Latest News

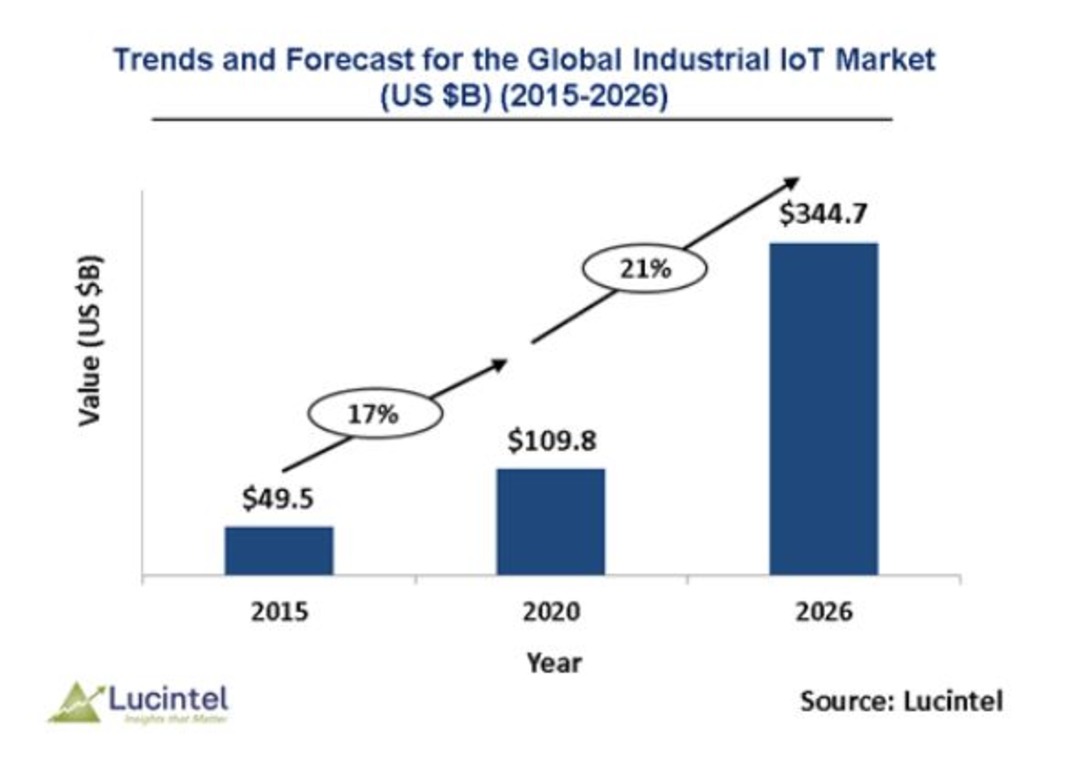

Industrial IoT Market is expected to reach $344.7 Billion by 2026- An exclusive market research report by Lucintel

According to a recent study from Lucintel the industrial IoT market is projected to reach an estimated $344.7 billion by 2026 from $109.8 billion in 2020, at a CAGR of 21% from 2020 to 2026. Growth in this market is primarily driven by increasing demand for automation in manufacturing industry, increasing adoption for IoT and AI, rising awareness for safety and security, and standardization of IPv6.

Browse 86 figures / charts and 75 tables in this 160 – page report to understand trends, opportunities and forecast in Industrial IoT market by end use industry (manufacturing, transportation, energy, retail, healthcare, and others), connectivity (wired and wireless), component (solution and service), device and technology (sensors, RFID, industrial robotics, distributed control system, and others), and region (North America, Europe, Asia Pacific, and the Rest of the World)

Download sample report and view detailed table of content by clicking on below link https://www.lucintel.com/industrial-iot-market.aspx

“Wireless connectivity market is expected to remain the largest segment during the forecast period”

Based on connectivity, the industrial IoT market is segmented into wired and wireless. Lucintel forecasts that the wireless connectivity market is expected to remain the largest segment due to increasing usage of Wi-Fi, bluetooth, and cellular and satellite technologies.

“Within the industrial IoT market manufacturing segment is expected to remain the largest end use industry”

Based on end use industry, the manufacturing segment is expected to witness the largest segment over the forecast period due to predicative maintenance, demand for technology advancement and need for improved operation efficiency in various industries.

“Asia Pacific will dominate the industrial IoT market in near future”

Asia Pacific is expected to be the largest region with the largest market for industrial IoT, supported by growing urbanization, increasing internet penetration, and growing adoption of IoT in various industries in the region.

