Fintech PR

Zoomd Technologies Reports Third Quarter 2023 Financial Results, Driven by Strong Adjusted EBITDA Growth

Conference call will be held on November 30, 2023, at 11AM ET.

VANCOUVER, British Columbia, Nov. 30, 2023 /PRNewswire/ — Zoomd Technologies Ltd. (TSXV: ZOMD) (OTC: ZMDTF) and its wholly owned subsidiary Zoomd Ltd. (collectively, “Zoomd” or the “Company“), the marketing technology (MarTech) user-acquisition and engagement platform, today reported its financial results for the three and nine month periods ended September 30, 2023. The Company’s financial statements and management discussion and analysis (“MD&A“) are available on SEDAR under the Company’s profile. All currency references in this press release are in USD.

Third Quarter Financial Highlights

- Revenues were $7.1M, a 27% decline versus 3Q22, primarily due to lower revenues from the cryptocurrency sector and Zoomd’s decision to discontinue unprofitable activities.

- Gross Margins increased roughly 900 basis points to 40%, versus 3Q22, reflecting lower revenues from the cryptocurrency sector, and discontinuation of unprofitable activities which carries lower margins.

- Total operating expenses decreased 36% versus 3Q22 as the Company implements its cost saving initiatives and costs saving measures.

- Adjusted EBITDA(1) increased to $575,000 or 8% of sales, versus $15,000 in 3Q22.

- Positive cash flow generated from operating activities for the first time in 5 consecutive quarters.

(1) Adjusted EBITDA is a Non-GAAP performance measure. Refer to “CAUTION REGARDING NON-IFRS FINANCIAL MEASURES” for further details.

Management Commentary

Amit Bohensky, Chairman of Zoomd Technologies, stated, “During the third quarter we made tremendous strides in improving our margins and bottom line, growing our Adjusted EBITDA to $575,000 versus $15,000 in last year’s period and achieved positive cash flow from operating activities for the first time in 5 consecutive quarters. The acceleration in probability is the direct result of the implementation of our restructuring initiatives and cost saving measures, which we initially disclosed in June. These initiatives were designed to optimize our operations and financial performance. As part of this process, we discontinued various unprofitable areas of our business, resulting in operating expenses decreasing by 36% in the third quarter. We will channel our resources towards activities and solutions that have demonstrated profitability, enabling us to better position ourselves competitively in the current market.

We expanded our gross margins by approximately 900 basis points during the third quarter, largely as the result of our business transitioning away from cryptocurrency customers which carried lower margins. In addition, we discontinued some non-profitable areas of our business. While these items contributed to our revenue decline of 27% in the quarter, gross profit dollars only declined by 8%.

We remain cautious yet optimistic regarding the advertising technology space. Historically, companies tend to cut their advertising budgets during periods of economic uncertainty as a cost-saving measure. However, when the business environment becomes more stable and secure, companies often increase their advertising investment to regain market share.”

Third Quarter 2023 Highlights

- Revenues for the three months ended September 30, 2023, were $7.1 million, a 27% decline relative to 3Q22. Revenues continued to be negatively affected by the global slowdown, in particular the areas of cryptocurrencies. We continue to diversify our business by increasing our exposure to sectors such as E-commerce, iGaming, transportation, and consumer product goods as well as offering a wider range of performance based products and services. Furthermore, our decision to discontinue unprofitable areas, including our publishers’ monetization business, led to a decline in revenue. Excluding both Cryptocurrency clients and non profitable operations clients that have been discontinued revenue in 3Q23 have risen in comparison to the corresponding period last year.

- Gross profit margin was 40% for the three months ended September 30, 2023, versus 31% for the same period last year. The 900 basis point increase was due to lower revenues from the cryptocurrency customers, which carry lower margins. In addition, the company exited certain non profitable areas of its business.

- Research and Development expenses for the three months ended September 30, 2023, were $0.7M, a 49% decrease relative to Q3 2022. Selling, General and Administrative expenses for the three months ended September 30, 2023, were $2.2M, a 30% decrease relative to Q3 2022. This decline in expenses was mainly the result of our cost savings restructuring initiatives, mainly reflect the impact of 40% reduction in headcount.

