Fintech

Artmarket.com: Here’s why the art market, via the NFT revolution, will enjoy exponential growth with Artprice

For 25 years now, Artprice by Artmarket – world leader in art market information – has been studying, analyzing and researching the structure of the art market from every possible angle. This work has engaged all of its human and technical resources, including its art history department, its databases, its econometricians and statisticians, its sociologists, and of course its economists, jurists and tax specialists.

According to thierry Ehrmann, founder and CEO of the group, ‘Over the past five years, Artprice by Artmarket has literally second guessed the impact of NFTs on the art market by adding blockchain to its core database business and digitizing its historical art market standardization work. Artprice is the sole author of these projects with IP protection of its source codes since 1999′.

For its innovative R&D and its creation of Artpriceblockchain.com, Artmarket was awarded the prestigious state label “Innovative Enterprise” by the BPI (French public investment bank) in 2015 and then again in 2018 (it is rarely awarded more than once).

Artmarket.com is now setting its sights even higher as it launches its NFT ® Marketplace with a realistic ambition to generate a future turnover of several tens of millions of euros, and possibly even hundreds of millions in the longer term.

This ambition is based on the logic and reasoning explained below, which, on the one hand involves a specific and unique approach to Blockchain and NFTs, and on the other, relies on a historical, sociological and economic analysis of the art market.

Specific and unique approach to Blockchain and NFTs

In the design of its DAO (Decentralized Autonomous Organization) Artmarket.com will produce ‘smart contracts’ registered on the Ethereum blockchain.

Today, Artmarket.com’s eco-responsibly designed DAO brings together the immutable and transparent rules governing the art market (one of the oldest market’s in the world) with total impartiality. Artprice has been scientifically codifying these rules for the last 25 years.

Artmarket.com’s DAO is transparent. It is de facto based on a supra-national framework and is the subject of contributions from the best historians, jurists, scientists and econometricians. These contributions have been collected over the past two decades to establish the company’s open data.

Artprice – world leader in art market information – has been the sole author of its databases for 25 years. Today, its databases are authoritative throughout the world and include the world’s largest documentary archive of notes, manuscripts and sales catalogs since 1700, which further guarantee the authenticity and historical legitimacy of its databases.

As a direct consequence of its reliability and its undisputed reputation in the art market, Artprice has the full capacity and is perfectly positioned to play the role of oracle (source of reliable information that allows the integration of variables from the real world into smart contracts) in Artmarket.com’s blockchain.

Artprice’s legitimacy as a blockchain oracle is based on its real-time collection of data from 6,300 auction houses around the world which automatically transfer their public auction results to Artprice.

Within Web 3.0 communities, an oracle can only be an oracle if it relies on a multitude of public sources, which is exactly what Artprice does with its 6,300 public sources.

As an oracle, Artprice will feed data from its databases. This data will include public auction results; historical, indexed and econometric data about artists and their works; detailed information concerning the traceability of works, etc.

As an oracle input, Artprice’s data will have the status of ‘recognized official market information’, and the activation or non-activation of ‘smart contracts’ will depend on the information provided by Artprice.

There is no doubt that Opensea and Rarible, to name but two, are among the NFT platforms that would immediately benefit from an industrial collaboration with Artmarket.com, the latter providing an indisputable, unavoidable and global art market reference going back a quarter of a century.

Artmarket.com will study each proposal, joint venture, capital participation, merger and/or acquisition and will give its approval if the proposals make good industrial sense and perpetuate its principal ethic: the promotion of art market information and transparency.

In view of the different legislation in force in France and, at a broader level, in Europe generally, Artmarket.com is looking into registering with the AMF as a Digital Assets Service Provider (DASP or PSAN in French) with a view to its forthcoming status as a FinTech company. At the same time, Artmarket.com will constantly monitor US and European legislation thereby allowing it and its American subsidiary to make the best choices as a future FinTech.

Historical, sociological and economic analysis of the art market

The following synthesis by Artmarket.com is based on the study of thousands of articles and reports, and hundreds of interviews, meetings and conferences on the world of cryptology, cryptocurrencies, blockchain, NFTs and the metaverse.

Thanks largely to the greater transparency and the greater ease of access to information – to which Artprice has been the main contributor in the world for 25 years – it has been made possible to observe that the art market experienced an overall turnover growth of +2700% between 2000 and 2020.

