Fintech PR

Online Soft Skills Training Market to Reach $24 Billion Globally by 2032 at 12.8% CAGR: Allied Market Research

Growing emphasis on effective communication and collaboration in the corporate sector is anticipated to drive the growth of the global online soft skills training market during the forecast period. The Asia-Pacific region is expected to observe significant growth during the forecast period.

NEW CASTLE, Del., Feb. 9, 2024 /PRNewswire/ — Allied Market Research has recently published a report, titled, “Online Soft Skills Training Market By Type (Communication, Teamwork, Time Management, Problem-solving, Creativity, Leadership, Others), By Company Size (Small Companies, Mid-sized Companies, Large Companies), By Learner (Male, Female), By Application (Business Services, Science and Engineering, Finance and Insurance, Technology, Marketing and Advertising, Healthcare, Others): Global Opportunity Analysis and Industry Forecast, 2023-2032″. According to the report, the global online soft skills training market generated $7.2 billion in 2022, and is anticipated to generate $24 billion by 2032, witnessing a CAGR of 12.8% from 2023 to 2032.

Prime Determinants of Growth

The increasing demand for remote and hybrid work arrangements as well as the rising emphasis on effective cooperation and communication is boosting the growth of the online soft skills training market. However, challenges such as potential technological faults, connection concerns, and skepticism about the reliability of online soft skills training programs are factors restraining the market growth during the forecast period. On the other hand, the rising recognition of the critical role soft skills play in the evolving workplace and the increasing investments in innovative technologies to enhance online training experiences are expected to unlock rewarding growth opportunities in the global online soft skills training market during the forecast period.

Request Sample Pages: https://www.alliedmarketresearch.com/request-sample/A295265

Report Coverage & Details:

|

Report Coverage |

Details |

|

Forecast Period |

2023–2032 |

|

Base Year |

2022 |

|

Market Size in 2022 |

$7.2 billion |

|

Market Size in 2032 |

$24 billion |

|

CAGR |

12.8 % |

|

No. of Pages in Report |

320 |

|

Segments covered |

Type, Company Size, Learner, Application, and Region |

|

Drivers |

Increased demand for remote and hybrid work arrangements Growing awareness about the significance of soft skills in adapting to technological advancements and automation |

|

Opportunities |

Increasing investments in advanced technologies to enhance the quality and personalization of online soft skills training

Rising recognition of the importance of emotional intelligence and adaptability |

|

Restraints |

Skepticism about the reliability of online soft skills training programs owing to their technical and connection errors |

COVID-19 Scenario:

- The COVID-19 pandemic significantly impacted the global online soft skills training market. The pandemic significantly increased access to professional development opportunities, driving a surge in demand for online soft skills training.

- The removal of physical barriers due to the pandemic boosted inclusivity, allowing individuals across the globe to participate in high-quality training programs from the comfort of their homes.

- The pandemic surged the importance of soft skills in the remote work environment, leading to an increased emphasis on online training to meet evolving workplace demands.

- Buy this Complete Report (317 Pages PDF with Insights, Charts, Tables, and Figures) at:

Buy this Complete Report (320 Pages PDF with Insights, Charts, Tables, and Figures) at:

https://www.alliedmarketresearch.com/online-soft-skills-training-market/purchase-options

Type: Communication Sub-Segment to Grow with Highest CAGR by 2032

The communication sub-segment dominated the market in 2022, holding a major share of 24.5%. This dominance is expected to continue till 2032, growing with a CAGR of 14.1%. This growth is mainly due to the growing recognition of the pivotal role effective communication plays in remote work environments, fostering effective leadership, and meeting the rising demand for clear and efficient communication skills in the evolving professional landscape.

Company Size: Large Companies Sub-Segment Expected to Hold Leading Market Share by 2032

The large companies sub-segment dominated the global online soft skills training market share in 2022, holding a major share of 40.4%. This sub-segment is expected to hold a leading market share of 39.8% by 2032. This growth is mainly because of the increasing awareness that employees with enhanced soft skills collaborate more efficiently, reducing misunderstandings and enhancing overall productivity in large corporate settings.

Learner: Male Sub-Segment Predicted to Hold Leading Market Share by 2032

The male sub-segment dominated the global online soft skills training market share in 2022, holding a major share of 55.3%. This sub-segment is expected to hold a leading market share of 54.2% by 2032. This growth is mainly because of the increasing recognition of the value of soft skills in fostering effective communication, leadership, and adaptability, driving a rising demand for tailored online training experiences.

