Latest News

LBank Exchange Will List BITONE (BIO) on February 23, 2022

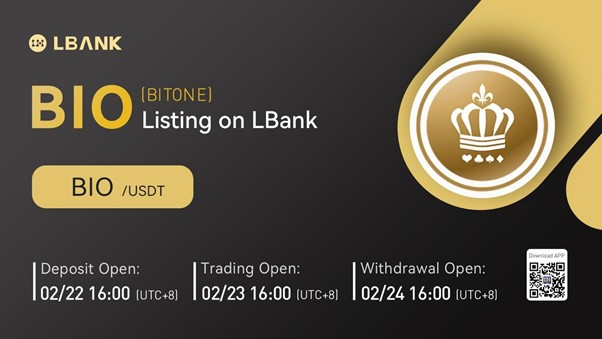

Internet City, Dubai–(Newsfile Corp. – February 22, 2022) – LBank Exchange, a global digital asset trading platform, will list BITONE (BIO) on February 23, 2022. For all users of LBank Exchange, the BIO/USDT trading pair will be officially available for trading at 16:00 (UTC+8) on February 23, 2022.

Figure 1: LBank Exchange Will List BITONE (BIO) on February 23, 2022

In today’s world, data verification is often done in a centralized way by relevant company, institution, or sometimes, auditors, therefore the integrity and reliability of the result cannot be assured. To address this issue, the BITONE (BIO) project utilizes blockchain technology to verify the integrity of the data with numerous audit nodes, and stores data in the blockchain using the IPFS method. Its native token BIO will be listed on LBank Exchange at 16:00 (UTC+8) on February 23, 2022, to further expand its global reach and help it achieve its vision.

Introducing BITONE Project

BITONE is a blockchain network that allows numerous audit nodes to verify the integrity of data through the self-developed 2DIVS (distributed data integrity verification system) and stores the verified data in the blockchain in the IPFS method. The project focuses on realistic technology that can be easily and quickly applied offline and online to services in operation in designing a perfectly decentralized data integrity verification technology.

To secure the reliability of online voting, BITONE provides B.V.C (Bio Voting Contractor), a blockchain-based electronic voting system which can be used by many industries that require online voting, and it also provides API for easy integration into existing online services.

Moreover, the B2O (Blockchain To Offline) market is developed that guarantees the integrity of offline product data and trusts the NFT technology and B.D.C (BIO Distribute Contractor) provided by BITONE.

In general, the random number generator (RNG) of online games runs on a centralized system, regardless of whether the results are random or pre-manipulated. B.R.C (BIO RNG CONTRACTOR), which is basically provided in BITONE, solves the reliability problem by including game participants in the process of deriving the RNG result value.

For protecting user assets, the BITONE project escrows coins or tokens commonly used by game operators through B.D.C technology supported for B2O service, and guarantees real-time data integrity through B.H.G (BIO Hash Generator). In addition, it provides a Web API to support HTML5 games and web services, and provides the Unity3d SDK, which is the most used for game development, so that many developers can use blockchain technology easily.

With these unique and advanced features, BITONE plans to support the multibillion-dollar interactive gaming market, including online card games, as well as the mobile gaming market.

About BIO Token

BIO is the native token of BITONE project, users store data and consume BIOs to ensure integrity, and miners earn BIOs by storing data and ensuring integrity. In addition, BIOs can be acquired through staking, and the amount of compensation is set in the Proof-of-Stake method and the Proof-of-Time method.

Based on TRC20, BIO has a total supply of 2 billion (i.e. 2,000,000,000) tokens. 71% of it is provided for mining pool incentives, 15% is provided for token sale, 7.5% will be used for marketing, and the rest 6.5% is allocated to the foundation.

BIO will be listed on LBank Exchange at 16:00 (UTC+8) on February 23, 2022, investors who are interested in BITONE investment can easily buy and sell BIO on LBank Exchange by then. The listing of BIO on LBank Exchange will undoubtedly help it further expand its business and draw more attention in the market.

Learn More about BIO Token:

Official Website: https://www.bit-one.io

Telegram: https://t.me/bitone_official

Twitter: https://twitter.com/bitone_twit

Medium: https://medium.com/@bitone_official

About LBank Exchange

LBank Exchange, founded in 2015, is an innovative global trading platform for various crypto assets. LBank Exchange provides its users with safe crypto trading, specialized financial derivatives, and professional asset management services. It has become one of the most popular and trusted crypto trading platforms with over 6.4 million users from now more than 210 regions around the world.

Start Trading Now: lbank.info

Community & Social Media:

l Telegram

l Twitter

l Facebook

l LinkedIn

Contact Details:

LBK Blockchain Co. Limited

LBank Exchange

[email protected]

PR Contact:

ZEXPRWIRE

[email protected]

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/114440

Powered by WPeMatico

Latest News

Sobha Developers bring to Singapore an Exclusive Dubai Property Showcase

Lucrative offers available to invest in Real Estate & Win a Free Trip To Dubai

SINGAPORE, May 11, 2024 /PRNewswire/ — Dubai, renowned globally for its surreal skyscrapers and stunning skyline, is the epitome of luxury and innovation. The city is part of a thriving economy complete with state-of-the-art infrastructure, stable government, and the best education and healthcare facilities that attract investors seeking both capital appreciation and steady rental income. Sobha Developers have now brought to Singapore the lucrative chance to invest in Dubai’s real estate market.

UAE’s top developers, including industry giant Sobha Developers, are gearing up to host an Exclusive Dubai Property Showcase on May 11th and 12th at the iconic Marina Bay Sands, Level 4, Lotus Ballroom, 4A & 4B.

