Fintech

How finance brands can drive the ROI with content creators

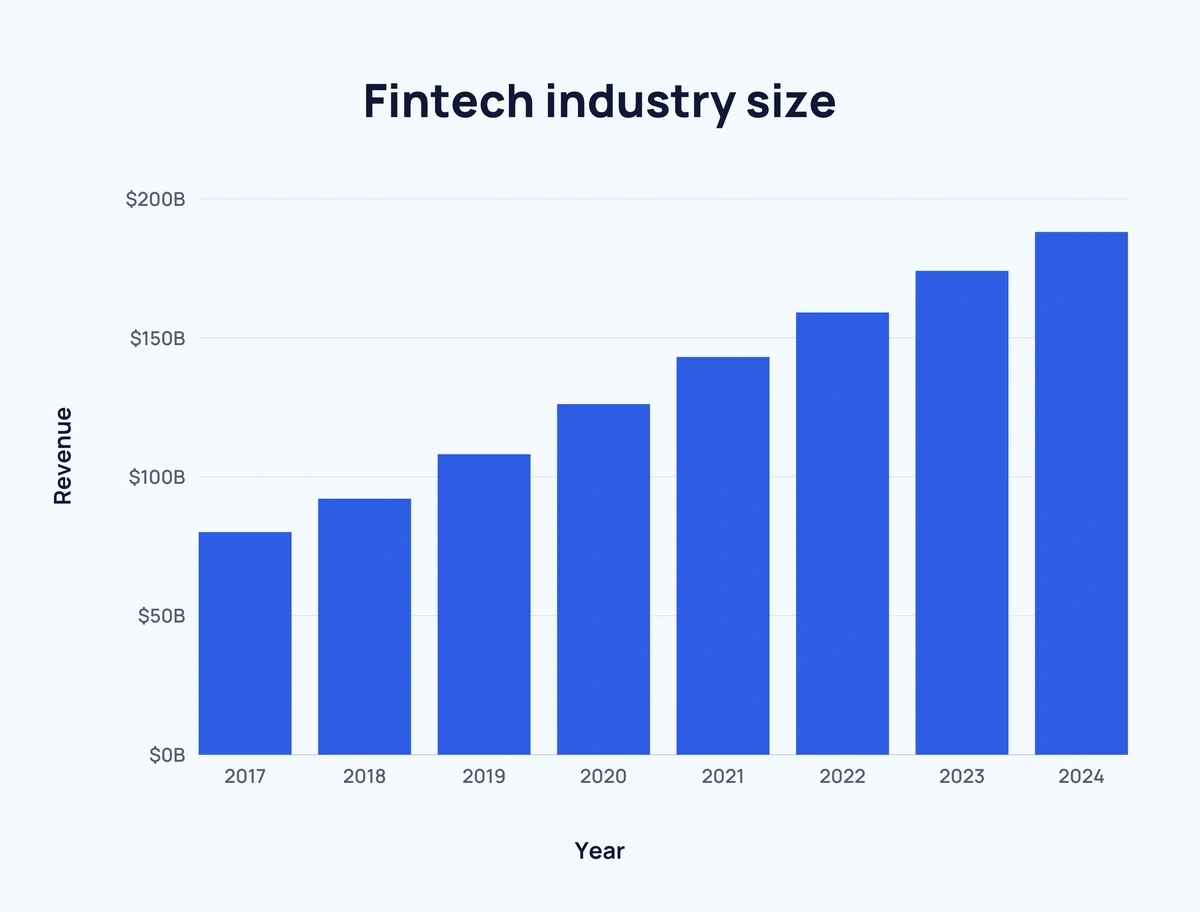

The FinTech industry is highly competitive. In 2017, global FinTech industry revenue was approximately $90.5 billion, and it has grown by over 100% by the end of 2023.

Finance brands are constantly seeking innovative ways to connect with their target audiences, as a result, their marketing channels have also changed. The once-traditional financial sector, often associated with formal advertising, such as billboards, TV commercials, and print advertisements, now commonly uses influencer marketing.

Today, trust in traditional advertising methods has weakened, and consumers now are turning to sources they perceive as authentic and relatable. Influencer marketing, with its ability to build trust and credibility, has become a common strategy for finance brands aiming to enhance their ROI and their engagement with audiences. At the same time, 67% of brands are increasing their influencer marketing budgets that also proves the effectiveness of this channel.

The rise of influencer marketing in finance

Influencers’ recommendations are highly effective, with 92% of consumers trusting influencers more than traditional advertising channels. Social media platforms have further amplified the impact of influencer marketing, allowing influencers to engage directly with their audiences and foster trust within niche finance communities.

Influencer marketing is commonly used by such companies as Binomo, Olymp Trade, Ego, Klarna, Exness, Pay Senger, Capital.com, and many more. If you are interested to see the example of a strategy, here is how Famesters helped FxPro drive 18K+ installations and more than 18M views.

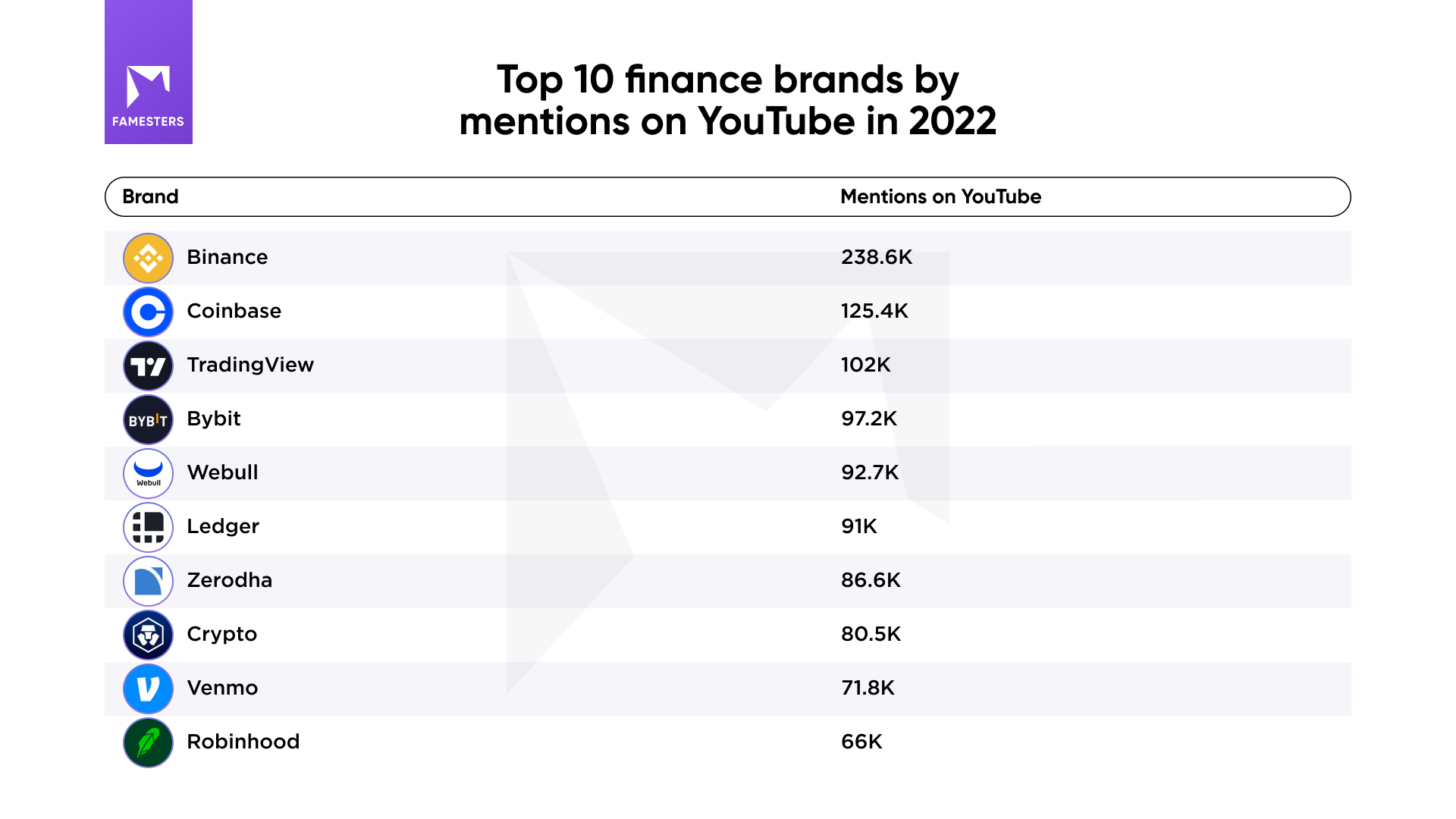

Trading services, especially those strongly connected with cryptocurrencies, get the largest influencer marketing budgets among finance brands. According to Famesters, in 2022 Binance was the top-mentioned finance brand on YouTube.

