfoundland and Labrador for its past financial support through the Junior Exploration Assistance Program.

Forward-Looking Statements

This press release contains certain forward-looking statements, including those relating to exploration activities at Golden Rose. These statements are based on numerous assumptions regarding Golden Rose that are believed by management to be reasonable in the circumstances and are subject to a number of risks and uncertainties, including without limitation: mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on Golden Rose; the exploration potential of Golden Rose and the nature and style of mineralization; risks inherent in mineral exploration activities; volatility in financial markets, economic conditions, and precious metals prices; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Fintech

SPAYZ.io prepares for iFX EXPO Dubai 2025

Leading global payments platform SPAYZ.io has confirmed it will be attending iFX EXPO Dubai 2025 on 14 to 16 January. Exhibiting at Stand 64 at Trade Centre Dubai, SPAYZ.io’s team of professionals will be on hand providing live demonstrations of its renowned payment services for payment providers. Attendees will also receive exclusive insight into SPAYZ.io’s plans for 2025 alongside early early access to its upcoming plans for the new year.

SPAYZ.io delivers a host of payment solutions that leverage the latest technological innovations and open access to the fastest growing emerging markets across Africa, Europe and Asia. Over the past year, there has been huge demand for its Open Banking and local payment method services, alongside bank transfers, mass payouts, online banking and e-wallets.

Yana Thakurta, Head of Business Development at SPAYZ.io commented: “We look forward to once again participating at iFX Dubai to expand our network of partners and clients. It’s a fantastic way to kick off the year, connecting with thousands of industry leaders from FOREX platforms to trading companies, and everything in between.

“Our key goal for iFX Dubai EXPO 2025 is to expand our portfolio of solutions and geographies. We’re using this as an opportunity to partner with like-minded entities who share our ambition to provide payment solutions that are truly global.”

Come meet SPAYZ.io’s team at the Trade Centre Dubai at Stand 64. You can also book a meeting slot with a member of a team.

The post SPAYZ.io prepares for iFX EXPO Dubai 2025 appeared first on News, Events, Advertising Options.

Fintech

Airtm Enhances Its Board of Directors with Two Strategic Appointments

Airtm, the most connected digital dollar account in the world, is proud to announce the addition of two distinguished industry leaders to its Board of Directors: Rafael de la Vega, Global SVP of Partnerships at Auctane, and Shivani Siroya, CEO & Founder of Tala. These appointments reflect Airtm’s commitment to innovation and financial inclusion as the company enters its next phase of growth.

“We are thrilled to welcome Rafael and Shivani to Airtm’s Board of Directors,” said Ruben Galindo Steckel, Co-founder and CEO of Airtm. “Their unique perspectives and proven track records will be invaluable as we continue scaling our platform to empower individuals and businesses in emerging markets. Together, we’ll push the boundaries of financial inclusion and innovation to create a more connected and equitable global economy. Rafael and Shivani bring a wealth of experience and strategic insight that will strengthen Airtm’s mission to connect emerging economies with the global market.”

Rafael de la Vega, a seasoned leader in fintech global partnerships and technology innovation, is currently the Global SVP of Partnerships at Auctane. With a proven track record of delivering scalable, impactful solutions at the intersection of fintech, innovation, and commerce, Rafael’s expertise will be pivotal as Airtm continues to grow. “Airtm has built a platform that breaks down barriers and opens up opportunities for people in emerging economies to connect to global markets. I am excited to contribute to its growth and help further its mission of fostering financial inclusion on a global scale,” said Rafael.

Shivani Siroya, CEO and Founder of Tala, is a pioneer in financial technology, renowned for empowering underserved communities through access to credit and essential financial tools. Her leadership in leveraging data-driven innovation aligns seamlessly with Airtm’s vision of creating more equitable financial opportunities. “Empowering underserved communities has always been at the core of my work, and Airtm’s mission resonates deeply with me. I’m thrilled to join the Board and work alongside such a dynamic team to expand access to financial tools that truly make a difference in people’s lives,” said Shivani.

The post Airtm Enhances Its Board of Directors with Two Strategic Appointments appeared first on News, Events, Advertising Options.

Fintech

Fintech Pulse: Your Daily Industry Brief (Revolut, Bestow, Advyzon, Tyme Group, Nubank)

The Ever-Evolving Landscape of Fintech: Top Stories Today

The fintech world continues to thrive with new developments shaping its future. Today’s highlights cover Revolut’s enhanced crypto fraud protections, Bestow’s recognition as a leading fintech company, Advyzon’s CEO receiving a prestigious award, Tyme Group’s global expansion supported by Nubank, and the rise of Israeli fintech startups. Let’s dive into the details and explore the broader implications.

Revolut Steps Up Crypto Fraud Protection

In a significant move to fortify customer trust, Revolut has announced enhancements to its crypto fraud protection systems. Leveraging advanced security risk scores, the company aims to shield users from the growing menace of crypto-related scams. The platform’s new measures will involve deeper scrutiny of transactions, sophisticated algorithms to flag potential fraud, and proactive alerts for unusual activities.

Revolut’s focus on fraud protection reflects the escalating challenges faced by fintech firms operating in the crypto space. As digital currencies gain traction, fraudsters continue to exploit vulnerabilities, necessitating robust security mechanisms. Revolut’s initiative could set a precedent for the industry, emphasizing that user safety is as critical as innovation. However, the success of these measures will depend on striking the right balance between security and user experience.

