Fintech PR

How Stationary Battery Storage Will Become a $1.57 Trillion Market by 2034: Key Drivers and Opportunities

NEWARK, Del., Feb. 7, 2024 /PRNewswire/ — Future Market Insights, Inc.’s latest report illuminates the burgeoning stationary energy storage market, which is primed for significant expansion due to a critical need for reliable energy solutions. illuminate your path to success in the dynamic world of stationary energy storage market research report.

The global stationary battery storage market size is projected to reach US$ 123.14 billion in 2024. The sales of stationary battery storage are expected to witness a robust CAGR of 29.0% from 2024 to 2034. The demand for stationary battery storage is anticipated to reach a valuation of US$ 1,571.48 billion by 2034.

Request Exclusive Sample Report: Stationary Battery Storage Industry Strategic Insights, https://www.futuremarketinsights.com/reports/sample/rep-gb-15985

The stationary energy storage market is expected to increase significantly due to the growing need for dependable energy storage solutions. The market growth of stationary battery storage is predicted to be fueled by factors such as the increasing use of renewable energy sources, grid modernization initiatives, and the increased emphasis on energy efficiency.

The economic potential and adoption of stationary battery storage systems are increasing across several industries, including commercial, industrial, and residential, due to advancements in battery technology and falling costs. The stationary battery storage industry gains momentum due to government regulations that support renewable energy and carbon emission reduction programs.

Issues like regulatory uncertainty and worries about battery safety and recycling must be resolved for the stationary battery storage market to flourish. The market is anticipated to thrive rapidly, providing opportunities for stationary battery storage producers.

“With the increasing need for dependable energy storage solutions, the demand for stationary battery storage keeps advancing. Technological advancements, expanding initiatives to integrate renewable energy, and grid modernization present significant opportunities for the expansion of the market.”, opines Nikhil Kaitwade (Associate Vice President at Future Market Insights, Inc.).

Regional Outlook

Due to its ambitious renewable energy objectives, rapid industrialization, and ambitious renewable energy objectives, China leads the Asia Pacific stationary energy storage market. Growing energy storage and grid stability demand in nations like Australia and Japan propels the Asia Pacific stationary battery storage market.

The widespread adoption of renewable energy sources and electric vehicles is fueling a notable increase in fixed battery storage installations in North America. The United States leads the North American stationary battery storage market due largely to state-level renewable energy regulations and energy storage deployment incentives. Owing to strict environmental laws and aggressive renewable energy targets, Europe has become a significant stationary energy storage market. The expansion is stimulated by supportive regulations, such as subsidies and incentives, that encourage the use of energy storage.

Key Takeaways

- The lithium-ion segment in the battery type category to grab a share of 90.5% from 2024 to 2034.

- In the energy capacity category, the 251kWh to 1MWh segment to acquire a market share of 30.6% between 2024 and 2034.

- The sales of stationary battery storage in the United States are anticipated to surge at a CAGR of 32.4% by 2024.

- Germany stationary energy storage market is likely to evolve at a CAGR of 28.8% through 2024.

- China stationary energy storage market is expected to soar at a CAGR of 33.4% until 2034.

- India stationary battery storage industry is anticipated to boost at a CAGR of 30.35% by 2024.

- Australia stationary energy storage market is envisioned to develop at a CAGR of 21.2% by 2024.

Competitive Landscape

Many prominent stationary energy storage manufacturers fight for dominance in the fiercely competitive market. The stationary energy storage vendors are strengthening their positions by concentrating on technology improvements, regional expansion, and strategic alliances. Leading stationary energy storage providers are actively involved in research and development to offer novel solutions and obtain a competitive edge in this fast-paced and shifting market.

Pivotal Stationary Battery Storage Manufacturers

- Tesla

- Durapower Group

- Johnson Controls

- Exide Technologies

- Duracell, Inc

- BYD Company Ltd

- Toshiba Corporation

- Samsung SDI Co., Ltd

- Panasonic Corporation

- GS Yuasa International Ltd

- A123 Systems, LLC

- LG Chem Ltd.

- Furukawa Battery Co., Ltd.

- HydraRedox

- Narada Power Source Co. Ltd

- Siemens

- Lockheed Martin Corporation

- CMBlu Energy AG

- JenaBatteries GmbH

- SCHMID Group

Purchase this report now to get key companies with their Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis.