The art market’s growth – initially specific to the West – is now happening on five continents of the globe. Lately it has been substantially driven by a veritable explosion of the media employed by artists and the arrival of young artists with astonishing auction debuts in what is clearly now an efficient market.

The principal question Artprice has been studying and following closely is the impact of NFTs on the art market. Each of its annual reports devotes a large chapter to NFTs, such as its latest Contemporary Art Market Annual Report published in October 2021: https://www.artprice.com/artprice-reports/the-contemporary-art-market-report-2021

At the Beginning of 2022, Artmarket.com will publish a comprehensive report on NFTs and their impact on the art market.

Using the experience of its various departments, Artprice compares NFTs with the market for multiples (lithographs, prints, serigraphs, etc.) in the 20th century.

It was traditionally believed that multiples weakened artists whose markets were already established. This belief was essentially based on a technical and scientific reality: it was not possible to control with absolute certainty the number and quality of prints/multiples in circulation. As a result, prints/multiples are often considered the poor cousins of the art market.

Another interesting fact to consider before pursuing this comparison is liquidity. In reality, if you want to buy an artwork that you can be sure to sell within a year, you need to pay at least €20,000. In 2021, if you are looking for exit liquidity within a month, you need to pay at least €50,000.

NFT artworks, because they represent a complete paradigm shift, challenge the whole traditional economy of the art market.

Indeed, the NFT revolution, which undermines all the barriers inherent to the mores, customs and standards of the traditional art market, is now clearly approved by a broad consensus of users, collectors and creators, and notably, by whole communities of artists themselves.

Blockchain technology, via ‘smart contracts’, allows the issuance of ‘non fungible tokens’ with scientific certainty about their origin, their number and indeed about their every detail. This instantly affords confidence to the art market which, under these conditions, accepts the creation and circulation of multiples, which, in the past, might have weakened the artist’s market.

But, the NFT revolution doesn’t stop there. It is now based on digitally-certified issues that, thanks to blockchain, no-one can divert. For example, this allows a recognized artist (with an established price range) to issue a large number of NFTs forming a collection of digital works that become a sort of dialogue with his/her public. This interactivity will attract new collectors to the artist’s universe/metaverse. The artist will then be able to see his/her income and notoriety grow, without damaging his/her reputation and relationship with the art market’s key players.

According to our cross-checked calculations based on a large range of criteria and considerations, this radical transformation of the art market is likely to grow the population of art collectors from approximately 120 million today (with an average age of 54) to more than 900 million buyers of NFTs (and who knows what other artistic formats…) with a much younger and much more varied sociological profile.

Put simply, there exists today a whole generation of humans that has always lived with digital technology and completely understands that art NFTs are a sought-after, rare and speculative product surrounded by hype and considered avant-garde, and affording a degree of digital social recognition… and neither the hip factor, nor the modishness, nor the speculative aspect are a problem for this generation.

In addition, in 2021, digital media are absolutely everywhere: smartphones, smartTVs, tablets and computers, number in the billions. These high definition screens, now with very low power consumption due to MicroLEDs with deflationary prices, are increasingly prevalent in our daily lives, both in the private, and professional spheres, and in public spaces like airports and shopping centers, etc..

NFT Art has been conceptualized to penetrate into everyone’s daily lives, in an ‘ultra-democratization’ of art, without loss of rarity and quality. The revenues generated by this historic change are already spectacular, as we saw with the result of Beeple,alias Mike Winkelmann, ($69.3 million) at Christie’s, already rivaling historical auction records for physical works. These results are playing a spearhead role for this new world.

In addition, the new buyers of NFTs can engage in a form of double speculation: on the one hand, there’s the artwork which is a thousand times easier to sell (on an NFT platform) than the multiples of the last century; and on the other hand, there’s the fluctuation in the value of the cryptocurrency in which its value is denominated. This is a significant factor as it adds the possibility of economic gain to the pleasure of accessing art.

Through its expertise in the art market, Artprice by Artmarket has the ability to ‘bring out’ thousands of communities of artists (with known market prices) originating from recent trends like Street Art (whose visual works seems to have been born for NFTs) among others, or even more fringe trends like performance art, which has been always excluded from the mass market.

With Artmarket.com smart contracts, the artist or his/her beneficiaries and Artmarket.com will receive recurring income from the NFT artwork, from its primary issue to its various transactions on the secondary market.