Choosing the right influencers

Selecting the right influencers is key to the success of influencer marketing campaigns in any business sector, and it is especially crucial for the finance sector due to its specificity. To find the right influencers with authentic audiences, you have to spend time and resources. But if aligned with a creative strategy, such publications can pay off greatly: brands can earn around $5.78 for every dollar spent on influencer marketing. Here are some key considerations to pay attention on:

- Alignment with brand values. This ensures that the influencer’s content will reflect the brand’s mission, maintaining consistency in messaging.

- Target audience compatibility. Effective influencer marketing hinges on reaching the right audience. Finance brands should thoroughly analyze an influencer’s follower demographics to ensure they match the intended target audience. For instance, promoting credit cards to young adults may require influencers with a predominantly youthful and financially active audience.

- Domain expertise. In the world of finance, domain expertise is a significant asset. Influencers who demonstrate a deep understanding of financial matters and can communicate complex topics in a clear and accurate manner are considered to be the best choice to cooperate with.

Not all financial products are best promoted by financial influencers. For instance, if you’re marketing a banking product designed for children, it’s more effective to collaborate with influencers who are able to reach the parents of potential users. Similarly, for B2B financial products like business bank accounts, it makes more sense to partner with influencers who cater to entrepreneurs rather than those focused on personal finance or budgeting advice.

- Engagement and trustworthiness. High engagement rates, authentic interactions, and a track record of trust-building are indicators of an influencer’s effectiveness in conveying messages and recommendations (that are crucial for finance brands). Besides, the FinTech creators market is full of fraud and scam, this is why it is worth taking time and ensuring the quality of potential partners.

Ask for a screencast of the creator’s statistics instead of a screenshot if you have doubts; a trustworthy creator would provide it, and if the statistics are fake, the influencer will likely refuse.

- Content quality. FinTech brands should assess an influencer’s content quality and relevance to ensure it aligns with their campaign goals. Consistency in producing valuable, informative, and engaging content is key.

You can analyze around 10-15 of the latest videos on the channel, review the comments, and ensure that they have not been purchased from a shady website. For example, when you come across comments such as “Yes sir,” “Great video,” “Thanks!”, “Love you man!”, “Quality content,” etc., they should raise red flags, as these are most likely bot-generated comments.

- Past collaborations and reputation. Examine an influencer’s past collaborations and reputation. For instance, if a FinTech company partners with an influencer known for promoting risky investment schemes in the past, or associated with controversial practices, it could harm the brand’s credibility and integrity.

Besides choosing the right creators for your campaign it is also crucial to craft a well-thought brief – a clear communication tool that helps convey your app or platform’s value. Provide influencers with guidelines on your brand message, goals, budget, and content expectations, including tone of voice and key messages. Trust influencers to communicate naturally while ensuring essential ad points are covered.

Influencer fraud risks and how to reduce them

Influencer fraud is actually decreasing year by year as more tools to detect it appear and improve. But still, 64% of companies name influencer fraud an issue that worries them. And yes, there are significant risks that can be divided into two major categories: distorted ROI and brand reputation risks.

Distorted ROI:

- Brands engage with influencers expecting benefits like enhanced brand recognition, sales boosts, or greater audience interaction. However, influencer fraud distorts these projections.

- Investments in influencers who have artificial followers or engagement don’t deliver tangible outcomes, resulting in a reduced ROI.

Brand reputation risks:

- In the finance market where authenticity is highly valued by consumers, the discovery of deceit by an influencer connected to a brand can breed doubt, not only about the influencer but also about the brand itself. This association can damage the brand’s reputation and weaken trust with its audience.

Influencer fraud in the FinTech sector doesn’t just affect individual campaigns; it threatens the integrity of influencer marketing as a whole. In an industry built on trust and precision, deceptive practices have far-reaching consequences, making vigilance and informed decision-making imperative for FinTech brands.

To avoid fraudulent influencers and reduce risks, finance brands should prioritize vetting influencers. To do so, brands can:

- Review content history, engagement rates, and alignment with brand values.

- Look for genuine audience interaction and content that resonates with your brand’s message.

- Engage directly with influencers to grasp their audience’s age, gender, and location.

- Seek personal stories of audience interactions, indicating authentic connections.

Here are some FinTech brands’ self-audit tips:

- Engagement analysis. Check the ratio of followers to engagement; low engagement with high followers is a warning sign.

- Audience location. Be wary of influencers with most followers from regions irrelevant to their supposed base.

- Content evaluation. Genuine influencers mix sponsored and organic content, showing true interest in their niche.

- Feedback checks. Seek testimonials from other brands or agencies.

- Consistency. Authentic influencers show regular posting and engagement patterns.

And last but not least: for brands venturing into influencer marketing, especially in sectors like FinTech where trust and credibility are essential, the importance of formalizing collaborations through contracts cannot be overstated. Contracts serve as a foundational safeguard against influencer fraud, clearly delineating expectations, deliverables, and terms of engagement. This formal agreement helps to ensure that both parties are accountable and that the influencer’s following and engagement metrics are authentic and aligned with the brand’s objectives. Contracts also provide legal recourse in the event of misrepresentation or non-compliance, significantly reducing the risk of financial loss and reputational damage.

A well-structured contract is not just a formal requirement; it is a strategic tool in mitigating the risks associated with influencer fraud, ensuring transparency, and maintaining the integrity of the brand’s marketing efforts.

Conclusion

You can see that the success of influencer marketing in the FinTech sector hinges on a strategic and analytical approach. Its key aspects include:

- Selective influencer engagement. Choosing influencers with a deep understanding of financial products and alignment with brand values is crucial for effective audience engagement.

- ROI and risk management. It’s vital to employ robust analytics for assessing influencer authenticity to mitigate risks to ROI and brand reputation.

- Audience and content analysis. Detailed examination of the influencer’s audience demographics and content relevance is essential for ensuring alignment with the brand’s target market.

- Adaptive strategies. Staying adaptive to the evolving digital marketing trends and consumer behaviors in the fast-paced FinTech industry is key.

Effectively navigating these elements can significantly enhance ROI and market positioning for FinTech brands in an industry that values innovation and trust.

Fintech

Fintech Pulse: Your Daily Industry Brief – March 27, 2025 | Almond Fintech, Maplerad & More

In today’s fast-paced financial landscape, staying ahead of the curve is not a luxury—it’s a necessity. Welcome to Fintech Pulse: Your Daily Industry Brief, where we dissect the latest trends, news, and insights in financial technology. Today’s edition, dated March 27, 2025, brings you an in-depth look at the disruptive forces shaping our industry—from emerging regulatory concerns over payday loan apps to transformative digital strategies in banking, pioneering AI initiatives, corporate FX expansion by Almond Fintech, and Maplerad’s innovative approach in reshaping Africa’s financial ecosystem. Our comprehensive briefing not only summarizes the news but also provides an op-ed-style analysis to help industry professionals, investors, and consumers understand the broader implications for our digital future.

Table of Contents

-

Overview of Today’s Fintech Landscape

-

Payday Loan Apps and the Debate on Fintech Usury

-

Digital Transformation in the Banking Sector

-

Embracing AI: “Be the Change or Be Changed”

-

Almond Fintech’s Corporate FX Service Expansion

-

Maplerad’s Revolutionary Banking as a Service in Africa

-

Interconnecting Trends: A Broad Industry Analysis

-

Looking Ahead: Future Directions for Fintech

1. Overview of Today’s Fintech Landscape

The digital revolution has irreversibly transformed how we manage, transfer, and invest money. With rapid technological advancements and evolving consumer expectations, the fintech industry has become the epicenter of financial innovation. Today, we see not only startups challenging traditional banking but also established financial institutions embracing digital solutions to remain competitive.

Key themes in the current landscape include:

-

Innovation vs. Regulation: Balancing disruptive services with consumer protection.

-

Digital Transformation: How traditional banks are integrating advanced technology to streamline operations.