Recent Developments

- BYD Company Ltd. declared in May 2022 that it intended to acquire six lithium-ion mines in Africa to improve its standing in the lithium-ion technology industry and provide the corporation with a significant global footprint in the stationary lithium-ion battery storage market.

- Tesla installed 1,274MWh of storage and 85MW of solar in 2021. Large-scale battery storage initiatives accounted for an extensive growth in storage installations, while household storage deployments also rose annually.

Stationary Battery Storage Industry Segmentation

By Battery Type:

- Lithium-Ion

- Lithium Iron Phosphate

- Nickel Manganese Cobalt

- Sodium Sulphur

- Lead Acid

- Flow Battery

- Other Batteries

By Energy Capacity:

- Up to 250Kwh

- 251kWh to 1MWh

- 1.1MWh to 10MWh

- 10.1 MWh to 20 MWh

By Application:

- Grid Services

- Frequency Regulation

- Flexible Ramping

- Black Start Services

- Energy Shifting and Capacity Deferral

- T&D Congestion Relief

- Capacity Firming

- Reduced RE Curtailment

- Reduced Reliance on Diesel Gensets

- Behind the Meter

- Electricity Consumers

- System Operation

- Mini-Grids

- Off Grid

By Region:

- North America

- Latin America

- Europe

- Asia Pacific

- The Middle East and Africa

Request to Access the Detail Research Methodology from here!

About the Author:

Nikhil Kaitwade (Associate Vice President at Future Market Insights, Inc.) has over a decade of experience in market research and business consulting. He has successfully delivered 1500+ client assignments, predominantly in Automotive, Chemicals, Industrial Equipment, Oil & Gas, and Service industries.

His core competency circles around developing research methodology, creating a unique analysis framework, statistical data models for pricing analysis, competition mapping, and market feasibility analysis. His expertise also extends wide and beyond analysis, advising clients on identifying growth potential in established and niche market segments, investment/divestment decisions, and market entry decision-making.

Nikhil holds an MBA degree in Marketing and IT and a Graduate in Mechanical Engineering. Nikhil has authored several publications and quoted in journals like EMS Now, EPR Magazine, and EE Times.

Explore FMI’s Extensive Coverage in the Materials and Chemicals Domain:

- USA and Canada Alumina Market by Grade, Application & Region | Forecast 2022 to 2032 . – Review and Request to Access the Sample PDF.

- High Performance Fibers for Defense Market by Product Type, Application & Region | Forecast 2022 to 2032. – Review and Request to Access the Sample PDF.

- Polyethylene Terephthalate Glycol (PETG) Market Covering Sales Outlook, Up-to-date Key Trends, Market Size and Forecast, 2023-2033. – Review and Request to Access the Sample PDF.

- Industrial Rubber Products Market by Mechanical Rubber Goods, Rubber Hose & Belting, Forecast, 2023-2033. – Review and Request to Access the Sample PDF.

- India Industrial Lubricants Market Based on Hydraulic Fluids, Metalworking Fluids, Gear Oil, Compressor Oil, Grease, Turbine Oil, Transformer Oil, Refrigeration Oil, and Textile Machinery Lubricants, 2023-2033. – Review and Request to Access the Sample PDF.

About Future Market Insights (FMI)

Future Market Insights (FMI) is a leading provider of market intelligence and consulting services, serving clients in over 150 countries. FMI is headquartered in Dubai, and has delivery centers in the UK, U.S. and India. FMI’s latest market research reports and market analysis help businesses navigate challenges and make critical decisions with confidence and clarity amidst breakneck competition. Our customized and syndicated market research reports deliver actionable insights that drive sustainable growth. A team of expert led analysts at FMI continuously tracks emerging trends and events in a broad range of industries to ensure that our clients prepare for the evolving needs of their consumers.

Contact Us

Nandini Singh Sawlani

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware – 19713, USA

T: +1-845-579-5705

For Sales Enquiries: [email protected]

Website: https://www.futuremarketinsights.com

LinkedIn| Twitter| Blogs | YouTube

Logo – https://mma.prnewswire.com/media/1197648/3531122/FMI_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/how-stationary-battery-storage-will-become-a-1-57-trillion-market-by-2034-key-drivers-and-opportunities-302056242.html

View original content:https://www.prnewswire.co.uk/news-releases/how-stationary-battery-storage-will-become-a-1-57-trillion-market-by-2034-key-drivers-and-opportunities-302056242.html

Fintech PR

7th CIIE Successfully Wraps: Highlights by the Numbers

SHANGHAI, Nov. 28, 2024 /PRNewswire/ — The 7th China International Import Expo (CIIE) drew to a successful close on November 10th in Shanghai. While many intangible achievements and connections were made, this year’s data shows how the Expo achieved unprecedented success in global participation and business opportunities. Tentative deals totaled USD 80.01 billion, marking a 2 percent increase from the previous year.

