Latest News

FJB Coin is Now Available for Trading on LBank Exchange

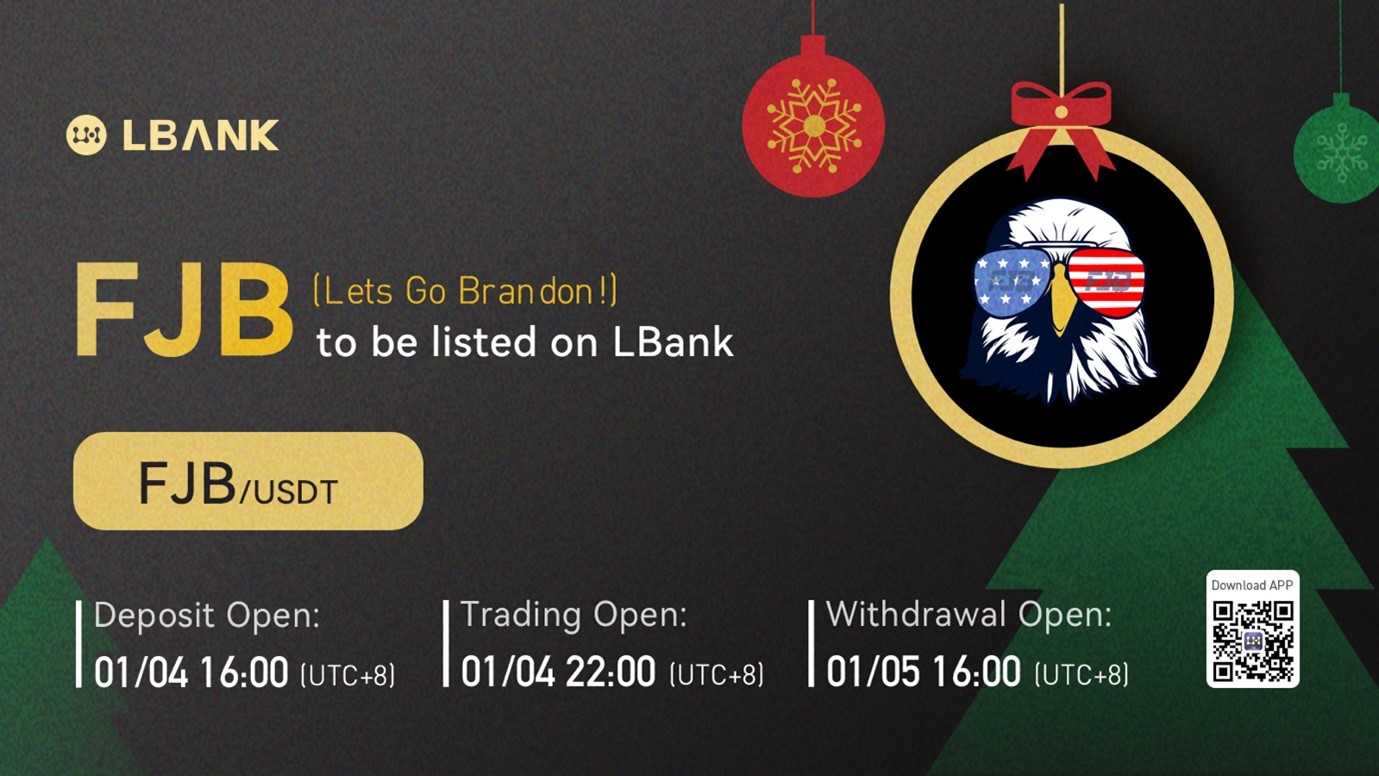

Internet City, Dubai–(Newsfile Corp. – January 5, 2022) – LBank Exchange, a global digital asset trading platform, has listed FJB Coin (Lets Go Brandon!) on January 4, 2022. For all users of LBank Exchange, the FJB/USDT trading pair is now officially available for trading.

Figure 1: FJB Coin is now available for trading on LBank Exchange

While driving innovation, crypto can also support for movement. As the coin that fights for America, FJB (Lets Go Brandon!) is here to give back to Veterans, and build a community where people are free to voice their views without fear of being shamed, discriminated against or cancelled. FJB has been listed on LBank Exchange at 22:00 (UTC+8) on January 4, 2022 to further expand its global reach.

Introducing FJB Coin (Lets Go Brandon!)

There is a movement about the voices of every individual across the world being heard when they felt like they’ve been silenced. The FJB project started as a rally around this movement with two main objectives, one, to build a community where people are free to voice their views without fear of being shamed, discriminated against or cancelled and two, charitable giving to Veterans, first responders and all of those who have given their lives for their country.