-

Artificial Intelligence: The increasing reliance on AI to drive personalized financial services.

-

Global Expansion: How emerging markets are harnessing banking-as-a-service models to leapfrog legacy systems.

-

Corporate Solutions: The rising demand for tailored financial services, including robust foreign exchange (FX) offerings for global business operations.

This briefing captures these transformative trends through a careful analysis of today’s top stories. As we dive into each piece, we provide a balanced mix of factual summaries and opinion-driven commentary aimed at empowering you with actionable insights.

2. Payday Loan Apps and the Debate on Fintech Usury

The first story of the day comes with a striking headline: payday loan apps have been at the center of a heated debate regarding fintech usury. According to recent coverage, payday loan applications have collectively amassed an astonishing $500 million in a remarkably short period. This surge in activity has reignited discussions around high-cost lending practices and consumer protection.

Source: The City

A Closer Look at the Numbers

The figure of $500 million is not just a statistic—it represents a wave of financial activity that underscores the growing reliance on digital platforms for short-term loans. Payday loan apps, originally designed as a quick fix for emergency cash, are now attracting significant volumes of consumer engagement. The ability of these platforms to process and distribute funds rapidly has made them an essential tool for many in dire need of immediate financial relief. However, this same efficiency raises questions about the cost and terms of such loans.

The Usury Debate

The rapid growth of these digital lending platforms has sparked debates about usury. Critics argue that while these apps provide much-needed financial access, they often do so at exorbitant rates that can trap consumers in cycles of debt. Regulatory bodies have begun to scrutinize these platforms, and the question remains: how do we balance financial innovation with ethical lending practices?

From an analytical perspective, the discussion on fintech usury is multi-faceted. On one hand, the democratization of credit through technology is a welcome evolution. On the other, the aggressive lending practices could exacerbate economic inequality if left unchecked. Financial regulators face the challenging task of ensuring that innovation does not come at the expense of consumer rights.

Consumer Impact and Market Implications

For many consumers, payday loan apps represent a lifeline. In emergencies, access to fast cash can make a substantial difference. However, when the cost of that cash is steep, the long-term repercussions can be damaging. The market reaction has been mixed, with some investors expressing concern over potential regulatory backlash and others championing the accessibility of credit in the digital age.

As industry players, it is crucial to note that fintech companies must navigate these ethical waters carefully. The future of digital lending may well depend on developing transparent, fair, and sustainable lending practices. In essence, innovation must be tempered by responsibility—a lesson that is as relevant to startups as it is to established financial institutions.

Opinion: The Need for a Balanced Approach

In our view, the payday loan app debate is emblematic of a larger challenge facing fintech: how to drive growth while safeguarding consumers. As technology evolves, so too must the frameworks that govern its application. This issue calls for proactive dialogue among industry leaders, regulators, and consumer advocacy groups. The goal should be a balanced regulatory approach that promotes innovation while ensuring financial fairness.

3. Digital Transformation in the Banking Sector

Our second headline highlights a sweeping trend: the traditional banking sector is undergoing a radical digital transformation. An insightful article from Trade Magazin illustrates how the once-staid banks are now embracing a dynamic digital shift, rethinking their strategies to stay relevant in a world dominated by technological advancements.

Source: Trade Magazin

The Evolution of Traditional Banking

In decades past, banks were synonymous with paper checks, branch visits, and manual processes. Today, the digital revolution has forced these institutions to reimagine their operations. Digital transformation in banking is not merely about adopting new technology—it represents a complete overhaul of business models. Banks are leveraging data analytics, artificial intelligence, and mobile platforms to deliver seamless, efficient, and customer-centric services.

This shift is evident in the proliferation of online and mobile banking solutions, digital wallets, and automated customer service systems. The digitalization process has enabled banks to reduce operational costs, improve risk management, and offer personalized financial solutions at scale.

Bridging the Old and the New

While the benefits of digital transformation are immense, the transition has not been without challenges. Legacy systems, entrenched organizational cultures, and regulatory complexities can impede rapid change. However, forward-thinking banks are not just digitizing—they are transforming their entire operational ethos. The convergence of fintech startups and traditional banks is fostering a fertile ground for collaboration, where the strengths of both sectors can be combined to drive innovation.

Consumer-Centric Strategies

At the heart of this transformation lies the customer. Banks are increasingly focusing on enhancing user experience by offering intuitive digital interfaces, 24/7 accessibility, and tailored financial advice. As customers become more digitally savvy, their expectations evolve, and banks must respond by delivering services that are not only efficient but also secure and convenient.

Industry Implications and Future Prospects

The digitalization of banking is a powerful driver of economic change. For fintech innovators, this represents an opportunity to partner with established institutions and tap into their vast customer bases. Conversely, traditional banks that resist change risk becoming obsolete in an era defined by technological disruption. The ripple effects of this transformation are far-reaching, influencing everything from customer engagement to financial product design.

Opinion: Embracing Change for Sustainable Growth

From an industry perspective, the trend toward digital banking is both inevitable and essential. Banks that embrace digital transformation are poised to unlock new revenue streams and build more resilient business models. However, the journey is complex, requiring a careful balance between leveraging technology and managing legacy challenges. In our view, the path forward for banks lies in embracing a mindset of continuous innovation—one that aligns with the evolving needs of today’s digital consumers.

4. Embracing AI: “Be the Change or Be Changed”

Artificial Intelligence (AI) is revolutionizing every facet of the fintech industry, and our third story, featured in Fintech Futures, underscores this transformation with the bold statement: “Be the Change or Be Changed.”

Source: Fintech Futures

AI as a Catalyst for Transformation

The phrase “Be the Change or Be Changed” encapsulates the urgency with which fintech companies must adopt AI-driven solutions. From fraud detection to personalized investment advice, AI is now at the core of innovative financial services. Machine learning algorithms can analyze vast amounts of data in real time, enabling companies to predict market trends, mitigate risks, and offer tailored products that meet individual customer needs.

Strategic Implementation of AI

Successful implementation of AI in fintech is not just about technology; it’s about strategic vision. Companies must invest in robust data infrastructures, foster a culture of innovation, and ensure that AI applications align with broader business objectives. While the promise of AI is significant, its execution requires careful planning and ethical considerations. Issues such as data privacy, algorithmic bias, and transparency are paramount.

The Competitive Edge

For fintech startups and established companies alike, AI represents a formidable competitive advantage. Firms that harness AI effectively can streamline operations, reduce costs, and enhance customer engagement. The ability to anticipate market shifts and adapt quickly is a game changer in the fast-moving world of finance. Furthermore, AI-driven insights offer new avenues for product innovation, enabling companies to design financial instruments that are both more responsive and more resilient.

The Ethical Dimension

However, the adoption of AI is not without its ethical dilemmas. The drive for efficiency must be balanced against the need for fairness and accountability. Financial institutions must ensure that their AI systems are transparent, unbiased, and compliant with regulatory standards. This ethical dimension is not merely a compliance issue—it is a cornerstone of building trust with consumers and investors alike.

Opinion: AI as a Double-Edged Sword

Our analysis suggests that while AI is undoubtedly the future of fintech, its benefits come with inherent risks. Industry leaders must approach AI adoption with a balanced perspective—one that celebrates innovation while rigorously addressing ethical challenges. The mandate is clear: adapt or risk being left behind. In the dynamic environment of fintech, those who invest wisely in AI technologies today will set the foundation for long-term success.

5. Almond Fintech’s Corporate FX Service Expansion

Turning our focus to corporate finance, the fourth story highlights a significant development by Almond Fintech, which is expanding its foreign exchange (FX) service offerings to cater to corporate clients.

Source: PRWeb

Expanding Horizons in Corporate Finance

Almond Fintech’s expansion into the FX services space is a strategic move aimed at addressing the complex needs of corporate clients operating in an increasingly globalized economy. As businesses continue to expand their international footprints, managing currency risk and optimizing exchange rates becomes a critical component of financial strategy.

Enhancing Service Offerings

By broadening its FX service portfolio, Almond Fintech is positioning itself as a comprehensive provider of corporate financial solutions. This expansion is expected to offer companies enhanced tools for real-time currency management, improved risk mitigation strategies, and more competitive pricing structures. The move signals a proactive approach to meeting the evolving needs of a diverse client base, from multinational corporations to rapidly growing startups.

