Fintech

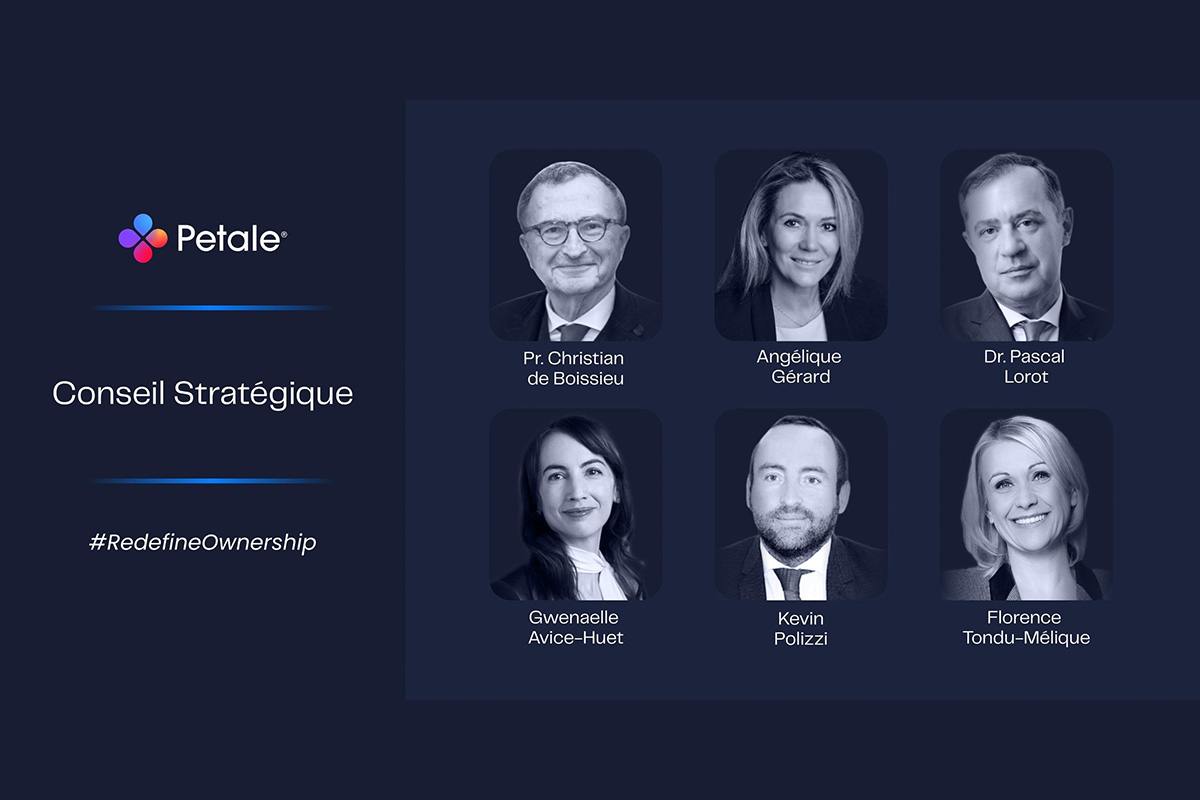

Petale Group introduces the members of its Strategic Council composed of eminent economists and business leaders

European fintech Petale, which operates innovative financial services from its digital infrastructure and democratises access to new forms of property and wealth management, is strengthening its governance with the formation of a prestigious strategic board.

This non-executive management body advises the group in its strategy to align synergies between traditional finance and decentralised finance using new technologies. It is composed of:

Pr. Christian de Boissieu, Professor Emeritus of Economics at the University of Paris 1 Panthéon-Sorbonne, vice-president of the Circle of Economists, former president of the Economic Analysis Council to the Prime Minister and regulator at the French Financial Markets Authority and former adviser of the World Bank and the European Commission. He provides, among other things, an insight into tokenomics, currency models, financing models, as well as compliance aspects.

Dr Pascal Lorot, Doctor of Economics, founding president of the Choiseul Institute and inventor of the concept of Geo-economics, brings his strategic, diplomatic and geopolitical expertise. His brilliant track record in both the institutional and private sectors, his unique network of young international economic decision-makers and his laureates from the Choiseul Institute rewarded for their innovation and influence, are all major assets to accelerate Petale’s international expansion.