- Adjusted EBITDA for the three months ended September 30, 2023, was $575,000 as compared with Adjusted EBITDA of $15,000 for the three months ended September 30, 2022, reflecting cost savings initiatives.

- Operating loss was $0.08M for Q3 2023, compared to an operating loss of $1.5M in Q3 2022, reflecting the cost savings initiatives.

- Net cash of $0.2M was generated from operating activities in 3Q23, reflecting positive cash generation from operating activities for the first time in 5 consecutive quarters. As of September 30, 2023, the Company’s cash and cash equivalents amounted to $1.5 million, and no long-term debt.

CONFERENCE CALL

Amit Bohensky, Founder and Chairman, will hold a conference call to discuss the quarter’s financial results at 11AM ET on November 30, 2023.

Interested parties can listen via a live webcast, from the link available in the Investors section of Zoomd’s website at https://zoomd.com/investors/ or at https://app.webinar.net/xyJNoQ9o8l7

A replay will be available after the call, in the Investors section of the Company’s website at https://zoomd.com/investors/ or via https://app.webinar.net/xyJNoQ9o8l7.

ABOUT ZOOMD:

Zoomd (TSXV: ZOMD) (OTC: ZMDTF), founded in 2012 and began trading on the TSX Venture Exchange in September 2019, offers a mobile app user-acquisition platform, integrated with many global digital media outlets, to advertisers. The platform unifies more than 600 media sources into one unified dashboard. Offering advertisers a user acquisition control center for managing all new customer acquisition campaigns using a single platform. By unifying all these media sources onto a single platform, Zoomd saves advertisers significant resources that would otherwise be spent consolidating data sources, thereby maximizing data collection and data insights while minimizing the resources spent on the exercise. Further, Zoomd is a performance-based platform that allows advertisers to advertise to relevant target audiences using a key performance indicator-algorithm that is focused on achieving the advertisers’ goals and targets.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTION REGARDING NON-IFRS FINANCIAL MEASURES

This press release refers to “Adjusted EBITDA” which is a non-IFRS financial measure that does not have a standardized meaning prescribed by IFRS. The Company’s presentation of this preliminary financial measure may not be comparable to similarly titled measures used by other companies. This preliminary financial measure is intended to provide additional information to investors concerning the Company’s estimated results. Adjusted EBITDA is defined as earnings before interest, tax, depreciation and amortization, as adjusted for share-based payments and one-time non-operating expenses and is a measure of a company’s operating performance. Essentially, it’s a way to evaluate a company’s performance without having to factor in financing decisions, accounting decisions or tax environments.

Management uses this non-IFRS measure as a key metric in the evaluation of the Company’s performance and the consolidated financial results. The Company believes Adjusted EBITDA is useful to investors in their assessment of the operating performance and the valuation of the Company. However, non-IFRS financial measures are not prepared in accordance with IFRS, and the information is not necessarily comparable to other companies and should be considered as a supplement to, not a substitute for, or superior to, the corresponding measures calculated in accordance with IFRS. A reconciliation of Adjusted EBITDA and operating profit is available in Zoomd’s MD&A located on the Company’s profile at www.sedar.com which is incorporated by reference into this press release.

DISCLAIMER IN REGARD TO FORWARD-LOOKING STATEMENTS

This news release includes certain “forward-looking statements” under applicable Canadian securities legislation. Forward-looking statements include, but are not limited to Zoomd’s future outlook, including as a result of the impact of general economic trends, its future ability to successfully continue its growth, its ability to improve profitability, as well as its ability to continue expanding into new geographies and industries. Forward-looking statements are based on our current assumptions, estimates, expectations and projections that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors that may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include but are not limited to general business, economic, competitive, technological, legal, privacy matters, political and social uncertainties, the extent and duration of which are uncertain at this time on Zoomd’s business and general economic and business conditions and markets. There can be no assurance that any of the forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether because of new information, future events or otherwise, except as required by law.

