Fintech PR

Oman’s BankDhofar is the First Bank in the Middle East to Install Diebold Nixdorf’s RM4V Cash Recycling Engine to Deliver a World-Class Customer Experience

Cash recycling pilot on DN Series® ATMs and CDMs reduces cash management costs and provides additional services to customers

MUSCAT, Oman and HUDSON, Ohio, Dec. 6, 2023 /PRNewswire/ — Diebold Nixdorf (NYSE: DBD) today announced that BankDhofar is the first bank in the Middle East to utilize its RM4V cash recycling engine in its DN Series® ATMs and cash dispensing machines (CDMs). The implementation offers customers additional banking services and is managed in collaboration with CNS, Diebold Nixdorf’s partner in Oman.

This launch puts BankDhofar at the forefront of customer centricity and innovation. The DN Series Recycler ATM/CDM has the capacity to dispense 300 banknotes more than the usual 50 banknotes and complies with the Central Bank of Oman’s cash and fraud detection protocols. Cash recycling reduces cash management costs for the bank by accepting, storing and recirculating cash that’s deposited in the ATM. Creating a closed-loop recycling environment that automatically moves money through the system provides the additional advantages of extending cash-in-transit (CIT) intervals and drastically reducing CO2 emissions.

The RM4V technology optimizes the cash storage solutions within the ATM and is based on a vertical design configuration of the cassettes without compromising the small footprint of the DN series. The cash recycling engine also provides:

- Multi-denomination capabilities

- Larger capacity for more banknotes

- More secure transport of banknotes

- Flexible configuration options for dispensing, depositing and recycling

One of the most important advantages of the Recycler ATM/CDM is that it functions like a 24×7 mini cashier, which caters to the diverse needs of individual, medium and large corporate customers. Apart from NFC-enabled technology that enhances customer experience through secure and convenient contactless transactions, customers can increase their withdrawal limits via the BankDhofar mobile app, thereby gaining access to higher withdrawals.

In 2020, BankDhofar also became the first bank in Oman to install DN Series ATMs. The bank’s commitment to transformation is evident in its remarkable network expansion aimed at reaching more customers. Starting the year 2022 with 129 ATMs and CDMs, the bank will grow to more than 300 ATMs and CDMs by the end of 2023. In a strategic move towards a ‘phygital’ experience, Bank Dhofar also expanded its retail branch network from 52 (at the beginning of 2022) to 130 branches by December 2023. This makes BankDhofar the fastest-growing bank in the region with double-digit growth in both physical and digital sectors.

Amjad Iqbal Al Lawati, chief retail banking officer, at BankDhofar said: “Customer experience is at the heart of everything we do. Investing in improving technology for a key banking channel such as ATMs/CDMs will make everyday banking more convenient. We are proud to announce a significant enhancement in our operational efficiency, resulting in an even more seamless and accessible experience for our customers when conducting withdrawals. This advancement is accompanied by a heightened focus on ensuring a secure environment for all transactions. Furthermore, our dedicated team remains committed to actively engaging with customers, fostering interactions, comprehending their needs, and providing thoughtful recommendations for tailored financial solutions.”

Joe Myers, executive vice president, Global Banking at Diebold Nixdorf said: “We are excited that our long-term partner BankDhofar is the first bank in the Middle East to utilize our RM4V cash recycling engine. This technology is driving the recycling market in many countries. The high level of availability of the DN Series, along with its security and efficiency, continue to make it the best solution on the market for cash recycling.”

About BankDhofar

BankDhofar is one of the best banks in the region that is responsive to customers’ needs and requirements and sets the standard for the best customer experience in the banking industry in Oman by using the latest technologies and providing cutting-edge financial solutions. The Bank has more than 100 branches and 300 plus ATMs, CDMs, FFMs and MFKs across Oman. BankDhofar customer can conduct their banking transactions 24/7 through internet banking and the award-winning mobile banking app which offers exclusive financial services. Customers can access the financial services through a wide network of branches, ATMs, CDMs, FFMs and MFKs across the Sultanate, operating 24 hours a day and boasting a highest ATM availability of 99.4%. Website: www.bankdhofar.com

About Diebold Nixdorf

Diebold Nixdorf (NYSE: DBD), Incorporated automates, digitizes and transforms the way people bank and shop. As a partner to the majority of the world’s top 100 financial institutions and top 25 global retailers, our integrated solutions connect digital and physical channels conveniently, securely and efficiently for millions of consumers each day. The company has a presence in more than 100 countries with approximately 21,000 employees worldwide. Visit www.dieboldnixdorf.com for more information.

