Latest News

LABEL Foundation Has Announced an Official Deployment on Binance Smart Chain

Tortola, British Virgin Islands–(Newsfile Corp. – December 8, 2021) – LABEL Foundation

Figure 1: LABEL Foundation has announced an official deployment on Binance Smart Chain

LABEL may be understood as a blockchain-oriented international education content platform which presents an incubation system that readily supports various promotion, distribution and investment processes in an attempt to eliminate obstacles and challenges pertaining to existing content production as well as investment procedures.

Previous to this development, LABEL Foundation has expanded its ecosystem with key partnerships within the blockchain and education industry. It has already collaborated with OPENTRACK, a leading music education platform operated by Clesson. The partnership will provide a batch of world-class instructors that will provide early content within the LABEL ecosystem. They announced that they are committed to bringing world-class artists to their platform to incubate and NFTize their IP rights.

LABEL Foundation’s primary objective is to hence provide its users with high-quality educational and entertaining resources. Apparently, with their migration to the Binance Smart Chain ecosystem, LABEL will be able to leverage all the best features of the mainnet to scale and increase their performance of their decentralized application.

An innovative platform

Through LABEL, an NFT framework has been constructed atop the Ethereum Network and Binance Smart Chain, and it is supported by the LBL utility as well as governance tokens, with a single purpose of establishing a fair profit-sharing economy with permissionless IP rights incorporation. LABEL is hence a decentralized P2P (Peer To Peer) incubation platform that invests in high-quality entertainment and education material via the DAO (Decentralized Autonomous Organization) voting system, allowing donors to collect profits via the NFT ownership mechanism.

Also, the LABEL platform creates an ecosystem that seeks to establish an unbiased and decentralised incubating system, with the goal of providing content creators in the MOOC industry with improved accessibility. It therefore strives to enhance a seemingly unfair profit structure which is often prevalent in the sector and to also prevent copyright infringement instances from occurring throughout the industry.

Bridge with BSC

As per the latest developments, LABEL is now officially bridged to Binance Smart Chain (BSC) and the token shall be deployed via the MultiBaas Middleware, built by Curvegrid. The bridge shall link Ethereum Mainnet with Binance Smart Chain, allowing for the smooth movement of LBL tokens from ERC-20 to BEP-20 and vice versa.

Additionally, Solanium shall be joining LABEL as a strategic adviser, assisting in the expansion of the LABEL ecosystem. In the Solana (SOL) ecosystem, Solanium is a platform based in Amsterdam and primarily used for governance voting, decentralized fundraising, and time weight token staking. Furthermore, LABEL’s IDO is also anticipated to take place on RedKite and NFTb for the purposes of conducting public sale.

As per its whitepaper, LABEL aims to offer an unrivalled sales framework and infrastructure situated on the usage of blockchain technology via the aforementioned incubating system. Through this, experts, professionals and specialists alike can be found and invested in. Moreover, through effective system integration, LABEL will also create a fair profit sharing environment for the purposes of intellectual property rights. Lastly, with the establishment of its NFT Market, LABEL will launch a virtuous loop that will initiate the Global Value Chain by making the IP rights embedded in the non-fungible token readily transactable. To that end, it is also partnering up with various organizations from the entertainment and media industry to focus on the cultivation of its respective incubating system.

Media Contact:

CEO name: Hyungsoon Choi

Email: [email protected]

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/107098

Powered by WPeMatico

Fintech

How to identify authenticity in crypto influencer channels

Modern brands stake on influencer marketing, with 76% of users making a purchase after seeing a product on social media.The cryptocurrency industry is no exception to this trend. However, promoting crypto products through influencer marketing can be particularly challenging. Crypto influencers pose a significant risk to a brand’s reputation and ROI due to rampant scams. Approximately 80% of channels provide fake statistics, including followers counts and engagement metrics. Additionally, this niche is characterized by high CPMs, which can increase the risk of financial loss for brands.

In this article Nadia Bubennnikova, Head of agency Famesters, will explore the most important things to look for in crypto channels to find the perfect match for influencer marketing collaborations.

