Fintech

Denarius Metals Announces Final Drill Results from Completed Phase 2 In-Fill Drilling at Its Polymetallic Lomero Project in Spain, Including 10.25 Meters Grading 0.27% Copper, 4.79% Lead, 9.82% Zinc, 161 g/t Ag and 6.82 g/t Au

Toronto, Ontario–(Newsfile Corp. – May 29, 2023) – Denarius Metals Corp. (TSXV: DSLV) (OTCQX: DNRSF) (“Denarius Metals” or “the Company”) announced today that it has received the final assays for 42 drill holes, mainly in-fill holes, totaling approximately 13,225 meters, from the Phase 2 surface validation and in-fill drilling program on its polymetallic Lomero Project in southern Spain. To date, Denarius Metals has completed approximately 41,850 meters of drilling in 128 drill holes, including twinning of historical drill holes. The in-fill phase, totaling 23,920 meters and representing 57% of the total drilling program, is now complete. A final 4,000 meters validation drilling campaign, designed to finish verifying the high-grade underground drill holes drilled in the 1980s by Indumetal/Billiton, is in progress. The full drilling results will be incorporated into the geological model and will be integrated in the Mineral Resource Estimate (“MRE”) update to be completed in conjunction with a preliminary economic assessment (“PEA”) in the second half of 2023.

Key takeaways from the exploration work carried out at the Lomero Project to date include:

-

Phase 2 validation and in-fill drill holes completed on the central part of the deposit have mostly intersected significant copper mineralization in massive sulphides, showing better grades than the Cu average grade of the current MRE, ranging from 0.6% up to 1.86% over intervals up to 15.70 meters thick;

-

Phase 2 in-fill drill holes completed on the eastern part of the deposit have intersected significant zinc and lead mineralization showing much better grades than the Zn and Pb average grades of the current MRE, ranging for Zn from 1.08% up to 11.01% over intervals up to 6.65 meters thick, and for Pb from 1.55% to 5.05% over intervals up to 6.65 meters thick. In-fill drilling has also, confirmed high zinc and gold grades over widths that widen to depth at the westernmost end of the permit. Zinc and lead mineralization is hosted primarily in the massive sulphide domain and, to a lesser extent, in the semi-massive sulphide domain;

-

Validation by directional drilling of the underground drilling program completed in the 1980s by Indumetal/Billiton in short < 60 m horizontal holes from underground stations was successful in returning exceptional high grades from the polymetallic mineralization hosted in the lower part of the historical mine, with drill hole LPDV002 intersecting 10.25 meters grading 0.27% copper, 4.79% lead, 9.82% zinc, 161 g/t Ag and 6.82 g/t Au;

-

A PEA-level metallurgical testwork program commenced in April 2023 at Grinding Solution UK’s facilities. The testwork will be completed using two separate composites, one semi-massive sulphide and one massive sulphide, with samples collected from drill cores produced during the Company’s Phase 1 and Phase 2 drill campaigns.

Serafino Iacono, Executive Chairman and CEO of Denarius Metals, commented, “We are encouraged by the Phase 2 drill assays validating the lateral and horizontal continuity of the massive sulphide and semi-massive sulphide mineralized lenses and confirming the presence of higher-grade mineralized zones within the broader resource envelope. In addition, the initial drill assays from the validation drilling program in process are very promising and could potentially increase the grades in the current geological model. For the balance of 2023, activities at the Lomero Project will be focused on completion of the PEA, additional engineering studies to support the future development of the project and execution of the planned greenfield exploration program. The greenfield exploration program comprises 6,000 m of drilling aimed at increasing the tonnage of the MRE update based on Phase 1 and Phase 2 drilling, targeting the Las Merinas and Alianza areas located along two main shear zones discovered in 2022 by field mapping, located to the south and to the north of the shear zone that hosts the Lomero-Poyatos deposit and both of which are E-W trending.”

The Phase 2 surface validation and in-fill drilling program commenced in October 2022 and was completed in February 2023. It was designed to validate some selected historical in-fill holes drilled by Corporacion de Recursos Iberia (CRI) in 2013 within the central sector of the existing mine and then conduct 50×50 m in-fill drilling to confirm the continuity of widths and grades within the massive sulphide and semi-massive sulphide lenses to upgrade the Inferred MRE to the Indicated category. Extension drilling was also carried out in 3 holes totaling 1,815 meters aimed at testing the combined TEM and gravity anomalies that occur down-dip of the main shear-zone hosting the Lomero-Poyatos deposit.