X: @DieboldNixdorf

LinkedIn: www.linkedin.com/company/diebold

Facebook: www.facebook.com/DieboldNixdorf

YouTube: www.youtube.com/dieboldnixdorf

DN-B

Logo – https://mma.prnewswire.com/media/2293516/Diebold_Nixdorf_BankDhofar_CNS_Logo.jpg

Fintech PR

Enabling Regenerative Agriculture for Independent Smallholders in Indonesia: The BIPOSC Project, in Collaboration with Musim Mas, L3F, SNV Indonesia, and ICRAF

JAKARTA, Indonesia, Oct. 18, 2024 /PRNewswire/ — Musim Mas Group, the Livelihoods Fund for Family Farming (L3F), SNV Indonesia, and World Agroforestry (ICRAF) are collaborating to improve the knowledge and capacity of independent oil palm smallholders through the Biodiverse & Inclusive Palm Oil Supply Chain (BIPOSC) project.

The project began in 2021 and takes a long-term approach to sustain a deforestation-free supply chain, regenerate degraded land, restore local biodiversity, and improve the livelihoods of independent smallholder farmers in Labuhanbatu, North Sumatra. BIPOSC will achieve this through implementing regenerative agriculture, locally adapted agroforestry models, capacity-building for sustainable businesses, and others.

The independent palm smallholders taking part previously received complementary training from Musim Mas. Following the training, these smallholders formed a smallholder’s association, Labuhanbatu Independent Oil Palm Smallholders Association (APSKS LB), North Sumatra. Musim Mas encourages smallholders to form associations to get better access to resources and obtain certification by the Roundtable on Sustainable Palm Oil (RSPO) and Indonesian Sustainable Palm Oil (ISPO).

“Musim Mas has long saw that smallholders are key to achieving palm oil sustainability, and that’s why we lead Indonesia’s most extensive smallholder program. We believe that the way forward is to collaborate with more partners to achieve a wider impact. With our BIPOSC partners, we hope to advance the skills and knowledge of smallholders through regenerative agriculture and related techniques. Regenerative agriculture and agroforestry have the potential to help smallholders be part of a sustainable palm oil supply chain. It could help them develop alternative sources of income, especially during the replanting period where their palm oil crops are unproductive, typically for three years,” said Rob Nicholls, General Manager, Projects & Programs, Musim Mas Group.

In the face of climate change and threatened biodiversity, regenerative agriculture can play a role for small farms because it maintains soil health, prevents erosion and water runoff, and can potentially reduce greenhouse gas emissions and nitrogen leakage.

“As a global development partner organization, SNV aims to support Indonesia in achieving its Sustainable Development Goals (SDGs). To achieve this, we need to implement effective and impactful programs to transform agricultural and food systems, energy, and water. In the BIPOSC program, we promote a comprehensive regenerative agriculture and agroforestry model to maintain soil fertility and biodiversity, providing maximum benefits for farmers’ livelihoods and economy,” said Rizki Pandu Permana, Country Director of SNV Indonesia.

The key regenerative agriculture techniques taught include the application of bio-input, mulching to protect topsoil, planting cover crops, integrated pest management that reduces the need for chemical pesticides, and application of compost that reduces the amount of chemical fertilizers needed. To date, 1,032 independent smallholders received training and implement these techniques on their farms, representing a total land with a total area of 1,063.68 hectares. The project trained 25 village facilitators to provide hands-on assistance to smallholders, and seven demo plots established as pilot areas and learning facilities for regenerative agriculture.

