Latest News

HIVE Blockchain Updates Total Bitcoin Equivalent 2021 Production Figures to 4,032

This news release constitutes a “designated news release” for the purposes of the Company’s prospectus supplement dated February 2, 2021 to its short form base shelf prospectus dated January 27, 2021.

Vancouver, British Columbia–(Newsfile Corp. – January 12, 2022) – HIVE Blockchain Technologies Ltd. (TSXV: HIVE) (Nasdaq: HIVE) (FSE: HBF) (the “Company” or “HIVE”) is clarifying its January 10, 2022 news release “HIVE Blockchain Presents December 2021 Production and Calendar Year 2021 Figures”.

In HIVE’s news release dated January 10, 2022, we understated certain aspects of our 2021 crypto production.

The news release stated that “in summary Total Bitcoin Equivalent mined was 3,222 based on BTC/ETH/ETC.” This was incorrect due to a typo.

The total Bitcoin Equivalent mined by HIVE in 2021 was 4,032. This takes into consideration the Bitcoin, ETH, and ETC mined by HIVE during calendar year 2021.

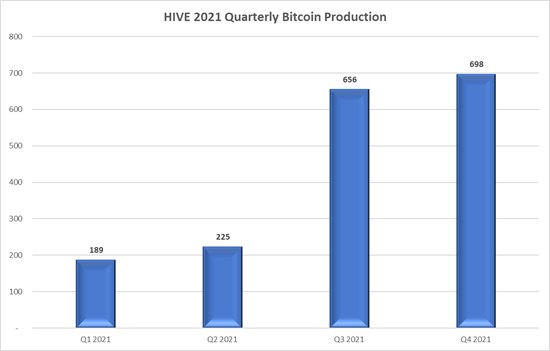

Here is a summary of the primary correction to the total Bitcoin Equivalent mined for calendar year 2021.

- Original press release: 3,222 BTC Equivalent

- Actual number: 4,032 BTC Equivalent

About HIVE Blockchain Technologies Ltd.

HIVE Blockchain Technologies Ltd. went public in 2017 as the first cryptocurrency mining company with a green energy and ESG strategy.

HIVE is a growth-oriented technology stock in the emergent blockchain industry. As a company whose shares trade on a major stock exchange, we are building a bridge between the digital currency and blockchain sector and traditional capital markets. HIVE owns state-of-the-art, green energy-powered data centre facilities in Canada, Sweden, and Iceland, where we source only green energy to mine on the cloud and HODL both Ethereum and Bitcoin. Since the beginning of 2021, HIVE has held in secure storage the majority of its ETH and BTC coin mining rewards. Our shares provide investors with exposure to the operating margins of digital currency mining, as well as a portfolio of cryptocurrencies such as ETH and BTC. Because HIVE also owns hard assets such as data centers and advanced multi-use servers, we believe our shares offer investors an attractive way to gain exposure to the cryptocurrency space.

We encourage you to visit HIVE’s YouTube channel here to learn more about HIVE.

For more information and to register to HIVE’s mailing list, please visit www.HIVEblockchain.com. Follow @HIVEblockchain on Twitter and subscribe to HIVE’s YouTube channel.

On Behalf of HIVE Blockchain Technologies Ltd.

“Frank Holmes”

Executive Chairman

For further information please contact:

Frank Holmes

Tel: (604) 664-1078

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Forward-Looking Information

Except for the statements of historical fact, this news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates and projections as at the date of this news release. “Forward-looking information” in this news release includes, but is not limited to, business goals and objectives of the Company; and other forward-looking information concerning the intentions, plans and future actions of the parties to the transactions described herein and the terms thereon.

Factors that could cause actual results to differ materially from those described in such forward-looking information include, but are not limited to, the volatility of the digital currency market; the Company’s ability to successfully mine digital currency; the Company may not be able to profitably liquidate its current digital currency inventory as required, or at all; a material decline in digital currency prices may have a significant negative impact on the Company’s operations; the volatility of digital currency prices; continued effects of the COVID-19 pandemic may have a material adverse effect on the Company’s performance as supply chains are disrupted and prevent the Company from carrying out its expansion plans or operating its assets; and other related risks as more fully set out in the registration statement of Company and other documents disclosed under the Company’s filings at www.sec.gov/EDGAR and www.sedar.com.

The forward-looking information in this news release reflects the current expectations, assumptions and/or beliefs of the Company based on information currently available to the Company. In connection with the forward-looking information contained in this news release, the Company has made assumptions about the Company’s objectives, goals or future plans, the timing thereof and related matters. The Company has also assumed that no significant events occur outside of the Company’s normal course of business. Although the Company believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future performance and accordingly undue reliance should not be put on such information due to the inherent uncertainty therein.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/109853

Powered by WPeMatico

Latest News

Allfunds has partnered with Google Cloud to leverage AI-powered innovation and optimize its infrastructure.