Key Highlights

-

Validation and in-fill drill holes completed on the central part of the deposit mostly showed cupriferous mineralization with maximum intersection grades of 1.86% Cu, 21 g/t Ag and 2.85 g/t Au over 6.70 meters (LM22091), 1.23% Cu, 7 g/t Ag and 1.67 g/t Au over 15.70 meters, including 1.65 meter at 1.86% Cu, 15 g/t Ag and 0.61 g/t Au (LM22085), and 1.43% Cu, 16 g/t Ag and 1.34 g/t Au over 6.30 meters (LM22084).

-

In-fill drill holes completed on the eastern part of the deposit mostly showed significant zinc and lead mineralization with maximum intersection grades of 6.12% Pb, 11.01% Zn, 95 g/t Ag and 4.01 g/t Au over 2.50 meters (LM22110), 3.43% Pb, 7.54% Zn, 88 g/t Ag and 5.30 g/t Au over 2.30 meters (LM22113), and 3.68% Pb, 3.56% Zn, 127 g/t Ag and 5.62 g/t Au over 1.70 meters (LM22116). Drill hole LM23103 confirms high zinc and gold grades at depth at the westernmost end of the permit, returning 0.32% Cu, 0.95% Pb, 2.04% Zn, 37 g/t Ag and 3.79 g/t Au over 6.65 meters, including 2.15 meters at 0.40% Cu, 1.29% Pb, 2.66% Zn, 52 g/t Ag and 5.09 g/t Au, demonstrating that the deposit remains open to the west.

-

Validation by directional drilling of the underground drilling program completed in the 1980’s by Indumetal/Billiton using a series of short < 60 m horizontal holes from underground stations was successful in confirming the high-grade polymetallic mineralization present in the lower part of the historical mine, with drill hole LPDV002 intersecting 10.25 meters grading 0.27% Cu, 4.79% Pb, 9.82% Zn, 161 g/t Ag and 6.82 g/t Au. Polymetallic mineralization is entirely hosted in the massive sulphide domain. Although, the same validation program failed to confirm the unusually wide historical intersections, in consensus with SRK Consulting (U.S.), Inc., the decision was made to continue the program by conventional inclined diamond drilling to speed up drilling, targeting key intersections from the historical program.

-

Extension drill hole LM22115, designed to test the combined TEM and gravity anomalies that occur well below the in-fill drilling carried out so far, intersected a wide zone of thin, dense veinlets, hosted by a much wider stockwork interval, showing trace chalcopyrite and coarse pyrite mineralization filling black chlorite-altered schistosity planes, returning low-grade Au mineralization of 16.10 meters at 0.13 g/t Au. This intercept is interpreted to be of a vertically extensive stringer feeder below the massive sulphide and semi-massive sulphide lenses. Drill holes LM22121 and LM22122 didn’t return any significant Au values.

-

The ongoing metallurgical test work program is testing two separate composites, one semi-massive and one massive sulphide, aimed at optimizing the base metal floatation on representative composites with the average deposit grade. The test work is expected to be completed by mid- 2023.

The following table lists the key intercepts from the Phase 2 validation and in-fill drilling program since the issuance of the current MRE with an effective date of July 19, 2022:

| Hole ID | Phase | From (m) |

To (m) |

Length (m) |

Cu % |

Pb % |

Zn % |

Ag g/t |

Au g/t |

CuEq % |

Min. Type |

| LM22081 | Infill | 201.00 | 202.00 | 1.00 | 0.97 | 0.12 | 0.04 | 6 | 2.15 | 2.66 | MS |

| LM22082 | Infill | 215.80 | 223.85 | 8.05 | 1.19 | 0.23 | 0.34 | 20 | 1.02 | 2.30 | MS |

| LM22083 | Infill | 206.50 | 211.00 | 4.50 | 0.60 | 0.06 | 0.08 | 4 | 0.43 | 1.00 | MS |

| LM22084 | Infill | 161.25 | 162.70 | 1.45 | 0.30 | 0.09 | 0.11 | 22 | 3.64 | 3.27 | MS |

| “ | 169.00 | 175.30 | 6.30 | 1.43 | 0.44 | 0.47 | 16 | 1.34 | 2.83 | MS | |

| LM22085 | Infill | 222.95 | 238.65 | 15.70 | 1.23 | 0.07 | 0.05 | 7 | 1.55 | 2.48 | MS |

| “ | 246.45 | 248.10 | 1.65 | 1.86 | 0.15 | 0.17 | 15 | 0.61 | 2.55 | MS | |

| LM22086 | Infill | 224.25 | 226.50 | 2.25 | 0.27 | 0.65 | 0.10 | 33 | 3.93 | 3.70 | MS |