What Artmarket.com brings to the NFT market is its guarantee as world leader in art market information along with its expertise, its extreme technological discipline and the strict terms in the metadata of its smart contracts, thereby creating the necessary conditions for the success of this new revolution in the art market.

The DNS artpricecoin.com, filed in December 2017 (along with all the corresponding names) illustrates Artprice by Artmarket’s early awareness of this paradigm shift to NFTs and cryptocurrencies.

As a global phenomenon, the advent of NFTs within a blockchain environment has parallels with the world of music. In its very early days, music was only available to those who went to listen to it. This changed with the technical capacity to record and reproduce sound on different media.

That technological advance democratized music, infinitely multiplying the listening possibilities. The number of musicians as well as the number of music enthusiasts literally exploded, generating colossal financial flows and profits within what is commonly called ‘the music industry’, which, at the end of 2021, had nearly one billion paying subscribers, thanks to digital technology.

With the arrival of NFTs, the paradigm shift in the art market is at least comparable. This change will take us towards a mass art market, but one that will always retain a certain elitist quality (like all cultural markets).

Through exchanges between Artprice by Artmarket and internationally renowned artists (and others) and/or their beneficiaries, we have become acutely aware of a strong demand to exploit the NFT medium in a carefully considered manner. And awareness of the potential of NFTs in the blockchain environment already appears to be very widespread.

For artists, past and present (768,000 artists are referenced and priced on Artprice by Artmarket), the NFT phenomenon represents a very powerful growth driver. Artists are the central core on which the whole art market is based and they will now apprehend the future of the art market, and their own futures, from a very positive angle within the Artmarket.com universe, which will progressively transform into a metaverse.

Images:

[https://imgpublic.artprice.com/img/wp/sites/11/2021/12/image1-AbodeofChaos-99.jpg]

[https://imgpublic.artprice.com/img/wp/sites/11/2021/12/image2-NFT-bill.jpg]

Copyright 1987-2021 thierry Ehrmann www.artprice.com – www.artmarket.com

- Don’t hesitate to contact our Econometrics Department for your requirements regarding statistics and personalized studies: [email protected]

- Try our services (free demo): https://www.artprice.com/demo

- Subscribe to our services: https://www.artprice.com/subscription

Fintech

How to identify authenticity in crypto influencer channels

Modern brands stake on influencer marketing, with 76% of users making a purchase after seeing a product on social media.The cryptocurrency industry is no exception to this trend. However, promoting crypto products through influencer marketing can be particularly challenging. Crypto influencers pose a significant risk to a brand’s reputation and ROI due to rampant scams. Approximately 80% of channels provide fake statistics, including followers counts and engagement metrics. Additionally, this niche is characterized by high CPMs, which can increase the risk of financial loss for brands.

In this article Nadia Bubennnikova, Head of agency Famesters, will explore the most important things to look for in crypto channels to find the perfect match for influencer marketing collaborations.

-

Comments

There are several levels related to this point.

LEVEL 1

Analyze approximately 10 of the channel’s latest videos, looking through the comments to ensure they are not purchased from dubious sources. For example, such comments as “Yes sir, great video!”; “Thanks!”; “Love you man!”; “Quality content”, and others most certainly are bot-generated and should be avoided.

Just to compare:

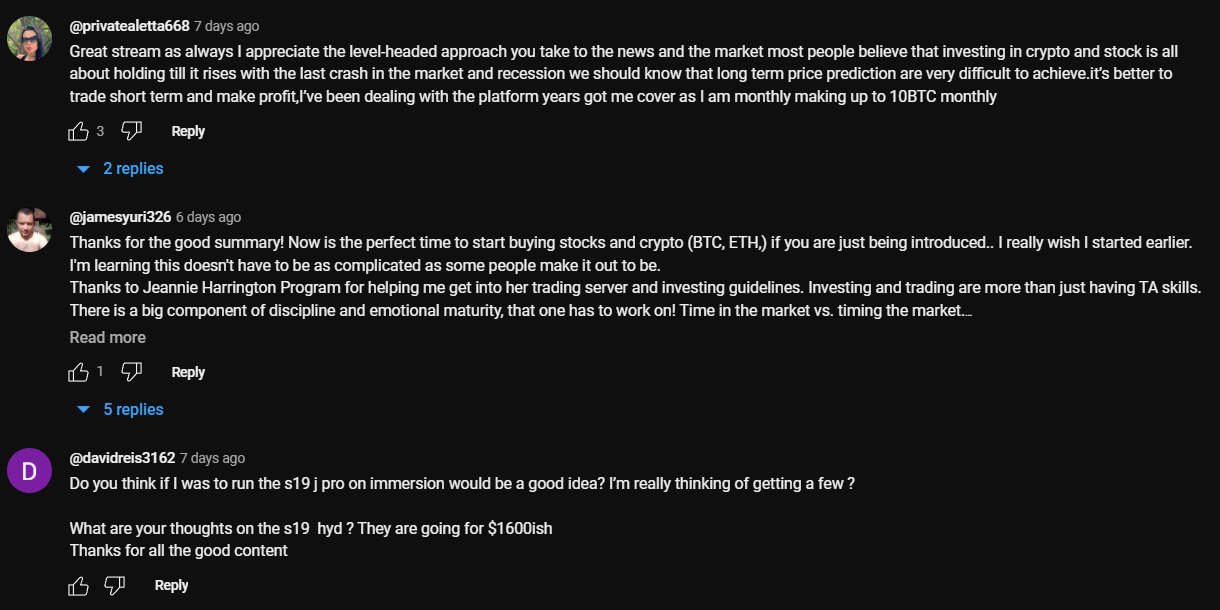

LEVEL 2

Don’t rush to conclude that you’ve discovered the perfect crypto channel just because you’ve come across some logical comments that align with the video’s topic. This may seem controversial, but it’s important to dive deeper. When you encounter a channel with logical comments, ensure that they are unique and not duplicated under the description box. Some creators are smarter than just buying comments from the first link that Google shows you when you search “buy YouTube comments”. They generate topics, provide multiple examples, or upload lists of examples, all produced by AI. You can either manually review the comments or use a script to parse all the YouTube comments into an Excel file. Then, add a formula to highlight any duplicates.

LEVEL 3

It is also a must to check the names of the profiles that leave the comments: most of the bot-generated comments are easy to track: they will all have the usernames made of random symbols and numbers, random first and last name combinations, “Habibi”, etc. No profile pictures on all comments is also a red flag.

LEVEL 4

Another important factor to consider when assessing comment authenticity is the posting date. If all the comments were posted on the same day, it’s likely that the traffic was purchased.

2. Average views number per video

This is indeed one of the key metrics to consider when selecting an influencer for collaboration, regardless of the product type. What specific factors should we focus on?

First & foremost: the views dynamics on the channel. The most desirable type of YouTube channel in terms of views is one that maintains stable viewership across all of its videos. This stability serves as proof of an active and loyal audience genuinely interested in the creator’s content, unlike channels where views vary significantly from one video to another.

Many unauthentic crypto channels not only buy YouTube comments but also invest in increasing video views to create the impression of stability. So, what exactly should we look at in terms of views? Firstly, calculate the average number of views based on the ten latest videos. Then, compare this figure to the views of the most recent videos posted within the past week. If you notice that these new videos have nearly the same number of views as those posted a month or two ago, it’s a clear red flag. Typically, a YouTube channel experiences lower views on new videos, with the number increasing organically each day as the audience engages with the content. If you see a video posted just three days ago already garnering 30k views, matching the total views of older videos, it’s a sign of fraudulent traffic purchased to create the illusion of view stability.