Market Trends and Competitive Landscape

The global FX market is characterized by volatility and rapid shifts driven by geopolitical events, economic data, and market sentiment. Almond Fintech’s decision to broaden its service offerings reflects a keen understanding of these market dynamics. In a competitive landscape where both traditional banks and fintech startups vie for market share, offering integrated and agile FX solutions can be a decisive factor in winning client loyalty.

Technology-Driven Solutions

At the heart of this expansion is technology. Almond Fintech is leveraging advanced analytics and real-time data processing to create a seamless, efficient FX platform that caters specifically to the needs of corporate clients. The integration of technology in foreign exchange operations not only improves speed and accuracy but also offers a more transparent view of transaction costs and market conditions.

Opinion: A Strategic Leap Forward

From our perspective, Almond Fintech’s strategic expansion is a clear signal that the future of corporate finance lies in tech-driven innovation. By investing in sophisticated FX solutions, Almond Fintech is not only responding to current market demands but also setting the stage for future growth. For corporate clients, the enhanced FX offerings promise greater control over international transactions and a competitive edge in managing currency risk. This development is a testament to the company’s commitment to innovation and its understanding of the shifting paradigms in global finance.

6. Maplerad’s Revolutionary Banking as a Service in Africa

Our final story for today comes from Africa Business Insider, spotlighting Maplerad and its ambitious efforts to transform Africa’s financial ecosystem through banking as a service (BaaS).

Source: Africa Business Insider

Transforming the Financial Landscape in Africa

Africa has long been seen as a frontier for financial innovation. With a large, underbanked population and a rapidly growing digital infrastructure, the continent presents unique challenges and opportunities. Maplerad is at the forefront of this transformation, leveraging a banking as a service model to provide scalable, cost-effective financial solutions that cater to the diverse needs of African consumers and businesses.

The Promise of Banking as a Service

Banking as a service is revolutionizing traditional financial services by offering a fully digital, on-demand banking platform that is both agile and user-friendly. For Maplerad, the BaaS model is a strategic approach to bridging the gap between conventional banking systems and the rapidly evolving needs of modern consumers. By offering services such as digital wallets, payment processing, and integrated financial management, Maplerad is not only enhancing financial inclusion but also fostering a more competitive market environment.

Addressing Challenges Head-On

Despite the promise of digital banking, Africa’s financial ecosystem faces several hurdles, including regulatory complexities, infrastructural limitations, and a need for greater consumer education. Maplerad’s innovative approach seeks to address these challenges by collaborating closely with local regulators, investing in robust technological frameworks, and launching targeted educational initiatives to empower consumers with the knowledge to navigate digital financial services.

Impact on the Broader Market

The introduction of BaaS by Maplerad is expected to have a ripple effect across the continent’s financial sector. By offering flexible, technology-driven banking solutions, Maplerad is setting a new standard for what is possible in emerging markets. This not only drives competition among existing banks but also creates new opportunities for fintech startups looking to enter the market. As Maplerad continues to innovate, it will likely become a benchmark for digital transformation in Africa.

Opinion: A Bold Vision for the Future

In our analysis, Maplerad’s commitment to banking as a service represents a bold and necessary evolution for Africa’s financial landscape. By harnessing the power of technology, Maplerad is not just offering an alternative banking solution—it is redefining the very framework of financial services in the region. The company’s efforts underscore the importance of innovation in addressing long-standing challenges and highlight the potential for digital platforms to drive significant social and economic progress.

7. Interconnecting Trends: A Broad Industry Analysis

As we integrate these diverse narratives, several overarching themes emerge that are reshaping the fintech industry:

Digitalization as a Universal Catalyst

From payday loan apps to the comprehensive digital transformation of traditional banks, the relentless pace of digitalization is a unifying force. The speed at which consumers and institutions are adapting to digital platforms is staggering, and this trend shows no signs of slowing down. Whether it’s through mobile banking, digital wallets, or real-time FX services, the infusion of technology is enhancing convenience, reducing operational costs, and driving transparency across financial services.

The Dual Role of Regulation and Innovation

A recurring theme in today’s stories is the tension between innovation and regulation. On one hand, fintech companies are pushing boundaries with new products and services that challenge traditional financial models. On the other, there is growing scrutiny over practices that may jeopardize consumer protection. The debate over payday loan apps exemplifies this dynamic—innovation must be balanced with ethical standards and robust regulatory frameworks to ensure that growth is sustainable and equitable.

AI and Data-Driven Decision Making

Artificial intelligence is no longer a futuristic concept; it is a present reality driving significant competitive advantages in fintech. Whether it’s enhancing customer experience or powering predictive analytics, AI’s integration into fintech is transforming operations and strategic planning. However, this integration also demands careful attention to ethical considerations, particularly around data privacy and algorithmic fairness.

Global Expansion and Market Diversification

Fintech is inherently global. Innovations emerging in one region often set trends that ripple across international markets. Almond Fintech’s corporate FX expansion and Maplerad’s pioneering BaaS approach in Africa are prime examples of how localized innovations can have far-reaching global implications. As financial ecosystems become increasingly interconnected, cross-border collaboration and knowledge exchange are essential to foster an environment of mutual growth and stability.

The Imperative of Consumer-Centric Design

At the heart of every technological innovation in finance is the end user. Whether through improved digital interfaces in traditional banking or AI-driven personalized financial advice, the focus on consumer experience is paramount. In today’s competitive landscape, companies that fail to put the customer first risk falling behind as digital natives continue to redefine expectations for speed, security, and simplicity.

Opinion: Navigating the Crossroads of Change

In our view, the fintech industry stands at a pivotal crossroads. The convergence of digital innovation, AI, and global market expansion creates both unprecedented opportunities and significant challenges. Industry leaders must navigate these crosscurrents with strategic foresight, balancing rapid technological adoption with a commitment to ethical practices and regulatory compliance. The future of fintech hinges on a collaborative approach that leverages the strengths of diverse stakeholders—from nimble startups to legacy banks—to drive sustainable, inclusive growth.

8. Looking Ahead: Future Directions for Fintech

As we reflect on today’s news, several predictions and trends are emerging that could shape the fintech industry in the coming months and years:

8.1 Continued Innovation in Digital Lending

The surge in payday loan app usage is likely to spur further innovation in digital lending. Expect to see:

-

Enhanced Transparency: New technologies will emerge to provide clearer insights into loan terms and costs, helping consumers make informed decisions.

-

Regulatory Evolution: Governments and regulatory bodies will likely introduce measures aimed at curbing predatory lending practices while still encouraging innovation.

-

Consumer Empowerment: With greater access to digital tools, consumers will increasingly demand financial products that balance speed with fairness, potentially driving the emergence of alternative credit models.

8.2 Accelerated Digital Transformation in Traditional Banking

Traditional banks are set to accelerate their digital transformation efforts by:

-

Investing in Cutting-Edge Technologies: Banks will increase their investments in blockchain, AI, and data analytics to streamline operations and improve customer engagement.

-

Forging Strategic Partnerships: Collaborations with fintech startups will become more common, as established banks seek to combine their expertise with agile technological innovation.

-

Enhancing Security Protocols: As digital channels become the norm, banks will continue to bolster their cybersecurity measures to protect customer data and maintain trust.

8.3 The Rise of AI-Driven Financial Services

AI is expected to play a pivotal role in shaping the future of financial services by:

-

Revolutionizing Risk Management: Advanced predictive models will help firms anticipate market fluctuations and mitigate risks more effectively.

-

Personalizing Financial Advice: AI will enable hyper-personalized services, offering tailored recommendations and financial planning tools that adjust in real time to customer behavior.

-

Fostering Innovation in Product Development: The insights gleaned from AI analytics will drive the creation of new financial products that better meet the evolving needs of consumers and businesses.

8.4 Global Expansion and Market Integration

The fintech sector will continue to witness significant growth in emerging markets:

-

Banking as a Service (BaaS): Companies like Maplerad will drive the adoption of BaaS models in regions with underserved populations, promoting financial inclusion on a massive scale.

-

Increased Cross-Border Collaboration: As fintech ecosystems around the world become more interconnected, international partnerships will become essential to navigate regulatory challenges and market complexities.

-

Localized Innovation: Innovations will be increasingly tailored to the unique economic and cultural contexts of different regions, resulting in a more diversified and resilient global fintech landscape.