The reader should not place undue importance on forward-looking information and should not rely upon this information as of any other date. All forward-looking information contained in this press release is expressly qualified in its entirety by this cautionary statement.

FOR FURTHER INFORMATION PLEASE CONTACT:

Company Media Contacts:

Amit Bohensky

Chairman

Zoomd

[email protected]

Website: www.zoomd.com

Investor relations:

Lytham Partners, LLC

Ben Shamsian

New York | Phoenix

[email protected]

Logo – https://mma.prnewswire.com/media/1039696/Zoomd_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/zoomd-technologies-reports-third-quarter-2023-financial-results-driven-by-strong-adjusted-ebitda-growth-302001944.html

View original content:https://www.prnewswire.co.uk/news-releases/zoomd-technologies-reports-third-quarter-2023-financial-results-driven-by-strong-adjusted-ebitda-growth-302001944.html

Fintech PR

Enabling Regenerative Agriculture for Independent Smallholders in Indonesia: The BIPOSC Project, in Collaboration with Musim Mas, L3F, SNV Indonesia, and ICRAF

JAKARTA, Indonesia, Oct. 18, 2024 /PRNewswire/ — Musim Mas Group, the Livelihoods Fund for Family Farming (L3F), SNV Indonesia, and World Agroforestry (ICRAF) are collaborating to improve the knowledge and capacity of independent oil palm smallholders through the Biodiverse & Inclusive Palm Oil Supply Chain (BIPOSC) project.

The project began in 2021 and takes a long-term approach to sustain a deforestation-free supply chain, regenerate degraded land, restore local biodiversity, and improve the livelihoods of independent smallholder farmers in Labuhanbatu, North Sumatra. BIPOSC will achieve this through implementing regenerative agriculture, locally adapted agroforestry models, capacity-building for sustainable businesses, and others.

The independent palm smallholders taking part previously received complementary training from Musim Mas. Following the training, these smallholders formed a smallholder’s association, Labuhanbatu Independent Oil Palm Smallholders Association (APSKS LB), North Sumatra. Musim Mas encourages smallholders to form associations to get better access to resources and obtain certification by the Roundtable on Sustainable Palm Oil (RSPO) and Indonesian Sustainable Palm Oil (ISPO).

“Musim Mas has long saw that smallholders are key to achieving palm oil sustainability, and that’s why we lead Indonesia’s most extensive smallholder program. We believe that the way forward is to collaborate with more partners to achieve a wider impact. With our BIPOSC partners, we hope to advance the skills and knowledge of smallholders through regenerative agriculture and related techniques. Regenerative agriculture and agroforestry have the potential to help smallholders be part of a sustainable palm oil supply chain. It could help them develop alternative sources of income, especially during the replanting period where their palm oil crops are unproductive, typically for three years,” said Rob Nicholls, General Manager, Projects & Programs, Musim Mas Group.

In the face of climate change and threatened biodiversity, regenerative agriculture can play a role for small farms because it maintains soil health, prevents erosion and water runoff, and can potentially reduce greenhouse gas emissions and nitrogen leakage.

“As a global development partner organization, SNV aims to support Indonesia in achieving its Sustainable Development Goals (SDGs). To achieve this, we need to implement effective and impactful programs to transform agricultural and food systems, energy, and water. In the BIPOSC program, we promote a comprehensive regenerative agriculture and agroforestry model to maintain soil fertility and biodiversity, providing maximum benefits for farmers’ livelihoods and economy,” said Rizki Pandu Permana, Country Director of SNV Indonesia.

The key regenerative agriculture techniques taught include the application of bio-input, mulching to protect topsoil, planting cover crops, integrated pest management that reduces the need for chemical pesticides, and application of compost that reduces the amount of chemical fertilizers needed. To date, 1,032 independent smallholders received training and implement these techniques on their farms, representing a total land with a total area of 1,063.68 hectares. The project trained 25 village facilitators to provide hands-on assistance to smallholders, and seven demo plots established as pilot areas and learning facilities for regenerative agriculture.