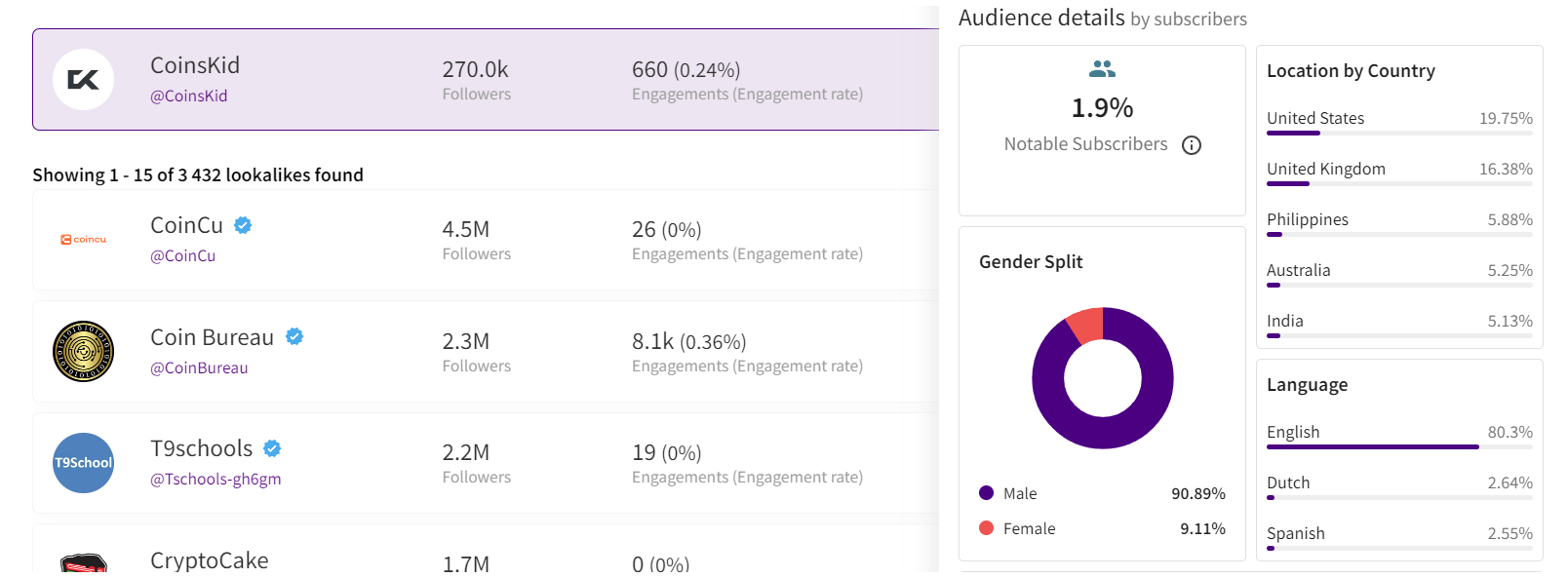

3. Influencer’s channel statistics

The primary statistics of interest are region and demographic split, and sometimes the device types of the viewers.

LEVEL 1

When reviewing the shared statistics, the first step is to request a video screencast instead of a simple screenshot. This is because it takes more time to organically edit a video than a screenshot, making it harder to manipulate the statistics. If the creator refuses, step two (if only screenshots are provided) is to download them and check the file’s properties on your computer. Look for details such as whether it was created with Adobe Photoshop or the color profile, typically Adobe RGB, to determine if the screenshot has been edited.

LEVEL 2

After confirming the authenticity of the stats screenshot, it’s crucial to analyze the data. For instance, if you’re examining a channel conducted in Spanish with all videos filmed in the same language, it would raise concerns to find a significant audience from countries like India or Turkey. This discrepancy, where the audience doesn’t align with regions known for speaking the language, is a red flag.

If we’re considering an English-language crypto channel, it typically suggests an international audience, as English’s global use for quality educational content on niche topics like crypto. However, certain considerations apply. For instance, if an English-speaking channel shows a significant percentage of Polish viewers (15% to 30%) without any mention of the Polish language, it could indicate fake followers and views. However, if the channel’s creator is Polish, occasionally posts videos in Polish alongside English, and receives Polish comments, it’s important not to rush to conclusions.

Example of statistics

Example of statistics

Wrapping up

These are the main factors to consider when selecting an influencer to promote your crypto product. Once you’ve launched the campaign, there are also some markers to show which creators did bring the authentic traffic and which used some tools to create the illusion of an active and engaged audience. While this may seem obvious, it’s still worth mentioning. After the video is posted, allow 5-7 days for it to accumulate a basic number of views, then check performance metrics such as views, clicks, click-through rate (CTR), signups, and conversion rate (CR) from clicks to signups.

If you overlooked some red flags when selecting crypto channels for your launch, you might find the following outcomes: channels with high views numbers and high CTRs, demonstrating the real interest of the audience, yet with remarkably low conversion rates. In the worst-case scenario, you might witness thousands of clicks resulting in zero to just a few signups. While this might suggest technical issues in other industries, in crypto campaigns it indicates that the creator engaged in the campaign not only bought fake views and comments but also link clicks. And this happens more often than you may realize.

Summing up, choosing the right crypto creator to promote your product is indeed a tricky job that requires a lot of resources to be put into the search process.