Application: Business Services Sub-Segment Anticipated to Hold Leading Market Share by 2032

The business services sub-segment led the market in 2022, holding a substantial share of 28.7%. This sub-segment is expected to hold a leading market share of 31.5% by 2032. The growth of the sub-segment is mainly because of the increasing demand for online soft skills training in response to the dynamic nature of the modern workplace, boosting the need for effective communication and collaboration within organizations.

By Region: Asia-Pacific Estimated to Dominate the Market in Forecast Period

The Asia-Pacific region dominated the global online soft skills training market in 2022, holding a major share of 35.7%. The dominance of this region is expected to continue by rising with a CAGR of 13.6% in the forecast period. This is mainly due to increasing demand for online soft skills training, rising flexibility offered by these programs, and the growing awareness of their cost-effectiveness in the region. Moreover, the region’s dynamic corporate environment and diverse workforce needs are key factors boosting the region’s dominance in the global online soft skills training market.

Enquiry Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/A295265

Leading Players in the Online Soft Skills Training Market:

- Pluralsight LLC

- HubSpot, Inc.

- Coursera

- Udemy Academy

- Toastmasters International

- Harvard Extension School

- Franklin Covey Co.

- edX LLC.

- Skillsoft

- LinkedIn Corporation

The report provides a detailed analysis of the key players of the global online soft skills training market. These players have adopted different strategies, such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain their dominance in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

AVENUE- A Subscription-Based Library (Premium on-demand, subscription-based pricing model):

AMR introduces its online premium subscription-based library Avenue, designed specifically to offer cost-effective, one-stop solution for enterprises, investors, and universities. With Avenue, subscribers can avail an entire repository of reports on more than 2,000 niche industries and more than 12,000 company profiles. Moreover, users can get an online access to quantitative and qualitative data in PDF and Excel formats along with analyst support, customization, and updated versions of reports.

Get an access to the library of reports at any time from any device and anywhere. For more details, follow the link: https://www.alliedmarketresearch.com/library-access

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports Insights” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060

Fax: +1-800-792-5285

[email protected]

Logo: https://mma.prnewswire.com/media/636519/Allied_Market_Research_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/online-soft-skills-training-market-to-reach-24-billion-globally-by-2032-at-12-8-cagr-allied-market-research-302058603.html

View original content:https://www.prnewswire.co.uk/news-releases/online-soft-skills-training-market-to-reach-24-billion-globally-by-2032-at-12-8-cagr-allied-market-research-302058603.html

Fintech PR

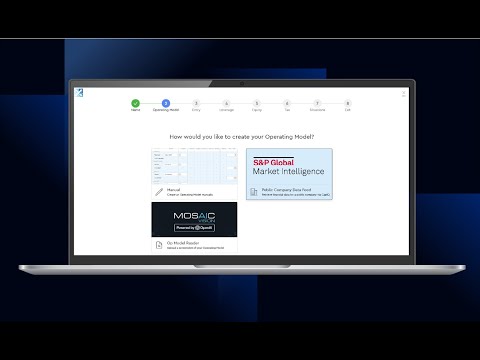

Mosaic Announces Strategic Integration with S&P Capital IQ Data to Streamline Public-to-Private Deal Modeling

NEW YORK, Nov. 25, 2024 /PRNewswire/ — Mosaic, the world’s leading Digital Deal Modeling platform, today announced the release of its integration with S&P Global Market Intelligence’s S&P Capital IQ, supercharging the Mosaic platform with high quality financial data from S&P Global Market Intelligence for mutual customers. S&P Capital IQ’s comprehensive financial and market data will automatically populate Mosaic’s industry leading Digital Deal Modeling engine for seamless, rapid screening of public-to-private transactions. This integration empowers private equity firms and investment banks on Mosaic to conduct complex take-private analysis in under one minute, leveraging Capital IQ’s extensive dataset, including fundamental financials, consensus estimates, and real-time market pricing – paired with the user’s differentiated judgements on appropriate capital structure and exit for the deal.

With this integration, dealmakers can now accelerate their deal idea generation processes by completing in minutes what used to take hours in legacy, spreadsheet-based workflows. Mosaic’s innovative platform, already renowned for its precision and efficiency in deal modeling, is now further enhanced by S&P Capital IQ’s high-quality data, enabling faster, more accurate insights for better-informed investment decisions.