Since the project was launched in October 2021, the support FJB has received from the community is unlike anything in crypto. FJB started with just a handful of members but grew into a community of over 6,000 people across the world and over 8,000 coin holders and it’s only getting stronger. There is hardly a second that goes by where someone in one of its online communities is not typing a message. Everyone wants to know how they can own a coin that gives back to Veterans, first responders and their family but most importantly be a part of something bigger than they are.

Stephen K. Bannon and Boris Epshteyn have taken strategic ownership positions in the FJB Coin blockchain project, and each hold a significant amount of tokens. Mr. Bannon is the Founder and Host of WarRoom. He is also a former Naval Officer and M&A investment banker at Goldman Sachs who holds Graduate Degrees from Harvard Business School and Georgetown University. He served as CEO of President Trump’s 2016 campaign and was the White House Chief Strategist and Senior Counselor to President Trump. Mr. Epshteyn is a political strategist, attorney, and investment banker. He is also a contributor to WarRoom and founder of Georgetown Advisory consulting group. Mr. Epshteyn is a graduate of Georgetown University’s School of Foreign Service and Georgetown Law. He served as Senior Advisor on President Trump’s 2016 campaign, as Special Assistant and Assistant Communications Director for Surrogate Operations to President Trump at the White House and as Strategic Advisor on Trump 2020.

About FJB Token

Built on BSC as a BEP20 token, FJB has a total supply of 40B (i.e. 40,000,000,000) and ~17.8B coins burned, which can be seen in the burn wallet on BscScan. Additionally, there is an 8% transaction fee which goes to both marketing and charity wallets to support its marketing initiatives and allows the project to donate to Veterans, first responders and those have had given their lives for America, which means every time someone buys or sells FJB, a portion of its transaction fees get donated to Veterans who gave everything for their country.

The FJB Coin has been listed on LBank Exchange at 22:00 (UTC+8) on January 4, 2022, investors who are interested in FJB Coin investment can easily buy and sell FJB on LBank Exchange right now.

Learn More about FJB Token:

Official Website: https://fjbcoin.org/

Telegram: https://t.me/letsgobrandoncoin

Twitter: https://twitter.com/OfficialFJBCoin

Listing Announcement on LBank Exchange: https://support.lbank.site/hc/en-gb/articles/4413762196249-FJB-Lets-Go-Brandon-will-be-listed-on-LBank

About LBank Exchange

LBank Exchange, founded in 2015, is an innovative global trading platform for various crypto assets. LBank Exchange provides its users with safe crypto trading, specialized financial derivatives, and professional asset management services. It has become one of the most popular and trusted crypto trading platforms with over 6.4 million users from now more than 210 regions around the world.

Start Trading Now: lbank.info

Community & Social Media:

l Telegram

l Twitter

l Facebook

l Linkedin

Contact Details:

LBK Blockchain Co. Limited

LBank Exchange

[email protected]

DISCLAIMER: Opinions expressed by FJB are those of its team and does not represent or reflect LBank in any way.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/109117

Powered by WPeMatico

Latest News

Credit repayment fintech Incredible raises $1m

Latest News

Bankart migrates payment processing to Diebold Nixdorf’s Vynamic Transaction Middleware

The post Bankart migrates payment processing to Diebold Nixdorf’s Vynamic Transaction Middleware appeared first on HIPTHER Alerts.

Latest News

ATM Giant Hyosung Americas Announces Fintech Innovation Veteran as CEO

The post ATM Giant Hyosung Americas Announces Fintech Innovation Veteran as CEO appeared first on HIPTHER Alerts.

-

Latest News5 days ago

AI-powered Panax raises $15m to reshape cash flow management

-

Latest News6 days ago

“Grand Huangshan” Debuts at the 2024 World Brand Moganshan Conference

-

Latest News6 days ago

Yili’s 2023 Revenue Reaches 126.2 Billion Yuan, Leading Global Dairy Industry towards Healthy and Sustainable Development

-

Latest News5 days ago

Egypt’s Swypex launches an all-in-one fintech platform after $4m seed round

-

Latest News5 days ago

Sweden’s Mitigram names Pedram Tadayon as new CEO

-

Latest News5 days ago

Sobha Developers bring to Singapore an Exclusive Dubai Property Showcase

-

Latest News5 days ago

South African fintech Lesaka snaps up Adumo in $86m deal

-

Latest News5 days ago

India has remained a steady ship in choppy waters says DSP Asset Managers