8.5 Enhancing the Consumer Experience

Ultimately, the success of any fintech innovation will hinge on its ability to enhance the consumer experience. Companies that prioritize user-centric design, seamless digital interactions, and robust security measures will be best positioned to capture market share. The focus on consumer empowerment and transparency will also be key in building long-term trust in digital financial solutions.

Opinion: Steering the Future with Purpose

Looking forward, the fintech industry must embrace a holistic approach that integrates technology, regulation, and human-centered design. While the pace of change is rapid, companies that take a balanced, ethical approach to innovation will not only thrive but also shape a more inclusive and sustainable financial ecosystem. As industry veterans and newcomers alike navigate these exciting times, the guiding principle should be clear: innovation is only valuable when it elevates the consumer and contributes to the overall health of the financial system.

Final Thoughts

Today’s briefing encapsulates the dynamic evolution of the fintech sector—a realm where technology meets finance in ways that are both exhilarating and challenging. From the ethical quandaries posed by payday loan apps to the relentless push for digital transformation in traditional banking, every story we’ve covered reflects a broader narrative of innovation, disruption, and adaptation.

In the age of digital banking and AI-powered services, industry players are called upon not only to innovate but to do so responsibly. The lessons from Almond Fintech’s expansion and Maplerad’s pioneering initiatives in Africa serve as important reminders that while technology can unlock unprecedented growth, its true value lies in empowering consumers and fostering a more inclusive financial ecosystem.

As we look ahead, it is clear that the fintech landscape will continue to evolve at a breathtaking pace. Regulatory frameworks will be tested, consumer expectations will shift, and new technologies will emerge to reshape the way we interact with money. In this ever-changing environment, staying informed, agile, and committed to ethical innovation is paramount.

Our daily industry brief is more than just a roundup of news—it’s a call to action for industry professionals, regulators, and consumers alike. By understanding the interplay of digital trends, market dynamics, and regulatory challenges, we can better navigate the complexities of this exciting era. As you digest today’s insights, consider how these developments might impact your business, your investments, or your personal financial decisions.

In closing, the fintech revolution is not a distant promise; it is happening now. Whether you are a seasoned industry expert or a curious newcomer, embracing the changes with a critical, informed, and forward-thinking mindset will be essential to thriving in this new financial reality.

A Comprehensive Recap

Today’s edition of Fintech Pulse has taken you through:

-

The rise of payday loan apps and the heated debate on usury, urging a balance between accessibility and consumer protection.

-

The digital transformation of traditional banks, showcasing how legacy institutions are evolving to meet modern demands.

-

The role of AI in reshaping financial services, with a call for ethical, strategic adoption to remain competitive.

-

Corporate FX expansion by Almond Fintech, illustrating the evolving needs of global business and the role of technology in currency management.

-

Maplerad’s groundbreaking approach in Africa, highlighting the potential of banking as a service to drive financial inclusion and transform entire markets.

Together, these stories paint a picture of an industry at the crossroads of tradition and transformation—a sector where every new innovation brings both opportunity and responsibility. By staying abreast of these trends and embracing a forward-thinking approach, fintech stakeholders can ensure that the future of finance is not only technologically advanced but also fair, inclusive, and sustainable.

A Deep Dive into Emerging Trends

Balancing Innovation and Consumer Protection

The fintech industry is frequently described as a double-edged sword—on one edge lies rapid innovation, on the other, the risk of exploitation if not carefully managed. Payday loan apps are a case in point. Their meteoric rise has democratized access to emergency funds, yet it has also opened the door to predatory lending practices. As regulators worldwide scrutinize these platforms, it is imperative that fintech companies adopt more transparent, consumer-friendly approaches to lending.

The Intersection of Technology and Traditional Banking

The transformation witnessed in traditional banking is not a simple case of modernizing old systems; it is a complete reinvention of the customer experience. Legacy banks are now collaborating with fintech startups to deliver services that are faster, more secure, and better tailored to individual needs. This hybrid model of operation is likely to become the standard, as institutions seek to harness the best of both worlds—robust regulatory frameworks and agile, innovative technologies.

AI’s Role in Shaping the Future of Finance

Artificial intelligence remains one of the most exciting frontiers in fintech. Its applications—from fraud detection and risk management to personalized financial advice—are revolutionizing how financial institutions operate. However, this transformation is not without challenges. Industry experts stress that the ethical implications of AI, particularly concerning data privacy and algorithmic transparency, must be addressed proactively. As we move forward, the successful integration of AI will depend on the ability to strike a balance between leveraging data for competitive advantage and upholding rigorous ethical standards.

Global Perspectives: From Silicon Valley to Africa

Fintech innovation is a global phenomenon. While Silicon Valley and other major financial centers continue to lead in terms of technological advancements, emerging markets are making significant strides with models tailored to their unique challenges. Maplerad’s innovative approach in Africa serves as a beacon for how digital solutions can be adapted to drive economic inclusion and transform regional financial ecosystems. This cross-pollination of ideas and strategies between developed and emerging markets is poised to redefine global financial services in the coming years.

Opinion: The Road Ahead for Fintech

Looking ahead, the future of fintech lies in its ability to be both adaptive and principled. Industry players must remain nimble in the face of rapid technological change while also committing to practices that protect and empower consumers. As we’ve explored today, every facet of fintech—from digital lending and corporate FX to AI and global banking as a service—presents unique opportunities and challenges. The guiding principle should be to innovate with integrity, ensuring that technological progress translates into tangible benefits for all stakeholders.

Concluding Reflections

Today’s deep dive into fintech news is a reminder that we are living in an era of unprecedented change. The innovations discussed—from payday loan apps challenging traditional lending norms to transformative digital banking strategies and the rise of AI-driven solutions—illustrate the dynamic nature of the industry. Each story, whether it’s the bold moves by Almond Fintech or the groundbreaking work of Maplerad, contributes to a larger narrative of progress, disruption, and the continuous reimagining of financial services.

For investors, regulators, and industry leaders, the message is clear: to succeed in this environment, one must remain informed, agile, and committed to ethical innovation. The interplay between technology, regulation, and consumer demand will define the next chapter of fintech, making it imperative for all stakeholders to engage in open, proactive dialogue about the best paths forward.

As we wrap up this edition of Fintech Pulse, we invite you to reflect on these insights and consider how they might influence your own strategies and decisions. In the world of fintech, the only constant is change—and those who are prepared to adapt will be the ones to shape the future of finance.

Thank you for joining us in today’s briefing. Stay tuned for more in-depth analysis, expert opinions, and the latest news as we continue to explore the pulse of the fintech world.

The post Fintech Pulse: Your Daily Industry Brief – March 27, 2025 | Almond Fintech, Maplerad & More appeared first on News, Events, Advertising Options.

Fintech

Fintech Pulse: Your Daily Industry Brief – March 27, 2025: Mercury, Jack Dorsey’s Startup, Grab Pay, Virginia, Straiker

In the ever-shifting landscape of financial technology, each day brings with it a fresh wave of innovation, disruption, and regulatory challenges. Today’s briefing offers an in‐depth look at some of the most impactful stories from across the global fintech ecosystem. As investments surge, strategic recalibrations occur, and regulatory decisions continue to shape the industry, our op-ed-style analysis brings you both the facts and a critical interpretation of these developments. In this comprehensive article, we will explore the intricacies of a landmark investment in Fintech Mercury, the controversial decision at a high-profile fintech startup led by Twitter co-founder Jack Dorsey, an aggressive hiring campaign by Grab Pay in Singapore, a politically charged veto on fintech lending legislation in Virginia, and the ambitious launch of Straiker with a fresh infusion of capital to safeguard emerging AI technologies.

Each section of our daily briefing not only recaps the latest news but also offers insights into the implications these events have for investors, innovators, employees, and regulators. As we delve into these stories, our analysis is driven by a deep understanding of market dynamics, regulatory trends, and the competitive spirit that defines fintech. Throughout this briefing, we make it a point to reference our trusted sources for every news piece, ensuring transparency and reliability in our reporting. (Source: )

I. Setting the Stage: The Dynamic World of Fintech

Financial technology has emerged as one of the most transformative sectors in modern business. Its rapid evolution is powered by innovations in payment processing, blockchain technology, digital banking, and a plethora of other advancements that continually reshape the financial services landscape. Today’s narrative is enriched by several critical stories that have far-reaching implications for the industry.