“Mosaic’s integration with S&P Capital IQ data represents a major leap forward in analytical capacity and capability for our shared customers,” said Ian Gutwinski, Founder & CEO of Mosaic. “By combining the advanced modeling capabilities of Mosaic with Capital IQ’s trusted data, we’re able to offer an unparalleled solution for transaction screening and analysis, reducing time spent on manual data collection and allowing users to focus on high-impact assumptions around a deal’s base case forecast, capitalization and exit.”

This integration aligns with Mosaic’s mission to empower financial professionals with cutting-edge tools that simplify complex financial transactions, offering greater speed and accuracy in a competitive market. With S&P Capital IQ’s data now available within Mosaic’s platform, users can now screen new opportunities with a level of agility previously unattainable.

For more information on the Mosaic platform and the new S&P Capital IQ integration, visit https://mosaic.pe/platform-updates

About Investor Technology Group, Inc. (doing business as Mosaic):

Investor Technology Group is digitizing the private equity front office through its pioneering Digital Deal Modeling™ platform, Mosaic.

Thousands of the world’s best investment professionals at firms managing over half a trillion of assets including Warburg Pincus, CVC, New Mountain Capital, Bridgepoint, Ontario Teachers’ Pension Plan, The Riverside Company, and many more leverage the Mosaic platform to efficiently screen a world of opportunity and identify the handful of investments worthy of their portfolios.

By combining our founding team’s deep sector expertise with cutting edge digital technologies – and the collective intelligence of our pioneering user base – we’re building the future of private equity. To be a part of that future, visit Mosaic.pe or contact [email protected].

Press Contact:

Manasa Grandhi

Director of Operations

[email protected]

https://mosaic.pe

Video – https://www.youtube.com/watch?v=mmtu2zn56Fc

Photo – https://mma.prnewswire.com/media/2566283/Mosaic_Screen_1_01.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/mosaic-announces-strategic-integration-with-sp-capital-iq-data-to-streamline-public-to-private-deal-modeling-302315132.html

View original content:https://www.prnewswire.co.uk/news-releases/mosaic-announces-strategic-integration-with-sp-capital-iq-data-to-streamline-public-to-private-deal-modeling-302315132.html

Fintech PR

Jiva Technologies Integrates Bitcoin into Treasury Strategy as Board Approves Up to $1 Million Investment

VANCOUVER, BC, Nov. 25, 2024 /PRNewswire/ — Jiva Technologies (CSE: JIVA) (Frankfurt: WNT1) (OTCQB: PLTXF) (“JIVA” or the “Company”), a leader in building niche online wellness communities and creating immersive physical environments, today announced that its Board of Directors has approved the purchase of up to $1 million in Bitcoin as part of the Company’s treasury management strategy.

“As Bitcoin continues to gain traction as a widely accepted and trusted asset class, we see a unique opportunity to strengthen our treasury with a resilient and innovative investment,” said Lorne Rapkin, CEO of Jiva Technologies. “Bitcoin’s inherent scarcity and finite supply position it as a modern hedge against inflation and a safe haven in times of economic uncertainty. We believe Bitcoin aligns with our forward-thinking strategy and complements our mission to drive innovation across all aspects of our business. The potential for favorable regulatory frameworks and increased institutional adoption, highlighted by the recent wave of Bitcoin ETFs, underscores Bitcoin’s value proposition and makes us believe it is an ideal asset for corporate treasuries seeking inflation-resistant stores of value,” Rapkin added.

While Bitcoin will now form part of Jiva Technologies’ diversified treasury strategy, the Company remains firmly committed to its core operations. This includes executing its previously announced joint ventures, driving growth in its plant subscription e-commerce platform, Bloombox Club, and continuing to develop its immersive wellness hub in Squamish, BC.

Jiva Technologies will monitor its Bitcoin holdings closely, ensuring they align with market conditions and the Company’s cash flow requirements.

