Fintech PR

FDX Managing Director Don Cardinal Testifies Before Congress on Big Data in Banking and Financial Data Security

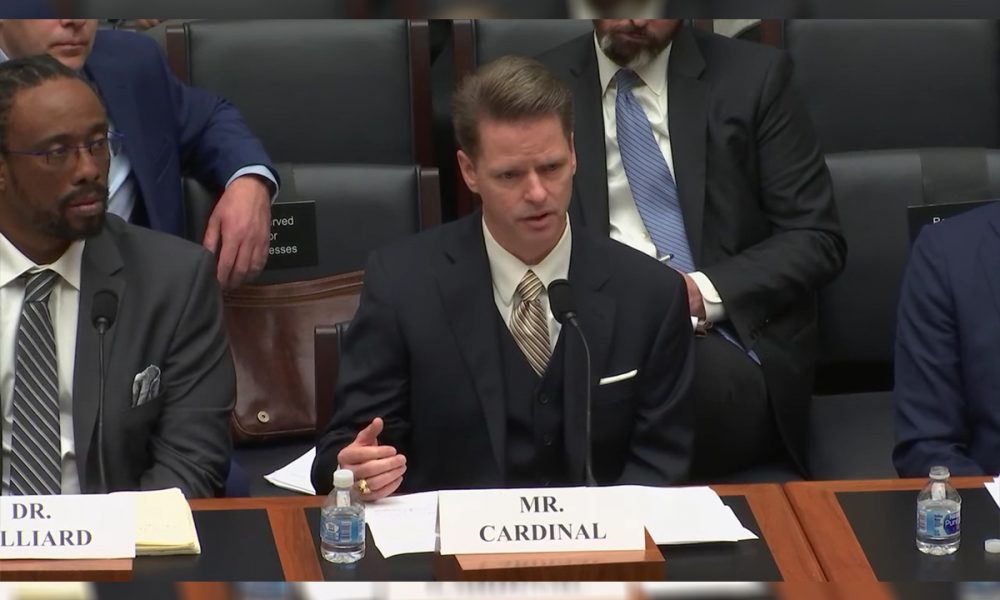

Today, Financial Data Exchange Managing Director Don Cardinal testified before the U.S. House Committee on Financial Services Task Force on Financial Technology, regarding the role of big data in financial services and the protection of consumer privacy.

In his testimony, Cardinal explained that technological innovations in financial services have empowered consumers with tools to control and understand their financial lives. The required financial data has traditionally been collected through an automatic process called screen scraping, which depends upon consumers to permission access through the use of their financial institution login credentials. Cardinal informed the Committee that FDX was formed to promote next-generation technology, moving the financial services industry away from screen scraping and toward the adoption of a common application programming interface (API) standard, the FDX API, to access consumer financial data.

Fintech apps and programs that utilize the FDX API allow consumers to log in and be authenticated directly by their own financial institutions, and then permission specific data for the chosen app. “Through broad adoption of the FDX API, screen scraping will eventually cease, while the flow of user permissioned data will encounter less friction, yet be more secure and reliable than ever,” Cardinal said. “This is the end state that everyone is working to – whether you’re a bank or brokerage, an aggregator or financial technology company.”

Cardinal pointed out that the only financial data that will be accessed with the FDX API is that which the consumer has expressly consented and permissioned to share with the specific fintech apps the consumer chooses. By defining specific use cases, the FDX API limits the collection of data to only that which is needed and consumer authorized. All use cases are guided by the Five Core Principles of Financial Data Sharing – Control, Access, Transparency, Traceability, and Security – which represent the organization’s understanding of the essential elements of a secure, transparent approach to the sharing of financial data.

The nonprofit’s membership consists of a wide range of fintech companies, local banks and credit unions, the largest financial institutions and consumer advocacy groups. The FDX API provides the framework necessary to provide scalable technology solutions so that even the smallest financial institutions are now able to offer the same fintech services and tools as the largest financial institutions at a fraction of the cost. The FDX API is royalty-free to use in perpetuity by all parties.

“FDX represents the financial services ecosystem coming together to put the consumer in the driver’s seat regarding the use and sharing of their financial data. Consumer demand for fintech apps has been the leading force behind the massive innovation that has taken place in financial services, and FDX believes the entire financial ecosystem is best positioned to ensure that these consumers are empowered and have the tools to share and use their financial data in the most secure manner possible,” Cardinal stated.

The financial services industry has been quick to adopt the FDX API standard in response to growing consumer and business demand for control over data. Earlier this month, FDX announced that the group’s membership has steadily grown through 2019 and now includes 72 members – compared to 23 at its 2018 launch. In January 2019, more than 2 million U.S. customers were empowered through the FDX API. Today, more than 5 million U.S. customers are benefiting from the FDX standard and FDX expects to have it rolled out to 8 million customers by year-end and approximately 12 million by April 2020.

SOURCE Financial Data Exchange