Vibrant Participation from around the World

As a crucial platform for global collaboration, the 7th CIIE invited 77 countries and international organizations from five continents for the Comprehensive Country Exhibition. Participants incorporated unique cultures, national identities, and modern technology into booth designs, with an impressive lineup of over 200 captivating events hosted at the booths. A total of 3,496 companies from 129 countries and regions participated in the Enterprise & Business Exhibition, including 1,585 companies from 104 countries in the Belt and Road Initiative, 1,106 companies from 13 countries in the Regional Comprehensive Economic Partnership, and 132 exhibitors from 35 least developed countries.

Wide Range of Cutting-Edge Innovations and Debuts

Innovative achievements and diverse debuts have consistently been a major highlight from each edition of the expo. At the 7th CIIE, the Innovation Incubation Special Section showcased 360 innovative projects from 34 countries and regions, supporting the development of small and medium-sized enterprises (SMEs) and startups. In addition, multinational companies introduced 450 new products, services, and technologies, including over 100 global launches, 40 Asia premieres, and over 200 China debuts, unlocking momentum for new drivers of consumer demand.

International Perspectives and Collaborative Dialogues at the HQF

Serving as an important platform for international communication, the Hongqiao International Economic Forum (HQF) becomes a focal point of attention at each edition of the CIIE. Focusing on trending topics, the 7th HQF attracted over 8,600 registrations and convened more than 300 globally renowned experts and leaders in politics, business, and academia. The 7th HQF also released the World Openness Report 2024 alongside the World Openness Index, delivering a message of openness and fostering international cooperation.

The 7th China International Import Expo was undoubtedly a complete success, demonstrating its significant role as a stage for advancing global cooperation. With preparations for the 8th CIIE actively underway, the expo continues to expand opportunities for global trade and economic cooperation, warmly inviting countries and enterprises from abroad to join!

Visit CIIE official website for more information: https://www.ciie.org/zbh/en/?from=prnewswire

Contact: Ms. Cui Tel.: 0086-21-968888 Email: [email protected]

Photo – https://mma.prnewswire.com/media/2569264/image_5031553_31815944.jpg

Fintech PR

Europi Property Group AB (publ) successfully issues senior unsecured green bonds

STOCKHOLM, Nov. 28, 2024 /PRNewswire/ —

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES OR TO ANY PERSON LOCATED OR RESIDENT IN ANY OTHER JURISDICTION WHERE IT IS UNLAWFUL OR WOULD REQUIRE REGISTRATION OR OTHER MEASURES TO DISTRIBUTE THIS ANNOUNCEMENT.

Europi Property Group AB (publ) (“Europi” or the “Company“) has successfully issued senior unsecured green bonds of EUR 50m under a framework of up to EUR 100m and a tenor of three years (the “Green Bonds“). The Green Bonds have a floating interest of 3M Euribor plus 500 basis points per annum. Europi intends to list the Green Bonds on the sustainable bond list of Nasdaq Stockholm within 12 months and Nasdaq Transfer Market within 60 days, with an ambition to have the Green Bonds admitted to trading within 30 days.

An amount corresponding to the net proceeds from the Green Bonds will be used in accordance with the Company’s green finance framework (the “Green Finance Framework“).

Skandinaviska Enskilda Banken AB (publ) and ABG Sundal Collier AB have acted as advisors in relation to the issue of the Green Bonds. Vinge has acted as legal counsel in relation to the issue of the Green Bonds.

More information regarding the Green Finance Framework and Sustainalytics’ second party opinion can be found at https://europi.se/bond-investors/

For further information, please contact:

Jonathan Willén, CEO, [email protected]

+46 (0) 8 411 55 77

About Europi (www.europi.se)

Europi Property Group, founded in 2019, is a pan-European real estate investment company headquartered in Stockholm (with an office also in London) investing discretionary capital across all sectors with a flexible investment strategy. Europi has since inception completed public and private transactions of more than €700m in gross asset value alongside its established network of local operating partners and completed four successful exists. By combining a truly entrepreneurial, active ownership approach with focus on social and environmental sustainability, Europi generates long term value and positive impact for all stakeholders.