Angélique Gérard, a graduate of INSEAD, is a special advisor to Xavier Niel, Chairman of the ILIAD Group, where she was Director of Free Subscriber Relations for 22 years and Chairperson of 8 subsidiaries, and a member of the Executive Committee of Iliad, of which she is a founding director. She was noticed by the Choiseul Institute, which awarded her first place in the “100 leaders of the French economy under 40” list in 2015, thus succeeding Emmanuel Macron at the top of the list. In 2020, she was ranked among the 40 most inspiring French women by Forbes.

Gwenaelle Avice-Huet, a physics graduate and holding an engineering degree from the Corps des Ponts et Chaussées, is a member of Schneider Electric’s Executive Committee, Executive Director of Strategy and Sustainable Development. She is also a member of the Board of Directors of Air France KLM. Gwenaelle previously spent over 10 years at Engie where she was a member of the executive committee in charge of global renewable energy and Managing Director North America. Gwenaelle brings her engineering and digital skills and her knowledge of the American market.

Florence Tondu-Mélique, Chairman and CEO of Zurich France and a member of the Group’s executive team. A graduate of HEC Paris and Harvard Business School, she began her career at McKinsey & Company before joining AXA Investment Managers and then Hiscox, at the heart of the global insurance market at Lloyd’s of London, where she held various executive roles including Chief Operating Officer for Europe. She is a director of listed and private companies in France and the UK. Florence brings her skills in strategy, risk management, governance and knowledge of the financial services sector.

Kevin Polizzi, Chairman of Unitel Group and founder of Jaguar Networks, one of France’s leading providers of secure data hosting with PCI-DSS banking accreditation, telecom solutions and intelligent services. Kevin brings skills in digital transformation, cybersecurity and data governance.

The members of the strategic board all bring their experience and vision in different areas of development to efficiently cover the high demand for accountability for “entreprises à missions et impact” (French status whereby businesses commit to corporate social responsibility initiatives) and new customer uses.

“With this strategic board, we are consolidating our governance in order to accelerate our development in this new and fast growing market of asset tokenisation. As such, we will continue to create new payment, investment and asset management experiences for our customers,” Babacar N. Seck, Chairman and Founder of Petale Group.

Petale continues to deploy its technologies, automating the investment and wealth management processes. Its value proposition responds to a very open market initiated to new types of digital assets. The group is preparing to open up its financial services via its mobile application to the largest possible number of qualified investors.

Fintech

Central banks and the FinTech sector unite to change global payments space

The BIS, along with seven leading central banks and a cohort of private financial firms, has embarked on an ambitious venture known as Project Agorá.

Named after the Greek word for “marketplace,” this initiative stands at the forefront of exploring the potential of tokenisation to significantly enhance the operational efficiency of the monetary system worldwide.

Central to this pioneering project are the Bank of France (on behalf of the Eurosystem), the Bank of Japan, the Bank of Korea, the Bank of Mexico, the Swiss National Bank, the Bank of England, and the Federal Reserve Bank of New York. These institutions have joined forces under the banner of Project Agorá, in partnership with an extensive assembly of private financial entities convened by the Institute of International Finance (IIF).

At the heart of Project Agorá is the pursuit of integrating tokenised commercial bank deposits with tokenised wholesale central bank money within a unified, public-private programmable financial platform. By harnessing the advanced capabilities of smart contracts and programmability, the project aspires to unlock new transactional possibilities that were previously infeasible or impractical, thereby fostering novel opportunities that could benefit businesses and consumers alike.

The collaborative effort seeks to address and surmount a variety of structural inefficiencies that currently plague cross-border payments. These challenges include disparate legal, regulatory, and technical standards; varying operating hours and time zones; and the heightened complexity associated with conducting financial integrity checks (such as anti-money laundering and customer verification procedures), which are often redundantly executed across multiple stages of a single transaction due to the involvement of several intermediaries.

As a beacon of experimental and exploratory projects, the BIS Innovation Hub is committed to delivering public goods to the global central banking community through initiatives like Project Agorá. In line with this mission, the BIS will soon issue a call for expressions of interest from private financial institutions eager to contribute to this ground-breaking project. The IIF will facilitate the involvement of private sector participants, extending an invitation to regulated financial institutions representing each of the seven aforementioned currencies to partake in this transformative endeavour.

Source: fintech.globa

The post Central banks and the FinTech sector unite to change global payments space appeared first on HIPTHER Alerts.

Fintech

TD Bank inks multi-year strategic partnership with Google Cloud

TD Bank has inked a multi-year deal with Google Cloud as it looks to streamline the development and deployment of new products and services.

