Fintech

How finance brands can drive the ROI with content creators

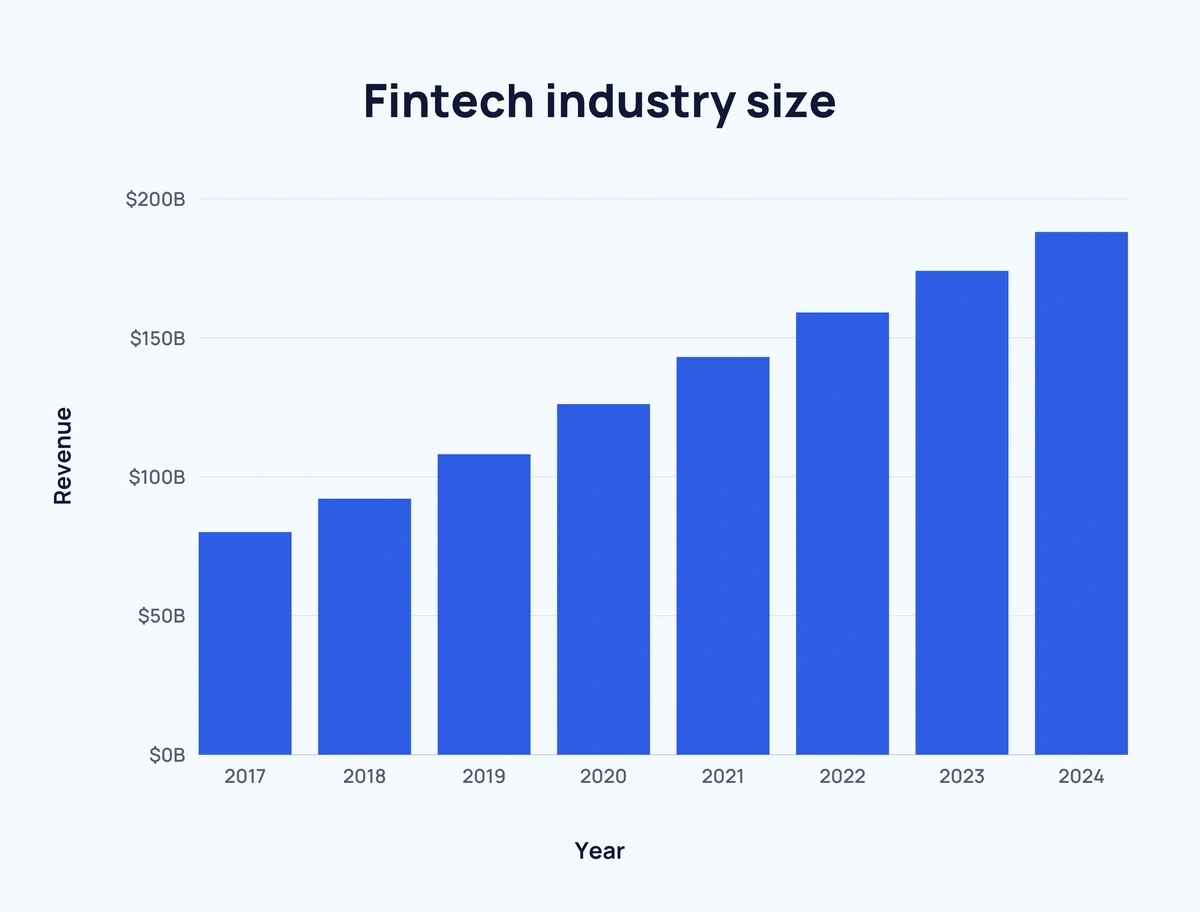

The FinTech industry is highly competitive. In 2017, global FinTech industry revenue was approximately $90.5 billion, and it has grown by over 100% by the end of 2023.

Finance brands are constantly seeking innovative ways to connect with their target audiences, as a result, their marketing channels have also changed. The once-traditional financial sector, often associated with formal advertising, such as billboards, TV commercials, and print advertisements, now commonly uses influencer marketing.

Today, trust in traditional advertising methods has weakened, and consumers now are turning to sources they perceive as authentic and relatable. Influencer marketing, with its ability to build trust and credibility, has become a common strategy for finance brands aiming to enhance their ROI and their engagement with audiences. At the same time, 67% of brands are increasing their influencer marketing budgets that also proves the effectiveness of this channel.

The rise of influencer marketing in finance

Influencers’ recommendations are highly effective, with 92% of consumers trusting influencers more than traditional advertising channels. Social media platforms have further amplified the impact of influencer marketing, allowing influencers to engage directly with their audiences and foster trust within niche finance communities.

Influencer marketing is commonly used by such companies as Binomo, Olymp Trade, Ego, Klarna, Exness, Pay Senger, Capital.com, and many more. If you are interested to see the example of a strategy, here is how Famesters helped FxPro drive 18K+ installations and more than 18M views.

Trading services, especially those strongly connected with cryptocurrencies, get the largest influencer marketing budgets among finance brands. According to Famesters, in 2022 Binance was the top-mentioned finance brand on YouTube.

Choosing the right influencers

Selecting the right influencers is key to the success of influencer marketing campaigns in any business sector, and it is especially crucial for the finance sector due to its specificity. To find the right influencers with authentic audiences, you have to spend time and resources. But if aligned with a creative strategy, such publications can pay off greatly: brands can earn around $5.78 for every dollar spent on influencer marketing. Here are some key considerations to pay attention on:

- Alignment with brand values. This ensures that the influencer’s content will reflect the brand’s mission, maintaining consistency in messaging.