“When I visited palm oil smallholders a few years ago in the area, their biggest concern was access to more fertilizers. While fertilizers play a key role in boosting yields, there was a noticeable gap in understanding how to protect the soil from long-term degradation. Smallholders needed more knowledge about maintaining soil health, preserving soil structure, and other critical factors. This is exactly what the BIPOSC project aimed to address, and we’re pleased to see that the farmers involved are now reporting not only higher yields but also healthier soils on their plots,” said Bernard Giraud, President & Co-Founder, Livelihoods.

The projectalso looks into capacity-building. In addition to home composting, the project enabled the local farmer association, APSKS LB, to develop and manage a composting unit with a capacity of 100-150 tons/month. Producing compost at scale with inputs from nearby mills and farmer plots, the unit offers compost to member farmers at half of typical market prices. In 2023, its first year of operation, the unit produced 588 tons of compost, and generated a profit of IDR 421 million. The project partners believe it is a model that can be replicated elsewhere.

“One of the most impactful outcomes of this project for smallholders is the Composting Unit as the business model around it. It enables smallholders to obtain compost affordably, and the profits are shared among member farmers. This is a practical solution to promote the adoption of composting, and all ASPKS-LB smallholders are now using compost in their plots,” said Syahrianto, Chairman of the Labuanbatu Independent Oil Palm Smallholders Association.

As of 2023, independent smallholders manage about 41% of oil palm planted areas in Indonesia, representing 6.94 million hectares. This figure is expected to increase to 60% by 2030, making projects like BIPOSC critical in shaping the future of sustainable palm oil production.

Devane Sharma

[email protected]

Photo – https://mma.prnewswire.com/media/2533466/DSCF9193.jpg

Photo – https://mma.prnewswire.com/media/2533468/DSC07760.jpg

Photo – https://mma.prnewswire.com/media/2533467/DSCF0748.jpg

Fintech PR

BRI Partners with Nium to Expand Real-Time Cross-Border Payment Solutions

JAKARTA, Indonesia, Oct. 18, 2024 /PRNewswire/ — Nium, the leading global infrastructure for real-time cross-border payments, is thrilled to announce a partnership with Bank Rakyat Indonesia (BRI) to provide Indonesian customers with real-time international money transfer capabilities. This collaboration aims to enhance the cross-border offerings for BRI’s individual and corporate customers, delivering more accessible and cost-effective financial services across Indonesia.

This partnership empowers more than 150 million BRI account holders, including those in remote regions of Indonesia, to access modern, real-time cross-border payment services. The offering includes a variety of real-time payment mechanisms, supporting bank account destinations, a global electronic card network, and digital wallets. These innovations are closely aligned with BRI’s ongoing mission to provide affordable and customer-focused financial products, particularly for traditionally underserved communities.

BRI’s Corporate Secretary, Agustya Hendy Bernadi, emphasized BRI’s dedication to constantly improving customer convenience through innovations in its global network and cross-border transaction services. “This collaboration reflects BRI’s continuous efforts to enhance productivity and efficiency by expanding its digital payment channel network to meet the growing demand for global transactions,” he said. Agustya added that the partnership with Nium aligns perfectly with BRI’s vision to be Southeast Asia’s most valuable banking group and a champion of financial inclusion by 2025. “With Nium’s global transaction network, BRI strengthens the digitalization of its business processes and enhances retail banking capabilities in line with our 2025 strategic vision.”

Anupam Pahuja, General Manager and Executive Vice President for Asia Pacific, Middle East, and Africa at Nium, shared his excitement about the partnership, highlighting BRI’s extensive presence across Indonesia’s 17,000 islands. “By integrating Nium’s advanced technology into BRI’s platform, we are dedicated to providing BRI’s customers, no matter where they are, with access to exceptional financial services. This partnership will remove the risks associated with cash handling and provide faster, more cost-effective transactions—whether individuals are sending money to family members abroad or businesses are making international payments.”

Cross-border payments are projected to grow significantly in Indonesia, with a forecasted year-on-year increase of 15% through 2025, driven largely by the digital transformation in financial services (Statista, 2024).