About JIVA Technologies

JIVA Technologies is dedicated to building niche online wellness communities and creating immersive physical environments. With a proven track record in e-commerce marketplaces, bolstered by expert UI/UX design and SEO, JIVA now focuses on joint ventures to support wellness brands in developing their online presence. The company owns and operates Bloombox Club, an online plant delivery marketplace serving the United States, Germany, the United Kingdom, Austria, the Republic of Ireland, France, Spain, and Italy, as well as The Locavore Bar and Grill, a vibrant dining and gathering destination in Squamish, BC. Recently, JIVA became a shareholder in VEG House, a leader in the plant-based space, through a share exchange agreement. Committed to e-commerce, marketing, and wellness, JIVA’s mission is to cultivate online communities of like-minded consumers through education and collaboration. The company is actively pursuing joint ventures, such as the recently announced partnership with LIV3 for SugarShield, to empower wellness brands online by building their websites and managing all digital marketing.

Contact

Lorne Rapkin

Chief Executive Officer

(416) 419-1415

Forward-looking Information

This press release contains “forward-looking information” within the meaning of applicable securities laws. All statements contained herein that are not clearly historical in nature may constitute forward-looking information. In some cases, forward-looking information can be identified by words or phrases such as “may,” “will,” “expect,” “likely”, “should,” “would,” “plan,” “anticipate,” “intend,” “potential,” “proposed,” “estimate,” “believe” or the negative of these terms, or other similar words, expressions and grammatical variations thereof, or statements that certain events or conditions “may” or “will” happen, or by discussions of strategy. The forward-looking information contained herein includes, without limitation, statements regarding the availability of Future Farm products, PlantX promotional events and the business and strategic plans of the Company.

By its nature, forward-looking information is subject to inherent risks and uncertainties that may be general or specific and which give rise to the possibility that expectations, forecasts, predictions, projections or conclusions will not prove to be accurate, that assumptions may not be correct, and that objectives, strategic goals and priorities will not be achieved. A variety of factors, including known and unknown risks, many of which are beyond our control, could cause actual results to differ materially from the forward-looking information in this press release including, without limitation: receiving sufficient demand for the Offering; the Company’s ability to comply with all applicable governmental regulations including all applicable food safety laws and regulations; impacts to the business and operations of the Company due to the COVID-19 epidemic; the conflict in eastern Europe; having a limited operating history; the ability of the Company to access capital to meet future financing needs; the Company’s reliance on management and key personnel; competition; changes in consumer trends; foreign currency fluctuations; and general economic, market or business conditions.

Additional risk factors can also be found in the Company’s continuous disclosure documents, which have been filed on SEDAR and can be accessed at www.sedar.com. Readers are cautioned to consider these and other factors, uncertainties and potential events carefully and not to put undue reliance on forward-looking information. The forward-looking information contained applicableherein is made as of the date of this press release and is based on the beliefs, estimates, expectations and opinions of management on the date such forward-looking information is made. The Company undertakes no obligation to update or revise any forward-looking information, whether as a result of new information, estimates or opinions, future events or results or otherwise or to explain any material difference between subsequent actual events and such forward-looking information, except as required by law.

Logo – https://mma.prnewswire.com/media/2554030/5046019/Jiva_Technologies_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/jiva-technologies-integrates-bitcoin-into-treasury-strategy-as-board-approves-up-to-1-million-investment-302315274.html

View original content:https://www.prnewswire.co.uk/news-releases/jiva-technologies-integrates-bitcoin-into-treasury-strategy-as-board-approves-up-to-1-million-investment-302315274.html

Fintech PR

The Secret Metal That Helped Win WWII is Back, And Prices Are Soaring

FN Media Group Presents Oilprice.com Market Commentary

LONDON, Nov. 25, 2024 /PRNewswire/ — More than 100 years ago, a ship left a Nova Scotia harbor carrying a precious cargo that few today would recognize as valuable. The crew, full of optimism, was bound for Wales hoping that the metal they carried would lead them to riches. Unfortunately, they never made it. Companies mentioned in this release include: United States Steel (NYSE: X), ArcelorMittal (NYSE: MT), Energy Fuels (NYSE American: UUUU), Huntington Ingalls Industries (NYSE: HII), Leidos (NYSE: LDOS).

A German U-boat lurking in the cold Atlantic waters fired a torpedo and the ship went down, sinking to the ocean floor along with its mysterious cargo.

At the time, the metal seemed unimportant, but its true value wasn’t fully realized until later. Fast forward to today and that same metal is critical to modern military and industrial applications. That metal, once forgotten at the bottom of the sea is not gold or silver, but antimony—a mineral that has become a key player in global conflicts and high-tech industries alike.

