Latest News

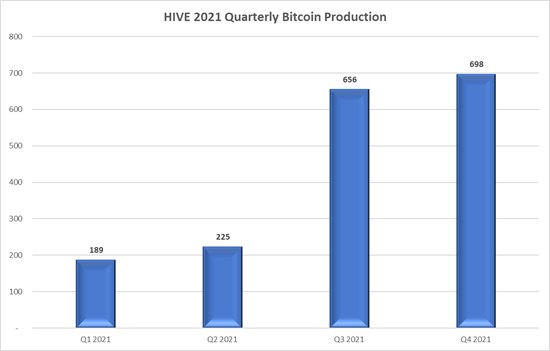

RETRANSMISSION: HIVE Blockchain Updates Total Bitcoin Equivalent 2021 Production Figures to 4,032

This news release constitutes a “designated news release” for the purposes of the Company’s prospectus supplement dated February 2, 2021 to its short form base shelf prospectus dated January 27, 2021.

Vancouver, British Columbia–(Newsfile Corp. – January 12, 2022) – HIVE Blockchain Technologies Ltd. (TSXV: HIVE) (Nasdaq: HIVE) (FSE: HBF) (the “Company” or “HIVE”) is clarifying its January 10, 2022 news release “HIVE Blockchain Presents December 2021 Production and Calendar Year 2021 Figures”.

In HIVE’s news release dated January 10, 2022, we understated certain aspects of our 2021 crypto production.

The news release stated that “in summary Total Bitcoin Equivalent mined was 3,222 based on BTC/ETH/ETC.” This was incorrect due to a typo.

The total Bitcoin Equivalent mined by HIVE in 2021 was 4,032. This takes into consideration the Bitcoin, ETH, and ETC mined by HIVE during calendar year 2021.

Here is a summary of the primary correction to the total Bitcoin Equivalent mined for calendar year 2021.

- Original press release: 3,222 BTC Equivalent

- Actual number: 4,032 BTC Equivalent

About HIVE Blockchain Technologies Ltd.

HIVE Blockchain Technologies Ltd. went public in 2017 as the first cryptocurrency mining company with a green energy and ESG strategy.

HIVE is a growth-oriented technology stock in the emergent blockchain industry. As a company whose shares trade on a major stock exchange, we are building a bridge between the digital currency and blockchain sector and traditional capital markets. HIVE owns state-of-the-art, green energy-powered data centre facilities in Canada, Sweden, and Iceland, where we source only green energy to mine on the cloud and HODL both Ethereum and Bitcoin. Since the beginning of 2021, HIVE has held in secure storage the majority of its ETH and BTC coin mining rewards. Our shares provide investors with exposure to the operating margins of digital currency mining, as well as a portfolio of cryptocurrencies such as ETH and BTC. Because HIVE also owns hard assets such as data centers and advanced multi-use servers, we believe our shares offer investors an attractive way to gain exposure to the cryptocurrency space.

We encourage you to visit HIVE’s YouTube channel here to learn more about HIVE.

For more information and to register to HIVE’s mailing list, please visit www.HIVEblockchain.com. Follow @HIVEblockchain on Twitter and subscribe to HIVE’s YouTube channel.

On Behalf of HIVE Blockchain Technologies Ltd.

“Frank Holmes”

Executive Chairman

For further information please contact:

Frank Holmes

Tel: (604) 664-1078

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Forward-Looking Information

Except for the statements of historical fact, this news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates and projections as at the date of this news release. “Forward-looking information” in this news release includes, but is not limited to, business goals and objectives of the Company; and other forward-looking information concerning the intentions, plans and future actions of the parties to the transactions described herein and the terms thereon.

Factors that could cause actual results to differ materially from those described in such forward-looking information include, but are not limited to, the volatility of the digital currency market; the Company’s ability to successfully mine digital currency; the Company may not be able to profitably liquidate its current digital currency inventory as required, or at all; a material decline in digital currency prices may have a significant negative impact on the Company’s operations; the volatility of digital currency prices; continued effects of the COVID-19 pandemic may have a material adverse effect on the Company’s performance as supply chains are disrupted and prevent the Company from carrying out its expansion plans or operating its assets; and other related risks as more fully set out in the registration statement of Company and other documents disclosed under the Company’s filings at www.sec.gov/EDGAR and www.sedar.com.