In recent years, we have witnessed an accelerated pace of investment in fintech startups, with significant capital flowing into companies that are not only innovating but also challenging traditional financial institutions. The investment by Fintech Mercury, which recently raised $300 million in a Sequoia-led Series C round and doubled its valuation to an impressive $3.5 billion, is emblematic of the trend. Such a move highlights the market’s increasing appetite for disruptive financial solutions and the confidence that top-tier investors have in the transformative potential of fintech innovations. (Source: )

Simultaneously, we see stories of strategic shifts and operational recalibrations at fintech companies. One of the more high-profile examples involves a fintech startup led by Twitter co-founder Jack Dorsey, where a difficult but necessary decision resulted in the cutting of over 900 jobs. This decision not only signals internal challenges but also invites broader industry reflection on the balance between growth ambitions and sustainable business practices. (Source: )

Meanwhile, the momentum in Asia remains strong, with Grab Pay in Singapore ramping up its hiring efforts. The surge in talent acquisition is a testament to the region’s robust digital payment ecosystem and the increasing demand for innovative fintech services. As the company positions itself for future growth, its strategy underscores the importance of human capital in driving digital transformation in financial services. (Source: )

Regulatory developments also play a pivotal role in shaping the fintech narrative. In Virginia, a recent veto by Governor Youngkin of a fintech lending bill has stirred debates among policymakers and industry stakeholders alike. This decision is a stark reminder of how political dynamics can impact the pace of innovation and the regulatory frameworks that underpin fintech operations. (Source: )

Finally, the story of Straiker’s launch with a $21 million investment to safeguard AI represents the intersection of fintech with the broader technological revolution. As artificial intelligence continues to permeate various sectors, the infusion of capital into AI-related fintech solutions highlights a growing focus on the convergence of technology and finance. This initiative is expected to set new benchmarks for how emerging technologies can be harnessed to secure and optimize financial operations in an increasingly digital world. (Source: )

In the pages that follow, we will dissect each of these stories, offering not only factual summaries but also nuanced commentary on their broader implications. Our analysis will consider investment trends, talent management strategies, regulatory impacts, and the emerging technological convergences that are redefining fintech. By contextualizing these developments within the larger narrative of digital transformation, we aim to provide you with a clear understanding of where the fintech industry is headed and what it means for all stakeholders involved.

II. Fintech Mercury’s $300M Series C: A Game-Changer for Disruptive Innovation

The Investment Landscape and Strategic Implications

The recent funding round by Fintech Mercury is a watershed moment that underscores the strategic importance of robust capital inflows in fueling innovation. Raising $300 million in a Sequoia-led Series C round has not only doubled the company’s valuation to $3.5 billion but also sent strong signals to the market about the viability and long-term potential of fintech innovations.

At its core, this investment reflects a broader industry trend where investors are increasingly betting on companies that can integrate advanced technology with financial services. Fintech Mercury’s approach to combining digital banking solutions with robust analytics has resonated with investors, particularly in an era marked by rapid digital adoption and heightened competition. The confidence displayed by Sequoia Capital and other prominent backers suggests that the company is well-positioned to capitalize on emerging market opportunities and drive significant value creation over the coming years. (Source: )

Catalysts for the Investment Surge

Several factors have contributed to the surge in investment for Fintech Mercury. One of the primary catalysts is the company’s proven ability to adapt to changing market dynamics. By leveraging data analytics and machine learning, Fintech Mercury has developed a suite of products that cater to a wide range of customer needs—from personalized financial advice to real-time risk assessment. This technological prowess, combined with a clear vision for scaling its operations, has attracted significant investor interest.

Moreover, the fintech ecosystem has become increasingly competitive, pushing companies to innovate continuously. Fintech Mercury’s investment round is not just a financial milestone but a strategic endorsement of its future roadmap. The injection of $300 million will likely accelerate its product development cycles, expand its market presence, and enhance its technological infrastructure. Such investments are crucial for companies looking to stay ahead in an environment where technological disruption is the norm rather than the exception.

Operational Enhancements and Market Expansion

The capital raised in the Series C round is expected to be deployed across several critical areas, including research and development, market expansion, and strategic partnerships. For instance, increased R&D spending will enable Fintech Mercury to explore cutting-edge technologies such as blockchain and artificial intelligence. These technologies hold the promise of further revolutionizing financial services by enhancing security, improving transaction speeds, and enabling more personalized customer experiences.

From a market expansion perspective, the infusion of funds will support the company’s efforts to enter new geographies and broaden its customer base. As digital banking continues to gain traction globally, Fintech Mercury’s enhanced capabilities will be pivotal in capturing untapped market segments. Additionally, strategic partnerships with other industry players could further amplify its reach and drive collaborative innovation—a trend that is becoming increasingly prevalent in the fintech space.

A Critical Perspective: Risks and Opportunities

While the investment is undoubtedly a positive signal, it is also essential to consider the inherent risks and challenges. Scaling operations at such a rapid pace can expose the company to operational and regulatory risks. The fintech sector is subject to strict regulatory oversight, and any misstep in compliance can have significant repercussions. Moreover, the pressure to deliver rapid returns may lead to hasty decision-making or overextension in new markets.

Nevertheless, the opportunities presented by this investment far outweigh the risks. With a strong backing from Sequoia Capital and other leading investors, Fintech Mercury is well-equipped to navigate these challenges. Its proven track record of innovation, combined with a strategic vision for growth, positions it as a leader in the fintech arena. Investors and industry analysts alike will be watching closely as the company leverages this new capital to accelerate its growth trajectory and redefine the competitive landscape of financial technology.

Industry Implications and Future Outlook

The implications of Fintech Mercury’s funding round extend beyond the company itself. It serves as a bellwether for the broader fintech industry, signaling that robust investor confidence and significant capital injections will continue to be hallmarks of the sector. As more companies adopt data-driven and customer-centric approaches, the competitive landscape is likely to evolve, leading to increased consolidation and the emergence of new market leaders.

Furthermore, the success of Fintech Mercury’s Series C round may encourage other fintech startups to pursue aggressive growth strategies, potentially spurring a new wave of innovation. For stakeholders across the board—from investors to regulatory bodies—the message is clear: the future of fintech is bright, but it will require a delicate balance between rapid innovation and sustainable business practices. (Source: )

In our view, Fintech Mercury’s achievement is not just a milestone for the company but a reflection of the dynamic forces shaping the financial technology sector. As digital transformation continues to disrupt traditional financial models, companies that can harness innovation while managing risks will be best positioned to succeed. The lessons from this funding round are manifold, offering valuable insights into the evolving nature of fintech investment, market dynamics, and the ongoing quest for technological excellence.

III. Jack Dorsey’s Fintech Startup: Navigating Tough Decisions Amidst Workforce Reductions

The High Stakes of Scaling and Downsizing

In a bold and challenging move, the fintech startup associated with Twitter co-founder Jack Dorsey has recently announced the elimination of over 900 jobs. This decision, as outlined in a candid email to employees, reflects the difficult realities of operating in a highly competitive and rapidly evolving market. For many in the industry, the news is a stark reminder that even high-profile companies are not immune to the pressures of market volatility and operational restructuring. (Source: )

The announcement came at a time when many fintech firms are grappling with the dual challenges of scaling operations rapidly while maintaining a sustainable cost structure. In this context, the decision to reduce the workforce can be interpreted as a strategic move aimed at ensuring long-term viability. However, the short-term impact on morale and public perception cannot be underestimated. Such workforce reductions often serve as a litmus test for a company’s resilience and its ability to navigate turbulent market conditions.

Internal Pressures and External Expectations

For startups led by visionary entrepreneurs like Jack Dorsey, the pressures to innovate and grow are immense. The fintech startup in question has been celebrated for its bold approach to redefining financial services through technology. Yet, the realities of the market demand that even the most innovative companies make difficult choices when growth targets are not met or when operational costs spiral. In this instance, the decision to cut over 900 jobs was not taken lightly. The full email to employees—shared publicly—offered a glimpse into the tough internal deliberations and the weight of leadership responsibilities in times of crisis.

This move has sparked a wide range of reactions within the industry. On one hand, some analysts argue that such drastic measures are necessary to streamline operations and ensure the company’s survival in a competitive market. On the other hand, critics worry about the human cost of such decisions, questioning whether the drive for efficiency might come at the expense of innovation and employee morale. As stakeholders weigh in, it is clear that this decision will have lasting implications for the company’s future, as well as for the broader narrative around workforce management in the fintech sector.