-

Comments

There are several levels related to this point.

LEVEL 1

Analyze approximately 10 of the channel’s latest videos, looking through the comments to ensure they are not purchased from dubious sources. For example, such comments as “Yes sir, great video!”; “Thanks!”; “Love you man!”; “Quality content”, and others most certainly are bot-generated and should be avoided.

Just to compare:

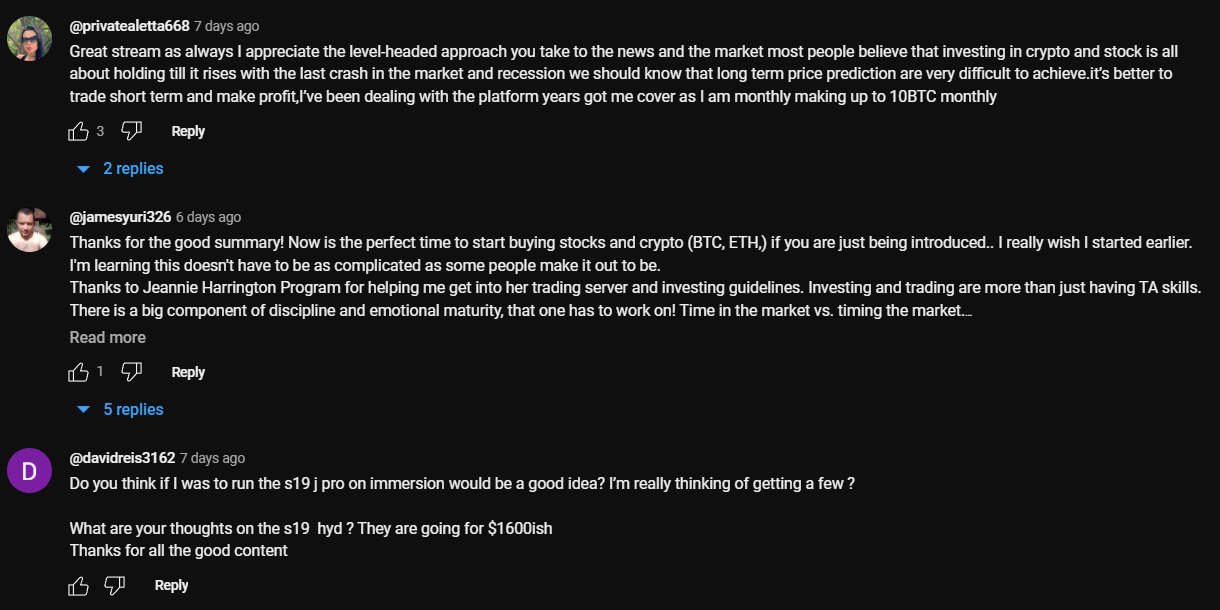

LEVEL 2

Don’t rush to conclude that you’ve discovered the perfect crypto channel just because you’ve come across some logical comments that align with the video’s topic. This may seem controversial, but it’s important to dive deeper. When you encounter a channel with logical comments, ensure that they are unique and not duplicated under the description box. Some creators are smarter than just buying comments from the first link that Google shows you when you search “buy YouTube comments”. They generate topics, provide multiple examples, or upload lists of examples, all produced by AI. You can either manually review the comments or use a script to parse all the YouTube comments into an Excel file. Then, add a formula to highlight any duplicates.

LEVEL 3

It is also a must to check the names of the profiles that leave the comments: most of the bot-generated comments are easy to track: they will all have the usernames made of random symbols and numbers, random first and last name combinations, “Habibi”, etc. No profile pictures on all comments is also a red flag.

LEVEL 4

Another important factor to consider when assessing comment authenticity is the posting date. If all the comments were posted on the same day, it’s likely that the traffic was purchased.

2. Average views number per video

This is indeed one of the key metrics to consider when selecting an influencer for collaboration, regardless of the product type. What specific factors should we focus on?