“When I visited palm oil smallholders a few years ago in the area, their biggest concern was access to more fertilizers. While fertilizers play a key role in boosting yields, there was a noticeable gap in understanding how to protect the soil from long-term degradation. Smallholders needed more knowledge about maintaining soil health, preserving soil structure, and other critical factors. This is exactly what the BIPOSC project aimed to address, and we’re pleased to see that the farmers involved are now reporting not only higher yields but also healthier soils on their plots,” said Bernard Giraud, President & Co-Founder, Livelihoods.

The projectalso looks into capacity-building. In addition to home composting, the project enabled the local farmer association, APSKS LB, to develop and manage a composting unit with a capacity of 100-150 tons/month. Producing compost at scale with inputs from nearby mills and farmer plots, the unit offers compost to member farmers at half of typical market prices. In 2023, its first year of operation, the unit produced 588 tons of compost, and generated a profit of IDR 421 million. The project partners believe it is a model that can be replicated elsewhere.

“One of the most impactful outcomes of this project for smallholders is the Composting Unit as the business model around it. It enables smallholders to obtain compost affordably, and the profits are shared among member farmers. This is a practical solution to promote the adoption of composting, and all ASPKS-LB smallholders are now using compost in their plots,” said Syahrianto, Chairman of the Labuanbatu Independent Oil Palm Smallholders Association.

As of 2023, independent smallholders manage about 41% of oil palm planted areas in Indonesia, representing 6.94 million hectares. This figure is expected to increase to 60% by 2030, making projects like BIPOSC critical in shaping the future of sustainable palm oil production.

Devane Sharma

[email protected]

Photo – https://mma.prnewswire.com/media/2533466/DSCF9193.jpg

Photo – https://mma.prnewswire.com/media/2533468/DSC07760.jpg

Photo – https://mma.prnewswire.com/media/2533467/DSCF0748.jpg

Fintech PR

BRI Partners with Nium to Expand Real-Time Cross-Border Payment Solutions

JAKARTA, Indonesia, Oct. 18, 2024 /PRNewswire/ — Nium, the leading global infrastructure for real-time cross-border payments, is thrilled to announce a partnership with Bank Rakyat Indonesia (BRI) to provide Indonesian customers with real-time international money transfer capabilities. This collaboration aims to enhance the cross-border offerings for BRI’s individual and corporate customers, delivering more accessible and cost-effective financial services across Indonesia.

This partnership empowers more than 150 million BRI account holders, including those in remote regions of Indonesia, to access modern, real-time cross-border payment services. The offering includes a variety of real-time payment mechanisms, supporting bank account destinations, a global electronic card network, and digital wallets. These innovations are closely aligned with BRI’s ongoing mission to provide affordable and customer-focused financial products, particularly for traditionally underserved communities.

BRI’s Corporate Secretary, Agustya Hendy Bernadi, emphasized BRI’s dedication to constantly improving customer convenience through innovations in its global network and cross-border transaction services. “This collaboration reflects BRI’s continuous efforts to enhance productivity and efficiency by expanding its digital payment channel network to meet the growing demand for global transactions,” he said. Agustya added that the partnership with Nium aligns perfectly with BRI’s vision to be Southeast Asia’s most valuable banking group and a champion of financial inclusion by 2025. “With Nium’s global transaction network, BRI strengthens the digitalization of its business processes and enhances retail banking capabilities in line with our 2025 strategic vision.”

Anupam Pahuja, General Manager and Executive Vice President for Asia Pacific, Middle East, and Africa at Nium, shared his excitement about the partnership, highlighting BRI’s extensive presence across Indonesia’s 17,000 islands. “By integrating Nium’s advanced technology into BRI’s platform, we are dedicated to providing BRI’s customers, no matter where they are, with access to exceptional financial services. This partnership will remove the risks associated with cash handling and provide faster, more cost-effective transactions—whether individuals are sending money to family members abroad or businesses are making international payments.”

Cross-border payments are projected to grow significantly in Indonesia, with a forecasted year-on-year increase of 15% through 2025, driven largely by the digital transformation in financial services (Statista, 2024).