A Deep Dive into the Operational Rationale

At the heart of this decision lies the challenge of balancing growth with operational efficiency. The fintech startup, known for its cutting-edge technology and ambitious growth targets, found itself at a crossroads where scaling operations required a recalibration of its resource allocation. The move to reduce the workforce can be seen as a measure to eliminate redundancies, optimize performance, and align the company’s operational structure with its strategic objectives. In a market where agility is paramount, streamlining operations—even at the cost of significant job losses—can sometimes be the only path to long-term sustainability.

Yet, such decisions are rarely without consequences. For the employees affected by the layoffs, this move represents a significant upheaval in their professional lives. The transparency of the communication, which explicitly acknowledged the difficulty of the decision, is a testament to the complexities of leadership in the tech-driven era. It also serves as a cautionary tale for other startups facing similar dilemmas: the pursuit of rapid growth must be carefully balanced against the need for a stable, motivated workforce. (Source: )

Industry Reactions and Broader Implications

The news of these layoffs has reverberated across the fintech community. Industry insiders are closely monitoring the fallout, with many expressing concerns over the long-term implications for talent retention and innovation. Workforce reductions, particularly in a high-profile startup, can set off a chain reaction that affects investor confidence, customer loyalty, and overall market sentiment. Some commentators have suggested that this decision might signal a broader trend within the fintech space—one where companies are forced to reassess their growth strategies and make tough calls in the face of mounting operational challenges.

From an op-ed perspective, the situation invites a broader reflection on the nature of disruption in the digital age. Fintech startups, while celebrated for their innovative spirit, must contend with the harsh realities of market economics and regulatory pressures. The experience of Jack Dorsey’s startup is a powerful reminder that innovation, no matter how groundbreaking, must be underpinned by sound operational strategies. As the industry continues to evolve, the lessons learned from these workforce reductions could prove invaluable for both emerging startups and established players alike.

Navigating Forward: A Balanced Perspective

In our assessment, the decision to cut over 900 jobs is emblematic of the inherent tensions in the fintech sector. It highlights the need for companies to maintain a delicate balance between ambitious growth and the sustainable management of resources. While the immediate impact may be unsettling, the long-term objective remains clear: to build a resilient organization that can thrive amidst market volatility and technological disruption.

As stakeholders digest this development, it is crucial to recognize that such decisions are rarely black and white. The path forward will likely involve a combination of strategic recalibrations, enhanced operational efficiencies, and a renewed focus on innovation that prioritizes both technological advancement and human capital. In this sense, the current situation offers an opportunity for introspection—not only for the company involved but for the entire fintech ecosystem. (Source: )

IV. Grab Pay’s Strategic Hiring Surge in Singapore: Fueling the Digital Payment Revolution

Strengthening the Human Capital Backbone

In a move that underscores the critical importance of talent in driving digital innovation, Grab Pay in Singapore has embarked on an aggressive hiring campaign. This surge in recruitment is designed to meet the rising demand for cutting-edge fintech solutions in a region that is rapidly emerging as a global digital payments hub. With an eye toward both short-term growth and long-term sustainability, Grab Pay is positioning itself to capitalize on the dynamic interplay between technology and finance. (Source: )

As fintech companies continue to expand, the competition for skilled professionals has intensified. Grab Pay’s strategic hiring efforts reflect a broader industry trend where access to top talent is seen as a key competitive differentiator. By bolstering its workforce, the company aims to not only enhance its product offerings but also foster an environment of innovation that can drive the next wave of digital transformation in financial services.

A Catalyst for Regional Innovation

Singapore’s fintech ecosystem is renowned for its vibrant startup culture, robust regulatory framework, and supportive government policies. Against this backdrop, Grab Pay’s hiring initiative takes on added significance. The company’s decision to expand its team is a clear signal that it intends to push the boundaries of what is possible in digital payments, leveraging technology to deliver seamless, efficient, and secure financial services to an increasingly tech-savvy consumer base.

The surge in hiring is expected to fuel a number of key initiatives, including the development of advanced payment solutions, the integration of artificial intelligence into customer service, and the expansion of digital banking services. Each of these initiatives is geared toward meeting the evolving needs of consumers who are increasingly looking for convenience, security, and innovation in their financial transactions. (Source: )

Strategic Growth and Competitive Positioning

From a strategic standpoint, Grab Pay’s recruitment drive is more than just an operational necessity—it is a bold statement of intent. By investing in human capital, the company is preparing itself for a future where the boundaries between traditional banking and digital finance continue to blur. In a highly competitive market, the ability to attract and retain top talent can provide a significant edge, enabling a company to innovate faster, respond more agilely to market trends, and ultimately deliver superior value to its customers.

Moreover, the company’s aggressive hiring campaign can be seen as part of a broader effort to solidify its position as a market leader in the digital payments space. As more players enter the market and consumer expectations evolve, having a robust, dynamic team in place will be crucial for maintaining competitive momentum. In this context, Grab Pay’s move is both timely and strategically astute, aligning with the broader trends of innovation and digital transformation that are redefining the fintech industry.

Industry and Market Perspectives

The emphasis on talent acquisition by Grab Pay has not gone unnoticed within the industry. Market analysts are closely watching the developments, noting that such moves are indicative of a more mature and competitive digital payments ecosystem. The success of Grab Pay’s hiring initiative will likely have ripple effects, prompting other fintech companies in the region to re-examine their own talent strategies.

Furthermore, the move is expected to drive increased investment in research and development, as a larger, more skilled workforce is better equipped to innovate and scale. This, in turn, will benefit consumers, who can expect to see more advanced, user-friendly, and secure fintech solutions in the near future. As the digital payments space continues to evolve, the focus on human capital will remain a critical factor in determining which companies emerge as clear market leaders. (Source: )

Challenges and Opportunities Ahead

While the hiring surge presents significant opportunities, it also comes with its share of challenges. The competition for talent in the fintech sector is fierce, and companies must be prepared to offer not only competitive compensation packages but also a dynamic and inclusive work culture that fosters innovation and growth. In addition, as the company scales its operations, ensuring that new hires are effectively integrated into its corporate culture will be essential for maintaining momentum and achieving long-term success.

Despite these challenges, the overall outlook remains positive. Grab Pay’s strategic focus on talent acquisition is a forward-thinking move that is likely to yield substantial dividends in the form of enhanced innovation, improved customer service, and sustained market leadership. For investors and industry observers alike, this initiative serves as a clear indicator of the company’s commitment to staying at the forefront of the digital payments revolution.

V. Regulatory Crossroads: Virginia Governor Youngkin’s Veto on the Fintech Lending Bill

The Intersection of Innovation and Regulation

Regulatory decisions play a pivotal role in shaping the trajectory of fintech innovation. Recently, Virginia Governor Youngkin vetoed a fintech lending bill—a move that has ignited debates among policymakers, industry stakeholders, and consumer advocates. This decision underscores the complex interplay between fostering innovation and ensuring consumer protection in a rapidly evolving market. (Source: )

At a time when fintech companies are pushing the boundaries of traditional financial services, the regulatory environment remains a critical area of focus. The veto by Governor Youngkin has raised important questions about how regulatory frameworks should evolve to balance the need for innovation with the imperative of safeguarding the financial system from potential risks. As lawmakers grapple with these issues, the decision serves as a reminder of the delicate balance that must be struck between encouraging disruptive technologies and ensuring that adequate protections are in place for consumers and investors alike.

Political Dynamics and Industry Reactions

The decision to veto the fintech lending bill was met with a mix of praise and criticism. Proponents of the veto argue that the bill, as proposed, could have led to an overly permissive lending environment that might expose consumers to undue risks. They contend that stringent regulatory oversight is essential to prevent the potential misuse of fintech lending platforms and to maintain market stability. Conversely, opponents of the veto suggest that it could stifle innovation by placing unnecessary constraints on fintech companies that are already operating in a competitive global market.

In our analysis, the veto reflects a broader political debate about the role of government in regulating emerging technologies. On one hand, there is a compelling case for robust regulatory frameworks that protect consumers and prevent financial malpractices. On the other hand, excessive regulation could impede the growth of fintech startups, curtail innovation, and limit the competitive edge of the sector. Governor Youngkin’s decision thus highlights the need for a more nuanced approach—one that balances the interests of all stakeholders while fostering an environment that encourages innovation and responsible growth. (Source: )

Implications for Fintech Lending and Market Dynamics

From a market perspective, the veto on the fintech lending bill is likely to have significant implications for both startups and established financial institutions. Fintech lending platforms have emerged as a disruptive force in the financial services landscape, offering alternative solutions to traditional banking channels. However, the lack of clear regulatory guidelines has, at times, created uncertainty for market participants. The veto introduces a new dynamic, one that may prompt companies to reassess their lending models and compliance strategies.