First & foremost: the views dynamics on the channel. The most desirable type of YouTube channel in terms of views is one that maintains stable viewership across all of its videos. This stability serves as proof of an active and loyal audience genuinely interested in the creator’s content, unlike channels where views vary significantly from one video to another.

Many unauthentic crypto channels not only buy YouTube comments but also invest in increasing video views to create the impression of stability. So, what exactly should we look at in terms of views? Firstly, calculate the average number of views based on the ten latest videos. Then, compare this figure to the views of the most recent videos posted within the past week. If you notice that these new videos have nearly the same number of views as those posted a month or two ago, it’s a clear red flag. Typically, a YouTube channel experiences lower views on new videos, with the number increasing organically each day as the audience engages with the content. If you see a video posted just three days ago already garnering 30k views, matching the total views of older videos, it’s a sign of fraudulent traffic purchased to create the illusion of view stability.

3. Influencer’s channel statistics

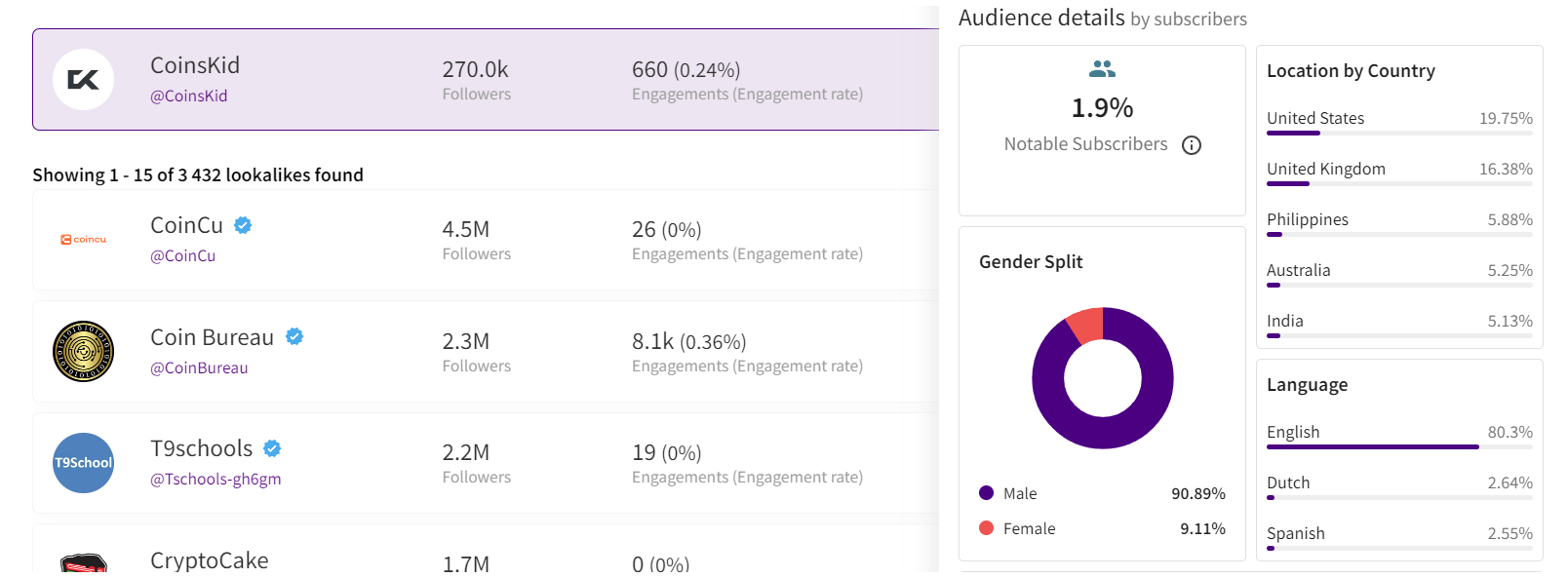

The primary statistics of interest are region and demographic split, and sometimes the device types of the viewers.

