We are eager to announce that we have released the final agenda for Prague Gaming & TECH Summit 2024. The agenda is showcasing an impressive...

LONDON, Jan. 31, 2024 /PRNewswire/ — Wirex, a leading Web3 money app, is excited to introduce an exclusive early access to WPay, a decentralised payment network,...

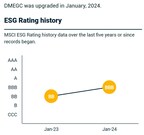

DONGYANG, China, Jan. 31, 2024 /PRNewswire/ — Recently, Morgan Stanley Capital International (commonly known as “MSCI”), an international authoritative rating agency, announced the latest ESG (Environmental,...

– First manufacturing run successful for MFG7 facility at the Ireland site– Largest manufacturing scale to date achieved by combining four 4,000-liter single-use bioreactors DUNDALK, Ireland,...

PASAY CITY, Philippines, Jan. 31, 2024 /PRNewswire/ — The SM Group, led by SM Investments Corporation, with BDO Unibank, Inc., SM Foundation Inc., and SM Supermalls, won...

PASAY CITY, Philippines, Jan. 31, 2024 /PRNewswire/ — SM Investments Corporation, one of the country’s leading conglomerates, says there is still room for growth with the...

Plumery has chosen Sumsub as its technological partner to bring a new generation of digital onboarding solutions to market LONDON and AMSTERDAM, Jan. 31, 2024 /PRNewswire/...

The most followed profile of Cristiano Ronaldo received 27.9 million views PRAGUE, Jan. 31, 2024 /PRNewswire/ — Flashscore’s app and website had on average more than...

DUBAI, UAE, Jan. 31, 2024 /PRNewswire/ — OKX, a leading global Web3 technology company and crypto exchange, today announced the publication of its 15th monthly Proof of...

PANAMA CITY, Jan. 31, 2024 /PRNewswire/ — Gate.io, a leading cryptocurrency exchange and Web3 innovator, has established a dominant position in the Inscription token market. Of the...