In the short term, the decision may lead to a period of adjustment as companies adapt to a more ambiguous regulatory landscape. Over the long term, however, it could stimulate further dialogue between industry stakeholders and policymakers, paving the way for more balanced regulatory reforms. This is a critical juncture for the fintech lending space—one that will require cooperation, transparency, and a willingness to innovate not only in technology but also in regulatory practices. (Source: )

The Broader Debate: Regulation Versus Innovation

The broader debate surrounding this veto touches on some of the fundamental questions facing the fintech industry today. Should regulation act as a catalyst for innovation by providing clear guidelines, or should it serve as a constraint to prevent excessive risk-taking? In our view, the answer lies in striking the right balance. Innovation and regulation need not be mutually exclusive; rather, they can be complementary forces that drive sustainable growth.

By vetoing the fintech lending bill, Governor Youngkin has signaled a cautious approach to deregulation in this space. While the decision may be perceived as a setback by some innovators, it also opens up an opportunity for more constructive policy discussions. In the long run, a well-calibrated regulatory framework that protects consumers while encouraging innovation could benefit the entire fintech ecosystem—ensuring that growth is both dynamic and sustainable.

VI. Straiker’s Bold Move: $21 Million to Safeguard AI in the Fintech Era

Merging AI with Financial Security

The launch of Straiker, accompanied by a $21 million investment aimed at safeguarding AI technologies, represents a fascinating convergence of two of the most disruptive forces in modern technology: artificial intelligence and fintech. In an era where digital transformation is accelerating at an unprecedented pace, the integration of AI into financial services is not merely an option—it is a necessity. Straiker’s initiative to secure AI applications in fintech is poised to address some of the most pressing challenges related to cybersecurity, data privacy, and operational efficiency. (Source: )

At its core, the investment in Straiker is a testament to the growing recognition of AI as a critical component in the future of finance. With the increasing complexity of financial transactions and the ever-present threat of cyberattacks, there is an urgent need for robust solutions that can protect both institutions and consumers. Straiker’s approach is both innovative and timely, combining cutting-edge AI technologies with a deep understanding of the unique challenges faced by fintech companies.

Strategic Objectives and Technological Innovations

The $21 million capital infusion is earmarked for several key initiatives that are expected to drive the next phase of innovation in fintech. One of the primary objectives is to enhance cybersecurity measures through the development of advanced AI algorithms that can detect and mitigate fraudulent activities in real time. In an industry where security breaches can have catastrophic consequences, such proactive measures are indispensable.

Additionally, the funding will support the integration of AI into risk management systems, enabling financial institutions to better anticipate market fluctuations and mitigate potential losses. By leveraging AI-driven analytics, Straiker aims to provide a layer of protection that is both adaptive and resilient—a critical advantage in today’s unpredictable financial environment. (Source: )

The Convergence of Fintech and AI: Opportunities and Challenges

The integration of AI into fintech represents a paradigm shift that offers both significant opportunities and formidable challenges. On the one hand, AI-powered solutions have the potential to revolutionize financial services by increasing efficiency, reducing costs, and improving the overall customer experience. On the other hand, the rapid pace of technological change necessitates that companies remain agile and vigilant in the face of evolving threats.

Straiker’s bold move to secure $21 million in funding reflects a deep-seated belief in the transformative power of AI. It also highlights the need for continuous innovation in an industry that is increasingly defined by its reliance on technology. As fintech companies continue to explore the myriad ways in which AI can enhance their operations, the challenges of integration, regulation, and ethical considerations will undoubtedly remain at the forefront of the conversation.

Market Reactions and Future Projections

Industry observers have lauded Straiker’s initiative as a forward-thinking move that could set new benchmarks for how AI is deployed in the fintech sector. The investment is seen as a catalyst for broader adoption of AI-driven solutions, potentially spurring a wave of innovation that could transform everything from customer service to risk assessment and regulatory compliance. As financial institutions grapple with the dual imperatives of innovation and security, initiatives like Straiker’s will likely serve as a model for how to navigate these complex challenges.

Looking ahead, the success of Straiker’s initiative could pave the way for additional investments in AI and fintech convergence projects. The interplay between technological innovation and financial security is set to become a defining feature of the next generation of financial services. As companies and regulators alike work to adapt to this new reality, the lessons learned from Straiker’s launch will be invaluable in shaping the future of fintech.

VII. Synthesis and Outlook: Navigating the Future of Fintech

Reflections on Today’s Developments

As we bring today’s briefing to a close, it is important to step back and reflect on the broader implications of these developments. The fintech landscape is characterized by rapid change, intense competition, and a constant drive for innovation. Each of the stories we have explored today—from Fintech Mercury’s landmark Series C funding to the difficult workforce decisions at Jack Dorsey’s startup, from Grab Pay’s strategic talent acquisition to Virginia’s regulatory challenges and Straiker’s bold foray into AI security—offers a unique lens through which we can view the multifaceted world of financial technology.

These stories collectively underscore the notion that innovation in fintech is not a linear journey. It is a complex interplay of investments, strategic recalibrations, regulatory shifts, and technological breakthroughs. The industry’s evolution is driven by both the promise of disruptive innovation and the realities of operating in a highly regulated, competitive environment. In many ways, today’s news serves as a microcosm of the larger forces at work in fintech—a dynamic mix of risk and reward, challenge and opportunity.

The Road Ahead for Investors, Innovators, and Regulators

For investors, the clear takeaway is that robust capital investment remains critical for fueling innovation. The success of Fintech Mercury’s funding round, for example, signals strong confidence in the potential of fintech startups to reshape the financial services landscape. Yet, with significant investments come significant expectations—and with them, the need for careful oversight and strategic planning. Investors will need to keep a close eye on how these companies manage their growth trajectories, operational efficiencies, and regulatory compliance as they scale.

For innovators and entrepreneurs, the lessons from today’s briefing are manifold. The fintech ecosystem rewards bold, innovative thinking but also demands a keen awareness of the risks involved. Whether it is adapting to market challenges, streamlining operations, or integrating emerging technologies like AI, the key to sustained success lies in maintaining a delicate balance between ambition and pragmatism. The stories we have covered today highlight that every strategic decision, from fundraising to workforce management, carries with it a ripple effect that can shape the future of the entire industry.

Regulators, too, are an integral part of this evolving narrative. The delicate balance between encouraging innovation and ensuring consumer protection is a challenge that demands constant vigilance and adaptability. Governor Youngkin’s veto of the fintech lending bill serves as a potent reminder that policy decisions can have profound implications—not only for individual companies but for the broader market dynamics. Moving forward, a more collaborative approach between industry players and regulators may well be the key to fostering an environment where innovation can flourish without compromising on accountability and security.

Strategic Insights for a Dynamic Future

Looking to the future, several strategic insights emerge from today’s developments. First, the importance of capital cannot be overstated. Whether it is through high-profile funding rounds or targeted investments in emerging technologies, the infusion of financial resources is a crucial enabler of innovation. Companies that are able to secure robust funding will be better positioned to invest in research and development, expand their market presence, and ultimately drive transformative changes in the industry.

Second, the role of talent in fueling innovation is more critical than ever. Grab Pay’s aggressive hiring campaign in Singapore underscores the fact that human capital remains a cornerstone of fintech success. As companies continue to vie for the best minds in technology and finance, those that can create a dynamic, inclusive, and forward-thinking work environment will enjoy a competitive advantage in the race for innovation.

Third, the interplay between regulation and innovation will continue to define the fintech landscape. As we have seen, regulatory decisions can either accelerate or impede progress. A more nuanced and collaborative regulatory framework—one that takes into account the unique challenges and opportunities presented by fintech—will be essential for ensuring that the industry can grow in a sustainable and responsible manner.

Finally, the convergence of emerging technologies such as artificial intelligence with traditional financial services is poised to transform the industry in unprecedented ways. Straiker’s initiative to safeguard AI is a prime example of how technology can be harnessed to enhance security, improve efficiency, and drive innovation. As these technological frontiers continue to expand, companies that can successfully integrate AI and other disruptive technologies into their business models will be at the forefront of the fintech revolution.

Concluding Thoughts