This partnership between BRI and Nium is expected to transform the way Indonesians engage with global financial services, meeting the rising demand for modern payment infrastructure and enhancing the overall experience for BRI’s customers in their international transactions.

About Nium

Nium, the leading global infrastructure for real-time cross-border payments, was founded on the mission to deliver the global payments infrastructure of tomorrow, today. With the onset of the global economy, its payments infrastructure is shaping how banks, fintechs, and businesses everywhere collect, convert, and disburse funds instantly across borders. Its payout network supports 100 currencies and spans 220+ markets, 100 of which in real-time. Funds can be disbursed to accounts, wallets, and cards and collected locally in 40 markets. Nium’s growing card issuance business is already available in 34 countries. Nium holds regulatory licenses and authorizations in more than 40 countries, enabling seamless onboarding, rapid integration, and compliance – independent of geography. The company is co-headquartered in San Francisco and Singapore.

Logo – https://mma.prnewswire.com/media/1678669/4973639/Nium_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/bri-partners-with-nium-to-expand-real-time-cross-border-payment-solutions-302279138.html

View original content:https://www.prnewswire.co.uk/news-releases/bri-partners-with-nium-to-expand-real-time-cross-border-payment-solutions-302279138.html

Fintech PR

Grexie Signchain Launches on November 1st, 2024: Enabling Smart Contract Developers to Bring Off-Chain Data On-Chain with Seamless Gas-Paid Signing

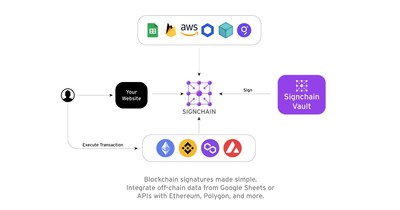

Grexie Signchain enables developers to sign off-chain data into smart contracts, with self-hosted or secure vault signer wallet management.

MANCHESTER, England, Oct. 17, 2024 /PRNewswire/ — Grexie Limited proudly announces the launch of its innovative smart contract solution, Signchain, on November 1st, 2024. Designed specifically for developers, Signchain introduces a powerful way to bring off-chain data on-chain through user-paid gas fees and secure signing of data into smart contract methods using its extendable smart contract, Signable.

In the growing landscape of blockchain technology, securely managing off-chain data and integrating it into on-chain smart contracts has posed significant challenges for developers. Signchain eliminates these hurdles by offering a robust, gas-efficient system for signing and authenticating data in real-time.

Key Features of Signchain:

1. Seamless Off-Chain to On-Chain Data Integration

Signchain enables developers to securely bring off-chain data on-chain by signing it directly into smart contract methods through user-paid gas fees. This integration ensures that data authenticity is preserved, and its entry into the blockchain remains tamper-proof, streamlining processes for industries relying on real-world data verification. Signchain also supports integration with Google Sheets, AWS, and Firebase, making it easy to pull data from popular off-chain data sources.

2. Extendable Smart Contract – Signable

The core of Signchain’s technology is its extendable smart contract, Signable, which allows developers to customize and build upon existing smart contracts. With Signable, developers can easily implement contract signatures for any data type, offering flexibility across industries from finance to logistics and beyond.

3. Signer Wallet Management

Signchain offers comprehensive signer wallet management as part of its service, empowering developers to manage and authenticate signers effectively. Wallets can either be self-hosted using Signchain’s Docker container for those who prefer their own infrastructure, or they can leverage Signchain’s network of secure vaults for maximum security.

4. Self-Hosted or Managed Service

For developers who want full control of their infrastructure, Signchain provides a self-hosted option via Docker containers, allowing them to deploy the platform on their own servers. Alternatively, developers can opt to use Signchain’s secure vault network, offering a hassle-free solution with enterprise-grade security and wallet management.

5. User-Paid Gas Fees

By integrating a user-paid gas fee model, Signchain allows users to cover the costs of signing and authenticating their data, ensuring the signing process is efficient and doesn’t overburden developers with additional expenses. This makes Signchain an ideal solution for dApps and platforms handling high transaction volumes.