Author

Nadia Bubennikova, Head of agency at Famesters

Fintech

Central banks and the FinTech sector unite to change global payments space

The BIS, along with seven leading central banks and a cohort of private financial firms, has embarked on an ambitious venture known as Project Agorá.

Named after the Greek word for “marketplace,” this initiative stands at the forefront of exploring the potential of tokenisation to significantly enhance the operational efficiency of the monetary system worldwide.

Central to this pioneering project are the Bank of France (on behalf of the Eurosystem), the Bank of Japan, the Bank of Korea, the Bank of Mexico, the Swiss National Bank, the Bank of England, and the Federal Reserve Bank of New York. These institutions have joined forces under the banner of Project Agorá, in partnership with an extensive assembly of private financial entities convened by the Institute of International Finance (IIF).

At the heart of Project Agorá is the pursuit of integrating tokenised commercial bank deposits with tokenised wholesale central bank money within a unified, public-private programmable financial platform. By harnessing the advanced capabilities of smart contracts and programmability, the project aspires to unlock new transactional possibilities that were previously infeasible or impractical, thereby fostering novel opportunities that could benefit businesses and consumers alike.

The collaborative effort seeks to address and surmount a variety of structural inefficiencies that currently plague cross-border payments. These challenges include disparate legal, regulatory, and technical standards; varying operating hours and time zones; and the heightened complexity associated with conducting financial integrity checks (such as anti-money laundering and customer verification procedures), which are often redundantly executed across multiple stages of a single transaction due to the involvement of several intermediaries.

As a beacon of experimental and exploratory projects, the BIS Innovation Hub is committed to delivering public goods to the global central banking community through initiatives like Project Agorá. In line with this mission, the BIS will soon issue a call for expressions of interest from private financial institutions eager to contribute to this ground-breaking project. The IIF will facilitate the involvement of private sector participants, extending an invitation to regulated financial institutions representing each of the seven aforementioned currencies to partake in this transformative endeavour.

Source: fintech.globa

The post Central banks and the FinTech sector unite to change global payments space appeared first on HIPTHER Alerts.

Fintech

TD Bank inks multi-year strategic partnership with Google Cloud

TD Bank has inked a multi-year deal with Google Cloud as it looks to streamline the development and deployment of new products and services.

The deal will see the Canadian banking group integrate the vendor’s cloud services into a wider portion of its technology solutions portfolio, a move which TD expects will enable it “to respond quickly to changing customer expectations by rolling out new features, updates, or entirely new financial products at an accelerated pace”.

This marks an expansion of the already established relationship between TD Bank and Google Cloud after the group previously adopted the vendor’s Google Kubernetes Engine (GKE) for TD Securities Automated Trading (TDSAT), the Chicago-based subsidiary of its investment banking unit, TD Securities.

TDSAT uses GKE for process automation and quantitative modelling across fixed income markets, resulting in the development of a “data-driven research platform” capable of processing large research workloads in trading.

Dan Bosman, SVP and CIO of TD Securities, claims the infrastructure has so far supported TDSAT with “compute-intensive quantitative analysis” while expanding the subsidiary’s “trading volumes and portfolio size”.

TD’s new partnership with Google Cloud will see the group attempt to replicate the same level of success across its entire portfolio.

Source: fintechfutures.com

The post TD Bank inks multi-year strategic partnership with Google Cloud appeared first on HIPTHER Alerts.

-

Fintech5 days ago

Fintech5 days agoHow to identify authenticity in crypto influencer channels

-

Latest News4 days ago

HSBC-backed fintech Monese is considering splitting its operations as it grapples with increasing losses.

-

Latest News4 days ago

EverBank has announced a groundbreaking partnership with Finzly, poised to revolutionize payment processing.

-

Latest News4 days ago

FinTech leaders express caution regarding the promises made in #Budget2024 concerning open banking, stating that the “devil is in the details.”

-

Latest News4 days ago

Gotion High-tech’s operating profit up 391% in 2023, nearly RMB 2.8 billion invested in R&D for the year

-

Latest News4 days ago

Wells Fargo, a leading financial institution, is set to revolutionize its trade finance operations by incorporating artificial intelligence (AI) technology through its collaboration with TradeSun.

-

Latest News4 days ago

Aurionpro Solutions acquires Arya.ai, to power next generation Enterprise AI platforms for Financial Institutions

-

Latest News4 days ago

Latvian Fintech inGain Raises €650,000 for No-Code SaaS Loan Management System