The deal will see the Canadian banking group integrate the vendor’s cloud services into a wider portion of its technology solutions portfolio, a move which TD expects will enable it “to respond quickly to changing customer expectations by rolling out new features, updates, or entirely new financial products at an accelerated pace”.

This marks an expansion of the already established relationship between TD Bank and Google Cloud after the group previously adopted the vendor’s Google Kubernetes Engine (GKE) for TD Securities Automated Trading (TDSAT), the Chicago-based subsidiary of its investment banking unit, TD Securities.

TDSAT uses GKE for process automation and quantitative modelling across fixed income markets, resulting in the development of a “data-driven research platform” capable of processing large research workloads in trading.

Dan Bosman, SVP and CIO of TD Securities, claims the infrastructure has so far supported TDSAT with “compute-intensive quantitative analysis” while expanding the subsidiary’s “trading volumes and portfolio size”.

TD’s new partnership with Google Cloud will see the group attempt to replicate the same level of success across its entire portfolio.

Source: fintechfutures.com

The post TD Bank inks multi-year strategic partnership with Google Cloud appeared first on HIPTHER Alerts.

Fintech

MAS launches transformative platform to combat money laundering

The MAS has unveiled Cosmic, an acronym for Collaborative Sharing of Money Laundering/Terrorism Financing Information and Cases, a new money laundering platform.

According to Business Times, launched on April 1, Cosmic stands out as the first centralised digital platform dedicated to combating money laundering, terrorism financing, and proliferation financing on a worldwide scale. This move follows the enactment of the Financial Services and Markets (Amendment) Act 2023, which, along with its subsidiary legislation, commenced on the same day to provide a solid legal foundation and safeguards for information sharing among financial institutions (FIs).

Cosmic enables participating FIs to exchange customer information when certain “red flags” indicate potential suspicious activities. The platform’s introduction is a testament to MAS’s commitment to ensuring the integrity of the financial sector, mandating participants to establish stringent policies and operational safeguards to maintain the confidentiality of the shared information. This strategic approach allows for the efficient exchange of intelligence on potential criminal activities while protecting legitimate customers.

Significantly, Cosmic was co-developed by MAS and six leading commercial banks in Singapore—OCBC, UOB, DBS, Citibank, HSBC, and Standard Chartered—which will serve as participant FIs during its initial phase. The initiative emphasizes voluntary information sharing focused on addressing key financial crime risks within the commercial banking sector, such as the misuse of legal persons, trade finance, and proliferation financing.

Loo Siew Yee, assistant managing director for policy, payments, and financial crime at MAS, highlighted that Cosmic enhances the existing collaboration between the industry and law enforcement authorities, fortifying Singapore’s reputation as a well-regulated and trusted financial hub. Similarly, Pua Xiao Wei of Citi Singapore and Loretta Yuen of OCBC have expressed their institutions’ support for Cosmic, noting its potential to ramp up anti-money laundering efforts and its significance as a development in the banking sector’s ability to combat financial crimes efficiently. DBS’ Lam Chee Kin also praised Cosmic as a “game changer,” emphasizing the careful balance between combating financial crime and ensuring legitimate customers’ access to financial services.

Source: fintech.global

The post MAS launches transformative platform to combat money laundering appeared first on HIPTHER Alerts.

-

Latest News4 days ago

DEMAND AT ASIAN FACTORIES RISES AT STRONGEST RATE IN OVER 2 YEARS, IMPROVING NEAR-TERM GROWTH OUTLOOK FOR MANUFACTURING WORLDWIDE: GEP GLOBAL SUPPLY CHAIN VOLATILITY INDEX

-

Latest News7 days ago

EQT to sell Rimes, a global leader in enterprise data management solutions for the investment industry, to Five Arrows

-

Latest News5 days ago

Former Dreambox CEO Jessie Woolley-Wilson Joins Owl Ventures as Operating Partner

-

Latest News7 days ago

Innovation in Abu Dhabi: The Venom Blockchain Revolution Begins

-

Latest News4 days ago

Bitrue Gears Up for 2024 Bitcoin Halving with Trading Competition

-

Latest News4 days ago

Spendesk combines procurement with spend management through Okko acquisition

-

Latest News4 days ago

Global Airlines Appoints New Head of Finance from KPMG

-

Latest News3 days ago

“The Hainan FTP and Me”: Looking at Hainan’s Transformations