| “ | 226.50 | 231.50 | 5.00 | mine void fill | |||||||

| “ | 240.70 | 243.10 | 2.40 | 0.46 | 0.26 | 0.74 | 10 | 1.02 | 1.59 | MS | |

| LM22087 | Infill | 192.90 | 198.10 | 5.20 | 0.62 | 0.50 | 0.24 | 34 | 3.22 | 3.54 | MS |

| “ | 198.10 | 201.30 | 3.20 | mine void fill | |||||||

| “ | 201.30 | 204.20 | 2.90 | 0.75 | 0.06 | 0.21 | 4 | 0.33 | 1.11 | MS | |

| LM22088 | Infill | 214.70 | 216.70 | 2.00 | 1.26 | 0.18 | 0.06 | 22 | 0.84 | 2.17 | MS-SM |

| “ | 222.10 | 228.30 | 6.20 | 0.71 | 0.41 | 0.40 | 15 | 1.68 | 2.32 | SM-MS | |

| “ | 228.30 | 234.80 | 6.50 | mine void | |||||||

| LM22089 | Infill | 255.55 | 274.50 | 18.95 | 0.50 | 0.42 | 0.78 | 20 | 2.38 | 2.79 | MS-SH |

| including | 259.25 | 265.75 | 6.50 | 0.67 | 1.13 | 2.06 | 48 | 5.03 | 5.75 | MS | |

| LM22089 | 283.70 | 287.50 | 3.80 | 0.51 | 0.32 | 0.65 | 9 | 0.53 | 1.45 | MS | |

| LM22090 | Infill | 201.30 | 203.30 | 2.00 | 0.44 | 0.05 | 0.04 | 13 | 0.94 | 1.29 | MS |

| “ | 209.00 | 211.50 | 2.50 | 0.28 | 0.82 | 0.59 | 102 | 3.81 | 4.52 | MS | |

| “ | 211.50 | 213.80 | 2.30 | mine void | |||||||

| LM22091 | Infill | 236.10 | 249.10 | 13.00 | 1.20 | 0.07 | 0.06 | 12 | 1.61 | 2.55 | MS |

| including | 236.10 | 242.80 | 6.70 | 1.86 | 0.10 | 0.03 | 21 | 2.85 | 4.22 | MS | |

| LM22093 | Infill | 270.90 | 282.70 | 11.80 | 0.43 | 0.54 | 0.40 | 22 | 2.24 | 2.58 | MS-SM |

| including | 270.90 | 276.65 | 5.75 | 0.65 | 0.85 | 0.27 | 36 | 3.80 | 4.12 | MS-SM | |

| LM22095 | Infill | 279.15 | 289.30 | 10.15 | 0.64 | 0.47 | 0.97 | 29 | 3.34 | 3.80 | MS-SH |

| LM22096 | Infill | 274.40 | 281.80 | 7.40 | 0.56 | 0.63 | 2.06 | 31 | 3.59 | 4.28 | MS-SM |

| LM22097 | Infill | 222.60 | 225.85 | 3.25 | 0.15 | 0.88 | 1.63 | 25 | 0.54 | 1.49 | SM |

| LM22098 | Infill | 34.75 | 36.60 | 1.85 | 0.67 | 0.21 | 0.17 | 14 | 1.12 | 1.74 | SH |

| LM22099 | Infill | 205.90 | 207.40 | 1.50 | mine void | ||||||

| “ | 207.40 | 209.30 | 1.90 | 0.48 | 0.33 | 0.75 | 14 | 2.41 | 2.72 | MS | |

| LM22100* | Infill | 75.30 | 78.30 | 3.00 | 0.12 | 0.18 | 0.23 | 9 | 1.24 | 1.03 | SM-LH |

| “ | 78.30 | 81.20 | 2.90 | mine void | |||||||

| LM22103 | Infill | 249.55 | 256.20 | 6.65 | 0.32 | 0.95 | 2.04 | 37 | 3.79 | 4.32 | MS |

| including | 249.55 | 251.70 | 2.15 | 0.40 | 1.29 | 2.66 | 52 | 5.09 | 5.77 | MS | |

| LM22104 | Infill | 309.20 | 310.80 | 1.60 | 0.05 | 0.36 | 0.57 | 13 | 0.84 | 1.06 | STKW |

| LM22105 | Infill | 343.70 | 345.70 | 2.00 | 0.63 | 0.23 | 0.64 | 9 | 0.56 | 1.38 | MS |