This partnership between BRI and Nium is expected to transform the way Indonesians engage with global financial services, meeting the rising demand for modern payment infrastructure and enhancing the overall experience for BRI’s customers in their international transactions.

About Nium

Nium, the leading global infrastructure for real-time cross-border payments, was founded on the mission to deliver the global payments infrastructure of tomorrow, today. With the onset of the global economy, its payments infrastructure is shaping how banks, fintechs, and businesses everywhere collect, convert, and disburse funds instantly across borders. Its payout network supports 100 currencies and spans 220+ markets, 100 of which in real-time. Funds can be disbursed to accounts, wallets, and cards and collected locally in 40 markets. Nium’s growing card issuance business is already available in 34 countries. Nium holds regulatory licenses and authorizations in more than 40 countries, enabling seamless onboarding, rapid integration, and compliance – independent of geography. The company is co-headquartered in San Francisco and Singapore.

Logo – https://mma.prnewswire.com/media/1678669/4973639/Nium_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/bri-partners-with-nium-to-expand-real-time-cross-border-payment-solutions-302279138.html

View original content:https://www.prnewswire.co.uk/news-releases/bri-partners-with-nium-to-expand-real-time-cross-border-payment-solutions-302279138.html

Fintech PR

Grexie Signchain Launches on November 1st, 2024: Enabling Smart Contract Developers to Bring Off-Chain Data On-Chain with Seamless Gas-Paid Signing

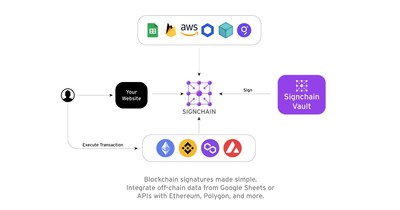

Grexie Signchain enables developers to sign off-chain data into smart contracts, with self-hosted or secure vault signer wallet management.

MANCHESTER, England, Oct. 17, 2024 /PRNewswire/ — Grexie Limited proudly announces the launch of its innovative smart contract solution, Signchain, on November 1st, 2024. Designed specifically for developers, Signchain introduces a powerful way to bring off-chain data on-chain through user-paid gas fees and secure signing of data into smart contract methods using its extendable smart contract, Signable.

In the growing landscape of blockchain technology, securely managing off-chain data and integrating it into on-chain smart contracts has posed significant challenges for developers. Signchain eliminates these hurdles by offering a robust, gas-efficient system for signing and authenticating data in real-time.

Key Features of Signchain:

1. Seamless Off-Chain to On-Chain Data Integration

Signchain enables developers to securely bring off-chain data on-chain by signing it directly into smart contract methods through user-paid gas fees. This integration ensures that data authenticity is preserved, and its entry into the blockchain remains tamper-proof, streamlining processes for industries relying on real-world data verification. Signchain also supports integration with Google Sheets, AWS, and Firebase, making it easy to pull data from popular off-chain data sources.

2. Extendable Smart Contract – Signable

The core of Signchain’s technology is its extendable smart contract, Signable, which allows developers to customize and build upon existing smart contracts. With Signable, developers can easily implement contract signatures for any data type, offering flexibility across industries from finance to logistics and beyond.

3. Signer Wallet Management

Signchain offers comprehensive signer wallet management as part of its service, empowering developers to manage and authenticate signers effectively. Wallets can either be self-hosted using Signchain’s Docker container for those who prefer their own infrastructure, or they can leverage Signchain’s network of secure vaults for maximum security.

4. Self-Hosted or Managed Service

For developers who want full control of their infrastructure, Signchain provides a self-hosted option via Docker containers, allowing them to deploy the platform on their own servers. Alternatively, developers can opt to use Signchain’s secure vault network, offering a hassle-free solution with enterprise-grade security and wallet management.

5. User-Paid Gas Fees

By integrating a user-paid gas fee model, Signchain allows users to cover the costs of signing and authenticating their data, ensuring the signing process is efficient and doesn’t overburden developers with additional expenses. This makes Signchain an ideal solution for dApps and platforms handling high transaction volumes.