This shipwreck might sound like an intriguing piece of history, but it’s far more than that. It’s a reminder of how vital antimony has been and continues to be for national security and economic stability.

Now, thanks to Military Metals Corp. (MILI.CN; MILIF.QB), the very same mine in Nova Scotia that once produced this valuable metal is being re-visited. And it couldn’t have come at a more crucial time.

Antimony: The Unsung Hero of Modern Warfare

Antimony might not be a household name, but it’s been an essential material in warfare for centuries. During both World War I and World War II, antimony was used in everything from bullet casings to explosives.

Today, it’s more important than ever. According to the U.S. Geological Survey, American manufacturers use over 50 million pounds of antimony each year.

That’s because antimony is a critical component in the production of semiconductors, batteries, and solar panels. From electronics to renewable energy, the modern world runs on antimony.

In short, antimony is critical to both offensive and defensive operations. Any disruption to the supply of this key mineral could have devastating effects on national security.

The Growing Threat of an Antimony Shortage

This is where things get concerning. For decades, the U.S. has relied on antimony imports from China. In fact, China controls nearly 50% of antimony mining and 80% of the world’s antimony production. This has put the U.S. in a precarious position, especially as tensions with China continue to rise.

The U.S. military is well aware of the risks. The Pentagon has been scrambling to secure a domestic source of antimony, recognizing that losing access to this vital mineral could severely impact America’s ability to defend itself.

That’s why Military Metals (MILI.CN; MILIF.QB) is stepping in at the perfect moment.

The company has taken a bold step with their plans to redevelop the historic West Gore Antimony Project in Nova Scotia. This mine was once a key source of antimony during both World War I. Today, it stands as one of the few potential sources of antimony in North America.

The company has also recently acquired one of Europe’s largest antimony deposits with a historical resource in Slovakia which could prove even more promising as tensions between Russia and Europe escalate.

The above table is data from their recent Slovakian acquisition and helps to show the potential in situ value of Military Metals.

Simply multiply the antimony tons (60,998) by the current spot price ($38,000) to arrive at a total of $2,000,000,000 in situ value of antimony in the ground. The company is merely $23 million at its current market cap with a healthy cash position. Also, the average grade of the resource is 2.478%, which is considered very high for antimony. Most antimony is produced at low grades as a by-product of some gold deposits.

By comparison, Perpetua Resources, which is in the process of receiving a $1.86-billion government loan to develop their strategic resource, is valued at around $700 million with 90,000 tons of antimony.

By announcing the definitive agreement on Slovakia assets as well as acquiring the West Gore project in North America, Military Metals Corp. is positioning itself as a critical player in the fight to secure domestic antimony production.

The company’s CEO, Scott Eldridge, has stated, “The acquisition of the West Gore Antimony Project demonstrates our strategy of becoming a significant global antimony player.”

Eldridge understands the importance of antimony not just for military use, but also for a wide range of industrial applications. He’s betting that as tensions with China escalate, the value of domestically produced antimony will skyrocket.

This isn’t just speculation. The U.S. government has already started investing heavily in securing domestic sources of critical minerals, including antimony. And Military Metals Corp., with its historic West Gore project, is perfectly positioned to capitalize on this growing demand.

The Strategic Importance of Domestic Antimony Production

The potential reopening of the West Gore mine is more than just a business opportunity. It’s a strategic move to safeguard North America’s supply of a mineral that could decide the outcome of the next global conflict.

Antimony is on the U.S. government’s list of critical minerals, and for good reason. Without it, the military cannot produce the advanced weapons systems needed to defend the country. As China tightens its grip on global antimony production, securing a domestic source has become a matter of national security.

Military Metals (MILI.CN; MILIF.QB) West Gore project is one of the only known sources of antimony in North America. This puts the company in a unique position to benefit from government initiatives aimed at stockpiling critical minerals.

With billions of dollars being allocated to secure domestic mineral supplies, companies like Military Metals Corp. stand to gain substantial financial support.

But it’s not just the government that’s interested. The private sector is also waking up to the importance of antimony. As industries like renewable energy and tech continue to grow, demand for antimony will only increase. And with China controlling most of the world’s supply, companies that can produce antimony domestically will be in high demand.