| LM22109 | Infill | 162.15 | 168.80 | 6.65 | 1.55 | 1.55 | 1.08 | 49 | 2.83 | 4.84 | MS |

| LM22110 | Infill | 158.80 | 159.60 | 0.80 | 0.61 | 5.05 | 10.15 | 104 | 2.72 | 7.83 | SH |

| “ | Infill | 166.30 | 168.80 | 2.50 | 0.26 | 6.12 | 11.01 | 95 | 4.01 | 8.86 | MS |

| LM22112 | Infill | 173.10 | 175.00 | 1.90 | 0.23 | 0.50 | 2.01 | 14 | 2.41 | 2.84 | MS-DISS |

| LM22113 | Infill | 108.90 | 111.20 | 2.30 | 0.28 | 3.43 | 7.54 | 88 | 5.30 | 8.10 | MS |

| LM22116 | Infill | 62.10 | 66.20 | 4.10 | 0.16 | 1.62 | 1.54 | 59 | 3.04 | 3.86 | SH-MS |

| including | 64.50 | 66.20 | 1.70 | 0.29 | 3.68 | 3.56 | 127 | 5.62 | 7.69 | MS | |

| LM22119 | Infill | 263.00 | 264.00 | 1.00 | 0.56 | 0.15 | 0.84 | 12 | 0.73 | 1.50 | SM |

| LM22120 | Infill | 221.45 | 225.90 | 4.45 | 0.30 | 1.20 | 1.69 | 58 | 5.58 | 5.80 | MS |

| “ | 238.30 | 240.30 | 2.00 | 0.14 | 2.26 | 3.63 | 18 | 0.15 | 2.03 | STKW | |

| LPDV002 | Validation | 276.30 | 286.55 | 10.25 | 0.27 | 4.79 | 9.82 | 161 | 6.82 | 10.96 | MS |

| including | 277.30 | 281.90 | 4.60 | 0.32 | 4.61 | 9.25 | 176 | 9.66 | 13.04 | MS | |

Notes:

(1) The holes were drilled at -45 to -80 degrees from the horizontal. Grades are for semi-massive sulphide to massive sulfide intersections and some stockwork and shear zones. Sample interval grades over CuEq >1% are reported. The width is the sample length and is not necessarily the true width of the intersection. All base and precious metal grades are uncut and are not diluted to a minimum mining width.

(2) The following holes returned intervals grading <1% CuEq and so are not listed in the table: LM22092, LM22094, LM22101, LM22102, LM22106, LM22107; LM22108, LM22111, LM22114, LM22115, LM22117, LM22118, LM22121 and LPDV003.

(3) Equivalent copper grade (CuEq%) was calculated using prices of US$1,800/oz gold, US$25/oz silver, US$3.55/lb copper, US$1.00/lb zinc and US$0.90/lb lead. No adjustments were made for recovery as the project is at an exploration stage and metallurgical data to allow for estimation of recoveries is not yet available.

(4) MS: massive sulfides; SM: semi-massive sulfides; STKW: stockwork; DISS: disseminated; SH: shear-zone.

(5) LM22100 partial reassays by ALS are pending (see QAQC below).

Please refer to the attached illustrative images (Attachments 1 to 7) showing (i) the location of drill holes, (ii) the location of the best copper, lead and zinc drill holes and (iii) five cross sections for drill holes LM22084, LM22088, LM22120, LPDV002, LM22115.

Qualified Persons Review

Dr. Stewart D. Redwood, PhD, FIMMM, FGS, Senior Consulting Geologist to the Company, is a qualified person as defined by National Instrument 43-101 – Standards of Disclosure or Mineral Projects and prepared or reviewed the preparation of the scientific and technical information in this press release. Verification included a review of the quality assurance and quality control samples, and review of the applicable assay databases and assay certificates.

Quality Assurance and Quality Control

The Lomero-Poyatos samples were prepared by ALS Labs (ISO/IEC 17025:2017 and ISO 9001:2015) at their facilities in Seville, Spain and assayed in Clonmel, Ireland. Gold was assayed by 30 g fire assay with AAS finish, while silver and base metals were analyzed in a multi element analysis of base metal ores and mill products by strong oxidizing digestion and ICP-AES finish. Blank, standard and duplicate samples were routinely inserted and monitored for quality assurance and quality control.