The Dubai Property Showcase is a haven for investors. From expert guidance to a diverse portfolio, there are several reasons why you should attend the event where there will be a portfolio of luxury properties, with starting prices at 300,000 SGD. At the event one can engage in personalised consultations with industry experts for tailored investment advice. Best of guidance and information about project locations, features, and amenities will be available to help investors and buyers understand the best investment opportunities in Dubai real estate. Upon making a property investment at the show, buyers will be entitled to a complimentary 2-night stay for two in Dubai.

Dubai is one of the world’s most profitable real estate markets to invest in and a tax free economy, boasting of returns exceeding 6%, backed by a robust economy and stellar infrastructure. Dubai’s strategic location and stable economy solidify its position as an investment hotspot, promising long-term growth and prosperity. Buyers can even gain access to Dubai’s prestigious Golden Visa program, offering long-term residency benefits to property investors and their families.

To become a part of this exclusive opportunity to explore Dubai’s real estate horizon, you can register on https://tinyurl.com/4836wff2 for the Exclusive Dubai Property Showcase and take the first step toward securing your financial future in one of the world’s most dynamic real estate markets.

CONTACT:

Yasmine: +6585575024

Abdullah: +971553367231, [email protected]

Photo – https://mma.prnewswire.com/media/2410348/Dubai_Property_Showcase.jpg

![]() View original content to download multimedia:https://www.prnewswire.co.uk/news-releases/sobha-developers-bring-to-singapore-an-exclusive-dubai-property-showcase-302142915.html

View original content to download multimedia:https://www.prnewswire.co.uk/news-releases/sobha-developers-bring-to-singapore-an-exclusive-dubai-property-showcase-302142915.html

Latest News

South African fintech Lesaka snaps up Adumo in $86m deal

Latest News

AI-powered Panax raises $15m to reshape cash flow management

Panax, a pioneering FinTech firm, has recently announced the successful completion of a $15 million funding round, with Team8 and TLV Partners leading the investment charge.

Founded by Noam Mills (CEO), Sefi Itzkovich (CTO), and Niv Yaar (CBO), Panax specializes in offering an AI-driven cash flow management platform tailored to cater to the needs of mid-market and large enterprises grappling with intricate treasury management requirements. The platform consolidates data directly from banks and ERP systems, providing users with real-time access to crucial cash positions and insights.

As finance teams face mounting challenges in managing multiple bank accounts, disparate fintech solutions, diverse locations, currencies, and entities, Panax’s platform emerges as a comprehensive solution. Customers have reported notable savings on interest payments and increased cash investments in interest-bearing accounts, owing to the automation capabilities of Panax’s platform, which streamlines processes and allows teams to redirect their focus towards strategic activities.

Mackenzie Moore, VP of Finance at Oddity, a publicly traded company in the U.S., lauded the platform’s effectiveness: “The automated data collection and analysis, along with proactive alerts, have helped us automate our cash policies. This not only saves us money but also frees up many hours of manual work that we can now allocate to more strategic pursuits.”

Panax aims to bridge the gap in the market by providing simpler and more accessible solutions tailored for lean finance teams. Leveraging Open Banking and GenAI technologies, the company streamlines and automates financial processes, thereby enhancing operational efficiency.

Recognizing financial forecasting as the top use case for AI in corporate finance, Gartner acknowledges Panax’s utilization of AI to bolster various capabilities, including transaction categorization, proactive reporting, and trend analysis.

The $15 million funding infusion is poised to accelerate Panax’s growth trajectory significantly. It will facilitate the scaling of sales and support teams, the establishment of a New York City office to strengthen the company’s U.S. presence, and an increase in product development resources to cater to the burgeoning market demand for its advanced treasury management solutions.

CEO Noam Mills underscored the company’s mission, stating, “In our previous roles, we witnessed firsthand the challenges faced by finance teams in companies with complex treasury operations. That’s why we founded Panax.”

Panax’s notable achievement of doubling its customer base in the first quarter of 2024 attests to its rapid traction in the market, positioning it as a prominent player in reshaping cash flow management and treasury solutions.

Source: fintech.global

The post AI-powered Panax raises $15m to reshape cash flow management appeared first on HIPTHER Alerts.

-

Latest News6 days ago

TerraPay Continues to Attract Top Industry Talent, Names Hassan Chatila as Vice President and Global Head of Network

-

Latest News6 days ago

The General Assembly of Siniora Food Industries Company approved the distribution of cash dividends amounting to JD 4.2 million representing 15% of its paid-in capital, and stock dividends amounting to 2,147,059 shares

-

Latest News6 days ago

IRIS Business Services Introduces “IRIS Myeinvois” SaaS Platform for Seamless e-Invoice Compliance in Malaysia

-

Latest News6 days ago

Top 10 Sessions You Can’t Miss at MARE BALTICUM Gaming & TECH Summit 2024 (Tallinn, Estonia, 4-5 June)

-

Latest News4 days ago

Mashreq Partners with Silent Eight for Compliance Alert Adjudication

-

Latest News6 days ago

Halal Economy Leadership Forum 2024 Riyadh: IsDB, HPDC and HDC’s Collaboration to Spearhead Innovation for Global Halal Industry

-

Latest News6 days ago

ICEYE Announces API That Allows Customers to Directly Task World’s Largest SAR Satellite Constellation

-

Latest News5 days ago

Wego and Moroccan National Tourist Office Forge Strategic Alliance, Unveiled at the Arabian Travel Market (ATM)