Latest News

Graphlinq Partners with QuickSwap for Integration on Our Nocode Ecosystem

Paris, France–(Newsfile Corp. – February 22, 2022) – Following up on the partnership with Polygon and Elrond. With the addition of QuickSwap, Graphlinq continues to grow its ecosystem.

On Polygon, QuickSwap is the leading DEX with nearly $1 billion in liquidity, almost $100 million in daily trading volume, and approximately 20 thousand users. Users of QuickSwap can trade ERC-20 assets with very low gas fees.

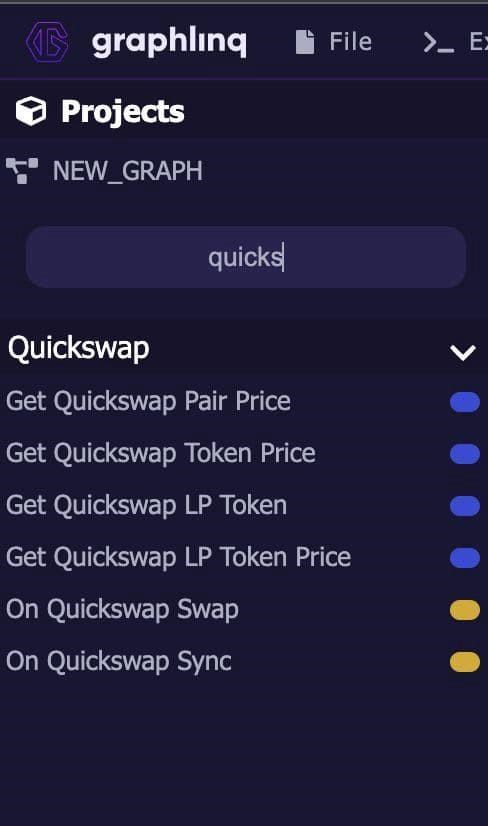

With their GraphLinq IDE, you can experiment with their QuickSwap components since they have added some logical blocks for QuickSwap components. Create your first smart workflow by experimenting with them.

Live Integrations For Quickswap On GraphLinq:

- Get Pair price for QuickSwap

- Get Token price for QuickSwap

- Get LP Token for QuickSwap

- Get LP Token price for QuickSwap

Figure 1: Graphlinq partners with QuickSwap For Integration on our Nocode Ecosystem

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/8378/114491_f5633c86f4612a98_002full.jpg

About QuickSwap

QUICK is the native governance and utility token that powers QuickSwap – a decentralized exchange that runs on the Polygon Network in order to provide faster and cheaper transactions on Ethereum. QUICK can be used to vote on governance proposals concerning QuickSwap and can be staked to earn a portion of trading fees. Every day, tens of thousands of users rely on QuickSwap for their trades.

About Graphlinq

GraphLinq is a no-code ecosystem that allows anyone to automate crypto-oriented on-chain & off-chain actions without having to code. The ecosystem consists of a simple app and an advanced IDE for nocoders, an analytics platform, & an upcoming Marketplace for buying/selling of templates. With pre-made templates available for users with no knowledge about the technical terms, anyone can simply change some values here and there to deploy their automation without worrying about anything.

GraphLinq will launch more blocks, and pre-made templates for QuickSwap in the coming weeks. Also as part of partnership, QuickSwap will be updating GraphLinq’s logo on its Dex.

Media Contact –

Contact Name: Rishabh Anand CMO

Organization name: GraphLinq

Email: [email protected]

Website URL: https://graphlinq.io/

PR Partner –

ZEX PR WIRE

http://zexprwire.com/

[email protected]

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/114491

Powered by WPeMatico

Latest News

Credit card fintech Pliant lands €18m Series A extension led by PayPal Ventures

Pliant, a Berlin-based B2B credit card fintech, has secured over €18 million in a Series A extension, pushing the total funding for this round beyond €50 million.

PayPal Ventures led the latest investment round, with participation from existing investors Alstin Capital, SBI Investment, and Motive Ventures.

Earlier this year, Pliant raised €28 million through its initial Series A funding round. With this new injection of capital, the company is set to expand its cards-as-a-service (CaaS) product into markets outside the European Union, with a focus on the UK.

To facilitate its expansion plans, Pliant has developed multi-currency capabilities, allowing it to offer services in 11 different currencies. This enhancement enables customers to receive invoices in the same currency used for the transaction, a feature particularly beneficial for businesses dealing with significant volumes in non-EUR currencies.