6. Google Sheets, AWS, Firebase Integration with Serverless Model

Signchain supports integration with Google Sheets, AWS, and Firebase in a serverless model, powered by a hosted Sign In With Ethereum (SIWE) implementation provided by Signchain’s API. Developers can simply connect their Google Sheets and configure the contract parameters associated with each column. Signchain will automatically look up the user’s wallet address in the spreadsheet, sign the transaction data, and execute it in the blockchain along with any user-supplied parameters. This creates an easy, efficient way to manage data inputs from off-chain sources without heavy infrastructure setup.

Revolutionizing Smart Contract Workflows

With Signchain, developers now have the tools to handle the complexities of integrating off-chain data into smart contracts. The extendable nature of Signable offers flexibility, allowing developers to cater to various use cases, whether it’s automating financial transactions, supply chain data, or verifying legal agreements.

Tim Behrsin, CEO of Grexie Limited, said, “Signchain is more than just a signing solution—it’s a platform that empowers developers to securely integrate off-chain data into their smart contracts with minimal effort. The flexibility of Signable and our focus on signer wallet management offers developers control and security at every stage of the process.”

Why Signchain Matters

Signchain addresses critical challenges faced by developers, particularly those dealing with off-chain data. By signing data into smart contracts and enabling user-paid gas fees, the platform significantly reduces friction in managing secure, scalable smart contracts. Whether developers need to manage high volumes of data transactions or create bespoke smart contracts, Signchain offers a scalable and secure solution.

In industries like DeFi, real estate, and supply chain management, data integrity and security are paramount. Signchain’s secure vault network and customizable signing workflows allow businesses to handle sensitive information with confidence.

Launch Event and Future Developments

The official launch of Signchain will take place on November 1st, 2024, alongside a virtual event. The event will showcase live demonstrations of Signable, with detailed walkthroughs of the Docker-based self-hosted solution and signer wallet management features. Attendees will also get an exclusive preview of future enhancements, including multi-signature workflows and advanced blockchain network integrations.

About Signchain

Signchain is a cutting-edge platform developed by Grexie Limited, based in Manchester, Cheshire, United Kingdom. Signchain simplifies smart contract development by offering a secure, scalable, and customizable solution for signing and authenticating off-chain data on-chain. Developers can either self-host the solution using Signchain’s Docker container or rely on the network’s secure vault infrastructure. With an emphasis on security, flexibility, and developer experience, Signchain is set to transform how smart contracts handle off-chain data.

For more information, visit signchain.net.

Logo – https://mma.prnewswire.com/media/2533672/Signchain_Logo.jpg

Photo – https://mma.prnewswire.com/media/2533843/Signchain_flow.jpg

PDF – https://mma.prnewswire.com/media/2533539/Signchain_Whitepaper.pdf

SOURCE Grexie Limited

-

Fintech PR7 days ago

Fintech PR7 days agoBybit Doubles Down on Rewards for Late Entrants of WSOT 2024 With New 100,000 Prize Pool

-

Fintech PR7 days ago

Fintech PR7 days agoVantage Markets Adds Another Feather to its Cap: Wins Best Forex Affiliate Program at Global Brand Awards 2024

-

Fintech PR7 days ago

Fintech PR7 days agoRSM US and RSM UK pursue transatlantic merger to strengthen global client offering and deliver long-term growth

-

Fintech PR7 days ago

Fintech PR7 days agoBybit x Block Scholes Derivatives Report Uncovers BTC Call Option Boom Amidst Election Uncertainty

-

Fintech PR7 days ago

Fintech PR7 days agoOCI to Close Divestment of Controlling Stake in Fertiglobe

-

Fintech PR7 days ago

Fintech PR7 days agoBitget Launches Telegram App Centre, Featuring Over 600 TON Trending Mini-Apps

-

Fintech PR7 days ago

Fintech PR7 days agoBingX Launches Telegram Mini App for Seamless Copy Trading

-

Fintech PR5 days ago

Fintech PR5 days agoStatement regarding revised possible cash offer from ABC Technologies Inc. and extension of Rule 2.6 deadline