Latest News

Zetrix/MYEG and MaiCapital Ink MoU to Launch Virtual Asset Funds

KUALA LUMPUR, Malaysia, April 24, 2024 /PRNewswire/ — Zetrix Foundation and MY E.G. Services Berhad (“MYEG”) signed a Memorandum of Understanding (MoU) with MaiCapital, a licensed virtual asset manager in Hong Kong, to collaborate on the launch of a virtual asset fund or Hong Kong virtual assets exchange-traded fund (ETF) products.

The MoU focuses on a collaboration to issue a Securities and Futures Commission of Hong Kong (SFC) approved ETF, which would consist of a basket of cryptocurrencies, such as Bitcoin and Zetrix, and potentially other suitable cryptocurrencies.

This collaboration follows MYEG-developed Zetrix’s announcement of a strategic alliance with Web3Labs Hong Kong, a powerhouse in Web3 development and investment, alongside venture capital firm Summer Capital. Together, they aim to drive forward Hong Kong’s Web3 ambitions and position Zetrix as the preferred blockchain infrastructure for applications aligned with the Hong Kong government’s objectives, an initiative launched earlier this year.

The collaborative effort between MYEG and MaiCapital is timely, coming just as the SFC has begun granting approvals to several asset managers to launch the first spot bitcoin and ethereum ETFs.

TS Wong, Managing Director of MYEG, says that this partnership marks another milestone in integrating digital assets into mainstream finance.

“MYEG is pleased to partner with MaiCapital, a leading provider of virtual asset (VA) fund services in Hong Kong, to expand our offerings of cryptocurrency virtual assets fund or ETF options for investors. This collaboration aims to provide investors with additional avenues for diversification across multiple cryptocurrencies, thereby helping to mitigate the risks and volatility associated with owning a single cryptocurrency.”

Managing Partner of MaiCapital Limited, Marco Lim says this collaboration is a testament that Hong Kong’s embrace of Web3 technologies and positioning itself as a hub for innovation in this space is bearing fruit.

“VAs are a key part of a vibrant Web3 ecosystem, and more and more leading Web3 players are recognising Hong Kong’s progressive yet prudent stance on Web3. Our latest MoU with Zetrix Foundation/MYEG is yet another testament,” he says.

About Zetrix

Zetrix is a layer-1 public blockchain that facilitates smart contracts and delivers privacy, security and scalability. Zetrix’s cryptographic infrastructure can be introduced to multiple industries to connect governments, businesses and their citizens to a global blockchain-based economy. Developed by MY E.G. Services Bhd, the cross-border and cross-chain integration with China’s national public blockchain Xinghuo BIF enables Zetrix to serve as a blockchain gateway that facilitates global trade by deploying critical building blocks for Web3 services such as Blockchain-based Identifiers (BID) and Verifiable Credentials (VC).

Website: https://www.zetrix.com/

About MY E.G. Services Bhd (“MYEG”)

MYEG is Malaysia’s premier digital services company. Having commenced operations in 2000 as the flagship e-government services provider, MYEG continues to play a leading role in driving technological change in the region, bringing a diverse and complete range of innovations spanning the online delivery of major government services to a variety of commercial offerings in the areas of immigration, automotive, healthcare and financial services, among others. Committed to staying firmly at the forefront of the region’s digital revolution, MYEG has embraced the potential of blockchain technology to enhance all aspects of life and is actively pioneering its adoption across its main markets. MYEG has operations in key regional markets such as the Philippines and Indonesia.

Website: https://www.myeg.com.my/

MaiCapital Limited (“MaiCapital”)

MaiCapital is a leading virtual assets investment manager in Hong Kong and is a pioneer in applying institutional investment practices to the innovative cryptocurrency space. The firm aims to offer crypto-inclined investors with legitimate and compliant products that provide positive returns with maximum protection.

MaiCapital has received Securities and Futures Commission of Hong Kong’s (SFC) approval to manage funds that may comprise up to 100% virtual assets. The firm is subject to the SFC’s “Proforma Terms and Conditions for Licensed Corporations which Manage Portfolios that Invest in Virtual Assets”.

In early 2019, the firm launched its first crypto-themed product, the Blockchain Opportunity Fund. The multi-strategy investment approach of this Fund has garnered global recognition, with the London-based investment data company Preqin ranking its 2021 return among the Top 3 hedge funds across all of Asia.

Website: https://www.maicapital.io/

Photo – https://mma.prnewswire.com/media/2391963/Group_Photo.jpg

Logo – https://mma.prnewswire.com/media/2163610/ZETRIX_Hires_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/zetrixmyeg-and-maicapital-ink-mou-to-launch-virtual-asset-funds-302124475.html

View original content:https://www.prnewswire.co.uk/news-releases/zetrixmyeg-and-maicapital-ink-mou-to-launch-virtual-asset-funds-302124475.html

Latest News

Nium and Thredd Expand Partnership to Power B2B Travel Payments in APAC

SINGAPORE, April 23, 2024 /PRNewswire/ — Nium, the global leader in real-time cross-border payments, today announced the expansion of its partnership with Thredd, a leading global payments processor, to issue virtual cards in the Asia Pacific (APAC) region.