Pliant attributes this funding success to its strong performance in 2023, where it doubled its annual revenues.

Additionally, the fintech has broadened its reach by extending its Electronic Money Institution (EMI) license to cover 25 countries across the European Economic Area (EEA). This expansion allows Pliant to offer financial services beyond card issuance in the region.

Source: fintechfutures.com

The post Credit card fintech Pliant lands €18m Series A extension led by PayPal Ventures appeared first on HIPTHER Alerts.

Latest News

Latvian Fintech inGain Raises €650,000 for No-Code SaaS Loan Management System

The post Latvian Fintech inGain Raises €650,000 for No-Code SaaS Loan Management System appeared first on HIPTHER Alerts.

Latest News

Gotion High-tech’s operating profit up 391% in 2023, nearly RMB 2.8 billion invested in R&D for the year

HEFEI, China, April 20, 2024 /PRNewswire/ — On the evening of 19 April, Gotion High-tech (002074) released its 2023 annual report. The company achieved operating revenue of RMB 31.605 billion, an increase of 37.11% YoY; operating profit of RMB 975 million, an increase of 390.92% YoY; and net profit attributable to the owner of the listed company of RMB 939 million, an increase of 201.28% YoY. The company’s net cash flows from operating activities was RMB 2.419 billion, up 201.86% YoY.

On the same day, Gotion High-tech also released its 2024 quarterly report. The company achieved revenue of RMB 7.508 billion, a YoY increase of 4.61%, and net profit attributable to the owner of the listed company after deducting non-recurring profits and losses increased by 195.26% YoY.

The report shows that Gotion High-tech’s product delivery exceeded 40GWh in 2023, with a YoY growth of more than 40%, and sales revenue including tax increased by more than 50% YoY under the situation of continuous decline in battery prices. Power battery sales revenue of RMB 23.051 billion, a YoY growth of 24.72%. Energy storage business revenue was RMB 6.932 billion, up 97.61% YoY, with the revenue share rising to 21.93%.

Gotion High-tech adheres to innovation drive, increases R&D investment, and accelerates product technology iteration. In 2023, the company’s R&D investment reached RMB 2.768 billion, a YoY increase of 14.57%. The company’s Unified Cell, 4695 cylinder cell, semi-solid punch cell and third-generation battery cell products such as L300, M600 and N300 have been recognized by the market for their excellent performance in terms of safety, energy density, power performance and service life. Among them, Gotion has been designated by Volkswagen Unified Cell globally; the energy density of the in-house developed Astroinno battery pack reaches 190Wh/kg.

In addition, Gotion High-tech continues to deepen the strategic layout of globalization. With four Pack plants in Germany, Indonesia, Thailand and Silicon Valley of the U.S. launching their products, and production bases such as in Vietnam, Chicago of the U.S., Michigan of the U.S., Slovakia, Argentina, and Indonesia progressing step by step, Gotion High-tech initially formed the layout of ten overseas bases covering materials, cells, and Pack, and realized localization of production and R&D. In 2023, Gotion achieved overseas revenue of RMB 6.428 billion, a YoY growth of 115.69%.

View original content:https://www.prnewswire.co.uk/news-releases/gotion-high-techs-operating-profit-up-391-in-2023–nearly-rmb-2-8-billion-invested-in-rd-for-the-year-302122659.html

-

Latest News7 days ago

“The Hainan FTP and Me”: Looking at Hainan’s Transformations

-

Latest News5 days ago

Millions of people unite around doing good on the 18th International Good Deeds Day held yesterday worldwide

-

Latest News5 days ago

Banxso Acquires Australian ASIC License, Enhancing Its Global Trading Operations

-

Latest News3 days ago

BMO Announces Election of Board of Directors

-

Latest News5 days ago

135th Canton Fair Launches a Showcase of Innovative Products of New Collection to Lead Global Market Trends

-

Latest News4 days ago

HaloWallet Rebrands To Halo: Integrating SocialFi & AI To Revolutionize Social Influence Monetization

-

Latest News5 days ago

BII and FMO back BECIS with joint US$50 million financing facility supporting commercial and industrial renewables sector in South-East Asia

-

Latest News5 days ago

Former PayPal chief Dan Schulman joins Valor Capital as managing partner