6. Google Sheets, AWS, Firebase Integration with Serverless Model

Signchain supports integration with Google Sheets, AWS, and Firebase in a serverless model, powered by a hosted Sign In With Ethereum (SIWE) implementation provided by Signchain’s API. Developers can simply connect their Google Sheets and configure the contract parameters associated with each column. Signchain will automatically look up the user’s wallet address in the spreadsheet, sign the transaction data, and execute it in the blockchain along with any user-supplied parameters. This creates an easy, efficient way to manage data inputs from off-chain sources without heavy infrastructure setup.

Revolutionizing Smart Contract Workflows

With Signchain, developers now have the tools to handle the complexities of integrating off-chain data into smart contracts. The extendable nature of Signable offers flexibility, allowing developers to cater to various use cases, whether it’s automating financial transactions, supply chain data, or verifying legal agreements.

Tim Behrsin, CEO of Grexie Limited, said, “Signchain is more than just a signing solution—it’s a platform that empowers developers to securely integrate off-chain data into their smart contracts with minimal effort. The flexibility of Signable and our focus on signer wallet management offers developers control and security at every stage of the process.”

Why Signchain Matters

Signchain addresses critical challenges faced by developers, particularly those dealing with off-chain data. By signing data into smart contracts and enabling user-paid gas fees, the platform significantly reduces friction in managing secure, scalable smart contracts. Whether developers need to manage high volumes of data transactions or create bespoke smart contracts, Signchain offers a scalable and secure solution.

In industries like DeFi, real estate, and supply chain management, data integrity and security are paramount. Signchain’s secure vault network and customizable signing workflows allow businesses to handle sensitive information with confidence.

Launch Event and Future Developments

The official launch of Signchain will take place on November 1st, 2024, alongside a virtual event. The event will showcase live demonstrations of Signable, with detailed walkthroughs of the Docker-based self-hosted solution and signer wallet management features. Attendees will also get an exclusive preview of future enhancements, including multi-signature workflows and advanced blockchain network integrations.

About Signchain

Signchain is a cutting-edge platform developed by Grexie Limited, based in Manchester, Cheshire, United Kingdom. Signchain simplifies smart contract development by offering a secure, scalable, and customizable solution for signing and authenticating off-chain data on-chain. Developers can either self-host the solution using Signchain’s Docker container or rely on the network’s secure vault infrastructure. With an emphasis on security, flexibility, and developer experience, Signchain is set to transform how smart contracts handle off-chain data.

For more information, visit signchain.net.

Logo – https://mma.prnewswire.com/media/2533672/Signchain_Logo.jpg

Photo – https://mma.prnewswire.com/media/2533843/Signchain_flow.jpg

PDF – https://mma.prnewswire.com/media/2533539/Signchain_Whitepaper.pdf

SOURCE Grexie Limited

-

Fintech PR7 days ago

Fintech PR7 days agoBybit Doubles Down on Rewards for Late Entrants of WSOT 2024 With New 100,000 Prize Pool

-

Fintech PR7 days ago

Fintech PR7 days agoVantage Markets Adds Another Feather to its Cap: Wins Best Forex Affiliate Program at Global Brand Awards 2024

-

Fintech PR7 days ago

Fintech PR7 days agoRSM US and RSM UK pursue transatlantic merger to strengthen global client offering and deliver long-term growth

-

Fintech PR7 days ago

Fintech PR7 days agoBybit x Block Scholes Derivatives Report Uncovers BTC Call Option Boom Amidst Election Uncertainty

-

Fintech PR7 days ago

Fintech PR7 days agoOCI to Close Divestment of Controlling Stake in Fertiglobe

-

Fintech PR7 days ago

Fintech PR7 days agoBitget Launches Telegram App Centre, Featuring Over 600 TON Trending Mini-Apps

-

Fintech PR7 days ago

Fintech PR7 days agoBingX Launches Telegram Mini App for Seamless Copy Trading

-

Fintech PR6 days ago

Fintech PR6 days agoStatement regarding revised possible cash offer from ABC Technologies Inc. and extension of Rule 2.6 deadline