LEVEL 1

When reviewing the shared statistics, the first step is to request a video screencast instead of a simple screenshot. This is because it takes more time to organically edit a video than a screenshot, making it harder to manipulate the statistics. If the creator refuses, step two (if only screenshots are provided) is to download them and check the file’s properties on your computer. Look for details such as whether it was created with Adobe Photoshop or the color profile, typically Adobe RGB, to determine if the screenshot has been edited.

LEVEL 2

After confirming the authenticity of the stats screenshot, it’s crucial to analyze the data. For instance, if you’re examining a channel conducted in Spanish with all videos filmed in the same language, it would raise concerns to find a significant audience from countries like India or Turkey. This discrepancy, where the audience doesn’t align with regions known for speaking the language, is a red flag.

If we’re considering an English-language crypto channel, it typically suggests an international audience, as English’s global use for quality educational content on niche topics like crypto. However, certain considerations apply. For instance, if an English-speaking channel shows a significant percentage of Polish viewers (15% to 30%) without any mention of the Polish language, it could indicate fake followers and views. However, if the channel’s creator is Polish, occasionally posts videos in Polish alongside English, and receives Polish comments, it’s important not to rush to conclusions.

Example of statistics

Example of statistics

Wrapping up

These are the main factors to consider when selecting an influencer to promote your crypto product. Once you’ve launched the campaign, there are also some markers to show which creators did bring the authentic traffic and which used some tools to create the illusion of an active and engaged audience. While this may seem obvious, it’s still worth mentioning. After the video is posted, allow 5-7 days for it to accumulate a basic number of views, then check performance metrics such as views, clicks, click-through rate (CTR), signups, and conversion rate (CR) from clicks to signups.

If you overlooked some red flags when selecting crypto channels for your launch, you might find the following outcomes: channels with high views numbers and high CTRs, demonstrating the real interest of the audience, yet with remarkably low conversion rates. In the worst-case scenario, you might witness thousands of clicks resulting in zero to just a few signups. While this might suggest technical issues in other industries, in crypto campaigns it indicates that the creator engaged in the campaign not only bought fake views and comments but also link clicks. And this happens more often than you may realize.

Summing up, choosing the right crypto creator to promote your product is indeed a tricky job that requires a lot of resources to be put into the search process.

Author

Nadia Bubennikova, Head of agency

at Famesters

Latest News

Global Consulting Firm J.S. Held Recognizes 93 Experts with Senior Leadership Promotions

JERICHO, N.Y., April 19, 2024 /PRNewswire/ — Global consulting firm J.S. Held, proudly celebrating 50 transformative years, announces the promotion of 93 distinguished experts across multiple practices and geographies. These well-deserved senior expert promotions span the firm’s areas of expertise and exemplify our core values and commitment to delivering unrivaled expertise, unparalleled client service, and to be catalysts for change in our industry.

Technical and scientific experts are trusted advisors to organizations facing high-stakes situations requiring specialized expertise. Experts in construction; environmental, health, and safety (EHS); engineering; accident reconstruction; equipment, materials analysis & lab testing; and property & infrastructure damage, provide a comprehensive suite of services that enable clients to navigate complex, contentious, and often catastrophic situations across the globe.

J.S. Held experts deliver financial expertise across all assets and value at risk – uncovering the truth behind the numbers in financial disputes, bringing clarity to tangible and intangible asset valuation, and providing effective strategies to turn around troubled companies. Forensic accountants and economists are recognized industry leaders in financial investigations, quantifying economic damages, valuing businesses and their assets, and delivering expert witness testimony & litigation support in financial disputes. Corporate Finance experts provide turnaround & restructuring services, data analysis, compliance & regulatory consulting, financial reporting, interim management (c-suite level), receivership, and transaction advisory expertise.

J.S. Held’s risk and advisory experts have been engaged in some of the largest, most complex mandates across the world to advise in matters involving intellectual property, corporate investigations & monitorships, regulatory compliance, political risk, business intelligence, cyber security, fraud, corruption, and vast amounts of data. Multidisciplinary experts specialize in minimizing risk, navigating regulatory compliance, providing expert services in commercial disputes, and realizing business value.