Antimony-Focused Strategy

The company has made it clear that it’s focused on acquiring and developing antimony resources across North America and with their latest definitive agreement announcement on two Antimony projects in Europe, they have a chance to be a global powerhouse. This strategy is designed to potentially make them one of the leading suppliers of antimony outside of China.

With the global antimony market expected to grow significantly in the coming years, Military Metals Corp. is positioning itself as a key player in what could be one of the most critical supply chain battles of the 21st century.

In addition to the definitive agreement for Slovakian assets, the company is actively exploring additional opportunities to acquire other antimony assets, ensuring that it remains at the forefront of this growing industry.

Other companies to keep a close eye on:

United States Steel (NYSE: X)

United States Steel is an integrated steel producer with major operations in the United States and Central Europe. As a major steel supplier to the automotive, appliance, construction, and energy sectors, U.S. Steel plays a vital role in the U.S. economy. A strong domestic steel industry is essential for maintaining a robust manufacturing base, which contributes to national security by ensuring the ability to produce critical equipment and infrastructure.

U.S. Steel’s production capacity and focus on research and development are crucial for meeting the evolving demands of the defense industry. Their ability to produce advanced high-strength steels and other specialized steel products is essential for constructing modern military vehicles, ships, and infrastructure.

ArcelorMittal (NYSE: MT)

ArcelorMittal is the world’s leading steel and mining company with a significant presence in the United States. Their vast production capacity and global reach make them a critical supplier of steel to various industries, including the defense sector. ArcelorMittal produces a wide range of steel products, from basic sheet steel to specialized high-strength alloys, essential for manufacturing vehicles, ships, and infrastructure.

ArcelorMittal’s commitment to research and development keeps them at the forefront of steelmaking technology. This is crucial for meeting the evolving demands of the defense industry, which requires advanced materials to produce lighter, stronger, and more resilient equipment.

Energy Fuels (NYSE American: UUUU)

Energy Fuels is a leading U.S.-based uranium mining company, operating the only conventional uranium mill in the United States. With a diverse portfolio of uranium mines and projects across the Western U.S., they are a crucial player in the U.S. nuclear fuel cycle. Energy Fuels also produces vanadium, a metal used in high-strength steel alloys and aerospace applications.

The company plays a vital role in ensuring a secure and reliable domestic supply of uranium, which is essential for nuclear power plants that provide a significant portion of the nation’s electricity. This reduces reliance on foreign sources of nuclear fuel and strengthens energy security.

Huntington Ingalls Industries (NYSE: HII)

Huntington Ingalls Industries is America’s largest military shipbuilding company, with 42,000 employees. They design, build, and maintain nuclear-powered aircraft carriers and submarines, and provide after-market services for military ships globally. Huntington Ingalls also provides mission-critical national security solutions to government and commercial customers.

Huntington Ingalls Industries is the sole builder of aircraft carriers for the U.S. Navy and one of only two companies that build nuclear-powered submarines. The company’s shipbuilding expertise is critical to the U.S. Navy’s ability to maintain its global presence and protect national interests. Huntington Ingalls is also a major provider of technical and management services to the U.S. government.

Leidos (NYSE: LDOS)

Leidos is a major player in the national security arena, providing innovative solutions to the Department of Defense and intelligence agencies. Their work in artificial intelligence, machine learning, and big data analytics is transforming how these agencies operate and make critical decisions.

Leidos is also a leader in the civil market, offering a wide range of services to government agencies and commercial customers in areas like transportation, energy, and healthcare. This diverse portfolio demonstrates their ability to adapt and innovate across sectors.

By. Josh Owens

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. The forward-looking statements in this publication are based on current expectations and assumptions about future events, geopolitical developments, trade policies, market conditions, the company’s strategic initiatives to address the critical shortage of antimony, and current expectations, estimates, and projections about the industry and markets in which the company operates. Factors that could change or prevent these statements from coming to fruition include, but are not limited to, the potential impact of the upcoming U.S. elections on various industries and specific companies, changes in government policies, market conditions, regulatory developments, geopolitical events and the company’s ability to successfully acquire and develop new antimony resources and fluctuations in antimony prices. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

This communication is for entertainment purposes only. Never invest purely based on our communication. We have not been compensated by the companies mentioned in this article. While the opinions expressed in this article are based on information believed to be accurate and reliable, such information in our communications and on our website has not been independently verified and is not guaranteed to be correct. The content of this article is based solely on our opinions which are based on very limited analysis, and we are not professional analysts or advisors.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of the companies featured in this article and therefore has an incentive to see the featured companies’ stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of the featured companies in the market. The owner of Oilprice.com will be buying and selling shares of the featured companies for its own profit and may take this opportunity to liquidate a portion of its position. Accordingly, our views and opinions in this article are subject to bias, and why we stress that you should conduct your own extensive due diligence regarding the featured companies as well as seek the advice of your professional financial advisor or a registered broker-dealer before you consider investing in any securities of the featured companies or otherwise.