This information was brought to you by Cision http://news.cision.com

View original content:https://www.prnewswire.co.uk/news-releases/europi-property-group-ab-publ-successfully-issues-senior-unsecured-green-bonds-302318389.html

Fintech PR

Bybit x Block Scholes Derivatives Report: ETH Outperforms BTC

DUBAI, UAE, Nov. 28, 2024 /PRNewswire/ — Bybit, the world’s second-largest cryptocurrency exchange by trading volume, in collaboration with Blocks Scholes, released the latest weekly derivatives analytics report and uncovered signals indicating ETH’s rise above BTC in the past week.

Fueled by news of current U.S. SEC Chair Gary Gensler’s departure at the end of the Biden administration’s term, ETH performance has positively surprised investors. In particular, open interest in ETH perpetual has been on the rise. Several large-cap altcoins also benefited from Gensler’s announcement, anticipating less scrutiny upcoming January.

Key Insights:

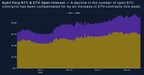

ETH outperformed BTC in open interest: Perpetual swap data has seen a gradual decline in BTC open interest while ETH contracts increased. ETH has also been taking a bigger share of daily trading volumes in the past 6-month time frame despite an overall slower market this week. The optimism could be attributed to hopeful investors’ expectation of a more crypto-friendly SEC Chair after Gensler’s last day on Jan. 20, 2025.

BTC price in retreat: BTC price’s ebbing from the $100K mark has flattened the ATM volatility term structure, with short-tenor options dipping below 60%. This mirrors a pattern observed since the U.S. election. Lower realized volatility explains the drop, while open interest in calls and puts remains unchanged, demands for short-term options this week have stagnated.

ETH options – bullish sentiment in moderation: ETH options show slightly more bullish sentiment than BTC options. Markets have recalibrated after the post-election high, but call options remain in the lead in both trading volumes and open interests.

Access the Full Report:

Read the full report in context here.

#Bybit / #TheCryptoArk /#BybitResearch

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving over 50 million users. Established in 2018, Bybit provides a professional platform where crypto investors and traders can find an ultra-fast matching engine, 24/7 customer service, and multilingual community support. Bybit is a proud partner of Formula One’s reigning Constructors’ and Drivers’ champions: the Oracle Red Bull Racing team.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: [email protected]

For more information, please visit: https://www.bybit.com

For updates, please follow: Bybit’s Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

Photo – https://mma.prnewswire.com/media/2569395/Bybit_x_Block_Scholes_Derivatives_Report_ETH_Outperforms_BTC.jpg

Logo – https://mma.prnewswire.com/media/2267288/Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/bybit-x-block-scholes-derivatives-report-eth-outperforms-btc-302318387.html

View original content:https://www.prnewswire.co.uk/news-releases/bybit-x-block-scholes-derivatives-report-eth-outperforms-btc-302318387.html

-

Fintech PR6 days ago

Fintech PR6 days agoAlkira Ranked 25th Fastest-Growing Company in North America and 6th in the Bay Area on the 2024 Deloitte Technology Fast 500™

-

Fintech2 days ago

Fintech2 days agoFintech Pulse: A Daily Dive into Industry Innovations and Developments

-

Fintech PR6 days ago

Fintech PR6 days agoCorinex Ranked Number 331 Fastest-Growing Company in North America on the 2024 Deloitte Technology Fast 500™

-

Fintech PR6 days ago

Fintech PR6 days agoCathay Financial Holdings Advances Climate Finance Leadership at COP29, Championing Public-Private Partnerships and Asia’s Low-Carbon Transition

-

Fintech PR6 days ago

Fintech PR6 days agoROYAL CANADIAN MINT REPORTS PROFITS AND PERFORMANCE FOR Q3 2024

-

Fintech PR6 days ago

Fintech PR6 days agoRedefining Financial Frontiers: Nucleus Software Celebrates 30 Years with Synapse 2024 in Singapore

-

Fintech PR6 days ago

Fintech PR6 days agoEliTe Solar: Realizing Our Mission and Standing by Our Core Values

-

Fintech PR6 days ago

OIVE and ViniPortugal celebrate closing of joint campaign that reached 100 million consumers