Source: Coindesk

Bestow Earns a Spot Among Top 100 Financial Technology Companies of 2024

Bestow, a digital life insurance innovator, has been named one of the Top 100 Financial Technology Companies of 2024. This recognition highlights Bestow’s transformative approach to life insurance, combining cutting-edge technology with customer-centric solutions. By simplifying the traditionally cumbersome insurance process, Bestow has made life insurance more accessible and affordable.

The accolade underscores the growing importance of insurtech in the broader fintech ecosystem. Bestow’s achievements signal a shift in consumer expectations—convenience, transparency, and technology-driven solutions are becoming non-negotiable. As insurtech continues to disrupt traditional insurance models, the emphasis will likely shift from mere digital transformation to delivering personalized and predictive services.

Source: PR Newswire

Advyzon CEO Hailin Li Wins ThinkAdvisor 2024 Luminaries Award

Hailin Li, CEO of Advyzon, has been honored with the ThinkAdvisor 2024 Luminaries Award for Fintech Executive of the Year. This award recognizes his exceptional leadership and Advyzon’s commitment to empowering financial advisors with innovative tools. Under Li’s stewardship, Advyzon has excelled in providing comprehensive technology solutions, enabling advisors to deliver superior client experiences.

Li’s recognition highlights the pivotal role of leadership in driving fintech innovation. Advyzon’s success is a testament to how visionary leadership can redefine financial advisory services. As advisors increasingly rely on technology to navigate complex markets, platforms like Advyzon are becoming indispensable. The award also serves as a reminder that the human element—inspired leadership—remains crucial even in a tech-driven industry.

Source: Business Wire

Nubank Backs Tyme Group’s International Expansion

In a strategic move, Nubank has announced an investment in Tyme Group, a digital bank with operations in South Africa and the Philippines. This partnership aims to accelerate Tyme’s growth in emerging markets, leveraging Nubank’s expertise in scaling digital banking operations. Tyme’s unique business model focuses on financial inclusion, catering to underserved populations in developing economies.

Nubank’s investment signifies a growing trend among fintech leaders to expand their footprint in emerging markets. The collaboration between Nubank and Tyme underscores the potential of digital banking to bridge financial inclusion gaps. However, challenges such as regulatory complexities and technological infrastructure limitations in these regions must be addressed to ensure sustainable growth.

Source: Business Wire

Israeli Fintech Startups Gaining Global Momentum

Israel’s fintech ecosystem is making waves internationally, with startups leveraging the country’s robust tech culture and innovation-driven mindset. From payment solutions to cybersecurity for financial services, Israeli fintech firms are attracting significant investments and partnerships globally. This trend reflects the country’s position as a hub for technological advancement and entrepreneurial spirit.

The rise of Israeli fintech startups is a testament to the country’s ability to harness innovation for global impact. However, scaling these ventures beyond local markets remains a challenge. Strategic partnerships and a focus on addressing global financial challenges will be crucial for these startups to cement their position on the world stage.

Source: Calcalist Tech

Broader Implications for the Fintech Industry

- Enhanced Security in Crypto: Revolut’s initiative highlights the need for continuous advancements in fraud prevention. The increasing complexity of scams calls for adaptive security measures that can evolve with emerging threats.

- Recognition Drives Innovation: Bestow’s accolade and Hailin Li’s award demonstrate the power of recognition in fostering innovation. Industry acknowledgment not only boosts morale but also sets benchmarks for others to emulate.

- Global Collaborations: Nubank’s partnership with Tyme Group underscores the importance of cross-border collaborations in fintech. As markets globalize, such alliances will play a pivotal role in shaping the future of financial services.

- Emerging Market Opportunities: Investments in developing economies highlight the untapped potential of these regions. Fintech companies must focus on understanding local needs and challenges to create impactful solutions.

- Tech Hubs as Catalysts: The success of Israeli fintech startups emphasizes the role of regional tech hubs in driving industry growth. Policymakers and stakeholders must nurture these ecosystems to sustain innovation.

The post Fintech Pulse: Your Daily Industry Brief (Revolut, Bestow, Advyzon, Tyme Group, Nubank) appeared first on News, Events, Advertising Options.

-

Fintech7 days ago

Fintech7 days agoFintech Pulse: Your Daily Industry Brief (Nuvei, Google, Upvest, Gen Digital, MoneyLion)

-

Fintech3 days ago

Fintech3 days agoFintech Pulse: Your Daily Industry Brief (Synapse, Shenzhen Institute, Visa, AutomatIQ, MeridianLink)

-

Fintech PR6 days ago

Fintech PR6 days agoCathay Financial Holdings Calls for Climate Finance Mobilization to Drive the Climate Industrial Revolution

-

Fintech PR6 days ago

Fintech PR6 days agoA New Era of $WUSD — Revolutionizing Stablecoins with Unmatched Security, Stability and Next-Gen Innovation

-

Fintech PR6 days ago

Fintech PR6 days agoLanistar launches new gaming sites in Brazil as secures right to operate pending final approval on its licence

-

Fintech2 days ago

Fintech2 days agoFintech Pulse: Your Daily Industry Brief (Revolut, Bestow, Advyzon, Tyme Group, Nubank)

-

Fintech PR6 days ago

Fintech PR6 days agoHealthcare Revenue Cycle Management (RCM) Market Surges to USD 658.7 Billion by 2030, Propelled by 24% CAGR – Verified Market Reports®

-

Fintech PR6 days ago

Fintech PR6 days agoInternational Communication Forum: Pathways To A Sustainable Future