With a strong belief that client service and employee engagement are synonymous, J.S. Held remains committed to providing a first-class work environment and cultivating a sense of community among its team. “In 2023, we launched J.S. Held Academy for continued team member development in support of our experts,” said Jonathon Held, Chief Executive Officer. “I am proud of our people who continue to demonstrate incredible drive and deliver integrated solutions to complex situations worldwide.”

Marjan Panah, the firm’s new Chief People Officer, added, “At J.S. Held, we recognize the importance of diversity of thought and experience in delivering the best solutions for our clients. These promotions reflect our commitment to fostering a culture that values and rewards expertise, collaboration, and innovation.”

J.S. Held remains dedicated to providing unparalleled expertise to clients facing high-stakes events demanding urgent attention, staunch integrity, clear-cut analysis, and an understanding of tangible and intangible assets.

Learn more about the dedicated and entrepreneurial experts who help transform J.S. Held, explore our story, and celebrate this momentous milestone, our 50 & Forward celebration, with us at jsheld.com.

About J.S. Held

J.S. Held is a global consulting firm providing technical, scientific, financial, and strategic expertise across all assets and value at risk. Our professionals serve as trusted advisors to organizations facing high-stakes matters demanding urgent attention, staunch integrity, proven experience, clear-cut analysis, and an understanding of both tangible and intangible assets. The firm provides a comprehensive suite of services, products, and data that enable clients to navigate complex, contentious, and often catastrophic situations.

More than 1,500 professionals serve organizations across six continents, including 81% of the Global 200 Law Firms, 70% of the Forbes Top 20 Insurance Companies (85% of the NAIC Top 50 Property & Casualty Insurers), and 65% of the Fortune 100 Companies.

J.S. Held, its affiliates and subsidiaries are not certified public accounting firm(s) and do not provide audit, attest, or any other public accounting services. J.S. Held, its affiliates and subsidiaries are not law firms and do not provide legal advice. Securities offered through PM Securities, LLC, d/b/a Phoenix IB, a part of J.S. Held, member FINRA/ SIPC or Ocean Tomo Investment Group, LLC, a part of J.S. Held, member FINRA/ SIPC. All rights reserved.

Media Contact

Kristi L. Stathis, J.S. Held, +1 786 833 4864, [email protected], JSHeld.com

Logo – https://mma.prnewswire.com/media/1824221/JS_Held_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/global-consulting-firm-js-held-recognizes-93-experts-with-senior-leadership-promotions-302119916.html

View original content:https://www.prnewswire.co.uk/news-releases/global-consulting-firm-js-held-recognizes-93-experts-with-senior-leadership-promotions-302119916.html

Latest News

Blair Institute Urges Labour to Embrace FinTech for Economic Growth

The post Blair Institute Urges Labour to Embrace FinTech for Economic Growth appeared first on HIPTHER Alerts.

-

Latest News7 days ago

DEMAND AT ASIAN FACTORIES RISES AT STRONGEST RATE IN OVER 2 YEARS, IMPROVING NEAR-TERM GROWTH OUTLOOK FOR MANUFACTURING WORLDWIDE: GEP GLOBAL SUPPLY CHAIN VOLATILITY INDEX

-

Latest News7 days ago

Bitrue Gears Up for 2024 Bitcoin Halving with Trading Competition

-

Latest News7 days ago

Global Airlines Appoints New Head of Finance from KPMG

-

Latest News6 days ago

“The Hainan FTP and Me”: Looking at Hainan’s Transformations

-

Latest News7 days ago

Spendesk combines procurement with spend management through Okko acquisition

-

Latest News7 days ago

BtcTurk Organizes Half Marathon in Istanbul to Celebrate Halving Period

-

Latest News4 days ago

Millions of people unite around doing good on the 18th International Good Deeds Day held yesterday worldwide

-

Latest News7 days ago

Bitget to Take Center Stage at Blockchain Life and Token2049 Dubai