As part of its Quality Assurance and Quality Control procedures, Denarius Metals sent 331 pulps and coarse rejects at the end of Phase 2 of drilling to ALS Labs for umpire analysis to check the results from the primary laboratory, AGQ. The results from ALS showed excellent correlation for all elements for Phase 1 drilling. However, certain deviations were observed for the Phase 2 drilling results, in particular for gold fire assay and lead. Following a thorough review of internal laboratory QA/QC procedures, and confirmation assays received from a third laboratory, SGS in Huelva, Spain, the Company decided to send 100% of sample pulps from the massive and semi massive sulphide zones, plus 50% of the stockwork zones, from the Phase 2 drilling to ALS for check assays. In addition, 20% of massive sulphide samples, 10% of semi-massive sulphide samples, and 5% of stockwork samples from Phase 1 of drilling were sent to ALS for check assays. A total of 514 samples were sent to ALS for check assays.

The check assays received from ALS confirmed that Phase 1 results, as reported by the Company, are reliable. However, the check assays confirmed that there is a bias in the Phase 2 assays of the primary laboratory for gold and lead. Therefore, the AGQ results for Phase 2 were discarded and it was decided only to use results from ALS for Phase 2 drilling. The remainder of the Phase 2 stockwork zone samples are currently being reassayed by ALS for completeness. This affects one significant intersection in hole LM22100 which is reported in the table above as pending reassay results. However, given the low-grade nature of the stockwork mineralization, it is not anticipated the results will demonstrate any material differences. In addition, ALS has been designated as the primary laboratory for all future assays.

About Denarius Metals

Denarius Metals is a Canadian junior company engaged in the acquisition, exploration, development and eventual operation of polymetallic mining projects in high-grade districts, with its principal focus on the Lomero Project in Spain. The Company signed a definitive option agreement with Europa Metals Ltd. in November 2022 pursuant to which Europa has granted Denarius Metals two options to acquire up to an 80% ownership interest in the Toral Zn-Pb-Ag Project, Leon Province, Northern Spain. The Company’s 100%-owned Zancudo Project in Colombia provides an opportunity to develop near-term production and cash flow through local contract miners and long-term growth through exploration.

Additional information on Denarius Metals can be found on its website at

Attachment 2 – Location of drill holes showing Cu and Pb/Zn enrichment of the deposit.

To view an enhanced version of this graphic, please visit:

Attachment 4 – Cross section for drill holes LPDV002 and LM22120 showing high Pb/Zn grades associated to high Au grades.

To view an enhanced version of this graphic, please visit:

Attachment 6 – Cross section for drill hole LPDV002 validating Indumetal/Billiton drill hole L5W2 exceptional high grades.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9396/167847_ee516ed5e4f18b10_006full.jpg

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/167847

Fintech

How to identify authenticity in crypto influencer channels

Modern brands stake on influencer marketing, with 76% of users making a purchase after seeing a product on social media.The cryptocurrency industry is no exception to this trend. However, promoting crypto products through influencer marketing can be particularly challenging. Crypto influencers pose a significant risk to a brand’s reputation and ROI due to rampant scams. Approximately 80% of channels provide fake statistics, including followers counts and engagement metrics. Additionally, this niche is characterized by high CPMs, which can increase the risk of financial loss for brands.

In this article Nadia Bubennnikova, Head of agency Famesters, will explore the most important things to look for in crypto channels to find the perfect match for influencer marketing collaborations.

-

Comments

There are several levels related to this point.

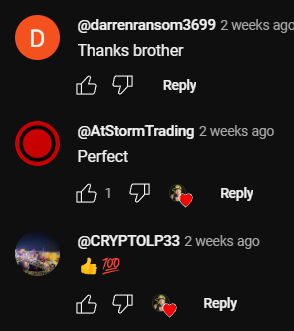

LEVEL 1

Analyze approximately 10 of the channel’s latest videos, looking through the comments to ensure they are not purchased from dubious sources. For example, such comments as “Yes sir, great video!”; “Thanks!”; “Love you man!”; “Quality content”, and others most certainly are bot-generated and should be avoided.