Major players of industrial IoT market are adopting various growth strategies like new product launches, expansions, merger and acquisitions, partnerships, agreements, and collaborations to expand their presence in this market. PTC, SAP, Cisco, General Electric, and Siemens are among the major industrial IoT providers.

This unique research report will enable you to make confident business decisions in this globally competitive marketplace. We also have reports related to IoT in the area of blockchain IoT market (https://www.lucintel.com/blockchain-iot-market.aspx), automotive IoT market (https://www.lucintel.com/automotive-iot-market.aspx), and IoT sensor market (https://www.lucintel.com/iot-sensor-market.aspx). For a detailed table of contents on any one of the above reports please contact us at +1-972-636-5056 or email us at [email protected].

Latest News

Chubb Report: Damage During Home Renovations and from Extreme Weather are Top Concerns of U.K. High Earners

Inaugural Wealth Report survey offers insight on the wealthy, their passions, and protecting what matters

LONDON, April 25, 2024 /PRNewswire/ — Extreme weather, the competitiveness of the U.K. economy, and challenges to building and preserving wealth: these are among the top concerns of the U.K.’s highest earners. Yet many of the most damaging threats on the minds of the wealthy are much closer to home. More than seven in 10 (71%) said that damage during renovations was the greatest risk to their homes, while half are worried about exposure to extreme weather due to climate change.

These are some of the key findings of the inaugural Wealth Report from Chubb, which gauges perceptions of affluent people about their passions, mindset about wealth, and the risks they face in protecting what matters most to them.

Stephen Vaughan, Chubb’s Head of Personal Risk Services in Europe, said: “In places where there is less available space, such as London and the home counties, more people are building subterranean living spaces, sometimes going down three or four stories. Such renovations entail significant changes to the floor plan and often increases the risk of flooding. The Wealth Report provides an insightful lens into the concerns and pressures the affluent are facing in the U.K. It shows a shift in how they value and invest their wealth, who they seek advice from to protect it, and what keeps them up at night.”

Theft is a primary concern. Nearly nine in 10 respondents (86%) said that theft is the primary worry when it comes to their collections, with many believing social media exposure is making them more of a target for thieves. “Watch thefts have risen dramatically,” said Vaughan. “It is really important for collectors to think about their surroundings and whether they really want to wear their most expensive pieces in places where they are hard to protect.”

Eight out of 10 respondents are collectors of fine art, jewellery, watches, cars, wine and other valuables. More than six in ten (62%) say they have a passion for what they collect, while 38% see it primarily as an investment.

Building wealth is now more challenging than ever before. Half of the U.K.’s most affluent do not yet consider themselves wealthy, and 72% say that affluence, upward mobility and prosperity are out of reach for middle-income families. Survey respondents are also working harder to keep their wealth: the majority (68%) are working, and 39% say they would prefer never to retire.

What keeps successful people up at night? Competitiveness of the U.K. economy was perceived as the greatest risk to affluent individuals’ wealth and lifestyle, with over three quarters (77%) of respondents identifying this as a top concern. Government spending, and conflicts between global powers, were also issues that 35% of respondents said kept them up at night.

The complete Chubb Wealth Survey report findings can be found here.

Chubb Wealth Report Survey Methodology

Findings are based on a survey of 350 high net worth individuals in the United Kingdom, conducted by iResearch Services in September and October 2023 on behalf of Chubb Personal Risk Services. Respondents have a net worth from £1 million upwards. Participants reside predominately in London and surrounding suburbs.

About Chubb

Chubb is a world leader in insurance. With operations in 54 countries and territories, Chubb provides commercial and personal property and casualty insurance, personal accident and supplemental health insurance, reinsurance and life insurance to a diverse group of clients. As an underwriting company, we assess, assume and manage risk with insight and discipline. We service and pay our claims fairly and promptly. The company is also defined by its extensive product and service offerings, broad distribution capabilities, exceptional financial strength and local operations globally. Parent company Chubb Limited is listed on the New York Stock Exchange (NYSE: CB) and is a component of the S&P 500 index. Chubb maintains executive offices in Zurich, New York, London, Paris and other locations, and employs approximately 40,000 people worldwide. Additional information can be found at: www.chubb.com.

Photo – https://mma.prnewswire.com/media/2397452/CHUBB_Stephen_Vaughan2.jpg

Logo – https://mma.prnewswire.com/media/2364677/4671245/CHUBB_Blue_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/chubb-report-damage-during-home-renovations-and-from-extreme-weather-are-top-concerns-of-uk-high-earners-302127292.html

View original content:https://www.prnewswire.co.uk/news-releases/chubb-report-damage-during-home-renovations-and-from-extreme-weather-are-top-concerns-of-uk-high-earners-302127292.html

Latest News

Trakx launches a new product: Trakx USDc Earn CTI powered by OpenTrade

PARIS, April 25, 2024 /PRNewswire/ — Trakx, an emerging global fintech company providing thematic Crypto Tradable Indices (“CTIs”), today announced the launch of the Trakx USDc Earn CTI powered by OpenTrade that is designed to allow users to easily generate high risk-adjusted returns on their USDc backed by US Treasury Bill yields.