The forward-looking information in this news release reflects the current expectations, assumptions and/or beliefs of the Company based on information currently available to the Company. In connection with the forward-looking information contained in this news release, the Company has made assumptions about the Company’s objectives, goals or future plans, the timing thereof and related matters. The Company has also assumed that no significant events occur outside of the Company’s normal course of business. Although the Company believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future performance and accordingly undue reliance should not be put on such information due to the inherent uncertainty therein.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/109857

Powered by WPeMatico

Latest News

Gotion High-tech’s operating profit up 391% in 2023, nearly RMB 2.8 billion invested in R&D for the year

HEFEI, China, April 20, 2024 /PRNewswire/ — On the evening of 19 April, Gotion High-tech (002074) released its 2023 annual report. The company achieved operating revenue of RMB 31.605 billion, an increase of 37.11% YoY; operating profit of RMB 975 million, an increase of 390.92% YoY; and net profit attributable to the owner of the listed company of RMB 939 million, an increase of 201.28% YoY. The company’s net cash flows from operating activities was RMB 2.419 billion, up 201.86% YoY.

On the same day, Gotion High-tech also released its 2024 quarterly report. The company achieved revenue of RMB 7.508 billion, a YoY increase of 4.61%, and net profit attributable to the owner of the listed company after deducting non-recurring profits and losses increased by 195.26% YoY.

The report shows that Gotion High-tech’s product delivery exceeded 40GWh in 2023, with a YoY growth of more than 40%, and sales revenue including tax increased by more than 50% YoY under the situation of continuous decline in battery prices. Power battery sales revenue of RMB 23.051 billion, a YoY growth of 24.72%. Energy storage business revenue was RMB 6.932 billion, up 97.61% YoY, with the revenue share rising to 21.93%.

Gotion High-tech adheres to innovation drive, increases R&D investment, and accelerates product technology iteration. In 2023, the company’s R&D investment reached RMB 2.768 billion, a YoY increase of 14.57%. The company’s Unified Cell, 4695 cylinder cell, semi-solid punch cell and third-generation battery cell products such as L300, M600 and N300 have been recognized by the market for their excellent performance in terms of safety, energy density, power performance and service life. Among them, Gotion has been designated by Volkswagen Unified Cell globally; the energy density of the in-house developed Astroinno battery pack reaches 190Wh/kg.

In addition, Gotion High-tech continues to deepen the strategic layout of globalization. With four Pack plants in Germany, Indonesia, Thailand and Silicon Valley of the U.S. launching their products, and production bases such as in Vietnam, Chicago of the U.S., Michigan of the U.S., Slovakia, Argentina, and Indonesia progressing step by step, Gotion High-tech initially formed the layout of ten overseas bases covering materials, cells, and Pack, and realized localization of production and R&D. In 2023, Gotion achieved overseas revenue of RMB 6.428 billion, a YoY growth of 115.69%.

View original content:https://www.prnewswire.co.uk/news-releases/gotion-high-techs-operating-profit-up-391-in-2023–nearly-rmb-2-8-billion-invested-in-rd-for-the-year-302122659.html

Latest News

Fintech Powerhouse CRED Receives In-Principle Approval for Payment Aggregator License

The post Fintech Powerhouse CRED Receives In-Principle Approval for Payment Aggregator License appeared first on HIPTHER Alerts.

Latest News

FinTech leaders express caution regarding the promises made in #Budget2024 concerning open banking, stating that the “devil is in the details.”

-

Latest News7 days ago

“The Hainan FTP and Me”: Looking at Hainan’s Transformations

-

Latest News5 days ago

Millions of people unite around doing good on the 18th International Good Deeds Day held yesterday worldwide

-

Latest News5 days ago

Banxso Acquires Australian ASIC License, Enhancing Its Global Trading Operations

-

Latest News3 days ago

BMO Announces Election of Board of Directors

-

Latest News5 days ago

135th Canton Fair Launches a Showcase of Innovative Products of New Collection to Lead Global Market Trends

-

Latest News4 days ago

HaloWallet Rebrands To Halo: Integrating SocialFi & AI To Revolutionize Social Influence Monetization

-

Latest News5 days ago

BII and FMO back BECIS with joint US$50 million financing facility supporting commercial and industrial renewables sector in South-East Asia

-

Latest News3 days ago

Vantage Markets Wins “Most Innovative Broker” Award from FXBT; Redefines Trader Empowerment