Just to compare:

LEVEL 2

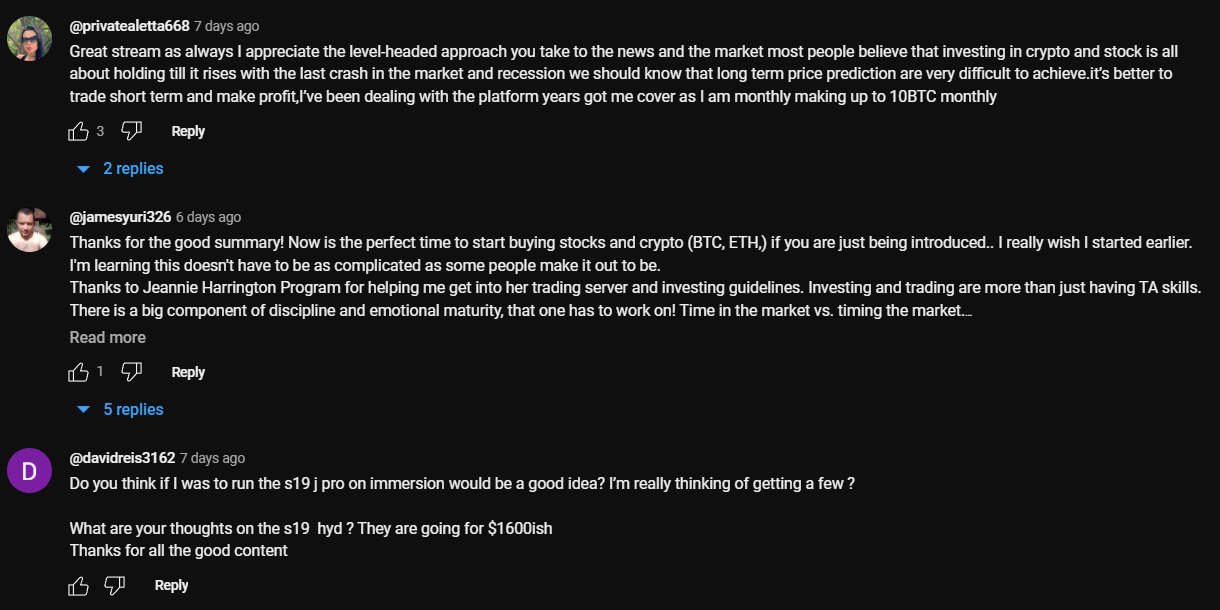

Don’t rush to conclude that you’ve discovered the perfect crypto channel just because you’ve come across some logical comments that align with the video’s topic. This may seem controversial, but it’s important to dive deeper. When you encounter a channel with logical comments, ensure that they are unique and not duplicated under the description box. Some creators are smarter than just buying comments from the first link that Google shows you when you search “buy YouTube comments”. They generate topics, provide multiple examples, or upload lists of examples, all produced by AI. You can either manually review the comments or use a script to parse all the YouTube comments into an Excel file. Then, add a formula to highlight any duplicates.

LEVEL 3

It is also a must to check the names of the profiles that leave the comments: most of the bot-generated comments are easy to track: they will all have the usernames made of random symbols and numbers, random first and last name combinations, “Habibi”, etc. No profile pictures on all comments is also a red flag.

LEVEL 4

Another important factor to consider when assessing comment authenticity is the posting date. If all the comments were posted on the same day, it’s likely that the traffic was purchased.

2. Average views number per video

This is indeed one of the key metrics to consider when selecting an influencer for collaboration, regardless of the product type. What specific factors should we focus on?

First & foremost: the views dynamics on the channel. The most desirable type of YouTube channel in terms of views is one that maintains stable viewership across all of its videos. This stability serves as proof of an active and loyal audience genuinely interested in the creator’s content, unlike channels where views vary significantly from one video to another.

Many unauthentic crypto channels not only buy YouTube comments but also invest in increasing video views to create the impression of stability. So, what exactly should we look at in terms of views? Firstly, calculate the average number of views based on the ten latest videos. Then, compare this figure to the views of the most recent videos posted within the past week. If you notice that these new videos have nearly the same number of views as those posted a month or two ago, it’s a clear red flag. Typically, a YouTube channel experiences lower views on new videos, with the number increasing organically each day as the audience engages with the content. If you see a video posted just three days ago already garnering 30k views, matching the total views of older videos, it’s a sign of fraudulent traffic purchased to create the illusion of view stability.