With the USDc Earn CTI, Trakx offers a unique instrument that seamlessly earns US Treasury Bills (T-Bills) like returns, while the assets are securely managed through OpenTrade’s bankruptcy remote structure.

USDc holders on Trakx can now maximize the value of their USDC holdings by investing in Trakx USDc Earn CTI to earn stable, predictable yield, backed by real world financial assets, all through the existing Trakx interface.The product will be available as a standard CTI on the Trakx platform but can also be customised based on specific needs and requirements.

Trakx’s partnership with OpenTrade is a case study in how France is emerging as a regional hub for digital asset companies that want to build products in an innovation-forward regulatory and business environment. As a French regulated Digital Asset Service Provider, Trakx exemplifies how digital asset firms are integrating traditional and digital asset finance in a secure and consumer-friendly manner.

Jeff Handler, Co-founder & Chief Commercial Officer of Opentrade comments, “The USDc Earn CTI is a great example of how RWA-backed yield products can drive value for users by providing them with the option to easily generate high risk-adjusted returns on idle balances in a way that is truly seamless and highly secured. We’re thrilled to have been able to work with Trakx on this solution, and look forward to seeing the growth of this product.”

Lionel Rebibo, CEO and founder of Trakx stated: “This initiative marks a pivotal moment as we are now offering a product that is at the intersection of both the digital and traditional worlds. USDc holders will soon be able to seamlessly transform their dormant assets into a reliable source of revenue. By investing in the USDc Earn CTI, clients will enjoy competitive returns comparable to other products, such as DeFi, while benefiting from the security offered by traditional finance.”

About Trakx

Trakx is a global fintech company creating new standards for digital asset investments. Through their trading platform, they offer thematic Crypto Tradable Indices (CTIs) and customised solutions, providing sophisticated investors a high degree of compliance, custody and liquidity. Trakx is registered with the French regulator (AMF). For more information, please visit us online at www.trakx.io

About OpenTrade

OpenTrade is an institutional grade platform for on-chain lending and yield products. OpenTrade’s platform allows FinTechs building next generation digital dollar apps to offer users yield products backed by high quality liquid assets in a way that is seamless, secure, and compliant. OpenTrade’s global customers can offer the world’s most accessible US Dollar- and Euro-denominated yield products with the click of a button, and the security guarantee of a bankruptcy remote, time-tested legal framework.

View original content:https://www.prnewswire.co.uk/news-releases/trakx-launches-a-new-product-trakx-usdc-earn-cti-powered-by-opentrade-302126366.html

Latest News

Sungrow Released Annual Report 2023: Operating Revenue Witnessed A Robust Growth of 79.5%

HEFEI, China, April 25, 2024 /PRNewswire/ — Sungrow, the global leading PV inverter and energy storage system provider, released its annual report 2023 recently. The company attained unprecedented revenues and profits, fueled by robust demand across diverse global markets.

In 2023, the global renewable energy market is poised for rapid expansion, with Sungrow prioritizing its core business, enhancing innovation and transformation, investing heavily in market research and development, and implementing a comprehensive strategy for products and services. Sungrow’s commitment to digitalization, streamlining operations, and fostering rapid growth in its core business has resulted in reinforced brand potential and an industry-leading position, ultimately leading to a significant boost in profitability.

Sungrow’s operating revenue experienced an impressive year-on-year surge of 79.5% in 2023, reaching a staggering $10.2 billion, while its net profit attributable to shareholders jumped significantly by 162.7% to $1.3 billion. This robust growth was primarily attributed to the company’s expanding customer base and increasing market share in key regions.

The company has witnessed a remarkable surge in PV inverter shipments, surpassing 130GW, indicating a widespread embrace of solar energy globally. Furthermore, Sungrow’s sales of energy storage systems have escalated dramatically to 10.5GWh, driven by the escalating demand for both grid-connected and off-grid applications.

Sungrow’s investments in research and development (R&D) have consistently borne fruit, evident from the successful introduction of an array of cutting-edge products throughout the fiscal year. This year, the company allocated $347 million towards R&D, marking a year-on-year growth of 44.6%. And Sungrow boasts a strong team of 5372 R&D technical personnel, having achieved a cumulative total of 4123 patent grants.