Nium’s virtual card solution is used by travel intermediaries to effectively pay hotels, airlines, and other global travel suppliers with enhanced security, efficiency, and reduced costs. The expansion comes as global B2B travel transaction volumes are projected to reach $1.7 trillion by 2027, according to Thredd’s latest report, with the APAC region the fastest-growing market expected to reach $480 billion in the same year.

By integrating Thredd APIs into its single platform for instant global payments, Nium has been able speed up transactions to 200 milliseconds when issuing and loading virtual cards in nearly 30 countries worldwide. Certified by Visa and Mastercard to process credit, debit, and prepaid card transactions globally on one platform, via the partnership Thredd also enables Nium to increase acceptance rates and guarantee card scheme protection for its travel intermediary customers. Together, the fintech duo have issued 86 million virtual cards globally since 2018.

Powered by Thredd’s global processing capabilities, Nium has successfully launched local issuing in Singapore as part of its strategic expansion in B2B travel payments across APAC. In the last 12 months, Nium has doubled APAC travel customer revenue and seen a 75% increase in virtual card transaction volumes in the region.

“APAC presents a substantial opportunity for global travel intermediaries that will in turn spur robust competition, a boon for consumers, and accelerated growth for the global travel ecosystem. Fuelling this unmistakeable growth is the rise of innovative B2B travel payment solutions, like that offered by Nium. Our long-standing collaboration is a great example of how fintech partnerships are propelling other industries forward,” said Jim McCarthy, CEO at Thredd.

“With a world of travel options now available in the palm of your hand, travel intermediaries and their hotel partners are under increasing pressure to reduce costs whilst maintaining a compelling customer experience. Virtual card payments are a game-changer for the travel industry, enabling intermediaries to improve cash flow for their hotel partners, in turn driving better prices and deeper connections with consumers. With Thredd’s technology, we can continue to meet the evolving needs of the travel ecosystem on a global scale, now and in the future,” said Spencer Hanlon, Global Head of Travel Payments at Nium.

Download Nium’s latest research on how virtual cards are transforming the travel payments landscape here.

About Nium

Nium, the global leader in real-time, cross-border payments, was founded on the mission to deliver the global payments infrastructure of tomorrow, today. With the onset of the global economy, its payments infrastructure is shaping how banks, fintechs, and businesses everywhere collect, convert, and disburse funds instantly across borders. Its payout network supports 100 currencies and spans 190+ countries, 100 of which in real-time. Funds can be disbursed to accounts, wallets, and cards and collected locally in 35 markets. Nium’s growing card issuance business is already available in 34 countries. Nium holds regulatory licences and authorizations in more than 40 countries, enabling seamless onboarding, rapid integration, and compliance – independent of geography. The company is co-headquartered in San Francisco and Singapore.

About Thredd

Thredd is the trusted next-gen payments processing partner for innovators looking to modernise their payments offerings worldwide. Processing billions of debit, prepaid and credit transactions annually, serving over 100 fintechs, digital banks, and embedded finance providers, from consumer to corporate, across 44 countries.

Thredd’s assured solution accelerates the development and delivery of consumer and corporate payments components embedded within digital banks, as well as for expense management, B2B payments, crypto, lending, credit, Buy Now Pay Later (“BNPL”), FX, remittance, and open banking innovators. Thredd has enabled market leaders since 2007 and has a highly reliable platform with 99.99% availability. Thredd’s highly customisable solutions on our API-first platform, surrounded by our in-depth industry expertise, value-added services, global presence, and technical resilience, are designed to scale with ease. Thredd is certified by Visa and Mastercard to process transactions globally.

Logo – https://mma.prnewswire.com/media/1678669/4666593/Nium_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/nium-and-thredd-expand-partnership-to-power-b2b-travel-payments-in-apac-302125165.html

View original content:https://www.prnewswire.co.uk/news-releases/nium-and-thredd-expand-partnership-to-power-b2b-travel-payments-in-apac-302125165.html

-

Fintech5 days ago

Fintech5 days agoHow to identify authenticity in crypto influencer channels

-

Latest News4 days ago

HSBC-backed fintech Monese is considering splitting its operations as it grapples with increasing losses.

-

Latest News4 days ago

EverBank has announced a groundbreaking partnership with Finzly, poised to revolutionize payment processing.

-

Latest News4 days ago

FinTech leaders express caution regarding the promises made in #Budget2024 concerning open banking, stating that the “devil is in the details.”

-

Latest News4 days ago

Gotion High-tech’s operating profit up 391% in 2023, nearly RMB 2.8 billion invested in R&D for the year

-

Latest News4 days ago

Aurionpro Solutions acquires Arya.ai, to power next generation Enterprise AI platforms for Financial Institutions

-

Latest News4 days ago

Wells Fargo, a leading financial institution, is set to revolutionize its trade finance operations by incorporating artificial intelligence (AI) technology through its collaboration with TradeSun.

-

Latest News4 days ago

Latvian Fintech inGain Raises €650,000 for No-Code SaaS Loan Management System