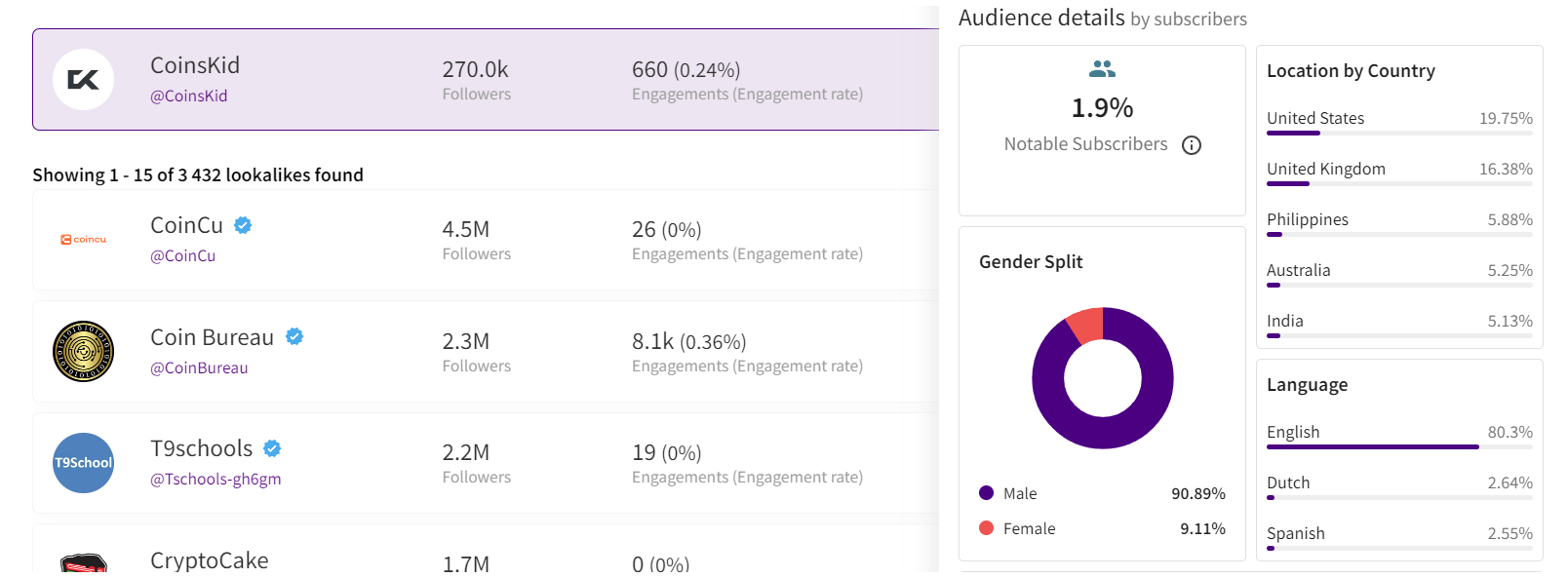

3. Influencer’s channel statistics

The primary statistics of interest are region and demographic split, and sometimes the device types of the viewers.

LEVEL 1

When reviewing the shared statistics, the first step is to request a video screencast instead of a simple screenshot. This is because it takes more time to organically edit a video than a screenshot, making it harder to manipulate the statistics. If the creator refuses, step two (if only screenshots are provided) is to download them and check the file’s properties on your computer. Look for details such as whether it was created with Adobe Photoshop or the color profile, typically Adobe RGB, to determine if the screenshot has been edited.

LEVEL 2

After confirming the authenticity of the stats screenshot, it’s crucial to analyze the data. For instance, if you’re examining a channel conducted in Spanish with all videos filmed in the same language, it would raise concerns to find a significant audience from countries like India or Turkey. This discrepancy, where the audience doesn’t align with regions known for speaking the language, is a red flag.

If we’re considering an English-language crypto channel, it typically suggests an international audience, as English’s global use for quality educational content on niche topics like crypto. However, certain considerations apply. For instance, if an English-speaking channel shows a significant percentage of Polish viewers (15% to 30%) without any mention of the Polish language, it could indicate fake followers and views. However, if the channel’s creator is Polish, occasionally posts videos in Polish alongside English, and receives Polish comments, it’s important not to rush to conclusions.

Example of statistics

Example of statistics

Wrapping up

These are the main factors to consider when selecting an influencer to promote your crypto product. Once you’ve launched the campaign, there are also some markers to show which creators did bring the authentic traffic and which used some tools to create the illusion of an active and engaged audience. While this may seem obvious, it’s still worth mentioning. After the video is posted, allow 5-7 days for it to accumulate a basic number of views, then check performance metrics such as views, clicks, click-through rate (CTR), signups, and conversion rate (CR) from clicks to signups.

If you overlooked some red flags when selecting crypto channels for your launch, you might find the following outcomes: channels with high views numbers and high CTRs, demonstrating the real interest of the audience, yet with remarkably low conversion rates. In the worst-case scenario, you might witness thousands of clicks resulting in zero to just a few signups. While this might suggest technical issues in other industries, in crypto campaigns it indicates that the creator engaged in the campaign not only bought fake views and comments but also link clicks. And this happens more often than you may realize.