NOT AN INVESTMENT ADVISOR. Oilprice.com is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. You should not treat any opinion expressed herein as an inducement to make a particular investment or to follow a particular strategy, but only as an expression of opinion. The opinions expressed herein do not consider the suitability of any investment with your particular objectives or risk tolerance. Investments or strategies mentioned in this article and on our website may not be suitable for you and are not intended as recommendations.

ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making any investment. This communication should not be used as a basis for making any investment in any securities. Past performance is not indicative of future results.

RISK OF INVESTING. Investing is inherently risky. Do not trade with money you cannot afford to lose. There is a real risk of loss (including total loss of investment) in following any strategy or investment discussed in this article or on our website. This is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities or the solicitation of any vote in any jurisdiction. No representation is being made as to the future price of securities mentioned herein, or that any stock acquisition will or is likely to achieve profits.

DISCLAIMER: OilPrice.com is Source of all content listed above. FN Media Group, LLC (FNM), is a third party publisher and news dissemination service provider, which disseminates electronic information through multiple online media channels. FNM is NOT affiliated in any manner with OilPrice.com or any company mentioned herein. The commentary, views and opinions expressed in this release by OilPrice.com are solely those of OilPrice.com and are not shared by and do not reflect in any manner the views or opinions of FNM. FNM is not liable for any investment decisions by its readers or subscribers. FNM and its affiliated companies are a news dissemination and financial marketing solutions provider and are NOT a registered broker/dealer/analyst/adviser, holds no investment licenses and may NOT sell, offer to sell or offer to buy any security. FNM was not compensated by any public company mentioned herein to disseminate this press release.

FNM HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E the Securities Exchange Act of 1934, as amended and such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. “Forward-looking statements” describe future expectations, plans, results, or strategies and are generally preceded by words such as “may”, “future”, “plan” or “planned”, “will” or “should”, “expected,” “anticipates”, “draft”, “eventually” or “projected”. You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements as a result of various factors, and other risks identified in a company’s annual report on Form 10-K or 10-KSB and other filings made by such company with the Securities and Exchange Commission. You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. The forward-looking statements in this release are made as of the date hereof and FNM undertakes no obligation to update such statements.

Contact Information:

Media Contact e-mail: [email protected], U.S. Phone: +1(954)345-0611

View original content:https://www.prnewswire.co.uk/news-releases/the-secret-metal-that-helped-win-wwii-is-back-and-prices-are-soaring-302314592.html

-

Fintech5 days ago

Fintech5 days agoFintech Pulse: Industry Updates, Innovations, and Strategic Moves

-

Fintech4 days ago

Fintech4 days agoFintech Pulse: Daily Industry Brief – A Dive into Today’s Emerging Trends and Innovations

-

Fintech PR5 days ago

Fintech PR5 days agoROLLER Releases 2025 Attractions Industry Benchmark Report, Unveiling Key Trends and Revenue Strategies

-

Fintech PR4 days ago

Fintech PR4 days agoTAILG Represents the Industry at COP29, Advancing South-South Cooperation with Low-Carbon Solutions

-

Fintech6 days ago

Fintech6 days agoFintech Pulse: Milestones, Partnerships, and Transformations in Fintech

-

Fintech7 days ago

Fintech7 days agoFintech Pulse: Navigating Expansion, Innovation, and Sustainability

-

Fintech PR3 days ago

Fintech PR3 days agoAlkira Ranked 25th Fastest-Growing Company in North America and 6th in the Bay Area on the 2024 Deloitte Technology Fast 500™

-

Fintech PR5 days ago

Fintech PR5 days agoThe CfC St. Moritz Announces New Speakers from BlackRock, Binance, Bpifrance, Temasek, PayPal, and More for Upcoming 2025 Conference