- Target audience compatibility. Effective influencer marketing hinges on reaching the right audience. Finance brands should thoroughly analyze an influencer’s follower demographics to ensure they match the intended target audience. For instance, promoting credit cards to young adults may require influencers with a predominantly youthful and financially active audience.

- Domain expertise. In the world of finance, domain expertise is a significant asset. Influencers who demonstrate a deep understanding of financial matters and can communicate complex topics in a clear and accurate manner are considered to be the best choice to cooperate with.

Not all financial products are best promoted by financial influencers. For instance, if you’re marketing a banking product designed for children, it’s more effective to collaborate with influencers who are able to reach the parents of potential users. Similarly, for B2B financial products like business bank accounts, it makes more sense to partner with influencers who cater to entrepreneurs rather than those focused on personal finance or budgeting advice.

- Engagement and trustworthiness. High engagement rates, authentic interactions, and a track record of trust-building are indicators of an influencer’s effectiveness in conveying messages and recommendations (that are crucial for finance brands). Besides, the FinTech creators market is full of fraud and scam, this is why it is worth taking time and ensuring the quality of potential partners.

Ask for a screencast of the creator’s statistics instead of a screenshot if you have doubts; a trustworthy creator would provide it, and if the statistics are fake, the influencer will likely refuse.

- Content quality. FinTech brands should assess an influencer’s content quality and relevance to ensure it aligns with their campaign goals. Consistency in producing valuable, informative, and engaging content is key.

You can analyze around 10-15 of the latest videos on the channel, review the comments, and ensure that they have not been purchased from a shady website. For example, when you come across comments such as “Yes sir,” “Great video,” “Thanks!”, “Love you man!”, “Quality content,” etc., they should raise red flags, as these are most likely bot-generated comments.

- Past collaborations and reputation. Examine an influencer’s past collaborations and reputation. For instance, if a FinTech company partners with an influencer known for promoting risky investment schemes in the past, or associated with controversial practices, it could harm the brand’s credibility and integrity.

Besides choosing the right creators for your campaign it is also crucial to craft a well-thought brief – a clear communication tool that helps convey your app or platform’s value. Provide influencers with guidelines on your brand message, goals, budget, and content expectations, including tone of voice and key messages. Trust influencers to communicate naturally while ensuring essential ad points are covered.

Influencer fraud risks and how to reduce them

Influencer fraud is actually decreasing year by year as more tools to detect it appear and improve. But still, 64% of companies name influencer fraud an issue that worries them. And yes, there are significant risks that can be divided into two major categories: distorted ROI and brand reputation risks.

Distorted ROI:

- Brands engage with influencers expecting benefits like enhanced brand recognition, sales boosts, or greater audience interaction. However, influencer fraud distorts these projections.

- Investments in influencers who have artificial followers or engagement don’t deliver tangible outcomes, resulting in a reduced ROI.

Brand reputation risks:

- In the finance market where authenticity is highly valued by consumers, the discovery of deceit by an influencer connected to a brand can breed doubt, not only about the influencer but also about the brand itself. This association can damage the brand’s reputation and weaken trust with its audience.

Influencer fraud in the FinTech sector doesn’t just affect individual campaigns; it threatens the integrity of influencer marketing as a whole. In an industry built on trust and precision, deceptive practices have far-reaching consequences, making vigilance and informed decision-making imperative for FinTech brands.

To avoid fraudulent influencers and reduce risks, finance brands should prioritize vetting influencers. To do so, brands can:

- Review content history, engagement rates, and alignment with brand values.

- Look for genuine audience interaction and content that resonates with your brand’s message.

- Engage directly with influencers to grasp their audience’s age, gender, and location.

- Seek personal stories of audience interactions, indicating authentic connections.

Here are some FinTech brands’ self-audit tips:

- Engagement analysis. Check the ratio of followers to engagement; low engagement with high followers is a warning sign.

- Audience location. Be wary of influencers with most followers from regions irrelevant to their supposed base.

- Content evaluation. Genuine influencers mix sponsored and organic content, showing true interest in their niche.

- Feedback checks. Seek testimonials from other brands or agencies.

- Consistency. Authentic influencers show regular posting and engagement patterns.

And last but not least: for brands venturing into influencer marketing, especially in sectors like FinTech where trust and credibility are essential, the importance of formalizing collaborations through contracts cannot be overstated. Contracts serve as a foundational safeguard against influencer fraud, clearly delineating expectations, deliverables, and terms of engagement. This formal agreement helps to ensure that both parties are accountable and that the influencer’s following and engagement metrics are authentic and aligned with the brand’s objectives. Contracts also provide legal recourse in the event of misrepresentation or non-compliance, significantly reducing the risk of financial loss and reputational damage.

A well-structured contract is not just a formal requirement; it is a strategic tool in mitigating the risks associated with influencer fraud, ensuring transparency, and maintaining the integrity of the brand’s marketing efforts.

Conclusion

You can see that the success of influencer marketing in the FinTech sector hinges on a strategic and analytical approach. Its key aspects include:

- Selective influencer engagement. Choosing influencers with a deep understanding of financial products and alignment with brand values is crucial for effective audience engagement.

- ROI and risk management. It’s vital to employ robust analytics for assessing influencer authenticity to mitigate risks to ROI and brand reputation.

- Audience and content analysis. Detailed examination of the influencer’s audience demographics and content relevance is essential for ensuring alignment with the brand’s target market.

- Adaptive strategies. Staying adaptive to the evolving digital marketing trends and consumer behaviors in the fast-paced FinTech industry is key.

Effectively navigating these elements can significantly enhance ROI and market positioning for FinTech brands in an industry that values innovation and trust.