Summing up, choosing the right crypto creator to promote your product is indeed a tricky job that requires a lot of resources to be put into the search process.

Author

Nadia Bubennikova, Head of agency at Famesters

Fintech

Central banks and the FinTech sector unite to change global payments space

The BIS, along with seven leading central banks and a cohort of private financial firms, has embarked on an ambitious venture known as Project Agorá.

Named after the Greek word for “marketplace,” this initiative stands at the forefront of exploring the potential of tokenisation to significantly enhance the operational efficiency of the monetary system worldwide.

Central to this pioneering project are the Bank of France (on behalf of the Eurosystem), the Bank of Japan, the Bank of Korea, the Bank of Mexico, the Swiss National Bank, the Bank of England, and the Federal Reserve Bank of New York. These institutions have joined forces under the banner of Project Agorá, in partnership with an extensive assembly of private financial entities convened by the Institute of International Finance (IIF).

At the heart of Project Agorá is the pursuit of integrating tokenised commercial bank deposits with tokenised wholesale central bank money within a unified, public-private programmable financial platform. By harnessing the advanced capabilities of smart contracts and programmability, the project aspires to unlock new transactional possibilities that were previously infeasible or impractical, thereby fostering novel opportunities that could benefit businesses and consumers alike.

The collaborative effort seeks to address and surmount a variety of structural inefficiencies that currently plague cross-border payments. These challenges include disparate legal, regulatory, and technical standards; varying operating hours and time zones; and the heightened complexity associated with conducting financial integrity checks (such as anti-money laundering and customer verification procedures), which are often redundantly executed across multiple stages of a single transaction due to the involvement of several intermediaries.

As a beacon of experimental and exploratory projects, the BIS Innovation Hub is committed to delivering public goods to the global central banking community through initiatives like Project Agorá. In line with this mission, the BIS will soon issue a call for expressions of interest from private financial institutions eager to contribute to this ground-breaking project. The IIF will facilitate the involvement of private sector participants, extending an invitation to regulated financial institutions representing each of the seven aforementioned currencies to partake in this transformative endeavour.

Source: fintech.globa

The post Central banks and the FinTech sector unite to change global payments space appeared first on HIPTHER Alerts.

Fintech

TD Bank inks multi-year strategic partnership with Google Cloud

TD Bank has inked a multi-year deal with Google Cloud as it looks to streamline the development and deployment of new products and services.

The deal will see the Canadian banking group integrate the vendor’s cloud services into a wider portion of its technology solutions portfolio, a move which TD expects will enable it “to respond quickly to changing customer expectations by rolling out new features, updates, or entirely new financial products at an accelerated pace”.

This marks an expansion of the already established relationship between TD Bank and Google Cloud after the group previously adopted the vendor’s Google Kubernetes Engine (GKE) for TD Securities Automated Trading (TDSAT), the Chicago-based subsidiary of its investment banking unit, TD Securities.

TDSAT uses GKE for process automation and quantitative modelling across fixed income markets, resulting in the development of a “data-driven research platform” capable of processing large research workloads in trading.

Dan Bosman, SVP and CIO of TD Securities, claims the infrastructure has so far supported TDSAT with “compute-intensive quantitative analysis” while expanding the subsidiary’s “trading volumes and portfolio size”.

TD’s new partnership with Google Cloud will see the group attempt to replicate the same level of success across its entire portfolio.

Source: fintechfutures.com

The post TD Bank inks multi-year strategic partnership with Google Cloud appeared first on HIPTHER Alerts.

-

Fintech4 days ago

Fintech4 days agoHow to identify authenticity in crypto influencer channels

-

Latest News7 days ago

BMO Announces Election of Board of Directors

-

Latest News4 days ago

HSBC-backed fintech Monese is considering splitting its operations as it grapples with increasing losses.

-

Latest News4 days ago

EverBank has announced a groundbreaking partnership with Finzly, poised to revolutionize payment processing.

-

Latest News3 days ago

FinTech leaders express caution regarding the promises made in #Budget2024 concerning open banking, stating that the “devil is in the details.”

-

Latest News3 days ago

Gotion High-tech’s operating profit up 391% in 2023, nearly RMB 2.8 billion invested in R&D for the year

-

Latest News3 days ago

Aurionpro Solutions acquires Arya.ai, to power next generation Enterprise AI platforms for Financial Institutions

-

Latest News4 days ago

Wells Fargo, a leading financial institution, is set to revolutionize its trade finance operations by incorporating artificial intelligence (AI) technology through its collaboration with TradeSun.