The innovations encompass several groundbreaking achievements. Among them are the world’s first 2000V inverter connected to the grid, the introduction of the world’s first 10MWh liquid cooling energy storage system, the successful deployment of its C&I liquid cooling energy storage system, the release of the industry’s inaugural “Stem Cell Grid Technology White Paper”, the successful demonstration of the grid-forming wind power converter, the introduction of flexible green hydrogen production system, and the global launch of the 180kW Integrated DC Fast Charger and etc.

The company’s strong financial performance has allowed it to expand its operations and strengthen its global presence. As of the previous year, Sungrow had exceeded 20 subsidiaries, successfully marketing its products in 170 nations and regions. Additionally, it boasted over 490 service outlets across six major service areas globally.

Simultaneously, the overseas employee count reached 1423, representing a year-on-year increase of 58.1%.

Over the course of the past year, the company’s brand awareness and reputation have steadily risen, earning multiple prestigious accolades such as “China Top 50 Most Innovative Companies” awarded by Forbes China, “Best ESG Practice Employer of the Year” by Forbes, “Fortune China 500″ and ” Future 50 Global” granted by Fortune and etc. Recently, in 2023, the company secured an impressive ranking of 117th on the annual “China’s 500 Most Valuable Brands” list compiled by the World Brand Lab, with a brand value of $11.37 billion.

The year 2023 was an exceptional one for Sungrow. Its power electronic converters has accumulated an installed capacity of over 515GW, about 330 million tons of carbon dioxide emissions can be avoided annually together with our customers. The company is committed to sustainable development practices and aims to achieve carbon neutrality at the operational level by 2028, across its entire supply chain by 2038, and reach net-zero emissions across the chain by 2048. As part of its accelerated RE100 goal, the proportion of green electricity used throughout the year has risen to 55%, and global volunteer service projects have been launched, with a total of 1,352 registered volunteers contributing 3,442 hours of service so far.

Looking ahead, Sungrow remains committed to the realm of clean power, prioritizing solar, wind, energy storage, and green hydrogen. The company strives to innovate consistently, aiming to make remarkable advancements in power electronics, grid support, and AI technology. Sungrow aims to provide integrated solutions, enhance the customer experience, and bolster its brand image. By executing this strategy, Sungrow aims to further expand its position as a global leader, enabling it to achieve sustainable and high-quality development.

About Sungrow

Sungrow Power Supply Co., Ltd. (“Sungrow”) is a global leading PV inverter and ESS provider with over 515 GW of power electronic converters installed worldwide as of December 2023. Founded in 1997 by university professor Cao Renxian, Sungrow is a leader in the research and development of solar inverters with the largest dedicated R&D team in the industry and a broad product portfolio offering PV inverter solutions and ESS for utility-scale, commercial & industrial, and residential applications, as well as internationally recognized floating PV plant solutions, NEV driving solutions, EV charging solutions and renewable hydrogen production systems. With a strong 27-year track record in the PV space, Sungrow products power over 170 countries worldwide. For more information about Sungrow, visit: www.sungrowpower.com.

Photo – https://mma.prnewswire.com/media/2397389/20240425140107.jpg

Logo – https://mma.prnewswire.com/media/1344575/Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/sungrow-released-annual-report-2023-operating-revenue-witnessed-a-robust-growth-of-79-5-302127207.html

View original content:https://www.prnewswire.co.uk/news-releases/sungrow-released-annual-report-2023-operating-revenue-witnessed-a-robust-growth-of-79-5-302127207.html

-

Fintech6 days ago

Fintech6 days agoHow to identify authenticity in crypto influencer channels

-

Latest News5 days ago

HSBC-backed fintech Monese is considering splitting its operations as it grapples with increasing losses.

-

Latest News5 days ago

EverBank has announced a groundbreaking partnership with Finzly, poised to revolutionize payment processing.

-

Latest News5 days ago

FinTech leaders express caution regarding the promises made in #Budget2024 concerning open banking, stating that the “devil is in the details.”

-

Latest News5 days ago

Gotion High-tech’s operating profit up 391% in 2023, nearly RMB 2.8 billion invested in R&D for the year

-

Latest News5 days ago

Aurionpro Solutions acquires Arya.ai, to power next generation Enterprise AI platforms for Financial Institutions

-

Latest News5 days ago

Wells Fargo, a leading financial institution, is set to revolutionize its trade finance operations by incorporating artificial intelligence (AI) technology through its collaboration with TradeSun.

-

Latest News5 days ago

Latvian Fintech inGain Raises €650,000 for No-Code SaaS Loan Management System